Stock Picks Bob's Advice

Tuesday, 10 October 2006

A Reader Writes "I do have a few questions about your mechanics."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I was getting ready to get to sleep when checking my mail, I found a very nice letter from Keith H. who writes from Melbourne, Floriday. I decided if Keith was so kind to write, to include some of my thoughts in his presentations to his stock club, well I could do no less than respond to his questions as soon as I got them!

Keith wrote:

Keith wrote:

"Hey Bob

This is Keith H. from Melbourne, Fl again. Sorry I have not written in a while. I have been recommending your podcast and blog to my IBD group....I hope they are listening. I even used you in one of talks on Selling Strategies (I included the presentation). I really like your disipline and that is what I try to teach them.

I do have a few questions about your mechanics.

1. Do you always buy in the same dollar amounts?

2. Are you on a buy or sell signal right now? I know you have said you are not buying anything at the moment but is that because you are on a sell signal and none of your stocks have given a buy signal or you are fully invested (whatever that means to you).

3. Do you have to get a buy signal for each purchase? For example: let's say we are in a bear market and you are down to 6 stocks and have lots of cash. You finally get a buy signal and buy a stock. Are you still on a buy signal or did you just satisfy that buy signal with a purchase and now have to wait for another buy signal? Or are you on a buy signal until you get a sell signal?

4. Is it a buy signal or sell signal when a stock hits a profitable trailing stop?

5. Have you ever thought of using Leaps instead of buying the stock so you are not on margin?

6. Have you created a spreadsheet to manage your portfolio and your buy, sell and trailing stops points?

I have included an interesting spreadsheet for you that I created. Not sure it will make a lot of sense with me not walking you through it but the Yearly Returns tab shows the yearly returns of various investment strategies (this was to show them stick with a strategy and over time it will work). I also showed them risk adjusted returns. And on tab % Gain Dif, I tried to show them the importance of what an addition % or 2 would mean to your portfolio over time.

Keep up the good work. I listen to your podcast on my daily walks. I just wish iTunes would post you podcast in a more timely manner.

Keith"

First of all, I thank you for writing, reading, and listening to my podcasts! You have absolutely NOTHING to apologize about! If anything, I would like to thank you for your enthusiasm and sharing my ideas with your stock club. You will have to let me know if any of the stocks I have presented have made it into your club's portfolio and how they turned out. Not everything I write about turns out profitable!

Let me try to answer your questions in order:

1. I don't always buy in the same dollar amount. Recently I have been trying to do this...hopefully buying about $5,000 worth of stock on each new position. Unfortunately, I do abuse this account....using funds for miscellaneous household expenses and I make my car payments out of this stock fund. This is a real account for me....probably shouldn't be doing this when I am writing a blog though. However, my trading rules are rather strictly followed (except for a shot at Kendle which lost me some money!). Regardless of what I have been doing, I would suggest that people do make equal dollar purchases.

2. Am I on a buy or sell signal right now? The answer is no. I am at 11 positions I recently wrote about. Unfortunately, I am flirting with two sales of stocks....my Healthways (HWAY) is acting ill after reporting a shortfall on revenue expectations due to some Medicare contracts that apparently got delayed, and my ResMed (RMD) stock is flirting with a 30% gain level which would signal me to sell (I have sold twice at 30 and 60% levels...so this would be a 50% retracement). Looking through my other stocks, my Coach stock is near a sale at a gain....my last sale, if you can believe it (!) was at a 300% gain, I am at a 329% gain now, and would sell 1/6th of my 102 shares if it hits a 360% gain. (with a cost basis of $8.33 (!), that works out to 4.60 x $8.33 = $38.32. COH closed today at $35.79...so that isn't too far off.) The only other stock that is possibly close to a sale at a gain is my Wolverine World Wide (WWW) which has a 16.84% gain. I shall not be selling until it either hits a loss of 8%, or appreciates to a 30% gain, which, with my cost basis of $23.55, would be at 1.3 x $23.55 = $30.62. WWW closed at $27.51 today....so that might not be too far off (?). Insofar as being 'fully invested', as I have indicated, my full investment is 25 positions, so at 11 positions, I am far from fully invested.

3. Do I have to get a buy signal for each purchase? Yes. However, you do talk about 'my exception'. That is, if I am at a minimum number of positions in my portfolio, then I will get a buy signal if either one of my six stocks sells on the downside...as I need to replace it, or if one of the six stocks hits an appreciation target. The buy signal, as I employ it, only allows me to buy one stock. And that stock needs to be on the top % gainers THAT day. How is THAT for an arbitrary decision?

4. If a stock hits a profitable trailing stop, that means it has declined from an even higher level, and I still call that "bad news". I only get an appreciation buy signal when a stock breaks into new territory and I sell 1/6th of my holding. When a stock pulls back to that trailing appreciation target (1/2 of it highest appreciation target), then that is definitely "bad news" and once again I sit on my hands unless my portfolio is at a minimum number of positions.

5. LEAPS....perhaps. But it isn't something I do with this portfolio. I have had a miserable track record with options. But that doesn't mean somebody else could do the same thing with LEAPS that I do with stocks using some of the same criteria. It might even work. It just isn't what I do.

6. Spreadsheet? No, unfortunately. I literally scan through each of my holdings, and Fidelity has a wonderful online reporting system that shows all of my sales, cost basis, current % gain/loss etc. I end up practically counting on my fingers going 30, 60, 90, 120%, etc. do figure out if I am near a sale target. Probably could do this a whole heck of a lot better....but you know I really AM an amateur. I am serious about that. I just love stocks.

p.s. I took a look at your spreadsheet you created. I am absolutely flattered to be in you PowerPoint presentation. I hope that I am helpful and have earned that place. One thing I really could do is to use a disciplined spread sheet with my purchases/sales and be able to present a more accurate performance evaluation of my trading portfolio. That I shall save for the future!

Thanks again for visiting!

If any of you have questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Bob

Johnson Controls (JCI) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

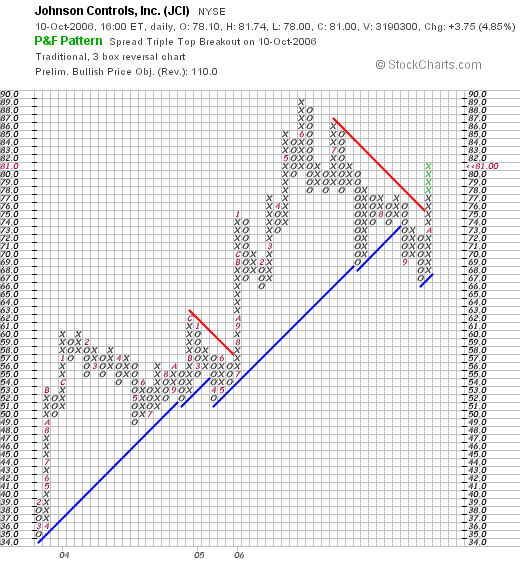

This blog is entering its fourth year (!) and I am starting to see some recurring names among the stocks making the lists. Johnson Controls made the list of top % gainers today, closing at $81.00, up $3.75 or 4.85% on the day. I do not own any shares of JCI, but a couple of my kids have a few shares (a lot less than even 100 shares total).

I first posted Johnson Controls on Stock Picks Bob's Advice on July 9, 2004, when the stock was trading at $53.24. With today's close at $81, this represents a gain of $27.76 or 52.1% since the original post.

I first posted Johnson Controls on Stock Picks Bob's Advice on July 9, 2004, when the stock was trading at $53.24. With today's close at $81, this represents a gain of $27.76 or 52.1% since the original post.

Almost exactly one year ago, on October 12, 2005, I "revisited" Johnson Controls (JCI) on Stock Picks when the stock was trading at $63.60. With today's close at $81.00, this still represents a gain of $17.40 or 27.4% since posting this stock a year ago on this blog.

Let's take another look at this company and see if it still deserves a spot on this blog!

1. What exactly does this company do?

Taking a look at the Yahoo "Profile" on Johnson Controls, we find that the company:

"... provides installed building control systems and technical and facility management services for the nonresidential buildings market worldwide. It operates through three segments: Building Efficiency, Interior Experience, and Power Solutions."

2. Was there any news today to explain the stock price move?

Scanning through the Yahoo "Headlines" on JCI, I found a report on an upgrade by Robert W. Baird from 'neutral' to 'outperform'. Also reported, was the story about Johnson Controls "Annual Analyst Meeting". Although the reports from the company sounds mixed to me--fourth quarter guidance was raised to $1.86 to $1.91/share, ahead of analysts' estimates of $1.84/share, but fiscal-year 2006 profit would come in at $5.10 to $5.15/share, slightly below analysts' expectations of $5.21/share. Also, first quarter 2007 results were guided to $.80 to $.85/share, below analyst predictions of $.95/share. However, fiscal 2007 was estimated at $6.00, ahead of the $5.99 expected.

Somehow, although I did NOT attend this meeting, it appears that the stock price has been held back due to the large portion of its business tied to the slowing American auto industry. However, the company is apparently doing better than expected in the battery business and building environmental control business. As Morgan Stanley analyst Jonathan Steinmetz, who reiterated his "overweight rating" stated:

"Today's analyst day showed that our thesis for upgrading the stock still holds but that at the margin, building efficiency and power solutions are doing better than we had originally anticipated, and the auto interior business is doing worse."

