Stock Picks Bob's Advice

Saturday, 17 November 2007

"Looking Back One Year" A review of stock picks from the week of May 15, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I missed the review last weekend. That's how my 'looking back a year' looks more and more like a year-and-a-half! In any case, I shall try to get this review posted this evening. I just have two stocks to review so it shouldn't be too bad :).

These reviews that I do are my way of examining the stocks that I posted about a year previously in some sort of methodical fashion. It helps me identify those things that are working in my process, and those that aren't. It will also give you a chance to see how this blog is doing in picking stocks. Credibility. That's what I really seek here. I hope that I shall be successful in my stock picking, but more important, is an honest appraisal of this entire process.

Anyhow, my reviews are based on a 'buy and hold' approach which isn't my own trading philosophy or the philosophy of this blog. I assume this buy and hold at this time for the ease of the review. In practice I employ and advocate a disciplined strategy of portfolio management that I have described multiple places on this blog. I try to sell my declining stocks quickly and completely and sell my gaining stocks slowly and partially. This difference in strategy would certainly affect the overall performance of any investment. Please take this into consideration when reading these write-ups.

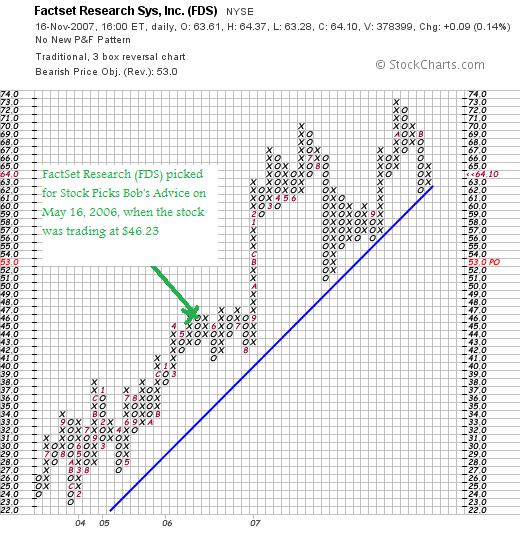

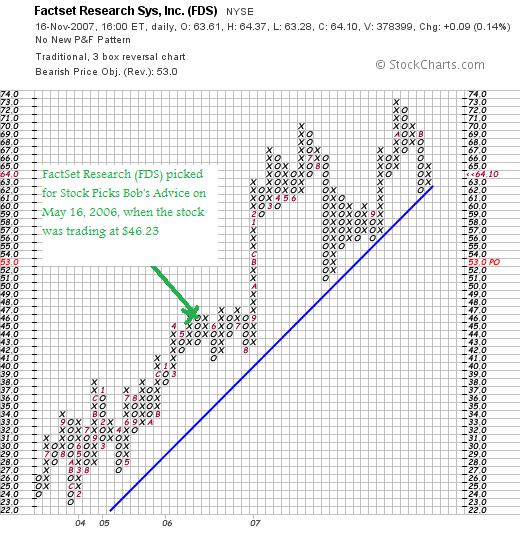

On May 16, 2006 I posted FactSet Research (FDS) on Stock Picks Bob's Advice when the stock was trading at $46.23. FDS closed at $64.10 on November 16, 2007, for a gain of $17.87 or 38.7%.

On May 16, 2006 I posted FactSet Research (FDS) on Stock Picks Bob's Advice when the stock was trading at $46.23. FDS closed at $64.10 on November 16, 2007, for a gain of $17.87 or 38.7%.

On September 25, 2007, FDS reported 4th quarter 2007 results. Revenues climbed 23.1% to $129.5 million from $105.2 million the prior year same period. Net income rose 31% to $30.7 million from $23.4 million the prior year. On a diluted earnings per share basis this worked out to $.60/share this year compared to $.46/share last year a 30.4% increase.

On September 25, 2007, FDS reported 4th quarter 2007 results. Revenues climbed 23.1% to $129.5 million from $105.2 million the prior year same period. Net income rose 31% to $30.7 million from $23.4 million the prior year. On a diluted earnings per share basis this worked out to $.60/share this year compared to $.46/share last year a 30.4% increase.

The company beat expectations which according to Thomson Financial were $.56/share on revenue of $128.7 million.

Taking a look at the 'point & figure' chart on FDS from StockCharts.com, we can see that the stock has appreciated nicely since it was picked on this blog and the upward move of this stock appears intact.

Reviewing the Morningstar.com "5-Yr Restated" financials page, we can see that the steady revenue growth, earnings growth, dividend growth, and stable outstanding shares is intact. Free cash flow is growing nicely and the balance sheet appears solid.

With all of these findings,

FACTSET RESEARCH (FDS) IS RATED A BUY

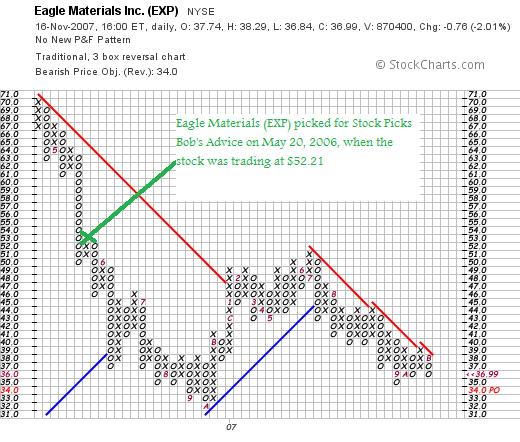

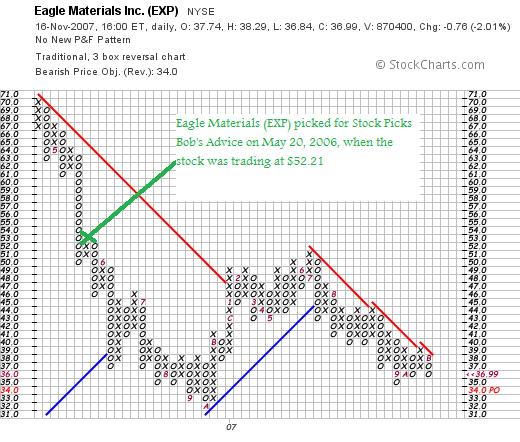

On May 20, 2006 I posted Eagle Materials (EXP) on Stock Picks Bob's Advice when the stock was trading at $52.21. EXP closed at $36.99 on November 16, 2007, for an effective loss of $(15.22) or (29.2)% since posting.

