Stock Picks Bob's Advice

Thursday, 12 February 2009

Ecolab (ECL) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I wanted to share with all of you my own disappointment at having to part ways with my recent purchase of 134 shares of Ecolab (ECL) that I had just purchased on 2/6/09 at a cost basis of $35.54. I sold these shares earlier today in the midst of the continued market correction at a price of $31.5948. This represented a loss of $(3.9452)/share or (11.1)% since purchase. (As I write, ECL is recovering somewhat trading at $32.04/share for a loss today of $(2.21) or (6.45)%.

I wanted to share with all of you my own disappointment at having to part ways with my recent purchase of 134 shares of Ecolab (ECL) that I had just purchased on 2/6/09 at a cost basis of $35.54. I sold these shares earlier today in the midst of the continued market correction at a price of $31.5948. This represented a loss of $(3.9452)/share or (11.1)% since purchase. (As I write, ECL is recovering somewhat trading at $32.04/share for a loss today of $(2.21) or (6.45)%.

After an initial purchase of stock, my own trading strategy dictates a sale at an (8)% loss regardless of the duration of my ownership of that stock. And that includes selling shares after only 6 days!

With this sale on a decline, which for me means a sale on 'bad news', I am back to my minimum of 5 positions and shall be 'sitting on my hands' with the proceeds of this sale--thereby moving once again a little more into cash and away from equities!

What triggered the slide today was apparently the disappointment in the 4th quarter 2008 earnings results which were announced today. Excluding one-time expenses, earnings game in at $.45/share, unchanged from last year and in line with expectations of $.45/share. Revenue, which climbed 3% in the quarter to $1.48 billion from $1.44 billion was a bit 'light' from where analysts had pegged the company---$1.51 billion.

In addition, the company reduced expectations about the current quarter, guiding now to $.30 to $.34/share, well below analysts' expectations of $.41/share.

Even though full-year guidance was essentially in line with expectations, the disappointment on last quarter's revenue and the decreased guidance for the current quarter, was enough to make investors turn tail on this stock and resulted in my own sale as the stock hit and passed the (8)% loss limit for me.

Thank you for visiting my blog and allowing me to share with you my own experiences, albeit disappointing today, in investing in this uncertain market. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Friday, 6 February 2009

PetSmart (PETM) and Ecolab (ECL) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Daniel Drew, a Wall Street financier of the late

Daniel Drew, a Wall Street financier of the late 1800's had a theory about stock market investing and stock trading. He commented about one of his strategies:

1800's had a theory about stock market investing and stock trading. He commented about one of his strategies:

"I ought to have [closed my position] without a moment’s delay - cut short your losses and let your profits run, is the rule.”

This really isn't a bad suggestion. It is far better to sell losing stocks than gaining stocks, but is it the best approach? Can't gaining stocks turn into losing positions (vis a vis my own WMS sale yesterday)?

As I have worked on my own investment strategy, I have developed my own philosophy which is similar to Drew's but perhaps has an interesting twist. I believe it is important to 'sell your losers quickly and completely and sell your gainers slowly and partially!'

I work very hard to select stocks of what I would call the highest quality. I anticipate that they will appreciate in price yet I am prepared to limit their potential declines on the downside as well. In addition, I believe their actions are as much the fault of the market as my own poor investment selections!

Thus, when a stock declines and triggers a sale I assume that there may well be something 'wrong' with the market environment and use that sale as a signal to 'sit on my hands' with the proceeds. (Unless of course I am at my minimum degree of equity exposure, which, in that case, I still replace that holding, but with a smaller-sized position of another stock which should be equally promising. And when a stock appreciates to one of my own appreciation targets, I sell a small amount of that holding (currently 1/7th of the position) and use that sale as a signal that not only did I make a great pick, but also that the market is acting 'healthy' and it might well be safe to expand my own exposure to equities with a new holding.

Today my PetSmart shares hit one of those 'appreciation targets' and I sold 14 shares of my 104 share position. These shares had been acquired on November 20, 2008, at a cost basis of $15.58. My first targeted appreciation point is a 30% gain and with the stock trading at $20.47 today, I sold 14 of my 104 shares at that price and had a gain of $4.89 or 31.4% since purchase. This sale on the upside also generated a 'buy signal' for me and I went ahead and purchased shares of Ecolab (ECL).

Ecolab (ECL) is an old favorite of mine. Most recently I wrote briefly about this stock on December 13, 2008, talking about the things I like to see in a stock. But before I get to that, I wanted to discuss my latest approach to 'position sizing' within my portfolio management strategy.

Ecolab (ECL) is an old favorite of mine. Most recently I wrote briefly about this stock on December 13, 2008, talking about the things I like to see in a stock. But before I get to that, I wanted to discuss my latest approach to 'position sizing' within my portfolio management strategy.

Until recently, my position sizing was rather arbitrary. I thought about $5,000 for a position would be reasonable and then I purchased shares that hopefully were divisible by 7 to allow for a possible first sale. It was that bad!

My greatest challenge was determining what to do with positions when I got down to what I call my minimum size of portfolio--5 positions. That is, when one of my minimum 5 holdings hit a sale point on the downside and I needed to sell that holding, my strategy still required me to buy another stock to replace it. But replacing one position with another of the same size (or even larger) would still cause me to compound my losses in an unrelenting bear market that we certainly have experienced.

I decided that I needed to have some formula to select the size of my investment and since I still wanted to have five positions, the replacing position needed to be smaller to allow me to continue to reduce my exposure to equities even while maintaining the same number (5) of positions. I chose to replace holdings in my minimum portfolio with new stocks that were only 1/2 of the size of the average remaining holding.

But what about new purchases on actual good news. That is, assuming I am at 15 positions, and less than 20 (my maximum), how much money should I put to work when I get a buy signal (as I did today)?

My initial thought was to add new holdings equal to the average of the remaining stocks. But that wasn't aggressive enough. It could be possible that the size of the remaining holdings was quite small secondary to that extended bear market I discussed. Therefore, my current strategy is to continue to expand exposure to equities aggressively with 'good news' sales and purchase new holdings equal to 125% of the average of the other positions in the account.

