Stock Picks Bob's Advice

Thursday, 1 May 2008

Heartland Payment Systems (HPY)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I want to try once again to make this a brief entry. I used to be able to write up these stocks in a paragraph, and lately, I have been writing up long entries explaining a 'pick'.

I want to try once again to make this a brief entry. I used to be able to write up these stocks in a paragraph, and lately, I have been writing up long entries explaining a 'pick'.

Heartland Payment Systems (HPY) made the list of top % gainers on the NYSE today and is currently trading at $24.32, up $2.42 or 11.05% on the day. I do not own any shares nor do I have any options on this stock.

Let me briefly go through this stock and explain why

HEARTLAND PAYMENT SYSTEMS (HPY) IS RATED A BUY

First of all, according to the Yahoo "Profile" on Heartland, the company

First of all, according to the Yahoo "Profile" on Heartland, the company

"...together with its subsidiaries, provides bank card payment processing services to merchants in the United States. Its services involve facilitating the exchange of information and funds between merchants and cardholders' financial institutions; and providing end-to-end electronic payment processing services to merchants, including merchant set-up and training, transaction authorization and electronic draft capture, clearing and settlement, merchant accounting, merchant assistance and support, and risk management. "

Regarding the latest quarter, it was the announcement of 1st quarter 2008 results today, prior to the opening of trading, that drove the stock higher. Total revenues for the quarter came in at $340 million, up 19.5% compared to the $284 million reported in the same year-earlier period.

Net income was $9.0 million, compared to $6.9 million last year and earnings/diluted share worked out to $.23/share, up from $.17/share last year.

The company beat expectations on the revenue and earnings side which, according to analysts polled by Thomson Financial, had been expected to come in at $.21/share on $333 million of revenue.

Longer-term, reviewing the Morningstar.com "5-yr Restated" on Heartland, we can see the steady revenue growth from $422 million in 2003 to $1.3 billion in 2007. Earnings growth has been less steady, dipping from $.62/share in 2003 to $.26/share in 2004, before rebounding steadily to $.90/share in 2007. The company initiated dividends in 2006 paying $.05/share, and increased that payment to $.25/share in 2007. Free cash flow has improved from a negative $(38) million in 2005 to $38 million in 2007.

The balance sheet appears solid with $36 million in cash and $163 million in other current assets which easily covers the $136 million in current liabilities as well as the $27.5 million in long-term liabilities reported on Morningstar.

Using Morningstar for a few Statistics, HYP has a p/e of 24.3 (industry average of 21.5), Price/Book of 4.9 (Industry average of 5.0) and a Price/Sales of 0.7 (Industry average of 3.2). The company is selling at 12.1x free cash flow, vs the industry average of 19.0 and yields 1.3% the same as the industry average.

The forward price/earnings is reported on Morningstar as 15.6 below the industry average of 18.5 and the company has a great PEG ratio of 0.7 vs the industry average of 1.3. The "PEG Payback" is 6.4 years, vs the industry average of 8.6 years.

Finally, Yahoo "Key Statistics" on HPY shows the company with 37.27 million shares outstanding with 21.88 million that float. There were 3.03 million shares out short as of 4/10/08, representing 11.2% of the float o4 a short ratio of 15 trading days. Using my own 3 day rule for short interest, this is quite significant and we may well be witnessing a bit of a squeeze today.

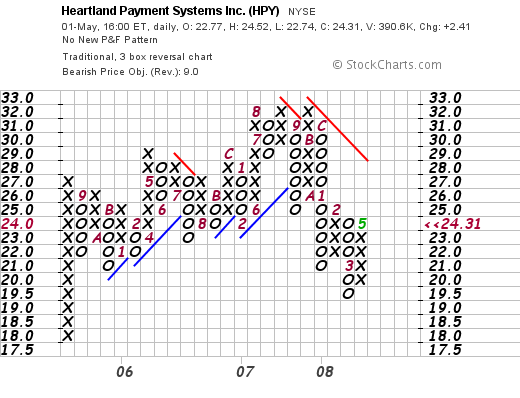

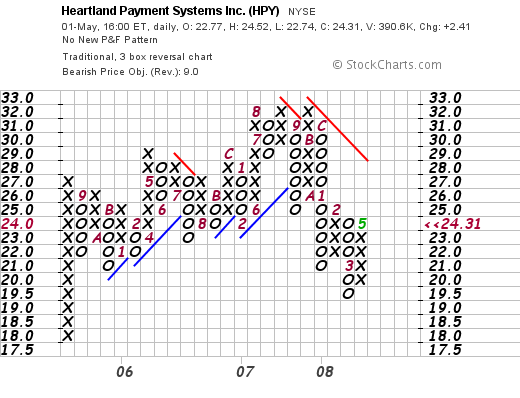

Taking a look at a 'point & figure' chart on Heartland (HPY) from StockCharts.com, we can see a rather uninspiring technical picture, with the stock gradually appreciating from the $18 level back in August, 2005, to a high of $32 in November, 2007. The stock sold off back to $19.50 in March, 2008, only to rally through April into today's price of $24.31. This is not a very strong chart, yet certainly the stock is not overextended either!

To summarize, I like this stock more than I like its chart. They reported a terrific quarter that beat expectations on both revenue and earnings. Their longer-term record is solid and the valuation figures are very attractive with a PEG well under 1.0 and other indices either at or below industry averages.

Anyhow, that's a wrap! I would like to try to keep things briefer around here yet get the information across. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 12:54 PM CDT

|

Post Comment |

Permalink

Updated: Thursday, 1 May 2008 12:55 PM CDT

Sunday, 27 April 2008

"Looking Back One Year" A review of stock picks from the week of October 9, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It is Sunday, and although I do have about a million other things to be doing around the house, I wanted to try to get this review up so that I don't get another week behind!

As I have explained many times before, these reviews assume a buy and hold approach to investing. This means that my performance analysis assumes an investment of equal $'s into each of the stock picked that particular week and continued holding of that stock regardless of its price performance.

In practice, I advocate a disciplined investment strategy that requires me to sell stocks completely after targeted declines and sell portions of appreciating stocks at pre-determined appreciation targets. O.K. if that sounds too complicated you can listen to my podcast on this topic.

Last weekend I reviewed the picks from the week of October 2, 2006 from this blog. Going a week ahead, let's take a look at the three stocks picked during the week of October 9, 2006! Too keep these reviews as concise as possible, I shall try to examine 1) the price performance since selected, 2) the latest quarter result, 3) the Morningstar.com "5-Yr Restated" financials, and 4) the chart. I choose my "buy" and "hold" and "sell" ratings, based on these screens. I am also lately reluctant to rate anything a "sell" if the chart suggests that most of the damage has already done.

