Stock Picks Bob's Advice

Friday, 3 October 2008

Estee Lauder (EL) "Trading Transparency"

Hello Friends! thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Hello Friends! thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I thought a picture of a rollercoaster, this one of the Colossos from Germany, might best describe my own feelings of the market as euphoria alternates with depression in what I would have to describe as one major financial 'bi-polar' disorder. This morning with stocks climbing in anticipation of the House approval of the $700 billion bail-out (?rescue), I picked up my 5th new position, Global Payments (GPN) which I wrote about here on this blog in an earlier post.

Moments later I realized that my Estee Lauder (EL) was now hitting a sale point with an (8)% loss after my initial purchase. I went ahead and sold my 140 shares of Estee Lauder (EL) at a price of $45.532. These shares had been purchased just weeks ago on 8/14/08 at a cost basis of $49.93/share. Thus, I had a loss of $(4.40) or (8.8)% since my purchase triggering (manually) my sale of the shares. EL actually rebounded slightly after my sale, closing today at $46.13, down $(2.12) or (4.39)% on the day.

With my own sale of these shares, and with the fundamentals of the entire market more uncertain, I cannot reduce my 'rating' to just a 'hold', thus,

ESTEE LAUDER (EL) IS RATED A SELL

Now, once again under my 5 position minimum, I literally have a 'permission slip' to be adding a new position to my portfolio. Generally after a sale on bad news I would be 'sitting on my hands' but in this case, I shall be looking for a new stock to purchase.

I shall do this Monday, pending an improvement of the overall market tone.

Meanwhile, I shall sit back, lick my wounds, and be simply amazed at the incredible volatility in stock prices we are witnessing.

Have a good weekend everyone!

By the way, if you are ever in La Crosse, stop by Grounded and you might catch me discussing a stock or too with Todd the proprietor!

Yours in investing,

Bob

Global Payments (GPN) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Yesterday I wrote about my sale of Greif (GEF) on an 8% loss. As I reminded my readers, my portfolio management strategy demands that I unload shares that hit pre-specified losses. After an initial purchase, stocks that dip 8% are sold. This limits my losses and enables me to preserve my gains.

Yesterday I wrote about my sale of Greif (GEF) on an 8% loss. As I reminded my readers, my portfolio management strategy demands that I unload shares that hit pre-specified losses. After an initial purchase, stocks that dip 8% are sold. This limits my losses and enables me to preserve my gains.

Also, I commented once again about the other part of my portfolio management strategy, that while not actually trying to 'time' the market, is designed to respond to market influences by shifting either into or out of cash and equities depending on the performance of my own holdings in my portfolio.

To accomplish this, my portfolio is planned to shift between 5 and 20 positions. When I sell a stock on 'good news' (which for me means a partial sale on reaching an appreciation target), I interpret this transaction as an indication that something is 'right' about the market, and give myself a 'buy signal' to be adding a new position to the portfolio. I do this as long as I am under my 20 position maximum. At the maximum number of holdings, I plan on ignoring this sale and placing the proceeds into cash (or paying down any margin!)

On the other hand, I also use sales of stocks on 'bad news' (either fundamental news that is negative or a sale on a decline in the price of a stock as I did with Greif when it reached an (8)% loss) as a signal that something is 'wrong' with the market and that leaving the proceeds of that sale in cash would be the correct approach. I utilize this strategy as long as my holdings are above 5 positions. At the minimum level (which I was at yesterday), a sale of a position would result in only 4 positions and in this particular situation a 'buy' signal is generated to get me back to 5 holdings.

Yesterday no stocks came up on my 'radar' and I sat on my hands with the proceeds. Today, however, with the atmosphere a little more optimistic that a 'bail-out' or 'rescue' of the financial companies might well pass the House of Representatives (?), stocks are moving higher with the Dow, as I write, is trading at 10,673 up 190, and the S&P is at 1,140.95, up 26.

Starting my usual search routing, I checked the list of top % gainers and came across Global Payments (GPN), an old favorite of mine (trading at $47.87, up $6.81 or 16.59% as I write), and with 'permission slip' in hand, went ahead and purchased 140 shares at $48.2395 in my account. (You can see that the stock has already dipped about $.40/share since my purchase).

GLOBAL PAYMENTS (GPN) IS RATED A BUY

Let me share with you briefly a few of the things that led me to this decision today.

First of all,

What exactly does this company do?

According to the Yahoo "Profile" on Global Payments (GPN), the company

"...provides payment processing and consumer money transfer services worldwide. The company�s Merchant Services segment provides credit and debit card transaction processing services, including processing Visa, MasterCard, Discover credit cards, and cards issued by other card associations; and check-related services comprising check verification, guarantee, and recovery services. This segment also offers proprietary software products to establish revolving check cashing limits for the casinos customers in the gaming industry. In addition, it sells, installs, and services automated teller machine and point of sale terminals; and provides authorization, electronic draft capture, and file transfer services, as well as offers merchant accounting and various back office services."

What about the latest quarterly result?

As is often the case (when the market appears to be functioning somewhat normally), it was the announcement of earnings yesterday after the close of trading that resulted in the sharp rise in the stock price today.

On October 2, 2008, Global Payment announced first quarter 2009 results. For the quarter ended August 31, 2008, sales climbed 30% to $405.8 million, up from $311 million last year. Earnings came in at $57.5 million or $.71/share, up from $43.6 million or $.54/share last year.

O.K. this was a nice result, so what makes it so special? From my perspective, results must always be evaluated in the context of what the street was expecting! In this case, analysts polled by Thomson Financial had been expecting sales of $395.7 million (the company beat expectations) and profit of $.60/share (again the company beat expectations!)

