Stock Picks Bob's Advice

Saturday, 5 July 2008

A Reader Writes "A couple of questions...."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I always enjoy receiving correspondence. Even when I was a kid I liked to run to the mailbox and find out what had just come in. O.K. it isn't as bad as in the musical The Music Man and The Wells Fargo Wagon song....but just the same...I really do like to hear from all of you readers.

I always enjoy receiving correspondence. Even when I was a kid I liked to run to the mailbox and find out what had just come in. O.K. it isn't as bad as in the musical The Music Man and The Wells Fargo Wagon song....but just the same...I really do like to hear from all of you readers.

One of my regular readers, John H. had a comment about my last response to the investor that had been losing money....

He wrote:

"First off, thanks for the great site, information, and willingness to share your methods and stock picks. I am going through your analysis of the current email from the person that lost money, and also how you go about

analyzing stocks to invest it or at least consider.

A couple of questions: for possible candidates to consider, do you look at any other sources initially other then top gainers? Also, in setting you

apprciation sell targets, rather then a percentage above the initial purchase price taking you out 1/7th, why not go with a trailing stop on the whole position?

I have my account with TDAmeritrade, and if I understand

them correctly there is such a thing as a percentage trailing stop which would move up as the price increased; thereby allowing a person to enjoy the

rising trend.

Thanks. John H."

Thank you John for writing!

Let me try to respond to your question. Please understand that in now way am I trying to imply that my approach to investing is the best or the only way to go about picking stocks and managing your holdings. I do not even know for sure if it is profitable over the long haul. It is just my best attempt to set up some sort of system that seems to be working for me.

In my current trading portfolio, you are absolutely correct. My first step is to look at the top % gainers each day. That is it. Nothing else. I have tried a few times (mostly unsuccessfully) to make a 'trade' of a stock after it seems to have 'over-reacted' to some news or other. Or just on a 'hunch'. I do those transactions less and less and my performance has improved significantly.

Of course it is not enough that a stock is on the top % gainers list to get my 'seal of approval'. I generally try to stay with stocks $10 or higher, and then go through my routine of checking the latest quarter, the Morningstar.com '5-Yr Restated' reports, valuation figures from Yahoo, and a 'point & figure' chart from StockCharts.com. It is only after looking at all of those that I 'pick' a stock for my blog.

Insofar as those trailing stops....am I mistaken or have you asked me that before? I know someone has inquired about that possibility.

It isn't a bad idea. But it isn't something I do. What I do is what Jim Cramer has described as "taking a little schnitzel off the table."

As was explained on TheStreet.com:

"Now on the German front, Cramer will use "schnitzel" when he's referring to making a small buy or sell. So if he's buying a "schnitzel," he's doesn't want to buy too much. He'd rather wait until the stock price pulls back, a.k.a. falls, more.

If he's selling a "schnitzel," he's selling a little bit. For instance, during a lightning round a few months ago in reference to Hansen Natural (HANS - Cramer's Take - Stockpickr), he said, "there's gonna be too much profit-taking. I don't trust it here ... I want you to schnitzel out of it." So he wanted the caller to start selling small pieces of his holding."

Now I happen to love Wiener-Schnitzel.

But that is an entirely different story!

But I view my approach to my stocks as even more conservative than yours. Not necessarily more profitable.

That is, by selling some of my gaining stocks as they appreciate I literally "lock-in" some of the gains. I can use these gains to balance against the losses that I take as stocks dip. I also use these sales as 'signals' for my own portfolio management system.

That doesn't mean that what I do is the best way to invest. It is just something that seems to work for me.

Same with the 'percentage trailing stop'. That isn't really a bad idea at all. But from my perspective, I want to give my top performing stocks more 'leash'. That is, instead of maintaining a standard percentage trailing stop, as you suggest, I base my trailing stop on the stock's prior performance. While a new purchase will be sold if it dips 8%, a stock that has appreciated 120% wouldn't be sold until it tipped to a 60% appreciation level....giving it almost a 50% dip before a sale. That way, I don't get 'whip-sawed' out of my 'favorites'....those stocks that have done the best for me.

Anyhow, I don't know if I answered your questions exactly as you might like, so if you have any other comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 1:57 AM CDT

|

Post Comment |

Permalink

Updated: Saturday, 5 July 2008 2:00 AM CDT

Thursday, 3 July 2008

A Reader Writes "I have lost a lot of money in the stock market...."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of my favorite parts of writing a blog is to receive email from readers with questions of their own. I am not a professional adviser so I am not qualified to give individual advice on anyone's particular situation. For that I would suggest seeking the advice of a professional.

One of my favorite parts of writing a blog is to receive email from readers with questions of their own. I am not a professional adviser so I am not qualified to give individual advice on anyone's particular situation. For that I would suggest seeking the advice of a professional.

However, I am happy to share some of my own ideas with readers about investing in general. Let me see if I can answer this question from Stan who obviously has not been treated very well by the market.

Stan writes:

"Dear Bob, I have been looking at your site and today I looked to see how your stock recommendation ECL made out.. For anyone getting into this they would have had to chase this right? Are all your picks like this where it moves immediately and perhaps during after hour trading and thus one would have to chase this stock?

Stan

ps

bob, you seem like a legitimate guy.;) I have lost a lot of money in the stock market and I would like to enter the market again but to be able to follow someone as astute as you are. Do you only give what you buy for yourself and do you also let people know what you are selling? If I were to follow your picks do I just hold on to them and wait for you to say sell? do you have stop losses and if so what kind will they be. If you dont mind calling me , my number is xxx xxxxxxx. I would love to meet you on the phone."

O.K....let me try and answer this question the best I can.

My goal in writing this blog is not about writing about stocks that anyone needs to 'chase'. I do start with stocks that are moving higher that particular day. It is my belief that identifying stocks moving higher that also have strong underlying fundamentals may also represent equities that are likely to move higher in the future as well.

Time will tell if that strategy will be successful. It appears to be working for me.

Regarding your losing a lot of money in the market, that is really a terrible thing. But perhaps you are not alone as this market has been merciless in destroying the value of equity after equity. For example, General Motors (GM) is now sitting at a 54 year low. ouch.

