Stock Picks Bob's Advice

Tuesday, 9 December 2008

Johnson Controls (JCI) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I cannot emphasize enough how my trading is driven by the performance of my underlying holdings. Especially in this time of extreme market volatility, having a plan to deal with price moves, whether they be on the upside or downside, is essential. In my own case, each of my holdings has sale points determined at their time of purchase whether it be a partial sale of 1/7th of my holding as the stock appreciates in price, or a complete sale of the holding should the stock decline 8% (or 16% if in the last 5 of my maximum of 20 positions), or at other set points should the stock have previously appreciated and experienced partial sales of that holding.

I cannot emphasize enough how my trading is driven by the performance of my underlying holdings. Especially in this time of extreme market volatility, having a plan to deal with price moves, whether they be on the upside or downside, is essential. In my own case, each of my holdings has sale points determined at their time of purchase whether it be a partial sale of 1/7th of my holding as the stock appreciates in price, or a complete sale of the holding should the stock decline 8% (or 16% if in the last 5 of my maximum of 20 positions), or at other set points should the stock have previously appreciated and experienced partial sales of that holding.

These sales drive my own responses to the market. On the downside, I either 'sit on my hands' with the proceeds (if I am above 5 positions) or I replace that holding with a new holding of smaller size. In any case, these downside sales drive my portfolio towards cash and away from equities. I am simply trying to "listen" to my stocks as they let me know like that canary in the coal mine whether it is a 'good time' to be investing, or rather a 'bad time' and I should enjoy whatever cash position I can possibly possess.

Johnson Controls (JCI) is a rather new position in my minimum of 5 holdings. These holdings have been decreasing in size in a planned fashion. This morning, I sold 13 shares of my 95 share position at $20.36, 1/7th of my holding, as it hit and passed my first appreciation target which is at a 30% gain over an initial purchase. I had just purchased these 95 shares on 11/20/08, not much more than two weeks ago, at a cost basis of $14.83. Thus with the sale at $20.36, this represented a gain of $5.53/share or 37.3%. It turned out to be a timely sale because as the market dipped later in the day, JCI also turned lower and closed at $19.44, down $(.09) on the day.

With a sale at an appreciation of a holding, I now have a 'buy signal' to add a new 6th position to my portfolio. I shall be waiting for a suitable stock to come along that meets my own criteria for stock selection and shall keep you posted.

Meanwhile, if you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 5:05 PM CST

|

Post Comment |

Permalink

Updated: Tuesday, 9 December 2008 8:49 PM CST

Thursday, 4 December 2008

Buckle (BKE) "Trading Transparency"

Just a very quick note to update you on my Buckle (BKE) stock, which I absolutely love, but have learned to part ways as "friends" :).

Doug S. dropped me a not earlier warning me about the technicals, but I used my old strategy in a very difficult and unfriendly market that turned around and headed lower today.

I sold my 143 shares of BKE which were purchased just hours ago at $24.3968, at $22.0132. That is more than an (8)% loss and being in position 6-20 of my portfolio, it is my loss limit. Anyhow, they are history.

It is unfortunate that a 'favorite' of mine should disappoint like that. But I remain committed to limiting losses, exercising trading discipline, and recognizing trading mistakes as soon as possible. I also am committed to sharing with you my own actual trades as foolish as they may sometimes appear.

Please feel free to comment here or email me at bobsadviceforstocks@lycos.com if you have any other thoughts.

Yours in investing,

Bob

Buckle (BKE) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I needn't tell you that the 'nickel in my pocket' from my partial sale of WMS (WMS) yesterday was burning a big hole and waiting to be spent!

I needn't tell you that the 'nickel in my pocket' from my partial sale of WMS (WMS) yesterday was burning a big hole and waiting to be spent!

If you didn't catch the story about Ford (F) yesterday, I would encourage you to take note of anything that sounds optimistic about the economy. Yesterday Ford (F) related that it was increasing production of the F-150 pickup.

As reported:

"Analysts said a sharp drop in gas prices curbed the decline in truck sales.

Ford already announced in October that it planned to restore in January a third shift at its other F-150 plant in Dearborn, Mich. Those roughly 1,000 workers had been laid off earlier this year as the automaker cut production.

The decision to shift workers at the plant in Claycomo near Kansas City to F-150s is continuing that strategy, Kozleski said.

"Despite the challenges in the market, the fullsize pickup remains one of the big sellers in the industry and we are ensuring we have capacity to meet market demand," she said."

Now this particular entry in my blog isn't about Ford (F) at all. We all know the CEO's of the 'big 3' automakers are back testifying to Congress over their need for federal subsidies to keep them in business. But isn't it somehow reassuring that some part of the auto business, even if it is the F-150 pickup line, is showing some life and growth in the midst of what sounds to be universal despair?

