Stock Picks Bob's Advice

Saturday, 22 September 2007

About the New Prosper.com Ad

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information ont his website.

I wanted to stop for a second and share with you a fascinating website that I have discovered courtesy my nephew Ryan K. who pointed it out to me last month, with a new twist on person-to-person borrowing/lending.

I wanted to stop for a second and share with you a fascinating website that I have discovered courtesy my nephew Ryan K. who pointed it out to me last month, with a new twist on person-to-person borrowing/lending.

I shall try to limit my digressions like this, and I do indeed receive a referral fee (full disclosure) if you do sign up through the above link. But it is indeed a fascinating, albeit potentially risky, venture.

In a nutshell, the website, started by one of the E-Loan founders and other web pioneers, involves individuals looking for short-term loans (36 month duration) of limited amount (up to $25,000) in an unsecured fashion. They apply to Prosper.com and submit a credit application. Much like any loan company, Prosper obtains a credit report but instead of loaning the money, the request is listed, eBay-style, and multiple investors are given the opportunity of bidding for a portion of the loan. Generally bids are in the $50 to $100 range.

If the borrower is successful, then the entire 'consortium' of lenders, (both lender and borrower remain anonymous to each other) become the lender and the borrower pays back a portion of that loan to each lender monthly (Prosper handles the distribution of funds). If the borrower fails to pay on time, then the usual collection process is initiated.

Prospers allows prospective lenders the right to sort through the loans (again with anonymous borrowers) based on credit ratings and other criteria. Many highly rated loans are placed with ratings of 8% and higher and rates climb into the 20% range as the riskiness increases. Of course, defaults on loans, which are then sold to collection agencies, will diminish one's overall performance and certainly could even result in a loss.

Anyhow, it's a fascinating site and if you use this link and do get involved, I do get some credit for referring people over. But I am intrigued with the entire process. It is a win-win for the little guy who now have an opportunty to obtain funds at a rate lower than otherwise would be possible. For the lender, this represents an opportunity to receive a return on one's funds far greater than available in a CD or Money Market!

Bob

Thursday, 20 September 2007

Apogee Enterprises Inc. (APOG)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please rmeember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

APOGEE ENTERPRISES (APOG) IS RATED A BUY

I was looking through the lists of top % gainers this morning and came across this small glass-products company, Apogee Enterprises (APOG) that deserves a spot on this blog. I do not own any shares or options on this company. (I should point out that by the time I got around to writing up this stock, the company was no longer on the top % gainers list, but having been there earlier, and being the author of this blog :), I would like to share this stock with you in any case! APOG as I write is trading at $25.76, up $1.18 or 4.8% on the day.

What exactly does this company do?

What exactly does this company do?

According to the Yahoo "Profile" on Apogee, the company

"... through its subsidiaries, engages in the design and development of glass products, services, and systems. The company operates in two segments, Architectural Products and Services, and Large-Scale Optical Technologies."

How did they do in the latest quarter?

As is so often the case on this blog, it was the announcement of 2nd quarter 2008 earnings after the close of trading yesterday that caused the stock to move higher this morning. Revenue for the quarter came in at $217.7 million, up 20% over the prior year period. Earnings came in at $.39/share, up from $.26/share last year. In addition, the company raised guidance for fiscal 2008 to $1.43 to $1.53/share, up from prior guidance of $1.37 to $1.47/share.

Analysts, according to Thomson Financial surveys, had been expecting second quarter profit of $.36/share. Thus the company beat expectations with this report.

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials, we can see that the company, after a dip in revenue from $538 million in 2003 to $490.8 million in 2004, has been steadily growing revenue to $779 million in 2007 and $802 million in the trailing twelve months (TTM). Earnings also dipped from $1.10 in 2003 to a loss of $(.20)/share in 2004. However, since 2004 earnings have been positive and growing to $1.10/share in 2007 and $1.40 in the TTM. Meanwhile, outstanding shares have been stable with 27 million reported in 2006 and increasing only to 28 million in the TTM.

Free cash flow has been positive but not growing, with $11 million reported in 2005, $8 million in 2007 and $6 million in the TTM. Overall operating cash flow has been growing solidly, but capital spending has also been keeping pase increasing from $20 million in 2005 to $47 million in the TTM. This has kept a lid on the free cash flow growth.

The balance sheet appears solid to me with $4 million in cash reported on the Morningstar.com page, with $225 million in other current assets. When compared to the $133.8 million in current liabilities, the current ratio works out to an acceptable 1.71. In addition, the company has a moderate amount of long-term liabilities reported at $83.1 million.

How about some valuation numbers?

According to the Yahoo "Key Statistics", this company is a small cap stock with a market capitalization of only $749.43 million. The trailing p/e is a very reasonable (imho) 19.10, with a forward p/e (fye 03-Mar-09) of only 14.89. With the strong growth expected, the PEG (5-Yr expected) is estimated at only 0.87.

The Fidelity.com eresearch website reports that the Price/Sales (TTM) is at 0.87, with an industry average of 0.75. According to Fidelity, the company has a Return on Equity (TTM) of 15.82%, compared to the industry average of 107.56%. (this isn't a typo!)

Finishing up with Yahoo, there are 28.90 million shares outstanding with 28.06 million that float. As of 8/10/07, there were 2.70 million shares out short representing 7.3 trading days of average volume (the short ratio), or 9.6% of the float. This is a significant number imho, using my own '3-day rule'. With the strong earnings report, this relatively thinly traded stock may well find short-sellers scrambling to cover their 'negative bets'.

