Stock Picks Bob's Advice

Monday, 30 January 2006

"Trading Transparency" FMC Technologies (FTI)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

From the previous post, you will note that I sold a portion of my JOSB stock at a gain. Thus, I have a "permission slip" to purchase a new position in my trading account as long as I am under my 25 position maximum--which I am.

Looking through the top % gainers list I came across FMC Technologies (FTI) which as I write is trading at $52.26, up $3.43 or 7.02% on the day. I took a quick look at the company, they apparently are a bit of a conglomerate involved in the oil service industry, and they announced that they shall be exceeding the estimates on the soon-to-be-announced quarterly report. The stock is climbing, fits my criteria fairly well, and I purchased 160 shares at $52.30 in my Trading Account.

I shall try to give you an update on this stock later today if I get the chance. Thanks so much for stopping by and visiting. If you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

"Trading Transparency" Jos A Bank Clothiers (JOSB)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

As I like to do, I want to share with you a transaction that I just made in my Trading Portfolio. Looking at my stocks this morning, I noted that my Jos. A Bank Clothiers had hit a sale point and I 1/6th of my 180 shares, 30 shares, at $51.10. These shares were purchased 4/4/05 at $31.90/share. Thus, I had a gain of $19.20 or 60.2%. This was my second partial sale, having sold shares at a 30% gain, and now again some shares at a 60% gain.

When is my next sale of shares of JOSB? As is my plan, I shall be selling additional shares on the upside at a 90% gain which would be at 1.9 x $31.90 or $60.61, or on the downside, if the stock retraces back to 50% of the highest sale point, which would be a 30% gain or 1.3 x $31.90 = $41.47.

Thanks so much for visiting! If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com or just leave your comments right here on the blog!

Bob

Sunday, 29 January 2006

A New ***PODCAST*** on Ventana Medical Systems (VMSI)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Click

HERE for my PODCAST on VENTANA MEDICAL SYSTEMS (VMSI). If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Saturday, 28 January 2006

"Looking Back One Year" A review of stock picks from the week of November 8, 2004

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

The Weekend Review is designed to evaluate the performance of past stock "picks" by reviewing them approximately a year later, advancing a week at a time. This review assumes a buy and hold approach and is not the strategy actually employed in my own trading portfolio which employs sales at 8% losses and small sales of gaining stocks at targeted gains. However, for the sake of review, this "buy and hold" approach serves us well.

On November 10, 2004, I

selected ASV (ASVI) for Stock Picks Bob's Advice when it was trading at $44.07. ASVI split 2:1 on 8/25/05, giving me an effective pick price of $22.04. ASVI closed at $33.54 on 1/27/06, giving us a gain of $11.50 or 52.2%. I do own some shares of ASVI in a managed retirement account.

On October 27, 2005, ASVI

announced 3rd quarter 2005 results. Net sales for the quarter ended September 30, 2005, grew 70% to $69.2 million, compared with $40.6 million in the same period in 2004. Net earnings for the quarter grew 81% to $8.0 million from $4.4 million the prior year. On a per diluted share basis this came in as a 71% increase to $.29/share compared with $.17/share in the same quarter in 2004. In addition the company raised guidance in the same announcement for both sales and earnings. This was what I call a "trifecta" in a report, increased revenue and earnings and raised guidance!

On November 14, 2004, I

posted GameStop (GME) on Stock Picks Bob's Advice when it was trading at $23.50. GME closed at $39.14 on 1/27/06 for a gain of $15.64 or 66.6% since posting.

On November 29, 2005, GameStop

announced 3rd quarter 2005 results. Sales came in at $534.2 million, up 28.2% from $416.7 million the prior year. However, same store sales decreased 12% during the quarter. And the company reported a net loss of $2.5 million, compared with $12.0 million in earnings the prior year. This worked out to a per diluted share loss of $(.04) compared to earnings of $.21/share last year. Much of the loss was attributed to the merger with Electronics Boutique. In fact, GameStop

announced December same store sales results which came in at a gain of 8.7% as reported on January 5, 2006. So all is not lost at GME :).