On May 20, 2006 I posted Eagle Materials (EXP) on Stock Picks Bob's Advice when the stock was trading at $52.21. EXP closed at $36.99 on November 16, 2007, for an effective loss of $(15.22) or (29.2)% since posting.

On October 22, 2007, Eagle Materials (EXP) reported 2nd quarter 2008 results. Revenue for the quarter ended September 30, 2007, came in at $210.5 millon, down 18% from the same quarter last year. Net earnings came in at $34.8 million, down 47% for the same period. On a per share basis, this worked out to $.73/share this year, down 44% from the $1.32/share reported last year.

On October 22, 2007, Eagle Materials (EXP) reported 2nd quarter 2008 results. Revenue for the quarter ended September 30, 2007, came in at $210.5 millon, down 18% from the same quarter last year. Net earnings came in at $34.8 million, down 47% for the same period. On a per share basis, this worked out to $.73/share this year, down 44% from the $1.32/share reported last year.

The company beat expectations for earnings but missed expectations on revenue with Reuters Estimates being for $.72/share in earnings on $213.11 million in revenue.

If we review the 'point and figure' chart on Eagle Materials from StockCharts.com, we can see that the stock has continued to decline from the date of our stock pick and does not show any good evidence of technical strength, instead moving lower under the 'support line'.

Reviewing the Morningstar.com "5-Yr Restated" financials on EXP, we can see that with the recent results, the trailing twelve months shows decreased in revenue, earnings, and free cash flow. The company has maintained and raised its dividend expressing optimism over its own prospects, and the balance sheet while adequate shows a current ratio of just a bit over 1.2 with significant long-term liabilities present.

With the weak earnings report and the associated weak price chart,

EAGLE MATERIALS (EXP) IS RATED A SELL

So how did I do with these two stock picks from that week about a year and a half ago? Well, I had one gainer and one loser. The average of these two stocks works out to a gain of 4.75%.

Thanks again for dropping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast website, where many of my stock picks are discussed. In addition, stop by my Covestor web page where my actual trading portfolio is reviewed, and my SocialPicks page where all of my stock picks from the past year have been reviewed.

Have a great Sunday everyone! And wishing you a wonderful Thanksgiving week!

Bob

Garmin (GRMN) "Revisiting a Stock Pick"

CLICK HERE FOR MY PODCAST ON GARMIN (GRMN)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It is Saturday, and I wanted to see if I could get this one posted before the weekend is over!

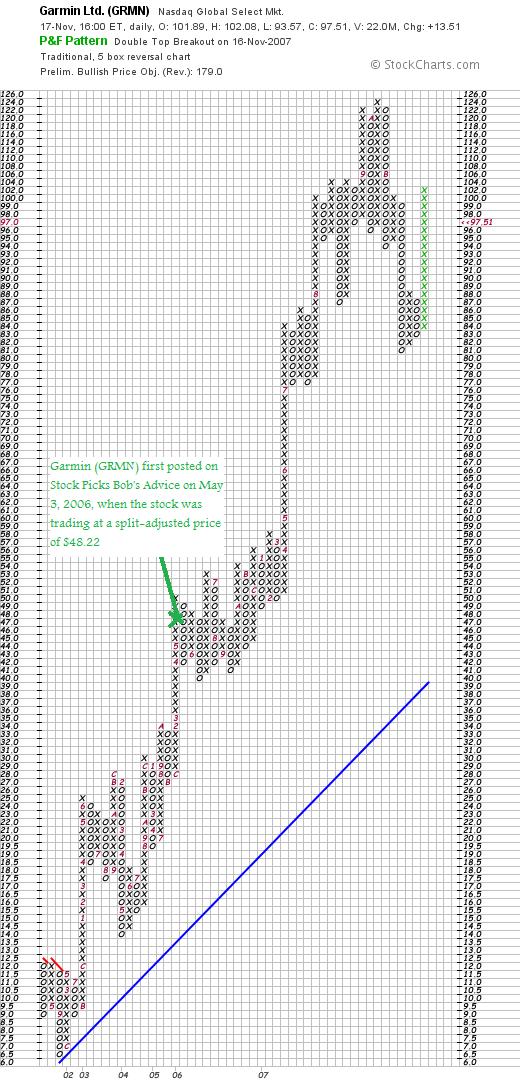

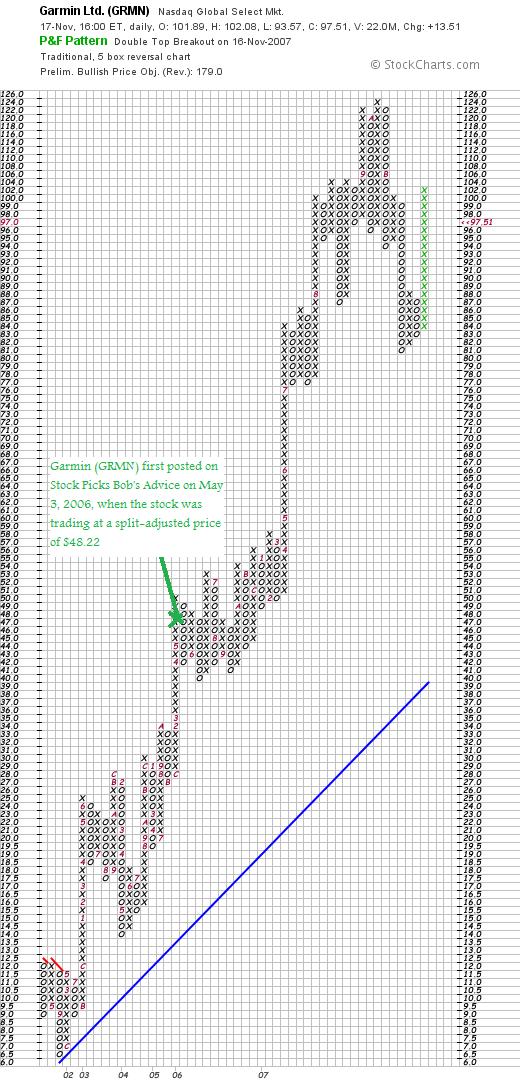

The market rebounded yesterday and I saw an old favorite of mine, Garmin (GRMN) make the list of top % gainers on the NASDAQ. I say 'old favorite' because I first posted about Garmin (GRMN) on May 3, 2006, when the stock was trading at $48.22, adjusted for a 2:1 stock split on August 16, 2006. Garmin closed at $97.51, up $13.51 on November 16, 2007, for a gain of 16.08% on the day! I do not own any shares nor do I have any options on this stock. (At Friday's closing price, this represents an appreciation of $49.29 or 102.2% since my stock pick!)