And that is what I did today with Ecolab (ECL).

With my buy signal in hand, and that nickel burning a hole in my proverbial pocket, I purchased 134 shares of Ecolab (ECL) at $35.4776 this morning. I have bent the rules recently, not requiring the new stock I am adding to my portfolio to be on the top % gainers list at all. That list is a great place to find new potential purchases and I continue to do so on this blog. But I am reserving the right to assemble what I consider the very best of stocks in my portfolio including all of the ones I have discussed in the past.

As I write, Ecolab (ECL) is trading at $35.73, up $.92 or 2.64% on the day.

Briefly, Ecolab was selected because of the solid latest earnings report, a great Morningstar '5-Yr Restated' financials, and reasonable valuation. I like the business they are in--"products and services for hospitality, foodservice, healthcare, and light industrial markets....", and like Sysco (SYY), I hope they are relatively recession-resistant.

Thank you very much for bearing with me as I reported on this trade and once again shared with you my own thoughts on dealing with portfolio holdings in as rational a manner as possible.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 1:44 PM CST

|

Post Comment |

Permalink

Updated: Friday, 6 February 2009 1:45 PM CST

Thursday, 5 February 2009

Dolby (DLB) and Badger Meter (BMI) "Two Stocks: A Revisit and a New Name"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I am starting to feel a little of what I would call the normal functioning of the stock market. I say this in regards to what I would describe as the normal response to news. That is, stocks report great earnings and the 'Street' responds with a large news to the upside. This is what is supposed to happen in my book and is something that for the last six months or so has been relatively absent from the market action.

I am starting to feel a little of what I would call the normal functioning of the stock market. I say this in regards to what I would describe as the normal response to news. That is, stocks report great earnings and the 'Street' responds with a large news to the upside. This is what is supposed to happen in my book and is something that for the last six months or so has been relatively absent from the market action.

It was great today to look at the list of top % gainers on the NYSE and see Dolby (DLB) an 'old favorite' of mine make the list closing at $30.18, up $4.31 or 16.66% on the day. I first wrote up Dolby (DLB) on Stock Picks Bob's Advice on January 7, 2008, and also purchased some shares that I held for a short period of time. (I do not own any shares of Dolby nor do I own any options presently). At the time of my write-up, Dolby (DLB) was trading at $49.21, so we can see the stock has along with the rest of the market been under pressure.

Let me explain why this stock and also Badger Meter (BMI), a new name for this blog, deserve a spot on this website.

Besides making the list of top % gainers, they did this with great news. Dolby (DLB) reported 1st quarter 2009 results yesterday evening after the close. Earnings came in at $.68/share, easily exceeding estimates of $.43/share. Revenue also beat expectations, coming in at $180.3 million as compared to the estimated $164.9 million expected. To top this off, the company went ahead and raised guidance for 2009 earnings but did cut the outlook on revenue.

Alex Davidson over at Forbes.com pointed out that shares were upgraded to "outperform" over at Pacific Crest Securities and that analysts anticipate that Microsoft Windows 7 will significantly add to earnings.

What I really like about Dolby (DLB) isn't about the fabulous products they offer. I just really like their numbers on Morningstar.com with their "5-Yr Restated" page.

I am impressed by the steady growth in revenue from $289 million in 2004 to $640 million in 2008. I like the earnings growth that has skyrocketed from $.43/share in 2004 to $1.70/share in 2008. And their relatively steady outstanding shares which did grow from 93 million in 2004 to 112 million in 2006 but through 2008 stood at a barely increased 115 million shares.

Cash flow for this company is positive and solidly growing. They reported free cash flow of $124 million in 2006 and increased it to $152 million in 2007 and $251 million in 2008.

The balance sheet is equally impressive with $395 million in cash and $297 million in other current assets. This total of $692 million, when compared to the $200.7 million in current liabilities yields a current ratio of 3.45. From my perspective a current ratio of 1.5 or higher is solid. The company has a relatively nominal amount of long-term liabilities totaling $86.2 million.

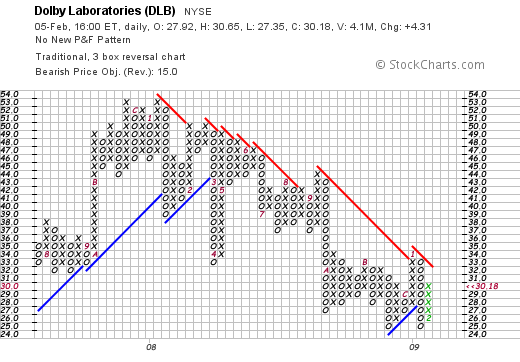

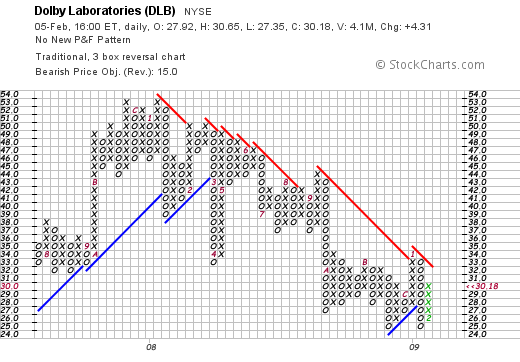

Like virtually every other tech stock on the market, Dolby (DLB) has been under pressure since early 2008 as this 'point & figure' chart from StockCharts.com demonstrates.

The stock is far from overpriced and appears to have 'double-bottomed' at around $25. However, a price move above $33 would be more reassuring to me that this stock is showing any particular technical strength at all.

Reviewing some Yahoo "Key Statistics" on Dolby, we find that Dolby is a mid cap stock with a market capitalization of $3.4 billion. The trailing p/e is only 17.36 with a forward p/e (fye 26-Sep-10) of 17.05. The PEG is a reasonable 1.12.

