Stock Picks Bob's Advice

Friday, 21 December 2007

Matrix Service Co (MTRX)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I have been spending some time discussing my various trades on this blog and I wanted to see if I could post a stock this afternoon that I don't own yet I still believe deserves a spot on this website.

I have been spending some time discussing my various trades on this blog and I wanted to see if I could post a stock this afternoon that I don't own yet I still believe deserves a spot on this website.

MATRIX SERVICE COMPANY (MTRX) IS RATED A BUY

There are certainly many different ways to select a stock for a possible purchase. Using Matrix Service (MTRX) as an example, let me once again go through the process that I use to identify possible 'winners' in the stock market.

My first screening device is to utilize the lists of top % gainers. I probably most often screen through the list of gainers on the NASDAQ, but l also will check the NYSE list and the AMEX list as well.

You might ask 'why use this list of all things?' I don't have a very good answer, but it has been my experience that stocks that show up on these top % gainers list, if they have good underlying fundamentals may well be on the way to additional gains.

Anyhow, checking the list of top % gainers today on the NASDAQ, I came across Matrix Service Co (MTRX) which closed today at $24.40, up $3.00 or 14.02% on the day. I do not own any shares of MTRX nor do I have any options.

What exactly does this company do?

According to the Yahoo "Profile" on MTRX, the company

"...together with its subsidiaries, provides construction, and repair and maintenance services primarily to the downstream petroleum and power industries in the United States and Canada. Its construction services include turnkey construction, civil construction, structural steel erection, mechanical installation, process piping, electrical and instrumentation, fabrication, vessel and boiler erection, millwrighting, plant modifications, centerline turbine erection, and startup and commissioning. The company also offers design, engineering, fabrication, and construction of aboveground storage tanks. Matrix Service Company provides its construction services to the downstream petroleum market, which includes refineries, pipelines, terminals, petrochemical plants, gas facilities, and bulk storage facilities."

I don't need to remind any of my readers of the recent ascent of the price of oil which closed at $93.31, up $2.25 on the day today. Intuitively and thus with a sort of Peter Lynch investing approach, I believe that stocks like MTRX that are dependent on investment in refining, storage, and transportation of petroleum products will benefit from the higher price of oil. Even while all of us consumers have to pay at the pump :(.

At this stage of my 'selection process' I have merely identified a stock that has moved higher today and has an interesting business. But that isn't even close to fulfilling all of my criteria, what I call my 'profile' of an 'investable stock'.

My next step is to examine the fundamentals of the company involved. I want to find out how the company did in the latest quarter and if that successful performance has been a continuation of similar financial performance in the past. This is more or less my search for a company with persistence of good results.

How did Matrix do in the latest quarter?

Generally, I am looking for a company with growing earnings, growing revenue, that can possibly beat expectations and raise guidance. That's a lot to ask out of a report. I don't always get it all, but let's see how MTRX did in their latest reported earnings report which was a first quarter 2008 report anounced on October 4, 2007.

In this 1st quarter report, for the quarter ended August 31, 2007 (please note that a company can set its financial year to any month. Many do use the calendar year, but this company obviously starts midway on June 1st for its fiscal year.), the company reported that revenue climbed 27.1% to $161.3 million from $126.9 million in the same quarter last year. Net income came in at $6.3 million, up over 100% from last year's $3.0 million. Fully diluted earnings per share came in at $.23/share up nearly 100% from last year's $.12/share result. These results were to say the least very strong.

As this separate AP Story notes, the company came in at $.23/share for the quarter, and analysts expected $.19/share, thus they did indeed beat expectations. The company, instead of raising guidance, reiterated guidance of $700 to $750 million in revenue for 2008. Still a strong result.

So Matrix had a great latest quarter. But that still is not enough for me.

What has been the longer-term results for this company?

I have found the Morningstar.com "5-Yr Restated" page the most helpful for evaluation of 'persistence' of results. For Matrix, as we often find with relatively small companies, results are slightly erratic, but overall the trend is clear. The company is growing and improving its performance steadily.

Revenue, which jumped from $288.4 million in 2003 to $607.9 million in 2004, otherwise has grown steadily to $639.9 million in 2007 and $674.3 million in the trailing twelve months (TTM).

Earnings have also been a bit erratic, declining from $.37/share in 2002 to $.25/share in 2003 before jumping to $.54/share in 2004. But earnings dipped to $(2.24)/share in 2005, before once again turning profitable at $.35/share in 2006 and $.81/share in the TTM.

I prefer to see stable or declining shares in general, but growth in outstanding shares is acceptable if the company has been otherwise growing its revenue and earnings even faster. In this case outstanding shares have increased from 15 million in 2002 to 20 million in 2006 and 24 million in the TTM. This 60% increase in the float has been accompanied by an almost 400% increase in revenue and an approximately 125% increase in earnings. From my perspective, this is acceptable.

On this page, I also review the free cash flow. This is the amount of cash that is being 'created' by the enterprise. During the tech bubble of the 1990's, it was common to discuss the 'burn rate' of companies, estimating the rate of consumption of available cash before all of the money was used up. In my perfect world of perfect companies :), I would prefer to see positive and growing free cash flow. At a minimum, I insist on positive free cash flow by itself. In the case of MTRX, the cash flow has improved from a negative $(33) million to $3 million in 2005, $30 million in 2006 and $4 million in the TTM.