Let me try to briefly review this stock and point out why I believe this stock deserves a spot on my blog and why

GARMIN (GRMN) IS RATED A BUY

What exactly does this company do?

According to the Yahoo "Profile" on Garmin, the company

According to the Yahoo "Profile" on Garmin, the company

"...and its subsidiaries engages in the design, manufacture, and marketing of navigation, communications, and information devices that are enabled by global positioning system (GPS) technology worldwide. It operates in four segments: Automotive/Mobile, Outdoor/Fitness, Marine, and Aviation."

Is there any news to explain the large move?

I haven't been following this stock closely, but two factors have been suppressing the stock price. The company had been involved in an attempt to acquire TeleAtlas and also the company had been under pressure as much of its mapping information has been coming from Navteq (NVT), which since it is being acquired by Nokia (NOK), there had been concerns about the company's access to this critical information. However, as reported:

"Navigation device maker Garmin is walking away from a costly bidding war with rival TomTom over Tele Atlas, a supplier of mapping data. Instead, Garmin (GRMN) worked out an agreement to get that valuable data from another source.

Garmin, based in the Kansas City suburb of Olathe, Kan., will extend through 2015 an existing contract to buy mapping from Navteq (NVT), the Chicago-based company that is being acquired by Finnish mobile-phone giant Nokia (NOK). Garmin also secured an option to renew the agreement for an additional four years. The companies also said they would explore "expanded points of cooperation" to improve mapping data quality. Financial terms of the deal were not disclosed.

The move brings an end to a dramatic takeover tussle that has shaken the navigation business to its core and fueled surges in the stock prices of takeover targets Navteq and Netherlands-based Tele Atlas. Though it has lost the bidding battle over Tele Atlas, Garmin sure looked like a winner to investors. It already buys about 98% of its mapping data from Navteq, so the extension of the current agreement lets it proceed without missing an operational beat. Garmin's plan for acquiring Tele Atlas included a transition period that would have lasted as long as two years."

How did they do in the latest quarter?

On October 31, 2007, Garmin reported 3rd quarter 2007 results. Total revenue came in at $729 million, up 79% from $408 million in the third quarter of 2006. Net income (GAAP) came in at $193.5 million, up sharply from $123.0 million in the same quarter last year. Diluted earnings per share climbed 57% to $.88/share from $.56/share last year.

The company beat estimates on earnings which had been expected to come in at $.82/share, and instead came in at $.88/share. The company also raised 2007 guidance to $3.40/share from prior forecast of $3.15/share. Also it raised revenue guidance for 2007 to more than $2.9 billion from prior guidance of 'at least $2.8 billion'.

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on GRMN, we can see a phenomenal picture of rapid and steady revenue growth from $465 million in 2002 to $1.77 billion in 2006 and $2.25 billion in the trailing twelve months (TTM). Earnings during this period have also grown rapidly from $.70/share in 2002 to $2.40/share in 2006 and $3.00 in the TTM. The company initiated dividends at $.30/share in 2004, raised them to $.50/share in 2006 and up to $1.30/share in the TTM. Meanwhile, shares outstanding have been very stable at 216 million in 2005, 217 million in 2006 and a drop to 216 million in the TTM.

Free cash flow has been positive and growing rapidly with $131 million in 2004 increasing to $269 million in 2006 and up to $473 million in the TTM.

The balance sheet is gorgeous with $668 million in cash which alone could pay off all of the current liabilities of $428.2 million and the smallish $91.5 million in long-term liabilities combined. Calculating the current ratio, we have a total of $1,689 million in total current assets compared to current liabilities of $428.2 million, yielding a current ratio of 3.94.

What about some valuation numbers?

Reviewing Yahoo "Key Statistics" on Garmin (GRMN), we can see that this is a large cap stock with a market capitalization of $21.15 billion. The trailing p/e is a moderate 29.37 with a forward p/e (fye 30-Dec-08) estimated at 22.57. The PEG ratio is a very reasonable 1.15.

In terms of valuation, the company is richly priced, with a Price/Sales (TTM) ratio of 8.20 compared to an industry average of 1.62, according to the Fidelity.com eresearch website. However, the Fidelity website also reports that the company is extremely profitable relative to its peers with a Return on Equity (TTM) of 40.65% compared to the industry average of 12.27%.

Returning to Yahoo, we can see that there are 216.88 million shares outstanding with 102.91 million that float. As of 10/26/07, there were 5.80 million shares out short, but owing to the large daily volume, this works out to only a 1.2 day 'short ratio'.

As noted above, the company is paying a dividend, which per Yahoo works out to $.75/share yielding .9%. The last stock split was a 2:1 split, as I mentioned above, on August 16, 2006.

What about the chart?

Looking at the StockCharts.com 'point & figure' chart on Garmin, we can see that the stock has moved sharply higher this past year with an increase from $44 in December, 2006, to a recent high of $124 in October, 2007. With concerns about the Navteq purchase by Nokia, and the recent acquisition attempt by the company, the stock price dropped to as low as $81 in November, 2007. With the removal of the acquisition attempt, and the contractual arrangements to obtain the Navteq data, the stock moved sharply higher yesterday, and is close to clearing the recent 'resistance line'. I am comfortable with the chart in light of all of the news.

Summary: What do I think about this stock?