The company even pays a small dividend with $.27/yr paid yielding 1.105. The last stock split was a 2:1 stock split in February, 2007.

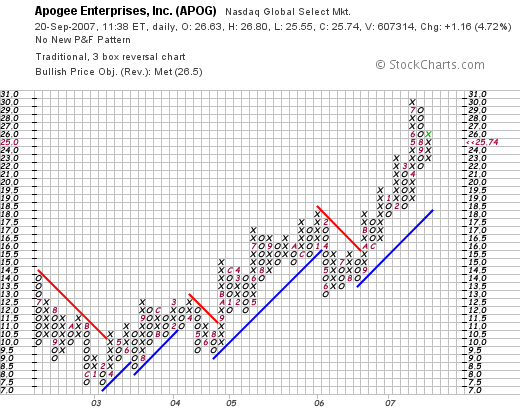

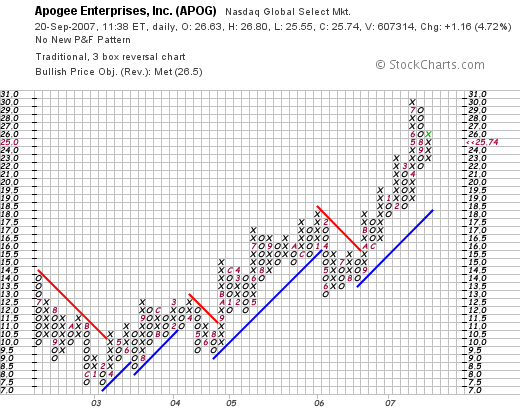

What does the chart look like?

Looking at the "point & figure" chart from StockCharts.com on Apogee (APOG), we can see the stock dipping from $14 in July, 2002, to a low of $7.50 in February, 2003. This was the same time the numbers 'turned around' as you recall on the Morningstar.com page. After this low, the stock has esssentially steadily been moving higher with a recent peak of $30 in July, 2007. The stock pulled back to the $22 level in September, 2007, and is now pushing higher at the $25.74 level. The chart looks strong to me.

Summary: What do I think?

Well, needless to say I like this stock. I especially get a 'kick' out of stocks from the humble midwest :). Seriously, they reported solid earnings that beat expectations and raised guidance simultaneously. They have a 3-4 year record of positive financial results, a stable # of shares, and positive free cash flow with a solid balance sheet. They have a reasonable p/e with a PEG under 1.0. Price/Sales and ROE are a bit under the industry average. Finally, there are a significant number of short-sellers out there.

The company even pays a small dividend and has a habit of frequently splitting its stock! I don't have any 'permission slip' to be buying any stocks, but this is my kind of small company! I shall keep it in my vocabulary and if the time is right, you never know when I may be able to make this one a holding!

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Be sure and visit my Stock Picks Podcast Website where I talk about a few of the many stocks I write about here on the blog. Also, if you are interested, stop by my Covestor Page which has been reviewing my own trading portfolio performance for the past three months, or my SocialPicks Page which has been looking at all of my stock picks this past year.

Regards and have a great day trading and investing!

Bob

Posted by bobsadviceforstocks at 9:56 AM CDT

|

Post Comment |

Permalink

Updated: Thursday, 20 September 2007 11:05 AM CDT

Wednesday, 19 September 2007

ICO Inc. (ICOC) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

With the early partial sale of VIVO (Please note,

MERIDIAN BIOSCIENCE (VIVO) IS RATED A BUY)

I had a 'permission slip' to add a new position. And that nickel was burning a hole in my pocket right away.

Checking the list of top % gainers on the NASDAQ, I saw that ICO (ICOC) made the list. As I am writing now, ICOC is trading at $14.82, up $.58 or 4.07% on the day. I purchased 420 shares of ICOC at $14.979 earlier this afternoon. This gave me 16 positions out of my maximum of 20.

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Meridian Bioscience (VIVO) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As part of my effort at transparency, I try to report on any trades that I have personally done in my own trading account. You can see more about my own holdings and activity on my Covestor Page where Covestor review my trading activity. To make a long story short, a few moments ago I sold 33 shares of my Meridian Bioscience (VIVO) stock at $29.94, representing 1/7th of my 232 shares, when VIVO hit a sale point on the upside.

I purchased Meridian (VIVO) on 4/21/05, at a cost basis of $7.42/share. Thus, these shares were sold with a gain of $22.52 or 303.5% appreciation since purchase. The 300% level is a targeted appreciation point for me. Currently, after a purchase, I sell shares if a stock hits 30, 60, 90, and 120% appreciation, then 180, 240, 300, and 360% appreciation levels. This was indeed the 7th partial sale of VIVO since my original purchase, having sold shares all along the way as the stock has been rising in price.

When shall I sell shares next? On the upside, I plan on selling 1/7th of my remaining shares if the stock should rise to a 360% appreciation level or 4.6 x $7.42 = $34.14/share. On the downside, my strategy is to sell if the stock should decline to 1/2 of the highest point at which a partial sale has been made. Having now sold a portion at a 300% gain, this would mean that if the stock should decline to a 150% appreciation level (working out to $7.42 x 2.50 = $18.55), then I would plan on selling ALL remaining shares. I also reserve the right to sell all shares if any fundamentally bad news is announced about the company.

In addition, sales on appreciation, like the current VIVO sale is a 'signal' for me. I use 'good news' like sales on appreciation as a signal that the market is o.k. to put another toe into equities, that is, to buy a new position, since I am at 15 positions, well under my maximum of 20. (Sales on 'bad news' like declines are indications to 'get out of the water' and I don't reinvest those proceeds.)

