Stock Picks Bob's Advice

Monday, 15 May 2006

"Trading Transparency" JLG

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

As part of my trading strategy, I am selling stocks that hit 8% losses. After a sale, I 'sit on my hands' and leave the proceeds in cash (or as more accurately is the case, I pay down my margin.) I don't second guess what the market is telling me through my portfolio.

This afternoon, with the market turning down once again, my JLG stock hit a sale point. I had purchased 320 shares on 1/12/06 (note that my latest purchases are being sold first), at a cost basis of $25.81. A few moments ago, I sold all 320 shares at $23.67 for a loss of $(2.14) or (8.3)%. No matter how much I

like JLG or CNXS or ANGO, these stocks were sold because my trading strategy dictated their sale. And out they went.

I shall be applying the proceeds to my shrinking margin level, and waiting for a stock to hit an appreciation target instead of a sale point, to add a new position to the portfolio. Meanwhile, I am battening the hatches.

Thanks so much for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Please also come and visit my

Stock Picks Bob's Advice Podcast Site.

Bob

"Trading Transparency" CNS Inc. (CNXS)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of the things I try very hard to do is to 'practice what I preach' :). As much as I 'like' my holdings, I am pretty cold-hearted and will part with them as they hit sale points on the downside. Case in point is CNS, (CNXS), which a few moments ago, hit my 8% loss limit on the downside and was sold. You can see that in the face of a market correction, the first stocks to go are the most recent purchases that are most vulnerable for a sale.

I just purchased these 240 shares on 5/5/06, at a cost basis of $24.44/share. A few moments ago I sold my 240 shares at $22.37, for a loss of $(2.07) or (8.5)% since purchase.

Again, as part of my strategy, I shall refrain from reinvesting the proceeds until such time as I have a sale of a portion of a stock at a gain, on what I call good news. You can see that my portfolio, which if I didn't have any margin, would currently be moving into cash as the market declined. It will be interesting to see how this works out as things proceed.

In any case, thanks so much for stopping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Also, remember to stop by and visit my

Stock Picks Bob's Advice Podcast Site.

Bob

Sunday, 14 May 2006

"Looking Back One Year" A review of stock picks from the week of February 21, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of the weekend tasks I like to address on this website, is to look at past stock picks and find out how they 'turned out'. For the purposes of this review, I assume a 'buy and hold' strategy of stock purchases. However, in real life, I actually recommend and practice a disciplined portfolio management system that requires me to sell stocks if they hit an 8% loss after an initial purchase, and to sell 1/6th of my holdings of stocks as they hit targeted appreciation points. This will definitely change actual investment performances however, for the sake of this review, a 'buy and hold' strategy is an easier approach to get a feel for the performance of these stock picks.

During the week of February 21, 2005, I only made one stock 'pick' which in itself was a revisit of an earlier post. On February 26, 2005, I

picked Synaptics (SYNA) for Stock Picks Bob's Advice when it was trading at $24.33. Synaptics closed on May 12, 2006, at $24.42, up $.09 from the initial pick, virtually unchanged, with a calculated gain of .4% since being 'picked'.

On April 20, 2006, Synaptics

reported 3rd quarter 2006 results. For the quarter ended March 31, 2006, net revenue came in at $40.4 million, down from $56.7 million for the same quarter the prior year. Net income for the quarter was $1.6 million or $.06/diluted share, compared with $11.7 million or $.38/diluted share in the third quarter of the 2005 fiscal year.

So how did I do that week? Well, there was only one stock 'picked'; ironically, I had a very slow week in picking stocks this week as well. And that stock, Synaptics, had a 0.4% gain. Nothing to write home about I guess.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Also, please remember to stop by and visit my

Stock Picks Bob's Advice Podcast Site where you can listen to me discuss many of the same stocks on my blog and also answer some readers questions regarding my trading strategy and individual stocks.

