Stock Picks Bob's Advice

Tuesday, 16 October 2007

Apogee (APOG) and Zumiez (ZUMZ) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of my strong beliefs in managing a portfolio is that we establish trading rules and stick by them. One of my rules is to sell any new purchase of stock should it hit or pass an 8% loss. By this, I mean to accomplish a couple of things--first limiting my losses so that no 8% loss becomes a 50% loss, and also, to allow me to star 'pulling in my horns' so to speak in the face of a weak market. In this case, my first stocks often to be sold are my latest purchases. Stocks which I may be terribly enthusiastic about, and yet were evidently purchased at exactly the wrong time.

With that in mind, I sold two of my recent purchase, both stocks that I feel are great stories and worthy of consideration at a future date. I sold my 280 shares of Apogee (APOG) at $25.12, and my 105 shares of Zumiez (ZUMZ) at $48.24.

My Apogee shares were purchased as recently as October 1, 2007, at a cost basis of $27.57. Thus, I had a loss on Apogee of $(2.45) or (8.9)% since purchase just a couple of weeks ago!

Zumiez was purchased just a few days ago on October 11, 2007, at a cost basis of $53.07. Thus, I incurred a loss of $(4.83) or (9.1)% since purchase. With these sales, I have lowered the rating on these otherwise attractive stocks:

APOGEE (APOG) IS RATED A HOLD

and

ZUMIEZ (ZUMZ) IS RATED A HOLD

Does this mean that I don't think these are great companies and possibly terrific investments? No, not at all. But my investing strategy requires me to sell stocks when they incur small losses. This may mean this is a result of just a small patch of volatility and that I just wasn't lucky. However, it may also be suggestive of a deeper correction, as my portfolio moves out of recently purchased stocks into cash.

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you can, visit my Stock Picks Podcast Website, where I discuss some of the many stocks I write about here on the blog. In addition, drop by and check out my SocialPicks page where my stock picks have been and continue to be analyzed since the first of the year. To find out how my portfolio has been performing compared to some other active investors, visit Covestor and check their analysis.

If you still have time :), and are interested in another area of investing, explore the Prosper.com page where if you sign up before the end of the year, both you and I can receive a cash incentive for your lending or borrowing. This person-to-person lending website may well represent very significant risks, so use caution. Spread out your risk. And start slowly!

Bob

Monday, 15 October 2007

"What America Means to Me" An Editorial

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! I will not give you the usual investment advice warning, because this entry is not about investment advice. It is about my thoughts on politics in America today, a subject I have chosen not to write about in the past. But a subject that I also hold close to my heart and a subject which moves me greatly.

I do not expect most or even many of you to agree with most or any of what I have to say. But as a blogger, it is difficult to always wear my financial hat without sharing with you opinions and ideas about the world as well. Both of my hats fit me well. I welcome your comments and your thoughts on adding such editorial comment to this blog.

It is often assumed that one who is interested in investing and the stock market must necessarily be conservative. This isn't always the case. It is also possible to care about profits as well as caring about the well-being of employees as well as their bosses. We can also be concerned about the shareholders as well as the profit margin of the corporation. We can care about free cash flow as well as free speech. We can care about the balance sheet as well as balance in our news media. We can care about global markets as well as global warming.

I know that I do.

I love the United States deeply. And yet I am concerned about the direction a few in Washington have been taking her.

America is a nation that has historically been slow to enter wars, but when America goes to war it goes with a vengeance. We certainly have not been a nation to initiate wars; nor should we ever move in that direction. We have been misled by group of men who chose to create the facts to justify their arguments about war. While needing to be firm in the fight over terrorism, we also cannot afford to be nation-building both from the financial and human cost it involves. We have been successful in removing the corrupt leadership in Iraq. Now it is time for us to separate from that nation; turning the reins of power back to the people in that nation.

America is a nation of equals. A democratic dream. A nation of laws. And yet we have leaders who ignore Congress and defy its laws in the name of an expansion of Executive power. This is not an America I recognize. We do not have a royal executive, we have an individual American who is chosen by the people to lead them, not as a monarch, but as a democratically elected President bound to uphold the laws of this land and the Constitution. And yet we now have an executive who defies the role of Congress, obstructs testimony, and loses millions of pertinent emails. We have an Administration that outs CIA agents as a sort of punishment when cooperation isn't forthcoming in doing their dirty deeds. This isn't the America I grew up with.

When I was in high school, I read about torture in other countries. I remember the appeals from Amnesty International about, as I recall, torture going on in Central American nations. I learned about the Russian use of Gulags in College when reading Solzhenitsyn. But all of this was about something bad happening by some other country somewhere else.

No longer.

