Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It is the weekend once again! (Do these weeks seem to fly by for anyone else as well?). Anyhow, I like to review past stock picks on weekends and update my ratings evaluations. So many things have changed this past year. And not all for the better!

Last weekend I took a look at the stocks discussed on this blog during the week of September 18, 2006. Going a week ahead, let's review the stocks 'picked' on this blog during the week of September 25, 2006. I know that it is a bit more than a year....more like a year-and-a-half....but when I started these reviews, it was a year....and then I missed a review one weekend....and then one thing led to another, and now my review is more than a year out. Anyhow.....let's get on with this review :).

These reviews assume a buy and hold approach to investing. In practice, I advocate and employ a disciplined investment strategy that requires quick and total sales on declines and partial sales as stocks reach appreciation targets on the upside. Without a doubt the difference in employing these two strategies to the same group of stocks would certainly affect performance and you should keep this in mind.

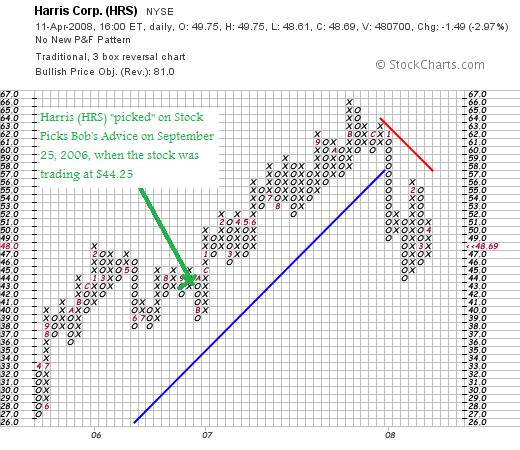

On September 25, 2006, I posted Harris Corporation (HRS) on Stock Picks Bob's Advice when the stock was trading at $44.25. Harris closed at $48.69 on April 11, 2008, for a gain of $4.44 or 10% since posting. I do not own any shares or options on Harris.

On September 25, 2006, I posted Harris Corporation (HRS) on Stock Picks Bob's Advice when the stock was trading at $44.25. Harris closed at $48.69 on April 11, 2008, for a gain of $4.44 or 10% since posting. I do not own any shares or options on Harris.

On January 30, 2008, Harris (HRS) announced 2nd quarter 2008 results. Revenue for the quarter came in at $1.3 billion, up 30% from the $1.0 billion reported in the same quarter the prior year. This also represented a 7% sequential increase in revenue.

Net income for the quarter came in at $114 million or $.83/diluted share vs. $94 million or $.67/diluted share the prior year.

In the same announcement the company raised guidance for fiscal year 2008 to $5.2 to $5.3 billion with GAAP earnings guidance to $3.35 to $3.45/diluted share.

The company beat expectations on both earnings where $.81/share was expected and revenue where $1.25 billion was expected according to analysts polled by Thomson Financial.

Reviewing the Morningstar.com "5-Yr Restated" financials on Harris, we can see that the latest numbers show persistent revenue growth, steady earnings growth, steady dividend growth, stable outstanding shares, and continued solid free cash flow. The balance sheet appears solid.

Looking at the 'point & figure' chart on Harris from StockCharts.com, we can see that the stock was moving strongly higher from April, 2005, when the stock was trading as low as $27, until August, 2007, when it hit a high at $66/share. The stock broke through support in January, 2008, and although moving higher, it hasn't convincingly re-established the upward price move.

Thus, even with all of the good data presented, the best I can do...

HARRIS CORPORATION (HRS) IS RATED A HOLD

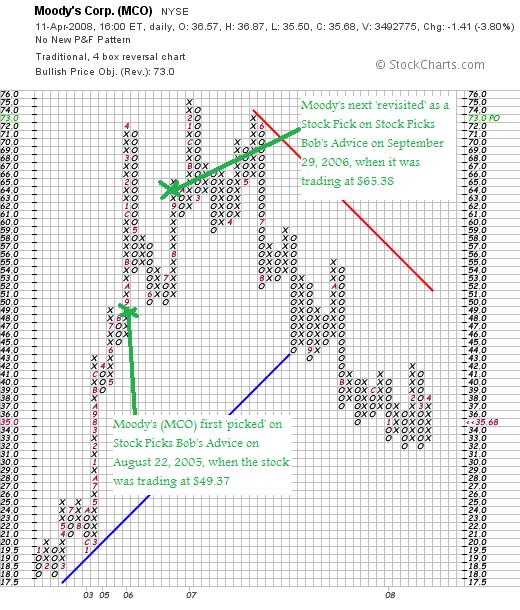

On September 29, 2006, I "revisited" Moody's (MCO) on Stock Picks Bob's Advice when the stock was trading at $65.38. I write 'revisit' because I first wrote up Moody's on this blog on August 22, 2005 when the stock was trading at $49.37. Moody's has not been immune from the near-meltdown of financial stocks we have observed and closed at $35.68 on April 11, 2008, for a loss of $(29.70) or (45.4)%. I do not have any shares or options on Moody's.

In terms of recent events, Moody's on March 11, 2008, cut the 2008 outlook due to 'shrinking bond issuance' with revenue now expected to shring in the 'mid-to-high-teens' from $2.3 billion in revenue last year. This was a revised estimate that was already predicting a decline in revenue in the 'low double-digits'.

On February 7, 2008, Moody's (MCO) announced 4th quarter 2007 results. Revenue for the three months ended December 31, 2007, declined 14% to $504.9 million from $590.0 million during the same period in 2006. Net income plunged to $127.3 millin from $278.6 million last year or $.49/diluted shear nearly 50% off the $.97/diluted share reported the prior year.

The Morningstar.com '5-Yr Restated' financials on Moody's (MCO) appears intact with sales growth steady, earnings growth stable (except for a flat 2007 at $2.58/share the same as 2006), dividends steadily increasing, and free cash flow positive and growing. The balance sheet, however, gives me pause with $426 million in cash and $563 million in other current assets. This total of $989 million, when compared to the $1,349.2 million in current liabilities yields a current ratio of .73.

At a minimum, a healthy current ratio is considered to be over 1.0. Moody's doesn't quite meet this level.

Reviewing the 'point & figure' chart on Moody's from StockCharts.com, we can see that the stock climbed sharply from January, 2002, when it was trading as low as $18 to a high of $75 in February, 2007, only to fail to reach that height in May, 2007, and then decline sharply from there, slipping below 'support' in August, 2007, as the stock dipped below $44. While seeming to be developing a new support in the $33 level, this is far from confirmed and convincing.

With the second lowering of guidance, the weak balance sheet on Morningstar.com and the very disconcerting chart on StockCharts.com, along with the entire credit meltdown that is ongoing,

MOODY'S (MCO) IS RATED A SELL

So how did I do with these two stock picks from the week of September 25, 2006? Well, except that I had the poor luck of including a financial company, it wouldn't have been that bad. O.K. no excuses, the two stocks combined for an average performance of a loss of (17.7)% since posting!

Thanks so much again for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

If you get a chance, be sure and visit my Covestor Page where you can monitor and see an evaluation of my actual trading portfolio (email me if you would like an 'invite' to open a free account on Covestor....I have 4 invitations available :)), my SocialPicks Page where all of my stock picks from the last year or so have been reviewed, and my Podcast Page where you can listen to me discuss some of the many stocks and issues discussed on this website.

Have a wonderful weekend everyone!

Yours in investing,

Bob