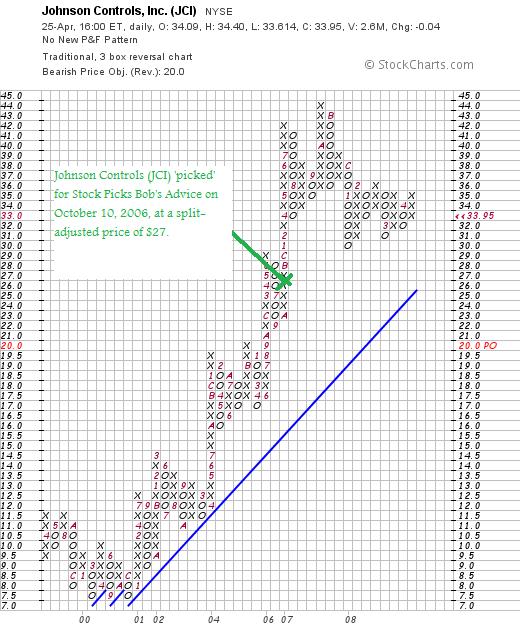

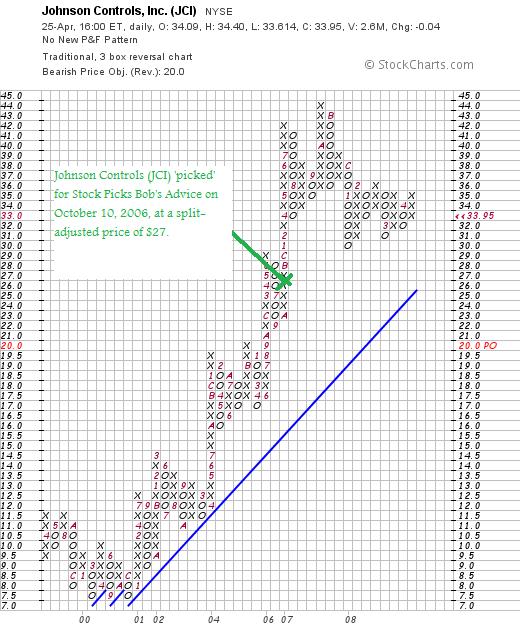

On October 10, 2006, I posted Johnson Controls (JCI) on Stock Picks Bob's Advice when the stock was trading at $81.00. JCI had a 3:1 stock split on October 3, 2007, making my effective 'pick price' actually $27. Johnson Controls closed April 25, 2008, at $33.95, giving this pick a gain of $6.95 or 25.7% since posting. I do not own any shares or options of JCI, but my wife has some shares in her IRA and my stock club own shares currently

On October 10, 2006, I posted Johnson Controls (JCI) on Stock Picks Bob's Advice when the stock was trading at $81.00. JCI had a 3:1 stock split on October 3, 2007, making my effective 'pick price' actually $27. Johnson Controls closed April 25, 2008, at $33.95, giving this pick a gain of $6.95 or 25.7% since posting. I do not own any shares or options of JCI, but my wife has some shares in her IRA and my stock club own shares currently

On April 16, 2008, Johnson Controls reported 2nd quarter 2008 results. For the quarter ended March 31, 2008, sales increased 11% to $9.4 billion from $8.5 billion last year. Net income came in at $289 million, up from $228 million last year. Diluted earnings per share grew to $.48/share from $.38/share. (Continuing operations earnings were $.48 vs. $.44/share last year).

This was a solid report that beat expectations. Analysts had expected $.47/share on revenue of $9.37 billion.

Review of the Morningstar.com "5-Yr Restated" financials on JCI shows continued steady revenue growth, earnings growth, dividend growth, stable shares outstanding increases, increasing free cash flow, and a satisfactory balance sheet.

Reviewing the 'point & figure' chart on JCI from StockCharts.com, we can see that while there has been some consolidation in the stock price from its recent high of $44/share, the stock appears quite strong and is trading well above the support line with recently demonstrating a series of higher lows.

JOHNSON CONTROLS (JCI) IS RATED A BUY

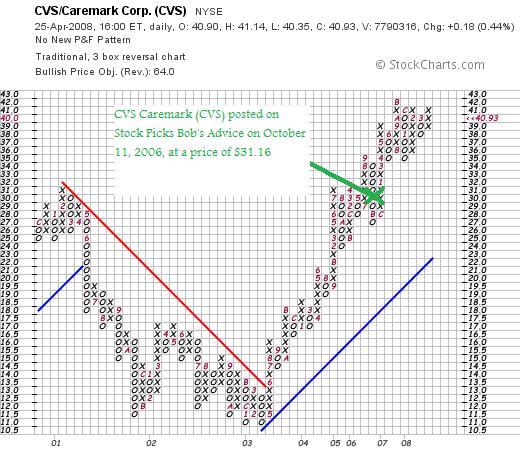

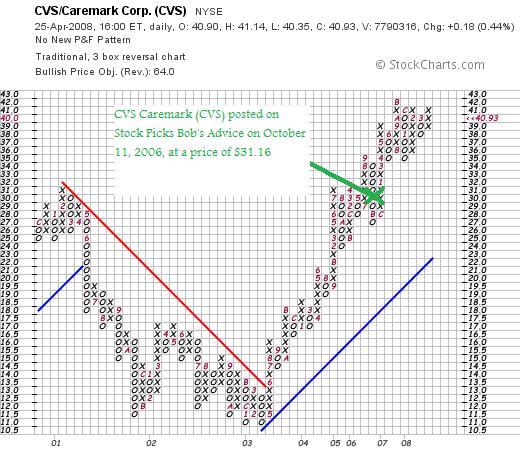

On October 11, 2006, I posted CVS Corp (CVS) on Stock Picks Bob's Advice when the stock was trading at $31.16/share. The following month, on November 2, 2006, CVS announced the pending acquisition of Caremark Rx Inc. in a $22.5 billion deal with the resulting company named CVS/Caremark (CVS). This acquisition was completed by March 23, 2007.

On October 11, 2006, I posted CVS Corp (CVS) on Stock Picks Bob's Advice when the stock was trading at $31.16/share. The following month, on November 2, 2006, CVS announced the pending acquisition of Caremark Rx Inc. in a $22.5 billion deal with the resulting company named CVS/Caremark (CVS). This acquisition was completed by March 23, 2007.

CVS Caremark (CVS) closed at $40.93 on April 25, 2008, giving this stock pick a gain of $9.77 or 31.4% since posting. I do not own any shares or options of this stock.

