Stock Picks Bob's Advice

Tuesday, 20 July 2004

July 20, 2004 Florida Rock Industries (FRK)

Hello Friends! Thanks so much for stopping by. I got caught by the JUNO sell-off today....sometimes better to avoid those micro-cap stocks that are overly-volatile. (Some day I may learn I hope.) Please remember that I am an AMATEUR investor, so please consult with your professional investment advisors prior to making any decisions based on things you read on this website. Also please do your own investigation of all stocks discussed to verify information posted.

Florida Rock Industries (FRK) is having a very nice day today trading currently at $42.21, up $2.04 or 5.08% on the day. I do not own any shares nor do I have any options in this stock. According to the

Yahoo "Profile" on FRK, they operate "...principally in three business segments: construction aggregates, concrete products and cement and calcium products." I believe this is our first "rock" stock.

On April 20, 2004, FRK announced their second quarter 2004 results. (I do not have a link for this as it came off of their website). Consolidated total sales for the quarter increased 40% to $228.6 million from $163.6 million the prior year. Net income came in at $24.5 million or $.56/share up from $16.3 million or $.37/diluted share a more than 50% increase. These are very nice results.

If we look a bit longer-term at

"5-Yr Restated" financials on Morningstar.com, we can see that revenue has steadily increased from $597 million in 1999 to $988 million in the trailing twelve months (TTM).

Earnings per share have shown a nice progression from $1.07/share in 1999 to $2.60/share in the TTM. Also nice, the company DOES pay a small dividend and it has been increasing it from $.16/share to $.61/share in the TTM...and increasing it EACH year since 1999. Free cash flow has also been excellent and INCREASING from $54 million in 2001 to $104 million in the TTM.

Looking at the balance sheet on Morningstar.com, we can see that the company has $42.5 million in cash and $162.7 million in other current assets. This is plenty to cover the $106.5 million in current liabilities and make a big dent in the $190.3 million in long-term liabilities reported.

How about valuation? Looking at

"Key Statistics" On Yahoo, we can see that this is a mid-cap stock with a Market Cap of $1.83 Billion. The trailing p/e is nice at 17.89 with a forward (fye 30-Sep-05) of 14.86. Thus the PEG is downright cheap at 0.99 with a Price/Sales of 1.99 which isn't too rich either.

Yahoo reports 43.25 million shares outstanding with 31.30 million of them that float. Of these shares, 1.33 million shares are out SHORT, which is a LOT for this company (as of 6/7/04), and thus, the short ratio is 7.319 trading days. As you know, I like to use 3.0 days to assign any significance to this number. This is a lot of trading days....and with good results, and a bit of an upward move, we might see a bit of a squeeze. I like this figure.

The company, as noted above, pays a $.66/share dividend yielding 1.66% which isn't too bad in today's low money-market rate environment. Yahoo does not report any stock split.

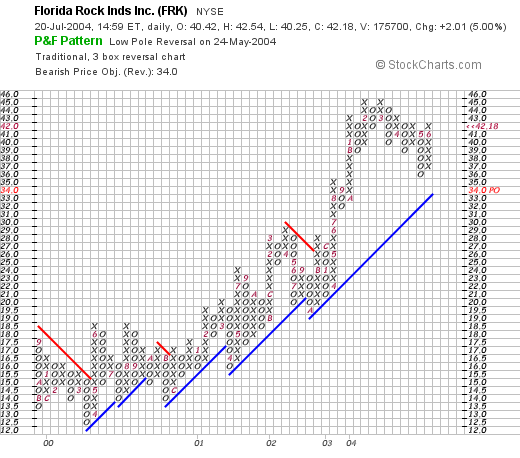

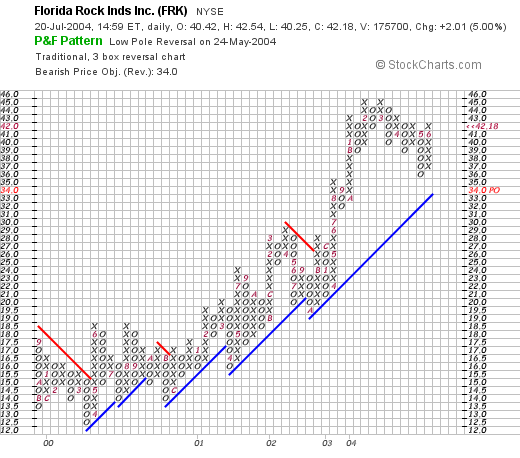

How about technicals? Looking at stockcharts.com, one of my favorite free websites for basic charting, we can see with a Point & Figure chart:

this stock has been trading very nicely above its support levels since it was about $12 in April, 2000. It does not appear over-extended. I don't see much I don't like about this chart imho.

Well what do I think? Well, I am not much into rock stocks :), but this stock looks very nice. We have a GREAT recent earnings report, the past five years shows steady growth in revenues and earnings, the company pays a small and GROWING dividend, the free cash flow is strong and growing, the balance sheet is fine, the valuation looks excellent with a PEG under 1.0, and why we even have a bunch of short-sellers out there WAITING to buy shares! Technically the chart looks just fine. If I wasn't WAITING for a stock to sell at a gain, I might just be nibbling on this cement stock (is that a mixed metaphor or what?)....but you know the same old problem...I don't have any money to buy stock now!