Anyhow, I had that nickel in my pocket this morning. If you aren't a regular reader of my blog, I should explain that my stock portfolio shifts between 5 and 20 positions. I use the performance of my own stocks to determine whether I should be adding a new position or shifting more funds into cash. With a sale of 1/7th of my WMS position at a 30% gain (my first targeted appreciation level), that action generated a 'buy signal' for me and I was on the 'lookout' this morning for a good prospect to add to my portfolio.

Checking first with my favorite starting point, the list of top % gainers, I found that an old favorite of mine, Buckle (BKE) had made the list and currently as I write is trading at $23.85, up $4.29 or 21.93% on the day. I went ahead an purchased 143 shares of Buckle (BKE) at $24.3968. I calculated this number of shares by purchasing 125% of the average of my other 5 holdings---as I have written about as my plan for the positions 6-20 in my portfolio---positions that are purchased on 'good news' events.

I say 'old favorite' of mine, because I first wrote up Buckle (BKE) on this blog on April 8, 2005, and then 'revisited' the stock again on December 23, 2006.

What drove the stock higher today was the announcement before the open of November sales for the four-week period ended November 29, 2008. Unless you are living in a cave, you probably are quite aware of the retail sales slump that we are experiencing in the United States, and the global economic slump the world is working through.

Anyhow, the Buckle reported that November sales overall increased 21.6% to $72.2 million from $59.4 million last year. Pretty solid! But even better was the same-store numbers which Buckle reported that for stores open at least one year, same-store sales during the period climbed 15.0%. Year-to-date, comparable store sales for the 43-week period ended November 29, 2008, increased 22.6% over the same period the prior year. So while the growth wasn't quite at the pace of the prior 6 months, it is still pretty amazing! In addition, the company in the same announcement reported that it was busy rebuying its own shares, acquiring 391,400 shares of stock at an average price of $16.23/share.

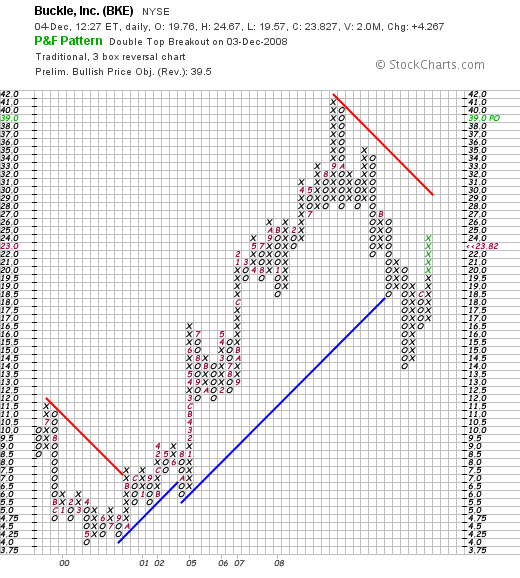

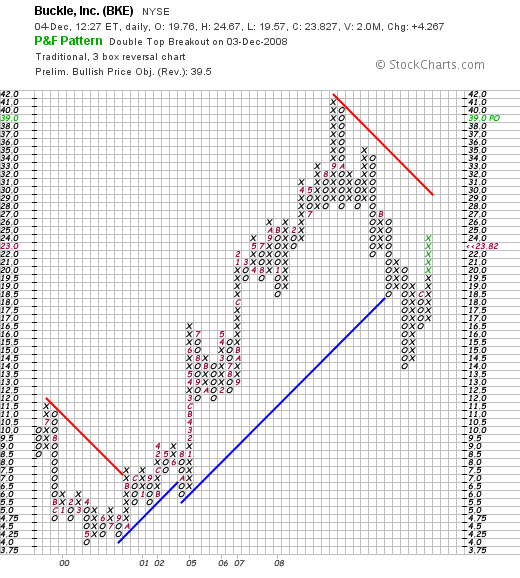

If we look at the StockChart 'point & figure' chart on Buckle (BKE), we can see that the stock peaked at $42/share back in September, 2008, and dipped to as low as $14 this past November, 2008. The stock is moving higher from that intermediate low point, breaking above prior 'support lines' (the blue line on the graph) at $18.50, and pushing towards resistance at $29.

Reviewing the Morningstar.com "5-Yr Restated" financials on Buckle (BKE), the growth in revenue, earnings, and free cash flow is unabated. The company is paying an increasing dividend and at the same time reducing its outstanding shares. The balance sheet is solid with a current ratio of almost 4. There is nothing not to like on this page.