My strategy has been and continues to be to attempt to build a portfolio of stocks that have the brightest prospects. I sell my stocks quickly on declines to avoid developing large losses. I sell my holdings partially as they appreciate to targeted levels. Generally I sell 1/7th of my holdings if they reach levels of 30%, 60%, 90%, 120%...etc. appreciation levels. Similarly, I sell my entire position if the stock should drop 8% after an initial purchase, break-even--if I have sold once at a 30% gain, or at 1/2 of the highest appreciation level of sale. In other words, I sell an entire position if the stock should dip to a 30% appreciation level after having already had a partial sale at a 60% appreciation target.

Sounds a bit complicated? It is. But it is keeping me afloat.

In addition, I try to respond to market influences by monitoring the actions of my own portfolio. That is, if my maximum holdings are 20 positions, my minimum is 1/2 of 1/2 of that or 5 positions. "Neutral" would be at 10 positions.

Starting out I would place 10 positions into equities and 50% of my account would be in cash.

If a stock got sold at a gain by appreciating I would add a position. If sold on the downside, I 'sit on my hands' and continue to add to cash. I replace positions if I sell a holding when I am at my minimum of 5 positions. Likewise, I sit on my hands if at my maximum and have a buy position by selling a portion of a holding that has appreciated.

Complicated? You bet. But I am doing it and it appears to work. I am currently at 5 positions.

I write up lots of stocks. Only a few I own. You can monitor my own activity by reading my blog. All of my entries are there going back to 2003. Read a few entries and you will start understanding my investment philosophy and my actual trades.

In addition, in the interest of transparency, I have my portfolio posted over at

Covestor. My stock picks are otherwise monitored over at

SocialPicks. And if you would like to hear me discuss my strategy and some of the stocks I write about, download some mp3's by going over to my

Podcast Page.

Whenever I buy or sell, this is recorded over at Covestor and I try to write up an entry ASAP entitled "trading transparency".

I do not tell people when they should sell stocks. I do not write up when a "buy" becomes a "sell". I leave that for my readers to determine. Setting up tight sale points at the time of purchase, identifying quality companies to invest in, managing my portfolio in response to market actions, these are all things I advocate and would believe they would work for many other people as well.

Please let me know if this has helped you understand my blog and my approach. So many people have lost so much in this bear market. You are not alone in this regard. But if you can always manage to learn from your experiences, if you can avoid repeating the same mistakes over and over again, and if you can develop a strategy that works for you in the future, it will all be worthwhile.

I hope that I can add to your understanding of how an amateur can approach investing. That is and has always been my goal. I am not even sure that I shall be successful myself.

If you have any other comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Ecolab (ECL)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

After so many days of downside action in the market, it was nice to see at least the Dow move higher today, trading at 11,288.54, up 73.03 on the day as I write. The Nasdaq, however, didn't participate in this rally and is currently at 2,245.38, down 6.08 on the day.

After so many days of downside action in the market, it was nice to see at least the Dow move higher today, trading at 11,288.54, up 73.03 on the day as I write. The Nasdaq, however, didn't participate in this rally and is currently at 2,245.38, down 6.08 on the day.

With the market moving a bit higher, this gave me an opportunity to identify a new name for this blog. Scanning the list of top % gainers on the NYSE today, I came across Ecolab (ECL), a stock that I haven't reviewed here before, and a stock that I believe deserves a spot on this website. Ecolab (ECL) closed at $44.48, up $2.04 or 4.81% on the day. I do not own any shares or options of this stock.

ECOLAB (ECL) IS RATED A BUY

Let me share with you my thoughts on this company that led me to this assessment.

First of all, what do they do?

According to the Yahoo "Profile" on ECL, the company

"...develops and markets products and services for the hospitality, foodservice, healthcare, and light industrial markets in the United States and internationally. The company offers cleaning and sanitizing products and programs, as well as pest elimination, maintenance, and repair services primarily to hotels and restaurants, healthcare and educational facilities, quick service units, grocery stores, commercial and institutional laundries, light industry, dairy plants and farms, food and beverage processors, and the vehicle wash industry."

"...develops and markets products and services for the hospitality, foodservice, healthcare, and light industrial markets in the United States and internationally. The company offers cleaning and sanitizing products and programs, as well as pest elimination, maintenance, and repair services primarily to hotels and restaurants, healthcare and educational facilities, quick service units, grocery stores, commercial and institutional laundries, light industry, dairy plants and farms, food and beverage processors, and the vehicle wash industry."

And how did they do in the latest quarter?

On April 24, 2008, Ecolab reported 1st quarter 2008 results. Revenue for the quarter increased 16% to $1.46 billion from $1.25 billion in the first quarter of 2007. Net income increased 15% to $102.9 million or $.41/share, from $89.5 million or $.35/share the prior year same period. The company beat expectations with this result as analysts polled by Thomson Financial had been expecting earnings of $.39/share.

What about longer-term results?

Examining the Morningstar.com "5-Yr Restated" financials on Ecolab, we can see that revenue has been steadily increasing from $3.76 billion in 2003 to $5.47 billion in 2007 and $5.67 billion in the trailing twelve months (TTM). In an equally impressive fashion, earnings have been increasing steadily from $.99/share in 2003 to $1.70/share in 2007 and $1.76/share in the TTM. Also convincing is the fact that the company pays a dividend and has increased the dividend each year during the past five years from $.30/share in 2003 to $.48/share in 2007 and $.49/share in the TTM.

But that isn't enough either! Insofar as maintaining a stable number of outstanding shares, the company has been regularly decreasing the shares from 263 million in 2003 to 252 million in 2007, with a slight increase to 253 million in the TTM.

Free cash flow has been solidly positive and steadily growing. Morningstar.com reports $321 million in free cash flow in 2005 increasing to $491 million in 2007 and $529 million in the TTM.

The balance sheet appears solid with $220 million in cash and $1.67 billion in other current assets, adequate to cover the $1.6 billion in current liabilities. The company has another $1.57 billion in long-term liabilities reported on the books.

And valuation?

Reviewing Yahoo "Key Statistics" on this stock, we can see that this is a large cap stock with a market capitalization of $10.99 billion. The trailing p/e is a tad rich at 25.34, with a forward p/e of 20.59. Thus the PEG (5 yr expected) also comes in a bit rich at 1.68. (I prefer to see stocks with PEG's in the 1.0 to 1.5 range...but with everything else looking nice, I can live with this PEG!)