On January 31, 2008, CVS Caremark reported 4th quarter 2007 results. Revenue for the quarter increased 81% to $21.9 billion for the quarter ended December 29, 2007. This large increase was attributed to the Caremark purchase which closed in March, 2007. Earnings came in at $815 million or $.55/share, compared to $.417.2 million or $.49/share.

The company beat expectations by a penny as analysts polled by Thomson Financial had been expecting $.54/share. Within the report, the company noted that same-store sales increased 3.4% balanced evenly between pharmacy sales which increased 3.6% and front-end sales which grew 2.9%.

Looking at the Morningstar.com "5-Yr Restated" financials on CVS, we can see the large jump in sales in the last twelve months, the steady increase in earnings as well as dividends, but unfortunately there was a large increase in outstanding shares from 853 million in 2006 to 1.3 billion in 2007.

However, the company was able to increase per share amounts in spite of this increase and still post increasing free cash flow as well as show a satisfactory balance sheet with approximately $14 billion in current assets vs. $10.7 billion in current liabilities. The company does have $12.6 billion in long-term liabilities reported on Morningstar.

Examining the 'point & figure' chart on CVS from StockCharts.com, we can see that after declining between 2001 through 2002 from $31 to a low of $11 in late 2002, the company turned around and started moving steadily higher to a high of $42 in November, 2007. With the company trading at $40.93, the company is just about a dollar under its all-time high. The chart looks very strong to me.

CVS CAREMARK (CVS) IS RATED A BUY

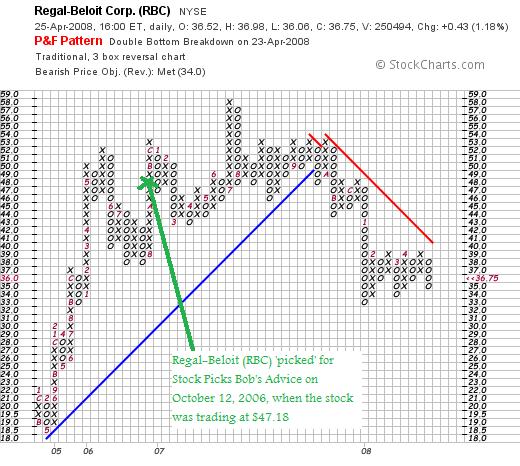

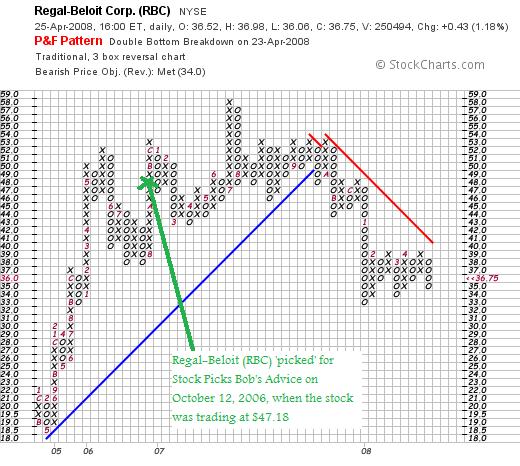

On October 12, 2006, I posted Regal-Beloit (RBC) on Stock Picks Bob's Advice when it was trading at $47.18. RBC closed at $36.75 on April 25, 2008, for a loss of $(10.43) or (22.1)% since posting. I do not own any shares or options of this stock.

On October 12, 2006, I posted Regal-Beloit (RBC) on Stock Picks Bob's Advice when it was trading at $47.18. RBC closed at $36.75 on April 25, 2008, for a loss of $(10.43) or (22.1)% since posting. I do not own any shares or options of this stock.

On February 6, 2008, Regal-Beloit (RBC) reported 4th quarter 2007 results for the quarter ended December 29, 2007. Net sales increased 29.5% to $474.7 million, from $366.6 million in the prior year same quarter. Diluted earnings per share increased 4.4% to $.71/share from $.68/share last year.

The company beat expectations on revenue which had been expected to come in at $461.2 million (the company reported $474.7 million) and met expectations of $.71/share according to analysts polled by Thomson Financial.

The company related that the residential market was difficult, likely reflecting the current slow-down in residential construction:

"The fourth quarter proved to be especially challenging. The combination of a weaker-than-expected fourth quarter residential heating, ventilating, and air conditioning (HVAC) market, the expected materials cost gap, and essentially no bottom line help from our new acquisitions, held back the margin and bottom line improvements that took place in our business," Chairman and Chief Executive Henry Knueppel said in a statement."

Looking longer-term, with the Morningstar.com "5-Yr Restated" financials on RBC, we can see an intact picture of steady revenue growth, steady earnings growth, steady dividend growth, relatively stable outstanding shares, increasing free cash flow, and a solid balance sheet with $730 million in current assets and $311.9 million in current liabilities. The company does have $692.3 million in long-term liabilities on the book reported by Morningstar.

Checking the 'point & figure' chart on Regal-Beloit (RBC), we can see the sell-off in shares starting in September, 2007, and continuing into 2008, although on the short-term, the company appears to have found some support in the $33 range with a series now of three consecutive higher lows short-term. I am not sure of the technical significance of the last observation. Certainly the stock has been under quite a bit of pressure and needs a lot of 'work' to get back on a bullish trend.

With the guarded performance the latest quarter, the continued weakness in housing and the economy, even though the company reported a good quarter, maintains a good Morningstar.com 5-Yr page, the chart looks discouraging. Thus,

REGAL-BELOIT (RBC) IS RATED A HOLD

So in summary, how did I do with these two stock picks? Well considering when I posted them and the difficult stock market since, well not that bad. Two showed gains and one a loss with an average of an 11.7% gain on these three stocks.

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

If you are interested, please feel free to visit my Covestor Page where you can review the performance and holdings of my actual trading portfolio, my SocialPicks Page where you can view an analysis of my picks for the past year-and-a-half, and my Podcast Page where you can download some mp3's and listen to me discuss some of the many stocks reviewed on this blog!

With my warmest wishes to you all! Wishing you a week full of good health and financial success!

Yours in investing,

Bob

Friday, 25 April 2008

A NEW Podcast for Trimble (TRMB)!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with our professional investment advisers prior to making any investment decisions based on information on this website.

I just wrote up Trimble (TRMB) on the blog.

Click HERE to listen to my podcast on Trimble!

Yours in investing!

Bob

Trimble Navigation (TRMB) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

The stock market has been acting a little bit healthier the last week or two. And it is nice to see 'our kind of stocks' moving higher and making the top % gainers list once more.

The stock market has been acting a little bit healthier the last week or two. And it is nice to see 'our kind of stocks' moving higher and making the top % gainers list once more.