I like this stock a lot! I do not own any shares but if I had the opportunity, I would be buying shares. To review, they recently dropped an acquisition attempt which generally helps an acquiring stock which otherwise might have its stock depressed in price. In addition, concerns about one of their suppliers being acquired (Navteq) is now resolved for the immediate future. They reported a terrific earnings report which beat estimates and they raised guidance. Their long-term report is impeccable with steady revenue and earnings growth, an increasing dividend, and a stable outstanding shares count.

Free cash flow is solid and growing and the balance sheet is very solid.

Valuation-wise, the p/e isn't bad in light of the fast growth reported resulting in a PEG ratio just over 1. Price/sales works out rich but the Return on Equity is impressive.

I guess I just like this stock!

Anyhow, that's a wrap for this week! Thanks so much for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. I cannot always answer all of the email I get, but I do read all of my mail and try to get around to commenting on all of the correspondence I receive!

If you get a chance, be sure and visit my podcast website. I shall try to post a new podcast this weekend if I get a chance :). Also, be sure and visit my Covestor page where my actual trading portfolio is analyzed and compared to other investors. In addition, my SocialPicks page reviews all of my 'stock picks' and keeps track of their performance.

Thanks again for visiting! Be sure and have a wonderful weekend.

Bob

Posted by bobsadviceforstocks at 5:32 PM CST

|

Post Comment |

Permalink

Updated: Sunday, 18 November 2007 9:58 PM CST

Tuesday, 13 November 2007

Fossil (FOSL) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

What a difference a day makes! After four days of a steadily deteriorating Dow, it was nice to see the indices move higher today on what appeared to be a little better earnings than expected from Wal-Mart! Not that I own any shares of Wal-Mart at this time, although my kids each own about 5 shares from their grandparents. I also should have known that once I wrote about 'what to do in a declining market' it would be close to the end of at least that leg of the correction. Let's see what tomorrow brings!

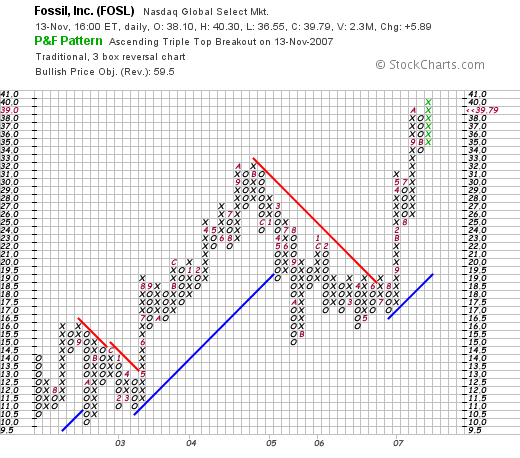

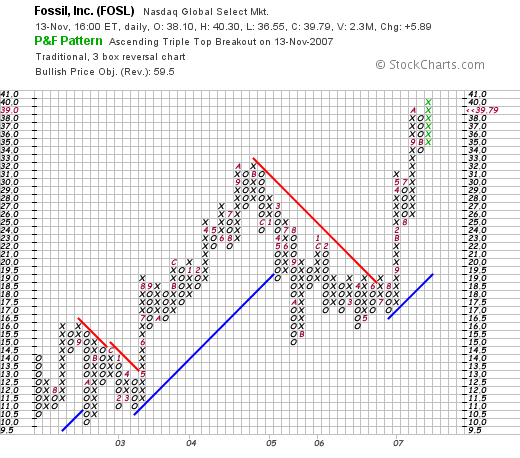

I had a little time this evening and wanted to see if I could find something to discuss on the blog. Looking through the list of top % gainers on the NASDAQ today, I saw that Fossil (FOSL) had made the list. I do not own any shares of FOSL nor do I have any options on this stock. Fossil closed at $39.79, up $5.89 or 17.37% on the day.

I had a little time this evening and wanted to see if I could find something to discuss on the blog. Looking through the list of top % gainers on the NASDAQ today, I saw that Fossil (FOSL) had made the list. I do not own any shares of FOSL nor do I have any options on this stock. Fossil closed at $39.79, up $5.89 or 17.37% on the day.

FOSSIL (FOSL) IS RATED A BUY

I call this entry a 'revisit' because Fossil is what I like to call an 'old favorite' of mine on this blog. I first wrote up Fossil on November 11, 2003, about six months after I started writing on this website when the stock was trading at $28.42. The stock split only once since that write-up, splitting 3:2 on April 12, 2004, giving me an effective 'pick price' of only $18.95. With FOSL closing at $39.79, this means a stock price appreciation of $20.84 or 110% since posting.

What exactly does this company do?

According to the Yahoo "Profile" on Fossil (FOSL), the company

According to the Yahoo "Profile" on Fossil (FOSL), the company

"...engages in the design, development, marketing, and distribution of fashion accessories, including apparel, belts, handbags, jewelry, small leather goods, sunglasses, and watches under proprietary and licensed brand names worldwide. The company offers a line of fashion watches under its proprietary brands, such as FOSSIL, MICHELE, RELIC, and ZODIAC; and pursuant to license agreements, under some prestigious brands, such as ADIDAS, BURBERRY, DIESEL, DKNY, EMPORIO ARMANI, MARC BY MARC JACOBS, and MICHAEL Michael Kors."

How did they do in the latest quarter?

As is often the case on this blog, it was the annoncement of earnings that drove the stock higher in trading today. In fact, the company reported 3rd quarter 2007 results today. Net sales for the quarter came in at $358.6 million, up 19.6% from $299.7 million in the same quarter last year. Net income soared 41.4% to $30.5 million, compared to net income last year of $21.5 million. Diluted eps grew 38.7% to $.43/share from $.31/share last year.

The company beat expectations for both earnings and revenue. Earnings were expected according to analysts polled by Thomson Financial to come in at $.43/share on revenue of $343 million. In addition the company raised guidance for 2007 to $1.67/share--analysts are currently expecting profit of $1.58/share.

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on Fossil, we can see the steady picture of revenue growth from $663 million in 2002 to $1.2 billion in 2006 and $1.3 billion in the TTM. Earnings/share have also steadily improved from $.80/share in 2002 to $1.10/share in 2006 and $1.40/share in the trailing twelve months (TTM). Interestingly, the outstanding shares which were 69 millon in 2002, are actually at 67 million in the latest twelve months.

