Stock Picks Bob's Advice

Monday, 14 June 2004

June 14, 2004 Curtiss-Wright (CW)

Hello Friends! Thanks again for stopping by. Sorry about the lapse of entries last week. You KNOW I am just an AMATEUR investor....and well...let me just point out that I am a bit of an AMATEUR blogger as well! It is amazing how one starts thinking of that invisible blog audience out there that is WAITING for your entry...or maybe I am just doing some wishful thinking. Anyhow, please remember to do your own investigation of all stocks discussed on this blog and please consult with your investment advisors regarding the suitability of any investment discussed here.

Now that I am back in business on this blog, I was scanning through the large percentage gainers today and came across Curtiss-Wright (CW). I do not own any shares nor do I have any leveraged or option positions in this company. CW had a nice day today, in an otherwise lackluster market, closed at $49.46, up $2.34 or 4.97% on the day. According to the Yahoo profile on CW, they are "...engaged in the design and manufacture of motion control, metal treatment and flow control products for the aerospace, metal working and other industries."

On April 29, 2004, CW

reported 1st quarter 2004 results. Net sales increased 19% to $214.9 million from $179.9 milllion in 2003. Net earnings were up 11% to $15.6 million or $.74/diluted share.

Looking at

Morningstar.com "5-Yr Restated" financials, we can see that revenue has grown steadily from $293.3 million in 1999 to $746.1 million in 2003. Earnings have grown, somewhat less consistently, from $1.91/share to $2.50/share in 2003. Free cash flow has been positive with $42 million in 2001, increasing to $50 million in 2003. The balance sheet looks reasonable if less than spectacular with $98.7 million in cash and $275.9 million in other current assets, more than enough to cover all of the current liabilities of $135.9 million and enough to make a dent in the long-term liabilities of $358.9 million.

What about valuation? Looking at

"Key Statistics" from Yahoo.com, we can see that this is a mid-cap investment with a market cap of $1.04 billion. The trailing p/e isn't bad at 19.36 and the forward p/e is even nicer at 14.63. I like the PEG which is quite reasonable at 1.07 and the price/sales is also quite nice at 1.27.

Yahoo reports 20.99 million shares outstanding with 18.50 million of them that float. Currently there are 955,000 shares out short as of 5/10/04 representing 5.16% of the float, and due to the relatively low trading volume of this stock, get this....22.738 trading days! Even though there aren't a lot of shares out short THAT is a lot of buying pressure on this stock if the stock should rise...as it did today...and possibly contribute to a bit of a "squeeze".

The company DOES pay a dividend of $.36/share yielding 0.76%. They recently split their shares 2:1 in December, 2003.

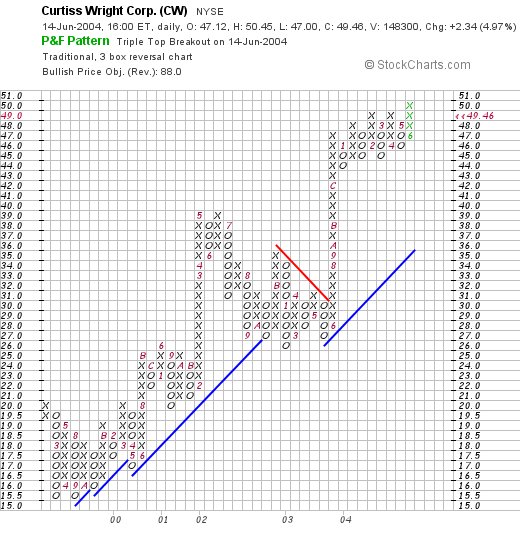

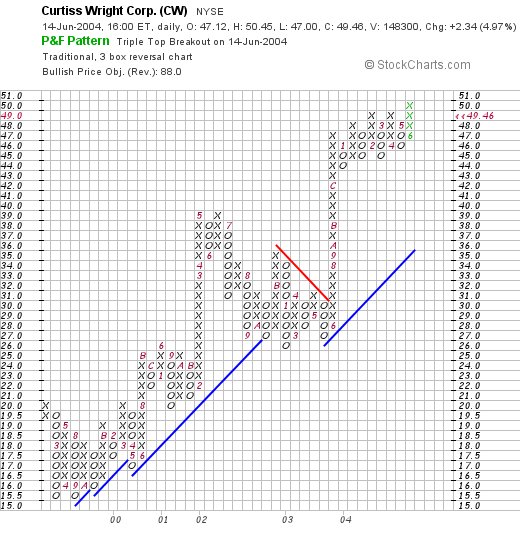

Well how do the "Technicals" look?

Looking at a "Point & Figure" chart from Stockcharts.com, a website that I HIGHLY recommend you visit and utilize....the graph simply looks beautiful...if not a little extended. The stock has been trading higher between 1999 and 2003 and then ran into a bit of resistance during 2003, finally breaking out in June 2003 and not looking back!

Well what do I think? The recent earnings are nice, the past revenue growth has been terrific, the free cash flow is excellent, the stock pays a dividend, the balance sheet is reasonable, the valuation is great with a PEG just over 1.0, and a Price/Sales just over 1.2, and the recent stock chart looks marvelous. Well, if I HAD some money, lol, I would probably buy a little of this stock. Well you know, I am waiting to SELL some of my existing positions at a GAIN before adding another position...but I guess I can dream about it :).