In fact, reviewing the list of top % gainers on the Nasdaq today, I noticed that Trimble Navigation (TRMB), an 'old favorite' of mine, had made the list closing at $34.71, up $6.58 or 23.39% on the day. I do not own any shares nor do I have any options on this stock.

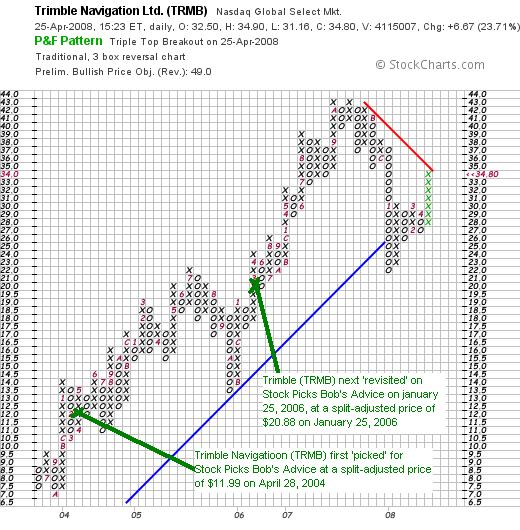

I say 'old favorite' because I first wrote up Trimble on Stock Picks Bob's Advice on April 28, 2004, when the stock was trading at $25.98, which adjusted for a 2:1 stock split on February 23, 2007, works out to a 'pick price' of $12.99. With TRMB closing at $34.72 today, this represents a gain of $21.73 or 167.3% since that original posting.

In addition to the write-up in 2004, I again visited Trimble (TRMB) on Stock Picks on January 25, 2006, when the stock was then trading at $41.76, which adjusted for the same 2:1 split in 2007, works out to a pick price of $20.88. Again, with the stock closing today at $34.72, this represents an appreciation of $13.84 or 66.3% since that pick!

So you can see that I didn't really want to hesitate about writing up this stock once again today!

Let's take a closer look at Trimble (TRMB) and I will explain why

TRIMBLE NAVIGATION (TRMB) IS RATED A BUY

First of all,

First of all,

What exactly do they do?

According to the Yahoo "Profile" on Trimble (TRMB), the company

"...provides advanced positioning product solutions to commercial and government users worldwide. It operates in four segments: Engineering and Construction, Field Solutions, Mobile Solutions, and Advanced Devices."

How did they do in the latest quarter?

Yesterday, after the close of trading, Trimble announced 1st quarter 2008 results. Revenue for the quarter ended March 28, 2008, came in at $355.3 million, up 24% over the revenue of $285.7 million in the first quarter of 2007.

Net income for the quarter was $40.1 million, up 40% compared to net income of $28.7 million in the same quarter last year. Diluted earnings per share worked out to $.32/share, up 35% from diluted eps of $.24/share in the first quarter of 2007.

Most importantly, the company beat expectations of $.35/share (they earned $.40/share excluding one-time items). Revenue had been expected to come in at $338.7 million and as noted above, they came in at $355.3 million.

To top off things, the company went ahead and raised guidance for 2nd quarter 2008. Analysts had been expecting revenue of $375.2 million and earnings of $.41/share. The company guided to revenue of $374 to $379 million in revenue and earnings between $.44 and $.46/share.

In my own idiosyncratic terminology, I like to call this a 'trifecta-plus' which for me means an earnings report of increasing earnings, greater revenue, that beats guidance and then the company raises guidance. Trimble delivered and the street responded in a very favorable fashion!

What about longer-term results?

Checking the Morningstar.com "5-Yr Restated" financials on TRMB, we can see that revenue has been steadily growing from $541 million in 2003 to $1.22 billion in 2007. During this period earnings have also been increasing from $.39/share to $.94/share. Outstanding shares have grown modestly from 100 million shares in 2003, they company increased the float by 24% to 124 million in 2007. During this same time, the sales increased more than 100% and earnings likewise increased greater than 100%. Thus, this is an acceptable dilution from my perspective.

Free cash flow the last several years has been positive and growing, increasing from $69 million in 2005 to $174 million in 2007. The balance sheet, as presented by Morningstar, appears solid. The company has $103 million in cash and another $453 million in other current assets. Comparing this to the $249.9 million in current liabilities yields a current ratio of 2.22.

What about some valuation numbers?

According to the Yahoo "Key Statistics" on Trimble (TRMB), the company is a mid cap stock with a market capitalization of $4.23 billion. The trailing p/e is a relatively rich 37.01, with a forward p/e of 20.41 (fye 28-Dec-09 estimated). Thus, with the rapid growth anticipated, the PEG comes in at a reasonable 1.12. (Reasonable for me is 1.0 to 1.5).

Referring to the Fidelity.com eresearch website, we can see that at least by the Price/Sales (TTM) ratio, TRMB is reasonably priced with a ratio of 2.77 compared to the industry average for Price/Sales (TTM) of 8.13. In terms of profitability, Fidelity reports TRMB with a Return on Equity (TTM) of 11.31, ahead of the industry average of 9.41%.

Yahoo reports that TRMB has 121.16 million shares outstanding with 120.19 million that float. As of 8/26/08, there were 5.64 million shares out short representing 7 trading days of volume (the short ratio), well ahead of my own idiosyncratic '3 day rule' for short interest. This short interest was ahead of the prior month's 4.78 million number and today's sharp move higher may well have been the result of short-sellers getting 'squeezed'.

No cash dividends are paid, and as I noted above, the last stock split was a 2:1 split on February 23, 2007.

What does the chart look like?

Reviewing the 'point & figure' chart on Trimble (TRMB) from StockCharts.com, we can see that this stock has not escaped the recent pressure on all stocks this year as it dipped from its high at $43/share set in October, 2007, to a recent low of $22 in January, 2008. With the stock now trading at $34.80, it is moving in on resistance area (the 'red line')---it would nice to see this stock break through this price area to confirm a new bullish move higher.

Summary: What do I think about this stock?

Well it would be corny to say I love this stock. I mean, my kids would say, 'if you love that stock, why don't you MARRY it?' O.K., so it isn't love, but how about intense affection?

They made a terrific move higher today. This is the third time it has come across my horizon the past four years!

Their earnings were great, they beat expectations and raised guidance. They have a long-term track record to 'write home about!' I mean, steady revenue growth, steady earnings growth, relatively stable outstanding shares, growing positive free cash flow and a strong balance sheet.

Valuation is a tad rich per p/e but the PEG suggests that even this isn't so bad! Meanwhile, the Price to Sales is less than its peers and the Return on Equity is greater! To top it off there were loads of shares out short and I suspect some of them are getting squeezed. Even the chart looks acceptable without being overvalued.