Adding to this share reduction was the announcement today that the company planned to buy back up to 2 million additional shares.

Free cash flow, which did dip from $53 million to a negative $(19) million between 2004 and 2005, improved to $98 million in 2006 and a stronger $138 million in the TTM.

The balance sheet appears solid with $170 million in cash and $467 million in other current assets. This total of $637 million, when compared to the $204.6 million of current liabilities yields a current ratio of over 3. In addition, the company has a very nominal level of long-term liabilities reported by Morningstar to be at $60.8 million.

What about some valuation numbers?

Reviewing Yahoo "Key Statistics" on Fossil, we find that the company is a mid-cap stock with a market capitalization of $2.71 billion. The trailing p/e is a moderate 28.61 with a forward p/e of 19.99. The PEG is a very reasonable (imho) level of 1.12.

Looking at the Fidelity.com eresearch website, we find that the Price/Sales (TTM) for FOSL comes in at a nice 1.77, compared to the industry average of 2.64. In terms of Return on Equity (TTM), the company doesn't come in quite as nice compared to other companies in the same industry with a figure of 15.78% vs. the industry average of 23.71%.

Finishing up with Yahoo, there are 68.14 million shares outstanding with 41.55 million that float. Currently there are 4.16 million shares out short as of 10/10/07, giving a short ratio of 8.4 trading days of average volume. Using my own idiosyncratic '3 day rule' this does appear to be a significant short interest and may well have contributed to the sharp run-up today in the face of good news that exceeded expectations.

No dividends are reported, and as I noted above, the stock last split 4/12/04 with a 3:2 stock split.

Summary: What do I think?

Well, I liked this stock back in 2003, and I still like it in 2007! I just haven't had the opportunity to buy shares :(. I see so many stocks I like and there are only a few that I can buy.

They reported great earnings, beat expectations, raised guidance, and announced a share buy-back! In addition, they have been steadily growing their company over the past five years while actually decreasing the outstanding shares. The stock chart looks strong, the balance sheet is pristine, and they even have a 'Peter Lynch' appeal, with a product that is well known and visible in malls across the country.

Thanks again for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Be sure to try and visit my podcast site, my Covestor page and my SocialPicks page! Each serve different purposes and you might enjoy listening to me discuss some of these same stocks, reading about how my actual trading account is doing (Covestor) and review an analysis of my stock picks this past year (SocialPicks).

Regards to all of my friends and readers!

Bob

Posted by bobsadviceforstocks at 6:26 PM CST

|

Post Comment |

Permalink

Updated: Tuesday, 13 November 2007 9:46 PM CST

Monday, 12 November 2007

Some Thoughts about Difficult Markets---Revisiting Trading Philosophy

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I have missed another 'Weekend Review'. We shall get to it next week. But while looking through my past entries during the week of May 15, 2006, I came across an entry that I wrote back at that time which seemed to be a difficult trading environment. What I wrote then still holds true. Here is that entry:

Wednesday, 17 May 2006

Maintaining Trading Discipline in a Declining Market

One of my greatest challenges as an investor is knowing how to deal with market declines and investment losses. One would like to have something automatic like this

Rube Goldberg machine.

In other words, to have a trading system that will diminish your losses in a bear market and maximize your gains in a bull market.

Too often we find our emotions working against our own best interests. When investments decline we rationalize the losses and defer the realization implicit in a sale of holdings at a price below their cost. This exposes our investments to greater losses and delays the eventual 'day of reckoning'.

In the same fashion, as stocks move higher, our greed overcomes our rational thoughts and we delay realizing some of the gains by selling a portion of the holding, and instead allow our dreams of larger and greater profits override our need to 'lock-in' some gains with a sale.

Within every successful trading system there should be a method of avoiding the problem of compounding one's losses while at the same time encouraging the compounding of gains. In other words, when investments within a portfolio develop losses, they should be sold at a predetermined price point and the proceeds from such sales should not be re-invested; instead, the proceeds should be kept in cash to be re-invested when an appropriate buy signal occurs.

In the same fashion, when stocks are sold on 'good news' events, such as price appreciation, this should also be considered a bullish indicator and the proceeds from such good news sales should be re-invested in a new stock position.

I have expressed this strategy as being hardest on declining stocks that are sold completely and quickly on developing losses, and easiest on gaining stocks which are on the other hand sold slowly and partially as they appreciate in price. This bias will also select for the strongest stocks within your portfolio.

A strategy with pre-determined sale points both on the upside and downside reduces trading stress as one simply needs to review the stock price to determine one's action. It is the requirement for arbitrary decisions that may lead to over-trading as well as under-trading of one's holdings.

No system can respond quickly enough to avoid all losses and lock in all gains. However, having a system that can move one's holdings back and forth from equities to cash and back again, should be helpful in the long-run in building one's assets by maximizing gains and minimizing losses.

Wishing my readers the very best of luck in dealing with the difficult investing environment we are all facing!

Bob

I dont know how the market is going to trade tomorrow. Certainly the Asian markets have been 'taking it on the chin' this evening. But where will the Dow close tomorrow? I simply don't know.

What I do know is that my stocks have predetermined sale points on the upside and the downside. And that I shall stay as much 'put' as possible before implementing any trades. I shall try to let my own portfolio dictate my trading and not my fears or hopes regarding stocks.

Wish me luck! Thanks again for dropping by! Good-luck trading tomorrow!

Bob

Friday, 9 November 2007

Yours Truly Gets Mentioned on 'Silicon Alley Insider'

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

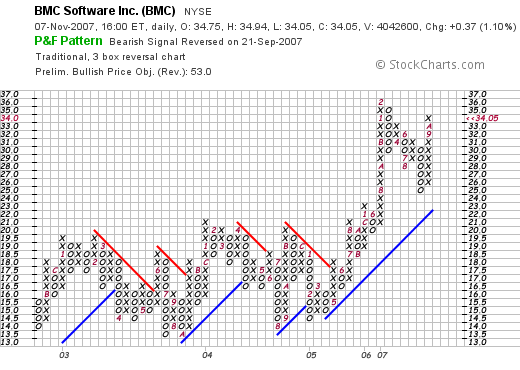

We have had a couple of really awful trading days in the market! I am sure you noticed. And I probably shouldn't have bought that BMC stock. Not that BMC is a bad selection but I am going to give myself a new rule. When I get a stock sale on bad news AND a sale on good news on the same day, the bad news wins if I am able to make that decision. That is, I knew I had a sale on bad news....so why should I go ahead and listen to that other signal. TOO risky. O.K. that's money under the bridge. Or as we say in Wisconsin....that money is already out of the barn.