Finally, when examining this Morningstar.com page, I want to at least briefly examine the balance sheet. I do not pretend to be an expert at this or anything else I have discussed. But this is the process I use to identify my stock picks. Again, keeping it simple, I am looking for stocks that have more assets than liabilities. Now that wasn't too hard was it?

More precisely, I want to find stocks that have more current assets than current liabilities, and possibly more current assets than total liabilities which is the combination of current and long-term liabilities combined. Think of current and long-term as descriptors explaining whether the cash amount in consideration is either available easily in the next twelve months or needs to be paid in the same period of a year.

The comparison of the total current assets to the total current liabilities is called the current ratio. Different authorities have different criteria of identifying what is 'good' or not in this ratio. Generally I have kept to a cut-off of about 1.25 for a 'good' current ratio. Higher ratios are even more financially 'healthy' from my perspective.

In the case of MTRX, Morningstar.com reports them with $7 million in cash and $140.6 million in other current assets. This level of current assets is actually enough to pay off both the $94.1 million in current liabilities and the $21.6 million in long-term liabilities combined. Calculating the Current ratio we have $147.6/$94.1 million = 1.57. A completely adequate level of assets to liabilities from my perspective.

Working through this process, I like to examine some valuation numbers. That is what kind of a value stock does this investment represent?

What about some valuation numbers for this stock?

I once again turn to Yahoo for these numbers. In particular, I utilize the Yahoo Key Statistics which for Matrix is here. Some of the numbers I like to examine include the 'size' of the company in terms of market capitalization. In particular, Matrix is a small cap stock with a market cap of only $649.04 million.

The trailing p/e is reasonable from my perspective at 28.57. Based on estimates, the forward p/e even looks nicer at 16.94. There aren't enough analysts out there making predictions about earnings results long-term to help us determine the PEG ratio (5-yr expected). But certainly, if anything like the current growth rate in earnings continues, this should be well under 1.0.

The Price/Sales ratio is another nice way of looking at a stock. According to the Fidelity.com eresearch website, MTRX is an outstanding value with a Price/Sales (TTM) ratio of only 0.78 compared to the industry average of 3.40. However, according to Fidelity, at least as measured by the Return on Equity (TTM) ratio, Matrix doesn't do quite as well with a ROE (TTM) of 19.51% compared to the industry average of 28.97%.

Finally, returning to Yahoo, we can see that there are only 26.60 million shares outstanding with 26.41 million that float. As of 11/27/07, there were 1.58 million shares out short representing 6% of the float or 4.9 trading days of volume. This days of trading volume is known as the 'short ratio". I have chosen to use 3 days of short interest as my cut-off for significance. I suspect that interest much more than three days may have the potential for a short squeeze which could propel a stock even higher. In the case of Matrix, the short ratio is 4.9 days of volume. A plus in my humble opinion.

Finally, the company doesn't pay any dividends and the last stock split was a 2:1 split in November, 2003.

What about the stock chart?

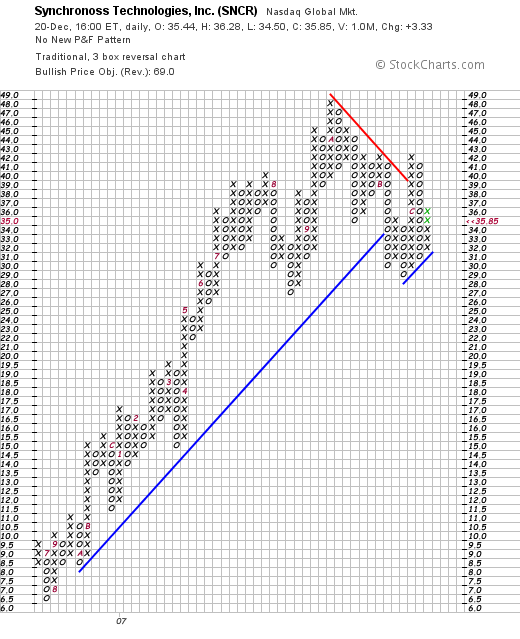

I am certainly an amateur (if not less) at looking at stock charts. The analysis of stock charting patterns is known as Technical Analysis. Over the last several years, after being presented with "Point & Figure" charts at my stock club by a local broker, I have learned to appreciate these columns of x's and o's.

But on a much more simple level, I am looking for a stock chart which shows that the price has been steadily increasing or at least appears to be doing so in the intermediate past to the present.

Looking at the 'Point & Figure' chart on MTRX from StockCharts.com, we can see that the stock took a steep drop from $20/share in January, 2004, to a low of $3.25 in April, 2005. Since that date, the stock price has steadily increased to as high as $30 in November, 2007, before dipping to $21 and now once again moving higher to the $24.40 level. The chart looks encouraging to me for at least the last year-and-a-half. Recall the dip in revenue and earnings results that ocurred in 2005 and you will understand my strong belief in the close association between financial results and technical performance.

Summary: What do I think?