Thanks so much for stopping by. If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

"Trading Transparency" JUNO

Hello Friends! Just a quick note to catch you up. The market has turned around nicely today but my Juno Lighting (JUNO) which I only had 100 shares in my trading account has NOT been performing well and hit a 13% loss. Out it went. A few moments ago I pulled the plug at $28.53. I had purchased the shares on 4/7/04 at $33.37. Will keep you posted!

Bob

Monday, 19 July 2004

July 19, 2004 Stryker (SYK)

Hello Friends! The market has closed and there is one stock I would like to review with you. I actually reviewed this once before on a MSN site, but haven't posted it yet here as it just made the

list of top % gainers on the NYSE. Stryker Corporation (SYK) closed at $47.95, up 4.15% on the day. As always, please remember that I am an amateur investor, so please consult with your own professional investment advisor prior to making any investment decisions based on information on my

blog, Stock Picks Bob's Advice or elsewhere on the website.

According to the

money.cnn.com "Snapshot", Stryker Corporation's "...principal activities are to develop, manufacture and market surgical and medical products. The Group operates in two segments: Orthopaedic Implants and MedSurg Equipment." I do not own any shares or options in this company.

Stryker

reported 2nd quarter 2004 earnings on July 15th. Total second-quarter sales rose to $1.04 billion from $891.7 million last year. Second quarter net earnings rose to $152.7 million or $.37/share from $107.5 million or $.26/share last year. They also announced they had paid down virtually all of their debt during the quarter.

In addition, on the same day, SYK

upped their earnings outlook for fiscal 2004 to $1.42/share up from its previous forecast of $1.40. Although the revision is small, it is the direction and the fact that there was a revision that is significant.

If we look at a

"5-Yr Restated" financials on Morningstar.com, we can see that revenue has steadily grown from 1999 when it was $2.1 billion to the $3.8 billion in revenue in the trailing twelve months.

Earnings/share have also grown strongly during this period from $.05/share in 1999 to $1.19/share in the TTM. A cash dividend is paid, rising from $.03/share to $.06 in 2002. (Per Yahoo, the company has paid $.07/share yielding 0.15% in the TTM).

Free cash flow is excellent increasing from $311 million in 2001 to $453 million in the TTM. This company is spinning off almost 1/2 of a billion dollars each year in free cash flow!

Balance sheet wise, SYK has $48.9 million in cash and $1.4 billion in other current assets, enough to easily pay off both the current liabilities of $798.3 million and the $145.5 million in long-term liabilities combined. From the latest quarterly report, apparently they HAVE paid off virtually all of their debt and are looking into acquisitions.

How about valuation? If we look at

"Key Statistics" from Yahoo, we can see that this is a Large Cap stock with a market cap of $19.19 billion. The trailing p/e is 40.26, the forward p/e is 28.54 (fye 31-Dec-05), and the PEG is 1.94 with a price/sales of 4.65. This stock is not a cheap stock at all!

There are 400.19 million shares outstanding with 272.20 million that float. Currently there are 5.99 million shares out short, for a short ratio of 4.904 as of 6/7/04. This is significant, and may account for the price rise today in the face of an overall declining market.

Yahoo shows that SYK does pay a dividend of $.07/share (even though Morningstar does not show any dividend for 2003), yielding 0.15%. The stock recently split 2:1 in May, 2004.

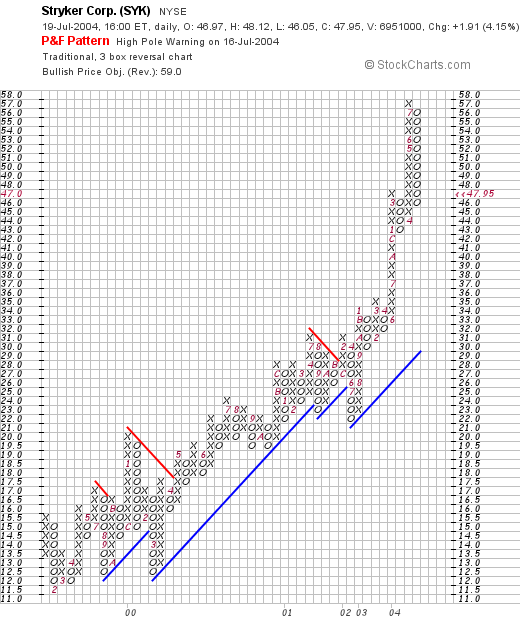

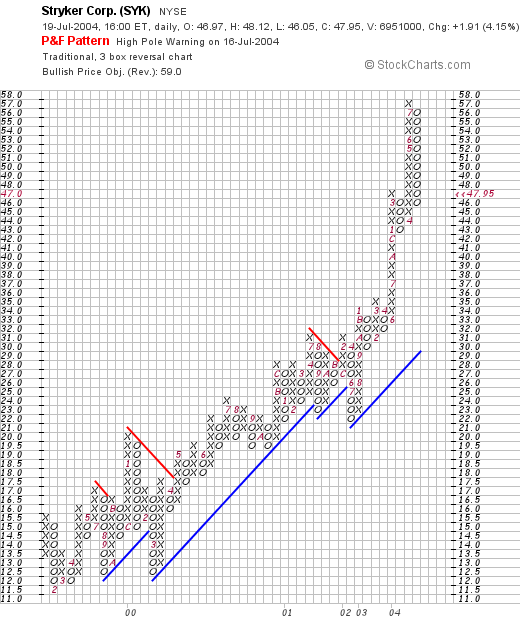

How about the "technicals"? If we look at a Point & Figure chart from Stockcharts.com:

we can see what appears to be one of the strongest graphs on this blog with a nice ascent from February, 2000, to the current level. The stock has pulled back from its lofty $57 level recently, but the price chart, in my opinion, while a bit ahead of the support line, has not broken down at all.