Bob

Posted by bobsadviceforstocks at 10:58 PM CDT

|

Post Comment |

Permalink

Updated: Sunday, 14 May 2006 10:59 PM CDT

Friday, 12 May 2006

"Trading Transparency" Dynamic Materials (BOOM)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

A few moments ago I sold my 200 shares of Dynamic Materials (BOOM) at $33.12. Due to my "day-trade" in BOOM last month, the basis for these shares is considered $36.89 and the purchase date of 4/27/06. Thus, with this basis, my shares have incurred a loss of $(3.77) or (10.2)%. Thus, regardless of how much I like this particular company, my trading discipline demands that the shares be sold. Further, with the sale of shares at a loss, I shall be 'sitting on my hands' with the proceeds, moving from equities into cash. (or less margin as the case is actually). Again, I am waiting for a sale at a gain, what I call "good news" to add another position to my portfolio.

Thanks so much for stopping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Also, please be sure to visit my

Stock Picks Bob's Advice Podcast Site where I talk about many of my picks as well as my investing strategy.

Bob

Thursday, 11 May 2006

"Trading Transparency" AngioDynamics (ANGO)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

A few moments ago, I sold my 200 shares of AngioDynamics at $27.85. This was one of my latest purchases, having purchased these shares 4/28/06 at a cost basis of $30.30. Thus, I had a loss of $(2.45) or (8.1)% on this purchasse. Having hit my 8% loss limit, all of my 200 shares were sold. With my system of avoiding 'compounding' my losses, I shall be sitting on my hands with these proceeds, waiting for a sale on 'good news' or a sale that is at a gain in one of my other positions.

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to drop me a line at bobsadviceforstocks@lycos.com or just leave them on the blog. Also, be sure to stop by and visit my

Stock Picks Bob's Advice Podcast Site.

Bob

Wednesday, 10 May 2006

Readers Write: Feedback to Lots of Questions and Comments!

Click

HERE FOR MY PODCAST ON READER FEEDBACKI touch on Hansen (HANS) first and then answer a few questions and comments about my blog and stock picking.

Bob

Sunday, 7 May 2006

JLG Industries (JLG) Weekend Trading Portfolio Analysis

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Another of the tasks that I like to accomplish on weekends is to take a closer look at the actual stocks that I hold in my trading portfolio. I am currently up to 23 positions, and reviewing one every other week, going alphabetically, should take me almost one year.

Two weeks ago I

reviewed Healthways on Stock Picks Bob's Advice. Going alphabetically, I am now up to JLG Industries (JLG). I currently own 320 shares of JLG which were purchased 1/12/06 with a cost basis of $25.81. I have yet to sell any of these shares. JLG closed at $29.54 on 5/5/06, for an unrealized gain of $3.73 or 14.5% since my purchase. Currently, planned sales would be to sell all of my shares if the stock hit an 8% loss or dropped to .92 x $25.81 = $23.75. On the upside, if the stock should appreciate 30%, I plan on selling 1/6th of my shares or 53 shares. The first targeted sale is at 1.3 x $25.81 = $33.55.

I last

reviewed JLG on Stock Picks Bob's Advice when the stock was trading at $51.55/share. JLG split its stock 2:1 on March 28, 2006, giving this pick an effective price of $25.78. Let's take another look at this holding of mine and see if the numbers are still promising!

1. What does the company do?According to the

Yahoo "Profile" on JLG, this company

"...provides access equipment and highway-speed telescopic hydraulic excavators. The company operates through three segments: Machinery, Equipment Services, and Access Financial Solutions."

2. How about the latest quarterly result?On February 22, 2006, JLG

reported 2nd quarter 2006 results. Revenue in the quarter ended January 29, 2006, grew 40% to $494 million, from the prior year same period. Net income was up 265% to $27.4 million from $7.5 million, and per share this year the company reported $.52/share, up over 200% from last year's $.17/share.

3. How about longer-term results?The

Morningstar.com "5-Yr Restated" financials on JLG shows that revenue actually declined from $1.0 billion in 2001 to a low of $751 million in 2003. Since 2003, however, revenue has resumed its steep climb to $1.2 billion in 2004, $1.7 billion in 2005 and $2.0 billion in the trailing twelve months (TTM).