So how did I do with these two picks? In a word, fantastic! ASVI was up 52.2% and GME was up even stronger at 66.6% appreciation. The average gain for these two stocks worked out to a gain of 59.4%.

Thanks so much for stopping by! Please remember that past performance is not a guarantee of future performance! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

"Weekend Trading Portfolio Analysis" Ventana Medical Systems (VMSI)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

It is the weekend and I would like to continue to review the stocks in my

Trading Portfolio. These are the real holdings in my trading account, stocks that I have picked and purchased based on my trading strategies on this blog. Two weeks ago I

reviewed Meridian Biosciences (VIVO) on Stock Picks Bob's Advice, today I am at the bottom of my list alphabetically and would like to take a look at Ventana Medical Systems (VMSI).

Ventana was an early pick of mine on this blog. I

posted Ventana Medical Systems (VMSI) on Stock Picks Bob's Advice on December 23, 2003, when it was trading at $39.80. Ventana had a 2:1 split March 15, 2005, giving me an effective stock pick price of $19.40. VMSI closed at $41.42 on 1/27/06, giving my pick an appreciation of $22.02 or 113.5% since my selection.

I currently own 225 shares of Ventana (VMSI) which were acquired 4/16/04 at a cost basis of $23.47/share. With yesterday's (1/27/06) closing price of $41.42, these shares currently have an unrealized gain of $17.95 or 76.5% since my purchase of these shares.

Since it is my strategy to sell gaining stocks slowly and partially at pre-determined appreciation levels, I have already sold portions of my VMSI holding at the 30% and 60% levels. My next planned sale of a 1/6th of my remaining shares on the upside would be at a 90% appreciation level or 1.90 x $23.47 = $44.59. On the downside, since I like to allow my shares to retrace only 50% of the highest sale point on a decline, I plan on selling all remaining shares if the stock should drop back to the 30% gain level or 1.30 x $23.47 = $30.51.

Let's take a closer look at this stock.

First of all, let's review their business. As described by the

Yahoo "Profile" on Ventana, the company

"...engages in the development, manufacture, and marketing of instrument-reagent systems that automate slide staining in anatomical pathology and drug discovery laboratories worldwide. Its clinical systems are used in anatomical pathology labs in analyzing human tissue to assist in the diagnosis and treatment of cancer and infectious diseases. The company’s drug discovery systems are used by pharmaceutical and biotechnology companies to accelerate the discovery of new drug targets and to evaluate the safety of new drug compounds."

And how about the latest quarterly result?

On October 21, 2005, VMSI

reported 3rd quarter 2005 results. For the quarter ended September 30, 2005, sales came in at $50.7 million, up 29% over the same quarter in 2004. Net income for the quarter was $3.6 million or $.10/diluted share, compared with net income of $4.1 million or $.11/diluted share last year. This

was a drop in net income for the company and is not my preferred result. If this is repeated, it certainly would be a consideration to sell the stock on fundamental weakness.

And how about longer-term? Looking at the

Morningstar.com "5-Yr Restated" financials, revenue has grown steadily from $71.1 million in 2000 to $166.1 million in 2004 and $192.9 million in the trailing twelve months (TTM).

Earnings have also grown steadily from a loss of $(.93)/share in 2000 to $.59/share in 2004 and $.64/share in the TTM.

Free cash flow is positive and growing from $5 million in 2002 to $21 million in 2004 and $27 million in the TTM. The balance sheet as presented by Morningstar.com also looks solid with $47.7 million in cash, enough to cover both the $42.3 million in current liabilities and the $2.4 million in long-term liabilities combined. In addition, Morningstar reports an additional $58.4 million in other current assets.

How about valuation?

