Stock Picks Bob's Advice

Friday, 31 December 2004

December 31, 2004 Laserscope (LSCP)

Hello Friends! As I just noted earlier, I purchased 160 shares of Laserscope (LSCP) today and I promised you that I would review the stock and show you why I found it attractive as an investment. As always, remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this blog,

Stock Picks Bob's Advice. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com and I will try to get back to you, most likely with an entry right here!

This morning, looking through the

list of top % gainers on the NASDAQ, I came across Laserscope Inc. (LSCP) which, as I write, is currently trading at $35.99, up $2.40, or 7.14% on the day. According to the

Yahoo "Profile" on LSCP, Laserscope "...designs, manufactures, sells and services, on a worldwide basis, a line of medical laser systems and related energy devices for the medical office, outpatient surgical center and hospital markets."

Taking a look at their latest quarterly report, on October 27, 2005, LSCP

reported 3rd quarter 2004 results. Revenue came in at $24.2 million, for the quarter ended September 30, 2004, a 69% increase from $14.3 million in the same quarter last year. Net income for the quarter was $4.4 million or $.19/diluted share an over 800% increase from the $533,000 or $.02/diluted share last year. These were outstanding results and the stock price has reflected this!

How about longer-term? If we take a look at the Morningstar.com

"5-Yr Restated" financials on LSCP, I do find a disturbing decrease in revenue from $41 million in 1999 to $35.1 million in 2001. This is NOT what I would call a "perfect" stock from my perspective, but everything else is in line with what I like to see. That is, since 2001, revenue has grown swiftly from $35 million to $82 million in the trailing twelve months (TTM). The latest quarterly report continues this trend.

In the same fashion, earnings, slightly erratic between 1999 and 2001, have overall increased from a loss of $(.60) in 1999 to the $.50/share in the TTM.

Morningstar reports that free cash flow which was "0" in 2001, has subsequently improved to $3 million in the TTM.

Balance-sheet-wise on Morningstar, we find $12.7 million in cash and $39.3 million in other current assets. Balanced against the $20.4 million in current liabilities and the -0- long-term liabilities, this looks solid!

What about "valuation"? Using Yahoo

"Key Statistics" on LSCP, we can see that this is a small cap stock with a market cap of $770.28 million. The trailing p/e is a bit rich (!) at 73.84, and the forward p/e isn't much better at 44.95, but the rapid growth rate gives us a PEG of 1.80, which isn't a bargain, but isn't that bad either. The Price/Sales ratio is also rich at 8.76.

Yahoo reports 21.42 million shares outstanding with 19.60 million of them that float. The shares out short as of 11/8/04 stand at 2.32 million, representing 11.86% of the float, or 4.437 trading days of volume. Using my personal 3.0 trading days as a cut-off, there ARE a few shares out short but then again, this doesn't appear to be a big issue.

How about dividends? None. And no stock splits are reported on Yahoo.

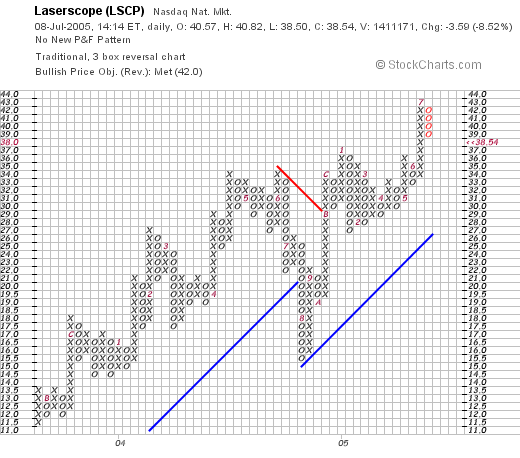

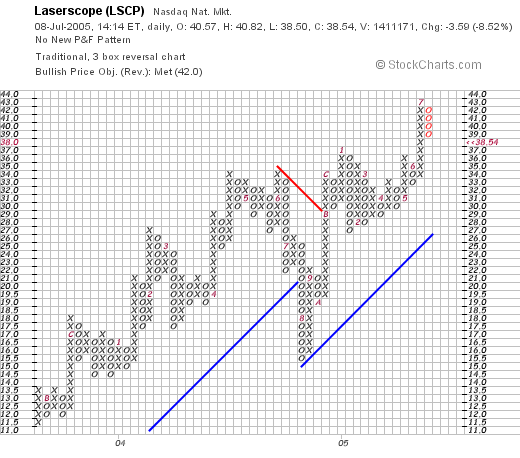

What about "technicals"? For this I like to look at a "Point & Figure" chart from Stockcharts.com. Here we can see that this stock has been trading higher since late 2002 when it was selling at $3.00/share. Sometime in July, 2004, the stock sold off, seemingly breaking down price support as it broke through $21, heading towards $16. Since then, the chart has been charging higher, breaking through a resistance level at $30 to its current level of around $35.87. The chart looks strong to me!

So what do I think? Well the stock made a strong move higher today, and does have a strong chart behind it. The latest quarter was fabulous. The last several years, if not all five, have been quite strong with solid growth in revenue and earnings and the balance sheet is solid. Valuation is a bit rich, but I believe this stock is growing so fast that this valuation may very well be worth it. In fact, I like this stock so much I bought some shares!