Using the Fidelity.com eresearch website for some more statistics, we can see that valuation as measured by the Price/Sales (TTM) is more reasonable with Ecolab coming in at a 1.84 ratio compared to the industry average of 4.12. In terms of profitability, as measured by the Return on Equity (TTM), ECL also is a bit more profitable than its peers with a 24.19% ROE reported on Fidelity compared to the industry average of 22.8%.

Finishing up with Yahoo, there are 247.16 million shares outstanding with only 172.15 million that 'float'. Currently there are 5.06 million shares out short (as of 10-Jun-08), representing a short ratio of 5.6 trading days. This is ahead of my own '3 day rule' and may present opportunities for a 'squeeze'.

The company, as I have noted, currently pays a forward annual dividend rate of $.52/share with a 1.2% yield. The last stock split was a 2:1 June 9, 2003.

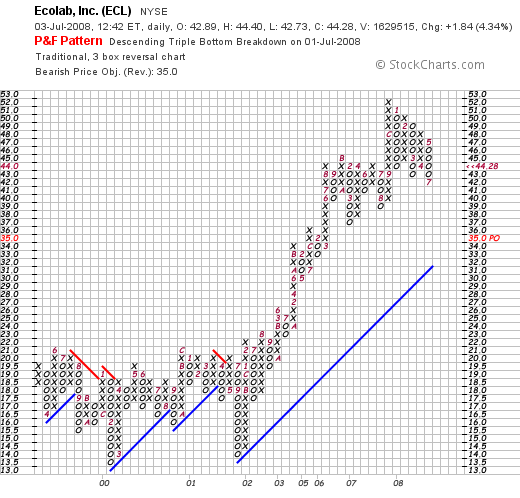

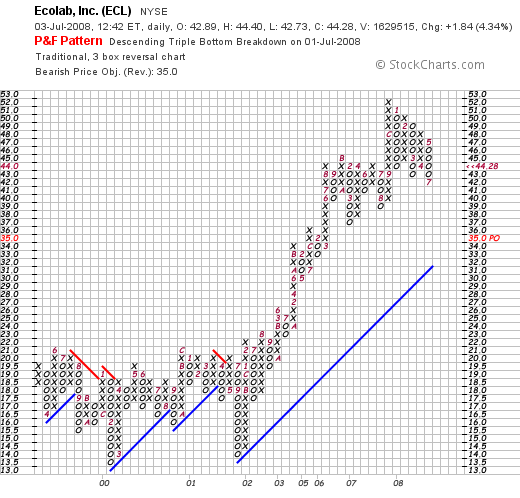

What about the chart?

Looking at a 'point & figure' chart on Ecolab from StockCharts.com, we can see a strong rise in price from September, 2001, when the stock dipped to $13.50/share. Since then the stock has been strongly moving higher, peaking at $52/share in December, 2007, only to dip down to $42 recently. The chart looks strong and 'optimistic' to me.

To summarize:

My search for stocks of potential interest involves identifying companies with strong price momentum with associated steady and high quality financials. This company fits the bill. They moved ahead nicely today, have been reporting steady revenue and earnings growth while maintaining a stable outstanding share count. They pay a dividend and have been steadily increasing it.

Valuation is reasonable with a bit of a steep PEG, but a solid Price/Sales ratio as well as Return on Equity compared to similar companies.

The chart looks good with only a recent pull-back reflecting the overall bearish environment of every stock. There are even a good number of shares out short waiting to be squeezed.

This is the kind of stock I would be buying if I had a 'signal' from my own portfolio indicating that it might be time to be moving into additional equities. Meanwhile I shall be adding this to my 'watch-list', waiting for the right time to be adding to my own portfolio. Hopefully, I shall be able to 'clean-up' with this stock one day!

Thanks again for dropping by and visiting my blog. If you have any comments or questions, please feel free to leave them right on the website or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor page where you can review my actual trading portfolio and my performance with those holdings as well as my SocialPicks page where you can review my stock picks and their subsequent performance.

If you get a chance, be sure and visit my Podcast Page where you can listen to some of my podcasts about the stocks on this website.

Have a happy and safe 4th of July everyone!

Yours in investing,

Bob

Posted by bobsadviceforstocks at 12:47 PM CDT

|

Post Comment |

Permalink

Updated: Thursday, 3 July 2008 1:26 PM CDT

Sunday, 29 June 2008

***New Podcast*** "My Trading Portfolio" and "Adventures of Isabel" by Ogden Nash

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I found a little time to get a podcast together! If you are interested,

CLICK HERE FOR MY PODCAST

on "My Trading Portfolio", "Adventures of Isabel" by Ogden Nash, and some comments on Investment Philosophy, selling at an 8% loss, responding to market influences by paying attention to one's own portfolio, and blogging and being open to criticism on Seeking Alpha!

Yours in Investing,

Bob

Posted by bobsadviceforstocks at 10:56 PM CDT

|

Post Comment |

Permalink

Updated: Sunday, 29 June 2008 11:02 PM CDT

"Trading Portfolio Update" June 29, 2008

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

My blog and my investment strategy continues to be an experiment for me. I think it makes sense. And the only way to figure it out is to employ my idiosyncratic strategy in real life. Much like when I was younger and played with my Gilbert Chemistry Set!

As part of my promise to all of you to be as transparent as possible, I have been regularly sharing with you my actual trading portfolio. You can also monitor my trades and my current performance on my Covestor Page. And of course you can monitor all of my picks from the last year-and-a-half on my SocialPicks Page.

And if you have any comments or questions about all of that or anything I write, you certainly can leave them on the blog or email me at bobsadviceforstocks@lycos.com and I shall do my best at answering you.

My last update on my trading portfolio was a bit over a month ago on May 11, 2008. Let me try to get this done in as concise and brief a fashion as possible.

Currently I have 5 positions in my Trading Portfolio. This is my minimum exposure to equities in terms of number of positions. My maximum number of positions is 20. I haven't been up near 20 for awhile now.