Earnings also have been a bit erratic dropping from $.40/share in 2001 to a loss of $(1.18)/share in 2002. However, the company turned profitable at $.15/share in 2003 and has been steadily improving this number with $.60/share reported in 2005 and $1.14/share in the TTM.

The company does pay a small dividend which was $.02/share in 2001, $.01/share in 2002 and the same since then. The company has been expanding its float somewhat with 84 million shares outstanding in 2001, growing to 93 million in 2005 and 106 million in the TTM.

Free cash flow, which was a negative $(121) million in 2003, improved to $(24) million in 2004, turned positive at $96 million in 2005 and grew to $99 million in the TTM.

The balance sheet looks solid with $183.3 million in cash and $700.4 million in other current assets, which, when balanced against the $360.4 million in current liabilities, gives us a 'current ratio' of 2.45. In addition, JLG has $325.3 million in long-term liabilities. Thus the current assets are sufficient to easily cover the current liabilities and are enough to also pay off all of the long-term liabilities as well.

4. How about some valuation numbers on this stock?

4. How about some valuation numbers on this stock?Reviewing

Yahoo "Key Statistics" on JLG, we find that the company is a large cap stock with a market capitalization of $3.12 billion. The trailing p/e is a moderate 27.20, with a forward p/e even nicer at 16.50 (fye 31-Jul-07 estimated). Thus, with the steady growth, the PEG ratio (5 yr expected) comes in at 1.27.

According to the

fidelity.com eresearch website, JLG is in the "Farm/Construction Machinery" industrial group. Within this group, JLG is moderately priced with a Price/Sales ratio of 1.5. Topping this group is Joy Global (JOYG) with a ratio of 3.9, next are JLG and Caterpillar (CAT) both with ratios of 1.5, Deere (DE) at 1.0, Terex (TEX) at 1.0 and AGCO (AG) at 0.5.

Returning to Yahoo, we find there are 105.51 million shares outstanding and 103.60 million that float. Currently 6.99 million shares (4/10/06) are out short representing 6.9% of the float or 5.3 trading days of volume. Using my own 3 day rule on short interest, I think this level of short sellers

is significant and may add to a move higher in the stock especially if the upcoming earnings are good.

Yahoo reports the estimated forward dividend is $.02/share yielding 0.2%. The last stock split was a 2:1 split on March 28, 2006.