Thanks again for stopping by! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

In this time of global disaster in Southeast Asia, I would be remiss not to say that stock performance is irrelevant to those in greatest needs and all of our prayers go out to the victims of the Tsunami in Southeast Asia. If you haven't done so already, you can donate to this effort by going to the CARE website (I have linked to CARE USA), but if you are elsewhere, there are links there as well. There are many other organizations working to raise money, so if you have had a good year investing this year, think about some of the victims who have lost families and homes this month.

In this time of global disaster in Southeast Asia, I would be remiss not to say that stock performance is irrelevant to those in greatest needs and all of our prayers go out to the victims of the Tsunami in Southeast Asia. If you haven't done so already, you can donate to this effort by going to the CARE website (I have linked to CARE USA), but if you are elsewhere, there are links there as well. There are many other organizations working to raise money, so if you have had a good year investing this year, think about some of the victims who have lost families and homes this month.

Bob

"Trading Transparency" LSCP

Hello Friends! Well that nickel was burning a hole in my pocket....having sold my latest 1/4 position in COH just a couple days ago, I was now eligible to add a new position. Looking through the top % gainers today, I came across Laserscope (LSCP), I do not believe I have reviewed that one before.

A few moments ago, I purchased 160 shares of LSCP at $36.246 for a total purchase cost of $5,799.36. I will try to update the blog and take a closer look and review LSCP for all of you as well.

As always, please remember I am an amateur investor sharing with you my own thoughts on investments, so please consult with your professional investment advisors prior to making any investment decisions of your own! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Thursday, 30 December 2004

December 30, 2004 Dialysis Corporation of America (DCAI)

Hello Friends! Thanks for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please consult with your professional investment advisors prior to using any information on this website. I cannot be responsible for any of your losses that you may experience using any such information, nor shall I attempt to take credit for any of your gains. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com . By the way, I hope all of you have a very happy, healthy, safe, and profitable 2005!

Since so many of you who stop by here are new to what I do, I will try to review some of the techniques to find what I would call "stocks of interest". For me personally, it is from these stocks that I have been forming my portfolio. Again, what you do with these stocks should be first to discuss them with your own advisors to determine if they are appropriate, timely, and likely to be profitable for you!

It has been my experience that stocks that are making strong moves on any particular day may be among those stocks that may turn out to be good investments. Thus, I like to scan the

NASDAQ list of top % gainers. In this case, I found Dialysis Corporation of America (DCAI) on the NASDAQ list. Due to my own constraints of selling at 8% losses to prevent losses from growing too large, I have found that stocks under $10 are far too volatile for me and I prefer to avoid these issues. DCAI made the list today with a strong gain of $1.75 (or 10.02%) to close at $19.21. I do NOT own any shares of DCAI as I write this issue. (Since my last portfolio transaction was a sale of a portion of COH at a gain, I am "eligible" to add a position and certainly will be looking at DCAI in the future.)

My first "screening" step after finding a stock is to look at the latest quarter. I am not very "picky" but do insist that the latest quarter show both revenue growth and earnings growth. For this information, I generally turn to Yahoo finance which is a nice place for researching recent quarterly results.

On November 15, 2004, DCAI

reported 3rd quarter 2004 results. First on the question of revenue, for the quarter ended September 30, 2004, revenue came in at $11.0 million compared with $7.6 million the prior year. Second, earnings: net income came in at $776,000 or $.09/diluted share, compared with $308,000 or $.04/diluted share the prior year. On both counts, DCAI passes my "test".

My next step is to look a little deeper on the quality of this company. What do I mean by that? For me, quality is about consistency of growth. I am looking for those companies, boring as it may sound, that have been consistently growing earnings and revenue over several years. It is my hope, that this earnings and revenue "momentum" as you might call it, will persist.

A good friend of mine introduced me to the Morningstar.com site, and I would encourage you to get familiar, and even consider subscribing if you are so oriented. I have found much of the free material adequate for my basic needs. Looking at the

"5-Yr Restated" financials from Morningstar.com on DCAI, we can see a very pretty picture of revenue growth from $5.9 million in 1999 to $37.5 million in the trailing twelve months (TTM).

How about earnings? This has grown almost linearly (except for a dip between 2002 and 2003) from a loss of $(.10)/share to $.22/share in the TTM.

I have also been looking at free cash flow. As noted on the chart, this is the difference between "Operating Cash Flow" and "Capital Spending." Not being an accountant, I am afraid I am not qualified to expound on free cash flow, but in my simple understanding, this amounts to the actual cash being created or consumed by a corporation. (For another view on free cash flow, I would encourage you to read this

discussion on the Motley Fool site)

I prefer to see positive free cash flow, but certainly, "break-even" is preferable to negative cash flow. In DCAI's case, free cash flow, as reported on Morningstar, was $(1) million in 2001, $1 million in 2002, and "0" in 2003 and the TTM. Thus, the company is at this point neither generating nor consuming free cash. (I prefer growth in free cash, but as long as everything else is growing strongly, "0" is acceptable imho.)

