Stock Picks Bob's Advice

Friday, 2 December 2005

Another PODCAST: Could you provide an analysis of some mistakes?

Hello Friends! I 'podcasted' the last post

MY LATEST PODCAST: A Reader Asks: Could You Share some Mistakes?.

Click on the above link to hear my latest podcast! Thanks so much for visiting; if you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 11:45 PM CST

|

Post Comment |

Permalink

Updated: Friday, 2 December 2005 11:51 PM CST

A Reader Writes "Could you provide an analysis of some mistakes?"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of my favorite things on this blog is to get comments and emails from readers. I appreciate the opportunity of joining with you in conversations about investment questions!

Steve made a comment on the blog and I promised him I would answer in an entry. He wrote:

I've been reading your blog for quite a while now and I notice that you rarely talk about your losers. Could you provide an analysis of some of your mistakes and how you decided when to sell etc...

Thanks

Well first of all I would like to thank you for being a regular reader. It means a lot to me that some people would find what I write worthwhile and would come back regularly!

Let me try to get right to your question. There are two parts (or more) to my blog! First of all, I like to write about investments in general; writing about stocks that may be worth considering for purchase. In addition, I write about stocks I have actually purchased. In both cases, I try to let the reader know about the good news and the bad news.

In other words, each week I review stocks I looked at a year earlier. Some of these reviews show losses. Others show large gains. I don't skip any of the stocks that I have picked. If it appears that many of the stocks have performed well since listing, it isn't because I have been leaving off the losers. It is just that what I have been done is working :).

And regarding my portfolio. I post all of the transactions in my portfolio in my blog under the heading of "trading transparency". If it seems like I am just mentioning sales on gains, well, in fact, I have mentioned losers, but I have simply been picking stocks for purchase that have done well the past two years.

Let me explain. I currently own 20 different positions in my portfolio. Of these stocks, only two are currently showing unrealized losses: Blue Coat Systems (BCSI), a recent purchase, is showing a loss of $(70.15) on my purchase or (.96)%. The other loss is Progress Software (PRGS) which has an unrealized loss of $(13.12) or (.18)%. The other eighteen holdings of mine have gains ranging from 2.9% for SRA (SRX) all the way to an unrealized gain of 442.53% for Quality Systems (QSII). I am very proud of my performance in my trading account, which currently has an unrealized gain totalling $38,000.14. Is this hard to believe? It is for me! But I have posted all of my transactions on this blog for the past two years and if you dig through it, everything is documented.

Welll, you might say, I must be selling all of my many losers, so what is the

realized gain or loss in the portfolio? As of 12/2/05 at 3:42 a.m., (the date and time on my Fidelity account that I am reading as I write), I have a net realized short-term gain of $6,174.91 in 2005 and a net realized long-term gain of $19,116.57, for a "Total Realized Gain/Loss" of $25,291.48 for 2005. My continued success is why I am not posting much about losses.

But I have had some significant losers. I have lost money on Abercrombie & Fitch (ANF), purchasing 160 shares on 6/7/05 for a cost of $10,902.40, and selling the shares on 8/16/05 for $9,847.83, for a loss of $(1,054.57). I lost $(695.25) this year on Alliance Data Systems (ADS), having purchased 2000 on 6/16/05 for $7,820.00, and selling the shares on 10/25/05 for $7,124.75. Other losses this year include a loss of $(621.02) on Ask Jeeves, sold one week after a purchase (!), $(744.20) on DRS Technologies purchased 12/20/04, and sold 1/3/05 just a little over two weeks later! Other stocks that I lost $1,000 or less on include Giant Industries (GI), Parlux Fragrances (PARL), Perficient, Quicksilver, and Synaptics. However, my gains have consistently overwhelmed my losses!

There really isn't much to talk about on the losses. After I purchase a stock, if it drops 8% I sell it. Period. No excuses. Otherwise, if I have sold a portion at a gain once (at about the 30% level) I let the stock drop back to break-even and then sell the remaining shares. If I have sold a stock more than once, perhaps twice with the second sale at 60% appreciation, I allow the stock to retrace to 50% of the highest sale appreciation point....in this example, back down to 30% gain, and then sell all the remaining shares.

I hope this explains my portfolio. When I tell you how I am doing, this does involve some trust. I work extremely hard at posting every little move in my stock portfolio. I think you probably could go back to the dates I mentioned and you will see the sales listed.