Needless to say I like this stock (or of course I wouldn't be posting it!). Briefly, they moved strongly higher today, reported very strong results last quarter which beat expectations, have a record of reporting strong results (except for a dip in 2005) with reasonable expansion of outstanding shares, positive free cash flow and a solid balance sheet.

Valuation-wise, the p/e is moderate with a presumed PEG of under 1.0 (my own estimate), a Price/Sales ratio low for its group, but a Return on Equity also a bit under average. There are plenty of shares out short, and the chart looks strong.

Unfortunately, I don't have a signal to be buying anything. (And I already own one stock, SNCR, for a 'trade'). But if I were buying a stock today, this is definitely the kind of stock I would be purchasing.

Thanks again for visiting my blog. I hope my explanations today weren't too lengthy. I want to always make my entries accessable to the most amateur investors like myself who are continuing to try to grasp the nuances of investing.

If you get a chance, be sure and stop by my Covestor Page where my trading portfolio is reviewed, my SocialPicks page where all of my stock picks from the past year are reviewed, and my Podcast Site where you can download mp3's of me discussing some of the same stocks I write about here on the website. Of course, if you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Have a great weekend and a very Merry Christmas next week!

Bob

Synchronoss Technologies (SNCR) "Trading Transparency'

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on my information on this website.

Yesterday I made an 'oversized' purchase of shares in Synchronoss Technologies (SNCR) as a 'trade'. This morning, with the market up strongly, I undid 2/3 of that position, selling 400 of my 600 shares at $37.77. These shares were purchased yesterday (12/20/07) with a cost basis of $35.98. Thus I had a gain of $1.79 or 5% on this purchase. Since I still like the numbers and the stock in general,

SYNCHRONOSS TECHNOLOGIES (SNCR) IS RATED A BUY

Since I generally like this company and the stock is acting well, I didn't sell my entire position and still have 200 remaining shares in my trading account. I am extremely novice (even more amateur than my 'disciplined' trading strategy approach) at these short-term trades and am feeling my way through these. Overall, I have had as many flops as successes with my "trades" and do not claim any expertise at all at this process.

I wanted to update all of you on this as I always want to share with you what and why I am doing. I look forward to hearing some of your comments either here on the blog or email me at bobsadviceforstocks@lycos.com if you have any comments or questions.

Meanwhile, be sure and stop by and visit my Covestor page where my overall trading account continues to be analyzed, my SocialPicks Page where my stock picks are reviewed and my Podcast Page where you can downloan an mp3 of me discussing some of the various stocks and my thinking behind their selection and portfolio management strategies. You might also hear me read a poem :).

Have a great afternoon and a wonderful Christmas and New Year Holiday!

Bob

Thursday, 20 December 2007

Synchronoss Technologies (SNCR) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

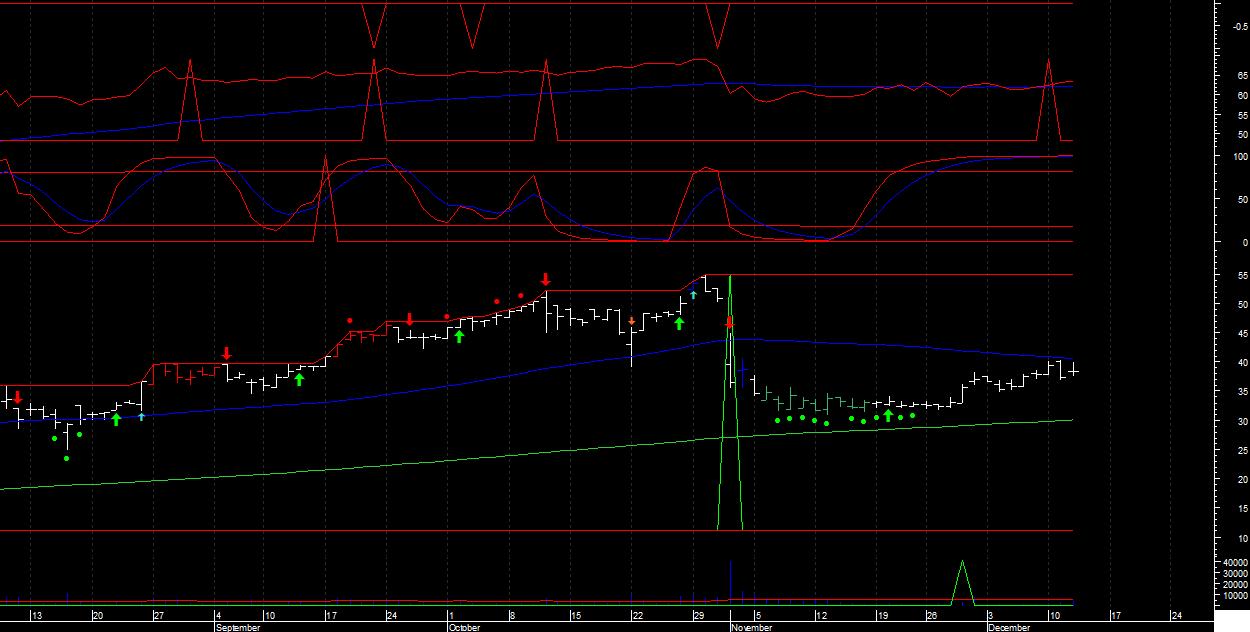

I wanted to update all of you about my latest 'trade' in my investment account. While the bulk of my portfolio remains as what I refer to as a 'disciplined investment strategy' approach, I continue to reserve the right to dabble in what I would call ultra-short-term trades. I am utilizing essentially the same screening criteria to identify these stocks and am trying to learn about what works and what doesn't. (I am certainly getting experience in 'what doesn't' lately!)