3. How did they do in the latest reported quarter?

On July 20, 2006, Johnson Controls announced 3rd quarter 2006 results. Sales for the 3 months ended June 30, 2006, came in at $8.4 billion, up 19% from the $7.1 billion reported in the same quarter the prior year. Net income came in at $338 milion, up from $255 million in the same quarter last year. Diluted earnings per share worked out to $1.70/share this year, up from $1.31/share the prior year. Insofar as expectations on this report, it was reported that analysts from Thomson First Call had been looking for earnings of $1.68 (the company beat this), on sales of $8.43 billion (the company came in a bit light from expectations.)

4. What about longer-term financial results?

The "5-Yr Restated" financials on Johnson Controls (JCI), as reported by Morningstar.com, is really a very pretty picture. imho. First of all, looking at the revenue, the ever-increasing row of purple bars demonstrates the vigorous revenue growth from $17.4 billion in 2001 to $27.5 billion in 2005 and $31 billion in the trailing twelve months (TTM). It is the consistency of results that defines quality for me! And Johnson Controls shows consistency!

Examining the earnings, we can see the same steady increase from $2.55/share in 2001 to $4.68/share in 2005 and $4.86/share in the TTM.

The company also pays a dividend which is a plus. And the big plus is the steady increase in the dividend from $.62/share in 2001 to $1.00/share in 2005 and $1.09/share in the TTM.

Free cash flow has been strong, if a bit variable, over the last several years with $205 million reported in 2003, increasing to $520 million in 2004, dropping to $263 million in 2005 and back to $572 million in the TTM.

Of all of the data, the balance sheet is the least impressive on this page, imho. Not because the company is insolvent, but simply because the combined cash and other current assets adds up to $9.34 billion, which when compared to the $8.68 billion in current liabilities, gives us a current ratio for Johnson Controls of only 1.08. It has not been uncommon on this blog to see companies with ratios at 2 or higher, a common value for a "healthy" balance sheet. But with the solid free cash flow, and growing revenue and earnings, I am not very concerned about the financial health of the company. However, I cannot gloss over these things that I fine, even if they are counter to my over-all impression of the stock!

5. What about some valuation numbers on this stock?

Taking a look at Yahoo "Key Statistics" on JCI, we find that this company is a large cap stock with a market capitalization of $15.84 billion. The trailing p/e is a very reasonable (imho) 16.68, with a forward p/e (fye 30-Sep-07) estimated at 13.52. Thus, the PEG suggest a reasonable valuation with a value of 1.12.

Evaluating the valuation from the Price/Sales perspective, and using the Fidelity.com eresearch website, we find that in the industrial group of "Auto Parts", Johnson Controls is very reasonably valued with a Price/Sales ratio of 0.1. Topping this group is BorgWarner (BWA) at 0.3, Magna International (MGA) at 0.3, American Axle (AXL) at 0.2, and both Johnson Controls and Lear (LEA) tied at the bottom of the group with a ratio of 0.1.

Checking profitability, from the perspective of the Return on Equity ratio (ROE), we find that Johnson Controls leads the group, tied with BorgWarner at 15%, followedby Magna Intl at 9.6%, American Axle at 5.3% and Lear with a negative (103.8)% ROE.

Thus, while the price/sales ratio is excellent for valuation, the profitability also leads its particular group of stocks.

Finishing up with Yahoo, we find that the company has 195.57 million shares outstanding with 194.63 million that float. Of these, 2.24 million (down from 2.68 million the prior month) as of 9/12/06 were out short representing just 1.20% of the float or 2.3 trading days of volume (under my cut-off of significance of 3 days for the 'short ratio').

As noted, the company does pay a dividend with an anticipated payment of $1.12 yielding 1.50%. The company last split its stock with a 2:1 stock split on January 5, 2004.

6. What does the chart look like?

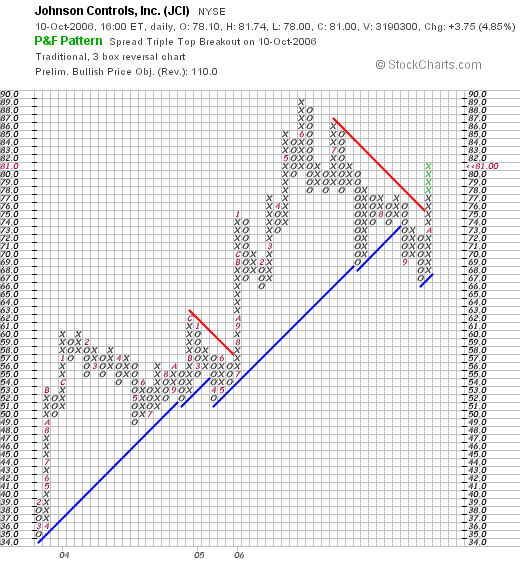

Taking a look at the "Point & Figure" Chart on JCI from StockCharts.com, we can see that the stock has made an extremely strong move from March, 2003, when the stock bottomed out at $35, until it hits its recent high at $89 in June, 2006. The stock has pulled back from that high after the last quarter was a bit of a mixed-bag, hitting a low of $67 in September, 2006. Recently, the stock has been quite strong, with analysts' upgrades and the like, breaking through resistance at $75 to its current level at $81. If I had my druthers, I would like to see this stock stay above $76 on its testing to the downside and once again move higher. Overall the graph is encouraging to me without being over-extended.

7. Summary: What do I think about this stock?

Let's review some of the things I discussed on this entry and compare the plusses and minuses on this company. First of all, this stock has been a tremendous performer for me on this blog....demonstrating the power of consistent revenue and earnings growth on price performance imho. The company moved higher after an analysts' meeting with the company. I believed that JCI convinced analysts that even though the auto market remains soft, that this company has enough other businesses to continue with dynamic growth...even IF the next quarter IS going to be a tad weak. The last quarter's result was strong although expectations were not completely exceeded. And the Morningstar.com report is beautiful with steady revenue growth, earnings growth, dividend growth, and free cash flow. The balance sheet is a bit average...with a current ratio just a little over 1.0. Would like to see the company with a bit more cash.

Insofar as valuation, the p/e is reasonable, the PEG is just over 1.1, the Price/Sales is the lowest in its group, and the Return on Equity is the highest. These are all great numbers.

There aren't many shares out short, the company pays a small dividend and has split its stock almost three years ago.

All-in-all I do like this stock. I especially like that strong and stead revenue, earnings, and dividend growth. I also appreciate the potential of the auto battery business as the company is a key player in the hybrid battery business. In a morbid note, with all of the school security problems recently, the company may well be a big player in security upgrades in classrooms across the country. My analysis does not depend on this unfortunate development.

Thanks again for stopping by and visiting! Each one of you who stops by and visits is welcome to stay and browse. I hope that my writing is helpful to you. If you have any comments or questions, I very much look forward to all of your emails. You can reach me at bobsadviceforstocks@lycos.com. I shall try to answer as many as I can and shall include the interesting ones in my blog. Also be sure and visit my Stock Picks Podcast where I discuss many of the same stocks I write about right here!

Bob

Monday, 9 October 2006

A Reader Writes "...when do you decide to sell the rest?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Checking my mail this evening I saw that I had a nice note from Steen S. who had some questions about my selling strategy. If you have any questions or comments, please feel free to drop me a line at bobsadviceforstocks@lycos.com and I will try my best to respond, possibly right in the blog!

Checking my mail this evening I saw that I had a nice note from Steen S. who had some questions about my selling strategy. If you have any questions or comments, please feel free to drop me a line at bobsadviceforstocks@lycos.com and I will try my best to respond, possibly right in the blog!

Steen wrote:

"Hey,

I am a fairly new reader of your blog and listner to your podcast.

I find the idea behind your system very good (about cashing in at certain % gain), but when do you decide to sell the rest of you holdings? Are you holding on to even very small number of stocks and sticking to the system or do you sell the rest at a certain time (exept from your loss sell signals).

Steen

Steen, thanks so much for writing! I shall try to go over my selling strategy which I have described on many different entries in my blog and on some of my podcasts.

I do believe that picking stocks is only one part of the formula to successful investing. The other parts include knowing when to buy and when to sell and how much.

A couple of thoughts. First of all credit goes to the CANSLIM technique of William O'Neil who wrote the great book How to Make Money in Stocks, which if you haven't read, is definitely worth your time. O'Neil stressed the importance of limiting your losses. He recommended, and I have adopted the strategy of selling stocks at an 8% loss after a first purchase. This has certainly helped me limit my losses.

After this, I was faced with the problem of knowing when to sell if stocks did well. This is often much harder than selling when things are bad. It is tough to sell when you feel good about a stock. I have solved this challenge by setting up targeted appreciation points. At these points I sell a portion of my remaining holdings. Initially I chose 1/4 of my remaining position, figuring if a stock had appreciated by 1/3, I would have 4/3 of a stock and if I sold 1/3, well I still would be "whole."