Furthermore, to add some icing on this great cake of results, (now that is an awful image don't you think?), the company raised guidance for fiscal 2009 to revenue of $1.64-$1.68 billion, compared to the $1.27 billion in revenue in fiscal 2008. Earnings estimates were also raised to a range of $2.37 to $2.45 from the $1.98 in 2008.

I cannot over-emphasize the importance of doing better than what everyone was expecting and to top off the announcement, to raise future expectations and estimates as well! Needless to say, in the context of a market already rebounding today, this gave this stock the extra momentum to make a very nice move---and move higher it did!

What about longer-term results?

If we review the Morningstar.com "5-Yr Restated" financials, you can see why this has been a stock that has been a 'favorite' of mine for literally years!

Let me explain. First of all, revenue has steadily improved from $629 million in 2004 to $1.27 billion in the trailing twelve months (TTM). Earnings have also not 'missed a beat' increasing from $.80/share in 2004 to $2.01 in 2008. The company has been paying a dividend of $.08/share, but unfortunately, has not been in the habit of raising it.

Total shares have been very stable with 75 million in 2004, increasing to only 78 million in 2008.

Free cash flow has been positive and relatively stable at $210 million in 2006 and $227 million in 2008. The balance sheet is solid with $456 million in cash and $161 million in other current assets, easily covering the $217.8 million in current liabilities yielding a current ratio of almost 3.0.

The company has a nominal amount of long-term debt reported at $101.3 million. What this means is that this company could easily 'write a check' with available cash and pay off ALL short-term and long-term liabilities almost 2x over! We don't get to see this kind of balance sheet too often!

What about some valuation numbers?

According to the Yahoo "Key Statistics" on GPN, the company has a market cap of $3.86 billion, making it a mid cap stock. The trailing p/e isn't bad at 24.12 (from my perspective), with a forward p/e (fye 31-May-10) of only 18.51. With the rapid growth in earnings estimated (and estimates are still moving higher--see above), the PEG works out to a very acceptable 1.22 level.

As I noted earlier, there are 79.66 million shares outstanding and currently (as of 9/10/08) there are 3.61 million shares out short, yielding a short ratio of 5.2 trading days (above my own '3 day rule'). Thus, this is significant imho.

Also as noted, the company pays a small dividend of $.08/share yielding 0.2%. The last stock split was a 2:1 split back on October 31, 2005.

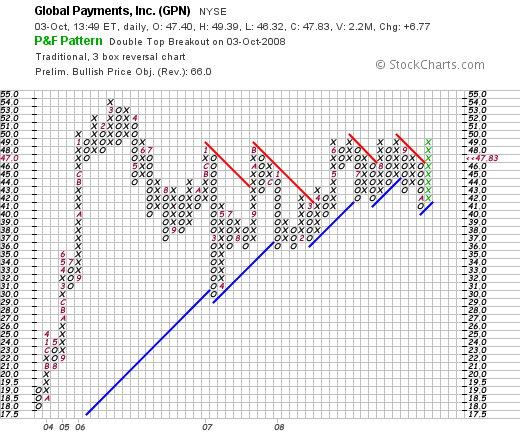

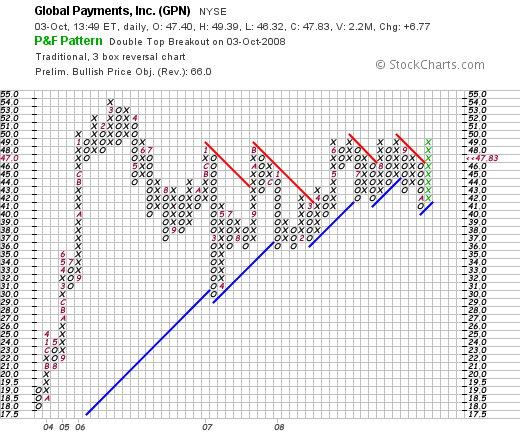

And the Chart?

If we look at a 'point & figure' on Global Payments (GPN) from StockCharts.com, we can see that the stock, which moved sharply higher from $18 in September, 2003, to a peak of $54 in March, 2006, dipped down to a low of $29 in March, 2007, and has been 'working hard' to build a slowly increasing base. The company just broke through resistance in its current move higher. It doesn't appear to be over-extended and appears to have some suppport at current levels.

Summary: What do I think?

Well obviously, I liked this stock enough to buy some shares :). But seriously, if it weren't for the terrible volatility in the current market, the uncertainty regarding the success of the 'bailout' and the difficult credit crisis, this stock ought to be flying higher.

The reported a great quarter last night which beat expectations, they raised guidance, and they have a record of steady financial results for the past five years (or more!). Their fundamentals also appear solid with plenty of free cash flow and a great balance sheet.

Their chart appears to be solid, and hopefully ready to move higher. Wish me luck! Of course, like any investment, I shall sell even shares of this great company should they decline (8)%! And I shall start selling on the upside (1/7th of my holding) should the stock instead appreciate and move higher!

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page, my SocialPicks page, and my Podcast Page.

Yours in investing,

Bob

Thursday, 2 October 2008

Greif (GEF) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of the greatest strengths of this blogging effort that I have been working on this past five years (!) has been the requirement for me to put into words a trading strategy that hopefully would respond to investment environments in both the best and worst of times.

One of the greatest strengths of this blogging effort that I have been working on this past five years (!) has been the requirement for me to put into words a trading strategy that hopefully would respond to investment environments in both the best and worst of times.