Anyhow, checking the list of top % gainers on the NASDAQ I came across Synchronoss Technologies (SNCR) trading at $36.23 up $3.71 or 11.41% as I write. A few moments ago I purchased 600 shares of SNCR at a cost of $35.96. Let me explain this, and explain why

SYNCHRONOSS TECHNOLOGIES (SNCR) IS RATED A BUY

First of all the stock is showing strong daily momentum today. Looking at some fundamentals, the last quarter was exceptionally strong with revenue increasing 82% year-over year, and 10% sequentially. Net income was also up sharply coming in at $8 million vs. a little over $3 million last year. On a per share basis this was $.25/share up from $.10/share last year.

Longer-term, the Morningstar.com '5-Yr Restated' financials page is also quite strong. The only noticeable blemish was a slight dip in earnings last year which has been more than made up with the recent reports. Also, the company has been increasing its shares outstanding, but revenue and earnings growth far exceeds this dilution.

Finally, the chart from StockCharts.com is quite strong, although recently the stock has pulled back from highs near $49 in October, 2007, and dipped as low as $29 in November, 2007. Most recently, the stock has broken through resistance and appears to be moving higher once more.

Anyhow, I sensed the market firming after earlier weakness this morning and appeared to want to race into the close. I thought I would hop on with this stock which is worthy of consideration in its own right.

Thanks so much for dropping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Have a great weekend everyone and a Merry Christmas to all of my friends from this amateur investor in Wisconsin. May Santa bring you everything you have asked for; and may 2008 bring you everything you need and not necessarily everything you want.

Bob

Monday, 17 December 2007

Movado Group (MOV) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Earlier today, in the midst of the continued market correction, my recent purchase of Movado (MOV) was 'undone' and I sold my 210 shares of MOV at an average price of $29.57. I had literally purchased these shares just days ago on 12/11/07 at a cost basis of $32.14. Thus, I had a loss of $(2.57) or (8.0)% since purchase. The 8% level is the loss point which triggers a sale (I use a 'mental stop' and do all of this manually) of a stock after an initial purchase. It doesn't really matter to me how long I have held a stock, how much I like this stock, and whether I think it is the stock market, the stock itself, manipulation in trading, or the price of tea in China. A signal is a signal and out it went.

Furthermore, with a sale on 'bad news' like this, I do not have permission to add a new position to replace Movado. I have to 'sit on my hands' and stay at what now amounts to a portfolio level of 12 positions (below my maximum of 20 and above my minimum of 5). I shall be waiting for some 'good news', whenever that may come, to add a new position. By this means, my portfolio moves in a more-or-less 'automatic' fashion towards cash and away from equities as the bear growls on Wall Street!

With my own sale of Movado, I am reducing my rating:

MOVADO (MOV) IS RATED A HOLD

Thanks so much for stopping by and visiting! I wish I had something more encouraging to greet you with than another gloomy sale. But investing is both about making money in a bull market and preserving your assets during corrections. I work at both of these and shall share with you the results of my efforts---whether they be successful or less than stellar.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where all of my transactions are reviewed from my actual trading account, my SocialPicks Page where my stock picks are analyzed from the blog, and my Podcast Page where you can download an mp3 of me discussing one of the many stocks reviewed on this website.

Wishing you all a successful and happy week trading and investing!

Bob

Sunday, 16 December 2007

A Reader Writes "...write something about margin?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of my favorite parts of blogging is to receive comments and emails from readers who range from the novice to the expert. I often learn as much from their questions as they might hope to learn from what I write! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Recently, Thierry, an avid reader, wrote me a note:

"hello Bob

always a pleasure to read your comments

i wanted to ask you if you can write something about margin

how much are you charged when you are on margin ???????

is it better to try to trade a stock who give you dividends when you are on margin , to try to lower the cost of the margin ?????

sorry for my english ....i am better in french

have a good day

thierry

ps: i did not succeed at leaving a comment ...it does not work , or maybe i do not know how to use it .."

Let me see if I can address Thierry's questions and add anything to the question about margin.

To answer your question, my current margin interest rate (12/14/07) is 9.075% in my Fidelity account. However, margin interest levels on Fidelity vary according to the amount of margin debt in the account. For instance, if your margin or borrowed amount totals $100,000 to $499,999, the rate is currently listed at 8.075%. If you have much less margin (as I do) the rate for a margin balance of $0-$9,999 is currently at 10.075%.. I am also sure that these rates may well vary between brokerage houses.

Your question about dividends is astute. All things being equal it is indeed better to have a stock that pays a dividend to offset the interest charges being accrued by being on margin. But even more important is the wisdom of buying a stock that will appreciate more than the next stock, regardless of dividend status. So in reality, the dividend issue is simply not as important as the price performance of the underlying stock itself.