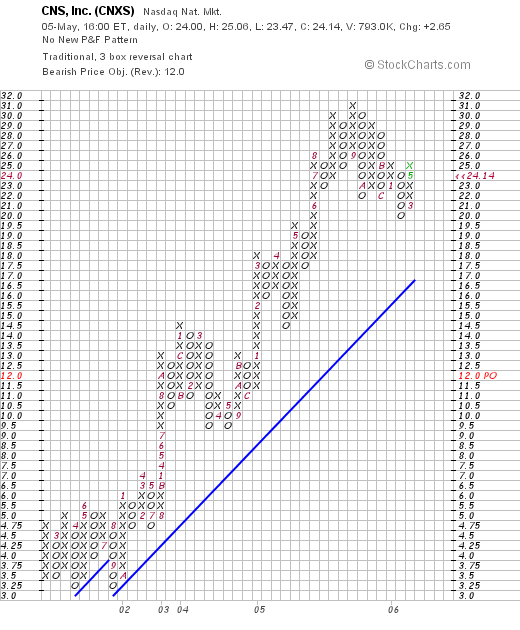

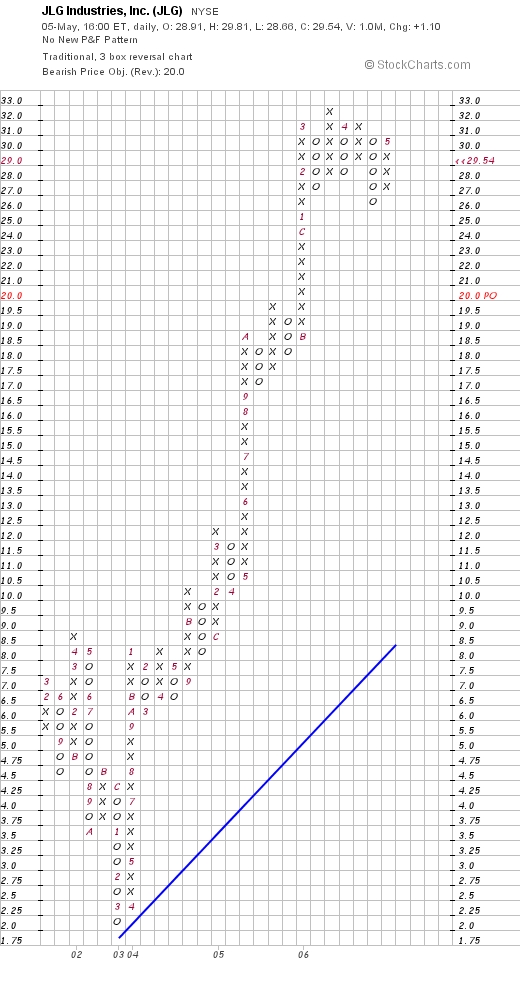

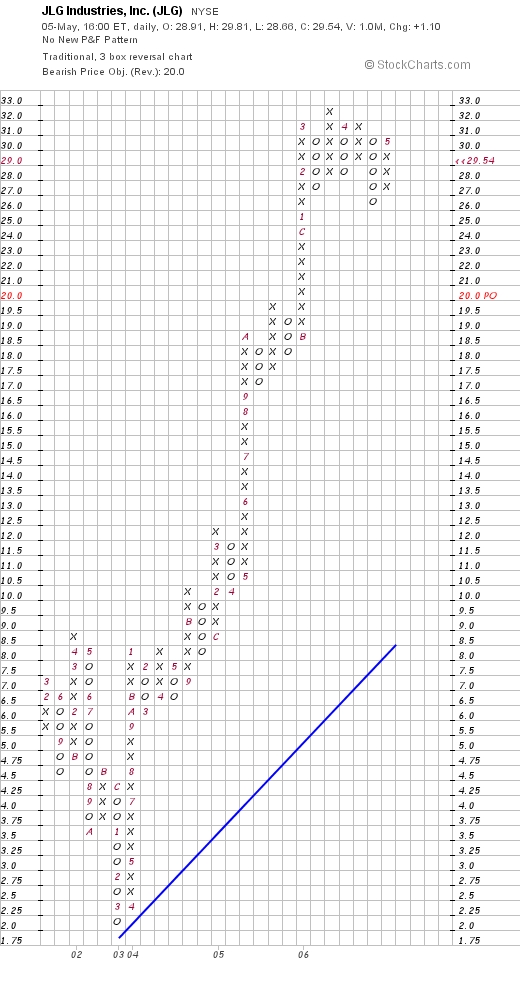

5. And what does the chart look like?If we look at the

"Point & Figure" chart on JLG from StockCharts.com:

We can see that the price dropped from $8.50 in April, 2002, to a low of $2.00/share in March, 2003. However, starting with a sharp rise in April, 2003, from $2.25 to $8.00 in January, 2004, the stock has been moving strongly higher to its current level of $29.54. If anything, with the stock flying high above its "blue support line" the stock looks a bit over-extended in price.

6. Summary: What do I think?

First of all, I am terribly biased about this stock as I own shares! But reviewing this analysis, the company had a terrific earnings report and has another one coming in a couple of weeks. Hopefully that report will be well-received. The Morningstar.com page looks nice for the past few years, after a couple of years of week results between 2001 and 2003. Earnings have been growing, the company pays a small dividend, and free cash flow is positive and improving. On a negative not, the company has been issuing shares, with a small amount of dilution effects. Finally, the balance sheet is solid and the chart looks strong. On a valuation basis, the forward p/e is under 20, the PEG is about 1.25, and the Price/Sales ratio looks reasonable within its group.