In terms of valuation, the Fidelity.com numbers suggest that the Price/Sales (TTM) is rich at 4.53 compared to the industry average of only 0.93. However, in terms of profitability, Fidelity reports that the Return on Equity (ROE) at 20.59% almost doubles the industry average of 11.11%.

Finishing up with Yahoo, there are 112.58 million shares outstanding but only 51.78 million that float. Currently there are 6.18 million shares out short (as of 12-Jan-09) with a resultant short interest ratio of 10.9 days. From my perspective, this is well above my own arbitrary 3 day rule for short interest suggesting that today's sharp price move might well have been a bit of a 'squeeze' of the shorts.

No dividend is paid and Yahoo does not report any stock splits.

Since I have gone on for some time about Dolby (DLB), let me briefly fill you in on the second stock I wanted to comment on--Badger Meter (BMI). I do not own any shares of this Wisconsin firm (I love those Wisconsin companies that show up in my blog---Go Badgers!)

Since I have gone on for some time about Dolby (DLB), let me briefly fill you in on the second stock I wanted to comment on--Badger Meter (BMI). I do not own any shares of this Wisconsin firm (I love those Wisconsin companies that show up in my blog---Go Badgers!)

Badger Meter (BMI) made the list of top % gainers today. They closed at $30.51, up $6.42 or 26.65% on the day (!). Basically they reported a terrific fourth quarter 2008 with solid revenue and earnings growth. They also have a terrific Morningstar.com "5-Yr Restated" page with steady revenue growth, earnings growth and yes (!) dividend growth. The free cash flow results are incomplete on the page but the 2007 results show $12 million in free cash flow. Their balance sheet appears solid with a current ratio of about 1.5.

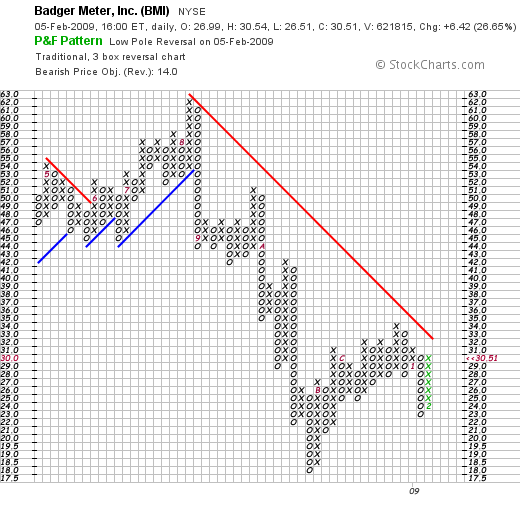

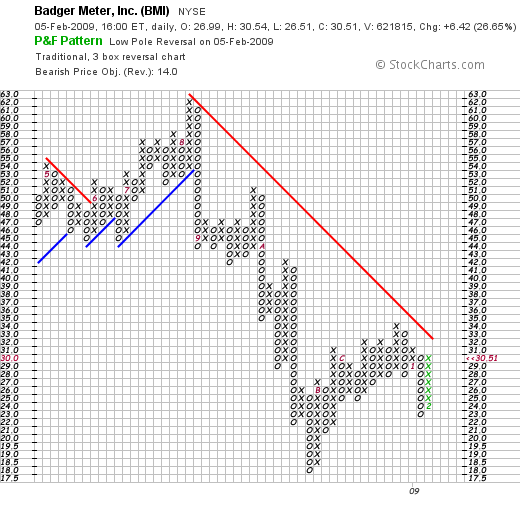

The 'point & figure' chart on Badger Meter from Stockcharts.com shows the stock price peaking at about $62 in August, 2008, only to dip as low as $18 in November, 2008. The stock price has been fighting back but like Dolby, I would like to see it above the 'resistance line' at about $32.

In terms of valuation, according to Yahoo "Key Statistics" the stock has a trailing p/e of 20.94 with a forward p/e estimated at 19.81 (fye 31-Dec-09). This is a smaller company that Dolby, actually a small cap stock with a market capitalization of only $451.18 million.

In terms of valuation, according to Fidelity.com, Badger has a Price/Sales (TTM) ratio of 1.31 compared ot the industry average of 0.77. The company is slightly more profitable than its peers as measured by the Return on Equity (TTM) which according to Fidelity comes in at 22.75% compared to the industry average of 20.17%.

Yahoo reports only 14.79 million shares outstanding with 13.66 million that float. As of 12-Jan-09 there were 1.55 million shares out short representing 4.2 trading days of short interest--a little above my own '3 day rule' for significance. As I noted, the company does pay a small dividend of $.44/share with an indicated yield of 1.8%. The last stock split was a 2:1 split back on June 16, 2006 per Yahoo.

If you read the Bob Herbert column from the January 29, 2008 edition of the New York Times, you might realize that the infrastructure stimulus might well include Badger Meter products in water projects (?). Anyhow, perhaps that is what the 'street' is thinking in dealing with this company!

Anyhow, I feel like more of my old self today---finding firms on the top % list reporting great earnings and being rewarded for their financial success!

Thank you again for visiting here and if you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 6:23 PM CST

|

Post Comment |

Permalink

Updated: Thursday, 5 February 2009 10:24 PM CST

Wednesday, 4 February 2009

Microsoft (MSFT) and WMS Industries (WMS) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As is my policy on this blog, I try to keep you posted as soon as possible regarding trades in my own 'trading account'. I also try to reasonably follow my own investment strategy that may lead me to part ways with stocks that I otherwise admire and otherwise would be thinking of holding.

Occasionally I 'toss out all of the rules' and do what I call a 'trade' which might mean holding a stock for hours, days or weeks, but otherwise is a purchase outside my own relatively rigid strategy for buying and selling of stocks.

My Microsoft purchase on 1/22/09 was one of these trades.

On that day, the stock was under severe pressure when the earnings announcement failed to meet expectations and an already 'beaten up' stock was beaten up further to levels not seen in over a decade. It was with that thought in mind, that perhaps things had really been 'overdone' that I chose to purchase what for me would be a very oversized purchase of 1,000 shares at a cost of $17.69.