How about the balance sheet? (Once again, for a more detailed discussion, I would like to refer you to the

Motley Fool balance sheet basics.) Basically, assets are dollar amounts that you own, and liabilities are dollar amounts that you owe to others. It doesn't take a genius, imho, to realize that you would rather own dollars than owe them to others! In addition, current vs. long-term, as I understand it, are assets or debts that you own or are owed divided by a twelve month period from the current time. For DCAI, from Morningstar, we can see that this company has $1.5 million in cash, and $10.3 million in other current assets. This is balanced against current liabilities of $9.2 million (with the over $11 million in cash and current assets easily covered) and $3.7 million in future liabilities (debts owed that will come due in a greater than 12 month time frame). Overall, the company appears solvent without additional cash needs at this time imho.

Thus far, I have looked at "momentum" both in terms of earnings and revenue growth, and some "fundamental" views of the soundness of the business venture, that is, 'is this company using or generating cash' and 'what is the balance-sheet like?'. This may sound like a lot of work, but if you follow my steps, I think you can see that with a few seconds of review, this information is easily available and readily understood.

My next step is an assessment of "valuation". For this I once again turn to Yahoo, and in particular for DCAI,

"Key Statistics" from Yahoo on DCAI. Here we find that this is really a small cap (under $500 million according to the

Ameritrade definitions with a market "cap" of $163.02 million. (Some people would even refer to this small a company as a "micro cap" stock (See

Investopedia.com) meaning those companies with capitalization between $50 and $300 million).

The trailing p/e is reported as a 'rich' 87.72, there is no PEG, and the Price/Sales is also a bit rich at 3.97. (imho the PEG and Price/Sales are 'bargains' when they hover near 1.0). So this is no great bargain in terms of value, but with a very fast small company, I do not personally rule out stocks on this basis, but it does give me pause.

There are only 8.49 million shares outstanding and only 6.40 million of them float. There are only 4,000 shares out short representing 0.06% of the float or 0.182 trading days, so this is not a factor imho. No cash dividends are paid, and the stock DID recently split 2:1 in February, 2004.

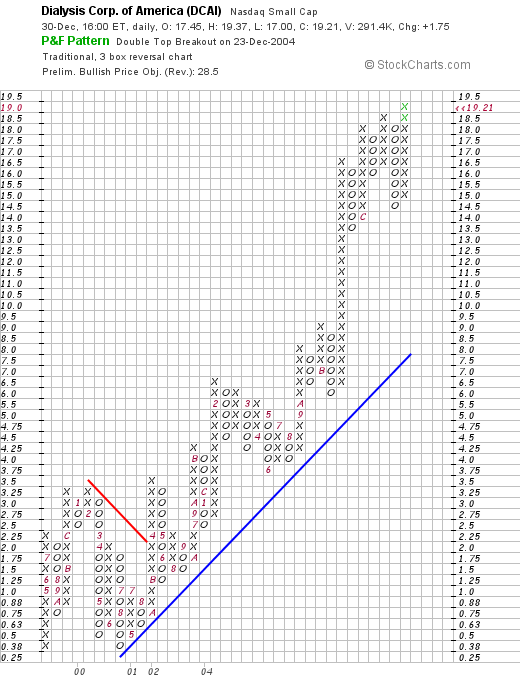

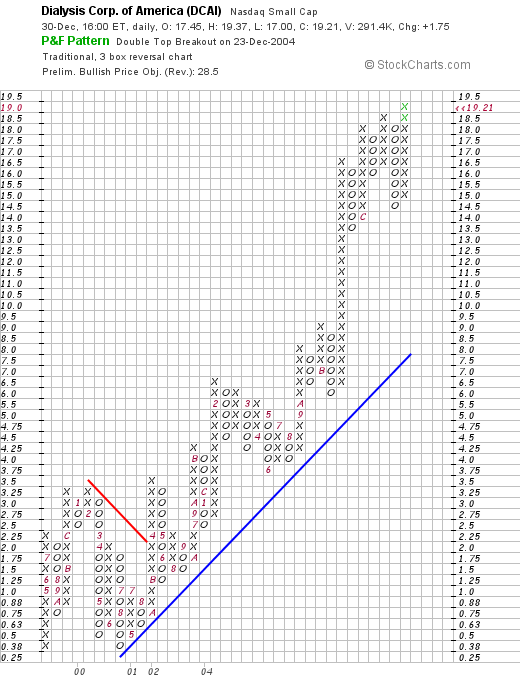

How about "technicals". This is my simple approach of at least looking at a chart! Personally, I believe that stock price performance is a function of the underlying fundamentals, and do not believe that stock charts determine future price performance. However, it is nice to at least look at a chart to either verify or give you pause about the rest of your assessments!

I have grown to like the "Point & Figure" charting techniques. An explanation of these charts is found on

Stockcharts.com, where I found this

"Point & Figure" chart on DCAI:

This is my kind of chart with a steadily increasing stock price going back all the way to 2001. It does appear that the stock might be a little ahead of itself, but the strength of the chart, without any sophisticated technical background, for me, is apparent.

So what do I think? Well, let's review, first of all, the stock made a nice move today, the latest quarter was very strong, the five-year growth in revenue and earnings is impressive, the free cash flow is break-even, but the balance sheet is solid. Valuation is a bit rich, with a p/e above 70, the PEG is unknown probably because there aren't any analysts with estimates. So it is attractive as an investment to me, and since I AM in the investment market....well I will have to sleep on this one!

So what do I think? Well, let's review, first of all, the stock made a nice move today, the latest quarter was very strong, the five-year growth in revenue and earnings is impressive, the free cash flow is break-even, but the balance sheet is solid. Valuation is a bit rich, with a p/e above 70, the PEG is unknown probably because there aren't any analysts with estimates. So it is attractive as an investment to me, and since I AM in the investment market....well I will have to sleep on this one!