Reviewing

Yahoo "Key Statistics" on Ventana, we find that this is a mid-cap stock with a market capitalization of $1.50 billion. The trailing p/e is rich at 64.72 and the forward p/e is also a bit steep (fye 31-Dec-06) at 40.21. The PEG (5 yr expected) is a bit high as well at 1.77.

According to information on the

Fidelity.com eResearch website, Ventana is in the "Medical Instruments/Supplies" industrial group. Within this group, the stock is also richly valued with a Price/Sales ratio of 7.9. This is only exceeded by Alcon (ACL) at 9.4. Other stocks in the group include Guidant (GDT) with a Price/Sales ratio of 6.7, Stryker (SYK) at 4.4, Boston Scientific (BSX) at 2.8 and Baxter (BAX) at 2.4.

Returning to Yahoo for some additional numbers on this company, we find that there are 36.12 million shares outstanding with 2.58 million shares out short representing 8.10% of the float or 7.9 trading days of volume (the short ratio). Using my 3 day cut-off for significance, we can see that there are a lot of short-sellers on this stock. If the company comes in with a strong quarterly report for the quarter, this may mean the shorts will be squeezed. However, with a weak report, the shorts will be vindicated. In any case, they will need to buy back the shares.

No cash dividend is paid and the last stock split, as noted above, was a 2:1 split in March, 2005.

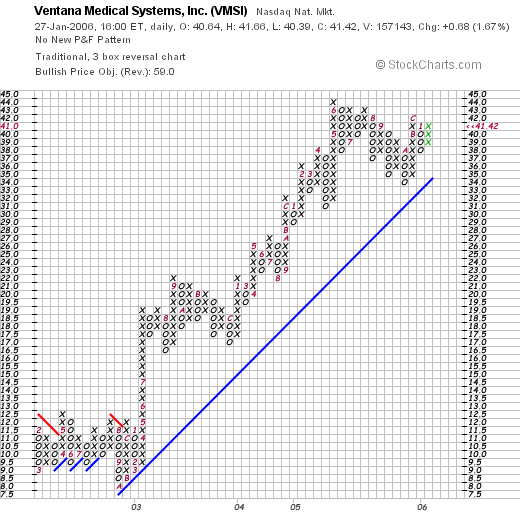

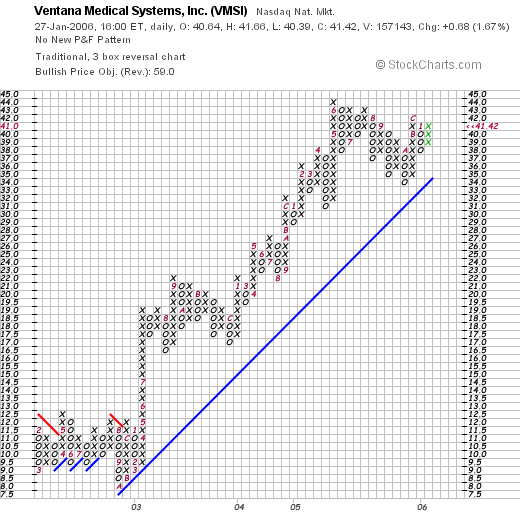

And how about a chart? Looking at a

"Point & Figure" chart on Ventana (VMSI) from Stockcharts.com:

We can see that the stock was trading sideways between February, 2002, and October, 2002, when it was trading in a range beteween $8.00 and $12.00. However, in January, 2003, the stock broke through resistance and has been heading higher since, currently at the $41.42 level. Overall, the graph looks strong to me!

So what do I think? Well I like the stock well enough to own it. The Morningstar.com report is quite strong as is the chart. However, the latest quarter had a glimpse of weakness with the earnings down a tad from the prior year. In addition, the standard measurements of valuation, such parameters as the P/E, PEG, and the Price/Sales ratio all look a bit pricey. I am awaiting the earnings for the final quarter of the year. If these are strong, we may see a nice price appreciation with the large number of short sales outstanding.