Anyway, THANKS so much for stopping by! I hope that my chatting is helpful to you and that you learn to look at stocks in a more analytic way...hopefully if you will add to my strategy and improve it! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com

Bob

Friday, 11 June 2004

"The Annual Review" Looking back on the week of June 2, 2003

Hello Friends! Thanks so much for stopping by. I was away from my computer this past week so I haven't been making many entries here. Every once in a while I "get a life." Before I go any further, let me please remind you that I am an AMATEUR investor so PLEASE check with your professional investment advisors regarding the appropriateness of investments discussed on this website for your particular needs.

The week of June 2, 2003, was quite a busy week for this blog. I actually wrote up THIRTEEN different stocks that week! I think now that I have settled into a groove in this blog, I find myself posting only one or two at the most. We really have quite a few stocks to work with here! If any of you have stocks that you feel I should discuss here, please email with them or with any other questions at bobsadviceforstocks@lycos.com

On June 2, 2003, I

posted Coach (COH) on Bob's Advice at a price of $51.53. COH split 2:1 in October, 2003, making my effective selection price $25.77. I also own COH in my

Current Trading Portfolio. COH closed on 6/10/04 at $45.70 for a gain of $19.93 or 77.3%.

On April 20, 2004, COH

announced 3rd quarter 2004 results. For the quarter ended March 27, 2004, COH reported net sales of $313.1 million, a 42% increase over the $220.4 million reported the prior year. Net income improved 83% to $58.3 million from $31.9 million the prior year. Earnings per share were up 76% to $.30/share compared to $.17/share the previous year. These are all great results.

The second stock listed that week was Affiliated Computer Services (ACS) which was

posted on Stock Picks Bob's Advice on June 2, 2003, at a price of $49.18. ACS closed at $49.75 on 6/10/04, for a gain of $.57 or 1.2%.

On April 20, 2004, ACS

announced 3rd quarter 2004 results. Excluding acquisitions, revenue grew to $1.01 billion. "Internal" revenue growth was 14%, the remaining growth was due to acquisitions. Excluding one-time events, earnings per share increased 18% to $.67/share compared to $.57/share the prior year. I am not real excited about all of these exclusions, but the company appears to be doing satisfactorily.

My third selection that week was ExpressJet (XJT) which was

selected for Stock Picks on June 2, 2003 at a price of $12.60. XJT closed at $11.78 on 6/10/04 for a loss of $(.82) or (6.5)%.

On April 15, 2004, XJT

announced 1st quarter 2004 results. Operating revenue increased 19% to $364.0 million, up from $306.6 million in the first quarter of 2003. Net income came in at $28.7 million or $.53/diluted share, a 33% increase over 2003 results. These results are certainly fine. The Airline Stocks have been under pressure recently due to increased energy costs with the spike in petroleum prices. However, XJT appears to be doing fine in their underlying business as demonstrated by the recent

"May, 2004 Performance" report.

On June 3, 2003, I

posted Walgreen (WAG) on the blog at a price of $32.17. WAG closed on 6/10/04 at a price of $34.62 for a gain of $2.45 or 7.6%.

On March 22, 2004, WAG

reported 2nd quarter 2004 results. Sales jumped 15.8% to $9.8 billion for the second quarter. Net earnings were up 16.9% to $433.5 million or $.42/diluted share from $370.9 million or $.36/diluted share last year. These were great results, but slightly shy of estimates. Recently, WAG

reported same store sales results for May, 2004. Comparable store sales were up 8.5% with comparable pharmacy sales up 10.5% and "front-end" sales up 5.3%. These are terrific numbers in my opinion. WAG remains soft along with a lot of the drug company stocks with apparent concerns about Canadian drug sales and governmental programs (in my opinion.)

On June 3, 2003, I

posted School Specialty (SCHS) on Stock Picks at a price of $25.45. SCHS closed on 6/10/04 at $35.88 for a gain of $10.43 or 41%.

On June 8, 2004, SCHS

announced 4th quarter 2004 results. For the quarter ended April 24, 2004, revenue rose 12% to $161.4 million, boosted by acquisitions. Net LOSS however, WIDENED to $(6.1) million or $(.32)/share compared to $(4.9) million or $(.26)/share the prior year. Even though this seems bad to me, on the same day SCHS

announced 2005 outlook which projected earnings of $2.30 to $2.50/share a 19 to 26% increase over 2004 results and consistent with analysts expectations. Overall the street appears to be satisfied with these results. Personally, I would like to see narrowing losses and improving earnings each and every quarter!

June 3, 2003, also found me

picking Select Medical (SEM) for Stock Picks at a price of $22.10. SEM closed at $12.92 on 6/10/04 for a loss of $(9.18) or (41.5)%.

On April 27, 2004, SEM

announced 1st quarter 2004 results. Net operating revenues for the quarter ended March 31, 2004, increased 35.1% to $422.0 million compared to $312.3 million the prior year. Net income increased 104.6% to $29.6 million compared to $14.5 million the prior year. On a fully diluted basis, this was $.27/share compared to $.15/share the prior year. These were great results but then WHY did SEM drop in price this last year? This was

explained by Herb Greenberg on CBS Marketwatch who pointed out that the fastest growing part of its business, operating long-term care hospitals inside existing acute care hospitals faced a "potential crackdown by regulators." The stock has dropped since this became known.

Also on June 3, 2003, I

posted United Financial Mortgage (UFM) on Stock Picks at $8.05/share. UFM closed at $5.20 on 6/10/04 for a loss of $(2.85) or (56.4)%.