Now, if only I had purchased some shares. I still don't have a signal to be buying anything, but if I were....well this is the kind of stock that would be making itself home in my portfolio!

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where you can read about how my actual trading portfolio is performing, my SocialPicks page where you can see how my picks are doing from the past year or so, and my Podcast Page where if you haven't had enough of my discussions, you can download some mp3's of me talking about some of the many stocks I write up and answer emails from readers.

Have a great weekend everyone!

Yours in investing,

Bob

Wednesday, 23 April 2008

My Prosper.com Account: Update #3

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Like a "mad scientist", I am continuing my Prosper.com experiment of person-to-person lending. I am still not sure whether this 'experiment' will turn out to be profitable for me or not. And I hope that my own experience will help you decide whether it is worthwhile for you to be venturing into this world of group-lending in the pursuit of higher interest returns on your loans as well as the possibility of finding funds that you might wish to borrow as well for your own ventures.

Like a "mad scientist", I am continuing my Prosper.com experiment of person-to-person lending. I am still not sure whether this 'experiment' will turn out to be profitable for me or not. And I hope that my own experience will help you decide whether it is worthwhile for you to be venturing into this world of group-lending in the pursuit of higher interest returns on your loans as well as the possibility of finding funds that you might wish to borrow as well for your own ventures.

Last month, I wrote up "Update #2". Well, another month has passed, I have contributed some more funds to this account and the results remain mixed.

The background of interest in person-to-person lending stems from the fact that interest rates paid to investors on CD's at banks continue to remain quite low. As reported on CNN.com this past February:

"Since September the central bank has lowered the so-called Fed funds rate, which affects how much consumers pay on credit cards, home equity lines of credit and auto loans, five times from 5.25% to 3%.

As a result, consumers looking to park their cash no longer enjoy a wealth of high-yielding options.

A one-year certificate of deposit is yielding an average 2.75%, down from 3.76% in September, according to Bankrate.com.

Even banks that scored multitudes of new customers by offering online savings accounts with high yields are now scaling back on the sky-high rates they once offered.

The rate on EmigrantDirect's online savings accounts, which yielded 5.05% a year ago, has fallen to 4.05%. ING Direct has slashed the rates on its offering by more than a full percentage point to 3.40% from 4.50% a year ago, according to Bankrate.com."

At the same time, many borrowers are finding that their balances on credit cards are costing them record amounts of interest.

As recently reported:

"When Brenda Fishkin got the letter from Bank of America last month, she thought it might be a joke.

The bank said it planned to almost double the interest rate on her credit card, from about 13 percent to 24.99 percent. Fishkin, who is 60, couldn't figure out what she'd done to incur the higher rate. She had never been late on a credit card payment, had just refinanced her home at a lower interest rate and had just been rewarded by her credit union with a lower rate on her credit card there, she said.

"Trust me," said Fishkin, who lives with her husband in Dallas, N.C. "I wouldn't be aggravated if I were a late customer and I deserved it."

Fishkin's displeasure is shared by hundreds of people who started filling up online message boards recently with complaints that issuers, including industry leader Bank of America, hiked their credit card rates without explaining why."

So with interest paid to savers near record lows, and many people facing credit card debt at high rates of interest, it is not surprising that the internet should offer the opportunity of savers and borrowers alike to meet and do business. But will it be profitable for the average investor like myself? That remains to be seen.

So back to my loan portfolio.

As of April 23, 2008, I have 60 active loans. 55 are now current. 2 are less than 15 days late, 1 is 15 to 30 days late on a payment, 1 is 1 month late and in collections, and 1 is 2 months late and also in collections. Thus far, there have been no default. But it appears that at least one or two of these loans are certainly headed in that direction.

I have now lent out a total of $3,423.57. I have received loan payments totaling $406.98. My current value of my loans is $3,167.84, with an average interest rate of 15.57%. My daily interest accrual is $1.34. Net income totals (interest + fees + reward) $120.07, and as noted there have been not defaults.

I mention "rewards" above, and indeed I have received $75.00 in "rewards" from Prosper.com for referrals which works out to $25.00 awarded to me for sending a new lender to the website, and $25.00 which is actually given to that lender as well when he/she initiates a new loan. (You can earn this $25 and I earn $25 as well when you go to Prosper with the hyperlinks on this blog!)

To get a 'third party' evaluation of my loan portfolio performance, you can visit LendingStats.com and see how they rate my loans. Currently they are estimating, when all things are said and done, that I will be earning closer to 5.36% not the 15.57% when defaults are considered.

Of course when you participate in loans, you depend a lot on what people say about who they are and what they are going to do with the funds. The site of course does verify much of their financial information and rates the borrowers by their 'credit-worthiness'.

But the unknown information about potential borrowers still recalls the great cartoon from the New Yorker by Peter Steiner:

Thanks again for dropping by! I shall keep you posted on my Prosper.com account. The jury is out on whether this shall even be a profitable venture for me! Meanwhile, I continue to add my $50 twice a month to the account and utilize automatic bidding by "Portfolio Plans" to pick my loans I which to participate on.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 10:36 PM CDT

|

Post Comment |

Permalink

Updated: Wednesday, 23 April 2008 10:38 PM CDT

Monday, 21 April 2008

Ametek (AME)---A New Podcast Posted!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I got around to posting another podcast tonight, and if you would like to hear me discuss my Ametek (AME) pick, you can click