Today, with Microsoft trading about a point higher, I chose to unload those 1,000 shares and sold them at a price of $18.68. This worked out to a gain of $.99/share or a 5.6% gain in the two weeks since my purchase. Overall, with a 1,000 share position, with a total cost of $17,697.99 and a net of $18,671.89, this yielded a gain of $973.90 on this trade.

With about half of my equity tied up with the Microsoft position, and with my own purchase outside of my usual trading rules, I was rather anxious to take my profit and run. However, this does not mean that I do not like Microsoft, but rather that my aim with that purchase was to exploit the short-term over-reaction on the stock price and pick up a short-term gain. Fortunately I was correct on this educated guess.

My other sale today was one of my regular positions: my 72 shares of  WMS Industries which were all sold a few moments ago at a price of $19.69. These shares were just purchased 10/28/08, so I had a loss of only $(.43)/share or (2.1)% since purchase.

WMS Industries which were all sold a few moments ago at a price of $19.69. These shares were just purchased 10/28/08, so I had a loss of only $(.43)/share or (2.1)% since purchase.

I have actually sold shares twice at the 30% gain (quite frankly an oversight (!) because the second 1/7th position was sold forgetting the first sale at the 30% gain!). I sold 13 shares 11/4/08 at $26.05, and 11 shares on 12/3/08 at a price of $25.48.

However, in any case, after a single sale at a gain, it has been my policy to sell all shares should a stock holding decline to under break-even. Normally after a purchase of shares I wait for an (8)% decline before pulling the plug. WMS has been sold previously at a gain, and now has declined into a losing position. No matter what my own personal affection for the stock, my 'trading system' was directing me to dispose of shares.

Ironically, the behavior of WMS in the market mimics the activity of MSFT prior to my own purchase. I am torn between wanting to override my own trading policy and actually buying shares at this point or following my rules and selling shares. With the market acting as anemic as it is, I chose the conservative action and entered the sell orders!

Looking hard for news, the best I could come up with today was the announcement of a 'downgrade' of shares by analysts over at JP Morgan who changed their recommendation from "overweight" to "underweight" and the rest is history.

In fact just a few days ago on January 29, 2009, WMS announced 2nd quarter 2009 results with total revenues increasing 12% year-over-year and earnings coming in at $.41/share, a nickel ahead of estimates of $.36/share per Reuters. Revenue at $178.4 million also beat expectations of $175.7 million expected. However, the company did guide slightly lower for the upcoming quarter with revenue of $178 to $185 million now expected, below the street's expectations of $188.1 million.

In any case, I felt that today was a day of sticking to rules, getting out of profitable trades, and otherwise taking stock of the market while maintaining a cautious optimism over future prospects!

Thank you again for visiting! If you have any comments or questions, please leave them right here on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Tuesday, 3 February 2009

Is That Jubak on the Marketwatch Page?

O.K. forget about stock picks for a moment. We can do that later!

I just want to know if you all think that cartoon looked like Jim Jubak from MSN.

First Jubak's actual picture:

Now the picture from MarketWatch today:

O.K., maybe it's just a coincidence, but I thought it was kind of cute and there is a resemblance there!

Thanks for bearing with me. So what do you think?

Yours in investing,

Bob

Monday, 2 February 2009

Guzzo the Contrarian: "I Resemble That Remark"

If you get a chance, stop by and visit Guzzo the Contrarian who has spoofed me quite well I should say! In these difficult and dreary times, thank you Michael for the slice of humor!

Au contraire.

Yours in Investing,

Bob

Alamo Group (ALG) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Sometimes looking through the lists of the top % gainers, I suspect that my strategy of searching there is obsolete and no longer useful. Simply put, there haven't been a lot of stocks that report anything close to 'good' earnings reports and when they do, there isn't any enthusiasm to buy those shares and push the price of the shares higher.

Sometimes looking through the lists of the top % gainers, I suspect that my strategy of searching there is obsolete and no longer useful. Simply put, there haven't been a lot of stocks that report anything close to 'good' earnings reports and when they do, there isn't any enthusiasm to buy those shares and push the price of the shares higher.

Lately, things have seemed to be doing a bit better. Like the spring, the snow is starting to melt a bit on Wall Street. (Or am I too much of a Polyanna to appreciate how bad things still are?)

Anyhow, I was relieved to see an 'old friend' of mine, Alamo Group (ALG), make the list of top % gainers on the NYSE, trading as I write this up at $13.66, up $1.11 or 8.85% on the day. I write 'old friend' (or should I say 'old favorite'?) because I first wrote up this stock on February 28, 2005, almost exactly four years ago, when the stock was trading at $24.80/share. Unfortunately, the stock has not split its shares since my review and is trading at just over 50% of that 'pick price' from four years ago.

So why should I think the stock is still worth a place in this blog after that dismal performance?

This company according to the Yahoo "Profile"

"...provides tractor-mounted mowers, such as boom-mounted mowers, and other types of cutters for maintenance around highway, airport, recreational, and other public areas; heavy-duty, tractor and truck-mounted mowing, and vegetation maintenance equipment; air, mechanical broom, and regenerative air sweepers; and environmental sweepers."

ALG announced 3rd quarter results on November 10, 2008. Sales for the quarter ended September 30, 2008, climbed 18% to $148.7 million from $126 million for the same period last year. Earnings came in at $.45/diluted share up from $.42/share the prior year.

If we review the Morningstar.com '5-Yr Restated' financials, we can see the remarkably consistent record of financial results. Revenue has increased steadily from $279 million in 2003 to $504 million in 2007 and $561 million in the trailing twelve months (TTM).

Earnings, except for a dip between 2004 and 2005, have grown from $.82/share in 2003 to $1.24/share in 2007 and $1.62/share in the TTM. The company pays a dividend of $.24/share which for a $13.66/share stock works out to a 1.9% yield. Unfortuantely the dividend has been unchanged since at least 2003. The company has held the 10 million shares outstanding over the past five years as well.