My number of positions floats between 5 and 20 depending upon the actions of my own holdings. That is, when I sell a stock on 'bad' news, which for me is a result of a decline or an announcement of something fundamentally unfavorable with a stock---I sell that stock and "sit on my hands" with the proceeds (unless I am at the minimum---where I am now---in which case I would still sell the stock but look for a replacement.)

On the other hand, if I sell a portion (1/7th) of one of my stocks at an appreciation target (30, 60, 90, 120, 180%, etc.) appreciation, then I have a 'signal' to be adding a new position.

It is my hope that this "experiment" will be successful and allow me to react to market conditions my shifting my exposure to equities from a minimal to a maximal level. Like my Gilbert Set, this is still an experiment, and I am awaiting the final results :).

(Please let me know if any of you have also adopted this strategy so that I can share your comments regarding the utility or uselessness of this approach!)

Anyhow, back to my portfolio. And I did say I would be brief :(.

Copart (CPRT): 180 shares, acquired 9/27/07 with a cost basis of $33.68/share. CPRT closed at $44.90 on 6/27/08, giving me a gain of $11.22 or 33.1% since purchase. I have sold 1/7th of my holding when the stock reached a 30% gain. Thus, my next sale on the upside would be at a 60% appreciation target or 1.6 x $33.68 = $53.89. On the downside, my plan is to sell if the stock drops to 'break-even' or $33.68.

Covance (CVD): 102 shares, acquired 4/9/07 at a cost basis of $62.61. CVD closed at $84.24/share on 6/27/08, representing a gain of $21.63 or 34.5% since purchase. I have sold 1/7th of my holding at the 30% appreciation level, so like my Copart stock, my next partial sale on the upside would be at a 60% gain or 1.60 x $62.61 = $100.18. On the downside, my sale point would be at break-even or $62.61.

Graham (GHM): 105 shares, purchased 5/30/08, at a cost basis of $64.48. GHM closed at $69.82 on 6/27/08, giving me a gain of $5.34 or 8.3% since purchase. Since I have yet to sell any of these recently-acquired shares, my first sale on the upside is at a 30% gain or 1.30 x $64.48 = $83.82. On the downside, I plan on selling these shares should they incur an 8% loss, or at a price of .92 x $64.48 = $59.32.

Morningstar (MORN): 103 shares, purchased 11/22/05, at a cost basis of $32.57. MORN closed at $73.59 on 6/27/08 for a gain of $41.02 or 125.9% since purchase. I have sold portions of MORN four times (at 30, 60, 90 and 120% appreciation levels). My fifth sale on the upside would be at a 180% appreciation level or 2.80 x $32.57 = $91.20. On the downside, after multiple sales at appreciation targets, I move my sale point to 1/2 of the highest appreciation level. Thus, with the last sale at a 120% appreciation level, my targeted sale on the downside is 1/2 of that or at a 60% appreciation target. (Note, I didn't mean that I would be selling at 1/2 of that price, but 1/2 of the appreciation %). Thus, on the downside 1/2 of 120% = 60% or at a price of 1.60 x $32.57 = $52.11.

Meridian Bioscience (VIVO): 171 shares, purchased 4/21/05 at a cost basis of $7.42. VIVO closed at $27.74 for a gain of $20.32 or 273.9% since purchase. I have sold portions of VIVO eight times (!) at levels of 30, 60, 90, 120, 180, 240, 300, and 360% appreciation targets. Thus on the downside, if VIVO slips further to the 180% appreciation level or $7.42 x 2.8 = $20.78, then I would sell all of my shares. On the upside, a partial sale would next be at a 450% appreciatio level or 5.5 x $7.42 = $40.81.

As of 6/28/08, the entire portfolio had a value of $44,952.44. This included cash of $8,623.55 and equities of $36,328.89. As of 6/28/08 I had a realized net loss for 2008 of $(78.62) representing a net short-term loss of $(4,642.85) and a net long-term gain of $4,564.23.

As of 6/28/08, I had unrealized gains of $12,477.83 in my five current holdings.

So far my experiment appears to be working!

Thanks for dropping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Saturday, 28 June 2008

"Looking Back One Year" A review of stock picks from the week of October 23, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I have managed to miss a few more weeks in these 'reviews' and now am pushing two years out. Yikes. However, let's see if I can at least get this weekend covered! My last review was back on May 10, 2008, when I took a look at stock picks from the week of October 16, 2006. Going a week ahead, let's review the selections from October 23, 2006.

The reviews assume a buy and hold approach to investing. In practice, I advocate as well as employ a disciplined portfolio management approach that requires me to sell my declining stocks quickly at small losses and sell my appreciating stocks slowly at targeted appreciation levels. This difference in approach would certainly affect performance and should be taken into consideration.

Taking a look at the week of October 23, 2006, I noticed that I didn't have any picks that week!

I will take advantage of this past lull in posting by skipping any retrospective reviews this weekend and again take a look at past stock picks next week!

Yours in investing,

Bob

Thursday, 26 June 2008

'Seeing the Forest For the Trees'--More on Investment Philosophy!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Last week, after holding my Visa (V) shares for two weeks, I experienced a slightly greater than (8)% loss which triggered a sale. I wrote about this on this blog and also over on Seeking Alpha, where my entry was entitled: Visa: Why I Sold All of My Shares. I received considerable criticism, in fact getting 93 comments, mostly about my lack of intellect for dumping Visa shares so quickly.

But my sale of a stock is not merely about my belief in the long-term outlook on any particular companies. There are many forces that act upon a stock including in particular the actual movement of the overall market.

I listen to my stocks. And I respond to their sales either on the upside with a 'permission slip' to be adding a new position. Or on the downside by 'sitting on my hands' unless I am at my minimum of 5 positions (as I am presently.)

Those that are unable to perceive market influences while focused solely on individual stocks that they passionately hang on to might be said to be having problems "seeing the forest for the trees".

While my blog is about "stock picks" it is also my attempt to share with all of you my own effort at listening to my own holdings and either moving more heavily into equities (on the sale of stocks that are appreciating) or swinging more into cash (by sitting on my hands when I sell stocks like my Visa (V) at a loss).

I try to find the very best stocks to own in the universe of stocks.

Visa was one of these. I do believe the outlook may be terrific for this stock.

But I am also greatly aware of the dangers and opportunities of investing.