I still like JLG.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com or just go ahead and leave your messages right on the blog. Please also remember to stop by and visit my Stock Picks Bob's Advice Podcast Website!

Bob

"Looking Back One Year" A review of stock picks from the week of February 14, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

The weekend is drawing to a close and I still haven't done all of my homework :(. So hear goes!

First of all, one of the tasks I give myself each weekend is a review of past stock picks from a period about a year earlier. I am actually up to about 60 weeks out. In this review I assess what would have happened if I had purchased the stocks I mention in equal dollar amounts from that period of time and if I had held them to the present. What is called a "buy and hold" approach.

In fact, I do not follow or advocate this strategy. I have implemented a strategy in my own trading account that includes selling stocks quickly after a purchase if they drop 8%, and selling portions of my stocks at targeted appreciation levels. This strategy would definitely affect the performance of any portfolio using these stock picks. But for the sake of ease of measurement, I like to assume this "buy and hold" strategy to determine performance.

On February 15, 2005, I

picked Ansys (ANSS) for Stock Picks Bob's Advice at $37.03/share. ANSS closed at $56.88 on May 5, 2006, for a gain of $19.85 or 53.6% since posting.

On April 27, 2006, Ansys

reported 1st quarter 2006 results. Revenue grew nicely to $46 million from $37.6 million in the same quarter last year. Net income was up to $12.9 million or $.38/diluted share, up from $9.7 million or $.29/diluted share in the same quarter last year.

On February 18, 2005, I

posted Allscripts Healthcare Solutions (MDRX) on Stock Picks Bob's Advice when it was trading at $13.16. MDRX closed at $18.35 on May 5, 2006, for a gain of $5.19 or 39.4%.

On May 2, 2006, MDRX

announced quarterly results. Total revenue for the quarter ended March 31, 2006, was $42.2 million, up strongly from revenue of $26.2 million in the same period the prior year. Net Income, however, was flat at $1.3 million or $.03/diluted share, unchanged from $1.3 million or $.03/diluted share the prior year same period. Without growth in earnings, the stock gets an automatic thumbs down.

So how did these two picks do? In a word, terrific. In fact, averaging the performance of these two picks results in an average gain of 46.5%. Please remember that past performance is no guarantee for future stock appreciation. But that was pretty nice!

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Also, be sure to visit my

Stock Picks Bob's Advice Podcast Website.

Bob

Saturday, 6 May 2006

CNS, Inc. (CNXS) Revisiting a Stock Pick

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Yesterday I had a "permission slip" generated when I sold a portion of my ResMed (RMD) at a gain. Thus, being under my 25 position portfolio maximum, I looked through the

list of top % gainers on the NASDAQ and came across CNS (CNXS) which was having a great day, and actually closed at $24.14, up $2.65 or 12.33% on the day. Earlier in the day I purchased 240 shares for $24.395. I moved my portfolio up to 23 positions, two under the maximum.

CNS is what I call an "old favorite" of mine, meaning I have previously written up this stock on the blog. On April 29, 2005, almost exactly one year ago, I

wrote up CNS on Stock Picks Bob's Advice when it was trading at $18.09. With yesterday's close at $24.14, this stock has appreciated $6.05 or 33.4% since posting.

Let's take an updated look at this company so I can explain why I picked this stock to purchase in my trading portfolio!

1. What does this company do?According to the

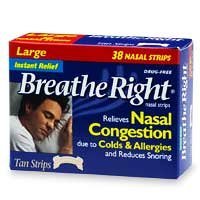

Yahoo "Profile" on CNS Inc., the company

"...engages in developing and marketing consumer health care products, including Breathe Right branded products focused on better breathing and FiberChoice branded products focused on digestive health."

(Does anyone else see the irony of selling shares in a company treating sleep apnea machines, and buying shares in a company that makes nasal strips and sprays to treat snoring?)