On March 9, 2004, UFM

reported 3rd quarter 2004 results. Revenues decreased $3.2 million to $12.7 million from $15.9 million for the same quarter the prior year. Net income was $638,000, or $.12/diluted share compared to $1.5 million or $.39/share the prior year. These appear to be LOUSY results, and thus the LOUSY stock performance in my opinion.

HANG IN THERE! SEVEN DOWN AND SIX TO GO!!!

On June 4, 2003, I

posted E-Loan (EELN) on Stock Picks at a price of $5.06. EELN closed at $2.76 on 6/10/04 for a loss of $(2.30) or (45.5)%.

On April 29, 2004, EELN

reported 1st quarter 2004 results. Total revenue came in at $32.02 million down from $36.2 million the prior year in "Total Revenue". Diluted eps came in at $(.02) vs a profit of $.10 the prior year. These are NOT encouraging results in my opinion...and thus would not be continuing to plug this stock!

On June 5, 2003, I

posted CarMax (KMX) on Stock Picks at a price of $28.65. KMX closed at $22.50 on 6/10/04 for a loss of $(6.15) or (21.5)%.

On March 30, 2004, KMX

reported 4th quarter 2004 results. Revenue for the quarter rose to $1.12 billion from $946.6 million the prior year. Net income increased 18% to $22.5 million or $.21/share up from $19.1 million or $.18/share the prior year. These results and guidance for the next quarter were UNDER analysts expectations and the stock subsequently declined. In fact, on June 4, 2004, just a few days ago KMX

reported 1st quarter same store sales results actually DECLINED 3%. For any retail venture, declining same store sales results are a NEGATIVE for any investor.

On June 5, 2003, I

wrote up Mothers Work (MWRK) on Stock Picks Bob's Advice at a price of $25.55. MWRK closed at $23.22 on 6/10/04 for a loss of $(2.33) or (9.1)%.

On June 3, 2004, MWRK

announced May, 2004, same store sales results. Blaming a loss of a Saturday in the month, they related that stores open at least a year had sales that FELL 3%. Not good. The latest quarterly report was

announced on April 27, 2004. For the quarter ended March 31, 2004, net sales increased 13.0% to $125.8 million with comparable store sales increasing 0.2% for the quarter. Net income came in at $.4 million or $.08/diluted share vs $.3 million or $.06/diluted share last year. These at best appear to be lukewarm results.

On June 5, 2003, I

posted American Pharmaceutical Partners (APPX) on Stock Picks at $37.39. APPX split 3:2 so our actual selection price was $24.93. APPX closed on 6/10/04 at $31.01 for a gain of $6.08 or 24.4%.

On April 21, 2004, APPX

announced 1st quarter 2004 results. Sales increased 10% to $89.2 million. However, net income came in at $11.8 million or $.16/diluted share vs. $17.1 million or $.23/diluted share in 2003. However, they emphasized anticipated excess of 20% in growth of sales in 2004. Overall, the street was satisfied with these results. Personally, I would prefer to see continued earnings growth ALONG with the revenue growth.

Also on June 5, 2003, I

posted Christopher & Banks (CBK) on Stock Picks at $33.45. CBK split 3:2 on 8/28/03 for a net effective pick price of $22.30. CBK closed on 6/10/04 at $17.26 for a loss of $(5.04) or (22.6)%.

On June 3, 2004, CBK

announced May Same store sales which fell 6% attributed to "weak sweater sales". They also announced REDUCED expectations for the first quarter of between $.26 and $.27/share. In April, they HAD announced expectations of $.28 to $.30/share. The street did NOT like this news...for good reason!

FINALLY (sigh), on June 6, 2003, I

posted Cardinal Health (CAH) on Stock Picks at $64.17. CAH closed at $68.84 on 6/10/04 for a gain of $4.67 or 7.3%.

On April 22, 2004, CAH

announced 3rd quarter results. Revenue rose 14% to $14.6 billion and earnings per diluted share improved 15% to $.98/share. These were good results!

In summary, my 13 selections experienced a net LOSS of (3.41)% for the year period. I was affected by declining retail sales for the specialty retailers listed, climbing petroleum costs, and climbing interest rates. This shows that this method is not infallible, cannot be followed by blindly holding these equities, and must be actively managed by sales of stocks that decline!

I hope this was helpful for you to review our past picks! The last two reviews showed strong gains in the 30% range...but this week was ANYTHING BUT strong!

Thanks again for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com

Have a GREAT weekend everyone!

Bob

A Reader Writes "What's your opinion on long-term and short-term investing?"

Hello Friends! Have been away from my computer for a few days and haven't been able to closely review the stock market. If you are an avid investor, you will understand how it is being away from those market numbers....Anyhow, thanks so much for stopping by!

Ross, my investor-reader from Alaska writes back,

Talk to a few people and still deciding if I should go short-term or

long-term. One pointed out that eventually, going short-term, you will

end up losing most of your investment or end up selling low and buying

high. He suggested, you should stick with a few established companies

and just invest into them. Ride it out for 20-30 years but make sure

every 10 years do some changing depending on how the market is going,

ie 20% of your portfolio is in wireless communication but somehow, its

going to die in a few years, then cash out. Said, you will make more

money this way due to splits. Sounds like a good idea but there is

always pluses and minuses for everything.

What's your opinion on long-term and short-term investing?O.K., here is my take on this question of short-term vs long-term. Why decide before you have invested money on whether the investment should be long- or short-term? In other words, I let the

performance of the stock dictate to me the duration of my holding.