We have a President who believes he can make torture go away if he just defines it that way. Who believes that Extraordinary Rendition is a State Secret and the Supreme Court can't hear the facts. That Abu Ghraib was an aberration even though the Attorney General called the Geneva Conventions "quaint". This isn't the America I understand.

Government isn't evil. We don't need to privatize everything because government does it badly. Private contractors have been employed in every aspect of government and these overpaid workers have failed us repeatedly. They have failed us at Walter Reed. They have failed us in Iraq. No, government isn't evil. It is us. We have government for the people, by the people and of the people. We don't all need to be shrunk down to the size that we can all be drowned in a bathtub. This isn't the America I love.

Taxes aren't evil. Taxes are the things we pay that allow us to have the best government in the world. The best educational system. The best healthcare system. The best military. And the best roads and utilities in the World. This at least was what I understood taxes to be. This government which runs out country literally hates itself. It cuts taxes irresponsibly running up massive deficits and burdening our children for generations to come. This isn't the America I want to see.

This nation supports science. We support education. We protect the environment. And yet we have leaders in office who undermine scientific investigation, deny the existence of man-caused global warming, censor scientists from talking about Polar Bears, or simply revise global warming reports before taking jobs with Big Oil.

Our no child left behind program undermines instead of supporting public education. The end-game of NCLB is the failure of every school to reach standards that are raised indefinitely, leading to the draining of funds from public schools into non-tested schools of faith. This isn't what education is about in America.

I could talk longer. But I have said enough. I hope you all are not upset that I have an opinion about the world that we live in. America is a land of possibility. Let us restore leadership to this nation that can dream of the possible and not wallow in the self-hate of the anti-government fanatics.

Cutting taxes without cutting spending is no tax cut at all. 'There aint no such thing as a free lunch' I learned in college. Deficits are taxes. Remember that.

And dead people don't pay taxes. Heirs and Heiresses do. And there is nothing wrong with taxing estates in a redistributive effort. Wealth is not going away in America. No, instead of disappearing, wealth continues to be more and more concentrated among the highest earneers. The poor get poorer and the rich richer. The way it always has been. But not the way it should be in America!

Bring America back to me. Bring back the belief in the future the avoidance of fear, and the confidence to face challenges in the future. America can and will do better. I love it too much to think otherwise.

Bob

Sunday, 14 October 2007

"Looking Back One Year" A review of stock picks from the week of April 17, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It is still the weekend for a few more hours and there is time for me to review picks from about a year ago. Last week I reviewed the stock picks from the week of April 10, 2006. Moving ahead a week, let's look at stock picks from the week of April 17, 2006.

As I have pointed out mutilple times previously, this review assumes a 'buy and hold' approach to investing, assuming an equal $ amount was invested in each of the 'picks' and performance is based on that assumption. In reality I practice and advocate a very disciplined portfolio management system that requires me to sell losing stocks quickly and completely and appreciating stocks slowly and partially. This difference in strategies would certainly affect performance and should be taken into consideration.

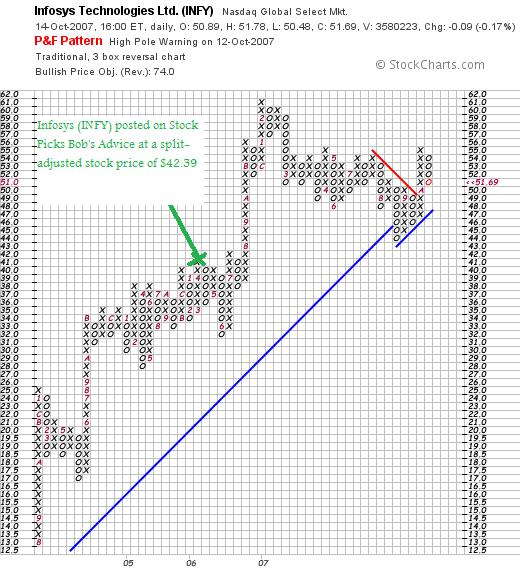

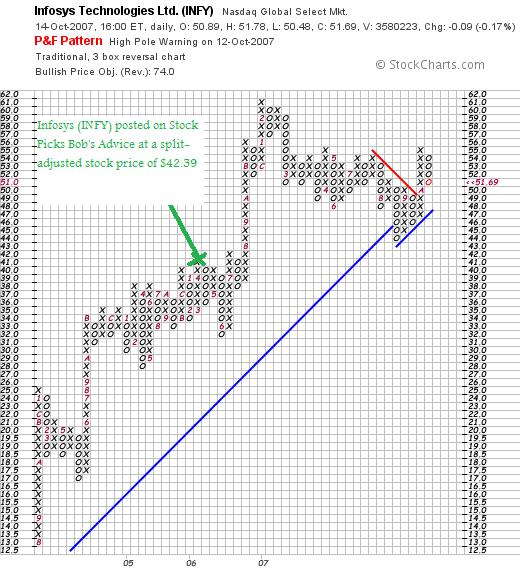

On April 17, 2006, I posted Infosys (INFY) on Stock Picks Bob's Advice when the stock was trading at $84.78. INFY had a 2:1 stock split on July 18, 2006, making my effective 'pick price' actually $42.39. Infosys closed at $51.69 on October 12, 2007, giving my pick an effective gain of $9.30 or 21.9% since posting.