HERE

Thanks for dropping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

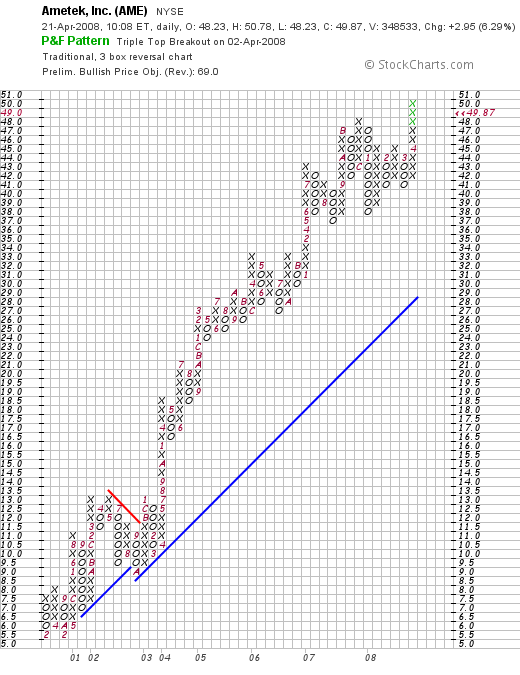

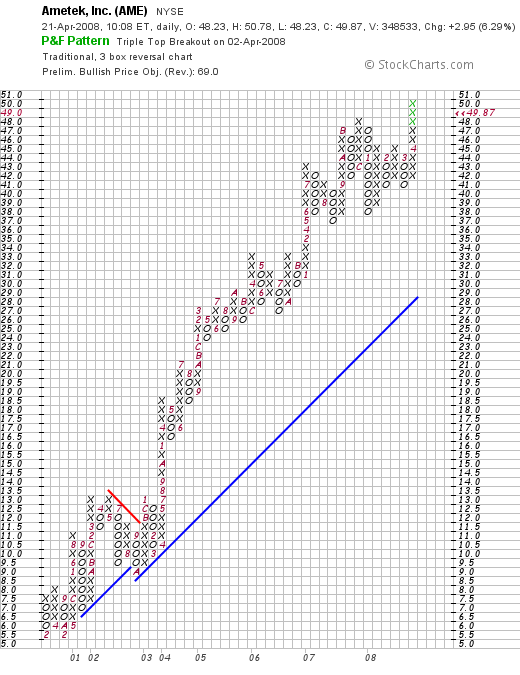

Ametek (AME) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I want to try to make this a brief post and get right to the point. (Is that possible for me?)

I want to try to make this a brief post and get right to the point. (Is that possible for me?)

O.K. here is the skinny:

AMETEK (AME) IS RATED A BUY

I do not own any shares or options on this stock. I first reviewed Ametek (AME) on this blog on January 25, 2007 when the stock was trading at $34.28. AME, as I write, is trading at $49.53, up $2.61 or 5.56% on the day, finding a place on the top % gainers of the NYSE.

I do not own any shares or options on this stock. I first reviewed Ametek (AME) on this blog on January 25, 2007 when the stock was trading at $34.28. AME, as I write, is trading at $49.53, up $2.61 or 5.56% on the day, finding a place on the top % gainers of the NYSE.

Ametek reported terrific first quarter 2008 results today before the open. They beat expectations and they increased guidance. A great day for announcements and the stock!

The "5-Yr Restated" financials are gorgeous. They even pay a dividend and are raising it regularly. Valuation is reasonable with a p/e at 23.47 and a PEG at 1.19.

Finally the chart looks terribly strong! What is there NOT to like?

O.K. that was the quick and dirty on Ametek (AME). I am usually far more verbose but I really wanted to get this one out and do it in brief.

Thanks for dropping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Sunday, 20 April 2008

NEW Podcast on Satyam (SAY) Posted!

Just a quick note to let all of you know that I got around to posting a new 'radio show' on Satyam (SAY) and if you would like to you can download this show

HERE

Have a great week ahead!

Yours in investing,

Bob

"Looking Back One Year" A review of stock picks from the week of October 2, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Last weekend, I reviewed the week of September 25, 2006. Going a week ahead, let's take a look at the week of October 2, 2006, a week in which I posted a single stock, Guess (GES).

These reviews all assume a 'buy and hold strategy' while in fact I advocate as well as employ a disciplined investment portfolio management strategy which requires to sell declining stocks if they incur small losses, and to sell appreciating stocks in part if they reach stock prices on the upside. The difference between these strategies would certainly affect performance and should be given consideration when reading these reviews.

On October 7, 2006, I posted Guess (GES) when it was trading at $53.89/share. Adjusted for a 2:1 stock split on March 13, 2007, this worked out to a price of $26.95. With GES closing at $40.03 on April 18, 2008, this works out to a gain of $13.08 or 48.5% since posting. I do not own any shares nor do I have any options on this stock.

On October 7, 2006, I posted Guess (GES) when it was trading at $53.89/share. Adjusted for a 2:1 stock split on March 13, 2007, this worked out to a price of $26.95. With GES closing at $40.03 on April 18, 2008, this works out to a gain of $13.08 or 48.5% since posting. I do not own any shares nor do I have any options on this stock.

Let's take a closer look at this company and see if the stock still deserves a spot on my blog! I will share with you why I believe that

GUESS? (GES) IS RATED A HOLD

What exactly does this company do?

According to the Yahoo "Profile" on Guess (GES), the company

"...designs, markets, distributes, and licenses lifestyle collections of apparel and accessories for men, women, and children. The company's products include collections of denim and cotton clothing, including jeans, pants, overalls, skirts, dresses, shorts, blouses, shirts, jackets, and knitwear. It also grants licenses to manufacture and distribute a range of products, which comprise eyewear, watches, handbags, footwear, kids' and infants' apparel, leather apparel, swimwear, fragrance, jewelry, and other fashion accessories."

"...designs, markets, distributes, and licenses lifestyle collections of apparel and accessories for men, women, and children. The company's products include collections of denim and cotton clothing, including jeans, pants, overalls, skirts, dresses, shorts, blouses, shirts, jackets, and knitwear. It also grants licenses to manufacture and distribute a range of products, which comprise eyewear, watches, handbags, footwear, kids' and infants' apparel, leather apparel, swimwear, fragrance, jewelry, and other fashion accessories."

How did they do in the latest quarter?

On March 19, 2008, Guess? (GES) reported 4th quarter 2008 results. For the quarter ending Februar 2, 2008, the company reported total net revenue of $514.6 million, up 29.9% from $396.2 million reported the prior year. Comparable store sales grew 13.1% during the quarter.

Net earnings for the quarter increased 20.3% to $55.2 million from $45.9 million during the same period the prior year. Diluted earnings per share were up 20.4% to $.59 from $.49 the prior year.

The company beat expectations with these results. Analysts surveyed by Thomson Financial had been expecting earnings of $.57/share on $470 million in revenue.

However, the company lowered guidance for the first quarter of 2009. Analysts had been expecting $.47/share on revenue of $450.6 million. However, Guess now expects earnings between $.44 to $.46 on $445 to $460 million in revenue.

How about longer-term results?

Reviewing the Morningstar.com '5-Yr Restated' financials on GES, unfortunately there is a very incomplete picture present. What we can see is that the company is generating free cash flow, and the balance sheet is solid.

What does the chart look like?

Looking at the 'point & figure' chart on Guess? (GES) from StockCharts.com, we can see the shar appreciation in stock price from a low of $1.75/share in October, 2002, to a high of $56 in October, 2007. The stock has been under pressure recently, along with the entire market, but has stayed well above support levels.

Summary: What do I think about Guess? (GES)?

Actually, except for the weak retail environment that our nation is facing, I still like Guess just fine :). The latest quarter was strong, but the company reduced guidance slightly. The chart looks adequate. Unfortunately, I don't have the longer-term results from Morningstar.