My strategy, and I am not sure if this is the best strategy at all...as you recall I am a fellow amateur investor..honestly...is to purchase a stock with all of the characteristics of what I will call a "winning" selection. I use current earnings, revenue growth, free cash flow, balance sheet and valuation to determine suitability.

After that, I let the price performance of the holding determine the action that I am going to take. I honestly try NOT to think too hard about my holdings when I have purchased them. In fact, when I DO start thinking, I usually get myself in trouble!

If you review the blog, and look for references to my Trading Portfolio, you will see that sometimes I hold a stock for a single day (!). I sell a new purchase if it declines 8% from my purchase price...no matter how long or short I have held it.

Hopefully, I will hold onto these purchases for many years! However, I do start selling portions of my holdings if they perform well. As you may recall, my sell points are 25% of the holding to be sold at goals of 30%, 60%, 90%, 120%, then by 60% at 180%, 240%....etc.

So in summary, I do both. I go short-term AND long-term. I do not want to hold a declining stock very long, and I would prefer to hold a climbing stock for a very long time!

I hope that answers your question.

As always please consult with your investment advisors before taking any action based on information on this blog....as I AM an amateur...and these are just my opinions.

Thanks so much for stopping by and taking the time to write! It is encouraging for me to receive email from those of you who I have inspired to do more thought on investing! If you or anyone else have questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com

Bob

Friday, 4 June 2004

"Trading Transparency" CMN

Hello Friends! Well that nickel was just burning a hole in my pocket. With the sale of a portion of KNSY earlier today, that allows me per my strategy to add another position as I work towards my 25 position portfolio.

I came across Cantel (CMN) which I have reviewed elsewhere in the blog. CMN is having a nice day trading at $20.00, up $.84 on the day or 4.38%.

With that in mind, I picked up 300 shares this afternoon at an average price of $20.01. They reported great earnings results today, and hopefully, this stock will have enough price momentum to continue its upward trajectory!

Thanks so much for stopping by! Please remember that I am an AMATEUR investor and that you should consult with a PROFESSIONAL investment advisor before making any decisions based on information presented on this website.

If you have any questions, comments or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com

Bob

"Trading Transparency" KNSY

Hello Friends! Well a good Friday morning to all of you. Kensey Nash Corp (KNSY) has done well for me! This morning, I sold 75 shares of my remaining 300 shares at $36.01/share. This leaves me 225 shares. These 300 shares were purchased 12/3/03 at a cost basis per share of $22.52 for a gain of $13.49/share or 59.9%. (Our target for this second sale was a 60% gain.) I sold my first 100 shares of KNSY on 1/26/04 at $27.53 which was a gain of $5.01 or 22.2%. Thus, I now have a nickel in my pocket waiting to be spent!

We are working our way back to the 25 position plan for the portfolio. After I get there, I will sell portions of stocks at gains and apply to the Margin balance...only buying a new stock when one has been sold at a loss, followed by a gain...do you follow?

Anyhow, have a great day. I will keep you posted. Remember I am an AMATEUR investor...so check things out yourself and consult with your investment advisors before acting on any information on this website! Write me at bobsadviceforstocks@lycos.com if you have any comments or questions!

Bob

Thursday, 3 June 2004

June 3, 2004 Bebe Stores (BEBE)

Hello Friends! Thanks so much for stopping by and visiting. Remember that I am an AMATEUR investor, so PLEASE do your own investigation of all stocks discussed on this website and PLEASE consult with your investment advisors before making any investment decisions. I worry sometimes about talking about stocks because I CANNOT be responsible for any decision you make but I DO like to share my thoughts on current stocks of interest in the market! As always, if you have any questions, comments, or words of encouragement, do not hesitate to email me at bobsadviceforstocks@lycos.com Be warned, that I may use your letter in the blog available to the public.

Anyhow, I came across Bebe Stores (BEBE) today while scanning the lists of greatest percentage gainers. BEBE is currently, as I write, trading at $21.17, up $1.06 or 5.27% on the day (by the time I finished up writing the post, the market was closed and BEBE closed at $20.44, up only $.33 or 1.64%...but the numbers look nice so I have stayed with this pick!). I do NOT own any shares nor do I have any options or leveraged positions in this stock. According to cnn.money, BEBE's principal activity "...is to design, develop and produce a line of contemporary women's apparel and accessories."

If you have been reading this blog for awhile, or if you follow any retail investments, one of the MOST important numbers that can be reported about a retail venture, besides their earnings of course, is their SAME STORE SALES. (sorry about shouting). This morning, before the open in New York, BEBE

reported May same store sales results. For stores open at least a year, sales increased 10.2%. In addition, they RAISED estimates for the fiscal fourth quarter ending in June, from $.11/share to $.15 to $.18/share. These are BOTH great things to help a stock move higher...and higher is the way this stock has been moving today!

What about the latest quarter results? On April 22, 2004, BEBE

announced 3rd quarter results. For the quarter ended March 31, 2004, net sales were $83.6 million, up 21.6% from the $68.8 million reported a year earlier. Same store sales for the quarter came in up 16.7% (!). Diluted earnings per share came in at $.21/share compared to just $.01/share in the prior year.

How about longer term? If we look at

Morningstar.com "5-Yr Restated" financials, we can see that revenue has grown steadily with $201 million in revenue in 1999 increasing to $344 million in revenue in the trailing twelve months.