Like I so often say, "that nickel is burning a hole in my pocket already!" With that permission slip, so to speak, I shall now be on the prowl for a new stock, perhaps one of my old favorites, on the top % gainers list to add to my own holdings. Wish me luck!

Bob

Monday, 17 September 2007

Another Podcast and another Carnival for You to Visit!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

This should be a short entry. At last! I just wanted to let you all know that you could download my latest podcast on LKQ Corporation (LKQX) by clicking HERE.

I also submitted this entry to the 54th Festival of Stocks, a blog carnival! You can see that post described as well as some other great posts from other bloggers on that page.

O.K., that's enough of a post! There, it was a short post, wasn't it? Have a great week trading. Good luck to all of us as Bernanke and the Fed meet tomorrow. I hope they make the right decision, whatever that may be!

Bob

Sunday, 16 September 2007

Enzo Biochem (ENZ) "Long-Term Review #12"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always please remember that I am an amateur investor so please remember to consult with your professsional investment advisers prior to making any investment decisions based on information on this website.

I was looking at the 'control panel' for this blog. It is hard to believe that I am now up to 1,605 entries (this is #1,606!). My first post was back on May 12, 2003, when I made a short entry on St Jude Medical (STJ). Needless to say, each entry got a little longer, a little more detailed. I added hyperlinks to source material, and learned how to add pictures. I continue to truly be an amateur blogger!

For some time, I have been doing weekend reviews like I did earlier today. A few months ago, I decided it would be a good idea to look deep into the blog and examine the early entries and find out how they turned out. And whether they still deserve a spot on this website!

Two weeks ago reviewed my entry on Dick's Sporting Goods (DKS). The next entry on the blog was Enzo Biochem (ENZ) which was also posted on May 22, 2003. I wrote:

Two weeks ago reviewed my entry on Dick's Sporting Goods (DKS). The next entry on the blog was Enzo Biochem (ENZ) which was also posted on May 22, 2003. I wrote:

"May 22, 2003

Enzo Biochem (ENZ)

Here is a new one for you. Near the top of the list for the NYSE best advancers is Enzo Biochem (ENZ). They are trading currently (1:42 pm Central time) at

$20.40 up $2.36 on the day or a gain of 13.08%.

News for the day is about a new Phase I Clinical Trial result for Crohn's disease....Phas II study to be initiated (this was on  5/20/03). Crohns is a form of inflammatory bowel disease which is "a highly debilitating widespread ailment for which there is no effective treatment"...quoting Dean L. Engelhardt, Ph.D., the President of Enzo on the NYTimes internet site.

5/20/03). Crohns is a form of inflammatory bowel disease which is "a highly debilitating widespread ailment for which there is no effective treatment"...quoting Dean L. Engelhardt, Ph.D., the President of Enzo on the NYTimes internet site.

Last quarter, revenues increased 11% and net income was up 76%. In actual amounts, revenue for the 3 months ending 1/31/03 amounted to $13.1 million vs $11.8 million a year ago...and operating income was about $2.0 million vs $1.0 million last year. According to the same news story cash flow, an important criterion to consider, was strongly positive at $9.3 million with cash and cash equivalents at $75.9 million vs $61.9 million a year ago.

Looking at the 5 year growth in revenues on Morningstar, we find 1998 at $40.4 million, 1999 at $44.3 million, 2000 at $42.8 million, a slight drop, 2001 at $52.3 million, 2002 at $54.0 million, and $59.3 million for the trailing twelve months.

Cash flow has indeed improved with a $4 million positive in 2000, $7 million in 2001, $9 million in 2002 and $14 million in the trailing twelve months.

Looking a Yahoo, we find the stock with a market cap of $578.4 million, and a p/e of 58.19. An interesting if not compelling issue to be considered for investment. I do not own any shares of this stock nor plan to be buying any in the immediate future. Good luck! Bob"

First of all, I selected ENZ on May 22, 2003, at a price of $20.40. ENZO had a 5% stock dividend on October 21, 2004, making my effective pick price actually $20.40 x 100/105 = $19.43. ENZ closed at $11.83 on September 14, 2007, for a loss of $(7.60) or (39.4)% since posting.

How about their latest quarterly report?

On June 11, 2007, ENZ reported 3rd quarter 2007 results. Revenues climbed 45% to $14.0 million vs. $9.6 million in the year-earlier same period. The net loss for the period was $(3.8) million or $(.10)/share, improved from a lossof $(3.4) million or $(.11)/share the year-earlier.

On June 11, 2007, ENZ reported 3rd quarter 2007 results. Revenues climbed 45% to $14.0 million vs. $9.6 million in the year-earlier same period. The net loss for the period was $(3.8) million or $(.10)/share, improved from a lossof $(3.4) million or $(.11)/share the year-earlier.

What about longer-term results?

Looking at the Morningstar.com "5-Yr Restated" financials page, we can see that revenue actually declined from a peak of $54 million in 2002 to as low as $39.8 million in 2006 and has improved to $44.9 million in the trailing twelve months (TTM). Earnings dipped from $.20/share in 2002 to a loss of $(.20)/share in 2004, profitable at $.10/share in 2005, then a loss of $(.50)/share in 2006, improving slightly (as noted above) to a loss of $(.40)/share in the TTM. Shares have been stable with 31 million in 2002 and 33 million in the TTM.

Free cash flow which was positive at $12 million in 2005, dipped to a negative $(14) million in 2006 and $(13) million in the TTM. The company has a solid balance sheet with $120 million in cash and $18 million in other currnt assets, vs. only $8.9 million in current liabilities and $1.1 million in long-term liabilities. Certainly, they can handle both the losses and the negative cash flow for quite awhile.