However, after several rounds of sales I found that my remaining position was dwindling in size. And I just really wanted to sell some of my gains, not my original investment. Working with fractions of remaining positions, I chose and now follow the strategy of selling only 1/6th of my shares at my targeted appreciation points.

The general strategy is to sell my losing stocks quickly and completely and sell my gaining stocks slowly and partially.

My next challenge was to determine the appropriate sale points. I chose to start selling at 30% and by 30% intervals x 4: 30, 60, 90 and 120% appreciation targets. At each of these points I attempt to sell 1/6th of my remaining shares. After each group of four sales, I have been increasing the intervals for appreciation. I do this because after a 120% appreciation in the stock price, the stock has more than doubled, and for a similar appreciation in price, a 60% interval would be appropriate. Thus, my next four targeted appreciation points are at 180, 240, 300, and 360%. I have chosen to add 30% to the intervals after I have sold portions four times. That is after 360%, I add 90% x 4: 450, 540, and 630%....etc.

If a stock appreciates and doesn't announce anything fundamentally 'bad', it is possible that I never sell all of my remaining shares. At least not for a long time.

I do reserve the right to sell all of my shares at any time if something fundamentally negative is announced.

However, my system does allow me to sell all of my shares after I have sold portions of my stock holding on appreciation.

Again, reflecting thinking from William O'Neil who suggested one should never let a gain turn into a loss, I move up my sale point to 'break-even' after I have sold a portion one time at a 30% appreciation target. After this first sale, I plan on selling each position if they retrace 50% of the greatest appreciation target.

When I sell on 'bad news' whether it be on a retracement to break-even after hitting my first sale point at a 30% gain, I sell ALL of my remaining shares. For instance, if I have sold a stock three times at 30%, 60%, and 90% appreciation targets and then the stock starts trading poorly, my targeted sale on the downside would be at 50% of my highest sale point or in this case at a 1/2 x 90% or 45% appreciation level. Again these sales on the downside are for ALL remaining shares.

I hope that this answers your questions!

Let me just touch on the concept of "signals" or "permission slips" as I like to call it.

Again, I would like to express my appreciation to William O'Neil, who when talking about CANSLIM talked about determining the "M" in the "Market" in determining the timing to buy stocks. One thing he pointed out was that if one paid attention to one's own portfolio, one could learn quite a bit. In particular, he was discussing the fact that if a lot of your stocks are hitting sales at 8% losses, maybe your portfolio was "talking to you" more or less and saying that the market was not optimal for investment.

I use sales of stocks on 'bad news' as a reason NOT to reinvest funds, and sales of stocks on 'good news' as a reason to ADD a position.

First of all, I confess to having erred many times in buying a stock, sellling it in a 'disciplined fashion' when it hit an 8% loss and then buying another stock in quick succession only to lose another 8% loss quickly. I am sure many other investors have also made this same mistake! I realized that I was "compounding" my losses making things really worse in an awful market environment.

How could I avoid this? How could I learn to "listen" to my portfolio as O'Neil suggested? It was clear to me that if I had sold shares of a stock on 'bad news', meaning selling either at a loss or on a retracement to a sale-point, or even on 'bad news', then I should really AVOID compounding my losses. Or as I like to put it, I should leave the cash uninvested, instead just "sit on my hands"!

Well then, if I had just decided that selling on 'bad news' was a "signal" to "sit on my hands" then my portfolio really needed a mechanism to tell me to "buy a new position".

Some of this thinking, this search for a semi-mechanized approach to investing was likely influenced by another innovator, Robert Lichello, who had written, and I had read, the important book, How to Make $1,000,000 in the Stock Market - Automatically!. This is another great book to read if you ever get a chance.

Lichello, who developed the AIM system or Automatic Investment Management approach to investing, believed that the action of his portfolio could determine his response as he was regularly shifting between mutual fund shares and a money market fund.

My approach is NOTHING like Lichello's. But I do believe in allowing my portfolio help me understand what I should do in the market.

This search for a signal to buy, led me to the next step of using sales of my own positions on "good news" as a signal or 'permission slip' to add a new position.

However, it seemed obvious that I would need to always have some exposure to equities, thus, I would need a 'minimum' number of holdings in my portfolio. I needed to own shares because these positions were themselves the indicators of market sentiment. Trying to think logically, I chose to have a maximum number of positions at 25. (Currently I am at 11). Thus my "neutral" or starting position would be at 50% invested with 12 positions. My "conservative" posiiton, would be half of that or 6 positions and my maximum as noted 25.

Thus, if I am at my minimum number of positions (6) and I hit a sale point on bad news, then instead of 'sitting on my hands' I will go ahead and sell the stock and replace it with an appropriate new purchase as if I had a 'buy signal'. In the same vein, if I sell a portion of one of my 25 positions at a targeted appreciation point, instead of adding a new position, I shall be adding to my cash (or paying down my margin), leaving my total at 25.

When starting out, I recommend starting at 50% cash and 50% equities. If one wanted to have a maximum of 20 positions, then I would start at 10, and let market forces dictate to me whether I should be adding to or selling those positions. I would drop down to a minimum of 5 and a maximum of 20. This would more or less shift me in and out of the market based on market forces themselves.

I hope this answers your question! Once again, thanks so much for writing! If you have any other questions or comments, please feel free to write me at bobsadviceforstocks@lycos.com and I shall answer the best that I am able. If you find the time, please be sure and stop by and visit my Stock Picks Podcast Site.

Bob

Sunday, 8 October 2006

My Trading Portfolio Update: From Jubak's Refugees Site

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Along the way I have been a contributor to the Jubak's Refugees on MSN. This is named after the famous stock picks Jim Jubak although he doesn't participate on that website as far as I can tell. Anyhow, from time to time, I have been sharing the results of my trades. Thus, what follows is what I wrote for the MSN site, which applies here as well:

It has been three months since I last posted. I have withdrawn money from my account for various sundry purposes, and probably shall be doing this once again with a new roof scheduled for my house this week. However, except for one "trade" in Kendle, I am sticking to my system.

This analysis is as of the close of trading on October 6, 2006.

I am now down to 11 positions (down from 14 positions three months ago). My maximum # of positions remains at 25, my minimum is still at 6.

The account net worth is $42,888.42. I am currently at 75.97% margin equity with a margin debt of $13,559.38. The market value of my securities stands at $56,447.80.

Current Positions (# shares, date of purchase, closing stock price, cost basis, % gain (loss))

Coach (COH) (102 shares, 2/25/03, $35.35, $8.33, 324.30%)

Cytyc (CYTC) (225 shares, 1/29/04, $23.53, $14.86, 58.39%)

Healthways (HWAY) (107 shares, 6/18/04, $42.76, $23.53, 81.75%)

Kyphon (KYPH) (150 shares, 5/20/06, $35.75, $29.21, 22.37%)

Morningstar (MORN) (167 shares, 11/22/05, $39.95, $32.57, 22.64%)

Quality Systems (QSII) (88 shares, 7/28/03, $40.69, $7.75, 425.11%)

ResMed (RMD) (150 shares, 2/4/05, $40.24, $29.87, 34.72%)

Starbucks (SBUX) (50 shares, 1/24/03, $38.41, $11.40, 236.79%)

Meridian Bioscience (VIVO) (210 shares, 4/21/05, $23.56, $11.13, 111.75%)

Ventana Medical Systems (VMSI) (188 shares, 4/16/04, $41.54, $23.47, 76.99%)

Wolverine World Wide (WWW) (240 shares, 4/19/06, $27.68, $23.55, 17.56%)

Since the last update on June 30, 2006, the following trades have been done: I sold 200 shares of Genesco (GCO) at $31.59 on 7/12/06, I sold 120 shares of Toro (TTC) at $44.06 on 7/13/06, and sold 360 shares of Barnes (B) on 7/17/06. On 7/27/06, I bought 800 shares of Kendle (for a trade) KNDL at $28.48, but sold it on 8/1/06 at $25.41.

As of 10/7/06, the account had $294.45 of taxable income and $2,642.47 of margin interest paid. The account had a net gain of $3,134.98, made up of a net short term loss of $(5,237.30) and a net long-term gain of $8,372.28.

As of the close of trading on 10/6/06, the company maintained its unrealized gain of $21,783.23.

I hope this continued reporting is helpful to you! The overall decline in value is both from the decline in stock prices as well as my pulling funds out for personal use. The figures to keep your eye on are the unrealized gains and the realized gains to get a better handle on how the account is doing.

If you would like more information, come and visit my blog at or email me at bobsadviceforstocks@lycos.com.

Bob

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Also, be sure to stop by and visit my Stock Picks Podcast Site!

Bob

"Weekend Trading Portfolio Review" Meridian Bioscience (VIVO)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Besides reviewing stock picks on this blog, and discussing some general portfolio management techniques that I employ, I also like to share with you my actual trading portfolio. These are stocks that I currently own and with which I really do employ these stock picking and buying and selling strategies. My goal is to review one position (of my current 11 positions) every two weeks. Normally, with a full portfolio of 25 positions, this would be about once/year. However, with only 11 holdings, I shall continue this process and currently at this rate will be reviewing these stocks about once every 6 months.

Two weeks ago I reviewed my Starbucks holding on this blog. Going alphabetically (through the stock symbols), I am now up to Meridian Bioscience (VIVO). Let's take another look at my own trading history with this investment and see if it still deserves a place on this blog!