On October 11, 2007, Infosys (INFY) reported 2nd quarter 2008 earnings results. Revenues came in at $1.02 billion, up 37% from the prior quarter last year. Earnings per American Depositary Share (ADS) climbed 33% to $.48/share from $.36/share. Due to the strength in the rupee and the weakness in the dollar, management forecast margins being hit by 50 to 100 basis points. The company beat its own guidance, but the stock dipped on the reduced guidance going forward.

On October 11, 2007, Infosys (INFY) reported 2nd quarter 2008 earnings results. Revenues came in at $1.02 billion, up 37% from the prior quarter last year. Earnings per American Depositary Share (ADS) climbed 33% to $.48/share from $.36/share. Due to the strength in the rupee and the weakness in the dollar, management forecast margins being hit by 50 to 100 basis points. The company beat its own guidance, but the stock dipped on the reduced guidance going forward.

With the solid quarterly report, the strong price chart, and an intact Morningstar.com "5-Yr Restated" financials page,

INFOSYS (INFY) IS RATED A BUY

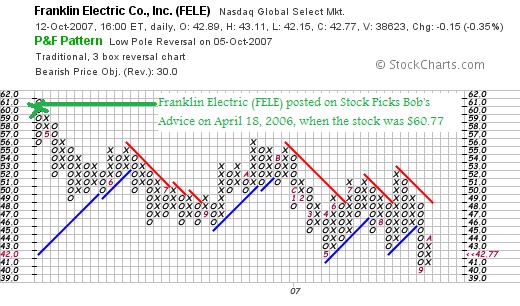

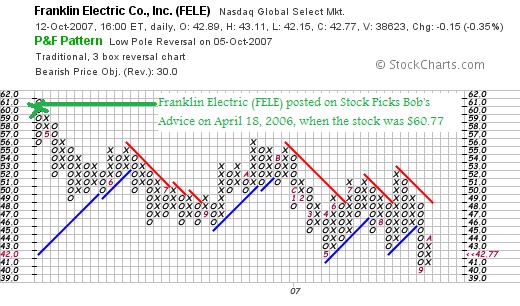

On April 18, 2006, I posted Franklin Electric (FELE) on Stock Picks Bob's Advice when the stock was trading at $60.77. Franklin closed at $42.77 on October 12, 2007 for a loss of $(18) or (29.6)% since posting.

On April 18, 2006, I posted Franklin Electric (FELE) on Stock Picks Bob's Advice when the stock was trading at $60.77. Franklin closed at $42.77 on October 12, 2007 for a loss of $(18) or (29.6)% since posting.

On July 30, 2007, Franklin Electric (FELE) reported 2nd quarter 2007 results. Sales for the quarter ended June 30, 2007, came in at $152.5 million, up slightly from the same quarter last year when sales came in at $152.2 million. Net income, however, came in sharply lower at $6.6 million down sharply from $16.4 million last year. Diluted earnings per share dropped (60)% to $.28/share, from last year's $.70/share in the same period.

On July 30, 2007, Franklin Electric (FELE) reported 2nd quarter 2007 results. Sales for the quarter ended June 30, 2007, came in at $152.5 million, up slightly from the same quarter last year when sales came in at $152.2 million. Net income, however, came in sharply lower at $6.6 million down sharply from $16.4 million last year. Diluted earnings per share dropped (60)% to $.28/share, from last year's $.70/share in the same period.

The company missed expectations by a wide margin, as analysts polled by Thomson Financial were expecting earnings of $.51/share on revenue of $162.5 million.

Checking the Morningstar.com "5-Yr Restated" financials, we can see that not only have earnings dipped on flat revenue but that free cash flow which was positive came in at a negative $(13) million in the TTM. The rest of the morningstar.com page looks solid.

With the weak price chart, the mediocre earnings report, and the inadequate Morningstar.com page results,

FRANKLIN ELECTRIC (FELE) IS RATED A SELL

Finally, on April 19, 2006, I posted Wolverine World Wide (WWW) on Stock Picks Bob's Advice when the stock was trading at $23.91. WWW closed at $26.80 on October 12, 2007, for a gain of $2.89 or 12.1% since being posted.