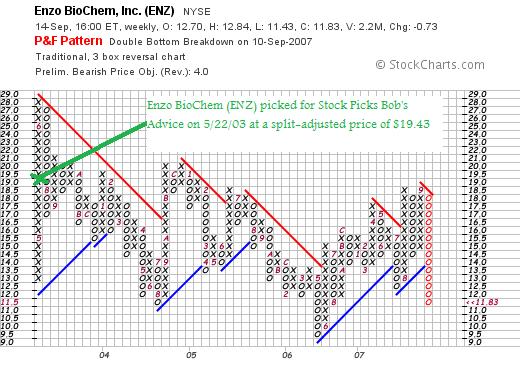

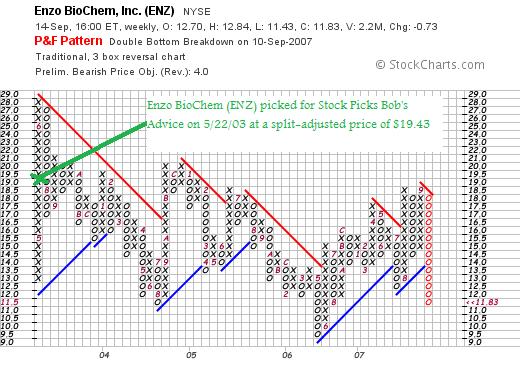

What about a chart?

Reviewing the 'point & figure' chart on ENZ from StockCharts.com, we can see a rather dismal price chart with the price basically staying below resistance levels for the past 4 1/2 years and a general drift lower with a recent sharp dip in the stock price. This is a poor chart from my amateur perspective.

What do I think?

With the poor quarterly report, the unimpressive Morningstar.com report, and the very weak stock chart,

ENZO BIOCHEM (ENZ) IS RATED A SELL

I rate these stocks with a 'rear-view' mirror. I do this based on my own fundamental screens that I have detailed above. I should note that Lazard Capital Markets just initiated coverage of ENZ with a "buy" rating. Clearly, they look at different things than I do. But I am limiting my own "buy" ratings to stocks with steady revenue and earnings growth, profits, and positive charts. This one just doesn't cut it for me.

Thanks again for stopping by and visiting my blog! If you have any comments or questions, be sure and leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Page where I discuss a few of the many stocks I write about on the blog. Also, if you want to know how my own Trading Portfolio is performing, visit my Stock Picks Covestor Page where Covestor, a third-party website, evaluates my actual holdings. Also, since January, 2007, or thereabouts, SocialPicks has been reviewing and analyzing all of my stock picks, and you can visit my Stock Picks SocialPicks Page to read about that! Now THAT should keep you busy :).

Stay well and keep on visiting!

Bob

"Looking Back One Year" A review of stock picks from the week of March 27, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! I am truly grateful for all of you who take the time to visit and read what I write. I have written this line so many times, I am afraid that some may think it isn't sincere. Don't worry. It is! As always, please do remember that I am an amateur investor, so please consult with your professional investment advisers prior to making any investment decision based on information on this website.

It is the weekend once again (!) and that means it is time for a 'weekend review'. I use these review to help me find out about some of the past stock picks on this blog and see whether my 'system' is working. These reviews assume a buy and hold strategy for performance review. In reality, I utilize an active portfolio management strategy involving monitoring each stock in my own Trading Portfolio closely, selling weak stocks on small losses completely and selling strong stocks slowly and partially at targeted appreciation levels. This difference in strategy would certainly affect performance results; for the ease of evaluation, I continue to review past stock selections with a 'buy and hold' assumption.

Last weekend I reviewed the picks from March 20, 2006. I am actually about 18 months out from these reviews instead of the "one year", but this happened, as you might guess, from times in which I, the amateur blogger that I am, missed reviews. I apologize for these absences but still strive to continue to post on as regular a basis as possible. Let's take a look at the stock picks from the next week, the week of March 27, 2006.

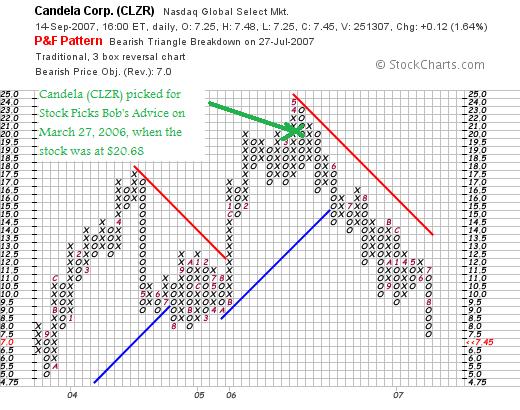

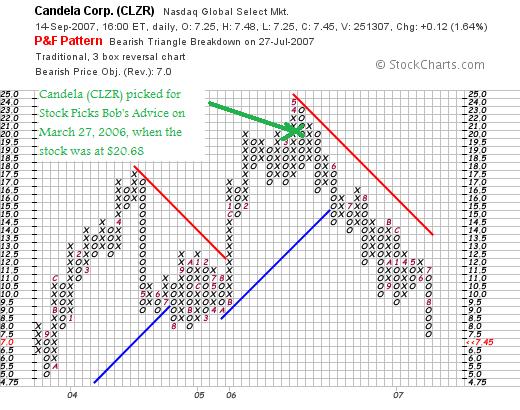

On March 27, 2006, I posted Candela Laser (CLZR) on Stock Picks Bob's Advice when the stock was trading at $20.68. CLZR closed at $7.45 on September 14, 2006, for a loss of $(13.23) or (64.0)% since posting.