In terms of free cash flow, the company which has a negative $(1) million in free cash flow in 2005 and a $(7) million in free cash flow in 2006, turned positive with $8 million in free cash flow in 2007 and $10 million in the TTM.

Finally, the balance sheet shows the company with $5 million in cash and $267 million in other current assets, easily covering the $100.3 millio in current liabilities as well as the $96.5 million in long-term liabilities combined. The current ratio works out to somewhere north of 2.5.

In terms of valuation this is a micro cap stock with a market capitalization of $135.22 million. The trailing p/e is a modest 8.40 with a forward p/e (fye 31-Dec-09) at 18.42. No PEG ratio is recorded. Probably because it is such a small stock that it is largely overlooked, I suspect, by most analysts!

Looking at the Price/Sales ratio, utilizing the Fidelity.com eResearch website, we can see that the Price/Sales (TTM) is 0.22 compared to an industry average of 0.77. Also from Fidelity, the Return on Equity (TTM) is 7.96% compared to the average of 20.35% for similar companies suggesting that while a good value in terms of profitability, the actual 'return' is less than some of its peers.

Returning to Yahoo, we can see that there are only 9.92 million shares outstanding with 6.65 million that float. As of 1/12/09 there were 225,800 shares out short representing a short interest ratio of 9.6 days well above my own arbitrary 3 day rule for significance. As I noted, the company pays a $.24/share dividend with a forward dividend yield of 1.9%. No stock splits are reported.

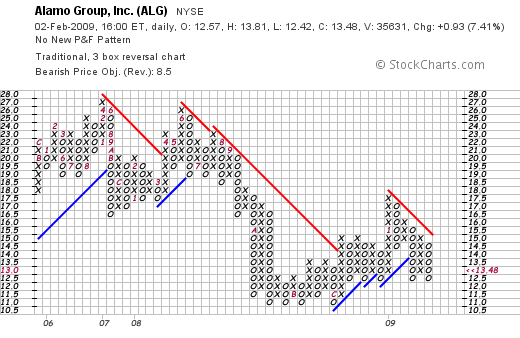

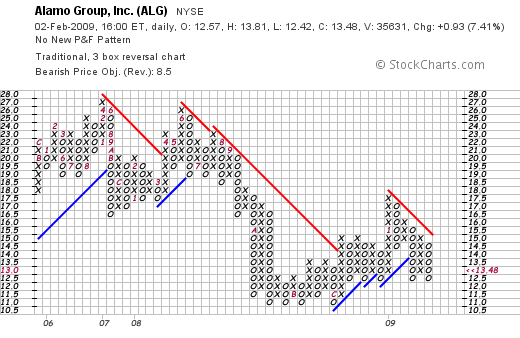

Looking at a 'point & figure' chart on Alamo Group (ALG) from StockCharts.com, we can see that the stock peaked at around $27 in the last few years in April, 2007. Since then it has been heading in a downward direction bottoming at around $11 in October, 2008, and repeatedly bottoming (a quadruple bottom?) at that level, with the latest dip in December, 2008. Recently the stock appears to have failed the latest rally with a peak of $17.50 in January, 2009. The stock is now forming a new 'quadruple bottom' at the $12.50 level--and rallying off that level. Overall the stock has met resistance and would need to climb above the $15 level for even a short-term technical bull signal in my amateur opinion.

I do not own any shares of Alamo Group (ALG) nor do I own any options on this stock. But I do like the numbers and the consistent growth and solid balance sheet and downright cheap valuation. The stock even pays a dividend!

But I don't think this is why maybe there is a bit of interest in this stock. I suspect that the Stimulus Plan making its way through Congress might just favorably affect a company like Alamo which sounds like it has its fingers in everything related to 'infrastructure spending'. Especially when you read some more of the 'profile' of the company from Yahoo:

"It also offers pothole patchers and snowblower products; hydraulics and telescoping booms; catch basin cleaners and roadway debris vacuum systems; sewer cleaners; parking lot sweepers; and snowplows, heavy duty snow-removal equipment, and hitches, as well as attachments for trucks, loaders, and graders. In addition, the company provides rotary cutters, front end loaders, backhoes, posthole diggers, and scraper blades, as well as finishing, flail, and disc mowers; cutting parts, plain and hard-faced replacement tillage tools, disc blades, and fertilizer application components; and heavy-duty mechanical rotary mowers, snow blowers, and rock removal equipment. Further, it offers hydraulic, boom-mounted hedge, and grass cutters; and other tractor attachments and implements, such as hydraulic backhoes, cultivators, subsoilers, buckets, and other digger implements."

Thanks again for stopping by and visiting my blog! If you have any comments or questions, please feel free to drop me a line at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 1:28 PM CST

|

Post Comment |

Permalink

Updated: Monday, 2 February 2009 6:13 PM CST

Wednesday, 28 January 2009

My Prosper.com Account: Update #6

Hello Friends! Thanks so much for stopping by and visiting my blog Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of the things I have been doing on this blog has been outlining some of my other investments that I have been making besides my 'trading account'. One of these has been my Prosper.com account. This "person-to-person" lending account has been described here first on February 10, 2008, when I related how my nephew Ryan introduced me to this website and most recently on July 13, 2008.

I had been contributing $50/month and a few of you may also have been inspired by my activity to also invest in Prosper.

In February I had 44 loans totaling $2,323.55 and by my las Update #5 in July, 2008, I was up to 96 loans totaling $5,964.23. (I had made additional transfers of funds into Prosper in addition to the regular deposits.)

Unfortunately, things are in a state of limbo for Prosper and for those of us who have been participating on this website. While existing loans continue to be serviced and payments credited to Prosper lenders, new funds and new loans are now suspended until Prosper.com meets SEC requirements and conforms to appropriate regulations.