This was a great stock pick for the week. Thus the only pick showed a gain of 48.5% since posting.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where my actual trading portfolio is tracked (I was doing well until the recent sell-off in VIVO stock), and my SocialPicks page where my stock picks and my blog entries are reviewed since the beginning of 2007. And if you still have some interest, be sure and visit my Podcast page where you can download an mp3 of me discussing one of the many stocks I write about here on the blog.

That's about it for the weekend! Wishing you all a wonderful Monday and a healthy and successful week ahead!

Yours in investing,

Bob

Saturday, 19 April 2008

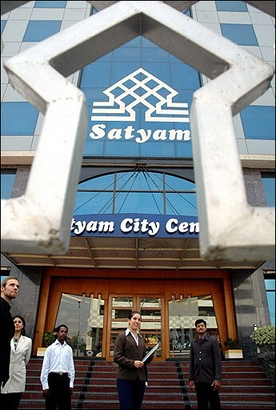

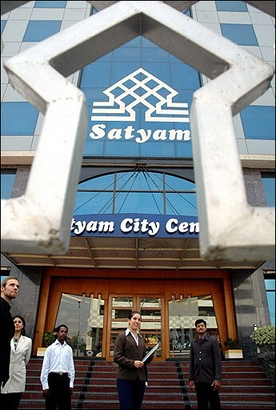

Satyam Computer Services (SAY) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It was a nice change to see stocks move higher Friday with the Dow closing at 12,849.36, up 226.87, the Nasdaq closing at 2,402.97, up 61.14, and the S&P 500 closing at 1,390.33, up 24.77 on the day.

It was a nice change to see stocks move higher Friday with the Dow closing at 12,849.36, up 226.87, the Nasdaq closing at 2,402.97, up 61.14, and the S&P 500 closing at 1,390.33, up 24.77 on the day.

The stock market appeared to rally initially, as reported, on the back of the Citigroup (C) announcement of earnings, which although disappointing must have allayed some fears about possibly even worse results. In addition, perennial favorite Google (GOOG), zoomed higher by $89.87 or 20% after reporting a 30% increase in earnings, exceeding expectations.

With the market acting almost giddy, I thought it would be a good time to take a look at the top % gainers lists and see if I could review a stock that might fit the criteria that I find important.

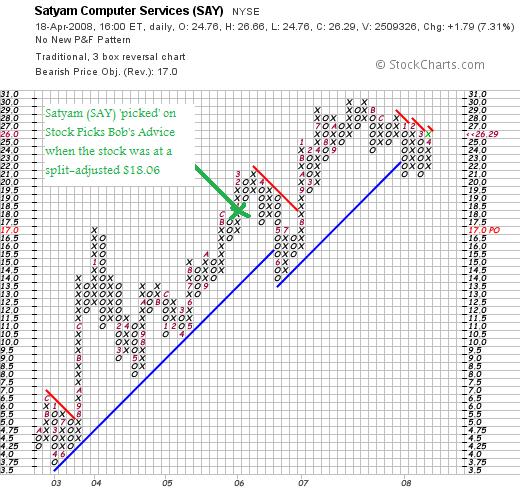

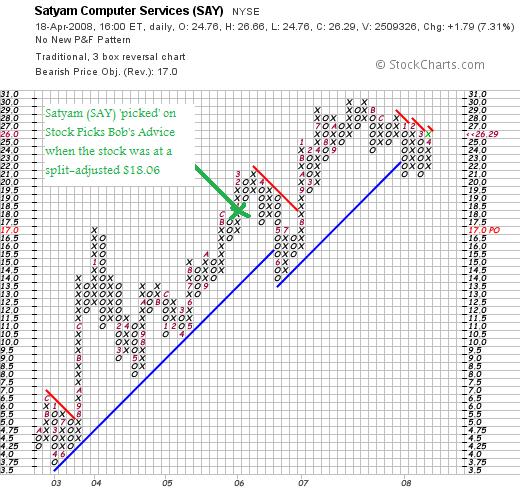

Looking at the list of top % gainers on the NYSE, I found Satyam (SAY), an old favorite of mine that I have also owned in the past, but which I no longer currently own any shares or options, making the list closing at $26.29, up $1.79 or 7.31% on the day. Let me explain why I like this stock and why

SATYAM (SAY) IS RATED A BUY

First of all let me explain that I call this stock a "favorite" because I have reviewed this stock previously---on December 15, 2005, almost 2 1/2 years ago---when the stock was trading at $36.11. Adjusting for a 2:1 stock split on October 18, 2006, this represents a pick price of $18.06. Thus with the stock trading at $26.29 this past Friday, this represents a gain of $8.23 or 45.6% since posting. Unfortunately, I was unable to 'hand on' to this stock which I owned for an interval and instead was 'shaken out'.

What exactly does this company do?

According to the Yahoo "Profile" on Satyam, the company

"...provides information technology (IT) services and business process outsourcing (BPO) services in the United States, Europe, the Middle East, and the Asia-Pacific region. It offers application development and maintenance services, consulting and enterprise business solutions, extended engineering solutions, and infrastructure management services."

"...provides information technology (IT) services and business process outsourcing (BPO) services in the United States, Europe, the Middle East, and the Asia-Pacific region. It offers application development and maintenance services, consulting and enterprise business solutions, extended engineering solutions, and infrastructure management services."

Beyond all of that 'marketing talk', the fact remains that Satyam is a leading outsourcing firm. As reported in 2006 in the Hindu Business Line:

"IT services provider Satyam Computer Services Ltd, has been ranked as the world's leading engineering services outsourcing vendor by the Brown-Wilson Group (BWG).

A BWG survey analysed 872 information technology and engineering outsourcing vendors in 63 countries and its results appeared in the company's "Black Book of Outsourcing," a highly respected publication.

Satyam led in several categories, including vendor overall preference, flexible pricing and brand image."

It has been a common-place event more many companies to outsource IT services to India and elsewhere to provide this service at a lower cost than available in America. However, one of the beneficial effects of the decline in the dollar value has been that it may once again be cost-effective to provide some of these services and manufacturing state-side instead of overseas. This insourcing, as it is called, is best exemplified by a story about IKEA, the European furniture manufacturer, which has announced plans to manufacture in the United States rather than in Poland.

How did the company do in the latest quarter?

On January 21, 2008, Satyam (SAY) reported 3rd quarter results for the quarter ended December 31, 2007. Revenue came in at $562.9 million, up 49.9% year-over-year and up 10.5% sequentially. Net income was $109.7 million, up 54.3% from the prior year and up 7.7% from the prior quarter. Basic earnings came in at $.33/share, up 50% from last year, and up 6.5% from the prior quarter. Certainly a beautiful earnings report from my perspective.