2. How about their latest quarterly result?

2. How about their latest quarterly result?In fact, it was the

announcement of 4th quarter 2006 results Thursday, after the close of trading, that pushed the stock higher on Friday! As reported:

"Net sales for the fourth quarter of fiscal 2006 were $32.1 million, up 13% compared to $28.4 million in the same period last year. Net income for the fourth quarter grew 14% to $4.7 million, or $0.32 per diluted share, compared to $4.1 million, or $0.28 per diluted share, for the fourth quarter of fiscal 2005."

As an added plus, the company boosted the quarterly dividend 17% from $.06/share to $.07/ share for shareholders of record as of May 26, 2006.

3. What about longer-term results?Regular readers of this blog will know that this is my critical part of an assessment of a stock. Consistent good results = quality. At least that is my perspective!

Reviewing the

"5-Yr Restated" financials from Morningstar.com, there is a gap for the 2002 results (? changing fiscal years?), but the company had revenue of $84 million in 2001, dropping to $79 million in 2003, but then increasing steadily to $94 million in 2005 and $109 million in the trailing twelve months (TTM).

Likewise, earnings which were $.01/share in 2001, climbed to $.46/share in 2003, $.59/share in 2004, $.93/share in 2005 and $1.11/share in the TTM.

The company initiated dividends in 2004 at $.12/share and has raised dividends each year since. The number of shares outstanding has remained stable at 14 million.

Free cash flow, while a bit erratic, has been positive with $19 million in free cash flow in 2003, $15 million in 2005, and $13 million in the TTM.

The balance sheet is quite solid imho, with $59.7 million in cash alone, enough to cover the $18.3 million in current liabilities more than 3x over. Added to the $29.1 million in other current assets, the current ratio works out to 4.9. (over 1.5 is generally considered 'healthy'). Morningstar shows NO long-term liabilities at all!

4. What about some valuation numbers on this company?Looking at

Yahoo "Key Statistics" on CNS, we see that this is a small cap stock with a market capitalization of $341.92 million. The trailing p/e is a very moderate 21.81, with a forward p/e (fye 31-Mar-07) estimated at 18.86. Thus, the PEG (5 yr expected) is quite nice at 1.16.

According to the

Fidelity.com "eresearch" website, CNXS is in the "Medical Appliances/Equipment" industrial group, and its Price/Sales ratio of 3.3 places it on the low side with St. Jude (STJ) topping the list at 5.1, Zimmer (ZMH) at 4.6, Biomet (BMET) at 4.5, followed by CNXS at 3.3, Edwards Lifesciences (EW) at 2.8.

Yahoo reports 14.16 million shares outstanding with 12.98 million that float. Interestingly, as of 4/10/06 there were 1.77 million shares out short representing 11.60% of the float or 12 trading days of volume (the short ratio). With the sharp rise yesterday on good earnings results, we may have been observing a bit of a squeeze on the short-sellers scrambling to cover their bet against the company.

As already noted, the company pays a dividend of $.28/share with a forward estimated yield of 1.3%. According to Yahoo, the last stock split was a 2:1 split on June 23, 1995.

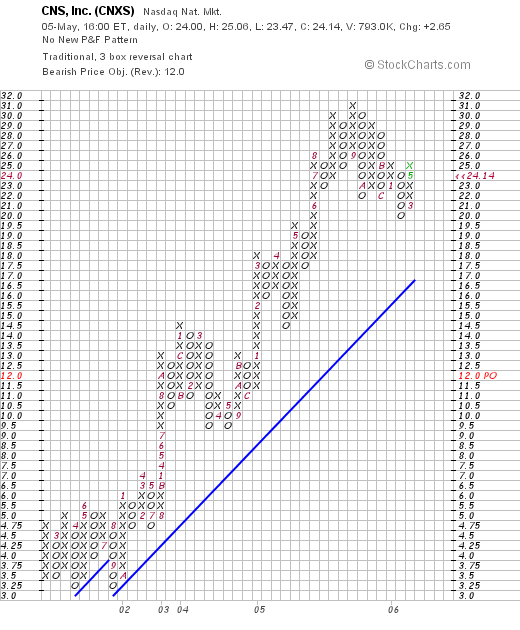

5. What does the chart look like?Looking at the

"Point & Figure" chart on CNXS from StockCharts.com, we can see the stock consolidating between $4.75 and $3.00 between February, 2001, and September, 2001. In December, 2001, the stock broke through resistance at $4.75 and has been moving higher since. Recently the stock has pulled back from the $31 level, dropping to the $20 level. However, the stock appears well above support levels and does not appear to have broken down in terms of price momentum.