Meanwhile, I wish you and your friends and family, a Happy, Healthy, Safe, and Profitable 2005. Please note my priorities. Profitable is nice, but the rest is so much more important! Thanks again for stopping by, and if you have any questions or comments on what I have written, please feel free to email me at bobsadviceforstocks@lycos.com or comment right here on the blog!

Bob

Wednesday, 29 December 2004

"Trading Transparency" COH

Hello Friends! My COH hit a sell point and a few moments ago, I sold 22 shares (about 1/4) of my 90 shares remaining at $57.05. These shares were purchased 2/25/03, at a cost basis of $16.66, so my gain was $40.39 or 242.4%. This was my SIXTH partial sale of COH since the purchazse, with sales at approximately 30%, 60%, 90%, 120%, then 180%, and just now 240%.

Thus, I am now "permitted" to add a new position...but I don't see anything much interesting with the market as sloppy as it is. In addition, Starbucks (SBUX) is also approaching a sale point!

Thanks again for stopping by! Please remember that I am an amateur investor, so please consult with your professional investment advisors prior to making any investment decisions based on information on this website. If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Friday, 24 December 2004

"Looking Back One Year" A review of stock picks from the week of November 3, 2003

Hello Friends! I wish all of my friends a very Merry Christmas and wishes for a Happy and Healthy New Year! Since we are at the end of the trading week (and because I skipped last week!), I thought I would take a few moments to review the stock picks from my blog,

Stock Picks Bob's Advice from about a year ago.

We have a trailing review, and unfortunately, I am getting a little more than a year out! Currently, I am up to the week of November 3, 2003. Our analysis assumes a buy and hold strategy which is NOT something I do on this website. However, for our purposes here, it gives us a rough idea of how the stocks have performed subsequent to my selection of them for this website.

As ALWAYS, please remember that I am an amateur investor so please consult with your professional investment advisor before making any decisions based on information on this website as selections may or may not be appropriate, timely, or even profitable for you! I cannot be responsible for any of your losses nor will I take credit for any of your gains! If you have any questions or comments, please feel free to drop me a line at bobsadviceforstocks@lycos.com .

On November 5, 2003, I

posted Beazer Homes (BZH) on Stock Picks at $106.34/share. BZH closed at $143.55 on 12/23/04 for a gain of $37.21/share or 35.0%.

On November 5, 2004, BZH

reported 4th quarter 2004 results. Revenue for the quarter ended September 30, 2004, came in at $1.21 billion, up 16.5%. Net income was $80.1 million, up 40.1% from the prior year. And on a diluted EPS basis, came in at $5.82, up 39.2% from the $4.18 the prior year. These were great results!

In fact, BZH recently

announced a 3:1 stock split subject to shareholder approval.

On November 5, 2003, I

picked Watson Pharmaceuticals (WPI) for Stock Picks at a price of $41.01. WPI closed at $32.30 on 12/23/04 for a loss of $(8.71) or (21.2)%.

On October 27, 2004, Watson (WPI)

announced 3rd quarter 2004 results. Total net revenue for the 3rd quarter ended September 30, 2004, increased 14% to $408.0 million from $358.8 million last year. Net income for the quarter was $14.6 million compared to net income of $51.5 million last year. Including charges, eps came in at $.13 vs $.47/share last year. (Without these one time charges, eps would still be only $.45/share, still down slightly from last year.) Certainly, imho, we could have seen better results!

On November 6, 2003, I

selected Rofin-Sinar Technologies (RSTI) for Stock Picks at a price of $28.87. RSTI closed at $41.09 on 12/23/04 for a gain of $12.22 or 42.3%.

On November 10, 2004, RSTI

reported 4th quarter 2004 results. For the quarter ended September 30, 2004, Net sales came in at $93.6 million, up 26% from the prior year's $74.1 million. Net income was $14.1 million, vs. $4.9 million the prior year, up 192%. Great numbers!

On November 6, 2003, I

posted Aceto Corporation (ACET) on Stock Picks at $17.42/share. ACET split 3:2 on 1/5/04 for an effective pick price of $11.62. ACET closed at $19.19 on 12/23/04 for a gain of $7.57 or 65.1%.

On November 9, 2004, ACET

announced 1st quarter 2005 results. Net sales increased 12% to $80.8 million. Net income grew 8% to $3.4 million or $.21/diluted share. Last year net income was $3.1 million or $.20/diluted share. On December 3, 2004, ACET

announced a 3:2 stock split and a 30% increase in the dividend. These are the kind of announcements showing confidence in a company that the street likes, and the stock price has responded accordingly!

Finally, on Friday, November 7, 2003, I

posted LeapFrog Enterprises (LF) on Stock Picks at $35.71/share. LeapFrog closed at $13.10 on 12/23/04 for a loss of $(22.61) or (63.3)%.

On October 27, 2004, LeapFrog (LF)

reported 3rd quarter 2004 results. Net sales increased 13% to $231.1 million from $203.9 million the prior year same quarter. Net income, however, came in at $20.2 million or $.33/share, down from $33.4 million, or $.55/diluted share the prior year. However, the company fortunately maintained 2004 guidance.