While I have utilized margin in my own accounts, my goal remains to eliminate this debt which only magnifies the volatility of my own account.

A good explanation of margin comes from the SEC itself in this

website:

"Let's say you buy a stock for $50 and the price of the stock rises to $75. If you bought the stock in a cash account and paid for it in full, you'll earn a 50 percent return on your investment. But if you bought the stock on margin – paying $25 in cash and borrowing $25 from your broker – you'll earn a 100 percent return on the money you invested. Of course, you'll still owe your firm $25 plus interest.

The downside to using margin is that if the stock price decreases, substantial losses can mount quickly. For example, let's say the stock you bought for $50 falls to $25. If you fully paid for the stock, you'll lose 50 percent of your money. But if you bought on margin, you'll lose 100 percent, and you still must come up with the interest you owe on the loan.

In volatile markets, investors who put up an initial margin payment for a stock may, from time to time, be required to provide additional cash if the price of the stock falls. Some investors have been shocked to find out that the brokerage firm has the right to sell their securities that were bought on margin – without any notification and potentially at a substantial loss to the investor. If your broker sells your stock after the price has plummeted, then you've lost out on the chance to recoup your losses if the market bounces back."

I hope that answers you question! If not, please feel free to leave additional comments/questions. Have a great week trading everyone!

Bob

Posted by bobsadviceforstocks at 1:08 PM CST

|

Post Comment |

Permalink

Updated: Sunday, 16 December 2007 5:29 PM CST

Saturday, 15 December 2007

"Looking Back One Year" A review of stock picks from the week of June 12, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Thank goodness for the weekend! We have certainly had a volatile week or two! We have had so many different forces acting upon the market that it is difficult to know which way to turn. Early in the week we had the American stock market moving higher on the news of the Fed injecting liquidity to ease some of the financial challenges facing the economy. But then later in the week we found ourselves faces with inflation data suggesting that the Fed was indeed caught between a rock and a hard place trying to ease liquidity issues without fueling the fires of inflation.

In the midst of all this, I foolishly thought I could do a few 'day-trades'. I am still learning, and still an amateur :). Fortunately, I had the discipline to quickly close out these trades before they did any significant damage to my account. When I write that I am an amateur investor, I think I have convinced all of you that I am honest!

Anyhow, it is the weekend and no use dwelling on things like that. Let's do what I like to do on the weekend which is to review past stock selections from the blog. I have been going a week ahead at a time from a period about a year-and-a-half ago. (This started out as a year-ago review, but after missing a week here and a week there....well you get the picture!)

Last weekend I took a look at the week of June 5, 2006 here on the blog. Let's move ahead a week and examine the week of June 12, 2006, which, fortunately I did review a stock!