Anyhow,

I got a nice mention on 'Silicon Alley Insider'. This is what they wrote:

Covestor's Amateurs Get To Gas On Like Pros

Covestor, the NYC/UK-based site that lets amateur stockpickers (like

Fred Wilson) show off their real-life portfolios, (Fred is rallying after a

slow start), is now letting them spout off at length: The company will highlight its top-performing members via an interview with

Wall Street Transcript, a monthly publication that normally interviews pros. The company also plans to distribute the interviews via

Investopedia, the stock education site purchased by Forbes Media earlier this year.

You can see the first example of the interviews, with Covestor star Robert Freedland,

here (pdf). "BobsAdvice" is trouncing the S&P, so it might well be worth paying attention to him. But boy, is that dense slug of text! We'd like an annotated version, please.

Now that's a nice mention.

It's a busy day for me and I have to run. But take a look at the article if you get a chance and visit

Covestor. Let me know if you need an invitation for a membership there as I have four more. One of you got one of my invites. I hope it is working out well for you. I love the place!

Bob

Wednesday, 7 November 2007

BMC Software (BMC) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Earlier today I wrote about how I sold a portion of my Harris (HRS) at a gain giving me the "permission slip" to add a new position. So I had a nickel in my pocket waiting to be spent! Now I know you are going to point out how the Dow is plunging (as I write it is down 360.92 points or a (2.64)% drop), and how the NASDAQ is also dropping (as I write it is down 76.42 points for a (2.70)% decline). But a nickel is a nickel. And in almost every market there are stocks that are moving higher for a reason.

Anyhow, that's my excuse :). Frankly, I just don't have any self-control!

BMC Software (BMC) was making the list of top % gainers on the NYSE. Of course, now it too is not as strong as earlier, and now, just before the close is trading at $34.12, up $.44 or 1.31% on the day. I went ahead and purchased 210 shares of BMC for my Trading account at $34.38.

I probably should have sat on my hands :).

BMC SOFTWARE (BMC) IS RATED A BUY

Very briefly, yesterday after the close of trading BMC announced 2nd quarter 2008 results. Earnings for the quarter came in at $78 million or $.39/diluted share, ahead of last year's $58 million or $.28/share last year. Non-GAAP earnings, taking out special one-time items, were even higher. Revenue for the quarter came in at $421 million, up 9% over last year's results. More importantly perhaps, the company beat expectations. And they also raised guidance. These are all important factors and it is rather impressive that BMC was able to advance at all in such a broad correction as we experienced today.

Longer-term, the Morningstar.com "5-Yr Restated" financials on BMC look strong with especially impressive revenue growth the past four years, increasing earnings, and actually decreasing outstanding shares. Free cash flow is solidly positive and balance sheet appears strong.

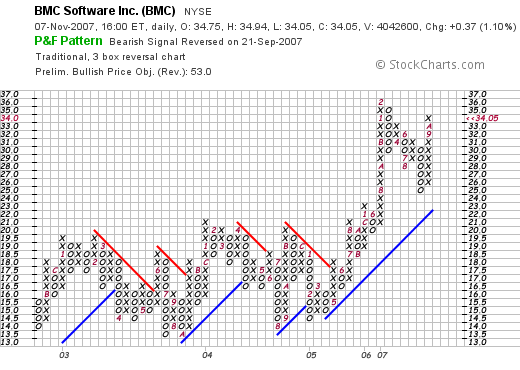

Finally, the "point & figure" chart on BMC from StockCharts.com appears reasonably strong without appearing over-extended.

So maybe I shouldn't have bought anything today. But then again, just like when I sell a stock I don't really feel like selling when everything is moving higher, if I have a signal to buy, well, I guess I should be buying when I have a signal. And BMC seemed to fit the bill. Wish me luck!

Thanks again for dropping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and drop by my Covestor Page or visit my SocialPicks Page where all of my picks are reviewed!

Bob

Harris (HRS) and U.S. Global Investors (GROW) "Trading Transparency"

Hello Frineds! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Earlier today I made two trades in my Trading Account that I wanted to keep you updated on. Both of these trades are examples of my investment strategy that defines my portfolio management approach.

First trade was Harris Corporation (HRS), which hit a sale point on appreciation yesterday to a 30% appreciation level. As you may recall, I have targeted appreciation levels which are set at 30, 60, 90, 120, then 180, 240, 300, 360, and 450%, etc. When a stock hits these levels, I sell 1/7th of my holding and use this sale on 'good news' as a signal to add a new position (assuming I am not already at my maximum 20 position portfolio size).

I sold 17 shares of HRS, representing 1/7th of 120 shares of the stock, earlier today at $65.81. My shares in Harris Corporation were originally purchased 1/31/07, at a cost basis of $50.05. Thus, at $65.81, this represented a gain of $15.76 or 31.5% since my original purchase. Since I am under 20 positions, this entitled me or gave me a "permission slip" to add a new position.

When would I sell Harris (HRS) next? Well, being optimistic, if the stock should rise to a 60% appreciation level or 1.60 x $50.05 = $80.08, then I would be selling 1/7th of my 103 shares or 16 shares at that level. On the downside, after a single sale at a 30% appreciation level (much like what happened with my WWW shares), if the stock should decline to break-even, then ALL remaining shares are sold.

HARRIS (HRS) IS RATED A BUY

The other sale today was my sale of my shares of U.S. Global Investors (GROW). In this particular case, I sold ALL of my shares which worked out to a sale of 245 shares at $19.7101. These shares had been purchased recently, in fact they were purchased 10/10/07 at a cost basis of $21.27. Thus, I had a loss of $(1.56) or (7.3)% since purchase. I initiated the sale when the stock was at a loss of (8)%.

