Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It is the weekend and it is time for a review.

But before I do that let me digress. I don't talk too much about my own personal life but let me share with you a wonderful evening I had last night in Lanesboro, Minnesota, listening to the great Garrison Keillor and the Prairie Home Companion crew.

Thank you Mr. Keillor for a great evening celebrating the greatest of fruits (vegetable?) rhubarb, and rhubarb pie.

I don't get out too much! But what a great evening under the stars sitting in Center Field on a lawn chair after a wonderful dinner with family and friends at the Pedal Pushers Diner in Lanesboro where I had a dinner of Liver and Onions and a great slice of Rhubarb Pie!

(forget the diet for an evening!). O.K. it was great, but let's get back to that review :). But then again, let me work hard at sharing with you a little more of a personal blog along with all of the endless entries about stocks! Let me know what you think. Probably make the whole thing more interesting for me and for all of you readers.

My weekend reviews always assume a buy and hold strategy. I do this for the ease of reviewing these past stock picks. In practice, those of you who read my entries will realize that I both advocate and employ a strategy of a disciplined portfolio management strategy with which I quickly sell my holdings that incur small losses and also sell my gaining stocks slowly and partially at targeted appreciation levels. This difference in strategy would certainly affect the overall performance of any stock purchases.

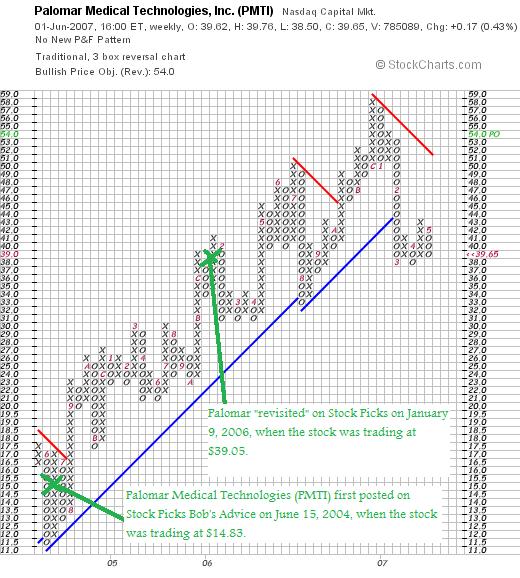

On January 9, 2006, I posted Palomar Medical Technologies (PMTI) on Stock Picks Bob's Advice when the stock was trading at $39.05. Palomar closed at $39.65 on June 1, 2007, for a gain of $.60 or 1.5% since posting.

Taking a look at the "Point & Figure" chart on PMTI from StockCharts.com, we can see what appears to be a short-term break down in price action with the stock dropping below support levels and lingering well below resistance levels (the lines in red and blue). Simply put, the chart is less than encouraging.

![]() On April 26, 2007, Palomar reported 1st quarter 2007 financial results. Revenue for the quarter increased 40% to $31.5 million from $22.5 million in the same quarter last year. GAAP net income, however, dropped to $5.9 million or $.30/diluted share this year, down from $6.2 million or $.31/diluted share in the same period last year.

On April 26, 2007, Palomar reported 1st quarter 2007 financial results. Revenue for the quarter increased 40% to $31.5 million from $22.5 million in the same quarter last year. GAAP net income, however, dropped to $5.9 million or $.30/diluted share this year, down from $6.2 million or $.31/diluted share in the same period last year.

In light of the strong revenue growth, but the weak earnings results and less than impressive appearance of the chart,

PALOMAR MEDICAL TECHNOLOGIES (PMTI) IS RATED A HOLD

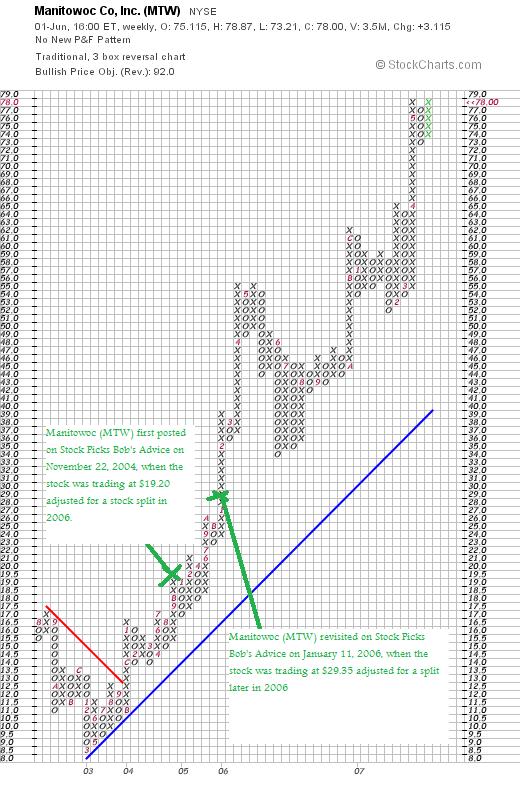

On January 11, 2006, I "revisited" Manitowoc Co. (MTW) when the stock was trading at $58.70. MTW split 2:1 April 11, 2006, making my effective stock pick price actually $29.35. MTW closed at $78.00/share on June 1, 2007, for a gain of $48.65 or 165.8% since posting.

On January 11, 2006, I "revisited" Manitowoc Co. (MTW) when the stock was trading at $58.70. MTW split 2:1 April 11, 2006, making my effective stock pick price actually $29.35. MTW closed at $78.00/share on June 1, 2007, for a gain of $48.65 or 165.8% since posting.

Looking at the "Point & Figure" chart on Manitowoc from StockCharts.com, we can see the incredible strength that this particular stock has shown since bottoming at $8.50 in March, 2003.

![]() On April 30, 2007, Manitowoc announced 1st quarter 2007 results. For the quarter ended March 31, 2007, sales increased 36% to $862 million from $633 million in the same period last year. Net earnings were up more than 100% at $64.1 million this year from last year's $29.7 million or $1.01/diluted share, up from $.48/diluted share last year.

On April 30, 2007, Manitowoc announced 1st quarter 2007 results. For the quarter ended March 31, 2007, sales increased 36% to $862 million from $633 million in the same period last year. Net earnings were up more than 100% at $64.1 million this year from last year's $29.7 million or $1.01/diluted share, up from $.48/diluted share last year.

In light of the strong price chart and the very strong earnings report,

MANITOWOC (MTW) IS RATED A BUY

![]() On January 13, 2006, I posted JLG Industries (JLG) on Stock Picks Bob's Advice when the stock was trading at $49.45. JLG split its stock March 20, 2006, with a 100% stock dividend, making my effective pick price actually $24.73. JLG was acquired by another stock pick favorite of mine in December, 2006, at $28/share. This represents a gain of $3.27 or 13.2% since posting.

On January 13, 2006, I posted JLG Industries (JLG) on Stock Picks Bob's Advice when the stock was trading at $49.45. JLG split its stock March 20, 2006, with a 100% stock dividend, making my effective pick price actually $24.73. JLG was acquired by another stock pick favorite of mine in December, 2006, at $28/share. This represents a gain of $3.27 or 13.2% since posting.

So how did I do during that week in January, 2006, with these three stocks. In a word, fabulous! All three climbed (unlike the prior week when all five declined!) and one was acquired with an average gain of 60.2%! Most of this gain is all about Manitowoc (MTW), an amazing stock of an amazing company!

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website where you can hear me discuss many of the same stocks I have been writing up here on the blog.

Bob

Updated: Saturday, 2 June 2007 8:53 PM CDT