Probably my first defense with any investment is to limit losses. After an initial purchase of stock, I limit my losses to (8)%. I do this manually. Brighter minds I am sure could develop this loss limit automatically. It wouldn't take that much effort.

In a declining market, the first stocks often to go will be the latest purchases. They will be the ones which will be sold as they hit their loss limits faster than other stocks which may have hopefully appreciated some sort of buffer in their price.

This is the story of Greif (GEF), a stock that I have written up several times on this blog, a company of outstanding financial results, raised expectations, and a solid balance sheet. Unfortunately, like virtually every stock in the market, the greatest force on any individual equity is the "M" in the CAN SLIM formula---the market itself.

Thus, to make this long story shorter, my investment in Greif (GEF) which amounted to 140 shares purchased just a couple of weeks ago on 9/16/08 at a cost basis of $66.16 passed my own loss tolerance and were sold this afternoon at $59.61. This represents a loss of $(6.55) or (9.9)% on my investment. As I have said above, I monitor my stocks intermittently and enter these sales manually. The stock dipped below my (8)% loss level, and was sold as soon as I realized what the stock price was.

With my own sale of my shares of Greif (GEF), and with the stock market environment still ever-so-worrisome,

GREIF (GEF) IS RATED A SELL

It would be unfair of me to advise anyone to hold a stock with the overlying market so weak. In an otherwise strong market, my own sale on the passage of some sort of technical price point would merit a reduction to "HOLD". I share the concern of so many investors and although I believe that the company is terrific---I am truly sad to see it leave my portfolio---I shall continue to keep it on my own investing horizon so that hopefully I can once again in the future, assuming continued financial success from the company---call myself a 'shareholder'!

My own portfolio management system asks me to find another stock to buy to get me back to my 5 positions. I shall certainly keep this in mind and once we see some sort of positive action in the market, with possibly some sort of resolution of this credit crisis, I shall be back in the midst of things, looking through the lists of top % gainers to identify a new name to share with you, or perhaps an old name that once again, like Greif (GEF) looks attractive for an investment.

Thanks so much for visiting and reading my sundry posts of this amateur struggling to deal with the pessimism and gloom the market offers us today. My committment to investing is not short-term. I have been in stocks for the past 41 years and look forward to many more.

Yours in investing,

Bob

Tuesday, 30 September 2008

More Thoughts! Market Turmoil Part II

It is late Tuesday night and rather than sleeping I thought I would take the time to share with you some of my own reactions to the market volatility that we are all observing.

It is not reassuring to me that the market can drop almost 800 points one day and then recover 500 the next. I shall need some Dramamine for this motion sickness soon. Hang on, the ride isn't over!

I haven't read the 100 pages of the bail-out or "rescue" suggested by the Paulson/Bush plan and amended by our legislators. What I do believe is that the free-wheeling days of hedge funds and derivatives is long over. And it is about time.

I also believe that the philosophy that "Government is the Problem" and that less regulation is always better is being shown to be a set of beliefs that are now obsolete. The failure of the financial markets may well have been contributed by the deregulation and the repeal of Glass-Steagle advanced by McCain ally Phil Gramm.

And no Americans are NOT whiners.

The greed and corruption that got us into this bind will not be easy to undo. While it is helpful to address the symptoms of the disease with acquisition of these questionable mortgage backed securities by the Fed, it is not unreasonable, much like a sovereign investment fund, to insist on equity for that investment.

This isn't any more about socialism than it is about America becoming an oil company just because we as a nation decided to acquire a petroleum reserve to protect us against the vagaries of markets.

And since much of the source of our problems derives from the collapsing real estate market, the displacement of home-owners who can no longer afford their mortgages, and the subsequent 'upside-down' nature of their loans, it would also behoove all of us to address these home-owners regardless of whether it was they or their lenders who were at fault.

To paraphrase the defenders of the current Iraq policy, it doesn't really matter much about how we got into this predicament, it is far more important to determine what we are going to do now to get us out of it!

Thus, it may be useful for the government to make banks whole by refinancing the mortgages under stress at reduced terms to keep homeowners in their homes and to reduce the need for fire-sale disposal of these homes adding to the declining price of housing and the additional failure of other home-owners in dealing with their own mortgages.

We cannot address only the banking system without addressing the homeowners who are at the bottom of the feeding pyramid and who are the ones who shall either be paying or not on these mortgages.

Much has been said about how we are going to spend the $700 billion and what we are going to need to do about cutting the budget to adjust for this expense. Actually, we need to make sure that our economy is healthy. Spending on infrastructure projects may well provide jobs and a nice stimulus to the economy more than any simple check mailed to each taxpayer.

And the rapid and timely end to our involvement in the Iraq conflict may also assist us in restoring our own financial health while encouraging our Iraqi allies to take over in their own self-determination and resolution of the conflict. As much as we would like to bein Iraq indefinitely, our nation cannot afford this for much longer.

These are just a few of my amateur thoughts this evening. I haven't been blogging much but shall keep you posted about my own trading activity and look forward to a time as the investment climate improves, that the kind of stocks we like to find will once again appear with more regularity on the top % gainers list---where we can once again discover and discuss them with you!

Until then,

Yours in investing,

Bob

Sunday, 21 September 2008

Some Thoughts on the Stock Market Turmoil

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It seemed appropriate to at least comment on the stock market's extreme volatility this week and how it has affected my own approach to investing and portfolio management. As you all know, and as I write over and over, I am an amateur investor. That means that like many of you who read this blog, I am not trained nor am I licensed to manage anyone's investments, receive compensation from anybody to select investments and time purchases and sales, nor am I as knowledgeable on market information as someone who has passed appropriate licensing boards to reach those levels.