In fact, if we check the latest quarterly report, the 3rd quarter results were reported just two weeks ago: earnings came in at $.62/share or $.64/share removing a one-time charge. This was $.01 ahead of estimates! Net sales came in at $210.6 million, up from $167.6 million last year. And same-store sales for the quarter came in up 19.1% (!) from last year. Nothing shabby there. In fact, I am a bit perplexed how this company has managed to escape the retail struggles of the other stores at the mall!

Looking at Yahoo "Key Statistics" for a brief update on some valuation numbers, the company has a market cap of $1.1 billion, making it a mid cap stock with a trailing p/e of 11.19. With a forward p/e of only 10.75, the company has a PEG ratio of 0.60 practically screaming to me of great value!

There are 46.46 million shares outstanding but only 24.16 million of them that float. As of 11/11/08, there were 8.74 million shares out short for a short ratio of 7.6 trading days (above my 3 days for significance.)

As I noted earlier, the company pays a great dividend of $.80/share yielding 4.60%. The payout ratio is only 33% giving it ample room to increase it in the future depending of course on future earnings and prospects. In fact, the company just completed a 3:2 stock split on October 31, 2008.

Anyhow, that's the news on my trading portfolio. I do not know if I am seeing the light at the end of the tunnel, but somehow that F-150 report yesterday got me a bit encouraged. And it is nice to see an 'old name' of mine moving higher on good earnings and sales news. Sort of like old times.

Thanks again for stopping by and visiting. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 12:27 PM CST

|

Post Comment |

Permalink

Updated: Thursday, 4 December 2008 12:28 PM CST

Wednesday, 3 December 2008

WMS Industries (WMS) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Late this afternoon, my shares of WMS Industries (WMS) reached the first targeted sale point with a 30% appreciation over my initial purchase. Only owning 83 shares (a reduced size position due to my recent strategy of replacing stocks in the minimum of 5 positions with smaller purchases), I sold 1/7th of my holding or 11 shares at $26.21. I had purchased my 83 shares just a month ago on 10/28/08 at a cost basis of $20.12. Thus, I had a gain of $6.09 or 30.3% since purchase.

My portfolio management strategy is to respond to sales of holdings within my account with specified actions. In this case, holding 5 positions, well under my maximum of 20, a sale at reaching an appreciation target generates a buy signal. That is, I now have a proverbial 'permission slip' to be adding a new holding to the account. Certainly, I need to review potential purchases to make sure they meet my own criteria for inclusion in my portfolio, but it is exciting to once more get some sort of positive signal about the market from my own portfolio!

In terms of sizing the new position, since I shall be adding a new holding on 'good news', and not just because one of my minimum of 5 holdings needed to be replaced, my size for the new position will be 125% of the average of the other 5 holdings currently. When the opportunity arises to purchase that holding, I shall be getting my calculator out and determining the number of shares to purchase.

I hope all of this strategizing out loud helps all of you in thinking about how you manage your own accounts. I know it helps me.

If you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Sunday, 30 November 2008

***NEW PODCAST POSTED*** on WMS Industries (WMS), and Investment Strategy

Click HERE for my latest podcast on WMS Industries (WMS), I read a poem "Filling Station" by Elizabeth Bishop, and discuss some of the recent changes I have made in my investment strategy due to my experience in this most severe of Bear Markets!

Please email me at bobsadviceforstocks@lycos.com if you have any comments or questions regarding this or any other podcasts or comments I have written!

Yours in investing,

Bob

A Reader Writes: "Maybe stock selection is worthless." and a closer look at my Trading Portfolio!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

My loyal reader and commenter, Doug S. gave me a prod this weekend about writing a bit more on the blog. He is finding it difficult to get very excited about any particular stocks and is finding the entire market rather discouraging.

My loyal reader and commenter, Doug S. gave me a prod this weekend about writing a bit more on the blog. He is finding it difficult to get very excited about any particular stocks and is finding the entire market rather discouraging.

Doug wrote:

"You have been very quiet both publicly and privately recently. Any thoughts where the general market may be heading short term? Individual stock selection has been a waste of time(and money) for the last few months."

Doug, you are right on the mark with this letter. I have indeed been a bit 'quiet' and share your own sense of discouragement at the relentless correction and bear market we have been experiencing. So many 'right' stocks have been acting simply 'wrong'!