I am not smart enough to know when to move to cash or into stocks. But I am capable if disciplined to respond to the signals of my own holdings.

Currently I am at 5 positions. My minimum. And the market sucks. The system is working.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing.

Bob

Wednesday, 25 June 2008

A Reader Writes "I'm writing because I need some advice...."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of the great pleasures of writing a blog is to receive comments and questions from readers who have perhaps gained something from your efforts. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

I received one of those letters yesterday from Ivy K. who wrote with some questions of her own:

I received one of those letters yesterday from Ivy K. who wrote with some questions of her own:

"Hi Bob! My name is Ivy K., 26 year old nursing student in Las Vegas, NV. I'm a complete newbie in the world of stock market investing. I joined CNBC.com's Portfolio challenge this morning. I'm writing because I need some advice on how to to search / research for good stocks. I read your June 23, 2008 article about FLUOR and why it's a good pick. Where did you get the news about their earnings and etc?

Also, I picked the following stocks for my virtual online portfolio and if you have the time, could you pls give me some advice on them? They are :

1.) VeraSun Energy Corp -- I chose this because alternative energy is always on the news even on CNN.

2.) Estee Lauder -- My sister and mom are loyal to Aveda, which was purchased by Estee Lauder. Plus, it was featured in MSNBC's Business of Innovation because it's a socially responsible company and that's something that I admire. Plus, that show also mentioned that their profits are rising.

3.) Waste Management -- I really believe that this kind of company can help with global warming.

4.) Whole Foods Market -- My teacher and other classmates do their groceries here and in the entertainment news, I see a lot of celebrities doing their groceries here. I figured if the celebrities are doing it, pretty soon other people will be doing it.

Finally, I go to reuters.com's finance section because they have analyst recommendations on whether to sell, hold or buy.

This is a long email and I really appreciate the time you've taken to read and hopefully, respond.

Yours,

Ivy"

Ivy, thank you so much for writing!

I am glad that you enjoyed my write-up on Fluor (FLR), and my explanation of why I believe it is a good "pick". Let me try and answer your questions in order.

You first asked me about "where I got my information on the earnings, etc.?" That's easy. I am a big fan of Yahoo Finance (and no I don't own any shares in Yahoo!). All you need to do is enter the symbol of the company that you wish to investigate into the box next to the "get quotes" button and you will get company-specific information.

For instance, let's use Verasun Energy (which after entering the name in the box I see that the symbol is VSE).

For instance, let's use Verasun Energy (which after entering the name in the box I see that the symbol is VSE).

I generally find the logo by first going to the homepage for the company. Virtually every company has a homepage on the internet. To get the location, you can go over to the Yahoo "Profile" for VSE.

HERE is the hompage for VSE if you are interested :).

Also on the "Profile page" from Yahoo is a description of the company:

"VeraSun Energy Corporation engages in the production and sale of ethanol and its co-products in the United States. Ethanol is primarily used as a blend component in the gasoline fuel market. The company's ethanol co-products include wet and dry distiller grains with solubles, which are used as animal feed; and corn oil that is used as an animal feed, as well as to produce biodiesel. It also markets VE85, an ethanol blended fuel through arrangements with gas distributors and retailers."

So now we can see that this particular company, that I have not been previously familiar with, is involved in ethanol production. Certainly this has been a very 'hot' area in the stock market.

There isn't anything wrong with buying a 'trendy' kind of stock. In fact, you could ride the obvious positive sentiment which may work out to price momentum hopefully to the upside. This isn't particularly my approach--but there are many ways to select stock and this might work for you!

But my own next step in looking at a stock is to check out the latest quarterly report. From my perspective, I am looking for companies that are growing their revenue, increasing their earnings, possibly beating guidance, and hopefully raising expectations. O.K. that's a lot to ask from a quarterly report, but remember that we cannot expect to buy every stock.

By the way, I do NOT own any shares of VSE nor do I have any options.

If we look down the left side of that "Profile Page on Yahoo" we can see the "Headlines" link. You might have been expecting something more spectacular than this basic approach :), but I do a lot of 'scrolling' through these headlines (one each stock I review) to find the stories about earnings and significant developments.

I did see a story about delaying the startup of the third ethanol production facility this month because of "market conditions". I don't like the sound of that story...hmmm. By the way, VSE closed today (6/25/08) at $4.11, up $.13 or 3.27% on the day. Generally, I have been avoiding low-priced stocks under $10/share, but that is another story.

But let's keep looking for those earnings.

On May 12, 2008, VeraSun (VSE) reported 1st quarter 2008 results. Revenues literally exploding climbing 257% to $516.5 million. Net income turned positive at $7.6 million or $.08/diluted share vs. a loss of $(.3) million during the same quarter last year.

Well that report looks pretty nice!

However, you probably know that I believe that earnings expectations are often critical in determining whether a financial result is actually good or bad news! In other words, if we look through the news, we can get another report from the A.P. that indicates that the company missed expectations on earnings ("Analysts polled by Thomson Financial expected, on average, earnings per share of 16 cents."). Within the same article, the reporter notes tha the company did beat expectations of $500 million in revenue when they reported the $516 million result.

So the earnings news were at best 'mixed' although on the surface they appear pretty spectacular.

My next step (which you may or may not wish to emulate) is to examine whether the longer-term results are just as positive. For this, I utilize Morningstar.com, another free website--Morningstar also has a subscription-based premium site that does cost money. (In this case, I do own some shares of Morningsar (MORN) in my trading account--full disclosure).

If you enter VSE into the "quotes" box near the upper left, and then click on "Financial Statements" on the left side, and finally click on the "5-Yr Restated" tab you will get here.

Let me give you my take on this company. First revenue growth is beautiful with steady increase from $13 million in 2003 to $848 million in 2007 and $1.2 billion in the trailing twelve months (TTM). Earnings, however, have been at best erratic, jumping from $.02/share in 2003 to $.39/share in 2004, before slipping back to $.01 in 2005. Earnings then climbed to $1.03/share in 2006, and diped back to $.31/share in 2007 and increased to $.39/share in the TTM. Not exactly steady and consistent growth.

Something else, a word about 'free cash flow'. This might or might not be important to you. It means a lot to me. I am looking for companies from a relatively conservative viewpoint. That is, I want to own shares in companies that from my most amateur viewpoint appear to be financially healthy. And that requires them to be producing free cash instead of consuming it.