Please let me know if I answered your question. I believe that selling losers in a disciplined fashion in the very most important thing one can do in managing your portfolio, no matter how much you like that stock!

Thanks again for visiting! If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com or just leave your comments on the blog!

Bob

Thursday, 1 December 2005

Another PODCAST: What to do with JOSB?

Hello Friends! I just wanted to share with you my latest

PODCAST ON JOSB.

You can listen on Podomatic.com or search for "Stock Picks" on the Podcast page of iTunes!

Have a great evening.

Bob

"A stock falls sharply!" Dealing with Jos. A Bank (JOSB)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

A few weeks ago, as part of my portfolio review, I

discussed Jos. A Bank Clothiers (JOSB) on Stock Picks Bob's Advice. At that time, JOSB was trading at $46.21/share.

I currently own 180 shares of JOSB which closed at $43.06, down $(6.95) or (13.90)% on the day. I originally purchased 240 shares with a cost basis of $31.90 on 4/4/05. I sold 1/4 of my position (I am now planning to reduce this to only 1/6 of a remaining position) when the stock had appreciated 30%. Thus I have 180 shares remaining.

This morning, prior to opening, JOSB

announced November sales results. Total sales for the month increased 16.1% to $41.9 million, compared with $36.1 million in November, 2004. Comparable store sales were a bit anemic (relatively) at 3.8%; however, combined catalog and internet sales grew 24.3% in the month compared to the same month last year.

The stock responded with a sharp drop today closing at $43.06, down $(6.95) or (13.90)% on the day. Compounding this was the

downgrade by Ryan, Beck & Co. to "Market Perform" from "Outperform" . The analyst felt that with the weak performance in November, December comps would be difficult especially with last year's 16.2% comparable store sales growth. This month's sales figures compares poorly with

October sales results for JOSB which were more upbeat showing total sales growth of 28.5% with comparable store sales increasing 16.2% and combined catalog and internet sales increasing 19.5% over the prior year period.

So how does my "strategy" deal with this 'mini-meltdown'? Recall that my 180 shares were purchased 4/4/05 with a cost basis of $31.90. With JOSB closing at $43.06, that still finds me with a gain of $11.26 or 35.3%. I sold my first batch of JOSB, 60 shares representing 1/4 of my 240 share position, on 6/7/05 with a proceeds/share of $41.62 representing a gain of $9.72 or 30.5%. Since I have sold one portion of my position at a 30% gain, my planned sale of the remaining shares would be at break-even on the downside, or a 1/6 (!) position sale if the stock appreciates to a 60% gain level or at $51.04.

Does the news represent something really significant or is this a bit overblown? I always reserve the right to unload shares of stock if something bad on a fundamental basis has occurred in any or all of my stocks. But is this result really fundamentally terrible? Recall that sales actually grew, not shrank, and that same store sales which are down from their torrid pace, are still showing positive growth with a 3.8% same store sales figure. In addition, the increase in catalog and internet sales of 24.3% was actually

higher than the prior month's results. In my mind, the stock decline was overdone, but I shall respond to the market, depending on how the stock actually performs.