Finally, on April 19, 2006, I posted Wolverine World Wide (WWW) on Stock Picks Bob's Advice when the stock was trading at $23.91. WWW closed at $26.80 on October 12, 2007, for a gain of $2.89 or 12.1% since being posted.

On October 3, 2007, Wolverine World Wide (WWW) announced

3rd quarter 2007 results. Revenue for the quarter ended September 8, 2007, came in at $310.2 million, up 3.8% over 3rd quarter 2006 results. Earnings for the quarter came in at $.54/share, up 17.4% from the $.46/share reported last year.

The company beat expectations on earnings expected by analysts according to Thomson Financial to come in at $.53/share. However, the revenue figure underwhelmed the street at $310.2 million while analysts were expecting an average of $316.9 million. The company also raised guidance from $1.60 to $1.64/share for 2007 to new estimates of $1.63 to $1.65/share.

With the solid earnings report, the still-strong price chart, and a good Morningstar.com page,

WOLVERINE WORLD WIDE (WWW) IS RATED A BUY

So how did I do with these three stock picks? Well one had a loss, and the other two gains, the average performance coming in at a gain of a meager 1.47% since posting!

Thanks so much for dropping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, drop by and visit my Stock Picks Podcast Website, my Covestor Page where my trading portfolio is actively tracked, and my SocialPicks page which has been following my picks since the first of the year!

Have a great week trading everyone!

Bob

Posted by bobsadviceforstocks at 5:37 PM CDT

|

Post Comment |

Permalink

Updated: Sunday, 14 October 2007 5:39 PM CDT

Thursday, 11 October 2007

Zumiez (ZUMZ) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

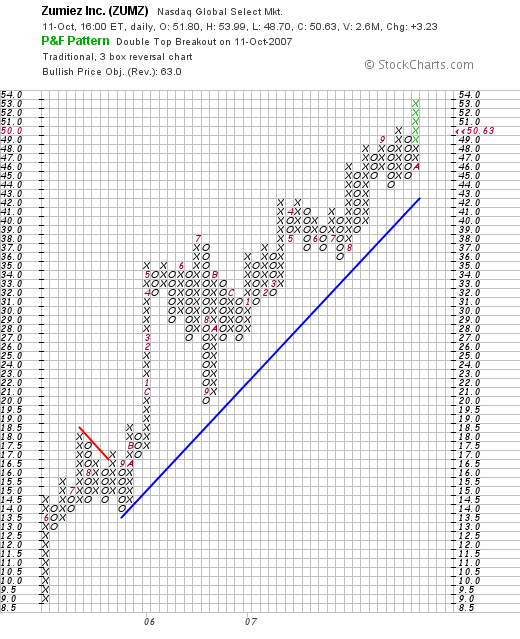

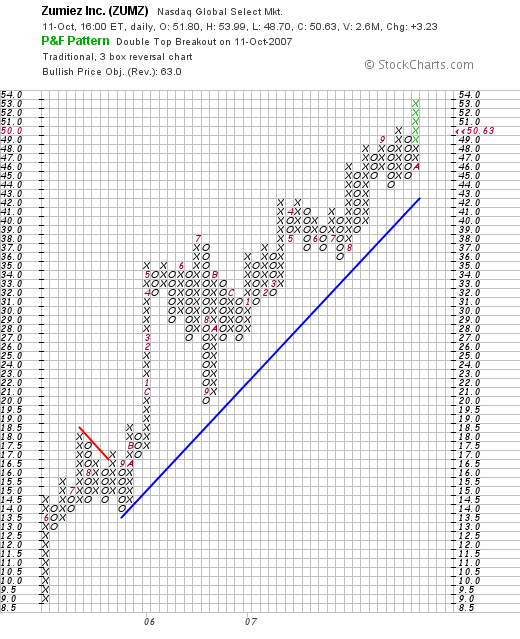

As I wrote earlier today, I purchased 105 shares of Zumiez (ZUMZ) at $52.96. ZUMZ later in the day sold off as many of the retail stocks also were weak as the NASDAQ corrected. ZUMZ closed at $50.63, up $3.23 or 6.81% on the day, a little of $2 under my purchase price. In spite of all that, I shall explain why

As I wrote earlier today, I purchased 105 shares of Zumiez (ZUMZ) at $52.96. ZUMZ later in the day sold off as many of the retail stocks also were weak as the NASDAQ corrected. ZUMZ closed at $50.63, up $3.23 or 6.81% on the day, a little of $2 under my purchase price. In spite of all that, I shall explain why

ZUMIEZ (ZUMZ) IS RATED A BUY

I first wrote up Zumiez on September 16, 2006, when the stock was trading at $26.24. As I pointed out, I did purchase some shares for my son's account (less than 50), but today's purchase is my first entry into this stock.