But I can share with you my own amateur take of the tremendous stresses being put on us each day and the wild swings of multi-hundred point dimension we are observing. Like a person with a bipolar disorder, the mood swings in the market have been going from severe depression to unbelievable euphoria, and everything in between.

If you read my blog entries regularly, you will know that I have taken advantage of the bull market in financials with a trade in Citigroup that netted me some profits on Thursday. I did this outside my regular trading strategy.

With somewhat less success, I have been shifting some of my holdings to get out of sectors that appeared to be dragging down my particular holdings. Moves like the correction in the oil market pulled down Lufkin which I sold out of my account.

But my overall investment strategy remains intact. I continue to look for companies with what I call quality characteristics--things like steady revenue growth, earnings growth, possibly dividends and dividend growth, stable outstanding shares, positive free cash flow and a solid balance sheet. I like to see companies report results that beat expectations and hopefully find them raising guidance as well. I enjoy finding a stock with reasonable Price/Sales and Return on Equity %'s. And I hope to invest in companies with a stock chart that appears to be continuing to appreciate in price.

While that is a lot to ask of an investment, there are so many different potential investments anyhow, and so little of my own money to invest! So why not?

In addition I continue to respond to the sales within my own portfolio that determine whether I shall be adding a position (if I am under 20 positions and generate a sale on 'good news'), or backing off a position (if I am over 5 positions and I generate a sale on 'bad news' which for means either selling a stock on a decline to a 'sale point' or the announcement of fundamentally 'bad news'.)

I am currently at 5 positions in my own Trading Account (which you can review if you like on my Covestor Page).

So while I don't have the foggiest idea about what shall be happening as soon as tomorrow (will the Administration and the Democrats get together in some sort of $700 billion bail-out or will they be symied at this attempt?) I do know that I shall have the directions develop from my own portfolio.

I just need to listen and observe closely and I shall know my own next step.

Thanks again for visiting and bearing with me! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Thursday, 18 September 2008

Citigroup (C) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website!

What a difference a day makes. While just a day or two ago I was contemplating selling everything and going to cash---perhaps in my mattress---today I got back a bit of my usual bravado and tried a 'trade'.

What a difference a day makes. While just a day or two ago I was contemplating selling everything and going to cash---perhaps in my mattress---today I got back a bit of my usual bravado and tried a 'trade'.

The market by the way closed today at 11,019.69, up 410.03, and the Nasdaq was up 100.25 at 2,199.10, and the S&P closed at 1,206.51, up 50.12 on the day. Wow. THAT was quite a bounce.

Anyhow, this afternoon as I was watching the market, all of the financials seemed ready to 'roar' ahead. In fact, as this report relates, it was quite a move and it was the financials that provided the engine for the move:

"Sept. 18 (Bloomberg) -- U.S. stocks rallied the most in six years on prospects the government will formulate a ``permanent'' plan to shore up financial markets, while regulators and pension funds took steps to curb bets against banks and brokerages.

Traders erupted into cheers on the floor of the New York Stock Exchange as the Dow Jones Industrial Average jumped 617 points from its low of the day after Senator Charles Schumer proposed a new agency to pump capital into financial companies. The Standard & Poor's 500 Index climbed 4.3 percent as 68 companies in the gauge rose more than 10 percent.

Wachovia Corp. soared 59 percent, Citigroup Inc. added 19 percent and Bank of America Corp. jumped 12 percent, sending the KBW Bank Index to its biggest gain since July. Morgan Stanley erased a 46 percent tumble and Goldman Sachs Group Inc. recovered most of a 25 percent slide after the nation's three largest pension funds stopped loaning shares of the brokerages to investors betting on their declines."

Quite frankly, I thought that the financials were oversold. And that efforts were being made to stabilize their prospects. With this in mind, I took a 1,000 share position in Citigroup (C) at a cost of $14.81. A little more than an hour later, with Citigroup rallying strongly, I went ahead and sold the entire position at $16.86. That was a gain of $2.05 or 13.8% all in an afternoon on that position! I don't think I can easily repeat that trade. Just as much luck as good timing :).

With my own purchase and sale of Citigroup shares,

CITIGROUP (C) IS RATED A HOLD

In any case, I wanted to share with you my 'unorthodox' move in the context of a disciplined trading portfolio.

I guess I am very aware that my performance is 'public' what with my Covestor Page available for perusal. And anything that can add a little bit of zip to my portfolio is something I am looking for.

Back to reality for the time being :). I must be very cautious about over concluding anything with my good fortune. Sometimes the worst thing a gambler can have happen to him is to get lucky when he enters a casino.

Thanks again for visiting my blog! If you have any comments or questions, please feel free to leave them right on the website or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 6:19 PM CDT

|

Post Comment |

Permalink

Updated: Thursday, 18 September 2008 6:22 PM CDT

Wednesday, 17 September 2008

Greif (GEF) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I wanted to update all of you readers with a trade that I did yesterday. And yet, even though it conforms to my own strategy of maintaining my 5 position minimum, I am starting to have some buyer's remorse.

I wanted to update all of you readers with a trade that I did yesterday. And yet, even though it conforms to my own strategy of maintaining my 5 position minimum, I am starting to have some buyer's remorse.

The market is really ugly this week. As I write, the Dow is trading at 10,724.22, down (334.80), the Nasdaq is at 2,128.48, down (79.42) and the S&P is declining by (44.27) at 1,169.18. Yikes.

My good friend Bob S. has been stopping by my blog. He is one of a group of us who frequent Grounded Specialty Coffee in the morning and shoot the bull about the economy, the stock market, politics, and whoever happens to drop by to get a cup of java. And he has been after me about WHY I don't talk about the terrible correction in the market. What is an investor to do?