So what do I think? I really like this stock....but I do not have any money available to buy shares :). The latest quarterly report was strong, they have announced an increase in their own estimates for 2004, the record on Morningstar is impeccable with a steady growth in revenue, earnings, and even dividends. The free cash flow is excellent. The balance sheet is nice, and the current quarterly report points out they have paid off their debt, the valuation IS a bit steep with a PEG over 2.0, but sometimes you just GOT to pay for quality, but this is a draw-back. And the graph looks very strong. Looks like a winner to me!

So what do I think? I really like this stock....but I do not have any money available to buy shares :). The latest quarterly report was strong, they have announced an increase in their own estimates for 2004, the record on Morningstar is impeccable with a steady growth in revenue, earnings, and even dividends. The free cash flow is excellent. The balance sheet is nice, and the current quarterly report points out they have paid off their debt, the valuation IS a bit steep with a PEG over 2.0, but sometimes you just GOT to pay for quality, but this is a draw-back. And the graph looks very strong. Looks like a winner to me!

Thanks so much for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Posted by bobsadviceforstocks at 6:31 PM CDT

|

Post Comment |

Permalink

Updated: Sunday, 1 August 2004 2:42 PM CDT

A Reader Writes

Hello Friends! Happy Monday everyone. Checking the mail this morning, Paul writes:

"

Bob - a wonderful site and thanks for your time consumming

analysis - could you tell me how to find "shorts" for any particular company - thanks, paul"

Thanks Paul for writing! I have found that the level of short interest is an interesting statistic which may be indicative of future price movement. This serves two purposes, raising the question that somebody may actually know something bad about a company...and maybe the individual investor should be cautious. Or perhaps on a more encouraging note, if there is a large short interest, then maybe these shares, which need to be covered eventually, will drive the price higher in a "squeeze".

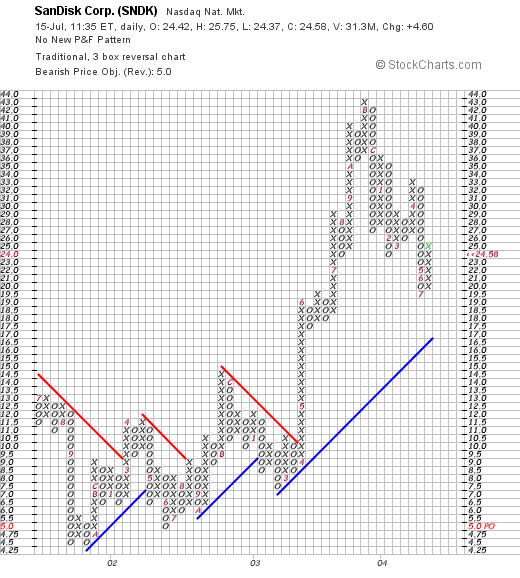

I use Yahoo.com for most of my data. Unfortunately, it is always a little stale...and if somebody has a better place to look, well then let me know. However, it is adequate for my purposes. If you go to

"Key Statistics", which for illustration purposes, I am using SANDISK...which can be found along the left hand side of the main quote section:

on the "Summary" section of each Yahoo finance quote, you can find "Key Statistics" under "Company"....then looking in the second column of the "Key Statistics" you will see the number of shares out short, the date of that statistic, and the short ratio which is the number of days of current average trading volume that it would take to cover. For my purposes, I use 3 days as a cut-off of significant short interest!

Thanks again for your inquiry. I hope that was helpful and answers your question. If you have any other questions or anyone else for that matter, please feel free to email me at bobsadviceforstocks@lycos.com . Please remember that I am an AMATEUR investor, so please consult with your professional investment advisors before making any investment decisions based on information contained on my website.

Bob

Posted by bobsadviceforstocks at 9:22 AM CDT

|

Post Comment |

Permalink

Updated: Sunday, 1 August 2004 2:41 PM CDT

Saturday, 17 July 2004

"Looking Back One Year" A review of stock picks from the week of July 7, 2003

Hello Friends! I just finished posting Masonite (MHM) and now for a little house-cleaning...time for the retrospective on this blog. If you are a new reader, I like to pick lots of stocks on my

blog, but to determine whether this is even working (!), I have always tried to look back and figure out what happened to these stocks. I must point out that the "system" that drives my trading portfolio includes sales at 8% losses, and other sales on gains as well. This review reflects a "buy and hold" philosophy that I do not personally practice....so my results would be affected by this. Please always remember, that I am an amateur investor, so please remember to consult with your own professional investment advisor to make sure if the investments discussed are appropriate and timely for you!

The week of July 7, 2003, was not a very busy week on this blog. In fact, I only posted two stocks. (About this time in the process, I am relieved to figure that out....so I can get to some personal "chores" around the house!)

On July 7, 2003, I

posted FindWhat (FWHT) on

Stock Picks Bob's Advice at a price of $22.16. FWHT closed at $18.23 on 7/16/04 for a loss of $(3.93) or (17.8)%.