Let me try to briefly explain my rationale for buying shares of this retailer in an otherwise weak retail environment, when given the choice of a new position with my own partial sale of my Cerner stock.

Any news on Zumiez?

One of the most important criteria for selecting a stock is 'same-store sales growth'. What pushed Zumiez up strongly was an outstanding report released yesterday after the close of trading. As reported:

growth'. What pushed Zumiez up strongly was an outstanding report released yesterday after the close of trading. As reported:

"Zumiez Inc (NasdaqGS:ZUMZ - News), which specializes snowboarding and skateboarding equipment and apparel and was sheltered in part by geography and its casual product mix, reported a 13.9 percent rise in September sales at its stores open at least a year."

13.9% is a phenomenal figure. And the stock took off to the upside on opening today. However, later in the day, the stock, along with other retail shares, sold off...leaving me with a purchase a couple of $'s in the red. Not helping the situation was a downgrade today from 'Buy' to 'Hold'!

Latest quarter?

As my regular readers know, I regularly check the latest quarterly report for basic results. In this case, Zumiez announced 2nd quarter 2007 results on August 22, 2007. Net sales for the quarter ended August 4, 2007, climbed by 47.0% to $82 million. Net income for the quarter was up even a greater percentage at $3.1 million, or $.11/diluted share, from $1.6 million or $.06/diluted share last year. This was an an 83.3% increase in earnings!

A couple of important points in the report: the company raised guidance for fiscal 2007 to $.97 to $.99/share from the prior guidance of $.94 to $.96/share. Also, the 13.8% same store sales growth reported for last month wasn't a 'fluke'. As the report notes:

"Comparable store sales increased 11.6% for the second quarter of fiscal 2007 compared to a 12.6% increase in the second quarter of fiscal 2006."

Thus, this double-digit same store sales increase was present in the first quarter of 2007 as well as the first quarter of 2006! This company is on a roll! In addition, the company beat expectations of $.08/share on revenue of $80 million for the quarter. This was a great earnings announcement!

What about longer-term results?

The '5-Yr Restated' Financials on Morningstar.com are intact and impressive with steady revenue and earnings growth, stable outstanding shares, positive free cash flow and a solid balance sheet.

Valuation?

Looking at Yahoo "Key Statistics" on Zumiez, we find that the stock is a mid cap stock with a market cap of $1.45 billion. The trailing p/e is very rich at 64.01, yet the growth is strong enough that the PEG is only slightly rich at 1.59 from my perspective.

There are 28.69 million shares outstanding with 15.27 million float. There are 6.05 million shares out short representing 6.7 trading days of volume, or 33.10% of the float. This is more than my '3 day rule' and should be taken into consideration.

No cash dividend is paid and the last stock split was a 2:1 split on April 20, 2006.

Checking the Fidelity.com eresearch website, we can also see the rich valuation with a Price/Sales (TTM) of 3.86 compared to the industry average of 0.97. The company has a Return on Equity (TTM) of 20.96% compared to the industry average of 26.08%. Thus both of these statistics show relatively rich valuation.

And the Chart?

If we examine a "point & figure" chart on Zumiez (ZUMZ) from StockCharts.com, we see a chart of amazing price strength going back into 2005. The current pullback does not appear significant enough to change the trend.

Summary

I liked this stock last year enough to buy some shares for my son. This year, with the opportunity arising with the sale of a portion of my shares of Cerner (CERN), I chose to add this stock to my Trading Portfolio. My timing today left a bit to be desired as the retail stocks pulled back sharply late in the day. However, the numbers underlying this stock's performance have not diminished and are just as impressive.

In particular, I am enthralled with the 13.8% same store sales growth number. In addition, they did the same kind of growth in the latest quarter and also did it a year ago! This company is on a sales roll!

The latest quarter was great as the company beat expectations for both revenue and earnings and also raised guidance. Valuation wise, the p/e is very expensive, but the rapid growth expected to continue brings down the PEG into a reasonable estimated level. Other valuation numbers are also steep including the Price/Sales and the Return on Equity which is a bit weak relative to other companies in the same Industrial Group.

There are lots of shares out short giving any correction possible support, and giving any rally in the price, additional energy. The chart looks great, and the company has a certain amount of "Peter Lynch" to its attractiveness. Anyhow, that's my call---and I liked the stock well enough to buy some shares!

Thanks again for stopping by and visiting my blog. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast site, my Covestor page where my portfolio is analyzed, and my SocialPicks page where all of my picks from this year going forward have been reviewed.

Have a great Friday everyone!