Earnings, however, have been a bit more erratic. They peaked at $.78/share in 2000, dropped to $.49/share in 2003, and have recently been picking up again.

Free cash flow looks nice with $16 million in 2001, $28 million in 2002, $27 million in 2003, and $40 million in the trailing twelve months.

As for the balance sheet, all of the "free cash flow" is adding to the rich $185.6 million in cash which can cover BOTH the current liabilities of $40.7 million AND the long-term liabilities of $14.7 million, more than 3x over! In addition, BEBE has $31.4 million in other current assets.

How about Valuation? Looking at

"Key Statistics" from Yahoo, we can see that this is a small cap with $791.6 million in market cap. The trailing p/e is 28.27 with a forward p/e (fye 30-Jun-05) of only 22.46. The PEG is reasonable at 1.17, with a Price/Sales not too out of line at 2.18.

BEBE has 39.02 million shares outstanding with only 8.40 million of them that float. There appear to be a LOT of those shares out short, with 2.19 million reported as of 5/10/04. This represents 26.04% of the float or 6.75 trading days. In my opinion, anything over 3.0 stands a decent chance of leading to a "squeeze"...and if the good results continue...well we shall see!

No cash dividend is paid, and the stock split 3:2 recently, in fact on 5/6/04!

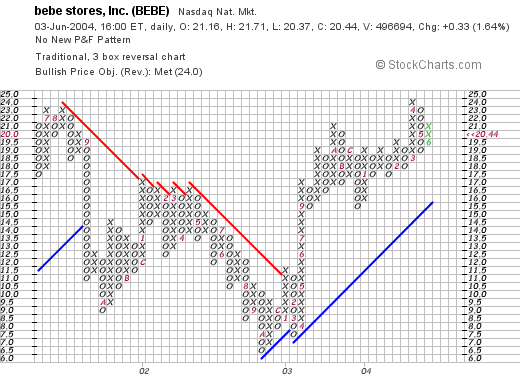

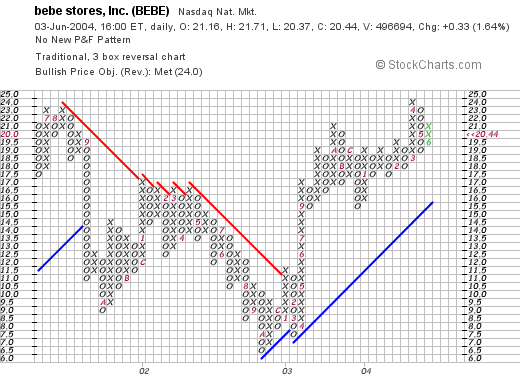

What about Technicals?

This stock was trading lower between August, 2001, and October, 2002, when it bottomed at around $6.50/share. Since that time, it has been trading above its support line, and the graph looks nice to me.

What do I think? Well, I wish the stock hadn't closed off its highs...but I like the same store sales numbers, the valuation is reasonable, the balance sheet is impeccable, the PEG is just over 1.1, and the graph looks nice. There really isn't much that I don't like about this stock...it is just that I don't have any money to buy it!

Well, thanks again for stopping by. Please email me if you have any comments or questions at bobsadviceforstocks@lycos.com

Bob

Wednesday, 2 June 2004

A Reader Writes "Just out of High School. How do I start?"

Hello Friends! Thanks again for stopping by. I was pretty excited this morning checking the mailbox (I felt like Steve Martin in the Jerk when he got his Phonebook!)...and had an email with an inquiry.

Ross D., from Anchorage, Alaska writes:

My initial investment is going to be around $500-$1,000 and add in around $300 monthly into my investments (split them up accordingly). I came across sharebuilder.com just a few minutes ago and found out that Wells Fargo offers their service too. Again, not sure if I should spread things around or do everything under one house. Seems like a good concept, but wouldn't buying the stocks individually be better? Also, is it good to have only one account versus having multiple accounts with different brokers? First of all Ross, I am NOT a professional investment advisor so I cannot give you specific advice on equities. But let me share with you my own start in investing...I am afraid to say that was about 35 years ago (!)...when I had a sharebuilder account with Merrill Lynch. I don't believe they still have this...but I may be wrong on that.

In general, if you are starting an account, I would stay with ONE brokerage house as paperwork gets tricky enough as it is...I like starting with about $1000 and adding $300/month. What I would do is start with the $1000, buying a single investment for about $750, and leaving $250 in a money market. Then I would each month place $250 in a total of four other investments, alternating each investment each month...with a cycle of four months. After twelve months, you should have $750 in each of five investments. I would continue rotating the five investments over a 5 month period of time until such time as each investment has $5000 value. If you do the math, at this rate, this will take several years...adding about $600/yr to each investment. You will also be building a money market fund, which I would draw upon if buying an additional position.

How do you manage this? Probably would set up a mental stop (that is in your mind keep a stop) about 10% below your purchase price. If any of your investments are down 10% from their total cost...then I would liquidate the investment, and purchase a DIFFERENT stock adding sufficient $'s from the money market to have the new investment pretty equal to the others. I probably would not sell any portion of the holdings until they were at a $5,000 level, then consider starting to sell a portion of the holdings when they hit a sell point...you can use the "sell 1/4 on a 1/3 gain" strategy that I use in my trading account.

You asked about currency investments and quite frankly, that is a sophisticated investment area that I know little about....so if you do that, good-luck!