So how did we do that week in November, 2003, a little over a year ago? I had two stocks losing money and three stocks gaining with an average gain of 11.58%. Not fabulous, but then again, not too bad either! Remember, in real life, I advocate selling losers quickly and selling gainers piecemeal slowly.

Thanks again for stopping by! I hope that all of your Holidays are always Merry! Above all have a healthy and safe 2005! If you have any questions, or just want to wish ME a Holiday Greeting (is that a hint or what?), feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Posted by bobsadviceforstocks at 3:10 PM CST

|

Post Comment |

Permalink

Updated: Friday, 24 December 2004 8:09 PM CST

Thursday, 23 December 2004

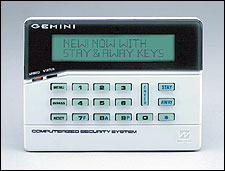

December 23, 2004 Napco Security Systems (NSSC)

Hello Friends! Thanks so much for stopping by my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so PLEASE consult with your professional investment advisors to make sure that all investments discussed are appropriate, timely, and likely to be profitable for you. I cannot be responsible for any of your losses nor take credit for any of your gains! If you have any questions, or comments, please feel free to email me at bobsadviceforstocks@lycos.com.

Today, while scanning the

list of top % gainers on the NASDAQ, I came across Napco Security Systems (NSSC) which, as I write, is trading at $13.141, up $1.482 or 12.71% on the day. I do NOT own any shares nor have any options or other positions related to this stock. According to the

Yahoo "Profile", NSSC is "...engaged in the development, manufacture, distribution and sale of security alarm products and door security devices for commercial and residential installations."

On November 9, 2004, NAPCO

reported 1st quarter 2005 results. Net sales increased 37% to $13.4 million from $9.8 million last year. The net income for the quarter was $513,000 or $.06/share compared to a net loss of $(282,000) or $(.04)/share last year. These were nice results.

If we look longer term at a

"5-Yr Restated" Financials on Morningstar.com, we can see several nice points: steady revenue growth (recently accelerating) from $54 million in 2000 to $62 million in the trailing twelve months.

Earnings per share have been a bit more erratic, dropping from $.24/share in 2000 down to $.12/share in 2003 but increasing steadily from then.

Free cash flow, however, has been positive and steady, increasing slightly from $6 million in 2002 to $7 million in the trailing twelve months (TTM).

Looking at the balance sheet, we can see $1.5 million in cash and $35.2 million in other current assets, plenty to cover BOTH the $8.4 million in current liabilities AND the $8.6 million in long-term liabilities combined.

How about valuation? Looking at

"Key Statistics" from Yahoo on NSSC we can see that this is a TINY company, really a microcap stock with a market cap of only $112.38 million. The trailing p/e is 27.40, no forward p/e is available (probably no analysts follow to give us these estimates), and thus no PEG. The price/sales isn't bad at 1.61, and that p/e sounds reasonable with the quick recent growth.

Yahoo reports 8.51 million shares outstanding and of these only 5.80 million float. Currently (11/8/04) there are 938,000 shares out short representing 12.676 trading days or 16.17% of the float. This imho might represent a possible "squeeze" of the shorts in the making....if the stock rises, they will need to scramble to buy shares to cover their short positions.

Yahoo shows no cash dividends. A 20% stock dividend was issued on 11/18/04.