On March 27, 2006, I posted Candela Laser (CLZR) on Stock Picks Bob's Advice when the stock was trading at $20.68. CLZR closed at $7.45 on September 14, 2006, for a loss of $(13.23) or (64.0)% since posting.

On August 21, 2007, Candela reported 4th quarter results. Revenue for the quarter ended June 30, 2007, declined to $39.0 million from $41.3 million the prior year. Earnings for the quarter came in at a loss of $(727,000) or $(.03)/share compared with net income of $2.4 million or $.10/share the prior year. Except for the poor quarterly report, the Morningstar.com "5-Yr Restated" financials is intact.

On August 21, 2007, Candela reported 4th quarter results. Revenue for the quarter ended June 30, 2007, declined to $39.0 million from $41.3 million the prior year. Earnings for the quarter came in at a loss of $(727,000) or $(.03)/share compared with net income of $2.4 million or $.10/share the prior year. Except for the poor quarterly report, the Morningstar.com "5-Yr Restated" financials is intact.

With the very weak quarterly report, and the weak stock chart,

CANDELA (CLZR) IS RATED A SELL

On March 28, 2006, I posted TALX Corporation (TALX) on Stock Picks Bob's Advice when the stock was trading at $28.26. As was announced, Equifax (EFX) acquired TALX Corporation for $35.50/share (or .861 shares of Equifax Stock). Assuming a sale at $35.50/share (I would not recommend taking the Equifax shares unless Equifax 'fitted' into my own investing strategy), this represented a gain of $7.24 or 25.6% since posting.

Since TALX is no longer traded, I shall not be following this stock further (obviously) and also do not have any buy or sell recommendations on this issue (double obviously!).

On March 30, 2006, I posted NS Group (NSS) on Stock Picks Bob's Advice when the stock was trading at $47.09. On September 11, 2006, NS Group announced that it had entered into an agreement with IPSCO to be acquired for $66.00/share. This was completed by December 4, 2006.

On March 30, 2006, I posted NS Group (NSS) on Stock Picks Bob's Advice when the stock was trading at $47.09. On September 11, 2006, NS Group announced that it had entered into an agreement with IPSCO to be acquired for $66.00/share. This was completed by December 4, 2006.

This acquisition represents an appreciation of $18.10 or 37.8% since being posted on the blog.

Finally, on March 31, 2006, I posted Kendle International (KNDL) on Stock Picks Bob's Advice when the stock was trading at $33.20. KNDL closed at $40.65 on September 14, 2007, for a gain of $8.45 or 25.5% since posting.

Finally, on March 31, 2006, I posted Kendle International (KNDL) on Stock Picks Bob's Advice when the stock was trading at $33.20. KNDL closed at $40.65 on September 14, 2007, for a gain of $8.45 or 25.5% since posting.

On August 1, 2007, Kendle reported 2nd quarter 2007 results. Net service revenues for the quarter June 30, 2007, came in at $97.8 million, up 58% over 2nd quarter 2007. Net income came in at $.29/share. This was unchanged from 2nd quarter 2006 results of $.29/share. However, adjusting for acquisition costs (from the Charles River Lab Acquisition), the amount worked out to $.34/share. The company also lowered guidance for 2007 to earnings in the range of $1.32 to $1.52 (an $.18 reduction from previous guidance). The company explained that this represented "The write-off of financing fees results from the debt payments made in July with the proceeds from the convertible note offering." With two explanations in one announcement, in spite of the fabulous revenue growth, and with the strong stock chart, but being an amateur, I cannot really assess the clarity of these results, and thus

KENDLE (KNDL) IS RATED A HOLD

So how did I do with these four stock picks? First of all, I do not think it is coincidental that we have two out of four of these stock picks being acquired. I suspect that acquiring companies are probably looking at all of the same fundamentals that I examine---steady revenue growth, solid earnings, positive, free cash flow, and a healthy balance sheet. Of course, they are able to examine more of the important details with far great comprehension and clarity than I could possible accomplish. But it is interesting, isn't it?

Anyhow, one of my stocks, CLZR imploded with a big loss. The other three showed solid gains. The average performance for these four stocks was a gain of 6.2%.

Thanks again for visiting! Please remember that past performance is no guarantee of future performance. And of course that I am an amateur.

If you get a chance, be sure and visit my Stock Picks Podcast Page where you can download some mp3's of me discussing some of my stocks from the blog. In addition, check out my Covestor Page to find out how my actual trading portfolio has been doing. Unfortunately, that goes back only the last three months. In addition, for anevaluation of my stock picks from at least the beginning of 2007, visit my SocialPicks Page where that website has been monitoring and measuring the accuracy of my picking on this blog!

Have a great weekend everyone. May we all get through the Bernanke-Tuesday upcoming without an excess of price volatility!

Bob

Posted by bobsadviceforstocks at 12:17 PM CDT

|

Post Comment |

Permalink

Updated: Sunday, 16 September 2007 12:53 PM CDT

Friday, 14 September 2007

ICO Inc. (ICOC)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It was a nice change today seeing the market open lower and fight back all day to close on the upside at 13,442.5 up 17.64 on the Dow, and 2,602.18, up 1.12 on the Nasdaq. I will take any of these gains! Next week will likely also be a bit volatile with the Fed meeting on Tuesday and finding out what Bernanke and company have decided to do about interest rates.