I have little words of advice for my friends. I do believe that as we build portfolios, we should prepare for the worst of world and hope for the best of investments. We should have built into our holdings known exit points, both on 'good' and 'bad' news. I do that.

But as evidenced by my own purchase yesterday of shares of Greif (GEF) to get me back to the 5 position minimum, even I am fallible. I like Greif and will discuss it further below, but with the market meltdown continuing, the best I can do is:

GREIF (GEF) IS RATED A HOLD

Greif has been an old favorite of mine. I have even owned shares of this stock on and off. Let me very briefly touch on some of the things I do like about this stock.

But before I do, let me review my own purchase. Yesterday I purchased 140 shares of Greif (GEF) at $66.104. As I write, I am already, as you might expect, losing money on Greif (GEF) which is trading at $64.27, down $(1.73) or (2.62)% on the day.

On a day like this, there are very few places to find a bull market in stocks.

Some things I like about Greif (GEF), (even while I do not like the current tone in this plunging market), include the latest quarter announced August 27, 2008, which beat expectations and they raised guidance.

Their '5-Yr Restated' financials from Morningstar.com look terrific.

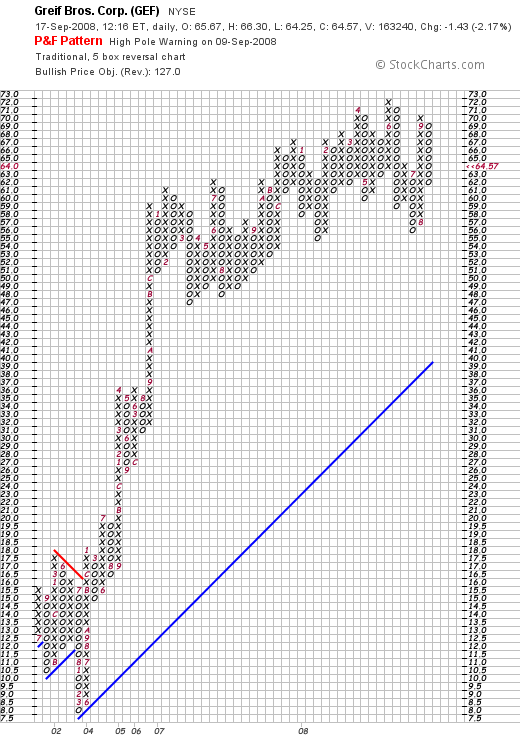

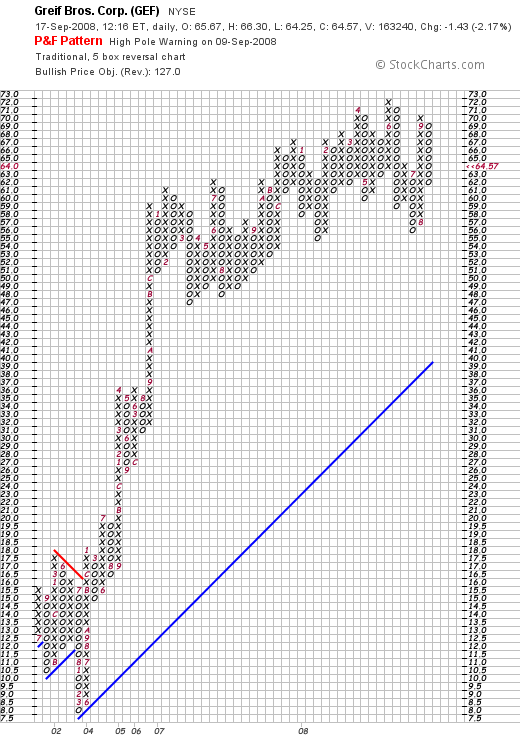

Finally, their 'point & figure' chart from StockCharts.com still looks solid:

So much for Greif.

But what about the ENTIRE market. What about the "M" in CAN SLIM?

I have been an investor for 41 years now. Seriously. I can remember 1987 without much difficulty. This seems much worse.

We really need to go back to 1929 to get to something like this.

No kidding.

I might just even sell all of my holdings and take a 'time out'. Seriously.

I shall keep you posted.

Yours in investing,

Bob

Monday, 15 September 2008

Robbins & Myers (RBN) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I really HATE buying a stock one day and then selling it a few days later. It really stinks. No kidding.

On September 11, 2008, just 4 days ago (!) I purchased 210 shares of Robbins & Myers (RBN) at a cost basis of $38.21/share. Today, I sold my 210 shares at $35.0832. That represented a loss of $(3.13)/share or (8.2)% since purchase.

On September 11, 2008, just 4 days ago (!) I purchased 210 shares of Robbins & Myers (RBN) at a cost basis of $38.21/share. Today, I sold my 210 shares at $35.0832. That represented a loss of $(3.13)/share or (8.2)% since purchase.

As you probably know (!) it was a pretty awful day in the market. The Dow closed down (503.99) to 10,917.51, and oil dropped $(5.47) to $95.71/barrel.