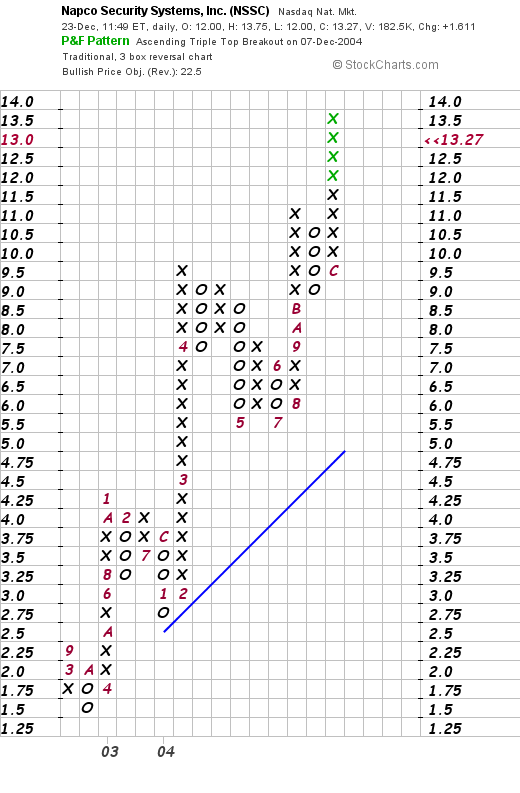

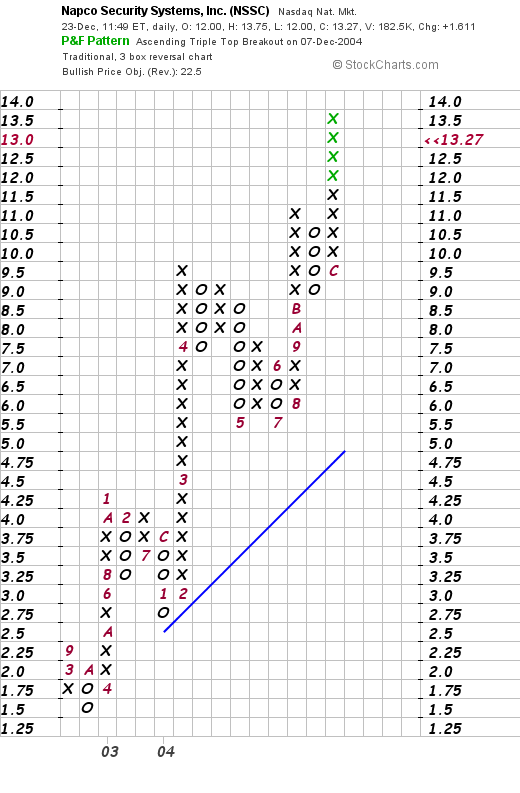

How about technicals? If we look at a Point & Figure chart from

Stockcharts.com:

We can see a very strong chart rising from $1.50 in late 2003 to the current level of around $14.00. the stock looks nice imho.

So what do I think? I really like this stock a lot. Only thing is it is quite small, has a price near $10.00, and might be quite volatile. Now, if I had any cash, or my portfolio gave me a buy signal, I might just be buying a few shares! Thanks again for stopping by! Have a wonderful Holiday Season and a very healthy, happy, and profitable 2005!

Bob

Tuesday, 21 December 2004

"Trading Transparency" AMMD and PARL

Hello Friends! I have been patiently (almost) waiting on my American Medical Systems stock (AMMD) which has been closing on my second sale point. A few moments ago I unloaded 35 shares of my 150 shares of AMMD at a price of $41.15. These shares were purchased on 1/9/04 at a cost of $25.82, so I had a gain of $15.33 or 59.4% (my goal was 60% so i did jump the gun a teency bit...is THAT a word?). My first sale of 50 shares out of the original 200 was executed on 6/24/04 at a price of $32.08, for a gain of $6.26 or 24.2%...so I jumped the gun a bit on that too! And after selling a portion today, well that gave me the "permission slip" to add a new position!

Scanning the lists of top % gainers today I came across Parlux Fragrances (PARL). I first

posted Parlux (PARL) on Stock Picks On October 7, 2004, when it was trading at $14.95. Today I purchased 300 shares of PARL at $22.20. PARL is trading strongly today, currently as I write at $22.181, up $1.551 or 7.52% on the day!

The rest as they say is history! Thanks so much for stopping by. Please remember that I am an amateur so please consult with your investment advisors before acting on any information on this website! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com .

Bob

Monday, 20 December 2004

Revisiting DRS Technologies (DRS)

Hello Friends! As I noted earlier, I sold some of my Cantel at the 60% sell point, enabling me to add a position. I picked up 200 shares of DRS Technologies (DRS) and wanted to revisit this stock. I

first posted DRS Tech (DRS) on

Stock Picks Bob's Advice on August 6, 2003, when it was trading at $27.98/share. DRS closed today at $44.35, up $1.28 or 2.97% on the day.

According to the

Yahoo "Profile", DRS "...is a supplier of defense electronic products and systems."

On November 5, 2004, DRS

announced 2nd quarter results. Revenue for the quarter was $328 million, up 59% from $206.2 million a year ago. The latest acquisition of Integrated Defense Technologies helped boost results. Quarterly income rose to $14.4 million or $.52/share, beating estimates of $.45/share, and up from $9.4 million or $.41/share last year.

Looking longer-term, the

Morningstar.com "5-Yr Restated" financials show that revenue has increased from $.4 billion in 2000 to $1.3 billion in the trailing twelve months (TTM).

Earnings during this period have also steadily increased from $.76/share to $2.02/share in the TTM. There has been some dilution in shares with 13 million in 2002, increasing to 27 million in the TTM.

Free cash flow has been positive and increasing from $14 million in 2002 to $99 million in the TTM.

The balance sheet looks fine, although long-term debt is a bit heavy, with $71.9 million in cash and $413.6 million in other current assets balanced against $352.1 million in current liabilities and $588.8 million in long-term liabilities.

How about "valuation"? Looking at

"Key Statistics" on Yahoo, we can see that this is a mid-cap stock with a market cap of $1.21 billion. The trailing p/e is reasonable at 22.23 and the forward p/e is nice at 18.56. The PEG is a bit high (?) at 1.28. And price/sales is a reasonable 0.93.

Yahoo reports 27.21 million shares outstanding with 26.60 million of them that float. Currently there are 1.42 million shares out short (11/8/04) representing 5.36% of the float or 4.814 trading days of volume. No stock dividend or stock split is reported on Yahoo.