The company raised guidance for 2008, which guidance now between $2.119.2 and $2.122 billion, suggesting a growth rate beetween 45.0 and 45.2% over the 2007 results. Earnings were estimated for 2008 to come at $1.27/share suggesting a growth rate of 39.6% over the prior year.

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on Satyam (SAY), we can see the steady picture of revenue growth from $459 million in 2003 to $1.46 billion in 2007. Earnings during this same period increased from $.26/share in 2003 to $.90/share in 2007. The company initiated dividends in 2005 at $.10/share and has increased it regularly to $.15/share reported in 2007. Meanwhile, outstanding shares have barely budged, increasing from 319 million shares in 2003 to 333 million in 2007.

Free cash flow is positive and increasing recently with $132 million reported in 2005 and $180 million reported in 2007.

The balance sheet is solid from my perspective with $152 million in cash and $457 million in other current assets, compared to $211.2 million in current liabilities and the relatively small amount of long-term liabilities totaling $41.9 million. Thus, calculating the current ratio, we obtain a result of 2.88, a very healthy ratio from my perspective.

What about some valuation numbers on this stock?

Using the Yahoo "Key Statistics" on Satyam as a guide, we can see that this is a large cap stock with a market capitalization of $8.80 billion. The trailing p/e is a moderate 21.91, with a forward p/e of 17.53. The PEG ratio confirms the reasonable valuation of this stock with a value of 0.96.

Reviewing data from the Fidelity.com eresearch website, we can see that Satyam (SAY) is fully valued in terms of the Price/Sales (TTM) ratio which comes in at 4.52 relative to the industry average of 3.32.

In terms of the Return on Equity (TTM), SAY does a bit better with a figure of 25.62% compared to the industry average of (26.50)%. The company also does better on Return on Assets (TTM) with 21.52% figure, relative to the industry average of 12.48%.

Finishing up with Yahoo, there are 334.77 million shares outstanding. Yahoo reports that as of 3/26/08, there were 7.71 million shares out short representing a rather sizeable short ratio of 5.1 trading days. This is up from the prior month figure of 6.81 million shares, which also suggests a possible short squeeze in the making as this stock climbs higher.

As I noted above, the company pays a dividend with a forward dividend rate of $.14/share yielding 0.6%. The last stock split, as I have already mentioned, was a 2:1 stock split on October 18, 2006.

What does the chart look like?

Examining the 'point & figure' chart on Satyam (SAY) from StockCharts.com, we can see that the stock has recently been under some pressure but has not convincingly broken-down from its steady increase from April, 2003, when the stock was trading as low as $3.75, to its peak in October, 2007, when the stock bounced against a high of $30/share. The stock certainly doesn't appear 'over-extended'.

Summary: What do I think?

Well, needless to say, I like this stock. I am not sure if I am enthusiastic about the possible effects on American jobs of 'outsourcing' but with global trade, this is fairly unavoidable. And besides, with the insourcing that may become more common, as with the Ikea story, jobs may be returning home. We can at least hope.

Anyhow, the company moved higher Friday along with the rest of the market. The large number (from my perspective) of shares out short may also be driving the stock to higher prices as short-sellers may be scrambline to cover their pessimistic wagers.

The latest quarter was strong and the company raised guidance. The longer-term view is equally impressive with steady revenue growth, earnings growth, and even dividend growth! Outstanding shares have been relatively quite stable and free cash flow is positive. The balance sheet is solid.

Valuation-wise, the company sells at a modest p/e with a great PEG ratio reported. Price/Sales is a bit rich but the company is more profitable than its peers as judged by the Return on Equity and Return on Assets ratios.

Finally, the chart looks satisfactory with the price undergoing a recent period of price consolidation and with the chart on the verge of 'breaking out' assuming the rest of the market holds up.

In other words this is my kind of stock! Now, if only I had been able to hang on to the shares I have owned in the past. Well, that is 'water under the bridge'.

Instead of kicking myself on this one, I shall wait for a signal from my portfolio that might give me the permission slip to be adding a new position to my portfolio which still consists of just six stocks.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where you can review my actual Trading Portfolio performance, my SocialPicks Page where you can monitor my stock picks from the first of 2007, and my Podcast Page where you can download some mp3's of me discussing some of the many stocks discussed here on this website.

Have a great weekend everyone!

Yours in investing,

Bob

Newer | Latest | Older

I want to try once again to make this a brief entry. I used to be able to write up these stocks in a paragraph, and lately, I have been writing up long entries explaining a 'pick'.

I want to try once again to make this a brief entry. I used to be able to write up these stocks in a paragraph, and lately, I have been writing up long entries explaining a 'pick'. First of all, according to the Yahoo "Profile" on Heartland, the company

First of all, according to the Yahoo "Profile" on Heartland, the company

On October 10, 2006, I

On October 10, 2006, I

On October 11, 2006, I

On October 11, 2006, I

On October 12, 2006, I

On October 12, 2006, I

The stock market has been acting a little bit healthier the last week or two. And it is nice to see 'our kind of stocks' moving higher and making the top % gainers list once more.

The stock market has been acting a little bit healthier the last week or two. And it is nice to see 'our kind of stocks' moving higher and making the top % gainers list once more. First of all,

First of all, Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website. Like a "

Like a "

I want to try to make this a brief post and get right to the point. (Is that possible for me?)

I want to try to make this a brief post and get right to the point. (Is that possible for me?) I do not own any shares or options on this stock. I first

I do not own any shares or options on this stock. I first

On October 7, 2006, I

On October 7, 2006, I

It was a nice change to see stocks move higher Friday with the Dow closing at 12,849.36, up 226.87, the Nasdaq closing at 2,402.97, up 61.14, and the S&P 500 closing at 1,390.33, up 24.77 on the day.

It was a nice change to see stocks move higher Friday with the Dow closing at 12,849.36, up 226.87, the Nasdaq closing at 2,402.97, up 61.14, and the S&P 500 closing at 1,390.33, up 24.77 on the day. "...provides information technology (IT) services and business process outsourcing (BPO) services in the United States, Europe, the Middle East, and the Asia-Pacific region. It offers application development and maintenance services, consulting and enterprise business solutions, extended engineering solutions, and infrastructure management services."

"...provides information technology (IT) services and business process outsourcing (BPO) services in the United States, Europe, the Middle East, and the Asia-Pacific region. It offers application development and maintenance services, consulting and enterprise business solutions, extended engineering solutions, and infrastructure management services."