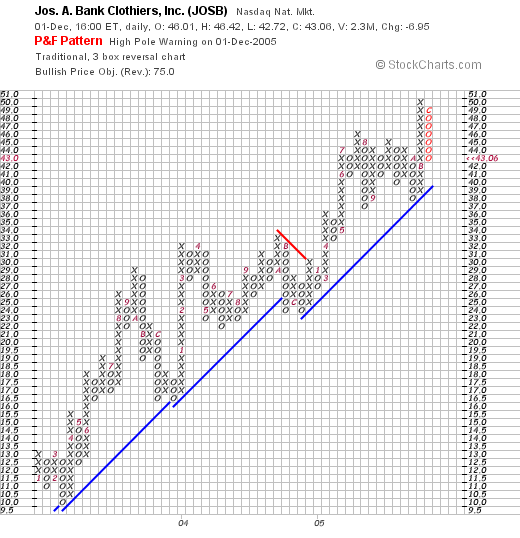

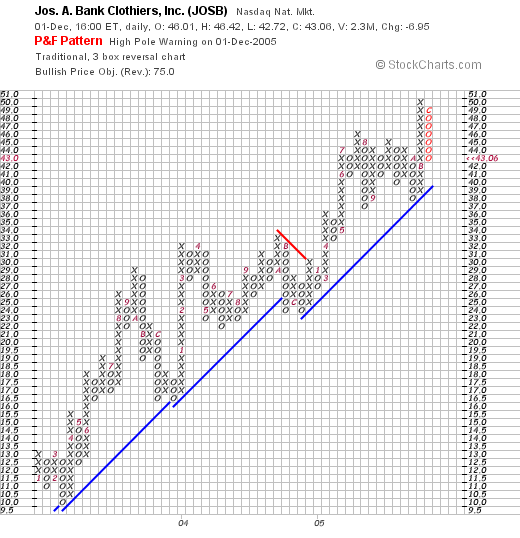

And did the chart actually 'break down' after this sell-off? Let's take a look at an updated

"Point & Figure" chart from Stockcharts.com on JOSB:

We can see that at least through today's closing trades, JOSB has preserved its strong upward-biased stock chart. The retracement today, keeps the stock above the support level, and I don't at this time anticipate the stock actually breaking down in price!

Thanks so much for stopping by! Each of us must decide how we are going to trade our stocks and investments. As for me, I shall listen to the stock market and let the market decide when I need to be in and out of the market!

If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com or just leave them right on the blog.

Bob

Wednesday, 30 November 2005

***New PODCAST for RPC (RES)***

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions.

A few moments ago, I posted my

PODCAST on RPC (RES) on PODOMATIC.com.

Please come and visit. You may need to register at this free site, PODOMATIC, to listen to my PODCAST, or you can find me on iTunes, searching for "Stock Picks" under the PODCAST section.

Regards!

Bob

"Revisiting a Stock Pick" RPC Inc. (RES)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Looking through the

list of top % gainers on the NYSE today, I came across RPC (RES), which closed at $33.20, up $1.18 or 3.69% on the day. I do not own any shares of this company nor do I own any options.

I first

posted RPC on Stock Picks Bob's Advice on November 26, 2004, when it was trading at $27.07. RPC had a 3:2 split on March 11, 2005, making my effective "pick price" actually 2/3 x $27.07 = $18.05. With RPC closing at $33.20 today, this represents a gain of $15.15 or 83.9% since posting!

According to the

Yahoo "Profile" on RPC, the company

"...together with its subsidiaries, provides a range of specialized oilfield services and equipment primarily to independent and major oilfield companies. Its serviced are offered to companies engaged in the exploration, production, and development of oil and gas properties throughout the United States, including the Gulf of Mexico, mid-continent, southwest, and Rocky Mountain regions, as well as in selected international markets."

Looking at Yahoo "News" on RES, we can see that the company recently experienced an

analyst downgrade with ADVEST downgrading the stock from "Strong Buy" to "Neutral". This is after last month's upgrade from "Buy" to "Strong Buy" from the same firm!

On October 26, 2005, RPC

reported 3rd quarter 2005 results. For the quarter ended September 30, 2005, revenues climbed 30.5% to $115.8 million, from $88.7 million last year. Earnings came in at $23.1 million or $.53/diluted share, up from $10.2 million or $.24/diluted share last year same period. In another "bullish" move, the company announced a 3:2 split, which will be the second split for the

Looking longer-term at the

"5-Yr Restated" financials on RPC, we can see that revenue has been a bit erratic with $202 million reported in 2000, $284.5 million in 2001, then $209 million in 2002. However, since 2002, revenue has steadily increased to $395.7 million in the trailing twelve months (TTM).

Earnings have also been erratic, dropping from $.71/share in 2000 to a low of $(.13)/share in 2002, but increasing strongly since to $1.29/share in the TTM. Free cash flow has remained positive but has been impacted by growing capital spending with $5 million reported in 2002 and $3 million reported in the TTM.

Looking at the Balance Sheet as reported by Morningstar.com, we can see that the combined $21.6 million in cash and $117.8 million in other current assets is more than enough to pay off both the $61.3 million in current liabilities

and the $27.6 million in long-term liabilities.

Reviewing

Yahoo "Key Statistics" on RES, we find that the company is a mid cap stock with a market capitalization of $1.42 billion. The trailing p/e is moderate at 25.90 and the forward p/e (fye 31-Dec-06) is even nicer at 17.29. Still, the PEG is reported at 2.08, a bit richer a number than I prefer to see. The Price/Sales was reported at 3.47.