The

1st quarter 2004 earnings results was released on April 26, 2004. Revenue in the first quarter ended March 31, 2004, increased 56% over the prior year. This represented 18 sequential quarters of revenue growth. Net income in the quarter came in at $3.8 million, or $.16/share, a 41% increase over the prior year's $2.7 million or $.13/share. In addition, FWHT raised fiscal 2004 guidance, based in part on acquisitions of Comet Systems and Espotting. The company does appear to be on track, but the stock price is certainly a bit disappointing....

On July 8, 2003, I

posted Websense (WBSN) on

Stock Picks Bob's Advice at $20.26. WBSN closed on 7/16/04 at $31.63 for a gain of $11.37 or 56.1%.

On May 7, 2004, WBSN

filed a 10-Q report for the quarter ended March 31, 2004. Revenue for the quarter increased to $24.6 million from $18.5 million the prior year. Fully diluted earnings jumped to $.22/share from $.17/share the prior year. The company appears to be doing just fine.

So how did we do that week? Well, one winner WBSN with a 56.1% gain, and one loser, FWHT, with a (17.8)% loss. Ironically, both were the so-called "dot-com" stocks. Averaging these two stocks, we come out with a 19.2% gain on the week. Not too bad over the past year.

Thanks again for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Masonite Intl (MHM)

Hello Friends! I don't usually post any new stock ideas on Saturday, but I had this stock I wanted to share with you on Friday but never got around to it! I am sure glad you stopped by and please do make yourself at home. If you are reading this on a third party website, like thegoldencoast.com, then be sure to come by and visit my

blog where you can review all of my endless commentary on stocks of interest. Please do remember, I am an amateur investor, this is my hobby, so please remember to consult with your professional investment advisors before taking any action on stocks discussed on this website to make sure they are timely, appropriate, and profitable for you!

Yesterday, while scanning the

list of top % gainers on the NYSE, I came across Masonite (MHM) which closed yesterday at $24.99, up $1.16 on the day or 4.87% in an otherwise mediocre market. First of all, I do not have any shares of this stock nor do I own any options. I believe that the stock is moving up on anticipation of 2nd quarter 2004 earnings, which should be released Monday per an

announcement from Masonite this past Tuesday. According to the

Yahoo "Profile", Masonite International "...is a manufacturer of doors, door components and door entry systems for new residential construction, home repair, renovation and remodelling, and commercial use."

We will have the 2nd quarter 2004 earnings results in just a couple of days, but let's take a look at the

1st quarter 2004 results which were released April 21, 2004. For the quarter ended March 31, 2004, sales increased 16% to $468 million from $402.2 million the prior year. Net income jumped 36% to $27.7 million from $20.3 million. And on a per share fully diluted basis, earnings jumped to $.51/share from $.38/share, a 34.2% increase. These were pretty nice results.

If we look longer-term, we can see from

Morningstar "5-Yr Restated" financials that revenue has grown steadily since even before 1999 when they reported $1.1 billion in revenue, and increased to $1.8 billion in the trailing twelve months. Earnings/share, while dipping from $1.00 in 1999 to $.84 in 2001, have steadily increased from that time. Free cash has been postitive and strong with $44 million reported in 2001 and $105 million reported in the trailing twelve months (TTM).

The balance sheet looks just fine with $129.7 million in cash and $625.9 million in other current assets, enough to easily cover the $370.6 million in current liabilites and much of the $589.6 million in long-term liabilities as well.

Looking at

"Key Statistics" on Yahoo we can see that the Market Cap is a mid-cap level $1.36 billion. The trailing p/e is a very reasonable 11.84 with a forward p/e of 8.89. I do not see a PEG on Yahoo, but with an

"Analysts Estimates" of $2.81 for Dec 05 on Yahoo and $2.54 from Dec 05, we can see that analysts are expecting a $.27/share growth or a $.27/$2.54 10.6% growth in earnings. If we divide the p/e of 11.84 by the 10.6 we get a PEG of 1.12 which isn't too high either! The Price/Sales is also very cheap at 0.70.

Yahoo reports 54.43 million shares outstanding with 52.30 million of them that float. Currently there are only 60,000 shares out short as of 6/7/04, but this does represent 3.75 trading days due to the low average trading volume on this company. No cash dividend is paid and no stock splits are reported on Yahoo.

How does the chart look like? If we look at a Point & Figure Chart from Stockcharts.com:

it appears that this stock was trading lower through late 2000, then in July, 2001, it broke through a resistance level at about $9.50 and has headed strongly higher since then to its current levels. The chart looks strong to me.

So what do I think. Frankly, I decided to post this one today because I thought it was too pretty a picture to ignore. I would pay close attention to the earnings results coming out Monday morning and this could confirm my assessment or cause me to give pause. I would look for continued strong revenue growth and earnings growth to confirm that this company is continuing on its excellent past record. I like the latest quarter earnings that I have available, the past revenue growth is superb, the cash flow and balance sheet look nice, the valuation is excellent and the chart is impeccable. My only hesitation is the rather low trading volume...but that is only a small footnote to my evaluation. I cannot personally buy any shares as my system of waiting for a sale at a gain to purchase shares is holding me back! But then again there are so MANY stocks that I do like!

Thanks again for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Thursday, 15 July 2004

A Reader Writes "Check out LEXR"

Hello Friends! In one of my posts today, I discussed SanDisk, the Flash Memory Card manufacturer.

Maxx, from theGoldenCoast.com writes:

Lexar (LEXR) is one to also keep an eye on if you like Sandisk. LEXR also is in the flash market and its price typically correlates pretty closely to SNDK. I have held both in the past but currently I don't have a posistion in either. They are both worth keeping an eye on however.