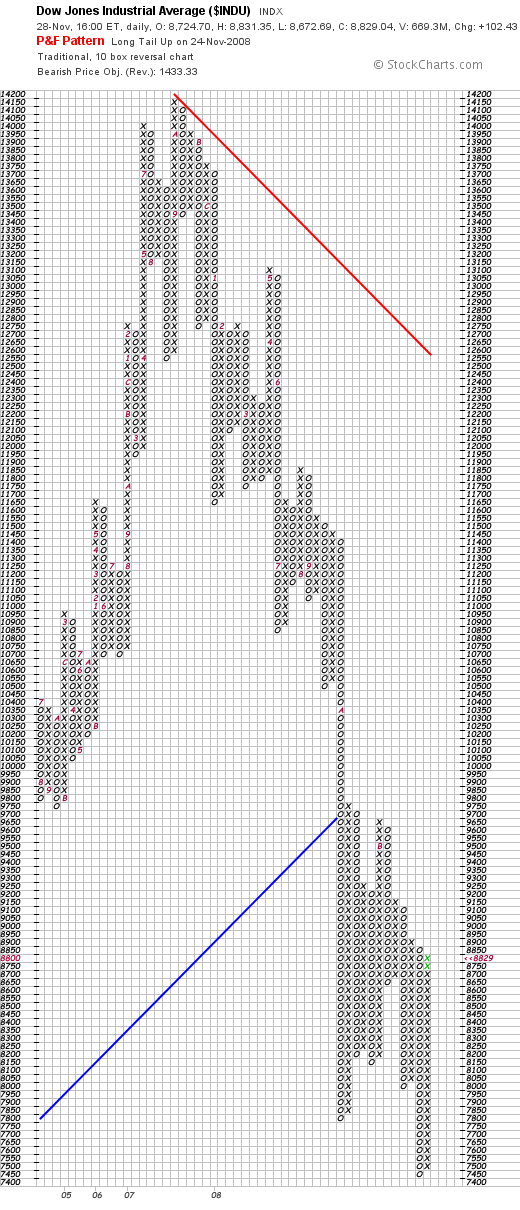

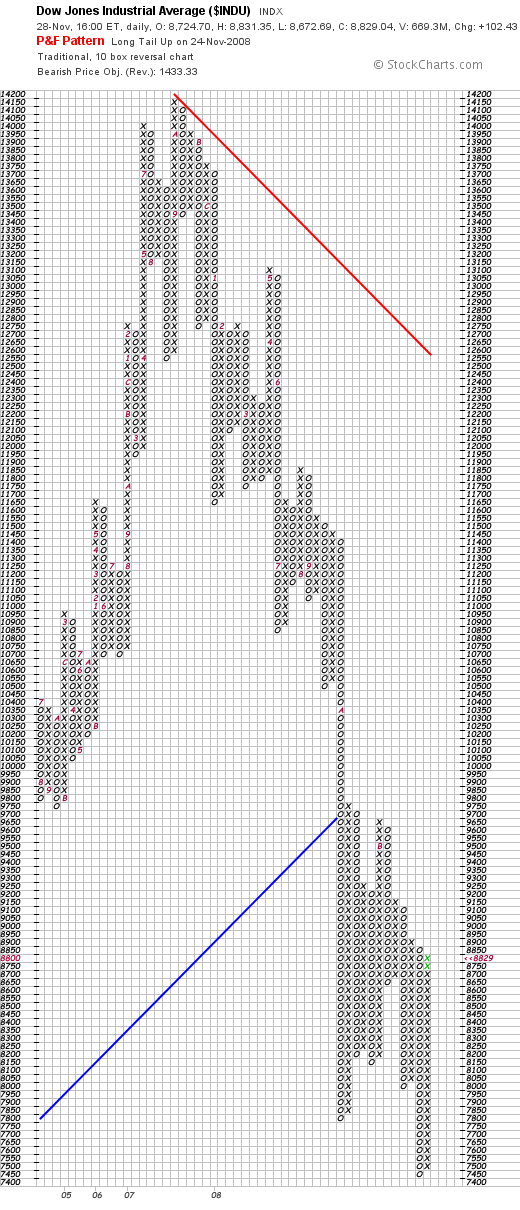

Using my 'point & figure' approach to charts, let's take a look at a point & figure graph from StockCharts.com on the Dow:

We can see that the Dow peaked at about 14,150 in October, 2007, and hit a recent low this month (November, 2008) at about 7,450. The stock market is currently rebounding and closed at 8829 on November 28, 2008. The chart is, however, far from encouraging. The trend appears to continue to be lower--with lower lows and lower highs. At least technically, I don't see anything that appears to be very promising.

Sorry to be so gloomy. But I can see what everyone else is looking at as well.

So what is an investor to do?

I feel like hibernating like this bear. Oh that is a very mixed metaphor so excuse me :)

But I do not believe that picking stocks is now obsolete. It is just that the over-riding influence on all of our investments has been the "M" in CAN SLIM.

My approach to investing has always been that I would try to maximize my own investments by picking what I thought were the 'best' stocks to own and yet being quite aware of the possible effects of both a climbing 'bull' market as well as the ravaging effects of a 'bear' market!