With the stock declining tied to something fundamental like the price of oil, I sold my shares and am downgrading my "buy":

ROBBINS AND MYERS (RBN) IS RATED A SELL

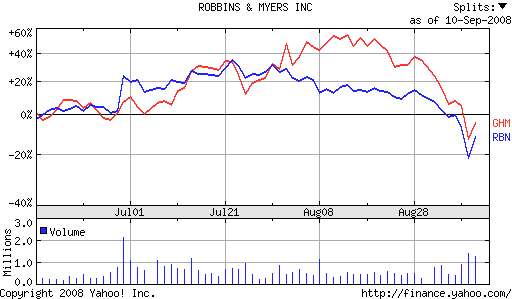

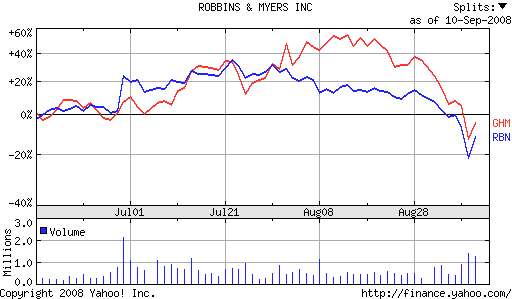

I don't like selling my own shares and leaving the rating at a "buy" either. Just doesn't seem right. But I do this if there is nothing what I would call "fundamentally" wrong with the stock. In this case, the stock is trading as an oil-related holding (again like Graham (GHM)), and with the price of oil continuing to break down, there is little reason for me to even leave RBN at a 'hold'. Anyhow, that's my rationale. Above all, remember that I am an amateur!

Since I was down at 5 positions, and this puts me at 4, paradoxically this sale actually gives me a "buy signal" since I was at my 'minimum' holding level of 5 positions.

I shall wait for something positive in the market and start scanning the lists of top % gainers when that happens. I am not in a hurry.

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them right here or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Thursday, 11 September 2008

Quality Systems (QSII) and Robbins & Myers (RBN) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

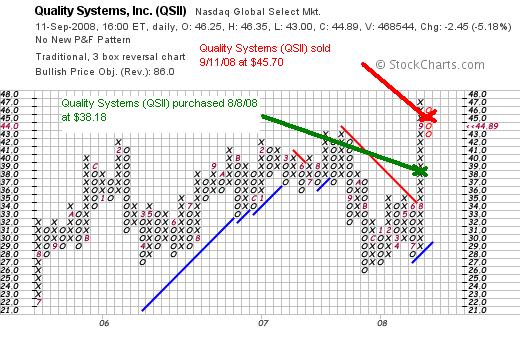

One of the strongest stocks in my portfolio the past two months has been Quality Systems (QSII). After purchasing this at a cost basis of approximately $38.18 just last month on August 8, 2008, the stock has moved sharply higher. QSII closed today at $44.89, well above my purchase price, but down $(2.15) or (4.57)% on the day.

One of the strongest stocks in my portfolio the past two months has been Quality Systems (QSII). After purchasing this at a cost basis of approximately $38.18 just last month on August 8, 2008, the stock has moved sharply higher. QSII closed today at $44.89, well above my purchase price, but down $(2.15) or (4.57)% on the day.

Earlier today, with the market turning higher after a sell-off, I found myself seeing QSII moving sharply lower, lagging the rest of the portfolio.

Although the fundamentals remain sound, I am quite aware of my overall performance and my 'followers' over at the Covestor Website, and my desire to continue to tightly monitor my holdings.

I went ahead and sold my 182 shares of Quality Systems (QSII) at $45.70/share. As I have just written, these shares were purchased 8/8/08 at an average cost of approximately $38.18. Thus, the sale today represented a gain of $7.52 or 19.7% on these shares in just over a month.

I can live with that I guess.

Since I have sold my shares and there are no underlying fundamental change that I can detect to the company itself, I am still reducing my rating but not to a "sell":

QUALITY SYSTEMS (QSII) IS RATED A HOLD

But what to do with the proceeds? I really wasn't entitled to 'sit on my hands' and move it to cash. So needing a new position, I checked the list of top % gainers on the NYSE to see what was moving higher today.

Checking the list of top % gainers on the NYSE, I came across Robbins & Myers (RBN) which appeared to fit the bill. I purchased 210 shares of RBN at $38.169 earlier today. The stock actually sold off a bit after my purchase and dropped off the list of top % gainers. Robbins & Myers (RBN) closed at $37.63, up $2.05 or 5.76% on the day. This was about $.50 below my purchase price.

Checking the list of top % gainers on the NYSE, I came across Robbins & Myers (RBN) which appeared to fit the bill. I purchased 210 shares of RBN at $38.169 earlier today. The stock actually sold off a bit after my purchase and dropped off the list of top % gainers. Robbins & Myers (RBN) closed at $37.63, up $2.05 or 5.76% on the day. This was about $.50 below my purchase price.

ROBBINS & MYERS (RBN) IS RATED A BUY

Let me briefly try to share with you my thinking behind this purchase.

First of all what exactly does this company do?

According to the Yahoo "Profile" on RBN, the company

"...and its subsidiaries supply engineered equipment and systems for various applications in energy, industrial, chemical, and pharmaceutical markets worldwide."

"...and its subsidiaries supply engineered equipment and systems for various applications in energy, industrial, chemical, and pharmaceutical markets worldwide."

Perhaps coincidentally, the company sounds a bit familiar with another company that I recently sold--Graham (GHM).

Was there any news to explain today's move higher?

As reported yesterday:

"BB&T’s investment upgrade helped the stock jump up $4.09 per share to $35.72 during Wednesday afternoon trading.

Robbins & Myers (NYSE: RBN) is an industrial equipment maker that had seen its stock raise throughout the summer, to a high of $54.20 per share on July 22, but then plummet to $31.63 as of yesterday."

Apparently, the analysts at BB&T Capital Markets felt that the selling had been 'overdone' so they upgraded the stock on valuation and the stock moved higher yesterday and followed through again today.