U.S. GLOBAL INVESTORS (GROW) IS RATED A HOLD

I have reduced my rating on GROW to "hold" because nothing fundamental has changed. However, my own sale was due to a technical price change and nothing fundamental that I have determined.

The question arises is what I should do with the proceeds of these two sales. My sale of HRS entitles me to buy a new position, and my sale of GROW requires me to 'sit on my hands' with the proceeds. I shall be doing both. That is, I shall look for a new position based on my HRS sale. However, I shall not be replacing my GROW position with a new position. I hope that makes sense :).

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my podcast website (I shall need to get a new program up ASAP), consider visiting my Covestor page where all of my trades and my trading portfolio performance is evaluated and monitored, and my Social Picks page where all of my stock picks since the beginning of the year are recorded and also monitored.

Bob

Tuesday, 6 November 2007

K-Tron (KTII) "A reader suggests a stock pick!"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I have the good fortune of having a bunch of great readers of my blog who also are often the source of terrific ideas. After having explained what I think makes a great stock, they are quick to bring some of the best ideas on this website to my attention.

I have the good fortune of having a bunch of great readers of my blog who also are often the source of terrific ideas. After having explained what I think makes a great stock, they are quick to bring some of the best ideas on this website to my attention.

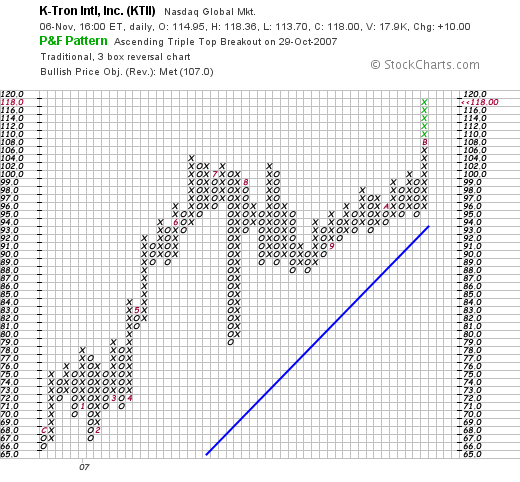

Doug S. has to be given credit for K-Tron (KTII). Earlier today he wrote:

"Fwd: K-Tron Reports Best Third Quarter and First Nine Months in its History, with Record Revenues, Net Income and Earnings Per Share in Both Periods" He commented: "This might hit your % gainers list today!"

Well Doug it did! In fact K-Tron closed at $118, up $10.00 or 9.26% on the day, making the top % gainers list on the NASDAQ! I do not own any shares or have any options on this stock. I do not know if Doug has a position or not at this time.

K-TRON (KTII) IS RATED A BUY

Let me briefly review some of the things that brought Doug to this decision and why I agree that this stock belongs on my blog.

As Doug pointed out, K-Tron (KTII) reported 3rd quarter 2007 results after the close of trading yesterday. Net income for the quarter was $4.93 million, up 80.1% from the $2.74 million reported in the same period last year. Revenues for the period climbed 38.1% to $48.17 million from $34.9 million last year.

As Doug pointed out, K-Tron (KTII) reported 3rd quarter 2007 results after the close of trading yesterday. Net income for the quarter was $4.93 million, up 80.1% from the $2.74 million reported in the same period last year. Revenues for the period climbed 38.1% to $48.17 million from $34.9 million last year.

Longer-term, the Morningstar.com "5-Yr Restated" financials is solid, with steady revenue growth, steady earnings growth, and a stable number of shares (only 3 million).

Free cash flow has been positive and growing and the balance sheet is solid.

Looking at Yahoo "Key Statistics" we see that this is a small cap company with a market cap of only $318.01 million. The trailing p/e is a reasonabvle 19.33, Price/Sales is 1.68, and Price/Book is 3.68.

There are 2.7 million shares outstanding with only 1.84 million that float. As of 10/10/07, there were 5,180 shares out short representing 1.3 trading days of volume, not a very significant level imho.

No dividend is paid and no stock splits are reported.

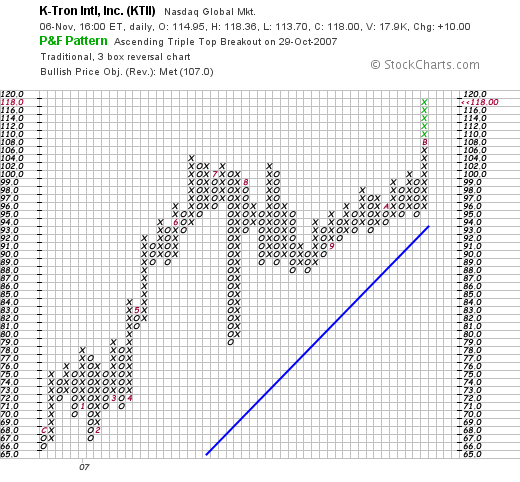

Finally, looking at the 'point & figure' chart on KTII from StockCharts.com, we can see a fairly healthy appreciation of the stock price except for a sharp dip in July, 2007, when the stock fell from $102 to a low of $79. Recently, the stock has moved into new high territory closing today at $118.

In summary, I think that Doug has once again brought a great stock to my attention. Thank you Doug! The company had a terrific quarterly report, their Morningstar.com page is great and the chart looks just fine. On the downside, there are less than 3 million shares outstanding. This adds to the volatility but if they continue to report strong results, this is likely to be on the upside.

Thanks again for stopping by and visiting! With a special 'thank-you' to Doug for writing and suggesting this stock. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Hologic (HOLX) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website!

Hologic (HOLX) is an old favorite of mine. I last reviewed the stock on July 25, 2006. I have been an owner of shares in the past and my stock club has also owned shares at times. In fact, Hologic was the purchaser of Cytyc (CYTC) a stock that was a terrific performer. Cytyc went higher and HOLX the other way leading to a sale as I recall the sequence of events.