In fact, my own approach which reduces my holdings down to a minimum of 5 (out of a maximum of 20) positions was not even adequate to deal with the tremendous correction we are facing. Thus, I recently reduced my 'replacement' positions in the bottom 5 to 1/2 of the average of the remaining holdings. In addition, in light of the record volatility of the market with hundreds of points in both directions in the same day becoming the norm, I have expanded my exposure to loss in any individual holding to 16% from 8% in my bottom 5 holdings only.

So I share your frustration. But I believe that we are closer to the bottom than the top and that the market will actually start moving higher before the recession is over, moving in anticipation of the actual economic recovery.

I have always pointed out that I am not able to call a bottom, a top, or anything in between. However, as an observer of the market, I can respond to the actions of my own portfolio that I hope will continue to generate 'signals' to let me know whether I need to continue to pull back from equities or whether it is time to shift some of my cash position into new holdings.

As part of my own effort to respond to the market when it does turn positive, I have changed my own arbitrary sizing rule for positions to the 125% of the average of my holdings on purchases above my minimum of five holdings, and have, as I have indicated, reduced the position sizes to 50% of the average holding on replacement purchases to maintain my five position exposure minimum.

I hope that these strategies will help me respond to market opportunities yet continue to allow me to protect my account value in the face of a savage bear market.

Speaking of my holdings, let me use this opportunity to briefly review my five holdings. This list will show the names of the stocks, their symbols (in alphabetical order of their trading symbols), the number of shares held, date of purchase, the cost basis, latest price (11/28/08), and the % gain or (loss).

Current holdings:

Haemonetics (HAE), 50 shares, 10/27/08, $51.70, $57.19, 10.62%

Johnson Controls (JCI), 95 shares, 11/20/08, $14.80, $17.66, 19.05%

PetSmart (PETM), 104 shares, 11/20/08, $15.58, $17.55, 12.67%

Rollins (ROL), 350 shares, 10/16/08, $14.69, $17.32, 17.91%

WMS Industries (WMS), 83 shares, 10/28/08, $20.12, $24.65, 22.49%

In terms of my overall portfolio, I currently have $21,903.32 in a Money Market account, and $14,470.35 in equities as described above. As of 11/28/08, I have $2,044.86 in unrealized gains in my trading account and this year, I have a net gain of $609.10, resulting from net short-term losses of $(8,679.66) and net long-term gains of $9,288.76. The total account value is $36,374.27. I am currently adding $200.00/month in new cash into the account each month.

My entire strategy is a very tedious business. When the market turns around, I am likely be slow in re-entering, but I shall commit new funds in a methodical fashion as my own stocks indicate. In the same fashion, if the bear market continues, I shall strive to protect my account with the same conservative stock management that has served me well thus far.

I am not sure if I adequately answered your question and comments Doug, but I came out of my slumber for a short while to write. Now, back to that cave and some more sleep. Will someone please wake me when it is all over :).

If you have any comments or questions, please feel free to leave them right here on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Thursday, 20 November 2008

Esco Technologies (ESE), PetSmart (PETM), and Johnson Controls (JCI) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

The market is acting in what is for me an unprecedented fashion.

The market is acting in what is for me an unprecedented fashion.

How do you explain a stock market that drops another 444.99 points today to 7,552 on the Dow, or another 70.30 points on the Nasdaq to 1,316? I guess you don't.

Needless to say that "M" in CAN SLIM, as William O'Neil would say is determining the performance of all of my holdings. And I was disappointed today that I needed to sell my 47 shares of Esco (ESE) at $27.27. These shares were purchased literally just days ago at $32.73, so in this short period of time I incurred a loss of $(5.46) or (16.7)% since purchase.

Since this position is one of my final five positions, as I have pointed out elsewhere, I have tried to tolerate the greater volatility in the market with (16)% loss limits (instead of my usual 8% loss limit). Even so, within days this stock managed to dip that 16% and I sold my shares this morning. The market deteriorated into the final hour (as it has been tending to do on a regular basis), and ESE closed at $25.97, down $(2.18) or (7.74)% on the day.

This is in no way a reflection on the underlying fundamentals of this stock, as far as I can tell, but rather on the underlying fundamentals of the entire market. Esco had great quarterly results reported just days ago, and as I wrote in my earlier post, a very nice Morningstar.com '5-Yr Restated' financials page.

But the powerful downward plunge of this market is 'lowering all ships' and Esco (ESE) is no exception.

I sold my shares and paradoxically, since I was then down to 3 positions, this generated a buy signal giving me the opportunity to purchase two positions, albeit reduced in size, to bring me back to my minimum of 5.