Regards

maxx

This is a timely question, because just MOMENTS ago, LEXR

announced 2nd quarter results and is trading lower in after hours trading. For the quarter, they posted a loss of $(18.1) million or $(.23)/share vs a profit of $7.0 million or $.09 a year earlier. LEXR blamed "aggressive industry price cuts". If you read my earlier post, you will see that SNDK announced EXPANDING margins in the face of price cuts....looks like they are doing a lot of damange to LEXR.

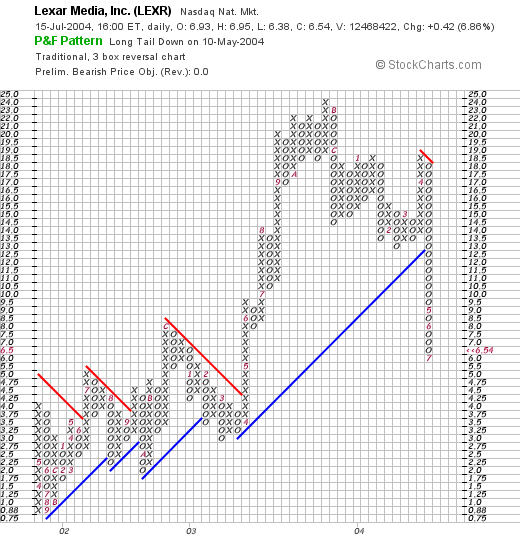

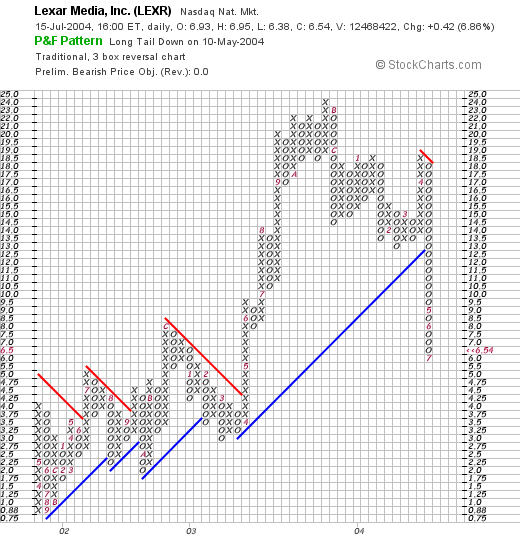

It is interesting that if we look at the Point & Figure chart on LEXR:

we can see that the stock actually broke down in mid-April when it fell through the $13 level, down from its peak at $24. The current news is confirmatory that this price move, that has in the past been quite strong, is now not a trend anymore.

Thanks for the opportunity of contrasting these two major media storage companies. I think the edge clearly goes to SNDK but Lexar has been a winning stock in the past. If you have any questions, or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

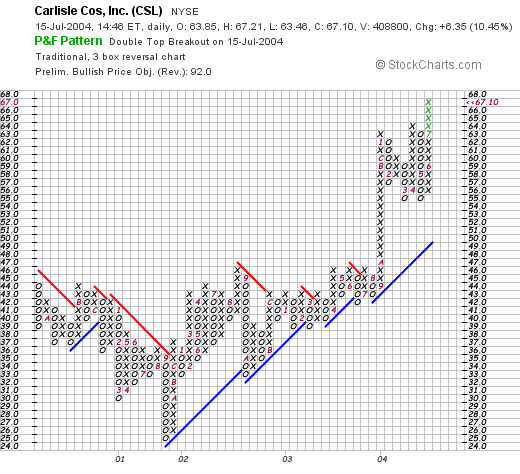

July 15, 2004 Carlisle Companies (CSL)

Hello Friends! Thanks so much for stopping by and giving me the opportunity to share some of my reflections of current stocks of interest. Please remember, however, that I am an amateur investor, so please remember to do your own investigation of all stock market ideas discussed on this website, and please consult with your professional investment advisors to make sure any ideas are appropriate and timely for you!

I came across the Carlisle Companies (CSL) while scanning the

top NYSE % gainers. I do not have any shares nor any options in this company. Currently, as I write, CSL is trading at $66.58, up $5.83 or 9.60% on the day.

According to the

Yahoo "Profile", Carlisle Companies, Inc. "...manufactures and distributes products across a range of industries, including, among others, roofing, construction, trucking, automotive, foodservice, industrial equipment, lawn and garden and aircraft manufacturing."

What is driving this stock higher is the

2nd quarter 2004 earnings report which was released this morning just prior to the opening of trading. CSL reported results for the quarter ended June 30, 2004, as follows: net sales of $640.7 million were 17% over 2nd quarter 2003 net sales of $545.8 million. Importantly, "organic" net sales growth accounted for essentially all of the sales growth. Currency effects were negligible, and acquisition effects were also under $5 million of the growth. Net earnings of $37.4 million, or $1.19/share were 31% over the prior year's results of $28.6 million or $.93/share. $1.8 million or $.06/diluted share WERE from discontinued operations...but still these were very nice results and the stock price has responded accordingly.

How about longer-term? Looking at a

"5-Yr Restated" financials from Morningstar.com, we can see that revenues have grown steadily since at least 1999 when they were $1.6 billion, increasing to $2.2 billion in the trailing twelve months (TTM). Earnings, which dropped from $3.14/share in 2000 to $.82/share in 2001, have rebounded nicely since then with $3.08/share in the TTM. Free cash flow has also been positive, ranging from $138 million in 2001 to $90 million in the TTM.