Thanks so much for visiting. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

p.s.: Next week I shall be starting over once again at the top of the list of stocks in the trading portfolio!

Posted by bobsadviceforstocks at 12:43 PM CST

|

Post Comment |

Permalink

Updated: Saturday, 28 January 2006 1:19 PM CST

"Revisiting a Stock Pick" Packeteer (PKTR)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

As I promised, I want to write a few words about Packeteer, a stock that I purchased shares in yesterday. If you are familiar with my trading strategy, you will know that I own a maximum number of positions in my trading portfolio, which I have set at 25. My approach has been to have my own portfolio holdings determine whether I should be moving into or out of equities. I do this by adding a new position when I sell a portion of one of my existing positions at a gain (what I call "good news"); I move back into cash when I sell one of my positions at a loss or a retracement of a gain (what I call "bad news"). Yesterday, my Dynamic Materials stock (BOOM) hit my first appreciation target for a sale (30%). I sold 1/6th of my holding of BOOM and set out to find a new position.

With that "permission slip" or as I like to say, that "nickel burning a hole in my pocket", I set out to identify a candidate for purchase. Looking through the

list of top % gainers on the NASDAQ yesterday, I came across Packeteer, Inc., near the top of the list. Packeteer closed yesterday at $12.15, up $2.66 or 28.03% on the day. I purchased 400 shares of PKTR at $11.91 in my trading account. I had done a quick review and found it suitable for purchase and made the trade.

Packeteer is an old "favorite" of mine, a name I use to refer to stocks I have discussed previously on this blog. In fact, Packeteer, which I have not previously owned in my trading account, was an early selection on this blog. I

posted Packeteer (PKTR) on Stock Picks Bob's Advice on June 10, 2003, over 2 1/2 years ago (!) when the stock was trading at $15.10. So the stock is actually trading

lower than when I first "picked" it! The stock is down $(2.95) or (19.5)% since posting. So certainly, this stock has

not gotten away from us!

First, let's review what this company actually does. For that, I like to refer to the

Yahoo "Profile" on Packeteer which reports that the company

"...provides wide area network application traffic management systems to enterprise customers and service providers. Its application traffic management system consists of a family of appliances, including PacketSeeker, PacketShaper, PacketShaper Xpress, PolicyCenter, and ReportCenter. PacketSeeker offers application monitoring that involves automatic identification and classification of traffic through Layer 7 to enable organizations to analyze application performance and network utilization."

I am not a very sophisticated hi-tech investor :), but apparently this stock is a computer networking type company.

My next step is to take a look at the latest quarterly report. In fact, Thursday after the close of trading, Packeteer

announced 4th quarter 2005 results. It was this report that drove the stock higher in trading Friday. For the quarter ended December 31, 2005, net revenues came in at $31.9 million, up from $26.2 million in the fourth quarter 2004. Net income came in at $9.1 million or $.26/diluted share up strongly from the prior quarter and also up strongly from the $5.7 million or $.16/diluted share reported in the same quarter last year.

How about longer-term? Taking a look at the

Morningstar.com "5-Yr Restated" financials, we can see that revenue has been steadily growing from $41.1 million in 2000 to $92.4 million in 2004 and $107.3 million in the trailing twelve months (TTM).

Earnings, which dropped from a loss of $(.35) in 2000 to $(2.40) in 2001, turned profitable at $.12 in 2002, increased to $.42/share in 2004 and is reported at $.45/share in the TTM.

Free cash flow has been positive and increasing from $2 million in 2002 to $19 million in 2004 and $25 million in the TTM.

The balance sheet as reported by Morningstar is strong with $109.7 million in cash, adequate to cover both the $38.6 million in current liabilities and the $3.3 million in long-term liabilities combined over 2 1/2 times over. In addition, the company is reported to have $26.2 million in other current assets.