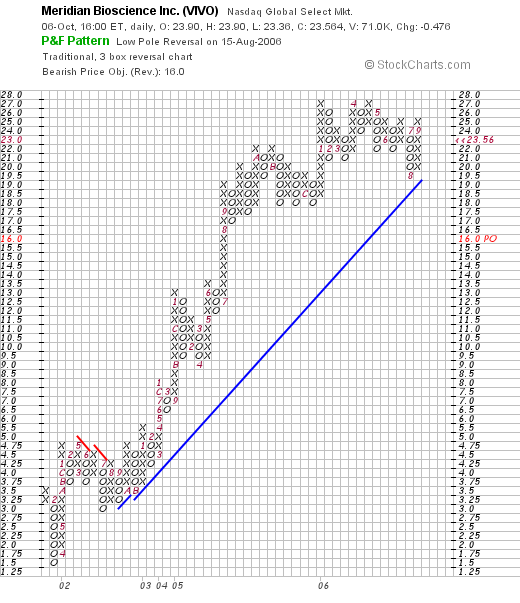

Currently, I own 210 shares of Meridian Bioscienc (VIVO) in my Trading Account. These shares were purchased April 21, 2005, with a cost basis of $11.13/share. I should note that this was not the first time I have owned Meridian in this account. Back on April 22, 2004, I purchased 400 shares of Meridian but only managed to hang on to these shares for a bit under a month before incurring a more than 8% loss, and selling the entire lot of shares on May 17, 2004. When the stock came up on the screens a year later, I went ahead and purchased my current holding.

Meridian closed October 6, 2006, at $23.56, down $(.47) or (1.98)% on the day. Thus, I have a current unrealized gain of $12.43 or 111.7% on these shares. As my trading strategy dictates, I have been selling portions of my holdings of Meridian at targeted appreciation levels. I have sold shares 7/25/05, 9/1/05, 10/3/05, and 1/6/06 at the 30, 60, 90, and 120% appreciation targets. Thus, my next targeted sale on the upside would be at a 180% gain or as calculated: 2.80 x $11.13 = $31.16. On the downside, with my last sale at a 120% appreciation target, allowing for a 50% retracement to a 60% appreciation level, would give me a sale target of 1.6 x $11.13 = $17.81. If the stock should drop to this level, I would be selling all of my shares, as opposed to my 1/6th remaining shares sale at positive appreciation targets.

But let's take a closer look at the stock itself and see how things 'stack up'!

1. What exactly does this company do?

Looking at the Yahoo "Profile" on VIVO, we find that the company

"...operates as an integrated research, development, manufacturing, marketing, and sales organization in the field of life science. It develops, manufactures, and distributes diagnostic test kits primarily for respiratory, gastrointestinal, viral, and parasitic infectious diseases; and bulk antigens, antibodies, and reagents used by researchers and other diagnostic manufacturers, as well as provides contract manufacturing service of proteins and other biologicals for use by biopharmaceutical and biotechnology companies that are engaged in research for new drugs and vaccines."

2. Is there any recent news that may be affecting the stock price?

Looking through the Headlines section on Yahoo, the only relatively recent news that I think is significant was the story on September 14, 2006, that MRO Software (MRO), which apparently was being acquired by IBM Corp., will be replaced in the Standard & Poor's SmallCap 600 index by Meridian (VIVO). For the S&P index, their SmallCap range is between $300 million and $2 billion. Since there are many investors and institutions that choose to make investments in vehicles that mirror these indices, this is a bullish news story for the company.

3. How did the company do in the most recent quarter?

On July 20, 2006, Meridian reported 3rd quarter 2006 results. Net sales for the quarter came in at $26.6 million, up 5% from $25.4 million in the same quarter the prior year. Net earnings were $4.86 million, up 39% from $3.50 million the prior year. Earnings per diluted share worked out to $.18/share, a 29% increase over the $.14/share reported the same quarter last year. In addition, in the announcement, they declared a regular quarterly dividend of $.115/share, with a $.46/share indicated annual rate, 44% higher than the regular quarterly rate of 2005. And also 'reaffirmed its recently increased guidance of net sales beteween $106 and $109 million (previously $103 to $107 million) and per share-diluted earnings between $.63 and $.66 (previously $.60 to $.63) for the fiscal year ending September 30, 2006.'

As good as this report sounds, the 'street' was a bit disappointed with the revenue report. As reported, the company did meet or exceed earnings results anticipated by analysts, they fell short of revenue estimates of $27.9 million and $26.8 million. Otherwise, the report was reasonably good especially with the continuing 'double-digit sales and earnings growth for fiscal 2007.'

4. What about longer-term financial results?

Reviewing the Morningstar.com "5-Yr Restated" financials on VIVO, we can see that the revenue growth has been very steady, increasing from $57 million in 2001 to $93 million in 2005 and $105 million in the Trailing Twelve Months (TTM).

Earnings, which were at a loss of $(.47)/share in 2001, turned profitable at $.23/share in 2002, and have increased steadily since to $.52/share in 2005 and $.66/share in the TTM. The company has been a steady dividend payer and has been raising its dividend each year (another plus for many investors.) The company paid $.17/share in 2001, $.31/share in 2005, and $.39/share in the TTM. There has been a small increase in the number of shares outstanding with 22 million reported in 2001 and 23 million in 2005 but 26 million reported in the TTM.

Free cash flow has been positive and growing. $11 million in 2003 increasing to $16 million in 2005 and $18 million in the trailing twelve months.

The balance sheet is gorgeous. The company is reported by Morningstar.com to have $35.7 million in cash, more than enough to pay off the current liabilities more than twice over and actually enough to pay off both the current and long-term liabilities which total togeter $22.7 million. The current ratio, when we add the $39.3 million of other current assets to the cash yields a ratio of 4.52. Generally, ratios of 2 or higher are considered 'healthy' at least from this particular perspective.

All-in-all, the Morningstar.com report is a very pretty picture of a small, steadily growing company.

5. What do the valuation numbers on this stock look like?

Looking at the Yahoo "Key Statistics" on VIVO we find that this company is a small mid-cap stock with a market capitalization of $615.52 million. The trailing p/e is moderately rich at 35.76, and the forward p/e is a bit better (fye 30-Sep-07) estimated at 28.05. No PEG is reported.

Examining the Fidelity.com eresearch website, we find that Meridian is in the "Diagnostic Substances" industrial group. Within this group, VIVO is reasonably priced with a Price/Sales ratio of 2.2. Topping the group is Human Genome Sciences (HGSI) with a ratio of 55.3, followed by ADEZA (ADZA) at 6.7, Myriad Genetics (MYGN) with a ratio of 4, then Meridian (VIVO) at 2.2, DIGENE (DIGE) at 1.5, and Dade Behring (DADE) at 0.9.

In terms of profitability, VIVO has the highest return on equity (ROE) of the group at 19.7%. This is followed by Dade Behring at 17%, ADEZA at 9.9%, DIGENE at 5.9%, Myriad Genetics at (17.1)%, and Human Genome Sciences at (63.3)%.

Finishing with Yahoo, we can see that there are only 26.12 million shares outstanding with 21.51 million that float. There are quite a few short-sellers on this stock with 1.24 million shares out short as of 9/12/06, representing 5.7% of the float or 8.9 trading days of volume. Using my own 3 day rule on the short ratio, this is triple that level, and if the company has any positive reports, there may well be a squeeze of the shorts pushing the shares higher. However, if the shorts are seeing something I don't....well that would mean they could be right! In any case, these 1.24 million shares that are already sold will need to be repurchased in the future and can only help prop up the stock price when that is done.

As noted, the company also pays a nice dividend with a forward annual rate of $.46/share yielding 2%. The company last split its stock with a 3:2 split on September 6, 2005.

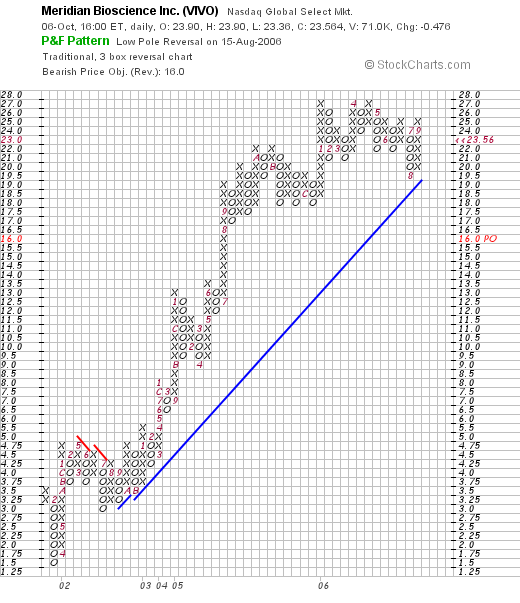

6. What does the chart look like?

If we look at the Meridian Bioscience (VIVO) "Point & Figure" chart from StockCharts.com, we can see that this company has had a steady ride from $1.50 in February, 2001, when it last showed significant weakness, to its peak at $27 which it has hit three times in January, 2006, as well as in April, 2006. The stock has actually been trading sideways this year, but still appears to be above its support level. It does not appear over-extended to me, but I would like to see this stock, which is trading just under $24, to get through that $27 level to feel confident that it is on the upswing once again.