Earlier today I was scanning the list of top % gainers on the Nasdaq and came across a new name for me ICO Inc. (ICOC) which closed today at $13.74, up $.21 or 1.55% on the day. (The stock was on the top % gainers list earlier in the day when I examined the company, later in the day the stock dropped off the list but still closed up.) I do not own any shares or options of this stock, but was impressed enough to purchase 50 shares for one of my children in their custodial account an

ICO INC. (ICOC) IS RATED A BUY

Let me review this company with all of you and share with you why I think this company deserves your consideration.

What exactly does this company do?

According to the Yahoo "Profile" on ICOC, the company

According to the Yahoo "Profile" on ICOC, the company

"...together with its subsidiaries, manufactures specialty resins and concentrates, and provides specialized polymers processing services. It offers specialty resins in powder form, which are used in the manufacture of household items, such as toys, household furniture, and trash receptacles; automobile parts; agricultural products, such as fertilizer and water tanks; paint; and metal and fabric coatings. The company also provides toll processing services, including ambient grinding, jet milling, compounding, and ancillary services for polymer resins produced in pellet form and other materials. Its concentrate products are primarily used by third parties to produce plastic films."

How did they do in the latest quarter?

On August 7, 2007, ICO, Inc. reported 3rd quarter 2007 financial results. For the quarter ended June 30, 2007, revenue came in at $113.4 million, up $30.9 million or 38% from the prior year results. Operating income for the quarter came in at $9.0 million, up 51% from last year's results. Income from continuing operations came in at $5.6 million, up 37% from last year's $3.5 million or $.20/diluted share up over 50% from the $.13/diluted share last year.

What about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on ICOC, we can see that revenue came in at $181 million in 2002 and has been steadily increasing to $324 million in 2006 and $382 million in the trailing twelve months (TTM). Earnings dipped from $1.10/share in 2002 to a loss of $(2.00)/share in 2003, breaking even at $.00/share in 2004 then increasing to $.10/share in 2005, $.40/share in 2006 and $.60/share in the TTM. During this time the outstanding shares increased by about 10% from 24 million in 2002 to 26 million in 2006. During this same time period, revenue essentially doubled.

Free cash flow which was $(1) million in 2004 and 2005, turned positive at $5 million in 2006 and $9 million in the TTM.

The balance sheet looks solid with $4 million in cash and $141 million in other current assets for a total of $145 million in current assets. When compared to the $96.3 million in current liabilities, this yields an acceptable current ratio of 1.51.

What about valuation?

Checking Yahoo "Key Statistics" on ICOC, we can see that this is a small cap stock with a market capitalization of only $360.51 million. The trailing p/e is a reasonable 23.02, with a forward p/e of only 17.62. There is no PEG ratio but certainly with the current earnings growth of over 30% and the current p/e of 23, the PEG might well be close to or under 1.0 (assuming growth persisted the next five years.) As is not unusual in these small cap stocks, there likely are no analysts making 5-yr earnings predictions which are required to calculate a PEG.

Using the Fidelity.com eresearch website, we can see that ICOC has a Price/Sales (TTM) ratio of 0.92, well under the industry average of 2.00. In addition, the company is more profitable than similar companies in the same industry as they are reported to have a Return on Equity (TTM) of 27.44%, double the industry average of 13.88%.

Finishing up with Yahoo, we can see that there are only 26.24 million shares outstanding with 24.24 million of them that float. As of 8/10/07, there were 203.5 thousand shares out short representing a short ratio of only 0.6 trading days of volume. No dividend is paid, and the last stock dividend was a reverse 1:5 split on June 16, 1993.

What about the chart?

If we review the "Point & Figure" chart on ICO Inc. from StockCharts.com, we can see a very strong price chart dating back to October, 2003, when the stock was trading as low as $.75/share. since then the stock has been moving steadily higher bouncing off the support line time after time to move higher. This is, from my amateur perspective, a very strong price chart.

Summary: What do I think?

Well, I really like this stock. It isn't that I like Polymers :), but seriously, I like the numbers, I like the price chart, and I like the latest quarter's earnings. No matter what they do. That is what makes me interested in a stock. It is rather small, and may well trade more unpredictably than a larger cap stock, but I don't see much that I don't like.

In fact I liked this stock enough to buy 50 shares for one of my kids. But I didn't buy any for my own Trading Portfolio. I just don't have a buy signal :). But then again, that's a whole different story! Anyhow, it is worth a place in the blog, and it shall be part of my "trading vocabulary" of stocks that I believe should be considered when those buying opportunities arise.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website, where you can download some mp3's and hear me talk about some of the stocks I write about. In addition, check out my Covestor Page where my actual trading portfolio is monitored and analyzed by that website, and my SocialPicks page where my stock picks for the last 9 months have been evaluated and my performance measured by the SocialPicks people!

Have a great weekend everyone!

Bob

Wednesday, 12 September 2007

An Interview With Yours Truly on WallSt.Net!

Hello Friends! I really enjoyed discussing blogging and my experience with  this blog with Dennis Olson from WallSt.Net on his podcast. You can view the interview description here, or if you prefer you can download the interview here.

this blog with Dennis Olson from WallSt.Net on his podcast. You can view the interview description here, or if you prefer you can download the interview here.

It is fun to be the subject of a podcast for a change!

I hope you all are surviving this turbulent market in one piece!

Bob

Monday, 10 September 2007

LKQ Corporation (LKQX)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I was looking through the list of top % gainers on the NASDAQ today and came across a new name that I wanted to share with all of you. LKQ Corporation (LKQX) which as I write is trading at $30.34, up $1.65 on the day for a gain of 5.75%. I do not have any shares or options on this stock.