Also, what about Wells Fargo vs. a discounter like Scott-Trade? I do not have any experience with Scott, but do with Fidelity and Schwab that I like. I would prefer to see you with a moderate discounter like Fidelity than a deep-discounter like Scott...mainly because you are a NEW investor and might need some of the additional services that are probably available with the less-than-deep discounters. Just a thought.

I am not sure if all of my discussion is helpful to you. Please remember that I am a fellow amateur investor so I would suggest you discuss these ideas with a professional investment advisor.

Please let me know how things work out and if you have any questions about my blog or website! Again, thanks for writing.

Bob

June 2, 2004 Micronetics (NOIZ)

Hello Friends! Was pretty busy today and finally towards the end of the day got around to working the lists of greatest percentage gainers. I sold 75 shares of CYTC thinking that was my SECOND sale...approaching the 60% gain level...but when writing it up realized it was my THIRD sale....so I shall skip the 90% sell point and look forward to a solid 120% gain before making the next sale. Anyway, I still worry about anyone thinking I am giving out investment advice for THEM...so PLEASE remember to do your own investigation of all stocks discussed on this blog as I am an AMATEUR investor....and you need to discuss these investments with YOUR professional investment advisors before taking any action on the equities discussed.

I came across Micronetics (NOIZ) which was having a GREAT day today, and in fact closed at $9.33, up $2.04 or 27.98% on the day! I DID purchase 400 shares of NOIZ just before the close of trading at $9.40, so I am actually DOWN $.07/share already! I generally AVOID stocks under $10 as the % volatility almost always causes me to sell at an 8% loss fairly quickly....but the numbers looked nice, and I decided to give them a try! According to the Yahoo "Business Summary", NOIZ "...manufactures microwave and radio frequency (RF) components and integrated subassemblies used in a variety of commercial wireless and defense and aerospace products, including satellite communications, electronic warfare and electronic counter-measures."

This morning, just before the open, NOIZ

reported 4th quarter and year 2004 results. For the quarter ended March 31, 2004, net sales came in at $13.8 million, an increase of $3.2 million or 29.6% from $10.7 million the prior year same quarter. For the 4th quarter, net income came in at $480,275 or $.11/diluted share compared to net income the prior year of $223,241 or $.05/dilued share, an increase of 115%. The "street" liked the report and thus the nice price move.

Looking at the Morningstar.com

"5-Yr Restated" financials, we can see the fairly steady revenue growth from $4.5 million in 1999 to $12.7 million in the trailing twelve months.

Earnings, while slightly erratic, have increased from $.08/share in 1999, to $.28/share in the trailing twelve months. Extrapolating the latest quarter gets us to a level of $.44/share.

There has unfortunately been negligible free cash flow with $0 reported in 2001, $(1) million in 2002, and $0 million in 2003.

Balance-sheet-wise, the company looks fine with $1.4 million in cash and $6.2 million in other current assets balanced against $1.5 million in current liabilities and $1.0 million in long-term liabilities.

Looking at

"Key Statistics" from Yahoo, we can see that this is a TINY company, truly a "micro-cap" stock with a market cap of $39.50 million. The trailing p/e is 33.93, but NO PEG is reported, and the Price/sales ratio came in at 2.44.

There are only 4.23 million shares outstanding with 3.00 million of them that float. Currently there are only 17,000 shares out short as of 5/10/04, representing 1 trading day or 0.57% of the float.

No cash dividend is paid, and no stock dividend is reported on Yahoo.

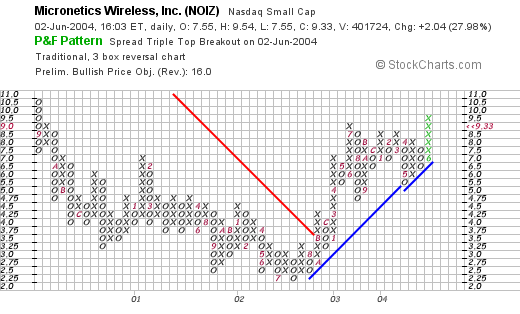

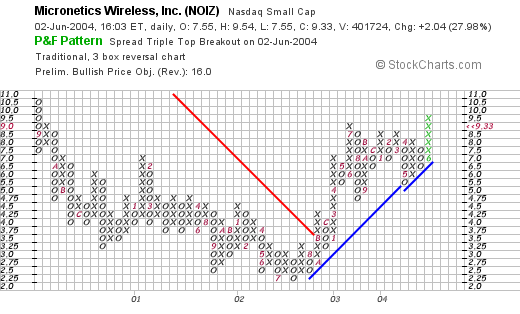

How does the graph look?

Looking at a Point & Figure chart from Stockcharts.com, we can see that NOIZ actually traded LOWER through much of 2000, through September, 2003, when it broke through a resistance level at about $3.50. The stock has traded higher since that time...and looks strong technically to me.

What do I think? Well THIS one I liked enough to actually BUY some shares...I sold some CYTC shares to allow me to add a position. (And I HONESTLY thought that was a SECOND sale!). What I don't like is that this is a micro-cap stock under $10/share, and I will likely see this stock retrace some of its great gains tomorrow...unless we can get a bit of a cushion on this purchase...there is a significant chance I get stopped out around 8%. The earnings were impressive, the balance sheet is fine, and frankly, the valuation doesn't look bad.

Thanks so much for stopping by! Please drop me a line at bobsadviceforstocks@lycos.com if you have any comments, questions, or words of encouragement! Have a great evening everyone!