Yahoo shows that RES has 42.91 million shares outstanding with 514,240 shares out short representing 2.2% of the float or 2.4 trading days fo volume. The company pays a dividend of $.16/share yielding 0.50%. As noted above, the company last split its stock in March, 2005, with a 3:2 stock split.

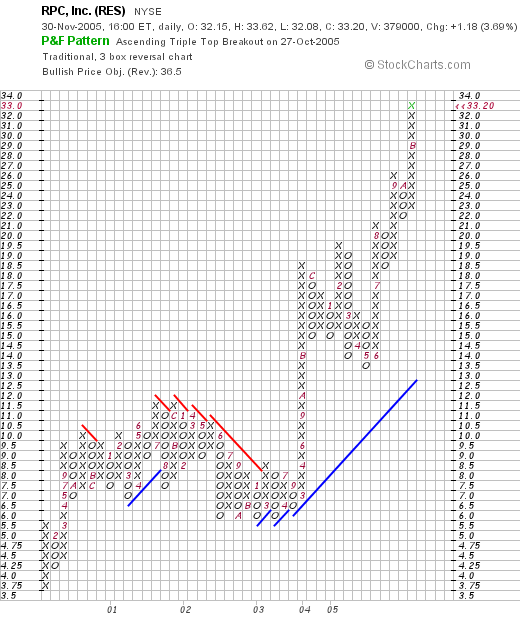

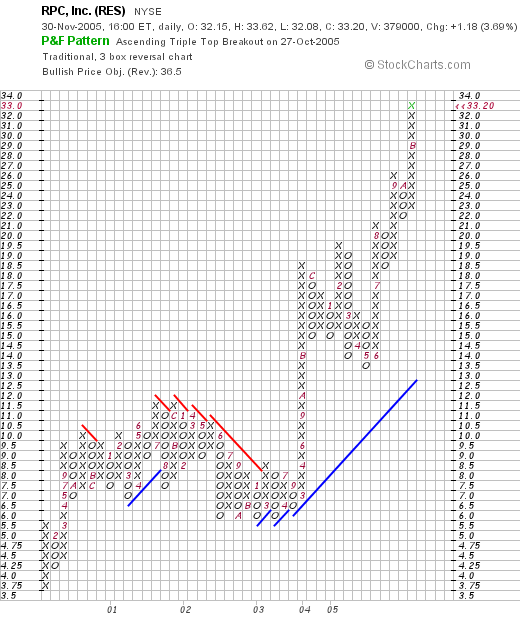

What about a stock chart? Taking a look at the

RES "Point & Figure Chart" from Stockcharts.com, we can see that RPC appreciated steadily between January, 2000, when the stock was trading as low as $3.75/share, but went sideways between 2001 and 2003, when the stock finally broke through resistance at $8.50 in January, 2003, ultimately trading as high as $33.20, where the stock closed today.

So what do I think? Well, the company sure has done well since I posted it a year ago! The latest quarterly result was quite strong and the second 3:2 split within 12 months for the stock is encouraging. The last several years have seen strong revenue and earnings growth, the cash flow is small but positive, and the chart looks encouraging. This looks like an interesting opportunity to me, but again, I regret that I have not had a sale recently at a gain that would entitle me to purchase anything, anywhere!

If you have any comments or questions, please leave them on the blog or email me at bobsadviceforstocks@lyco.com.

Bob

Posted by bobsadviceforstocks at 4:18 PM CST

|

Post Comment |

Permalink

Updated: Wednesday, 30 November 2005 4:39 PM CST

Tuesday, 29 November 2005

November 29, 2005 Orasure Technologies (OSUR)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember to check with your professional investment advisors prior to making any decisions based on information on this website as I am an amateur investor.

***CLICK HERE for my PODCAST on this subject

I was looking through the

list of top % gainers on the NASDAQ today and came across Orasure Technologies Inc. (OSUR) which last traded at $13.24, up $1.26 or 10.525 on the day. I do not own any shares nor do I have any options in this company.