(It is interesting that we can see these two stocks (GHM and RBN) trading similarly the past month!)

Anyhow, hoping that this bounce would be a bit longer-lasting than 48 hours, I purchased shares. Wish me luck! I certainly also looked at some of the fundamentals that I like to check before purchasing any shares!

For example,

How did they do in the latest quarter?

On June 30, 2008, Robbins & Myers (RBN) reported 3rd quarter 2008 results. Sales for the quarter grew 17% to $201 million compared to $171.4 million in the same period the prior year. Third quarter earnings before one time benefit from product line sales, came in at $40 million, up 47% over the prior year. This worked out to $.76/diluted share, up from $.39/share last year.

The company also beat expectations for the quarter and also raised guidance for the fiscal-year profit outlook.

What about longer-term results?

Checking the Morningstar.com '5-Yr Restated' financials, we can see that revenue has steadily increased from 2003 when the company reported $561 million in sales to 2007 at $695 million and $766 million for the trailing twelve months.

Earnings have been much more erratic dipping from $.51/share in 2003 down to a low of a loss of $(.66)/share in 2006, reverting to a profit at $1.48/share in 2007 and $2.19/share in the TTM.

The company paid $.11/share in dividends in 2003, increased it to $.13/share in 2007 and now has paid $.14/share in the TTM.

Outstanding shares show mild dilution with 28 million reported in 2003, increasing to 34 million in 2006 where they remain. Free cash flow has been increasing recently from $6 million in 2005 to $49 million in 2007 and $87 million in the TTM.

The balance sheet appears adequate with $92 million in cash and $294 million in other current assets. This total of $386 million in current assets, when compared to the $196.5 million in current liabilities yields a current ratio of 1.96. The company has an additional $155.5 million in long-term liabilities according to Morningstar.

What about some valuation numbers on this stock?

According to the Yahoo "Key Statistics" on RBN, this stock is a mid cap stock with a market capitalization of $1.3 billion. The trailing p/e is a moderate 17.15 with a forward p/e (fye 31-Aug-09) even nicer at 14.93. With rapid growth in earnings, the PEG (5 yr expected) works out to an even nicer level of 0.62.

Examining the Fidelity.com eresearch website for some valuation numbers, we find that the Price/Sales (TTM) is a bit rich relative to its peers, coming in at 1.60 with an industry average currently indicated at 1.07. Also, when measured by the Return on Equity (TTM), the company is valued a bit steeply relative to its peers with a ROE of 16.97% compared to the industry average of 20.79%.

Finishing up with Yahoo, we can see that there are only 34.62 million shares outstanding with 33.71 million that float. Currently (8/12/08) there are 2.23 million shares out short representing 3.8 trading days of volume. This is just slightly higher than my own '3 day rule' for short interest.

Yahoo indicates that the stock is paying a 12 month $.15/share dividend yielding 0.5%. The company last split its stock February 29, 2008, when they split 2:1.

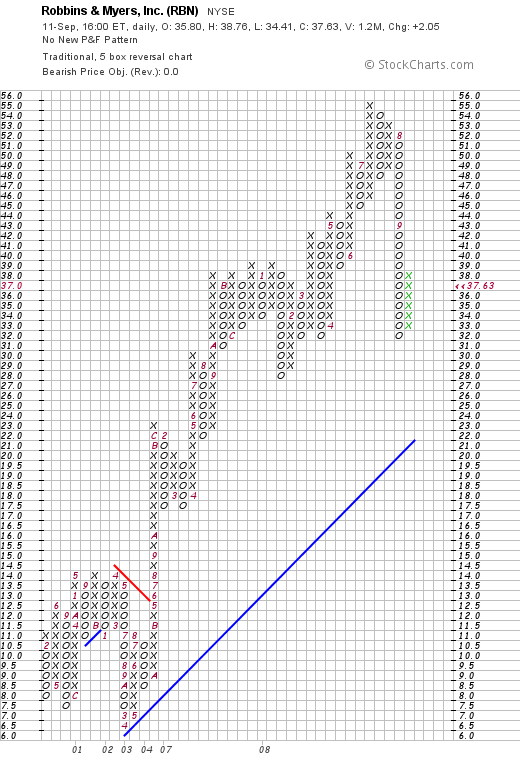

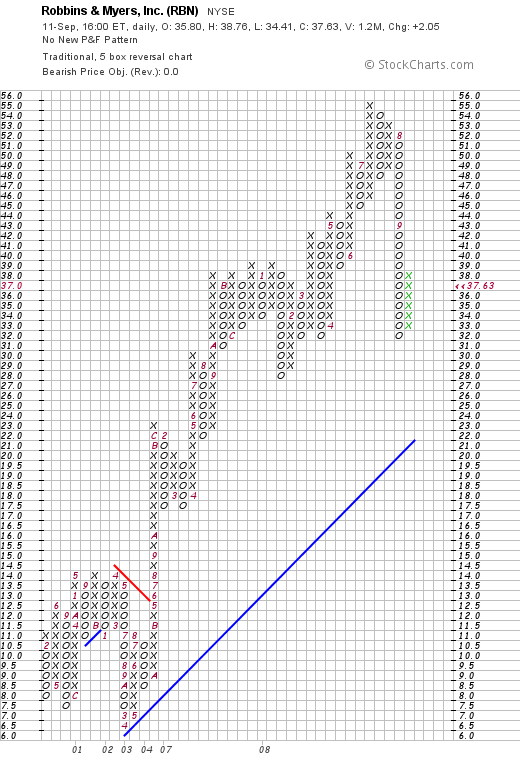

What does the chart look like?