With the market behaving relatively benignly earlier in the day with talk of a automotive manufacturer's bail-out discussed, I waded back into the water, purchasing two small positions: 104 shares of PetSmart (PETM) which announced good earnings, at $15.50/share, and thinking that the entire automotive industry might yet be 'saved', I thought it might be a good time to venture back into my 'old favorite' Johnson

With the market behaving relatively benignly earlier in the day with talk of a automotive manufacturer's bail-out discussed, I waded back into the water, purchasing two small positions: 104 shares of PetSmart (PETM) which announced good earnings, at $15.50/share, and thinking that the entire automotive industry might yet be 'saved', I thought it might be a good time to venture back into my 'old favorite' Johnson  Controls (JCI) and purchased 95 shares at $14.75.

Controls (JCI) and purchased 95 shares at $14.75.

PETM gave up much of its earlier gain before the close, itself being caught in the downdraft, and closed at $14.84, up $1.52 or 11.41% on the day. JCI closed down a little less from my own purchase at $14.14, up only $.07/share on the day or 0.50%.

I am back to my minimum of 5 positions. But with each of these purchases, I continue to shrink the size of my holdings, and shift a little more each time over to cash.

Currently my 5 positions add up to about $11,000 in value, and my cash position in my ever-shrinking portfolio is at $22,000. And to think that just months ago I was listening to my son tell me I needed to get out of margin. My portfolio management strategy is working, albeit in fits and starts, to shift me into cash while allowing me to continue to have equity holdings to direct my own future sales and purchases!

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Wednesday, 19 November 2008

Why Portfolio Management is Essential to Preserving Capital

What is an individual investor to do?

Is the market closer to the bottom or the top? Is it too late to sell or should one move to cash? Is it time to 'bottom-fish'? Are we on the verge of a Great Depression 2 or is 2009 to find us with indices pushing towards new highs?

I will be the first to tell you I don't know the answers to the above questions.

I am not sure anyone really knows.

But I do believe that each of us has the power to implement disciplined approaches to our own portfolios that may assist us to avoid excessive exposure to equities when times are bad and help us to know when to be adding to equities when the market firms up and improves profit possibilities for investors.

What I have been doing isn't very complex.

I have been using the actions of my own holdings to direct me to either be adding to stocks or moving from stocks into cash. It is that simple.

I am not sure this is a profitable approach; certainly there must be better ways to go about all of this. I just know that I find it helpful.

Without discussing the which stocks I buy which I have written about elsewhere and shall certainly write up again, let me simply suggest that from my approach I am trying to own only the highest 'quality' stocks on the market. We each may define quality differently, but there may be reasons why managing our holdings in response to market actions may be wise.

My approach is based on the belief that market actions may be interpreted through the price changes within our own portfolios of holdings.

Like a barometer responding to atmospheric pressure, my own portfolio is built to drift between 5 and 20 positions depending on the market's effects on my own holdings.

Assuming that a maximum of 20 positions is utilized, I believe that 10 positions would be a neutral posture, 5 is most conservative, and 20 is most aggressive. Once I have my holdings I either add positions (assuming I am under 20 positions), or sit on my hands with the proceeds---moving to cash (assuming I have at least 5 positions)---based on targeted moves higher or lower of my individual stock holdings.

These permission slips or directives to avoid reinvesting proceeds are the indicators I use to posture my own holdings. It is that simple.

I have set appreciation targets for partial sales at 30, 60, 90, 120, 180, 240, 300, 360, 450%...etc., at which point I sell 1/7th of my remaining shares of that holding. These sales are considered sales on 'good news' and they generate the signal to add a new position (unless at 20 in which case I do the opposite---sit on my hands).

On the other hand, sales on declines are used as indicators of sickness of the overall market environment as evaluated through the eyes of my own holdings. Targeted sale points are either at an (8)% loss (if I own 6-20 positions) or (16)% losses (if I own 5 or less positions). I have increased my loss limit for my last 5 positions to reduce my own trading velocity in a declining and highly volatile market. In addition, after a first sale of 1/7th of a holding at a 30% gain, I sell all of my shares if the stock should decline to break-even, or sell my entire position if a stock has reached two or more appreciation targets (60% or higher), I move my sale point up to 1/2 of the highest % sale. In other words, if I happened to sell a stock 3 times (1/7th of holdings each time) at 30, 60, and 90% holdings, I would move my sasle point up to 1/2 of 90% or at a 45% appreciation target for ALL remaining shares.

These 'bad news' sales generate a directive to NOT reinvest funds and instead to 'sit on my hands' unless I am at 5 or less positions. In those particular cases, which I currently find myself in, these sales paradoxically do generate a buy signal to get me back up to my minimum of 5 holdings. However, in my continued recognition of the need to shift from equities to cash in these situations, I have recently modified the purchase to a smaller holding--representing 1/2 of the average size of the remaining positions.

In fact, I have recently also been doing some more thinking on position size. As above, when buying to replace one of the last 5 holdings, I buy enough shares for 1/2 of the average size of the remaining positions. However, as the market presumably improves its tone and I wish to start once again increasing my exposure to equities, for positions 6 through 20, I plan on adding 125% of the size of the remaining positions.