7. Summary: What do I think about this stock?

Let's take a look at a few things that I have commented on above. First of all, I own this stock so that is my own bias. However, the news of its inclusion in the SmallCap 600 is encouraging. The latest quarter was a tad soft on revenue growth with strong earnings and an increased dividend report. In addition, guidance appears to be reasonably bullish. I think the stock, if indeed we get a good next quarter, will resume its upward move. However, until then, we may have to wait while it 'treads water' so to speak.

The Morningstar report was very nice with a consistent growth in revenue, earnings and free cash flow. As "icing on the cake" the company pays a small dividend that it is regularly increasing. The balance sheet is solid. Valuation-wise, the p/e is a bit rich in the mid 30's. However, with the 30% plus earnings growth reported, even though we don't have a PEG, at least from this current quarter, I would expect that a PEG wouldn't be much above 1.5 if at all. But THAT is just my guess. Finally the chart looks nice. I think all it will take is another nice earnings report, and the stock price moves higher with the short-sellers scrambling to cover their bets that the stock price declines. Anyway, that's my view!

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. When you get a chance, drop by and visit my Stock Picks Podcast Site where you can hear me talk about many of the same stocks I write about here on this website!

Bob

Saturday, 7 October 2006

"Looking Back One Year" A review of stock picks from the week of June 6, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website. I also always look forward to any of your comments, suggestions, or questions, and you can reach me at bobsadviceforstocks@lycos.com if you are so motivated!

One of my weekend tasks for the blog is to do a retrospective analysis of past stock selections. I have been doing this a week at a time, assuming that an equal dollar amount might have been purchased in each of the stocks discussed on the blog that particular week and that I employed a "buy and hold" strategy on these purchases. In reality, I suggest and employ a disciplined portfolio management system that involves selling losing stocks quickly and completely, and selling gaining stocks slowly and partially. For the sake of this review, I assume that stocks were purchased and still held at this time.

On June 7, 2005, I posted Harman International (HAR) on Stock Picks when it was trading at $94.77. HAR closed at $86.32 on October 6, 2006, for a loss of $(8.45) or (8.9)% since posting.

On June 7, 2005, I posted Harman International (HAR) on Stock Picks when it was trading at $94.77. HAR closed at $86.32 on October 6, 2006, for a loss of $(8.45) or (8.9)% since posting.

On August 15, 2006, Harman reported 4th quarter 2006 results. Revenue for the quarter came in at $859.1 million, up 6% from last year's $808 million. Analysts, according to Thomson Financial, had expected revenue of $873.4 million. The company earned $64.8 million or $.96/share, down from last year's $70.2 million or $1.01/share. After removing "restructuring charges and senior debt buybacks", the company earned $1.09/share, ahead of expected $1.07/share excluding charges. In that department, the company exceeded expectations. However, looking ahead, the company forecast $4.35/share in 2007, which is lower than the analysts' $4.46/share expected. All-in-all, a bit of a disappointing report.

On August 15, 2006, Harman reported 4th quarter 2006 results. Revenue for the quarter came in at $859.1 million, up 6% from last year's $808 million. Analysts, according to Thomson Financial, had expected revenue of $873.4 million. The company earned $64.8 million or $.96/share, down from last year's $70.2 million or $1.01/share. After removing "restructuring charges and senior debt buybacks", the company earned $1.09/share, ahead of expected $1.07/share excluding charges. In that department, the company exceeded expectations. However, looking ahead, the company forecast $4.35/share in 2007, which is lower than the analysts' $4.46/share expected. All-in-all, a bit of a disappointing report.

On June 8, 2005, I posted Balchem (BCP) on Stock Picks at a price of $29.50/share. On January 23, 2006, Balchem had a 3:2 stock split, making my effective stock pick price actually $19.67. BCP closed at $19.80 on October 6, 2006, for a gain of $.13 or .7% since posting.

On June 8, 2005, I posted Balchem (BCP) on Stock Picks at a price of $29.50/share. On January 23, 2006, Balchem had a 3:2 stock split, making my effective stock pick price actually $19.67. BCP closed at $19.80 on October 6, 2006, for a gain of $.13 or .7% since posting.

On August 1, 2006, BCP announced 2nd quarter 2006 results. For the three months ended June 30, 2006, net sales increased 28.8% to $25.1 million from $19.5 million in the same quarter last year. Net earnings increased 11.9% to $3.06 million, from $2.73 million in the same quarter last year. On a per diluted share basis, net earnings increased 8.7% to $.25/share, up from $.23/share.

On August 1, 2006, BCP announced 2nd quarter 2006 results. For the three months ended June 30, 2006, net sales increased 28.8% to $25.1 million from $19.5 million in the same quarter last year. Net earnings increased 11.9% to $3.06 million, from $2.73 million in the same quarter last year. On a per diluted share basis, net earnings increased 8.7% to $.25/share, up from $.23/share.

Finally, on June 20, 2005, I posted Boston Beer (SAM) on Stock Picks Bob's Advice when the stock was trading at $23.08. Boston Beer closed at $33.24 on October 6, 2006, for a gain of $10.16 or 44% since posting.

Finally, on June 20, 2005, I posted Boston Beer (SAM) on Stock Picks Bob's Advice when the stock was trading at $23.08. Boston Beer closed at $33.24 on October 6, 2006, for a gain of $10.16 or 44% since posting.

On August 8, 2006, Boston Beer announced 2nd quarter 2006 results. For the quarter ended July 1, 2006, revenue climbed 28% to $87.6 million from $68.5 million last year. Profit came in at $8 million or $.56/share, up 60% from $.35/share last year. This, according to Thomson Financial, exceeded analysts' expectations of $.38/share. The company also raised guidance for 2006 full year to $1.16 to $1.31, (excluding stock option expenses of $.06 to $.11), this was up from prior guidance between $1.10 to $1.18/share. Thus, this was a great earnings report, with strongly improving revenue and earnings, and also exceeding expectations and raising guidance!

On August 8, 2006, Boston Beer announced 2nd quarter 2006 results. For the quarter ended July 1, 2006, revenue climbed 28% to $87.6 million from $68.5 million last year. Profit came in at $8 million or $.56/share, up 60% from $.35/share last year. This, according to Thomson Financial, exceeded analysts' expectations of $.38/share. The company also raised guidance for 2006 full year to $1.16 to $1.31, (excluding stock option expenses of $.06 to $.11), this was up from prior guidance between $1.10 to $1.18/share. Thus, this was a great earnings report, with strongly improving revenue and earnings, and also exceeding expectations and raising guidance!

So how did I do with these three stocks? Well, I had one small loss, one break-even, and one strong gain for an average performance of a gain of 11.9% for this week a bit over a year ago!

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to drop me a line at bobsadviceforstocks@lycos.com. I cannot promise to answer every email I receive, but I read all of them and share many of the comments here and on my podcast. Speaking of which, be sure and visit my Stock Picks Podcast Site, where I also discuss many of these same stocks in an audio show.

Bob

Posted by bobsadviceforstocks at 10:15 PM CDT

|

Post Comment |

Permalink

Updated: Saturday, 7 October 2006 10:16 PM CDT

Guess (GES) October 7, 2006

CLICK HERE FOR THE PODCAST ON THIS ENTRY!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Two days ago, I promised you that I would write something about Guess (GES), and I wanted to get back to that stock and complete my review. GES closed yesterday at $53.89, down $(.01) or (.02)% on the day. I do not own any shares of Guess nor do I have any options on this stock. Even though yesterday the stock did not move strongly higher, on the previous day's trading, Guess had made a very strong move higher, making the list of top gainers on the NYSE. Let's review some of the things that led me to pick this stock for the blog!

Two days ago, I promised you that I would write something about Guess (GES), and I wanted to get back to that stock and complete my review. GES closed yesterday at $53.89, down $(.01) or (.02)% on the day. I do not own any shares of Guess nor do I have any options on this stock. Even though yesterday the stock did not move strongly higher, on the previous day's trading, Guess had made a very strong move higher, making the list of top gainers on the NYSE. Let's review some of the things that led me to pick this stock for the blog!

1. What exactly does this company do?

According to the Yahoo "Profile" on Guess (GES), the company

"...engages in the design, marketing, distribution, and licensing of lifestyle collections of casual apparel and accessories for men, women, and children. Its product lines comprise collections of denim and cotton clothing, including jeans, pants, overalls, skirts, dresses, shorts, blouses, shirts, jackets, and knitwear. The company also grants licenses to manufacture and distribute a range of products, including eyewear, watches, handbags, footwear, kids’ and infants’ apparel, leather apparel, fragrance, jewelry, and other fashion accessories."