I was looking through the list of top % gainers on the NASDAQ today and came across a new name that I wanted to share with all of you. LKQ Corporation (LKQX) which as I write is trading at $30.34, up $1.65 on the day for a gain of 5.75%. I do not have any shares or options on this stock.

LKQ CORPORATION (LKQX) IS RATED A BUY

Let's take a closer look at this stock and I will explain to you why I wish to add it to the blog.

What exactly does this company do?

According to the Yahoo "Profile" on LKQ, the company

"...together with its subsidiaries, provides replacement systems,  components, and parts to repair light vehicles in the United States. It provides recycled original equipment manufacturer (OEM) products and related services. The company's products include engines, vehicle front end assemblies, doors, transmissions, trunk lids, bumper assemblies, wheels, head and tail lamp assemblies, mirrors, fenders, and axles; and aftermarket products comprising head lamps, tail lamps, grilles, hoods, and mirrors. It also engages in refurbishing and distributing aluminum alloy wheels, head lamps, and tail lamps."

components, and parts to repair light vehicles in the United States. It provides recycled original equipment manufacturer (OEM) products and related services. The company's products include engines, vehicle front end assemblies, doors, transmissions, trunk lids, bumper assemblies, wheels, head and tail lamp assemblies, mirrors, fenders, and axles; and aftermarket products comprising head lamps, tail lamps, grilles, hoods, and mirrors. It also engages in refurbishing and distributing aluminum alloy wheels, head lamps, and tail lamps."

How did they do in the latest quarter?

On July 26, 2007 LKQ (LKQX) announced 2nd quarter 2007 results. For the quarter ended June 30, 2007, revenue increased 19.6% to $233.3 million, up from $195.0 million for the same quarter the prior year. Since the company has been involved with acquisitions, the report notes what is called organic revenue growth of 10.5%.

Net income came in at $14.0 million, up 20.2% from the $11.7 million reported in the same quarter last year. On a per share basis, this was $.25/share for the quarter vs. $.21/share last year.

The company beat expectations of the analysts per Thomson Financial, they had been predicting $.24/share and revenue of $232.8 million. In addition, the company raised guidance for 2007 to a profit of $56 to $58 million or $.99/share. The company had previously predicted a profit of $.97/share. Analysts expect a profit of $.97/share for the year.

A strong earnings reports that beats expectations and find the company raising guidance is about all an investor could hope for in an announcement!

What about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials, we can see that revenue has steadily grown since 2002 when they reported $287 million in revenue through 2006 at $789 million and $871 million in the trailing twelve months (TTM).

Earnings have just as steadily improved from a loss of $(1.00) in 2002 to a profit of $.40/share in 2003, dipping to $.20/share in 2004, then increasing to $.60/share in 2005, $.80/share in 2006 and $.90/share in the TTM.

Shares outstanding have increased somewhat from 42 million in 2005 to 53 million in 2006.

Free cash flow has been positive and generally increasing with $-0- reported in 2004, $11 million in 2005, $16 million in 2006 and $15 million in the TTM.

The balance sheet appears solid with $9 million in cash and $218 million in other current assets. This is plenty to cover the $66.1 million in current liabilities resulting in a current ratio of 3.43. In addition, the company reported another $142.7 million in long-term liabilities.

How about valuation?

Referring to the Yahoo "Key Statistics" on LKQ Corp, we find that this is a mid-cap stock with a market capitalization of $1.59 billion. The trailing p/e is a tad rich at 32.92, with a forward p/e of 23.15. The PEG ratio is still acceptable at 1.49.

Valuation-wise, the stock is a bit richly priced with a Price/Sales (TTM) ratio of 1.76 compared to the industry average of 0.89 per Fidelity.com eresearch website.

The company is also a little less profitable than its peers with a Return on Equity (TTM) of 12.28% compared to the industry average of 15.70%.

Finishing up with Yahoo, we can see that there are 53.70 million shares outstanding with 45.61 million that float. As of August 10, 2007, there were 8.03 million shares out short representing 7.9 trading days of volume (the short ratio). This is in excess of my '3 day rule' and may well be a significant factor in any subsequent price rise pending release of positive news.

No dividends are paid and the last stock split was a 2:1 stock split a year ago on January 17, 2006.