These sales and movement into cash and back again, and these position sizing allows me the opportunity to automatically respond to market actions in some sort of rational fashion.

I hope that the current currection is short-lived, although I have my doubts about that. In any case, I am positioning my portfolio to continue to have exposure to equities but to work hard at listening to my own portfolio as my own holdings let me know how to deal with the overall market.

Thanks so much for bearing with me. I wanted once again to lay out my strategy in some detail. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 2:14 PM CST

|

Post Comment |

Permalink

Updated: Thursday, 20 November 2008 12:08 AM CST

Rock-Tenn Co. (RKT) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I am not pleased to report that one of my five holdings, Rock-Tenn (RKT) has hit a sale point on a drop in price. But exactly that happened this morning and I sold my 93 shares of Rock-Tenn at $27.75. These 93 shares were acquired earlier this month on 11/4/08 at a cost basis of $33.15. Thus, these shares had incurred a loss of $(5.40) or (16.3)% since purchase.

I am not pleased to report that one of my five holdings, Rock-Tenn (RKT) has hit a sale point on a drop in price. But exactly that happened this morning and I sold my 93 shares of Rock-Tenn at $27.75. These 93 shares were acquired earlier this month on 11/4/08 at a cost basis of $33.15. Thus, these shares had incurred a loss of $(5.40) or (16.3)% since purchase.

Reflecting my current portfolio management strategy which requires me to have at least five positions and a maximum of 20 positions, and yet recognizes the special purchases that are involved at the bottom end of my equity exposure spectrum, I now tolerate a (16)% loss before selling one of my minimum of 5 positions. Thus with this sale, I now have a 'buy signal' to be looking for a new holding that fits into my own requirements for stocks. I am unlikely to find anything today, at least with the Dow down currently (211) points at 8213.

In addition, my strategy requires me to replace this position with an even smaller holding amounting to 1/2 of the average size of the remaining four positions. Thus, even while I maintain exposure to equities with these minimum of 5 holdings, I continue to shift my funds, albeit slowly, into cash in the face of the continued evidence of the continued bearish market environment.

My own sale is not based on any fundamental problem that I have observed with Rock-Tenn (RKT). Indeed with the decline in price it may well represent an increasing good value for that investor so inclined to evaluate stocks on that basis. Indeed as you may recall from my previous write-up on RKT, they reported outstanding earnings on November 3, 2008, which led me to my own purchase of shares. In addition, the 5-Yr Restated financials on Morningstar.com are also attractive.

But my own purchases, which are based on these fundamental findings, are separate from my sales which are price-dependent both on the upside as well as the downside. I respond to price movement with sales and adjust my own investment posture towards my entire portfolio as well.

Thank you for bearing with me as we all suffer from the ongoing market correction that is dragging down values of portfolios, retirement accounts, and is making this amateur investor feel much less than brilliant, totally humbled, and aware of limitations facing each of us as we try to respond to challenges not previously imagined.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Monday, 17 November 2008

Is it Time to Bring Back Savings Stamps?

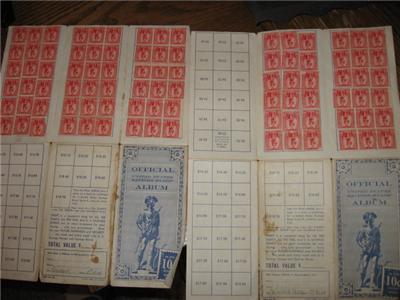

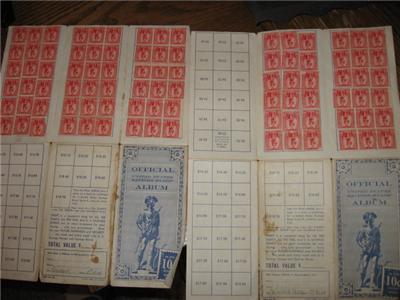

In 1961 I was in the second grade at Fort Ord III Elementary in Monterey, California. I don't remember much about school. I worked hard and was always proud of my report card that I brought back for my mom.

One thing I do remember was that I found Savings Stamps to be something that was sold at school and I put together a savings book to get enough stamps to buy a Savings Bond. 1961 was the last year Savings Stamps were issued.

To this day I wonder why Savings Stamps aren't still being sold to our young people and people of all ages who might buy a lottery ticket instead.

To this day I wonder why Savings Stamps aren't still being sold to our young people and people of all ages who might buy a lottery ticket instead.

How many of us would instead of buying a lottery ticket go ahead and spend the extra 25 or 50 cents to buy a savings stamp to fill a book and get a EE Savings Bond?