As reported by Morningstar.com, the balance sheet looks fine in my opinion with $30.1 million in cash and $603.6 million in other current assets, plenty to cover the $362.3 million in current liabilities and to make a significant dent in the $465.2 million in long-term debt.

How about valuation? Looking at

"Key Statistics" from Yahoo.com, we can see that this is a "mid-cap" stock with a market cap of $2.09 billion. The trailing p/e is reasonable at 21.74 with a forward p/e of just 16.28 (fye 31-Dec-05). The PEG is o.k. at 1.71 with a price/sales of only 0.86. This PEG should be declining if the current quarter's performance affects future estimates.

Yahoo reports 31.08 million shares outstanding with 29.20 million of them that float. There are only 345,000 shares out short as of 6/7/04, representing 3.52 trading days...so this is borderline significant in my opinion. I like to think of three trading days as my cut-off for significance in the short interest. Greater levels of short interest MAY and I should emphasize the MAY aspect of it...lead to a "short squeeze".

The company does pay a little dividend which IS nice...of $.88/share yielding 1.45%. The last stock split was a 2:1 in January, 1997.

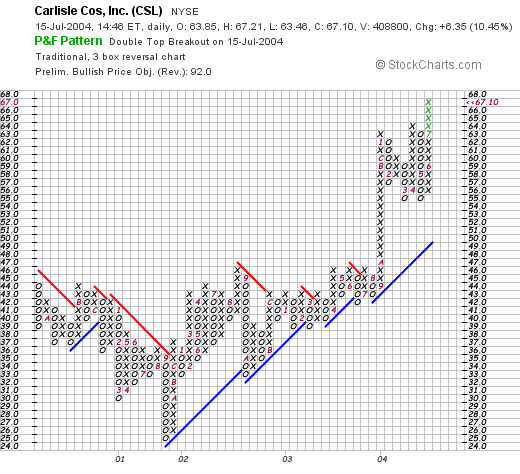

How does the chart look? If we take a look at the Point and Figure chart from Stockcharts.com:

we can see a steady improvement in price performance since November, 2002, when the stock bottomed at about $24/share. Since that time, the stock has been performing quite well and appears to be breaking out into new high ground as I write. Again, I am NOT a technician, so please take a look at the chart yourself!

Well what do I think? I like this stock a lot. The recent quarterly result is very pretty! The record of continued revenue growth is impressive and the balance sheet looks nice. Technically the stock has a nice chart and the valuation is reasonable. Why it even pays a dividend! Of course, I don't have ANY money to invest, but if I did, I probably WOULD nibble on a few of these shares!

Well what do I think? I like this stock a lot. The recent quarterly result is very pretty! The record of continued revenue growth is impressive and the balance sheet looks nice. Technically the stock has a nice chart and the valuation is reasonable. Why it even pays a dividend! Of course, I don't have ANY money to invest, but if I did, I probably WOULD nibble on a few of these shares!

Thanks so much for stopping by. If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

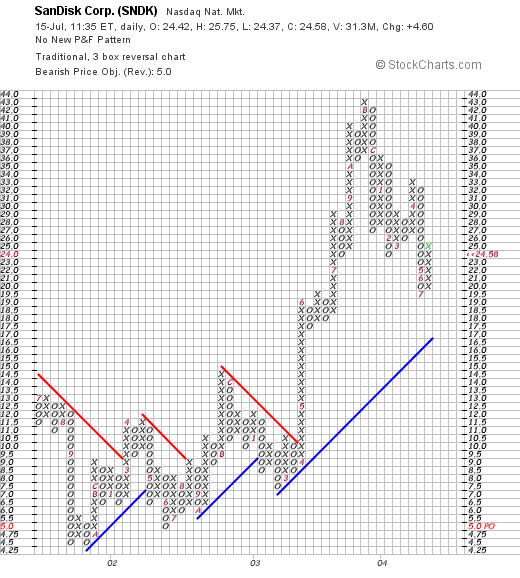

July 15, 2004 SanDisk (SNDK)

Hello Friends! Thanks so much for stopping by! If you are viewing this at another website, enjoy the post and come and visit

Bob's Advice on your next visit. As always, please remember that I am an amateur investor, so please do your own investigation of all stocks discussed on this blog and consult with your professional investment advisor to make sure the investment is timely and appropriate for you!

Looking at the

lists of top % gainers on the NASDAQ, I came across SanDisk (SNDK), a company that I am familiar with but that I do not currently own any shares or options. SNDK is trading, as I write, at $24.96, up $4.98 or 24.92% on the day. According to the

Yahoo "Profile", SanDisk "...designs, develops, manufactures and markets flast storage card products used in a variety of electronic systems." In my experience, these are the little memory cards that go into many of those digital cameras we all are using.

What is pushing the stock higher this morning, is the

2nd quarter 2004 earnings results which were reported after the close yesterday. Revenues rose 85% to $433 million from $234.6 million last year. Earnings for the quarter rose to $71 million or $.38/share from $41.3 million or $.26/share last year. Analysts apparently had been looking for the company to earn $.30/share and they beat this estimate handily. Pertinently, even with the "commodotization" of memory products, SanDisk's margins improved to 35% despite a 16% decline in the "average selling price per megabyte."

Looking longer-term, we can see from the

"5-Yr Restated" financials on Morningstar.com that revenue has grown steadily from $247 million in 1999, $602 million in 2000, dipping to $366 million in 2001, and then climbing to $1.08 billion by 2003.