According to the

Yahoo "Profile" on Orasure, the company

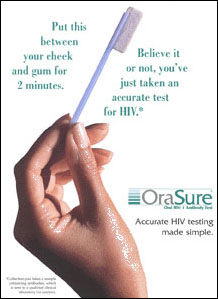

"...engages in the development, manufacture, and marketing of oral specimen collection devices. Its products include Q.E.D. Saliva Alcohol Test and Intercept, a laboratory-based oral fluid drug test; OraSure HIV-1 oral fluid specimen device, a collection device that collects oral fluid to test for antibodies to the HIV-1 virus; OraQuick Rapid HIV-1 antibody test, a point-of-care test to aid in the diagnosis of infection to HIV-1 using a fingerstick and venipuncture whole blood specimen; Toxicology kits for use in testing blood, urine, hair, oral fluid, sweat, and other forensic samples. "

On November 9, 2005, Orasure

announced 3rd quarter 2005 results. For the quarter ended September 30, 2005, revenues grew 28% to $18.1 million compared with $14.2 million the same quarter last year. Net income came in at $3.8 million or $.08/share, up from a net loss of $(294,000) or $(.01)/share for the same quarter last year. In addition, the company

increased guidance for the full-year.

How about longer-term results? Looking at the

Morningstar.com "5-Yr Restated" financials for OSUR, we can see the steady growth in revenue from $28.8 million in 2000 to $65.5 million in the trailing twelve months (TTM).

Earnings have been improving since 2000 when the company reported a loss of $(.36)/share. The company just turned profitable in the TTM with earnings of $.15/share. Free cash flow has also been improving, from a negative $(2) million in 2002, to a positive free cash flow of $8 million reported in the TTM.

What about valuation? Looking at

Yahoo "Key Statistics" on OSUR, we can see that this is a mid cap company with a market capitalization of $604.57 million. Since the company is

just turning profitable, the Price/Earnings is a anear-astronomic 92.22. The forward p/e (fye 31-Dec-06) is a bit better at 60.36. The PEG is a bit rich as well with a value of 2.85. The Price/Sales statistic is also a bit rich at 8.32.

Yahoo reports 45.53 million shares outstanding with 2.73 million shares out short as of 10/11/05. This amounts to a hefty 6.205 of the float or 10.1 trading days of volume. This appears to be a significant short interest on this stock.

No cash dividends and no stock splits are seen on Yahoo.

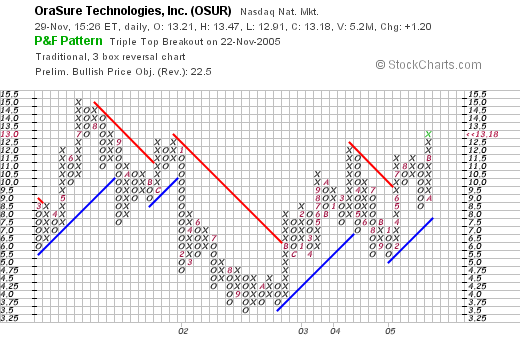

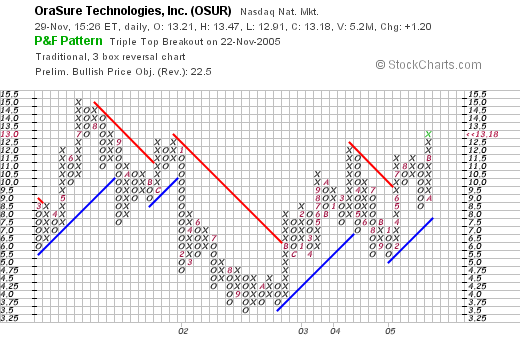

If we take a look at a

"Point & Figure" chart on OSUR from Stockcharts.com:

We can see that the stock has gone almost nowhere since peaking at $15 in July, 2001. The stock bottomed at $3.50 in September, 2002, and has subsequently been trading higher. The stock looks modestly optimistic and certainly not overextended.

So what do I think? Well, I think that AIDS is a huge problem and that an easy diagnostic test such as an oral swab, may have tremendous potential in the medical treatment and evaluation market. The latest quarterly result was solid, Morningstar.com looked reasonable, valuation is difficult to assess as the company is just turning profitable. The chart is encouraging and not overextended.

Now, if I only had a signal to give me the green light to buy some shares. Meanwhile, I am still sitting on my hands, awaiting a sale at a gain before a purchase of an additional position.

Thanks so much for stopping by! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com or go ahead and leave them on the blog!