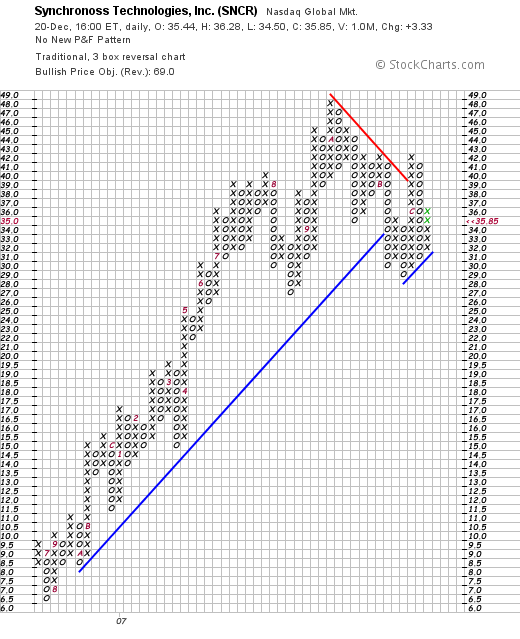

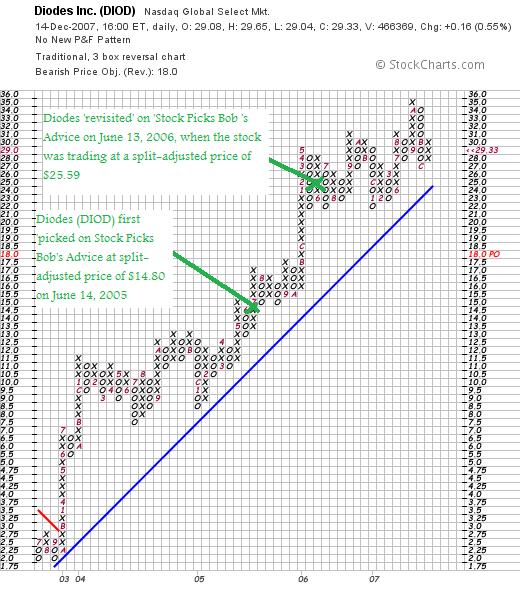

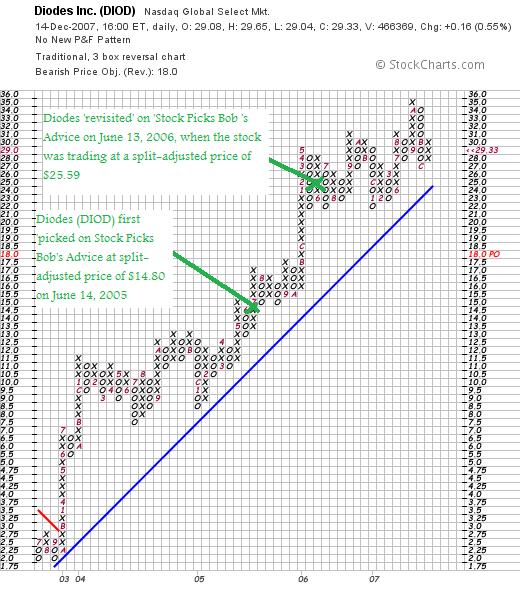

On June 13, 2006, I posted Diodes (DIOD) on Stock Picks Bob's Advice when the stock was trading at $38.39. This was the second post for me of Diodes, which was first 'picked' on this blog at $33.30/share on June 14, 2005. The stock has split 3:2 on December 1, 2005, and again 3:2 on July 31, 2007, making my first pick in 2005 having an effective pick price of $33.30 x 2/3 x 2/3 = $14.80 and my second pick in June, 2006, having an effective price of $38.39 x 2/3 = $25.59.

On June 13, 2006, I posted Diodes (DIOD) on Stock Picks Bob's Advice when the stock was trading at $38.39. This was the second post for me of Diodes, which was first 'picked' on this blog at $33.30/share on June 14, 2005. The stock has split 3:2 on December 1, 2005, and again 3:2 on July 31, 2007, making my first pick in 2005 having an effective pick price of $33.30 x 2/3 x 2/3 = $14.80 and my second pick in June, 2006, having an effective price of $38.39 x 2/3 = $25.59.

Diodes (DIOD) closed at $29.33 on December 14, 2007, representing a gain of $3.74 or 14.6% since my 'pick' last year and a gain of $14.53 or 98.2% since my first 'pick' in 2005. I do not currently own any shares of Diodes (DIOD) nor do I own any options on this stock.

Let's take a closer look at this company and see if it still deserves consideration and a spot on my blog.

DIODES (DIOD) IS RATED A BUY

Since we were discussing the price and appreciation of this stock,

What does the chart look like?

Looking at the "point & figure" chart on DIOD from StockCharts.com, we can see an impressively steady appreciation in this stock from a low of $2.00 in September, 2003, to the recent high at $35 in October, 2007.

What does this company do?

According to the Yahoo "Profile" on DIOD, the company

"...and its subsidiaries engage in the manufacture and distribution of standard semiconductor products to manufacturers in the consumer  electronic, computer, communications, industrial, and automotive markets. Its products include discrete semiconductor products, including performance Schottky rectifiers; performance Schottky diodes; Zener diodes and performance Zener diodes, such as tight tolerance and low operating current types; recovery rectifiers; bridge rectifiers; switching diodes; small signal bipolar transistors; prebiased transistors; MOSFETs; thyristor surge protection devices; and transient voltage suppressors."

electronic, computer, communications, industrial, and automotive markets. Its products include discrete semiconductor products, including performance Schottky rectifiers; performance Schottky diodes; Zener diodes and performance Zener diodes, such as tight tolerance and low operating current types; recovery rectifiers; bridge rectifiers; switching diodes; small signal bipolar transistors; prebiased transistors; MOSFETs; thyristor surge protection devices; and transient voltage suppressors."

How did they do in the latest quarter?

On November 1, 2007, Diodes (DIOD) reported 3rd quarter 2007 results. For the quarter ended September 30, 2007, DIOD reported:

-

- Revenues increased 13.7 percent year-over-year and 9.3 percent sequentially to a record $105.3 million

- Gross profit margin increased 50 basis points sequentially to 32.4 percent

- Net income increased 26.1 percent year-over-year to a record $16.1 million

- Adjusted net income increased to a record $17.1 million, or $0.40 per share, up from $14.2 million, or $0.33 per share on a stock split-adjusted basis, in the third quarter of 2006

This was a solid report! In addition, on December 12, 2007, Diodes raised guidance for the 4th quarter.

What about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on DIOD, we can see what to me really appears to be a beautiful report. Revenue has steadily increased with $115.8 million reported in 2002 climbing to $343.3 million in 2006 and $388.0 million in the trailing twelve months (TTM). Earnings have increased steadily from $.20/share in 2002 to $1.16/share in 2006 and $1.34/share in the TTM. Total shares are up a bit more than a third during the period in which revenue more than tripled and earnings more than quintupled. This is acceptable.

Free cash flow which was a negative $(5) million in 2004 increased to $28 million in 2005 and $26 million in 2006 and the TTM.

The balance sheet is solid with $45 million in cash and $475 million in other current assets, more than enough to cover both the $83.7 million in current liabilities and the $249.5 million in long-term liabilities. The current ratio works out to approximately 6. (over 1.25 is adquate).

What about valuation?

Looking at the Yahoo "Key Statistics" on DIOD, we see that this is a small cap stock with a market capitalization of $1.18 billion. The trailing p/e is a very reasonable 21.73 with a forward p/e (fye 31-Dec 08) of 16.03. The PEG (5 yr expected) works out to a nice 1.06.