And what about some valuation numbers? Looking at

Yahoo "Key Statistics" on PKTR, we find that this is a small cap stock with a market capitalization of $415 million. The trailing p/e isn't bad at 27.0, and the forward p/e (fye 31-Dec-06) is even nicer at 23.37. Thus the PEG (5 yr expected) isn't bad either at 1.14.

Within the "Information Technology Services" industrial group, as grouped by the

Fidelity.com eResearch website, PKTR is richly priced in terms of the Price/Sales ratio, topping the group at 3.8. The other stocks include SRA International (SRX) at 1.9, Affiliated Computer Services (ACS) at 1.7, Anteon (ANT) at 1.4, Computer Sciences (CSC) at 0.7 and Electronic Data Services (EDS) at 0.7.

Going back to Yahoo for some other numbers, we find that there are only 34.16 million shares outstanding with 1.72 million shares out short as of 1/10/06, representing 2.8 trading days of volume (the short ratio) which isn't very significant imho. No cash dividends and no stock dividends are reported.

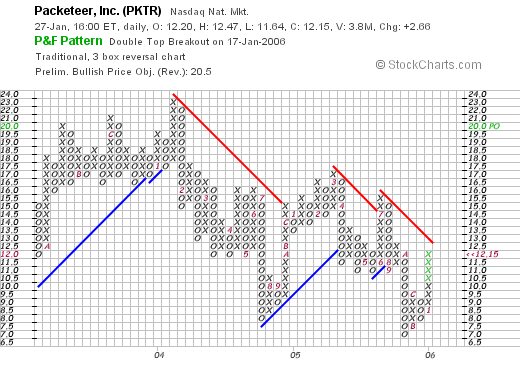

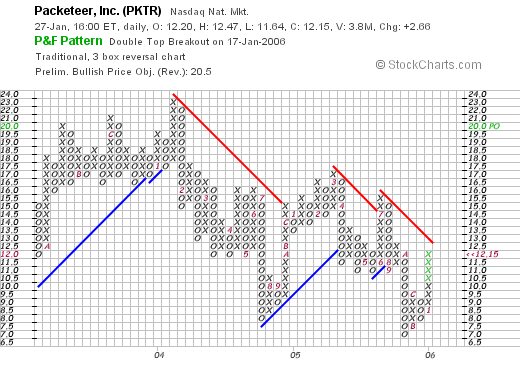

What about the chart? Taking a look at a

"Point & Figure" chart from Stockcharts.com:

We can see what appears to be the weakest attribute of this company. As we noted earlier, the stock is actually lower than my "pick" price 2 1/2 years ago.

In fact, the stock peaked at aroune $23 in January, 2004, and has been trading lower since with "lower highs" and "lower lows". Not very encouraging actually. The stock is currently on a short-term rise in price and I would like to see this stock close strongly above $13. The stock is certainly not over-extended on the upside. In fact, unless we see some more price strength, I couldn't even say it is moving higher :).

So what do I think? Well, I liked the stock enough to buy some shares. I like the latest quarterly report, the Morningstar.com 5-Yr Restated numbers look great and the valuation isn't bad insofar as the P/E and PEG are concerned. The Price/Sales ratio shows the stock is richly valued relative to its peers. And the chart is actually mediocre. However, I am comfortable enough with the Morningstar/recent quarterly report to purchase some shares. I guess the 8% loss limit provides some comfort. I always hedge my bets!

Anyhow, that's the write-up for this stock I promised you yesterday. Thanks again for visiting! Always remember that I am an amateur investor so check with your own professional advisors. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Friday, 27 January 2006

"Trading Transparency" Packeteer (PKTR)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As I always like to point out, I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Earlier this morning my Dynamic Materials (BOOM) stock hit a sell point and I unloaded 40 shares, 1/6th of my 240 share position, at a 30% gain. Owning only 20 different stocks, with a maximum of 25 planned, this gave me a "permission slip" so to speak, to add a new position.

A few moments ago I purchased 400 shares of Packeteer (PKTR) at $11.91. PKTR is an old favorite of mine have

posted Packeteer (PKTR) on Stock Picks Bob's Advice back on June 10, 2003.