Bob

Posted by bobsadviceforstocks at 3:45 PM CST

|

Post Comment |

Permalink

Updated: Tuesday, 29 November 2005 10:10 PM CST

Monday, 28 November 2005

November 28, 2005 Lamson and Sessions (LMS)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

***Listen HERE FOR MY PODCAST ABOUT THIS ENTRY***

There was a good bit of profit-taking in the market as the Dow closed at 10,890.72, down 40.90, and the NASDAQ closed at 2,239.37, down 23.64 on the day. But for me, it is another day at the market, scanning the top % lists for another pick for the blog!

In the face of all of this bearish trading action, Lamson & Sessions (LMS) made the

list of top % gainers on the NYSE today, closing at $23.70, up $.62 or 2.69% on the day. I do not own any shares nor do I have any options on this company.

According to the

Yahoo "Profile" on LMS, the company

"...engages in the manufacture and distribution of thermoplastic electrical, consumer, telecommunications, and engineered sewer products in the United States and Canada. It operates in three segments: Carlon, Lamson Home, and PVC Pipe. Carlon segment sells various products, including electrical and telecommunications raceway systems, as well as nonmetallic enclosures, electrical outlet boxes, and fittings to electrical contractors and distributors, original equipment manufacturers, electric power utilities, cable television, and telephone and telecommunications companies."

When looking at a new stock for possible inclusion in this blog, one of the first place I check is the latest quarterly results. I am looking for a solid picture of revenue growth combined with earnings growth.

On October 27, 2005, LMS

reported 3rd quarter 2005 results. The company reported net sales of $128.1 million, a 22.1% increase over the $104.9 million reported in the third quarter of 2004. Net income for the company rose to $5.4 million or $.35/diluted share, an increase of over 500% from the $833,000 or $.06/diluted share reported in the same period of 2004. In the same announcement the company

raised guidance for the fourth quarter of 2005 to sales of $110-$115 million and full year 2005 to a range of $460-$465 million, representing an increase of 18-20% over the $387 million reported in 2004. The company also raised earnings guidance from $3.5-$3.8 million or $.23-$.25/share, to $4.6-$5.0 million or $.30-$.33/share. This combined solid earnings report with increased guidance was helpful in powering the stock price higher.

How about longer-term? Looking at the

Morningstar.com "5-Yr Restated" financials on LMS, we can see that revenue was fairly stagnant between 2000 and 2002, actually declining from $347.3 million in 2000 to a low of $312.4 million in 2002. However, since 2002, the company has been steadily growing its revenue to $447.9 million in the trailing twelve months (TTM).

Earnings also deteriorated between 2000 when they were $1.53/share, to a low of a loss of $(2.99)/share in 2002. Since then, the company has also been steadily improving its earnings results. Free cash flow dropped from $23 million in 2002 to $1 million in 2003 but has been positive and growing since, with $15 million of free cash flow reported in the TTM.

The balance sheet looks adequate with $1.7 million in cash and $122.5 million in other current assets. This easily covers the $73.6 million in current liabilities and makes a nice 'dent' in the $101.6 million in long-term liabilities.

What about some valuation statistics? Taking a look at

Yahoo "Key Statistics" on LMS, we can see that according to the

Ameritrade definitions, Lamson & Sessions is a small cap stock with a market capitalization of only $343.39 million. The trailing p/e is a moderate 24.84 and the forward p/e (fye -1-Jan-07) is even nicer at 17.43. No PEG ratio is reported.

And what does the Price/Sales ratio tell us about the relative valuation of this company? According to the

Fidelity.com eResearch website, Lamson & Sessions is in the "Diversified Electronics" industrial group. Within this group, LMS has the lowest Price/Sales ratio at 0.8. Topping this list is JDS Uniphase (JDSU) at 4.9, International Game Technology (IGT) at 4.5, WMS Industries (WMS) at 2.3, Amphenol (APH) at 2.2 and Molex (MOLX) at 2. Thus, LMS looks very reasonably priced by this parameter as well!

Going back to Yahoo for a few additional numbers on this stock, we find that the company has only 14.49 million shares outstanding. As of 10/11/05, according to Yahoo, there were 387,960 shares out short representing 3.30% of the float or only 2 trading days of volume. This is not significant from my perspective. No cash dividend and no stock splits are reported.