Earnings, however, have been quite erratic in the past 5 years, from $.22/share in 1999, climbing to $2.06 in 2000, dropping to $(2.19) in 2001, but have climbed steadily since that time.

Free cash flow has also been improving recently, from $(98) million in 2001, $89 million in 2002, and up to $218 million in 2003.

The balance sheet, per Morningstar, is gorgeous! They have $1.3 billion in cash, enough to pay off the current liabilities of $346.8 million and the long-term liabilities of $176.0 million, about three times over! In addition, SNDK has $425.3 million in other current assets reported.

How about valuation? If we take a look at

"Key Statistics" from Yahoo.com, we can see that this is a Mid-Cap stock (if we use the definition of $2-$10 billion), with a market cap of $4.06 Billion. The trailing p/e is reasonable at 21.63 with a forward p/e of 16.11 (fye 28-Dec-05). Even NICER is the PEG which at 0.73 is downright reasonable!

Yahoo reports 161.48 million shares outstanding with 155.60 million of them that float. There are 31.46 million shares out short which represents 4.564 trading days as of 6/7/04. (Anything over 3.0 days is significant imho). Thus, we may be seeing a bit of a squeeze of the shorts in here.

No cash dividend is paid. The stock DID split 2:1 earlier this year, in February, 2004.

What does the chart look like? Looking at Stockcharts.com for a Point & Figure:

The stock was moving sideways between late 2001 through March, 2003, and then broke through a resistance level in April, 2003, at around $10/share and has headed higher since. The stock chart looks strong at this time, although it is off its highs set in November, 2003, of about $43/share.

So what do I think. Heck this is a great-looking stock! What is there NOT to like. The growth has been a bit inconsistent in around 2000-2001 time period, but recently has been quite strong. The latest earnings report was superb. The valuation is wonderful with a PEG of 0.73...and maybe dropping, the free cash flow is terrific, and the balance sheet looks nice. The only thing that does concern me is the dropping prices on these flash memory products but apparently, this company is handling this just fine!

Thanks again for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Wednesday, 14 July 2004

July 14, 2004 Genzyme (GENZ)

Hello Friends! Thanks so much for stopping by! And if you are reading this on theGoldenCoast.com, well that is almost as nice...I sure am flattered to participate in as powerful a website as that! Please remember that I am an amateur investor so do your own research on all stocks discussed on this website, and please consult with your professional investment advisor before making any investment decisions.

Genzyme (GENZ) is having a GREAT day in the market trading at $50.06 as I write, up $5.56 or 12.49% on the day. I do not own any shares or have any other positions in this stock. According to the

Yahoo "Profile", GENZ "...is a global biotechnology company with a product portfolio focused on genetic disorders, renal disease, osteoarthritis and organ transplant."

What drove the stock higher today was a

2nd quarter 2004 earnings report. Revenue for the quarter rose to $549.6 million from $347.7 million the year earlier. Net profit came in at $78.2 million or $.34/share compared with $70.8 million or $.32/share the prior year. In addition, the company raised revenue estimates for the full year and maintained full year earnings estimates of $1.65 - $1.75/share.

If we look longer term at a

"5-Yr Restated" financials statement from Morningstar.com, we can see that revenue has steadily grown from $772 million in 1999 to $1.8 billion in the trailing twelve months (TTM). Earnings, however, have been relatively flat during this period, with $.85/share reported in 1999, and $.43/share in the trailing twelve months. The current estimates (see above) of $1.65 to $1.75 would represent a significant improvement in the earnings picture.

Free cash flow, while variable recently, with $40 million in 2001, dropping to $(3) million in 2002, has improved significantly to $128 million in 2003, and $155 million in the TTM.

Morningstar reports that GENZ has $777.6 million in cash and $907.3 million in other current assets. This is plenty to cover the current liabilities of $923.0 million AND to make a nice dent in the $1.08 billion in long-term liabilities.

What about valuation? Looking at

"Key Statistics" from Yahoo, we can see that the Market Cap is a large $11.42 Billion. NO trailing p/e is reported but the forward p/e (fye 31-Dec-05) is a moderate 24.98 with a PEG of 1.60. A little rich but not bad imho.

Yahoo reports 226.52 million shares outstanding with 199.6 million of them that float. There are a LOT of shares out short, with 10.73 million of them reported short as of 6/7/04. This represents 5.38% of the float or 4.624 trading days. If we use 3 days as a cut-off...there is a bit of a risk of a squeeze to watch for.

No cash dividend is paid, and the last stock split was a 2:1 in June, 2001.

What about technicals? Taking a look at a point & figure chart from Stockcharts.com:

we can see that the stock has been moving higher since it broke through a resistance level in December, 2002. However, the chart DID break down in March, 2004, when it fell below $49 at a support level. Whether the stock continues to move higher from its current level is a wait and see. Would like to see this stock close above $52...to demonstrate the upward move is back on track...but then again, I am NOT a technician...so call it like you see it!

Overall, the stock is an interesting pick. The valuation is not perfect....the recent news is compelling with a great earnings report and estimates, the track record on earnings growth is less than perfect, and the technical aspects could be better. The balance sheet and free cash flow are solid however. I just SOLD a stock at a loss today...so I am NOT in the market for a new stock.

Thanks so much for bearing with me! If you have any questions or comments, please email me at bobsadviceforstocks@lycos.com and you are welcome to visit my main website at http://bobsadviceforstocks.tripod.com . Regards!