Anyhow, that's how the nickel in my pocket was spent :). If you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. I will try to update you on this stock a little later when I get a chance!

Bob

"Trading Transparency" Dynamic Materials (BOOM)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

The market is up nicely today and one of my stocks, Dynamic Materials (BOOM) has just hit a sale point. I purchased 240 shares of BOOM last month at a cost basis of $28.32. As you may know, my first targeted sale point is a 30% gain.

A few moments ago I sold 1/6th of my position, 40 shares, at $37.50. This represented a gain of $9.18 from my original purchase price or an appreciation of 32.4%. I now have 200 shares and shall be looking to sell all of my shares on the downside if the stock should retrace to a break-even position, or another 1/6th of my position, about 33 shares, if the stock should reach a 60% appreciation level or 1.60 x $28.32 = $45.31.

Thanks so much for stopping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

By the way, as you may also know, this sale at a gain, since I am under my 25 maximum position, entitles me to add a new position. I shall be scouring the top % gainers list for prospects and shall keep you posted. Meanwhile that nickel is already burning a hole in my pocket :).

Bob

Thursday, 26 January 2006

A New PODCAST for Stock Picks!

Hello Friends! Here is the new

***PODCAST*** on Trimble (TRMB), National Instruments (NATI), Headwaters (HW). Thanks for visiting!

Bob

"Revisiting a Stock Pick" Headwaters Inc. (HW)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor and that you should consult your professional investment advisors prior to making any investment decisions based on information on this website.

We had a great day in the market today with the Dow up almost 100 points to close at 10,809.47, and the NASDAQ up 22.35 points to close at 2,283.00. It is during these strong market periods that the kind of stocks that I like to discuss tend to show up on the lists of top % gainers.

Generally, when looking for a new stock to discuss, I start with the top % gainers lists that are readily available online. In fact, looking through the

list of top % gainers on the NYSE today, I came across Headwaters (HW), a stock that I have discussed before on Stock Picks. I actually do own 200 shares of HW in another managed account that I have farmed out to a professional manager. Headwaters closed today at $35.00, up $2.20 or 6.71% on the day.

Headwaters (HW) was an early selection of mine on this blog. In fact, I

posted Headwaters (HW) on Stock Picks Bob's Advice on October 22, 2003, when the symbol was HDWR, and the stock was trading on the NASDAQ. HDWR was trading at $17.41 at that time. Since that listing, the stock has appreciated $17.59 or 101% since posting.

Let's take a closer look at Headwaters which now is on the NYSE and has the symbol HW. According to the

Yahoo "Profile" on Headwaters, the company

"...through its subsidiaries, provides products, technologies, and services to the energy and construction materials industries in the United States. It operates in three segments: Construction Materials, Coal Combustion Products, and Alternative Energy. Construction Materials segment designs, manufactures, and markets shutters, gable vents, mounting blocks and tools, and architectural manufactured stones."

One of the first screens that I employ to "sift out" a suitable stock, is to look at the latest quarterly result. I am interested in a company with both increasing revenue and earnings. Headwaters

reported 1st quarter 2006 results two days ago on 1/24/06. Revenue for the quarter rose 28% to $280.5 million from $218.4 million a year ago. Income climbed over 100% to $28.3 million or $.60/share, up from $11.1 million or $.30/share last year. These results exceeded analysts' expectations of $.55/share on revenue of $268 million.

After noting a positive quarterly report as we have just reviewed with Headwaters, I generally look to Morningstar.com to determine whether the company is demonstrating persistence of revenue growth, earnings growth, positive free cash flow, and a solid balance sheet.