How many of us would instead of buying a lottery ticket go ahead and spend the extra 25 or 50 cents to buy a savings stamp to fill a book and get a EE Savings Bond?

I know I would.

I know my children would.

I have been meaning to write up this blog post so many times, but decided to do so this evening for whatever reason. With our nation building up our debt with stimulus packages for our banks, for our auto industry, for out insurance companies, for our money market funds, and for whatever is next, isn't it time we asked our citizens to reach into their pockets and purchase Savings Bonds?

And what a great way to do so with Savings Stamps that can be purchased with the change we have in our pockets. We can dispense them at gas stations and grocery stores, post offices and malls. Wherever people congregate. Wherever they go to school. We can teach our children once more about investing in their nation. And make it real easy. What a great habit.

Isn't this a time to be patriotic and buy Savings Stamps and Savings Bonds? Of course, the Post Office and the Treasury would need to start issuing these stamps once again. But I cannot think of a better lesson for all of the young people in America. Imagine, teaching them about saving a quarter at a time. And investing in their nation.

Isn't this a time to be patriotic and buy Savings Stamps and Savings Bonds? Of course, the Post Office and the Treasury would need to start issuing these stamps once again. But I cannot think of a better lesson for all of the young people in America. Imagine, teaching them about saving a quarter at a time. And investing in their nation.

What could be wrong about that?

If you like this idea, forward this to your Congressman or Congresswoman and ask them 'Why not?'. And tell them Bob sent you :).

Yours in investing,

Bob

Posted by bobsadviceforstocks at 11:01 PM CST

|

Post Comment |

Permalink

Updated: Monday, 17 November 2008 11:06 PM CST

Newer | Latest | Older

![]() I cannot emphasize enough how my trading is driven by the performance of my underlying holdings. Especially in this time of extreme market volatility, having a plan to deal with price moves, whether they be on the upside or downside, is essential. In my own case, each of my holdings has sale points determined at their time of purchase whether it be a partial sale of 1/7th of my holding as the stock appreciates in price, or a complete sale of the holding should the stock decline 8% (or 16% if in the last 5 of my maximum of 20 positions), or at other set points should the stock have previously appreciated and experienced partial sales of that holding.

I cannot emphasize enough how my trading is driven by the performance of my underlying holdings. Especially in this time of extreme market volatility, having a plan to deal with price moves, whether they be on the upside or downside, is essential. In my own case, each of my holdings has sale points determined at their time of purchase whether it be a partial sale of 1/7th of my holding as the stock appreciates in price, or a complete sale of the holding should the stock decline 8% (or 16% if in the last 5 of my maximum of 20 positions), or at other set points should the stock have previously appreciated and experienced partial sales of that holding.

My loyal reader and commenter, Doug S. gave me a prod this weekend about writing a bit more on the blog. He is finding it difficult to get very excited about any particular stocks and is finding the entire market rather discouraging.

My loyal reader and commenter, Doug S. gave me a prod this weekend about writing a bit more on the blog. He is finding it difficult to get very excited about any particular stocks and is finding the entire market rather discouraging.

The market is acting in what is for me an unprecedented fashion.

The market is acting in what is for me an unprecedented fashion.  With the market behaving relatively benignly earlier in the day with talk of a automotive manufacturer's bail-out discussed, I waded back into the water, purchasing two small positions: 104 shares of PetSmart (PETM) which announced

With the market behaving relatively benignly earlier in the day with talk of a automotive manufacturer's bail-out discussed, I waded back into the water, purchasing two small positions: 104 shares of PetSmart (PETM) which announced  Controls (JCI) and purchased 95 shares at $14.75.

Controls (JCI) and purchased 95 shares at $14.75. To this day I wonder why Savings Stamps aren't still being sold to our young people and people of all ages who might buy a lottery ticket instead.

To this day I wonder why Savings Stamps aren't still being sold to our young people and people of all ages who might buy a lottery ticket instead. How many of us would instead of buying a lottery ticket go ahead and spend the extra 25 or 50 cents to buy a savings stamp to fill a book and get a EE Savings Bond?

How many of us would instead of buying a lottery ticket go ahead and spend the extra 25 or 50 cents to buy a savings stamp to fill a book and get a EE Savings Bond? Isn't this a time to be patriotic and buy Savings Stamps and Savings Bonds? Of course, the Post Office and the Treasury would need to start issuing these stamps once again. But I cannot think of a better lesson for all of the young people in America. Imagine, teaching them about saving a quarter at a time. And investing in their nation.

Isn't this a time to be patriotic and buy Savings Stamps and Savings Bonds? Of course, the Post Office and the Treasury would need to start issuing these stamps once again. But I cannot think of a better lesson for all of the young people in America. Imagine, teaching them about saving a quarter at a time. And investing in their nation.