Bob

Posted by bobsadviceforstocks at 9:07 PM CDT

|

Post Comment |

Permalink

Updated: Friday, 12 October 2007 1:07 AM CDT

Cerner (CERN) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Earlier today I wrote about my partial sale of Cerner at a gain. Let me give you the details now that I have a minute to write about it. These shares were originally purchased 2/2/07 at a cost basis of $49.76. I sold 17 shares, or 1/7th of my 120 shares, at $64.84 this morning. (They closed lower than this!). This represented a gain of $15.08 or 30.3% since purchase. The 30% level is my first targeted sale point. I went ahead and sold the shares and then with the permission slip (being under my maximum of 20 positions), went ahead and purchased 105 shares of ZUMZ. More about THAT later.

Anyhow, that's a wrap. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Cerner (CERN) and Zumiez (ZUMZ) "Trading Transparency"

Quick post: Sold 1/7th of Cerner (CERN) (15 shares) at 30% gain and initiated a position in Zumiez (ZUMZ) (105 shares). Details to follow.

Bob

Wednesday, 10 October 2007

U.S. Global Investors (GROW) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Earlier today, after the partial sale of my Morningstar stock at a gain, I had a "permission slip" to add a new holding to my Trading Portfolio. I didn't wait long with that nickel in my pocket to spend it on something!

Reviewing the list of top % gainers on the NASDAQ today, I came across U.S. Global Investors (GROW) which as I write is trading at $21.53, up $2.53 or 13.32% on the day. I purchased 245 shares of GROW at $21.23/share.

U.S. GLOBAL INVESTORS (GROW) IS RATED A BUY

I purchased GROW after reviewing a satisfactory 4th quarter 2007 report issued on September 13, 2007, and a solid "5-Yr Restated" Morningstar.com financial page. On a down note, the "point and figure" chart on GROW gives me a little concern (I reviewed it after my purchase of course), with a little bit of recent technical weakness. I would like to see this stock trade a bit higher before I could feel reassured that the recent correction in the stock price was through.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Morningstar (MORN) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A little earlier today I noticed that my Morningstar stock (I do not do this automatically) had hit an appreciation target on the upside, passing the 120% appreciation level. (As you probably know, I use targeted appreciation levels after stock purchases to sell portions of my holdings.) I had sold Morningstar (MORN) shares 3 times previously, thus my target was at a 120% level (the first three levels being at 30, 60, and 90% appreciation points.) I sold 1/7th of my 120 shares which worked out to 17 shares at $71.89. These shares had been purchased 11/22/05 at a cost basis of $32.57. Thus, I had a gain of $39.32 or 120.7% since purchase.

Since I was under my 20 position maximum, this sale at a gain gave me a "permission slip" to add a new position to the portfolio. I did purchase shares of U.S. Global Investors (GROW)....more of that later.

When would I sell next? On the upside, my next targeted level is at a 180% appreciation point. I go with groups of four sales and then increase the interval by 30%. Thus, 30, 60, 90, 120, then 180, 240, 300, 360, then 450% etc. At that time, I would also plan on selling 1/7th of the remaining shares of 103/7 = 14 shares at 2.8 x $32.57 = $91.20. On the downside, after a 120% partial sale, my new targeted sale point would be at 1/2 of that appreciation level or at a 60% appreciation from purchase which works out to 1.6 x $32.57 = $52.11. At that level, I would plan on selling ALL remaining shares. Much like what I did with Bolt (BTJ) which retraced to 1/2 of the highest prior appreciation point.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Tuesday, 9 October 2007

Update on Prosper.com, Covestor.com, and Kiva.org

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It is late here and I wanted to jot down a quick note on Covestor and Prosper.com, and Kiva.org. These are websites (Prosper and Covestor) that I have gotten more involved in over the past few months, and one (Kiva.org), that I would like to publicize. They are quite different but all three are worth a visit.

First Prosper.com. Prosper is the person to person loan program that involves an eBay type auction of bidders bidding on loans. This is rather high risk and the interest rates are accordingly high. Yet it is possible to limit your activity to AA or A rated applicants (Prosper screens applicants for credit-worthiness) and by spreading out your loans to multiple individuals, you can hopefully reduce your risk and maximize your return. I currently have $200 in four loans outstanding with an average interest rate of 17.98%. I have one $50 loan not quite cleared at 15%. I will keep you posted on how these work out.

Until the end of the year if you join Prosper, you will receive $25 to start off your loan process. If you only add another $25 and loan it out...it is well worth the effort imho. (Full disclosure, I also will receive credit for referring you to Prosper, but after you visit, even if you don't participate, I am sure you will find the entire thing fascinating!).