Looking at the

Morningstar.com "5-Yr Restated" financials on Headwaters, we can see the steady growth in revenue from $0 in 2001 to $.1 billion in 2002, $.4 billion in 2003, $.6 billion in 2004 and $1.1 billlion in 2005. During this same time earnings have also steadily grown from $.87/share in 2001 to $2.79 in 2005. On a negative note, the company

has been diluting the shares somewhat with 23 million reported in 2001, increasing each year to 38 million shares in 2005 and 42 million in the trailing twelve months (TTM).

Free cash flow has been positive and growing the last several years. $47 million in 2003 growing to $95 million in 2005.

The balance sheet looks adequate if not terribly strong, with $13.7 million in cash, and $341.4 million in other current assets. This is plenty to cover the $237.7 million in current liabilities and enough to make a small dent on the $747.6 million in long-term liabilities.

My next step is to look for some valuation numbers and statistics on the stock. For this, I have been using Yahoo, reviewing the

"Key Statistics". Here we find that Headwaters (HW) is a mid-cap stock with a market capitalization of $1.47 billion. The trailing p/e is downright cheap at 12.56 and the forward p/e (fye 30-Sep-07) is even nicer at 11.48. Confirming the good valuation of this stock is a PEG (5 yr expected) which is reported under 1.0 at 0.53. Generally stocks that have PEG's near to or less than 1.0 are excellent values.

One thing that I picked up from my reading was an article by Paul Sturm at Smart Money Magazine who pointed out the usefulness of looking at Price/Sales ratios of companies relative to other companies in the same industrial group. Using the

Fidelity.com eResearch website, we find that HW is in the "Industrial Metals/Mineral" group. Within this group, the Price/Sales ratio of 1.4 for Headwaters is at the bottom of the bunch, suggesting again an excellent value insofar as an investment is concerned. Topping this list is Peabody Energy (BTU) with a Price/Sales ratio of 2.8, Arch Coal (ACI) at 2.3, Inco (N) at 2.3, Consolidated Energy (CNX) at 1.9, Foundation Coal (FCL) at 1.6 and Headwaters (HW) at the bottom of the group at 1.4.

Looking back at Yahoo, we find that there are 41.94 million shares outstanding with 7.99 million shares out short as of 12/12/05. This represents 19.60% of the float (!) or 15.7 trading days of volume (!!). In addition, the short shares are up from 6.58 million the prior month. With the strong earnings report, I would not be surprised to learn that we have been witnessing a short squeeze on this stock.

No cash dividends and no stock dividends are reported.

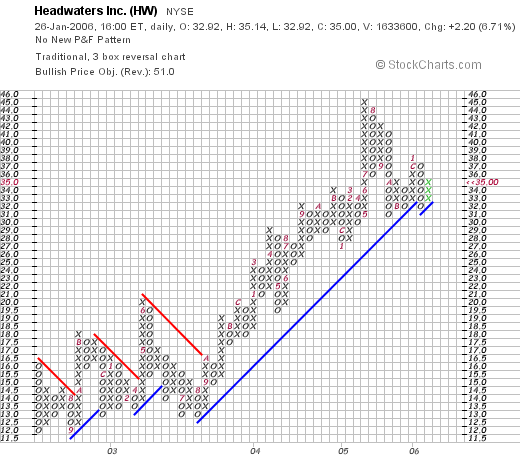

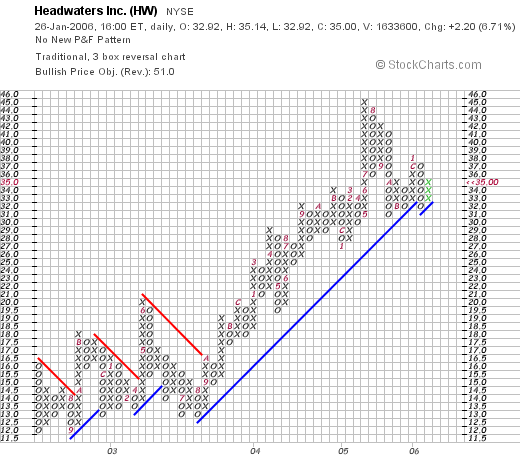

Finally, let's take a look at a chart. I have found it helpful to review the "point & figure" charts on the stocks I write up. Bear with me. You will get used to the climbing columns of x's and the descending columns of o's. Looking at the

"Point & Figure" chart on Headwaters (HW):

The chart looks quite strong with the stock rising from $12.00/share in September, 2002, to the current level of $35.00. The stock has been challenging the support level recently, but overall the graph looks nice.