6. Summary: What do I think?

Let's try to put this all together. First of all, I do own some shares (as of yesterday) of this stock. But I first wrote this one up a year ago and it subsequently appreciated 30% in price. The stock made a good move yesterday on a solid earnings report. Nothing spectacular but just the usual steady earnings growth, steady revenue growth, and an added plus of a raised dividend. The past several years have also seen steady growth.

The valuation is quite reasonable with a p/e at 21 with a PEG just over 1.1. The Price/Sales ratio isn't too rich on what appears to be a rather arbitrary group assignment. The company is generating free cash and has a beautiful balance sheet with lots of cash and NO long-term debt. The company even pays a dividend and is raising it as well. The chart looks pretty strong. And there are lots of short-sellers that need to cover if the stock continues to move higher.

On the downside this may be a "two-hit wonder" with just two main products, the nasal strips and the fiber tablets. However, the products are well-regarded and the management appears able to continue to manage these assets in a productive fashion.

I like the stock enough to buy it :).

Thanks so much for stopping by and visiting! If you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Please be sure to come and visit my Stock Picks Bob's Advice Podcast Site where you can hear me discuss more about many of the same stocks in the blog!

Bob

Friday, 5 May 2006

CNS, Inc. (CNXS) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Earlier today I sold 30 shares (1/6th of my position) of ResMed (RMD) which hit a 60% appreciation target. Thus, with the second targeted sale of this stock at a gain, I had the "permission" to add a new position in my trading portfolio.

Looking through the

list of top % gainers on the NASDAQ, I saw that an old favorite of mine, CNS (CNXS) was hitting the top % list on good earnings news. The Morningstar report looked good to me so I added this stock to my portfolio, purchasing 240 shares of CNXS at $24.40. As I write, the stock is now trading at $24.56/share, up $3.07 or 14.29% on the day.

I will try to get around to doing an updated review on this stock later today. Meanwhile, thanks again for visiting. Please feel free to leave comments here or email me at bobsadviceforstocks@lycos.com if you have any comments, questions, or any other thoughts you would like to share with me! As always, remember to also stop by and visit my

Stock Picks Bob's Advice Podcast Site.

Bob

Newer | Latest | Older

During the week of February 21, 2005, I only made one stock 'pick' which in itself was a revisit of an earlier post. On February 26, 2005, I

During the week of February 21, 2005, I only made one stock 'pick' which in itself was a revisit of an earlier post. On February 26, 2005, I  On April 20, 2006, Synaptics

On April 20, 2006, Synaptics

Two weeks ago I

Two weeks ago I  I last

I last  4. How about some valuation numbers on this stock?

4. How about some valuation numbers on this stock?

On February 15, 2005, I

On February 15, 2005, I  On April 27, 2006, Ansys

On April 27, 2006, Ansys  On February 18, 2005, I

On February 18, 2005, I  CNS is what I call an "old favorite" of mine, meaning I have previously written up this stock on the blog. On April 29, 2005, almost exactly one year ago, I

CNS is what I call an "old favorite" of mine, meaning I have previously written up this stock on the blog. On April 29, 2005, almost exactly one year ago, I  2. How about their latest quarterly result?

2. How about their latest quarterly result? Likewise, earnings which were $.01/share in 2001, climbed to $.46/share in 2003, $.59/share in 2004, $.93/share in 2005 and $1.11/share in the TTM.

Likewise, earnings which were $.01/share in 2001, climbed to $.46/share in 2003, $.59/share in 2004, $.93/share in 2005 and $1.11/share in the TTM. According to the

According to the