In VSE's case, the company was negative $(90) million of free cash flow in 2005, improved it to $54 million in 2006, dipped to a low of $(399) million in 2007 and has deteriorated further to a negative $(468) million in free cash flow in the TTM.

Not exactly the numbers I would prefer to see.

That doesn't mean that this might not be a terrific investment. Seriously. A great investment is a stock that when you have gone long, that is purchased shares for possible price appreciation, actually does go up in price. So these financial things are the stuff I look for in a stock. That doesn't mean that you need to...just my thing I guess.

Returning to Morningstar, we can see that the company has $73 million in cash and $323 million in other current assets. Considering the company has $189.3 million in current liabilites, this is a current ratio of over 2:1. Which would appear on first glance to be quite healthy. But when we take into consideration the nearly 500 million in cash flow 'destruction', we can see that the balance sheet could possibly be in the process of deteriorating somewhat. At least that's my take.

I usually go next to Yahoo "Key Statistics" to get some more information on the stock.

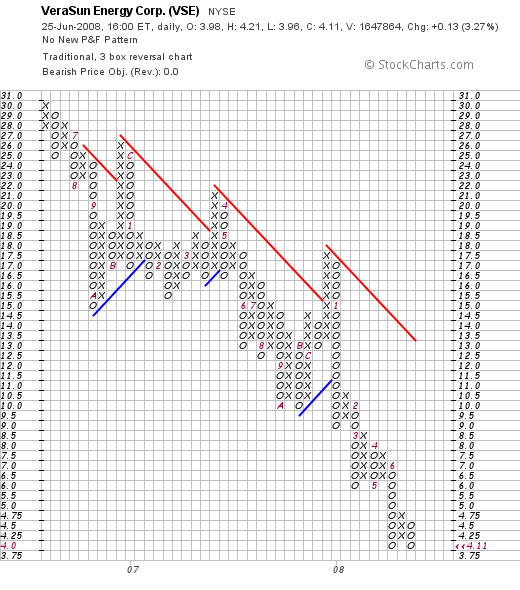

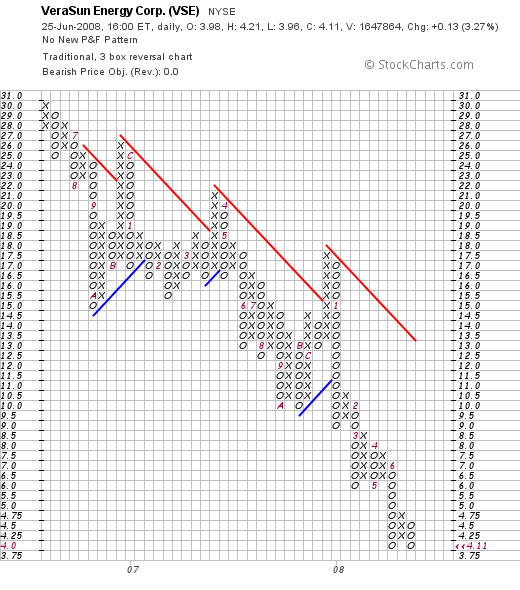

And check a chart over at StockCharts.com:

The chart isn't very encouraging to me. This kind of chart is known as a "point & figure" chart with columns of x's to suggest climbing stock prices, and o's to demonstrate declines.

I feel like I am 'late to the party' but I would be reluctant to buy these shares, at best a "hold", more likely

VERASUN (VSE) IS RATED A SELL

O.K. that wasn't what you wanted me to say, but it just doesn't work for my strategy. The last quarter was great but they missed expectations. They are delaying their ethanol plant openings because of "market conditions", they are burning up their available cash, and the chart looks awful to me.

I think you can check out the other stocks you mentioned in the same fashion as I did to reach your own conclusions.

Your list of stocks are basically what I would call 'top down' investing. It isn't a bad technique--many great investors do exactly that. They start with an idea, an observation, a realization, and then pursue the stock that sounds like it might work.

Peter Lynch successfully utilized this approach among other strategies during his stint with Fidelity Magellan fund.

Peter Lynch successfully utilized this approach among other strategies during his stint with Fidelity Magellan fund.

As reported on the Wharton Alumni page:

"Now vice-chairman of Fidelity Investments, Lynch has lived and breathed his strategy, even choosing one company, Hanes, in the 1970s because his wife bought and loved its new L’Eggs pantyhose line — the first department-store-quality pantyhose sold to American women via supermarkets.

“I did a little bit of research,” Lynch told PBS’s Frontline. “I found out the average woman goes to the supermarket or a drugstore once a week. And they go to a woman’s specialty store or department store once every six weeks. And all the good hosiery, all the good pantyhose is being sold in department stores. They were selling junk in the supermarkets. They were selling junk in the drugstores.” Lynch knew Hanes had a winner. L’Eggs became a huge success, and Hanes became Magellan’s biggest position."

So you are in good company if you subscribe to this approach. And it may work out well for you!

My own approach is more eclectic. I call it a "Zen" approach (of course I know next to nothing about Zen Buddhism). But what I mean is that I want to simply observe the market. Note which stocks are moving higher and examine their underlying fundamentals to see if they might be suitable investment vehicles.

I try to reduce my own calculations and concentrate on observations.

In addition, greatly influenced by Gene Walden who wrote about "100 Best Stocks to Own in America", as well as my own observations about finding the most consistent, steady growers in the market to park my own investment money, I started looking hard at recent quarterly reports (also influenced by William O'Neil and the CANSLIM strategy), I noted that companies like Fastenal (FAST) or Wal-Mart (WMT), had records of steady growth in revenue and earnings and these results were accompanied by steady and spectacular price appreciation.

Reading Robert Lichello and his AIM system from "How to Make $1,000,000 in the Stock Market Automatically" I started thinking about listening to my own portfolio. I limited my losses and started preserving my gains by small sales of appreciation stocks. I used these sales on the upside and the downside to give me 'signals' on when to be buying or selling positions in my portfolio.

I hope all of this works.

I am not sure if I have answered your questions. But I hope that I have encouraged you to seek more information, think about your investment strategy and perhaps to add to your knowledge by looking, observing, and responding to the stock market.