So what do I think? Well, this is a stock I reviewed almost 2 1/2 years ago that has already doubled in price since that selection. The latest quarter was exceptionally strong and the past five years have shown steady growth. The company has been financing some of its growth with the sale of additional shares of stock. Otherwise, valuation is excellent, free cash flow is positive and growing and the balance sheet is reasonable. Valuation is downright cheap! And the chart looks nice. I still like this stock. I don't have any shares in my trading account but do own some HW in a managed account.

Thanks so much for stopping by! If you have any comments or questions, please feel free to leave them right on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Newer | Latest | Older

On November 10, 2004, I

On November 10, 2004, I  On October 27, 2005, ASVI

On October 27, 2005, ASVI  On November 14, 2004, I

On November 14, 2004, I  On November 29, 2005, GameStop

On November 29, 2005, GameStop

Ventana was an early pick of mine on this blog. I

Ventana was an early pick of mine on this blog. I  I currently own 225 shares of Ventana (VMSI) which were acquired 4/16/04 at a cost basis of $23.47/share. With yesterday's (1/27/06) closing price of $41.42, these shares currently have an unrealized gain of $17.95 or 76.5% since my purchase of these shares.

I currently own 225 shares of Ventana (VMSI) which were acquired 4/16/04 at a cost basis of $23.47/share. With yesterday's (1/27/06) closing price of $41.42, these shares currently have an unrealized gain of $17.95 or 76.5% since my purchase of these shares. On October 21, 2005, VMSI

On October 21, 2005, VMSI  Reviewing

Reviewing

As I promised, I want to write a few words about Packeteer, a stock that I purchased shares in yesterday. If you are familiar with my trading strategy, you will know that I own a maximum number of positions in my trading portfolio, which I have set at 25. My approach has been to have my own portfolio holdings determine whether I should be moving into or out of equities. I do this by adding a new position when I sell a portion of one of my existing positions at a gain (what I call "good news"); I move back into cash when I sell one of my positions at a loss or a retracement of a gain (what I call "bad news"). Yesterday, my Dynamic Materials stock (BOOM) hit my first appreciation target for a sale (30%). I sold 1/6th of my holding of BOOM and set out to find a new position.

As I promised, I want to write a few words about Packeteer, a stock that I purchased shares in yesterday. If you are familiar with my trading strategy, you will know that I own a maximum number of positions in my trading portfolio, which I have set at 25. My approach has been to have my own portfolio holdings determine whether I should be moving into or out of equities. I do this by adding a new position when I sell a portion of one of my existing positions at a gain (what I call "good news"); I move back into cash when I sell one of my positions at a loss or a retracement of a gain (what I call "bad news"). Yesterday, my Dynamic Materials stock (BOOM) hit my first appreciation target for a sale (30%). I sold 1/6th of my holding of BOOM and set out to find a new position. With that "permission slip" or as I like to say, that "nickel burning a hole in my pocket", I set out to identify a candidate for purchase. Looking through the

With that "permission slip" or as I like to say, that "nickel burning a hole in my pocket", I set out to identify a candidate for purchase. Looking through the  First, let's review what this company actually does. For that, I like to refer to the

First, let's review what this company actually does. For that, I like to refer to the  How about longer-term? Taking a look at the

How about longer-term? Taking a look at the

Generally, when looking for a new stock to discuss, I start with the top % gainers lists that are readily available online. In fact, looking through the

Generally, when looking for a new stock to discuss, I start with the top % gainers lists that are readily available online. In fact, looking through the