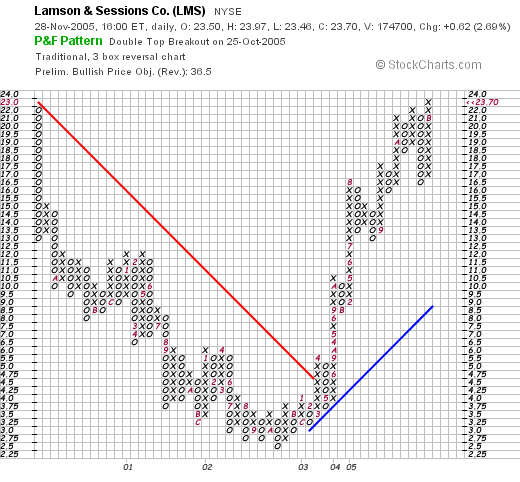

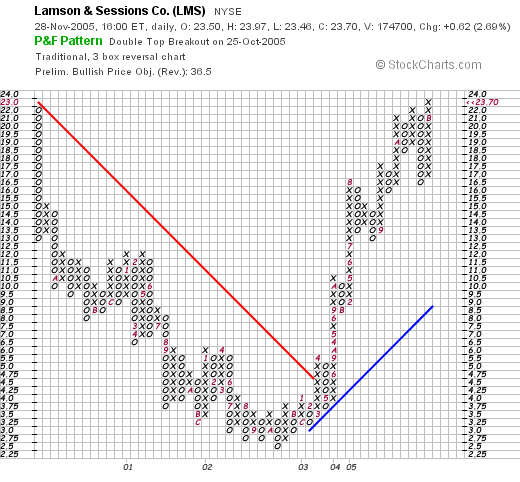

What about a chart? Looking at a

Stockcharts.com "Point & Figure" chart on LMS:

We can see how the company's price performance has mirrored its financial results. The company peaked in 2000 at $23.00/share, and dropped to a low of $2.50/share in October, 2002. The company, almost parallel to its improved financial results, made a "V" shaped turn to the upside and is now trading strongly higher to the current level of $23.70.

So what do I think? Well, this is a small company with a limited float. But the earnings and revenue report in the latest quarter were excellent. I especially appreciate the raised guidance. Morningstar.com demonstrates the turn-around in fortunes of this company the last few years. The company is growing its free cash, has a reasonable balance sheet and is reasonably priced in both p/e as well as price/sales perspectives. Finally, the chart looks strong. What else could an investor want?

Thanks so much for stopping by and visiting my blog. Always remember that I am truly an amateur investor. If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com, or leave them right on the blog.

Bob

Posted by bobsadviceforstocks at 9:50 PM CST

|

Post Comment |

Permalink

Updated: Monday, 28 November 2005 11:49 PM CST

Sunday, 27 November 2005

"How I Use Morningstar.com" Another Podcast

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisors prior to making any investment decisions.

I am on a roll tonight :). Am still working on my podcast skills and posted another discussion,

CLICK HERE FOR PODCAST: HOW I USE MORNINGSTAR TO EVALUATE STOCKS. Thanks again for visiting. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

***NEW for Stock Picks*** A Podcast :)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I am experimenting with Podcasting and you are welcome to listen in to an

Introduction to Stock Picks on my first Podcast. I look forward to your questions, comments, and encouragement. I think the podcast concept is going to be big.

There is a lot of polishing up I need to do, but I wanted to get going with this ASAP.

My website associated with the podcasts is located

here. Please do come and visit!

Bob

Newer | Latest | Older

Looking through the

Looking through the  I first

I first  Looking longer-term at the

Looking longer-term at the  Reviewing

Reviewing

I was looking through the

I was looking through the  According to the

According to the  What about valuation? Looking at

What about valuation? Looking at

There was a good bit of profit-taking in the market as the Dow closed at 10,890.72, down 40.90, and the NASDAQ closed at 2,239.37, down 23.64 on the day. But for me, it is another day at the market, scanning the top % lists for another pick for the blog!

There was a good bit of profit-taking in the market as the Dow closed at 10,890.72, down 40.90, and the NASDAQ closed at 2,239.37, down 23.64 on the day. But for me, it is another day at the market, scanning the top % lists for another pick for the blog! In the face of all of this bearish trading action, Lamson & Sessions (LMS) made the

In the face of all of this bearish trading action, Lamson & Sessions (LMS) made the  How about longer-term? Looking at the

How about longer-term? Looking at the  And what does the Price/Sales ratio tell us about the relative valuation of this company? According to the

And what does the Price/Sales ratio tell us about the relative valuation of this company? According to the