Looking at the 'point & figure' chart on RBN from StockCharts.com, we can see the steady appreciation from a low of $6.50 in April, 2003, to a recent high of $55 in July, 2008, only to see the stock dip as low as $32 this month. The stock is currenly rebounding from the recent low. The overall upward move of this stock appears intact.

Summary: What do I think?

First of all, I exercised impatience with Quality Systems (QSII) which has already moved nicely higher this past month. I still like that stock, but wanted to see if I could avoid the apparent sell-off and instead hop onto a stock moving higher.

Time will tell if this particular strategy will be successful. It is not exactly part of my usual portfolio strategy, but is something I have been incorporating into my approach the past few months.

Regarding Robbins & Myers, it has suffered the same fate as Graham (GHM) which is the decline that is related most likely to the sharp correction in the oil market. If those prices continue to decline further, I may find myself with another declining stock like Graham. That probably is the biggest risk to this particular move.

Otherwise, I like the stock upgrade, the recent quarterly report that beat expectations and found the company raising guidance. Furthermore, I like the 5-Yr Restated financials showing the steady revenue growth, the recent return to profitability, the fact that the company pays a dividend and has been increasing it recently and the nice results for free cash flow growth. The balance sheet appears solid and valuation is reasonable if not terrific. The PEG is well under 1.0. And the chart shows that the sharp recent correction may well be overdone.

Beyond that, I shall certainly limit any downside on this stock or any of my purchases to (8)%. Hopefully, I shall be able to miss that decline and instead particiapate in the rebound in price.

Thanks again for visiting. I apologize for not blogging more, but I shall do my best to continue to post on a timely basis. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

If you get a chance, be sure and visit my Covestor Page, my SocialPicks page, and my Podcast Page. Hopefully I shall be able to get another podcast up soon. Life as an amateur can be hectic :).

Yours in investing,

Bob

Thursday, 4 September 2008

Johnson Controls (JCI) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of the hardest things about being a blogger, and now a Seeking Alpha contributor, is the necessity of doing everything so publicly! I just got around to posting about my 'brilliant' decision to switch my Graham (GHM) holdings into Johnson Controls (JCI) and now my entire plan is hitting headwinds. Perhaps a bit of turbulence from Gustav?

One of the hardest things about being a blogger, and now a Seeking Alpha contributor, is the necessity of doing everything so publicly! I just got around to posting about my 'brilliant' decision to switch my Graham (GHM) holdings into Johnson Controls (JCI) and now my entire plan is hitting headwinds. Perhaps a bit of turbulence from Gustav?

It is my strategy to sell a holding should it hit an 8% loss. I don't really care whether that holding has been held for a year or 15 minutes. After an initial purchase, if that stock drops the required 8% out it goes.

And Johnson Controls (JCI) hit that (8)% loss for me this morning. And I sold my shares.

In fact, I sold my 210 shares of JCI at $29.5223. These shares were just purchased two days ago (yikes!) at a price of $32.0477. Thus, they had declined by $(2.5254) or (7.88)%. JCI as I write is trading at $29.47, down $(1.05) or (3.44)% on the day.

While Johnson Controls has indeed been talking about steps it will take to deal with the slowdown in the auto industry and the slowdown in construction---including taking a $450 to $500 million charge to account for the cutting of jobs and closing of plants---probably the biggest thing driving this stock down today is the overall market, which as I write, the Dow is down (281.30) points at 11,251.58, and the Nasdaq is down (58.91) points at 2,274.82. The market is down even with oil showing continued weakness, trading at $107.20 down $(2.15) on the day.

I still am long-term a fan of Johnson Controls (JCI), so even though my trading system requires me to be a seller of shares, my rating is being reduced:

JOHNSON CONTROLS (JCI) IS RATED A HOLD

And with my sale on 'bad news', I shall be 'sitting on my hands' with the proceeds, waiting for one of my other holdings to hit a sale on an appreciation target, what I call 'good news' prior to looking for a new position in which to place the proceeds.

Thanks again for visiting my blog! If you have any comments or questions, please feel free to leave them on the website or email me at bobsadviceforstocks@lycos.com.

Yous in investing,

Bob

Newer | Latest | Older

Hello Friends! thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Hello Friends! thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Yesterday I

Yesterday I

One of the greatest strengths of this blogging effort that I have been working on this past five years (!) has been the requirement for me to put into words a trading strategy that hopefully would respond to investment environments in both the best and worst of times.

One of the greatest strengths of this blogging effort that I have been working on this past five years (!) has been the requirement for me to put into words a trading strategy that hopefully would respond to investment environments in both the best and worst of times. What a difference a day makes. While just a day or two ago I was contemplating selling everything and going to cash---perhaps in my mattress---today I got back a bit of my usual bravado and tried a 'trade'.

What a difference a day makes. While just a day or two ago I was contemplating selling everything and going to cash---perhaps in my mattress---today I got back a bit of my usual bravado and tried a 'trade'.

One of the strongest stocks in my portfolio the past two months has been Quality Systems (QSII). After purchasing this at a cost basis of approximately $38.18 just last month on August 8, 2008, the stock has moved sharply higher. QSII closed today at $44.89, well above my purchase price, but down $(2.15) or (4.57)% on the day.

One of the strongest stocks in my portfolio the past two months has been Quality Systems (QSII). After purchasing this at a cost basis of approximately $38.18 just last month on August 8, 2008, the stock has moved sharply higher. QSII closed today at $44.89, well above my purchase price, but down $(2.15) or (4.57)% on the day.  Checking the

Checking the

One of the hardest things about being a blogger, and now a

One of the hardest things about being a blogger, and now a