Today, just prior to the opening of trading, Hologic announced 4th quarter 2007 results for the quarter ended September 29, 2007. Revenue for the quarter came in at $202.5 million, a 31% increase compared to the $154.1 million in the same quarter last year. Net income was even nicer, coming in at $32.1 million or $.58/share, compared to a net loss of $(1.5) million or $(.03)/share.

The company beat expectations of $.53/share and revenue figures of $198.8 million.

HOLOGIC (HOLX) IS RATED A BUY

However, what did the street do to the stock?

In the usual over-reaction of buying on expectations and selling on the news, the street took Hologic stock apart. The stock traded as low as $59.45 today, down almost $8 from yesterday's close near $67.

With the apparently irrational move, I chose to break all of my rules and bought and sold 400 shares of HOLX today. I purchased 400 shares of HOLX at $62.9799 earlier today, and then later today with the stock moving higher, sold my 400 shares at $63.97. I guess I made my point.

I do not own any shares of HOLX as I write. The trade is done.

This isn't really my strategy of disciplined buying and selling, but once in awhile, you know what I mean, sometimes a person just has to use his/her brains and get it right. Without a buy signal and without the appropriate characteristics to add the stock into my trading account, this still represents just a trade and me 'breaking all of my rules.'

Anyhow, that's the update! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Monday, 5 November 2007

Wolverine World Wide (WWW) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As part of this weblog, I like to keep my readers informed of any actual trades in my trading account. (You can also visit my Covestor Page where my trades are regularly updated.) A little earlier this morning I sold my 200 shares of Wolverine World Wide (WWW) at a price of $23.43. My shares of WWW were purchased last year on 4/19/06 at a cost basis of $23.55. Thus, I had a loss of $(.12)/share or (.5)% since purchase.

Why did I sell?

This sale was triggered by the stock passing a 'break-even' level. Previously, on 1/31/07, I sold 40 shares of my original 240 share position when the stock was at $30.57 which represented a 1/6th sale (I am now at 1/7th sales), at a gain of $7.02 or 29.8%. This is part of my strategy of selling at a 30% gain a portion of my holding.

As part of my strategy, after a single partial sale at the first sale point of 30%, I move my acceptable loss from (8)% to break-even. And this is exactly what happened to Wolverine World Wide (WWW).

Since I am selling my own shares of Wolverine World Wide, even though it is on what I would call a 'technical' basis, I shall be reducing my rating on the stock.

WOLVERINE WORLD WIDE (WWW) IS RATED A HOLD

I say 'hold' instead of 'sell' not because I am speaking in some sort of code, but rather because the Morningstar.com '5-Yr Restated' financials on WWW are still intact, and the latest quarterly report was strong and beat expectations, and the company raised guidance.

With this sale on 'bad news', I am now down to 14 positions and 'sitting on my hands' with the proceeds' That is, my idiosyncratic system requires me to avoid reinvesting funds received from sales on losses. My system is telling me that the market is weak (do I need a system to tell me THAT?), and I am waiting for a sale on a gain as a signal to do some buying!

Thanks again for dropping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, stop by and visit my Podcast Website where I have several 'shows' available discussing stocks from my blog and portfolio, my SocialPicks Page where all of my picks from the last year are assessed and my performance analyzed, and my Covestor Page where Covestor is reviewing the performance of my actual trading portfolio!

Have a great day regardless of the direction of the Dow!

Bob

Newer | Latest | Older

On May 16, 2006 I posted FactSet Research (FDS) on Stock Picks Bob's Advice when the stock was trading at $46.23. FDS closed at $64.10 on November 16, 2007, for a gain of $17.87 or 38.7%.

On May 16, 2006 I posted FactSet Research (FDS) on Stock Picks Bob's Advice when the stock was trading at $46.23. FDS closed at $64.10 on November 16, 2007, for a gain of $17.87 or 38.7%. On September 25, 2007, FDS reported 4th quarter 2007 results. Revenues climbed 23.1% to $129.5 million from $105.2 million the prior year same period. Net income rose 31% to $30.7 million from $23.4 million the prior year. On a diluted earnings per share basis this worked out to $.60/share this year compared to $.46/share last year a 30.4% increase.

On September 25, 2007, FDS reported 4th quarter 2007 results. Revenues climbed 23.1% to $129.5 million from $105.2 million the prior year same period. Net income rose 31% to $30.7 million from $23.4 million the prior year. On a diluted earnings per share basis this worked out to $.60/share this year compared to $.46/share last year a 30.4% increase.

On May 20, 2006 I posted Eagle Materials (EXP) on Stock Picks Bob's Advice when the stock was trading at $52.21. EXP closed at $36.99 on November 16, 2007, for an effective loss of $(15.22) or (29.2)% since posting.

On May 20, 2006 I posted Eagle Materials (EXP) on Stock Picks Bob's Advice when the stock was trading at $52.21. EXP closed at $36.99 on November 16, 2007, for an effective loss of $(15.22) or (29.2)% since posting. On October 22, 2007, Eagle Materials (EXP) reported 2nd quarter 2008 results. Revenue for the quarter ended September 30, 2007, came in at $210.5 millon, down 18% from the same quarter last year. Net earnings came in at $34.8 million, down 47% for the same period. On a per share basis, this worked out to $.73/share this year, down 44% from the $1.32/share reported last year.

On October 22, 2007, Eagle Materials (EXP) reported 2nd quarter 2008 results. Revenue for the quarter ended September 30, 2007, came in at $210.5 millon, down 18% from the same quarter last year. Net earnings came in at $34.8 million, down 47% for the same period. On a per share basis, this worked out to $.73/share this year, down 44% from the $1.32/share reported last year.

According to the

According to the

I had a little time this evening and wanted to see if I could find something to discuss on the blog. Looking through the

I had a little time this evening and wanted to see if I could find something to discuss on the blog. Looking through the

According to the

According to the

I have the good fortune of having a bunch of great readers of my blog who also are often the source of terrific ideas. After having explained what I think makes a great stock, they are quick to bring some of the best ideas on this website to my attention.

I have the good fortune of having a bunch of great readers of my blog who also are often the source of terrific ideas. After having explained what I think makes a great stock, they are quick to bring some of the best ideas on this website to my attention. As Doug pointed out, K-Tron (KTII) reported

As Doug pointed out, K-Tron (KTII) reported