Using the Fidelity.com eresearch website, we can see that this company has a Price/Sales (TTM) of 2.98 compared to the industry average of 4.17. The company is also more 'profitable' than its peers (Fidelity) as measured by the Return on Equity (TTM) ratio which works out to 17.41% for DIOD compared to the industry average of 15.10%.

Finishing up with Yahoo, we can see that there are 40.07 million shares outstanding and the float is 30.62 million. As of 11/27/07, there were 5.88 million shares out short representing 14 trading days of volume or 15.10% of the float. Using my own '3 day rule' for short interest, this appears significant and could be setting the stock up for a short squeeze should good news continue to be announced.

No dividends are paid and as already noted, the last stock split was a 3:2 split on July 31, 2007

Summary: What do I think?

Well, I really like this stock. Perhaps the only possible weakness might be a potential cyclical slowdown in semiconductor stocks, but even this appears remote with the company signalling strong results by raising guidance for the upcoming quarter. Going through some of the things I have just presented, the latest quarter was strong, the longer-term results are gorgeous with steady revenue and earnings growth, positive free cash flow, and a solid balance sheet. Valuation is excellent with a p/e just over 20, a PEG just over 1.0, a Price/Sales ratio low for its industry, and a Return on Equity high for the industry. The chart is gorgeous, and there are lots of naysayers out there who represent a large short interest on the stock.

I don't really like the overall tone of the market. But I like this stock a lot!

Thanks again for visiting my blog! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. I cannot respond to every email I receive, but I do read them all and try to respond to comments when posted.

If you get a chance, try to visit some of my related intenet sites: my Covestor Page where Covestor.com reviews my actual trading portfolio and compares it to other investors and how I am doing relative to the S&P; my SocialPicks Page where SocialPicks evaluates my stock picks from the past 12 months, my Podcast Page where I have been podcasting on many of the same stocks I write about on this blog.

Finally, if you are willing to take additional risks and are aware of the potential of loss, check out Prosper.com where if you sign up and initiate a loan both of us receive $25 credit. (Talking about win-win!). But be sure to take into consideration the high risk of loss on non-secured loans, be sure and spread out your loans to reduce that risk, and consider emphasizing higher-rated borrowers in your lending plans. That being said, it is a fascinating website even if you don't end up participating.

I hope you all have a wonderful weekend and a very wonderful Holiday Season. The best gift we can receive is not of the financial type at all. Remember to spend time with family, appreciate your good health if you are fortunate to enjoy good health, and be considerate of others who have less than you--whether it be of the financial or non-material type.

Peace.

Bob

Thursday, 13 December 2007

A Reader Writes "Stick to what you know."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I received an excellent comment today from another reader named 'Bob' who gave me some excellent advice. I should say I am prepared to follow it.

He wrote:

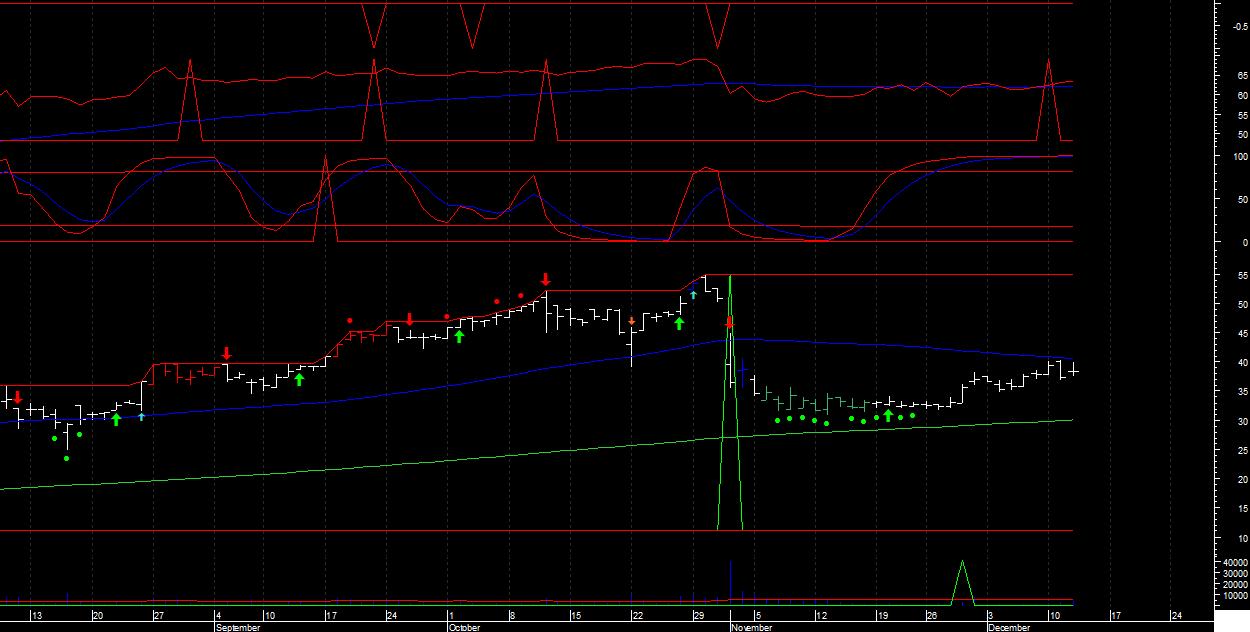

"Bob,

Stick to what you know. Stop the trading sideline or you will go broke. Nobody wins at trading except the brokers. Anyway, you should have had a plan for FTK before you bought it. You must know your selling price before buying the stock. After buying it, put in the sell stop at your sell price and never lower it. FTK may still work out if the fundamentals are so sound. It's just bouncing off the 50 dma. If it's sound fundamentally eventually it will break through the resistance. If however, there are more sellers (because the fundamentals are not what they appear to be) then the stock will sink like a rock off the 50 dma touch. Keep up the good work but quit trading and start investing again.

Bob"

(I have enclosed his chart attached to his letter.)

Thank you Bob for writing! Indeed technical analysis may well be required to execute successful trades over the extremely short-term. He is also correct about putting in the sell point at the time of purchase. I didn't do that either.

More importantly, he is kind to suggest that I have done well with investing (even though I clearly haven't done well with 'trading'.)

Once again, I am convinced of this fact. That is that there are definitely different skills and knowledge that is required of a trader that may possibly be unnecessary as an investor. If you can do either, continue to do so successfully. And don't think that if you are better than average in one skill, that there should be anything automatic about doing the 'other'.

Anyhow, thanks for writing Bob. You are very helpful and confirm my own assessment of my trades.

Bob

Wednesday, 12 December 2007

Flotek "Trading Transparency--update #2"

Just a quick update from this amateur investor. I am still quite amateur at trading stocks rather than investing. The market does not appear to be impressed with the liquidity added by the Fed and the bounce this morning after yesterday's plunge appears to be exactly that....a bounce.

Anyhow, I just sold the 200 shares of my Flotek (FTK) that I didn't sell earlier at $38.20 that were purchased earlier today at $39.55. The trade didn't work out and with the market acting less than vigorous, and me with significant margin anyhow....well it all added up to a sell...and that's what I did.

If you have any comments, suggestions, encouragement, scorn, amusement, or reactions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Flotek (FTK) "Trading Transparency--update"

Hello Friends! Thanks again for visiting my blog! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

With a significant margin load, I am a big talker about trades until the rubber hits the road as they say. Flotek was trading weakly this morning and I hedged my 'trade' by selling 400 of the 600 shares. And just as sure as night follows day, the stock seemed to turn around and move higher after my move. I still have 200 shares of this stock and am still optimistic about its fortunes. However, I am most concerned about limiting losses and the sale made sense....at least at that time.

I sold these 400 shares at $38.45 earlier. They had been purchased this morning at an average cost of about $39.55. Thus I had a loss on this purchase of $(1.10) or (2.8)% since purchase. I have a much lower tolerance for losses on these trades which are not part of my regular trading strategy.

Fortunately, the rest of my portfolio is moving higher as I write so I shall be able to absorb this small loss without much difficulty. It is difficult to trade stocks like this in a market as volatile as we are experiencing without getting 'whip-sawed'.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Flotek (FTK) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your investment advisers prior to making any investment decisions based on information on this website.

As part of my latest 'strategy' for making a trade alongside my tightly managed portfolio, I noted that Flotek (FTK) an old favorite of mine, was on the list of top % gainers of the AMEX today. With that in mind, I just purchased 600 shares at $39.55 in my trading account. As I write, FTK is trading at $39.24, up $1.97 or 5.29% on the day. So I am already a few cents underwater :(. Anyhow, let's see how this works in the account.

On October 31, 2007, FTK reported strong 3rd quarter earnings. Longer-term results are just as impressive and the chart (from StockChart.com) shows the recent pull-back in price, but the upward momentum appears intact.

FLOTEK (FTK) IS RATED A BUY

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 10:44 AM CST

|

Post Comment |

Permalink

Updated: Wednesday, 12 December 2007 10:53 AM CST

Newer | Latest | Older

I have been spending some time discussing my various trades on this blog and I wanted to see if I could post a stock this afternoon that I don't own yet I still believe deserves a spot on this website.

I have been spending some time discussing my various trades on this blog and I wanted to see if I could post a stock this afternoon that I don't own yet I still believe deserves a spot on this website.

On

On

electronic, computer, communications, industrial, and automotive markets. Its products include discrete semiconductor products, including performance Schottky rectifiers; performance Schottky diodes; Zener diodes and performance Zener diodes, such as tight tolerance and low operating current types; recovery rectifiers; bridge rectifiers; switching diodes; small signal bipolar transistors; prebiased transistors; MOSFETs; thyristor surge protection devices; and transient voltage suppressors."

electronic, computer, communications, industrial, and automotive markets. Its products include discrete semiconductor products, including performance Schottky rectifiers; performance Schottky diodes; Zener diodes and performance Zener diodes, such as tight tolerance and low operating current types; recovery rectifiers; bridge rectifiers; switching diodes; small signal bipolar transistors; prebiased transistors; MOSFETs; thyristor surge protection devices; and transient voltage suppressors."