Bob

Posted by bobsadviceforstocks at 3:48 PM CDT

|

Post Comment |

Permalink

Updated: Wednesday, 2 June 2004 3:50 PM CDT

June 2, 2004 "Trading transparency" CYTC, NOIZ

Hello Friends! I just made a couple of quick trades in my trading account that I wanted to share with you. I sold 75 shares of CYTC at $22.90, 1/4 of my 300 share position. My original purchase was on 1/29/04 at a cost basis of $14.86/share. This reperesents a gain of $8.04 or 54.1%. This is my third sale (frankly I thought it was my second!), so we will need to wait until the stock is up 120%, to make the fourth sale. The first sale was 100 shares at $18.6, and another 100 shares on 4/2/04 at $22.61.

Also, I bought 400 shares of NOIZ, Micronetics, at a cost of $9.40/share. I will be writing this one up shortly!

Thanks so much for stopping by! Please remember to consult with your own investment advisors before taking any action based on anything on this blog. If you ahve any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com

Bob

Tuesday, 1 June 2004

June 1, 2004 SRA International (SRX)

Hello Friends! It is a bit after 5 pm here in Wisconsin, and actually it is my stock club night. I am a member with bunch of great guys (and one great lady!) who meet monthly trying to divine the future of our investments. (Some of them occasionally stop by here so I will refrain from anything I might regret!) Let me just say, that I have about 41 minutes to fire off this entry! Remember, as ALWAYS, that I am an AMATEUR investor, these are just my observations on current stocks of interest, so PLEASE consult with your investment advisors before making any investment decisions based on what you read here!

I came across SRA International (SRX) a few moments ago...scanning the lists of greatest percentage gainers. I do NOT own any shares nor do I have any options or other leveraged positions. SRX did have a nice day today closing at $41.80, up $3.03 or 7.82% on the day. According to the profile on CBS Marketwatch, SRX's "...principal activity is to provide information technology services and solutions to the U.S. Federal government organization. The services provided include strategic consulting, systems designing, development, integration and outsourcing and operations management."

On May 3, 2004, SRX

announced 3rd quarter 2004 results. Revenue was up 37% from the prior year to $160 million. Net income increased 42% to $10.2 million. And diluted earnings per share for the quarter ended March 31, 2004, came in at $.37, up 23% from the prior year's figure of $.30/share. In addition, they raised fiscal year 2004 guidance. All of this was bullish for the stock!

If we look at the

"5-Yr Restated" financials on Morningstar.com, we can see that revenue, which was fairly flat between 1999 and 2001, increasing from $291.9 million in 1999 to $312.5 million in 2001, took off after that...increasing to $361.2 million in 2002 and $450.4 million in 2003 and $518.5 million in the trailing twelve months.

Earnings on Morningstar.com start in 2003 where they were at $1.25, increasing to $1.27 in trailing twelve months. However, from the recent quarter, we can see that the earnings are growing quicker than that!

Free cash flow has improved from $6 million in 2001 to $34 million in 2003.

The balance sheet is GORGEOUS with $189.1 million in cash, way more than enough to pay off both the $98.7 million in current liabilities and the smallish $5.9 million in long-term liabilities. In addition, Morningstar.com reports that they have an ADDITIONAL $153.8 million in OTHER current assets! With the growing free cash flow, this one looks financially healthy to me.

What about valuation? Looking at

"Key Statistics" from Yahoo.com, we can see that the market cap is $1.08 billion, the trailing p/e is 31.19, but the forward p/e (fye 30-Jun-05) is only 25.03. The PEG isn't bad at 1.26 (imho), and the Price/Sales is reasonably priced at 1.78.

Yahoo reports 25.78 million shares outstanding with 14.80 million of them that float. There are a LOT of shares out short (from my perspective) with 515,000 as of 5/10/04...representing 3.48% of the float, but more importantly representing 7.923 trading days of short interest. (I use 3.00 trading days as a cut-off...I am not sure what other people use...but this seems to be fairly predictive of the chances of observing a "squeeze".)

Yahoo reports no cash dividend and no stock dividend is reported.

What about Technicals?

If we look at a recent "Point & Figure" chart on SRX, we can see that the stock was trading "sideways" through much of 2002 and early 2003. In April, 2003, the stock broke through a resistance level at around $6 and has been trading higher since. In my humble opinion, this graph looks just fine!

What do I think. Well, first of all I don't have any money to invest...you know the old story. But otherwise it looks nice. I guess it is a bit depended on the Federal Government for business....and I am not sure about whether a change in Administrations, that is the Democrats taking over the White House, if that is the case, would mean any change for them. Other than that, things look nice. They have a great earnings record, are raising current estimates, have a wonderful balance sheet, reasonable PEG and Price/sales....and a nice graph to boot! What is there NOT to like?

Thanks again for stopping by! Please feel free to stay awhile and browse the myriad of posts...and please email me at bobsadviceforstocks@lycos.com if you have any comments, questions, or words of encouragement!

Bob

Newer | Latest | Older

Now that I am back in business on this blog, I was scanning through the large percentage gainers today and came across Curtiss-Wright (CW). I do not own any shares nor do I have any leveraged or option positions in this company. CW had a nice day today, in an otherwise lackluster market, closed at $49.46, up $2.34 or 4.97% on the day. According to the Yahoo profile on CW, they are "...engaged in the design and manufacture of motion control, metal treatment and flow control products for the aerospace, metal working and other industries."