Since I am no longer able to re-invest my funds into new loans, I have chosen to let my loan repayments collect waiting for the process to restart (?). As of January 28, 2009, my Prosper.com statistics are as follows:

Cash Balance: $945.61

Value of loans: $5,412.08

Payments in transit: $27.69

Total Account Value: $6,385.39

In regards to existing loans, I currently have 106 active loans. Of these, 93 are current, 3 are less than 1 month late, 4 are 1 month late, 2 are 2 months late, 2 are 3 months late and 2 are 4+ months late.

Prosper has been active writing off the 4+ months late loans. Currently I have received Net Income (interest + fees + awards): $607.95.

Net charge-offs: $(482.33)

Net gain/loss: $125.63.

The value of all of the loans is $5,412.08 with $1,964.91 of payments received. The average interest rate on remaining loans is 14.13% and the daily interest accrual is $2.07.

There has been little recent "news" regarding the status of Prosper.com. A summary of this event is well described on this "the Next web.com" entry by Zee. Zee also included the PDF of the actual SEC statement. Zee explains:

"It seems the shutdown is based on the amount of reliance both the lender and borrower have on the site. Since the lender does not know who the borrower it leaves the lender vulnerable and unable “to pursue his or her rights as a noteholder” if the borrower fails to meet the agreed payment terms. In addition, the document states that for the loan agreement to continue it would require Prosper.com to still exist and operate which in this climate, is no guarantee."

Another explanation of events at Prosper is found on the Inc. Website entry where Jason Del Rey explains:

"In November, the SEC filed a cease-and-desist order against San Francisco-based Prosper Marketplace, which runs Prosper.com, ruling that the loan notes being offered on the site were securities and needed to be registered with the commission. Prosper had stopped facilitating new loans the previous month in anticipation of the ruling, and to start the registration process to set up a secondary marketplace where lenders could package and sell loans to each other. Prosper also reached a $1 million settlement with the North American Securities Administrators Association, the membership organization for state securities commissioners. As a result, another peer-to-peer startup, New York-based Loanio, decided to do the same in November, only a month after launching. London-based Zopa.com also closed its U.S. peer-to-peer lending site in October."

Currently the only active person-to-person site in the United States is Lending Club. As Del Rey relates:

"As of the end of the year, San-Francisco based Lending Club was the only one left standing. The company first started talking to the SEC in October 2007 about setting up a secondary market for lenders who, in search of liquidity, wanted to package and sell their loan notes to other lenders, according to Renaud Laplanche, Lending Club's founder and CEO. After SEC staff members started hinting that Lending Club should register its loan notes for the primary market as well, the company decided in April to stop facilitating new loans and enter the registration process. It cost Lending Club several million dollars, but the company was able to restart its operations in October."

Additional explanations have been blogged by TreeHugger, by Erick Schonfeld on TechCrunch, and even the Daily Kos got into the action with an entry by bink.

Prosper has little to say itself. They simply report on their website:

"Prosper has started a process to register, with the appropriate securities authorities, promissory notes that may be offered and sold to lenders through our site in the future.

Until we complete the registration process, we will not accept new lender registrations or allow new commitments from existing lenders. If you're an existing lender, your current lender agreements will be unaffected; your existing loans will continue to be serviced; you'll be able to track and monitor your loans; and you'll be able to withdraw funds from your Prosper account.

If you're a borrower with an existing loan, you will continue with your current borrower agreement and be unaffected by the registration process. If you're a borrower seeking a loan, you will still be able to create a new loan listing, which we will endeavor to fulfill through alternative sources. As the appropriate securities authorities may consider a new loan listing to constitute the offer of a security, we are unable to post new loan listings on our site until our registration statement becomes effective.

A successful registration can take several months, but we assure you we will do our best to move forward as quickly as possible. Until this process is complete, we're required to be in a quiet period and will be unable to respond to press, blogger or other inquiries about Prosper or the registration filing until it becomes effective."

As for me, I shall continue to 'hang in there' with my nominal funds waiting to see what happens with Prosper. I suspect that if Lending Club can figure this out, then Chris Larsen the CEO and Co-Founder of Prosper as well as a co-founder of E-Loan should be the one to figure this out.

Meanwhile, I shall continue to report to you on intervals on the progress or lack thereof of this alternative investment which for me and for my nephew seemed so promising.

Yours in investing,

Bob

Thursday, 22 January 2009

Microsoft (MSFT) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment deciisons based on information on this website.

This morning Microsoft announed 2nd quarter 2009 results.

This morning Microsoft announed 2nd quarter 2009 results.

As was reported:

"Microsoft Corp. today announced revenue of $16.63 billion for the second quarter ended Dec. 31, 2008, a 2% increase over the same period of the prior year. Operating income, net income and diluted earnings per share for the quarter were $5.94 billion, $4.17 billion and $0.47, declines of 8%, 11% and 6%, respectively, compared with the prior year."

In light of deteriorating economic conditions Microsoft (MSFT) announced first-ever job cuts:

"In light of the further deterioration of global economic conditions, Microsoft announced additional steps to manage costs, including the reduction of headcount-related expenses, vendors and contingent staff, facilities, capital expenditures and marketing. As part of this plan, Microsoft will eliminate up to 5,000 jobs in R&D, marketing, sales, finance, legal, HR, and IT over the next 18 months, including 1,400 jobs today."

The news spooked the street over-riding the good earnings report from AAPL. The Dow closed down 105.30 today at 8,123 and the Nasdaq was off 41.56 at 1,465.

MSFT closed at $17.12 today, down $(2.26) or (11.66)% on the day.

It all seemed overdone. MSFT is already down from its 52 week high of $35.00. It is currently trading with a trailing p/e of 9.01 and has a dividend yield of 3.04%. The report wasn't great, but the company doesn't seem to be going out of business.

If we check the "5-Yr Restated" financials from Morningstar, we can see that Microsoft has grown its revenue from $36.8 billion in 2004 to $60.4 billion in 2008 and $61.7 billion in the trailing twelve months.

Earnings--up to the latest quarter--have increased from $.75/share in 2004 to $1.87/share in 2008 and $1.89/share in the TTM. Dividends were $.16/share in 2004 and increased to $.44/share in 2008 and $.46/share in the TTM.