Bob

Newer | Latest | Older

Florida Rock Industries (FRK) is having a very nice day today trading currently at $42.21, up $2.04 or 5.08% on the day. I do not own any shares nor do I have any options in this stock. According to the Yahoo "Profile" on FRK, they operate "...principally in three business segments: construction aggregates, concrete products and cement and calcium products." I believe this is our first "rock" stock.

Florida Rock Industries (FRK) is having a very nice day today trading currently at $42.21, up $2.04 or 5.08% on the day. I do not own any shares nor do I have any options in this stock. According to the Yahoo "Profile" on FRK, they operate "...principally in three business segments: construction aggregates, concrete products and cement and calcium products." I believe this is our first "rock" stock.  On April 20, 2004, FRK announced their second quarter 2004 results. (I do not have a link for this as it came off of their website). Consolidated total sales for the quarter increased 40% to $228.6 million from $163.6 million the prior year. Net income came in at $24.5 million or $.56/share up from $16.3 million or $.37/diluted share a more than 50% increase. These are very nice results.

On April 20, 2004, FRK announced their second quarter 2004 results. (I do not have a link for this as it came off of their website). Consolidated total sales for the quarter increased 40% to $228.6 million from $163.6 million the prior year. Net income came in at $24.5 million or $.56/share up from $16.3 million or $.37/diluted share a more than 50% increase. These are very nice results.  Earnings per share have shown a nice progression from $1.07/share in 1999 to $2.60/share in the TTM. Also nice, the company DOES pay a small dividend and it has been increasing it from $.16/share to $.61/share in the TTM...and increasing it EACH year since 1999. Free cash flow has also been excellent and INCREASING from $54 million in 2001 to $104 million in the TTM.

Earnings per share have shown a nice progression from $1.07/share in 1999 to $2.60/share in the TTM. Also nice, the company DOES pay a small dividend and it has been increasing it from $.16/share to $.61/share in the TTM...and increasing it EACH year since 1999. Free cash flow has also been excellent and INCREASING from $54 million in 2001 to $104 million in the TTM.

According to the

According to the  Stryker

Stryker  How about valuation? If we look at

How about valuation? If we look at

So what do I think? I really like this stock....but I do not have any money available to buy shares :). The latest quarterly report was strong, they have announced an increase in their own estimates for 2004, the record on Morningstar is impeccable with a steady growth in revenue, earnings, and even dividends. The free cash flow is excellent. The balance sheet is nice, and the current quarterly report points out they have paid off their debt, the valuation IS a bit steep with a PEG over 2.0, but sometimes you just GOT to pay for quality, but this is a draw-back. And the graph looks very strong. Looks like a winner to me!

So what do I think? I really like this stock....but I do not have any money available to buy shares :). The latest quarterly report was strong, they have announced an increase in their own estimates for 2004, the record on Morningstar is impeccable with a steady growth in revenue, earnings, and even dividends. The free cash flow is excellent. The balance sheet is nice, and the current quarterly report points out they have paid off their debt, the valuation IS a bit steep with a PEG over 2.0, but sometimes you just GOT to pay for quality, but this is a draw-back. And the graph looks very strong. Looks like a winner to me!

On July 7, 2003, I

On July 7, 2003, I  On July 8, 2003, I

On July 8, 2003, I  Yesterday, while scanning the

Yesterday, while scanning the  We will have the 2nd quarter 2004 earnings results in just a couple of days, but let's take a look at the

We will have the 2nd quarter 2004 earnings results in just a couple of days, but let's take a look at the

This is a timely question, because just MOMENTS ago, LEXR

This is a timely question, because just MOMENTS ago, LEXR

I came across the Carlisle Companies (CSL) while scanning the

I came across the Carlisle Companies (CSL) while scanning the  According to the

According to the  How about longer-term? Looking at a

How about longer-term? Looking at a

Well what do I think? I like this stock a lot. The recent quarterly result is very pretty! The record of continued revenue growth is impressive and the balance sheet looks nice. Technically the stock has a nice chart and the valuation is reasonable. Why it even pays a dividend! Of course, I don't have ANY money to invest, but if I did, I probably WOULD nibble on a few of these shares!

Well what do I think? I like this stock a lot. The recent quarterly result is very pretty! The record of continued revenue growth is impressive and the balance sheet looks nice. Technically the stock has a nice chart and the valuation is reasonable. Why it even pays a dividend! Of course, I don't have ANY money to invest, but if I did, I probably WOULD nibble on a few of these shares! Looking at the

Looking at the  What is pushing the stock higher this morning, is the

What is pushing the stock higher this morning, is the  Earnings, however, have been quite erratic in the past 5 years, from $.22/share in 1999, climbing to $2.06 in 2000, dropping to $(2.19) in 2001, but have climbed steadily since that time.

Earnings, however, have been quite erratic in the past 5 years, from $.22/share in 1999, climbing to $2.06 in 2000, dropping to $(2.19) in 2001, but have climbed steadily since that time.

Genzyme (GENZ) is having a GREAT day in the market trading at $50.06 as I write, up $5.56 or 12.49% on the day. I do not own any shares or have any other positions in this stock. According to the

Genzyme (GENZ) is having a GREAT day in the market trading at $50.06 as I write, up $5.56 or 12.49% on the day. I do not own any shares or have any other positions in this stock. According to the  What drove the stock higher today was a

What drove the stock higher today was a