Now that I am back in business on this blog, I was scanning through the large percentage gainers today and came across Curtiss-Wright (CW). I do not own any shares nor do I have any leveraged or option positions in this company. CW had a nice day today, in an otherwise lackluster market, closed at $49.46, up $2.34 or 4.97% on the day. According to the Yahoo profile on CW, they are "...engaged in the design and manufacture of motion control, metal treatment and flow control products for the aerospace, metal working and other industries." On April 29, 2004, CW reported 1st quarter 2004 results. Net sales increased 19% to $214.9 million from $179.9 milllion in 2003. Net earnings were up 11% to $15.6 million or $.74/diluted share.

On April 29, 2004, CW reported 1st quarter 2004 results. Net sales increased 19% to $214.9 million from $179.9 milllion in 2003. Net earnings were up 11% to $15.6 million or $.74/diluted share.

Hello Friends! Thanks so much for stopping by. I was away from my computer this past week so I haven't been making many entries here. Every once in a while I "get a life." Before I go any further, let me please remind you that I am an AMATEUR investor so PLEASE check with your professional investment advisors regarding the appropriateness of investments discussed on this website for your particular needs.

Hello Friends! Thanks so much for stopping by. I was away from my computer this past week so I haven't been making many entries here. Every once in a while I "get a life." Before I go any further, let me please remind you that I am an AMATEUR investor so PLEASE check with your professional investment advisors regarding the appropriateness of investments discussed on this website for your particular needs. On June 2, 2003, I

On June 2, 2003, I  The second stock listed that week was Affiliated Computer Services (ACS) which was

The second stock listed that week was Affiliated Computer Services (ACS) which was  My third selection that week was ExpressJet (XJT) which was

My third selection that week was ExpressJet (XJT) which was  On June 3, 2003, I

On June 3, 2003, I  On June 3, 2003, I

On June 3, 2003, I  June 3, 2003, also found me

June 3, 2003, also found me  Also on June 3, 2003, I

Also on June 3, 2003, I  On June 4, 2003, I

On June 4, 2003, I  On June 5, 2003, I

On June 5, 2003, I  On June 5, 2003, I

On June 5, 2003, I  On June 5, 2003, I

On June 5, 2003, I  Also on June 5, 2003, I

Also on June 5, 2003, I  FINALLY (sigh), on June 6, 2003, I

FINALLY (sigh), on June 6, 2003, I  Anyhow, I came across Bebe Stores (BEBE) today while scanning the lists of greatest percentage gainers. BEBE is currently, as I write, trading at $21.17, up $1.06 or 5.27% on the day (by the time I finished up writing the post, the market was closed and BEBE closed at $20.44, up only $.33 or 1.64%...but the numbers look nice so I have stayed with this pick!). I do NOT own any shares nor do I have any options or leveraged positions in this stock. According to cnn.money, BEBE's principal activity "...is to design, develop and produce a line of contemporary women's apparel and accessories."

Anyhow, I came across Bebe Stores (BEBE) today while scanning the lists of greatest percentage gainers. BEBE is currently, as I write, trading at $21.17, up $1.06 or 5.27% on the day (by the time I finished up writing the post, the market was closed and BEBE closed at $20.44, up only $.33 or 1.64%...but the numbers look nice so I have stayed with this pick!). I do NOT own any shares nor do I have any options or leveraged positions in this stock. According to cnn.money, BEBE's principal activity "...is to design, develop and produce a line of contemporary women's apparel and accessories."

Hello Friends! Was pretty busy today and finally towards the end of the day got around to working the lists of greatest percentage gainers. I sold 75 shares of CYTC thinking that was my SECOND sale...approaching the 60% gain level...but when writing it up realized it was my THIRD sale....so I shall skip the 90% sell point and look forward to a solid 120% gain before making the next sale. Anyway, I still worry about anyone thinking I am giving out investment advice for THEM...so PLEASE remember to do your own investigation of all stocks discussed on this blog as I am an AMATEUR investor....and you need to discuss these investments with YOUR professional investment advisors before taking any action on the equities discussed.

Hello Friends! Was pretty busy today and finally towards the end of the day got around to working the lists of greatest percentage gainers. I sold 75 shares of CYTC thinking that was my SECOND sale...approaching the 60% gain level...but when writing it up realized it was my THIRD sale....so I shall skip the 90% sell point and look forward to a solid 120% gain before making the next sale. Anyway, I still worry about anyone thinking I am giving out investment advice for THEM...so PLEASE remember to do your own investigation of all stocks discussed on this blog as I am an AMATEUR investor....and you need to discuss these investments with YOUR professional investment advisors before taking any action on the equities discussed.

I came across SRA International (SRX) a few moments ago...scanning the lists of greatest percentage gainers. I do NOT own any shares nor do I have any options or other leveraged positions. SRX did have a nice day today closing at $41.80, up $3.03 or 7.82% on the day. According to the profile on CBS Marketwatch, SRX's "...principal activity is to provide information technology services and solutions to the U.S. Federal government organization. The services provided include strategic consulting, systems designing, development, integration and outsourcing and operations management."

I came across SRA International (SRX) a few moments ago...scanning the lists of greatest percentage gainers. I do NOT own any shares nor do I have any options or other leveraged positions. SRX did have a nice day today closing at $41.80, up $3.03 or 7.82% on the day. According to the profile on CBS Marketwatch, SRX's "...principal activity is to provide information technology services and solutions to the U.S. Federal government organization. The services provided include strategic consulting, systems designing, development, integration and outsourcing and operations management."