Meanwhile outstanding shares have decreased from 10.89 billion in 2004 to 9.47 billion in 2008 and 9.39 billion in the TTM.

Free cash flow is particularly impressive with the company reporting $12.8 billion in free cash flow in 2006 increasing to $18.4 billion in 2008 decreasing slightly to $15.7 billion in the TTM. The balance sheet is solid with $9 billion in cash and $28 billion in other current assets. This is compared to the $24.4 billion in current liabilities and the $7.1 billion in long-term liabilities. The current ratio is approximately 1.5.

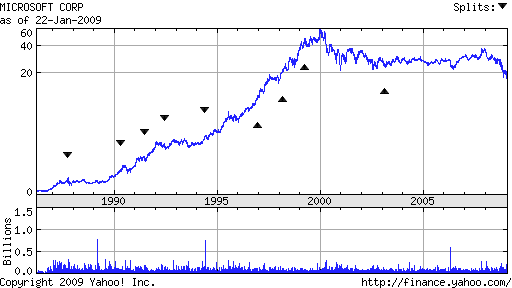

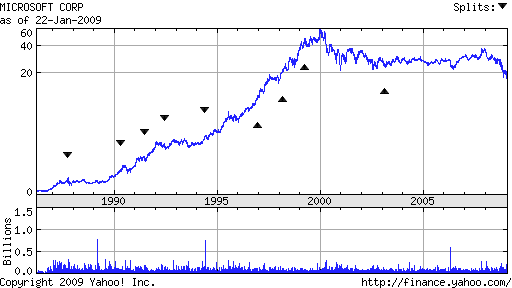

If we look at a Microsoft chart from Yahoo, we can see that the stock has now plunged to its lowest level since about 1997.

The price decline really seemed overdone. Maybe I am crazy, but I decided to buck the tide with a purchase of Microsoft (MSFT) shares. I don't think this one is going out of business!

I purchased 1,000 shares of Microsoft (MSFT) at $17.69. I certainly didn't catch the bottom today because the stock went lower and closed at $17.11 on the day, down $(2.27) or (11.71)%.

This was certainly out of my usual trading strategy. I am not abandoning that strategy but from time to time I have chosen to purchase lots of shares that just seemed to have a compelling story. I could be wrong, but I think this is one of those times! Wish me luck!

Yours in investing,

Bob

Wednesday, 21 January 2009

Morningstar (MORN) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

If you are a regular reader of my blog, then I am sure you will realize that five days ago I sold my shares of Johnson Controls (JCI) after they announced a disappointing earnings report and reduced guidance. I wrote about it here.

If you are a regular reader of my blog, then I am sure you will realize that five days ago I sold my shares of Johnson Controls (JCI) after they announced a disappointing earnings report and reduced guidance. I wrote about it here.

Most of my sales of shares are either at appreciation or depreciation targets. They are more or less mechanical in that I know in advance what I need to do and with how many shares. This time, I used my discretionary decision-making power to determine that it was time to part company with these shares and unloaded them before any targeted price. (By the way, I sold my shares of JCI at $15.60, and as I write, JCI is trading at $14.195, so thus far it wasn't a bad decision at all!)

I chose today to replace this position with a new holding and chose Morningstar (MORN), an old favorite of mine and purchased 116 shares at $33.464. (As I write, MORN is trading at $33.88, up $.87 or 2.64% on the day.)

In some fashion I have liberalized my trading system recently. I still follow my rules for selling 1/7th of my holding when a stock hits an appreciation target and using that sale as a buy signal to purchase a new stock. I still employ a strategy of selling complete holdings when they have declined to an 8% loss after an initial purchase or to some higher predetermined level if they decline after partial sales on appreciation. However, it has always been my approach to sell stocks arbitrarily when I felt some fundamental information dictated that trade. And that is what happened with Johnson Controls (JCI).

I have not clearly determined whether after such arbitrary sales I should 'sit on my hands' or replace those holdings with another position. With the market having corrected as much as it has, and my belief that we are closer to the bottom of this market than to the top, I chose to replace this holding. I might not do the same in the future.

Also, unlike many of my purchases, I have chosen to arbitrarily pick one of my favorites as my latest purchase, rather than restricting myself to the top % gainers lists. Again, with the market having declined as much as it has (The Dow as I write is trading at 8,031, down about 6,000 points or 43% since its high in late 2007), I find myself becoming more value oriented and with my growth approach I am more of a GARP investor than a momentum investor as virtually all stocks at this time have had the momentum literally beaten right out of them!

My basic philosophy in any case remains unchanged. I am still looking for stocks that have demonstrated consistent revenue growth, earnings growth, possibly dividend growth, stable outstanding shares, free cash flow, and a solid balance sheet. One of my favorite resources for identifying this information has been the Morningstar website. In fact, I like Morningstar so much I bought shares today. (My kids would of course have asked me if I liked Morningstar that much, why didn't I marry it!)

Let me briefly review some of the updated facts about this stock that led me once again to include it in my portfolio.

I first wrote up Morningstar on Stock Picks Bob's Advice on November 22, 2005. I have also previously owned shares in my trading account.

Regarding the latest quarter's results, Morningstar reported 3rd quarter 2008 results on October 30, 2008. Revenue climbed 12.2% in the quarter to $125.5 million from the $111.9 million reported a year earlier. Net income came in at $22.2 million or $.45/share, up from $19.9 million or $.41/share the prior year.

Checking the "5-Yr Restated" financials on Morningstar on the Morningstar webiste (!), we can see the steady growth in revenue from $139 million in 2003 to $435 million in 2007 and $501 million in the trailing twelve months (TTM).

During this period earnings have increased steadily from a loss of $(.31)/share in 2003 to $.21/share in 2004, increasing to $1.53/share in 2007 and $1.90 in the TTM.

Outstanding shares have nominally increased from 38 million in 2003 to 49 million in the TTM.

Free cash flow has been positive and growing recently with $41 million reported in 2005 increasing to $101 million in 2007 and $107 million in the TTM.