Next thing Covestor.com. This is an amazing website that tracks actual trading portfolios. You can visit my Covestor Page if you are interested in seeing how a third party evaluates my actual holdings as measured from June 12, 2007, when I signed up shortly after Covestor became available to the public. I do not receive any money or credit for plugging Covestor. I do this because it helps me evaluate my own performance and understand how each of my holdings is doing. Covestor is relatively available to the public. However, I have been assigned 5 invitations (I recently gave one out to a Stock Picks reader). If you are interested in one of the remaining four invites, please feel free to email me at bobsadviceforstocks@lycos.com with your name and email address and I will send you the appropriate information to get you started.

Finally, while I also love to make money, I would like to interest you all in Kiva.org, a website designed not to make any money at all, but to provide loans to third world individuals trying to get a start in life. While we may individually profit from all of our trades and investments, others need the smallest amount of help to make a difference. Visit Kiva.org and see what great work they are doing!

Bob

Sunday, 7 October 2007

Red Robin Gourmet Burger (RRGB) "Long-Term Review #13"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Sometimes I am absolutely dumbfounded by the mass of entries on this website. It is hard to believe that I have been blogging for almost five years not, since my first entry back in 2003. I encourage all of you to explore through the many entries on the blog as my own thinking has evolved and you may find many interesting ideas within the pages of this website.

Some time back I started doing the 'look back one year' entries on weekends. Now, I am continuing my effort to start going way back to the beginning of the blog with reviews of the early stock picks. Not every one has turned out a winner, but there have been some very interesting stocks discussed here on this blog.

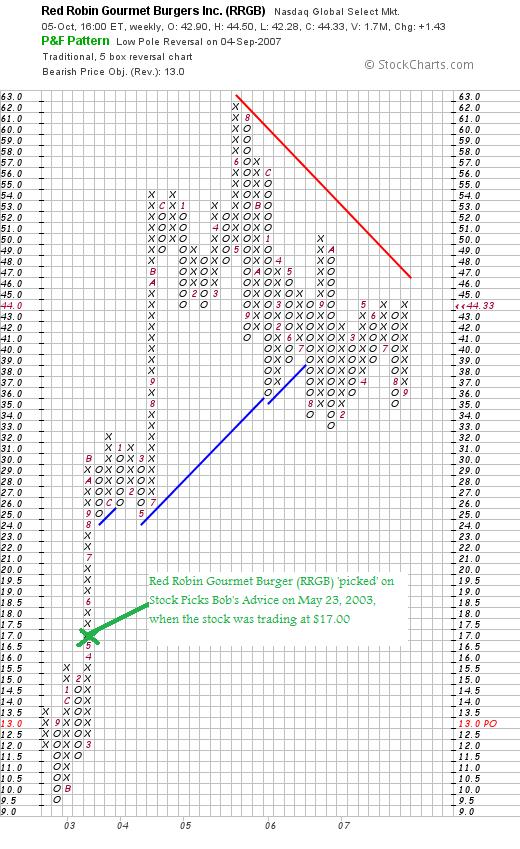

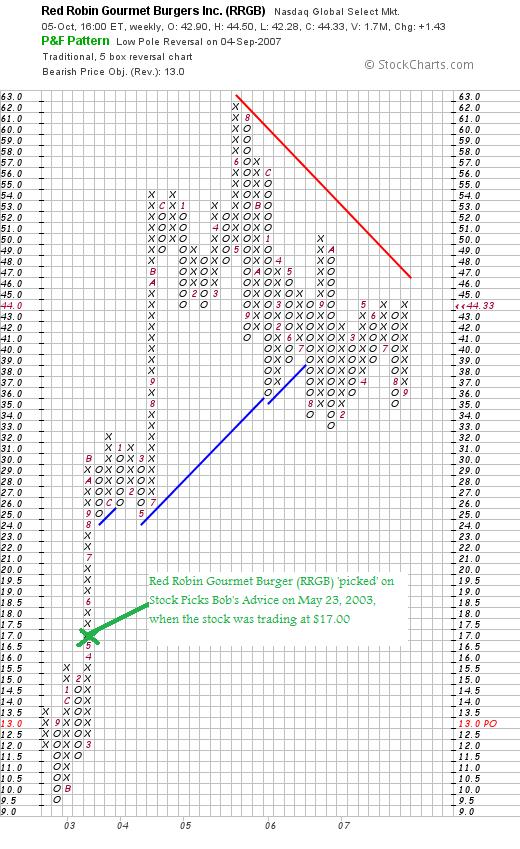

On September 16, 2007, I reviewed Enzo Biochem (ENZ), the 12th entry to be written up on the blog. Let's take a look at the next entry, Red Robin Gourmet Burgers (RRGB) which I wrote up on May 23, 2003.

On September 16, 2007, I reviewed Enzo Biochem (ENZ), the 12th entry to be written up on the blog. Let's take a look at the next entry, Red Robin Gourmet Burgers (RRGB) which I wrote up on May 23, 2003.