2. Was there any recent news to explain the stock's move higher?

As reported on Thursday, October 5, 2006, Guess reported their September 'same-store sales' results. This figure, as I have emphasized throughout this blog, is one of the most important factors, imho, determining the success or failure of any retail venture. If you are in the dark on this, you might want to read this Motley Fool explanation by Bob Fredeen. In any case, Guess announced that September same-store sales increased by 11.3%. Not only is this a very strong retail result, but two other factors should be considered. First, the news exceeded expectations, meaning that this good news exceeded the 4.3% figure expected by those who follow this company. Second point, the company related that same store sales in the third quarter increased 8.6%. Thus, the September figure represented an acceleration of same-store sales growth compared to the other months in this quarter. I guess the only thing that the company didn't do was to suggest that future same-store sales growth were also expected to increase at this rate.

As reported on Thursday, October 5, 2006, Guess reported their September 'same-store sales' results. This figure, as I have emphasized throughout this blog, is one of the most important factors, imho, determining the success or failure of any retail venture. If you are in the dark on this, you might want to read this Motley Fool explanation by Bob Fredeen. In any case, Guess announced that September same-store sales increased by 11.3%. Not only is this a very strong retail result, but two other factors should be considered. First, the news exceeded expectations, meaning that this good news exceeded the 4.3% figure expected by those who follow this company. Second point, the company related that same store sales in the third quarter increased 8.6%. Thus, the September figure represented an acceleration of same-store sales growth compared to the other months in this quarter. I guess the only thing that the company didn't do was to suggest that future same-store sales growth were also expected to increase at this rate.

I found another Motley Fool article that mentioned GES that pointed out another critical point in picking stocks. The article is titled "Misinterpreting the Mall", and Seth Jayson points out that just because your walk through the mall shows that folks seem to be buying a lot of stuff at store "A", but not at store "B" that this 'research' may encourage you to go out and buy stock in that mall store you saw full of customers, you might need to do a bit more research than that! This is commentary on what the now famous Peter Lynch, the former Fidelity Magellan manager whose famous comment,

"If you stay half-alert, you can pick the spectacular performers right from your place of business or out of the neighborhood shopping mall, and long before Wall Street discovers them."

has been mis-applied by too many investors for too long. What you see in the mall may be a good start, but the same-store sales figures are hard to argue with!

3. How did this company do in the latest quarter?

On August 2, 2006, Guess (GES) reported 2nd quarter 2006 results. For the quarter ended July 1, 2006, the company reported revenue of $231.0 million, a 29.6% increase over $178.2 million in the same quarter last year.

Comparable store sales during the quarter increased 17.4%. Net earnings for the quarter climbed 230% to $13.7 million from net earnings of $4.2 million the prior year. Diluted earnings per share increased 233.3% to $.30/share vs. $.09/share in the same quarter last year. The company went ahead and raised guidance for the third quarter for revenue growth to 'slightly more than 20%'. The company also raised guidance for earnings with an improvement of $1.5 million to $2.0 million or $.03-$.04/share over prior guidance.

I comment a lot about my 'trifecta-plus' in earnings announcements and this company did just this! In other words, they managed to announce strong revenue and earnings growth, raised guidance and they also beat expectations handily. As reported elsewhere, the company reported earnings per share of $.30. Analysts had been expecting $.22/share. Revenue came in at $231 million; analysts at Thomson First Call expected $219.3 million. This was a very strong quarterly report!

4. How about longer-term financial results?

Let's take a look at the Morningstar.com "5-Yr Restated" financials on Guess (GES). First of all, the company did have a week 2001/2002 sequence with revenue dipping from $678 to $583 million, and earnings dropping from $.14/share to a loss of $(.26)/share. However, since 2002, revenue has climbed steadily from $583 million to $936 million in 2005 and $1.03 billion in the trailing twelve months (TTM). Earnings have improved from that loss of $(.26) in 2002 to $1.31/share in 2005 and $1.67/share in the TTM. The number of shares outstanding has been stable with 45 million in 2001, dipping to 44 million in 2005 and climbing to only 46 million in the TTM. No dividends are paid.

Free cash flow the past several years has been positive and growing with $44 million in 2003, $47 million in 2004, $95 million in 2005 and $134 million in the TTM.

The balance sheet looks solid with $197.3 million in cash and $236.5 million in other current assets. This total of $433.8 million, easily covers the $225.1 million in current liabilities yielding a healthy 'current ratio' of 1.93.

5. What about some valuation numbers for this stock?

Reviewing the Yahoo "Key Statistics" on Guess, we can see that this company is a mid cap stock with a market capitalization of only $2.46 billion. The company has a moderately rich p/e of 32.52, and a more reasonable forward p/e estimated (fye 31-Dec-07) of 23.33. The PEG works out to an acceptable 1.26.

Looking at the Fidelity.com 'eresearch' website, we can see that Guess (GES) is in the "Textile-Apparel Clothing" industrial group and is moderately priced with a Price/Sales ratio of 0.6. Topping this group is BEBE Stores with a Price/Sales ratio of 1.7. This is followed by both Guess and VF Corp (VFC) at 0.6, Columbia Sportswear (COLM) at 0.3, Hot Topic (HOTT) at 0.1 and Quiksilver (ZQK) at 0.1.

Checking the Return on Equity (ROE) as a measure of 'profitability', we can see that Guess (GES) leads this group with a ROE of 25.4%. GES is followed by BEBE at 19.5%, VF Corp at 18.5%, Columbia Sportswear at 17.1%, Quiksilver at 7.9% and Hot Topic at 7%.

Returning to Yahoo, Guess has 45.62 million shares outstanding with 21.03 million that float. As of 9/12/06 there were 4.44 million shares out short, representing 18.50% of the float or 3.9 trading days of volume (the short ratio). Using my own '3 day rule' on short ratios, this is a bit high and may be a bullish influence on stock performance. No dividend is paid and no stock splits are reported on Yahoo.

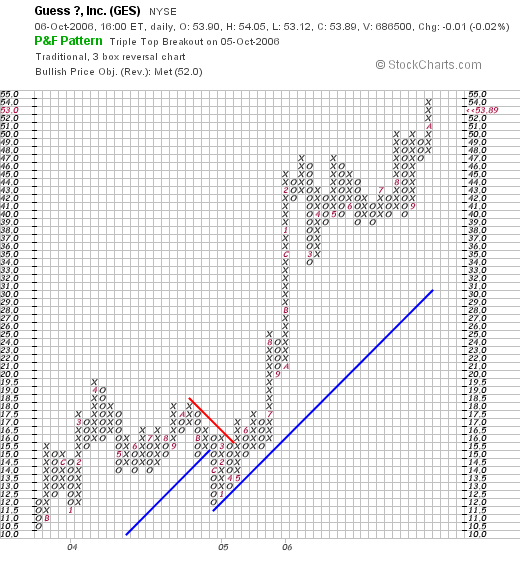

6. What does the chart look like?

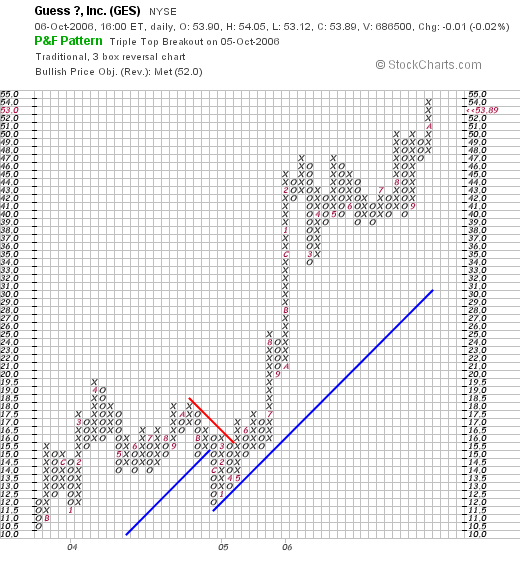

Reviewing a "Point & Figure" chart on Guess (GES) from StockCharts.com, we can see what appears to me to be a very strong performance the past few years. The stock price appreciated from $10.50 in late 2003, consolidating between that level and $19.50 until May, 2005, when the price broke out through resistance at $16, and moved strongly higher to its current level. Since January, 2005, the stock price has more than quadrupled to the recent $53.89 level.

7. Summary: What do I think about this stock?

Let's review some of the things that I have pointed out in the above discussion. First of all, the stock made a strong move higher on strong same-store sales results. This report beat expectations and demonstrated short-term acceleration in comparative sales results. The latest quarter earnings report was very nice with the company reporting strong revenue and extremely strong (more than 200%) increases in both earnings and earnings/share. This exceeded expectations as well and the company raised guidance. The Morningstar.com report looked nice with at least 4 years of steady revenue and earnings growth, steady shares outstanding and increasing free cash flow. The balance sheet appears solid.

Valuation-wise, the p/e is a bit rich in the 30's but the PEG is reasonable, the Price/Sales ratio is near the mean of its group, and the company leads the pack on Return on Equity. This is a company with relatively few shares floating and even some short-sellers who may have to cover (?) if the stock moves higher. No dividend is reported. Finally, the chart looks quite strong, if not a tad over-extended. All-in-all I like this stock for all of these reasons. I am not buying any shares as I do not have a 'signal' from my own portfolio but this is the kind of company I want to have in my 'vocabulary' of investable stocks!

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them right on the blog or email me at bobsadviceforstocks@lycos.com! Also, be sure and visit my podcast site where I discuss many of the same stocks I write about here on Bob's Advice!