The balance sheet appears solid with $234 million in cash and $186 million in other current assets. This easily covers the $218.7 million in current liabilities yielding a current ratio of 1.92. Long-term liabilities are reported to be relatively nominal at $30.7 million.

In terms of some valuation numbers, checking the Yahoo "Key Statistics" on Morningstar (MORN), the company is a mid cap stock with a market capitalization of $1.59 billion. The trailing p/e is a moderate 17.92 with a forward p/e reported to be 18.89 (fye 31-Dec-09). The PEG ratio works out to a reasonable 1.01.

According to the Fidelity.com eresearch website, the Price/Sales ratio (TTM) at 3.02 is a bit rich compared to the average of 1.49 in the same industry. Also on the Fidelity website, the profitability is above average coming in with a Return on Equity (TTM) of 19.85% compared to the industry average of 18.34%.

Finishing up with Yahoo, there are 46.77 million shares outstanding but only 17.94 million float. Currently there are 1.54 million shares out short (as of 12/10/08) representing 5 trading days of volume (the short ratio). I use an arbitrary 3 days for significance, so from my perspective, as with many stocks today, there are a lot of shares out short which may provide some buying support if any sort of good news is reported and a 'squeeze' develops.

No dividends are paid and no stock splits are reported on Yahoo.

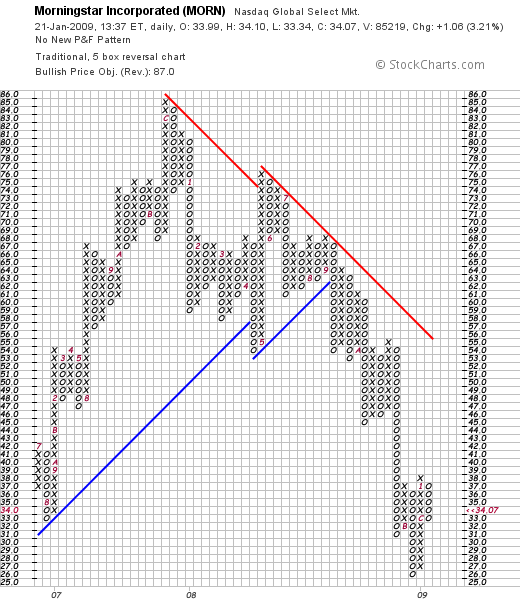

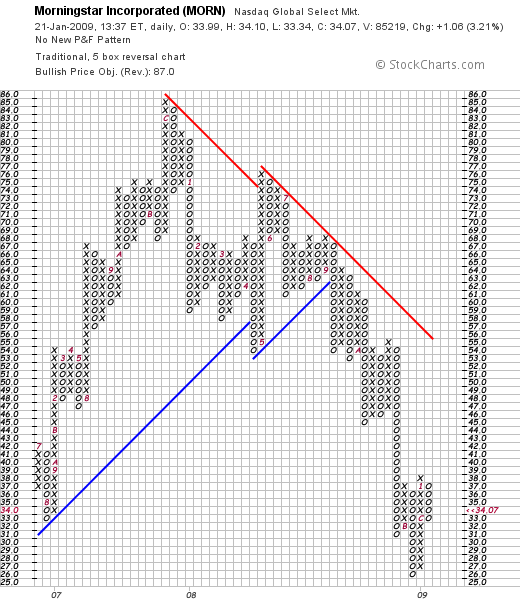

If we review the Morningstar 'point & figure' chart from StockCharts.com, we can see that the stock hit a high of $85 in November, 2007, only to trade lower with the rest of the market and especially the financials to hit a low of $26 in November, 2008. The stock has come up a little from the low but technically the chart does look very weak.

Incrementally, I chose to add a new holding to my portfolio and thereby return my equities exposure back to the 6 holding I had prior to my sale of JCI. I believe this is a good decision but shall manage this purchase as with all of my other holdings in the same strategy as I have previously followed.

In many ways, for me Morningstar is a Peter Lynch type of purchase. I am familiar with their services---at least their internet website, and like the underlying numbers and consistency in their growth. I have owned Morningstar shares previously, and once again am a stockholder!

Yours in investing,

Bob

Posted by bobsadviceforstocks at 12:35 PM CST

|

Post Comment |

Permalink

Updated: Wednesday, 21 January 2009 12:44 PM CST

Newer | Latest | Older

![]() I wanted to share with all of you my own disappointment at having to part ways with my recent purchase of 134 shares of Ecolab (ECL) that I had just purchased on 2/6/09 at a cost basis of $35.54. I sold these shares earlier today in the midst of the continued market correction at a price of $31.5948. This represented a loss of $(3.9452)/share or (11.1)% since purchase. (As I write, ECL is recovering somewhat trading at $32.04/share for a loss today of $(2.21) or (6.45)%.

I wanted to share with all of you my own disappointment at having to part ways with my recent purchase of 134 shares of Ecolab (ECL) that I had just purchased on 2/6/09 at a cost basis of $35.54. I sold these shares earlier today in the midst of the continued market correction at a price of $31.5948. This represented a loss of $(3.9452)/share or (11.1)% since purchase. (As I write, ECL is recovering somewhat trading at $32.04/share for a loss today of $(2.21) or (6.45)%.

1800's had a theory about stock market investing and stock trading. He

1800's had a theory about stock market investing and stock trading. He

Since I have gone on for some time about Dolby (DLB), let me briefly fill you in on the second stock I wanted to comment on--Badger Meter (BMI). I do not own any shares of this Wisconsin firm (I love those Wisconsin companies that show up in my blog---Go Badgers!)

Since I have gone on for some time about Dolby (DLB), let me briefly fill you in on the second stock I wanted to comment on--Badger Meter (BMI). I do not own any shares of this Wisconsin firm (I love those Wisconsin companies that show up in my blog---Go Badgers!)

Sometimes looking through the

Sometimes looking through the

If you are a regular reader of my

If you are a regular reader of my