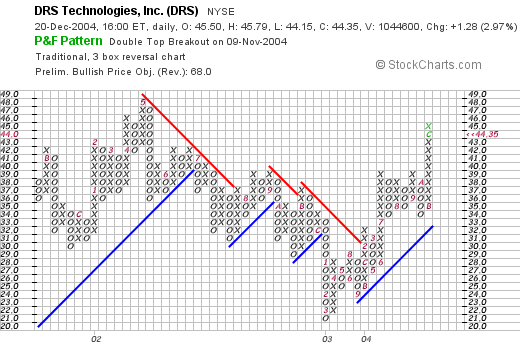

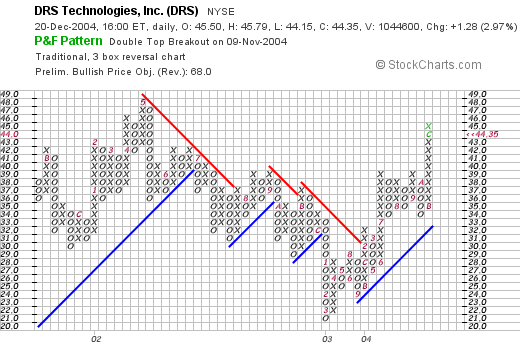

How about "technicals"? Taking a look at a

"Point & Figure" chart from Stockcharts.com, we can see that the stock which increased in price between August and December of 2001, peaked at around $48/share in May, 2002, then declined to a low of $21/share in March, 2003. The stock has been climbing since that time and appears to be on an upward trajectory without being over-extended. In other words the chart looks nice.

So what do I think about DRS? Well, I liked it enough to buy some shares today! Actually, it was a name that I was familiar with and seeing it on the list of top % gainers, well it was a no-brainer, imho, to buy some shares. The latest quarterly report is quite strong, the growth as reported on Morningstar is great. The free cash flow is positive and growing, the balance sheet looks fine, the valuations are reasonable. And if you haven't noticed it, the US is in an armed struggle and defense expenditures appear to be going nowhere but up!

Thanks so much for stopping by! If you have any questions, comments, or words of encouragement, please feel free to email me at bobsadviceforstocks@lycos.com .

Above all, I wish all of my readers the Merriest of Christmasses, the Happiest of New Years, and my personal wishes for good health, the most important gift of all!

Above all, I wish all of my readers the Merriest of Christmasses, the Happiest of New Years, and my personal wishes for good health, the most important gift of all!

Bob

"Trading Transparency" DRS Technologies (DRS)

Well that nickel didn't stay in my pocket very long! Looking through the lists of top % gainers, I came across DRS Technologies, a defense contractor that I have owned in the past.

I purchased 200 shares of DRS at $44.69 in my trading account. DRS is currently trading at $44.67/share as I write, up 3.71% on the day. I will try to update the DRS story later!

Regards!

Bob

"Trading Transparency" Cantel (CMN)

Hello Friends! This is a quick post to let you know that I hit a sale point on Cantel (CMN) on the upside. A few moments ago, I sold 55 shares, representing approximately 1/4 of my 225 shares of Cantel as it hit a 60% gain. The 55 shares were sold at $33.75. I have a cost basis of $20.04, and thus had a gain of $13.71 or 68.4%. These shares were acquired on 6/4/04, and thus I have owned them just over six months.

I sold my first shares (of my 300 shares originally purchased); 75 shares were sold 7/8/04 at a price of $25.20, for a gain of $5.16 or 25.7% (a little shy of the 30% gain!). Cantel recently announced a 3:2 stock split, but I am not sure what is driving the stock higher today as it is up $2.64 or 8.47% on the day enabling me to sell a portion of my holdings.

My favorite part of this is that I can now look around to purchase a new position! I don't have to sit on my hands at the moment...and I shall let you know if I find anything suitable to buy for my account!

Bob

P.S. Sorry about not getting that "Weekend Review" out...will address that soon hopefully!

Newer | Latest | Older

This morning, looking through the list of top % gainers on the NASDAQ, I came across Laserscope Inc. (LSCP) which, as I write, is currently trading at $35.99, up $2.40, or 7.14% on the day. According to the Yahoo "Profile" on LSCP, Laserscope "...designs, manufactures, sells and services, on a worldwide basis, a line of medical laser systems and related energy devices for the medical office, outpatient surgical center and hospital markets."

This morning, looking through the list of top % gainers on the NASDAQ, I came across Laserscope Inc. (LSCP) which, as I write, is currently trading at $35.99, up $2.40, or 7.14% on the day. According to the Yahoo "Profile" on LSCP, Laserscope "...designs, manufactures, sells and services, on a worldwide basis, a line of medical laser systems and related energy devices for the medical office, outpatient surgical center and hospital markets."  Taking a look at their latest quarterly report, on October 27, 2005, LSCP reported 3rd quarter 2004 results. Revenue came in at $24.2 million, for the quarter ended September 30, 2004, a 69% increase from $14.3 million in the same quarter last year. Net income for the quarter was $4.4 million or $.19/diluted share an over 800% increase from the $533,000 or $.02/diluted share last year. These were outstanding results and the stock price has reflected this!

Taking a look at their latest quarterly report, on October 27, 2005, LSCP reported 3rd quarter 2004 results. Revenue came in at $24.2 million, for the quarter ended September 30, 2004, a 69% increase from $14.3 million in the same quarter last year. Net income for the quarter was $4.4 million or $.19/diluted share an over 800% increase from the $533,000 or $.02/diluted share last year. These were outstanding results and the stock price has reflected this! In the same fashion, earnings, slightly erratic between 1999 and 2001, have overall increased from a loss of $(.60) in 1999 to the $.50/share in the TTM.

In the same fashion, earnings, slightly erratic between 1999 and 2001, have overall increased from a loss of $(.60) in 1999 to the $.50/share in the TTM.