Bob

Posted by bobsadviceforstocks at 11:06 AM CDT

|

Post Comment |

Permalink

Updated: Sunday, 8 October 2006 3:22 PM CDT

Thursday, 5 October 2006

Guess? (GES) and I answer a letter from a reader!

CLICK HERE FOR MY PODCAST ON THIS ENTRY!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Before I get to my entry on Guess?, I wanted to share with you all a very nice email I received from Alonso R. who wrote:

Before I get to my entry on Guess?, I wanted to share with you all a very nice email I received from Alonso R. who wrote:

"

Dear Bob,

I am writing you from Peru. I have been investing in the US stock market since last July and somehow I came across your podcast a couple of months ago. Personally, I believe it is great, thank you! I enjoy very much listening to it on my way back home after work and learning your methodology for stock screening and evaluation. I believe your approach is very straight forward and I find it extremely simple and helpful.

To this point I have not invested in any of the stocks you have recently analyzed, but I am planning of personally checking on some of them and maybe buy a couple os stocks, hovever I have been postponing it for for some weeks.

I know you are a big Morningstar fan and so I am, however, lately I see that the market is not behaving in the direction that Morningstar thinks. Any thoughts on that?

All the best to you and congratulations on the great work.

Best regards

Alonso R"

Well, Alonso, as I wrote back, I am very appreciative of your email and your comments regarding my podcast which I use to comment on many of the same stocks as my blog.

You have actually brought up two subjects: my stock picking, and my thoughts on the stock market in general vis a vis the Morningstar opinion on the market direction.

First of all, I think you are pretty familiar with my stock picking strategy. There may very well be many stock picking approaches that are superior to my approach; I would love to hear about your experience with the stocks I mention as compared to your experience with stocks that you choose with other techniques.

One of my portfolio strategies, however, is to allow my own portfolio to determine my own response to the stock market. I prefer not to anticipate or rely on my own deduction in this regards. I recall listening to William O'Neil, the publisher of the Investors Business Daily discuss his CANSLIM approach to investing. If you are not familiar with his strategy, you may wish to read his classic book, "How to Make Money in Stocks".

O'Neil astutely pointed out the importance of the "M" in CANSLIM, meaning the "Market". A particular comment that he made really was significant to me...he wrote about watching the behavior of the stocks you own. That when they start hitting sale points on bad news, it may well mean that the market itself is becoming weak. He emphasized the importance of keeping your losses small, and discussed selling stocks after an initial purchase at an 8% loss limit.

O'Neil has a different strategy on gaining stocks. I do not wish to speak for him, but he has certain sale points when stocks break down technically-speaking. He believes in adding to stocks, as I recall, that are climbing.

Personally, I listen and observe my own portfolio very closely. I also sell stocks after an initial purchase if they decline 8%. I call this 'selling my losing stocks quickly and completely.' What I have added is my own strategy for dealing with gaining stocks---selling my gaining stocks slowly and partially at targeted appreciation points. At this time, I have started selling 1/6th of my remaining shares at 30, 60, 90, and 120% points, then incrreasing by 60%: 180, 240, 300 and 360%; then by 90% intervals: 450, 540, 630, 720%....etc. In addition, if a stock I own retreats to 50% of its highest appreciation sale point, then I sell the entire position. For example, if I had last sold a stock...1/6th of my shares....at a 120% appreciation point, then, unless significant fundamental news was announced, I would sell all of my remaining shares if the stock price retreated to a 60% appreciation level from my purchase.

Finally, I use my sales as a signal....that is if a stock is sold on "bad news" either fundamental or technical, that is if something negative is announced or it hits a sale point on the downside, I use this as a signal that the market is not healthy and I do not reinvest the proceeds, instead I 'sit on my hands.' My only exception is if I am at my minimum portfolio level, which for me is 6 positions. In that case I would replace that stock with a new stock that fit my purchase criteria.

If selling a stock on a decline is 'bad news', then the converse may also be helpful. That is, I use a sale at an appreciation target as 'good news', giving me permission to add a new position (unless I am at my maximum portfolio size which is at 25 positions.)

Thus, I do not spend time guessing the direction of the market. I let my portfolio dictate my bias.

I really intended to write up Guess (GES) which made a nice move to the upside, but it is getting late and I shall save that post for another day...perhaps this weekend I can write it up. For the record, GES closed at $53.90, up $3.77 or 7.52% on the day today. The stock moved higher on strong same store sales results for September.

Thanks again for stopping by and visiting! If you have any comments or questions, please feel to drop me a line at bobsadviceforstocks@lycos.com and be sure to visit my podcast site.

Bob

Posted by bobsadviceforstocks at 10:17 PM CDT

|

Post Comment |

Permalink

Updated: Thursday, 5 October 2006 11:21 PM CDT

Saturday, 30 September 2006

"Looking Back One Year" A review of stock picks from the week of May 30, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

It is hard for me to believe that it is the weekend once again. Sometimes when you are busy, the days really fly by. Anyhow, without a market to be checking, the weekend offers me a chance to review past selections to find out how they are turning out and to help me refine my own stock-picking technique.

This review assumes a "buy and hold" strategy. In practice I employ a portfolio management strategy that actively manages my holding, selling losing stocks quickly after an initial purchase and gaining stocks slowly at set appreciation targets. However, for the sake of simplicity, I have been assuming that equal dollar amounts of each stock pick was purchased for the week that I am reviewing. When looking at the 'average performance' I have been average all of the individual performances for an arithmetic mean. Occasionally I own or have owned stocks discussed. I generally don't indicate this on reviews, but in this case, I currently still own some shares of COH, otherwise, I do not own the stocks discussed in this entry.

On May 31, 2005, I posted American Vanguard (AVD) on Stock Picks Bob's Advice when it was trading at $18.00/share. On April 18, 2006, AVD had a 4:3 stock split so my effective pick price works out to $13.50. AVD closed at $14.00 on September 29, 2006, for a gain of $.50/share since the stock was selected or 3.7% since posting.

On May 31, 2005, I posted American Vanguard (AVD) on Stock Picks Bob's Advice when it was trading at $18.00/share. On April 18, 2006, AVD had a 4:3 stock split so my effective pick price works out to $13.50. AVD closed at $14.00 on September 29, 2006, for a gain of $.50/share since the stock was selected or 3.7% since posting.

American Vanguard announced on September 28, 2006, that even though net sales should be rising in 2006, lower net income should result due to "increased opereating expenses and higher interest and tax rates." Just as 'raising guidance' is a big plus in my book, stocks that do the opposite, lowering guidance, is quite a damper on future price performance in my experience. Normally, I would have given this stock a 'thumbs-up' because on August 7, 2006, AVD reported 2nd quarter 2006 results. Sales for the quarter ended June 30, 2006, climbed 14% to $42.7 million, and net income jumped 21% to $3.3 million while earnings per share were up at $.12/share from $.11 in the second quarter of 2005. But with the lowered guidance, the stock does not deserve a 'thumbs-up'!

American Vanguard announced on September 28, 2006, that even though net sales should be rising in 2006, lower net income should result due to "increased opereating expenses and higher interest and tax rates." Just as 'raising guidance' is a big plus in my book, stocks that do the opposite, lowering guidance, is quite a damper on future price performance in my experience. Normally, I would have given this stock a 'thumbs-up' because on August 7, 2006, AVD reported 2nd quarter 2006 results. Sales for the quarter ended June 30, 2006, climbed 14% to $42.7 million, and net income jumped 21% to $3.3 million while earnings per share were up at $.12/share from $.11 in the second quarter of 2005. But with the lowered guidance, the stock does not deserve a 'thumbs-up'!

On June 1, 2005, I 'revisited' Coach (COH) and picked it again for the blog when it was trading at $30.67/share. COH closed at $34.40 on September 29, 2006, for a gain of $3.73 or 12.2% since posting.

On June 1, 2005, I 'revisited' Coach (COH) and picked it again for the blog when it was trading at $30.67/share. COH closed at $34.40 on September 29, 2006, for a gain of $3.73 or 12.2% since posting.

On August 1, 2006, Coach reported 4th quarter 2006 results. The company reported that net sales grew 23% to $514 million. Net income increased 31% to $118 million or $.31/diluted share, up from $90 million or $.23/diluted share in the same period a year earlier. The company beat expectations of $.29/share for the quarter. The company also went ahead and raised guidance for fiscal 2007 with sales now expected at $2.5 billion, up about 19% from the 2006 year. Earnings are now forecast to rise to at least $1.55, up 22% over the year earlier and ahead of the current analysts expectations of $1.53/share. Thus, this is my 'trifecta-plus' in a quarterly report, which means that the company did everything right: reported increased revenue, increased earnings, beat expectations and raised guidance. My kind of earnings report!

On August 1, 2006, Coach reported 4th quarter 2006 results. The company reported that net sales grew 23% to $514 million. Net income increased 31% to $118 million or $.31/diluted share, up from $90 million or $.23/diluted share in the same period a year earlier. The company beat expectations of $.29/share for the quarter. The company also went ahead and raised guidance for fiscal 2007 with sales now expected at $2.5 billion, up about 19% from the 2006 year. Earnings are now forecast to rise to at least $1.55, up 22% over the year earlier and ahead of the current analysts expectations of $1.53/share. Thus, this is my 'trifecta-plus' in a quarterly report, which means that the company did everything right: reported increased revenue, increased earnings, beat expectations and raised guidance. My kind of earnings report!