I wrote at that date:

"May 23, 2003

Red Robin Gourmet Burgers (RRGB)

TGIF. No not the restaurant but the day of the week! Terror alert up, unemployment up, volatility up. Anyhow, found this one this morning. Don't know much about it personally....and do not own any shares of this issue.

According to Morningstar, Red Robing Gourmet Burgers, Inc., "is a chain of 184 casual restaurants, 87 of which are company owned and 97 of which are franchised". Sounds a little like the old Fuddruckers chain (anybody been in one of those lately?).

The stock is grilling up pretty nicely today (sorry).

Currently (10:15 am Central), stock is at $17.00 up $1.17 or 7.39% on the day. Yesterday they reported the first quarter of 2003 (reported 5/22/03), per the New York Times website, "Total Company revenues increased 17.3% to $92.9 million, Company-owned comparable restaurant sales (sort of like retail same store sales figures)...up 2.1%," and reported that per share income unchanged at about $.23.

Annual revenue figures show steady increases from $115.7 million in 1997, 118.2 million in 1998, $130 million in 1999, $189.2 million in 2000 and $224.5 million in 2001, and $249.2 million in trailing twelve months per Morningstar.

Balance sheet wise we find a bit too much debt on this issue to make me very excited and per Morningstar is not yet cash flow positive....so looking closely, a possible purchase....but for my picks....not one of the top choices on this page.

Good luck investing....will see if we can find a better one later today! Bob"

Red Robin was "picked" on Stock Picks when it was trading at $17.00. RRGB closed at $44.33 on October 5, 2007, for a gain of $27.33 or 160.8% since posting. I do not have any shares nor do I have any options on this stock.

How did they do in the latest quarter?

Red Robin reported 2nd quarter 2007 results on August 16, 2007. For the quarter ended July 15, 2007, revenue climbed 31.5% to $178.6 million. GAAP diluted earnings per share dipped to $.29/share from $.43/share last year. Net income was $4.9 milion this year, down from $7.2 million last year. The company recorded multiple one-time expenses bringing down the earnings.

Red Robin reported 2nd quarter 2007 results on August 16, 2007. For the quarter ended July 15, 2007, revenue climbed 31.5% to $178.6 million. GAAP diluted earnings per share dipped to $.29/share from $.43/share last year. Net income was $4.9 milion this year, down from $7.2 million last year. The company recorded multiple one-time expenses bringing down the earnings.

The company missed expectations of analysts who had been expecting earnings of $.43/share on revenue of $175 million which the company was able to beat.

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials, we see that sales have continued to grow from 2002 through the TTM. Earnings, however, peaked at $1.80 in 2006 then dipped to $1.60/share in the TTM. Free cash flow has also been negative since 2004 with $(15) million in 2004, $(19) million in 2005, $(17) million in 2006 and $(4) million in the TTM.

The balance sheet leaves a bit to be desired per Morningstar.com, with $17 million in cash and $25 million in other current assets compared to a current liabilities level of $90.1 million. This results in a current ratio of .47. I like to see current ratios of at least 1.25, to be considered 'healthy' from my perspective. In addition, Morningstar shows RRGB with an additional $175.7 million in long-term liabilities.

What about the chart?

Looking at a "point & figure" chart on Red Robin Gourmet Burger (RRGB) from StockCharts.com, we can see the steep rise in price shortly after my stock pick was posted. The stock peaked in June, 2005, and then the stock price appears to have 'rolled over', with the stock breaking through support lines, and being unable to cross 'resistance lines'.

With the mediocre earnings report, the spotty Morningstar.com numbers, and the relatively weak chart, in spite of the fabulous performance of this stock pick,

RED ROBIN GOURMET BURGER (RRGB) IS RATED A SELL

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog. If you get a chance, drop by and visit my Stock Picks Podcast Website, where I have been discussing some of the stocks I have blogged about here on this website. In addition, be sure and visit my Covestor page where my actual trading portfolio is analyzed and ranked by the Covestor people. Also, visit my SocialPicks page where all of my stock picks from this year on have been reviewed and my 'picking performance' is evaluated.

Have a great trading and investing week everyone, and try to stay healthy!

Bob

Newer | Latest | Older

On October 11, 2007, Infosys (INFY) reported

On October 11, 2007, Infosys (INFY) reported  On April 18, 2006, I

On April 18, 2006, I

On July 30, 2007, Franklin Electric (FELE) reported

On July 30, 2007, Franklin Electric (FELE) reported  Finally, on April 19, 2006, I

Finally, on April 19, 2006, I

As I

As I  growth'. What pushed Zumiez up strongly was an outstanding report released yesterday after the close of trading. As

growth'. What pushed Zumiez up strongly was an outstanding report released yesterday after the close of trading. As

On September 16, 2007, I

On September 16, 2007, I