Thanks for visiting and writing!

Yours in investing,

Bob

Monday, 23 June 2008

Fluor (FLR)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

When looking for a new stock to "pick" and discuss, my first screening involves reviewing the top % gainers. From among these stocks, I try to identify the highest quality companies--which for me are the ones with evidence of persistence of revenue and earnings growth, stable outstanding shares, growing and positive free cash flow, acceptable balance sheets and reasonable valuations. These are the kind of companies that I try to own and to follow here on this blog.

When looking for a new stock to "pick" and discuss, my first screening involves reviewing the top % gainers. From among these stocks, I try to identify the highest quality companies--which for me are the ones with evidence of persistence of revenue and earnings growth, stable outstanding shares, growing and positive free cash flow, acceptable balance sheets and reasonable valuations. These are the kind of companies that I try to own and to follow here on this blog.

Fluor (FLR) made the list of top % gainers on the NYSE today. As I write, the stock is trading at $202.34, up $10.79 or 5.63% on the day. I do not own any shares or options on Fluor. But I would like to share with you why

FLUOR (FLR) IS RATED A BUY

Let's review some of the facts about Fluor (FLR) that led me to this assessment---first of all, what exactly does this company do?

According to the Yahoo "Profile" on FLR, the company

"...through its subsidiaries, provides engineering, procurement, construction management, and project management services worldwide. It operates in five segments: Oil & Gas, Industrial & Infrastructure, Government, Global Services, and Power."

"...through its subsidiaries, provides engineering, procurement, construction management, and project management services worldwide. It operates in five segments: Oil & Gas, Industrial & Infrastructure, Government, Global Services, and Power."

And the latest quarter?

On May 12, 2008, Fluor (FLR) reported 1st quarter 2008 results. Revenue for the quarter ended March 31, 2008, came in at $4.8 billion, up about 32% from the prior year $3.6 billion. Net earnings for the quarter came in at $138 million, up 63% from last year's $85 million in the same quarter. On a per share basis, this worked out to $1.50/share, up sharply from $.94/diluted share last year.

In light of new awards and excellent prospects in the near future, the company went ahead and raised guidance for 2008 with earnings now expected in the $6.25 to $6.55 range, up from the previous range of $5.10 to$5.55/share previously announced.

The company easily beat expectations with the $1.50 figure, as analysts polled by Thomson Financial had expected a profit of $1.27/share. The company also beat expectations on the revenue with the $4.8 billion figure as analysts had been expecting revenue of $4.64 billion.

I appreciate a great quarter, but quality is about great quarters one after another for many years! And for this information, I generally turn to Morningstar.com for additional information.

Reviewing the Morningstar.com "5-Yr restated" financials on Fluor (FLR), we can see that revenue has grown nicely from $8.8 billion in 2003 to $16.7 billion in 2007 and $17.9 billion in the trailing twelve months (TTM).

During this same period, earnings have dramatically and steadily improved from $1.95/share in 2003 to $5.85/share in 2007 and $6.41/share in the TTM. As a 'bonus', the company has also been paying a dividend and rather regularly increasing it from $.64/share in 2003 to $.80/share in 2006 and $.85/share in the TTM.

Outstanding shares have been expanding but at a modest rate from 81 million shares in 2003 to 91 million in 2007 and the TTM. Thus, this approximately 13% increase in shares was accompanied by an approximately 100% increase in revenue and a 200% increase in earnings. I am quite comfortable with a small increase in shares when this is associated with a larger increase in both earnings and revenue reported.

Free cash flow has been somewhat erratic dipping from $195 million in 2005 to $22 million in 2006. However, this jumped back sharply to $621 million in 2007 and the company has reported $656 million in free cash flow as reported by Morningstar.com.

The balance sheet appears adequate with $1.13 billion in cash and $3.32 billion in other current assets, which, when compared to the $3.13 billion in current liabilities yields a current ratio of 1.42.

Checking Yahoo "Key Statistics" for some valuation numbers, we see that this is a large cap stock with a market capitalization of $17.88 billion. The trailing p/e is reported at 31.46 with a forward p/e of 25.55 (fye 31-Dec-09). The PEG ratio is a bit rich at 1.73. (All things being equal, I would prefer to see a PEG between 1.0 and 1.5).

The trailing p/e is also a bit rich at 31.46.

Reviewing information from the Fidelity.com eresearch website, the Price/Sales ratio comes in at 0.95 (TTM), compared to an industry average of 1.06. In terms of profitability as measured by the Return on Equity (ROE) (TTM), the company also does well relative to its peers with a 27.43% ROE compared to the industry average of 23.97%.

Yahoo reports 88.7 million shares outstanding with 87.46 million that float. As of 5/27/08 there were 4.63 million shares out short representing a short ratio of only 1.9. (Less than my own arbitrary 3 day level for significance.) The company does pay a dividend (as noted above) of $1.00/share going forward, with a .5% dividend yield. No stock split is reported on Yahoo. (The company previously announced a 2:1 split to be effective July 2, 2008 for shareholders of record on June 6, 2008).

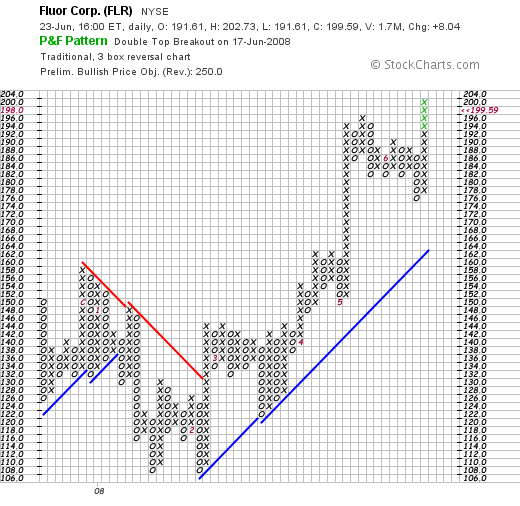

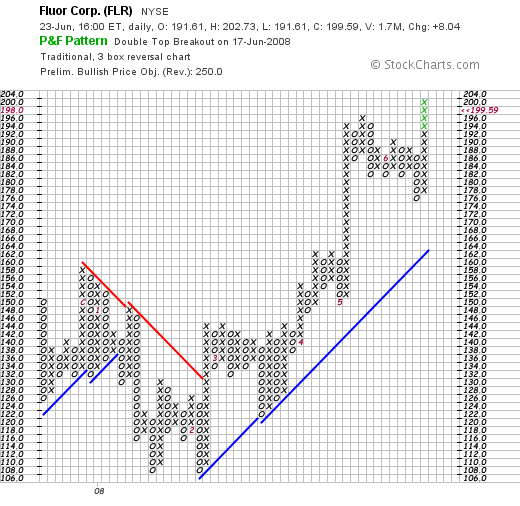

Checking a "point & figure" chart on Fluor from StockCharts.com, we can see that the stockwhich was trading sideways earlier this year, broke through resistance in February, 2008, and has been moving strongly higher the past four months.