Finally, on June 2, 2005, I 'revisited' Abercrombie & Fitch (ANF) on Stock Picks Bob's Advice when it was trading at $65.12/share. ANF closed at $69.48/share on September 29, 2006, for a gain of $4.36 or 6.7% since posting.

Finally, on June 2, 2005, I 'revisited' Abercrombie & Fitch (ANF) on Stock Picks Bob's Advice when it was trading at $65.12/share. ANF closed at $69.48/share on September 29, 2006, for a gain of $4.36 or 6.7% since posting.

On August 15, 2006, Abercrombie & Fitch reported 2nd quarter results. For the quarter ended July 29, 2006, sales climbed 15% to $658.6 million from $571.6 million. Profits came in at $65.7 million or $.72/share, up from $57.4 million or $.63/share in the same quarter last year. This came in pretty much in line with expectations which were for earnings of $.71/share on sales of $659 million. The stock moved higher on the announcement as the company guided second half expectations higher with earnings of $3.15 to $3.20/share in the second half of fiscal 2006 with full year earnings of $4.49 to $4.54/share. Analysts had been expecting full year earnings of $4.39/share.

On August 15, 2006, Abercrombie & Fitch reported 2nd quarter results. For the quarter ended July 29, 2006, sales climbed 15% to $658.6 million from $571.6 million. Profits came in at $65.7 million or $.72/share, up from $57.4 million or $.63/share in the same quarter last year. This came in pretty much in line with expectations which were for earnings of $.71/share on sales of $659 million. The stock moved higher on the announcement as the company guided second half expectations higher with earnings of $3.15 to $3.20/share in the second half of fiscal 2006 with full year earnings of $4.49 to $4.54/share. Analysts had been expecting full year earnings of $4.39/share.

So how did I do during that week picking stocks? Well, I guess you could say reasonably well with all three stocks moving higher and an average gain of 7.53% since being "picked" on the blog.

Thanks so much for visiting! Please note the new "Pico Search" feature on the blog which will allow you to search the many (over 1,000 entries!) on this website where I discuss many stocks of current interest. If you have any comments or questions, please feel free to drop me a line at bobsadviceforstocks@lycos.com and be sure to visit my Stock Picks Podcast Site.

Bob

Friday, 29 September 2006

"Revisiting a Stock Pick" Moody's (MCO)

CLICK HERE FOR MY STOCK PICKS PODCAST ENTRY ON MOODY'S

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Before I get to my main entry, I wanted to share with you a very nice email that I received the other day from Robert D. who wrote:

Before I get to my main entry, I wanted to share with you a very nice email that I received the other day from Robert D. who wrote:

"Bob, I love your site, your up-to-date research is very helpful, and I learned a lot about a lot of companies.

I'm not sure if you have it (maybe I did not see it), but it would be very useful as an organizational too, to include either a "search" feature on your site, where we can find your research on a given stock (since you have done quite a few now!), or a list of the companies covered with links to the appropriate research page.

I know I have a hard time finding old articles your wrote about a specific company, just thought it might help!

Keep up the great work, and best of luck in the market!"

Robert, I believe I have fixed the problem. I loaded up a "PICO SEARCH" which, although I am not sure all of my readers are familiar with this, should be able to search through the blog to find entries that you may be looking for. Give it a try and let me know what you think!

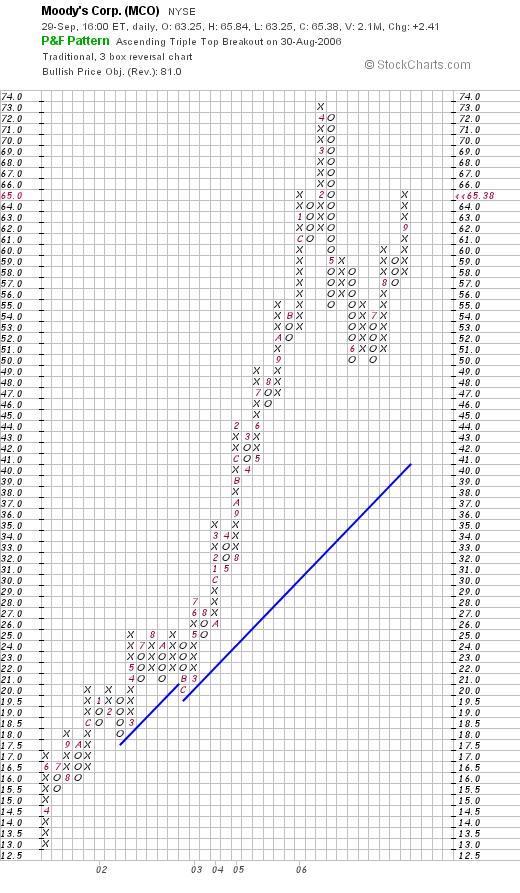

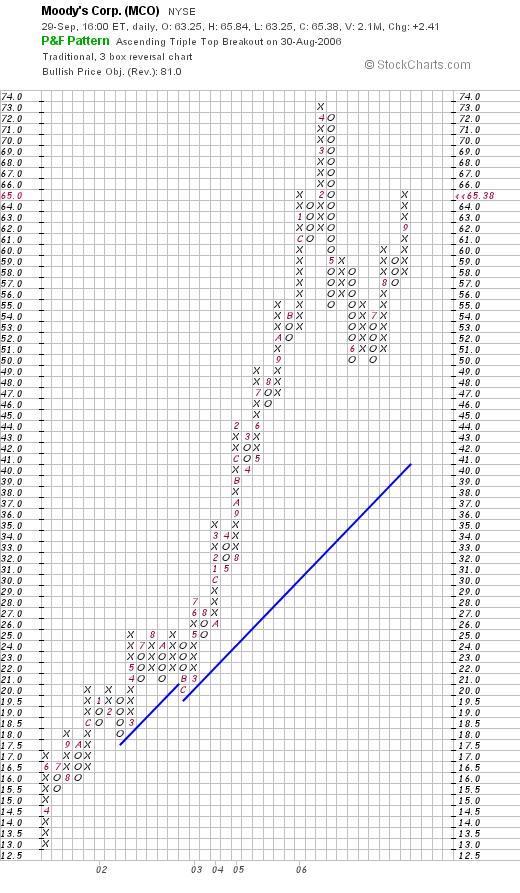

I was looking through the list of top % gainers on the NYSE today and came across Moody's, a stock that I first discussed on Stock Picks Bob's Advice on August 22, 2005, a bit more than a year ago when it was trading at $49.37. I still do not own any shares of Moody's (MCO) nor do I have any options. Moody's closed at $65.38 today, up $2.41 or 3.83% on the day. The stock is higher by $16.01 or 32.4% since I posted it about 13 months ago here on the blog.

I was looking through the list of top % gainers on the NYSE today and came across Moody's, a stock that I first discussed on Stock Picks Bob's Advice on August 22, 2005, a bit more than a year ago when it was trading at $49.37. I still do not own any shares of Moody's (MCO) nor do I have any options. Moody's closed at $65.38 today, up $2.41 or 3.83% on the day. The stock is higher by $16.01 or 32.4% since I posted it about 13 months ago here on the blog.

Let's take another look at this company and I shall share with you my thinking about why the stock is still worthy of consideration.

1. What exactly does this company do?

According to the Yahoo "Profile" on Moody's, the company

"...through its subsidiaries, provides credit ratings, and research and analysis services for capital markets worldwide. The company also offers credit training services, credit risk assessment products and services, and credit processing software for banks, corporations, and investors."

2. Was there any news to explain today's move higher?

Looking through the Yahoo "Headlines" on Moody's, I found a story that suggested that new legislation signed into law today by President Bush, gave authority to the SEC for new credit rating agencies. Apparently, they must be designated as "nationally recognized" agencies, giving Moody's, Standard and Poor's and the Fitch Ratings an edge over new credit rating firms. In any case, it appears the 'street' liked this development and the stock moved higher.

3. How did the company do in the latest reported quarter?

On August 2, 2006, Moody's reported 2nd quarter 2006 results. for the quarter ended June 30, 2006, the company reported revenue of $511.4 million, a 14% increase over the prior year's $446.8 million. Earnings came in at $172.1 million or $.59/share, up from $145.4 million or $.47/share in the prior year same period. According to the same report, analysts at Thomson First Call had expected revenue of $485.8 million and earnings of $.56/share. Thus, the company grew its revenue and earnings, and also exceeded expectations on both revenue and earnings. The company finished off this 'trifecta-plus' earnings report by raising guidance for its earlier profit forecast for 2006.

4. How about longer-term financial results?

If we review the Morningstar.com "5-Yr Restated" financials on Moody's (MCO), we can see that revenue has steadily increased from $.8 billion in 2001 to $1.7 billion in 2005 and $1.8 billion in the trailing twelve months (TTM).

During this same period, earnings have steadily increased (without a miss!) from $.66/share in 2001 to $1.84/share in 2005 and $2.05/share in the TTM.