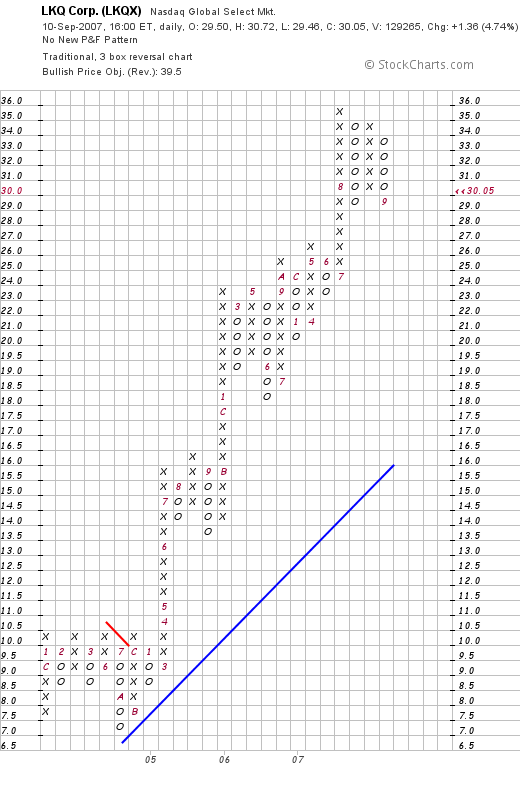

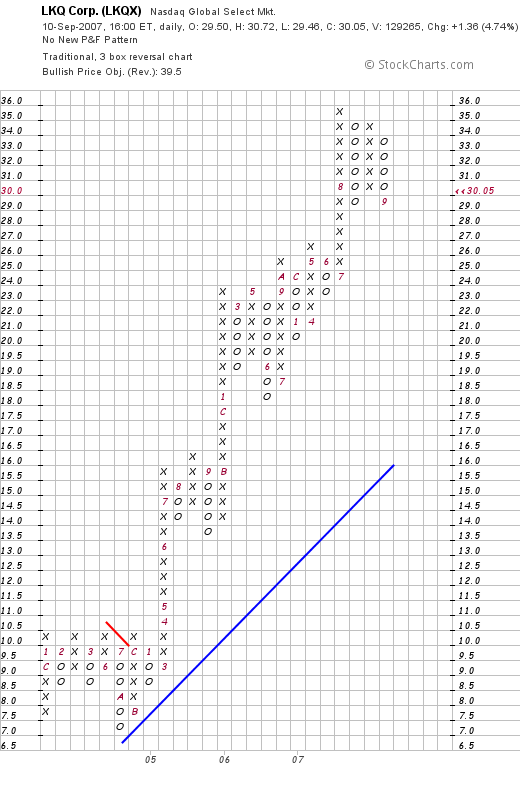

What does the chart look like?

Checking a "point & figure" chart from StockCharts.com on LKQ Corp., we can see an incredibly strong price move from as long ago as July, 2004, when the stock briefly dipped down to the $7.00 level. After breaking through resistance in December, 2004, at $10.00, the stock has moved steadily higher to the current range of $30.05. The graph certainly looks good to me!

Summary: What do I think?

This is a very intriguing stock. I do not own any shares but if I were buying anything today, this is the kind of stock I would be purchasing! They had a terrific quarter that beat expectations, they have been growing their company steadily for the last 4 years or so, and valuation is o.k. at least insofar as p/e and PEG goes. In addition, there are a lot of shares out short on the stock leading to some pent up buying demand down the road assuming they can continue to report good news.

On the negative side, the Price/Sales and the Return on Equity figures were indeed a bit anemic. However, with the strong price chart, and even the 'Peter Lynch' factor of rebuilt auto parts being a recession play (?) (don't you think people will tend to repair their old cars rather than buying new ones if the economy is weak?), this stock is worth a place in the blog.

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to place them right on the website. If you would like, you are more than welcome to email me at bobsadviceforstocks@lycos.com. Of course, I shall do my best to remove any spam from comments, but as long as the comment is pertaining to the entry, you needn't worry about agreeing with me :).

If you get a chance, be sure and visit my Stock Picks Podcast Website. Also, consider stopping by and visiting my Covestor Page where Covestor evaluates and reports on the performance of my actual Trading Portfolio (since June, 2007), and my SocialPicks page where SocialPicks evaluates my stock picking of all of my selections since about January, 2007.

Now THAT should keep you busy! Have a great day everyone!

Bob

Newer | Latest | Older

I wanted to stop for a second and share with you a fascinating website that I have discovered courtesy my nephew Ryan K. who pointed it out to me last month, with a new twist on person-to-person borrowing/lending.

I wanted to stop for a second and share with you a fascinating website that I have discovered courtesy my nephew Ryan K. who pointed it out to me last month, with a new twist on person-to-person borrowing/lending.

What exactly does this company do?

What exactly does this company do?

Two weeks ago

Two weeks ago  5/20/03). Crohns is a form of inflammatory bowel disease which is "a highly debilitating widespread ailment for which there is no effective treatment"...quoting Dean L. Engelhardt, Ph.D., the President of Enzo on the NYTimes internet site.

5/20/03). Crohns is a form of inflammatory bowel disease which is "a highly debilitating widespread ailment for which there is no effective treatment"...quoting Dean L. Engelhardt, Ph.D., the President of Enzo on the NYTimes internet site. On June 11, 2007, ENZ reported

On June 11, 2007, ENZ reported

On March 27, 2006, I

On March 27, 2006, I

On March 30, 2006, I

On March 30, 2006, I  Finally, on March 31, 2006, I

Finally, on March 31, 2006, I

According to the

According to the

this blog with Dennis Olson from WallSt.Net on his podcast. You can view the interview description

this blog with Dennis Olson from WallSt.Net on his podcast. You can view the interview description  I was looking through the

I was looking through the  components, and parts to repair light vehicles in the United States. It provides recycled original equipment manufacturer (OEM) products and related services. The company's products include engines, vehicle front end assemblies, doors, transmissions, trunk lids, bumper assemblies, wheels, head and tail lamp assemblies, mirrors, fenders, and axles; and aftermarket products comprising head lamps, tail lamps, grilles, hoods, and mirrors. It also engages in refurbishing and distributing aluminum alloy wheels, head lamps, and tail lamps."

components, and parts to repair light vehicles in the United States. It provides recycled original equipment manufacturer (OEM) products and related services. The company's products include engines, vehicle front end assemblies, doors, transmissions, trunk lids, bumper assemblies, wheels, head and tail lamp assemblies, mirrors, fenders, and axles; and aftermarket products comprising head lamps, tail lamps, grilles, hoods, and mirrors. It also engages in refurbishing and distributing aluminum alloy wheels, head lamps, and tail lamps."