Insofar as future prospects, Fluor should benefit from alternative electricity generation as this report on participating in a $350 million contract for an offshore British wind farm indicates. Last month, Fluor was also awarded a $1.8 billion contract for the world's largest offshore wind farm project. So besides doing well with existing oil and gas projects, Fluor is well positioned for the likely expanded role for wind and alternative energy.

Thus, with the nice price performance today, the solid earnings report that beat expectations and found the company raising guidance, the terrific Morningstar.com data, reasonable valuation a great stock price chart, and a good 'story' on wind farms as well, it is easy to see why I would be rating this stock so highly.

It is the kind of stock I would be buying if I had my own idiosyncratic signal to be acquiring a new stock. My own portfolio generates these signals as my own holdings hit appreciation targets and portions of them are sold. However, without such a signal, I shall be continuing to admire Fluor (FLR) from a distance.

Thank you again for stopping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor page where my actual holdings are reviewed, my SocialPicks page where all of my prior stock picks from the last year or so are assessed, and my Podcast Site where you can listen to me review some of the many stocks I discuss right here on the blog!

Yours in investing,

Bob

Sunday, 22 June 2008

A Short Comment on Visa (V) as it Pertains to my Investment Philosophy

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

With those words, I have been starting virtually every one of my entries on this blog. I do this because they are accurate words. Words that describe my own professional expertise--which is not in investment management or analysis--and yet do not reflect my own personal experience with investing or writing about stocks on this blog.

Recently I wrote about my short-term holding of Visa (V) stock. This started out with my entry here on Visa, which was then picked up and packaged by Seeking Alpha here. I initiated my amateur 'coverage' of Visa with a "Buy" rating.

Unfortunately, just two weeks later, my Visa shares demonstrated weakness....along with the rest of the market....and hit my 8% loss limit. I sold the shares. I discussed this on my blog here and this was also picked up by Seeking Alpha here.

With my own sale of shares for my idiosyncratic technical reasons, I did not feel it would be ethical to maintain my "Buy" rating on this stock, and reduced it to a "Hold".

Unfortunately, my own approach to investing is neither famous nor well-understood in the world of Seeking Alpha. I do believe that my regular readers understand my approach. I do not even know whether my particular investment strategy will even be successful or profitable over the long haul. I do not know whether it will be more profitable than simply buying an index fund.

I do know that it makes good sense to me.

I shall not be buying stocks because they are fad stocks.

I shall continue to listen to my portfolio by 'sitting on my hands' on sales of stocks on losses and looking to add to my equity exposure when my stocks hit appreciation targets.

I shall limit my losses when they hit sale points that I have established at the time of purchase.

In one comment on Seeking Alpha I was accused of using my 'calculator' instead of my brain or intuition in making a sale decision. I regret to inform that writer and any other commenter that I shall continue to use my calculator to make sale decisions. That is the heart of my approach.

There is no doubt that I shall miss many of the great moves of the stock market. But I shall not be in love with any of my investments to the point that I shall over-ride my own thought processes and strategy with infatuation.

In 1942, before becoming President, it has been reported that Harry S. Truman, as noted in The Soda Springs Sun had said:

In 1942, before becoming President, it has been reported that Harry S. Truman, as noted in The Soda Springs Sun had said:

"Favorite rejoinder of Senator Harry S. Truman, when a member of his war contracts investigating committee objects to his strenuous pace: 'If you don't like the heat, get out of the kitchen'."

I am not prepared to get out of the kitchen :). I can take the heat.

Time will tell whether my approach will be any better than a random selection of stocks.

I am glad that some of you have chosen to come along with me on this journey. I shall continue to try to make rational decisions not based on any affection for any stocks or dislike of any investment. But rather based on a systematic identification of potential investments, a clear management of each purchase, and a thoughtful response to the movements of my own portfolio in determining my next action in response to the market.

Thank you for coming along with me.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Newer | Latest | Older

I always enjoy receiving correspondence. Even when I was a kid I liked to run to the mailbox and find out what had just come in. O.K. it isn't as bad as in the musical The Music Man and The Wells Fargo Wagon song....but just the same...I really do like to hear from all of you readers.

I always enjoy receiving correspondence. Even when I was a kid I liked to run to the mailbox and find out what had just come in. O.K. it isn't as bad as in the musical The Music Man and The Wells Fargo Wagon song....but just the same...I really do like to hear from all of you readers.

For instance, let's use Verasun Energy (which after entering the name in the box I see that the symbol is VSE).

For instance, let's use Verasun Energy (which after entering the name in the box I see that the symbol is VSE).

Peter Lynch successfully utilized this

Peter Lynch successfully utilized this  When looking for a new stock to "pick" and discuss, my first screening involves reviewing the top % gainers. From among these stocks, I try to identify the highest quality companies--which for me are the ones with evidence of persistence of revenue and earnings growth, stable outstanding shares, growing and positive free cash flow, acceptable balance sheets and reasonable valuations. These are the kind of companies that I try to own and to follow here on this blog.

When looking for a new stock to "pick" and discuss, my first screening involves reviewing the top % gainers. From among these stocks, I try to identify the highest quality companies--which for me are the ones with evidence of persistence of revenue and earnings growth, stable outstanding shares, growing and positive free cash flow, acceptable balance sheets and reasonable valuations. These are the kind of companies that I try to own and to follow here on this blog.

In 1942, before becoming President, it has been

In 1942, before becoming President, it has been