In this time of global disaster in Southeast Asia, I would be remiss not to say that stock performance is irrelevant to those in greatest needs and all of our prayers go out to the victims of the Tsunami in Southeast Asia. If you haven't done so already, you can donate to this effort by going to the CARE website (I have linked to CARE USA), but if you are elsewhere, there are links there as well. There are many other organizations working to raise money, so if you have had a good year investing this year, think about some of the victims who have lost families and homes this month.

In this time of global disaster in Southeast Asia, I would be remiss not to say that stock performance is irrelevant to those in greatest needs and all of our prayers go out to the victims of the Tsunami in Southeast Asia. If you haven't done so already, you can donate to this effort by going to the CARE website (I have linked to CARE USA), but if you are elsewhere, there are links there as well. There are many other organizations working to raise money, so if you have had a good year investing this year, think about some of the victims who have lost families and homes this month.

My first "screening" step after finding a stock is to look at the latest quarter. I am not very "picky" but do insist that the latest quarter show both revenue growth and earnings growth. For this information, I generally turn to Yahoo finance which is a nice place for researching recent quarterly results.

My first "screening" step after finding a stock is to look at the latest quarter. I am not very "picky" but do insist that the latest quarter show both revenue growth and earnings growth. For this information, I generally turn to Yahoo finance which is a nice place for researching recent quarterly results.  A good friend of mine introduced me to the Morningstar.com site, and I would encourage you to get familiar, and even consider subscribing if you are so oriented. I have found much of the free material adequate for my basic needs. Looking at the

A good friend of mine introduced me to the Morningstar.com site, and I would encourage you to get familiar, and even consider subscribing if you are so oriented. I have found much of the free material adequate for my basic needs. Looking at the  Thus far, I have looked at "momentum" both in terms of earnings and revenue growth, and some "fundamental" views of the soundness of the business venture, that is, 'is this company using or generating cash' and 'what is the balance-sheet like?'. This may sound like a lot of work, but if you follow my steps, I think you can see that with a few seconds of review, this information is easily available and readily understood.

Thus far, I have looked at "momentum" both in terms of earnings and revenue growth, and some "fundamental" views of the soundness of the business venture, that is, 'is this company using or generating cash' and 'what is the balance-sheet like?'. This may sound like a lot of work, but if you follow my steps, I think you can see that with a few seconds of review, this information is easily available and readily understood.

So what do I think? Well, let's review, first of all, the stock made a nice move today, the latest quarter was very strong, the five-year growth in revenue and earnings is impressive, the free cash flow is break-even, but the balance sheet is solid. Valuation is a bit rich, with a p/e above 70, the PEG is unknown probably because there aren't any analysts with estimates. So it is attractive as an investment to me, and since I AM in the investment market....well I will have to sleep on this one!

So what do I think? Well, let's review, first of all, the stock made a nice move today, the latest quarter was very strong, the five-year growth in revenue and earnings is impressive, the free cash flow is break-even, but the balance sheet is solid. Valuation is a bit rich, with a p/e above 70, the PEG is unknown probably because there aren't any analysts with estimates. So it is attractive as an investment to me, and since I AM in the investment market....well I will have to sleep on this one!

We have a trailing review, and unfortunately, I am getting a little more than a year out! Currently, I am up to the week of November 3, 2003. Our analysis assumes a buy and hold strategy which is NOT something I do on this website. However, for our purposes here, it gives us a rough idea of how the stocks have performed subsequent to my selection of them for this website.

We have a trailing review, and unfortunately, I am getting a little more than a year out! Currently, I am up to the week of November 3, 2003. Our analysis assumes a buy and hold strategy which is NOT something I do on this website. However, for our purposes here, it gives us a rough idea of how the stocks have performed subsequent to my selection of them for this website. On November 5, 2003, I

On November 5, 2003, I  On November 5, 2003, I

On November 5, 2003, I  On November 6, 2003, I

On November 6, 2003, I  On November 6, 2003, I

On November 6, 2003, I  Finally, on Friday, November 7, 2003, I

Finally, on Friday, November 7, 2003, I  So how did we do that week in November, 2003, a little over a year ago? I had two stocks losing money and three stocks gaining with an average gain of 11.58%. Not fabulous, but then again, not too bad either! Remember, in real life, I advocate selling losers quickly and selling gainers piecemeal slowly.

So how did we do that week in November, 2003, a little over a year ago? I had two stocks losing money and three stocks gaining with an average gain of 11.58%. Not fabulous, but then again, not too bad either! Remember, in real life, I advocate selling losers quickly and selling gainers piecemeal slowly.  Today, while scanning the

Today, while scanning the  On November 9, 2004, NAPCO

On November 9, 2004, NAPCO  Looking at the balance sheet, we can see $1.5 million in cash and $35.2 million in other current assets, plenty to cover BOTH the $8.4 million in current liabilities AND the $8.6 million in long-term liabilities combined.

Looking at the balance sheet, we can see $1.5 million in cash and $35.2 million in other current assets, plenty to cover BOTH the $8.4 million in current liabilities AND the $8.6 million in long-term liabilities combined.

According to the

According to the  Looking longer-term, the

Looking longer-term, the  How about "valuation"? Looking at

How about "valuation"? Looking at

Above all, I wish all of my readers the Merriest of Christmasses, the Happiest of New Years, and my personal wishes for good health, the most important gift of all!

Above all, I wish all of my readers the Merriest of Christmasses, the Happiest of New Years, and my personal wishes for good health, the most important gift of all!