Stock Picks Bob's Advice

Tuesday, 13 June 2006

"Revisiting a Stock Pick" Diodes (DIOD)

CLICK HERE FOR MY PODCAST ON DIODESHello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

The last month has been very hard on my portfolio and I am sure very hard on yours! I stick to my trading strategy and shall continue to sell stocks that hit my targets for selling and defer buying any new stocks until I have a signal to buy, which means either I am at my minimum number of positions (6) and have sold one of my remaining positions, or I have sold a portion of an existing position at a targeted gain. My positions are still rather extensive, numbering numbering 16 positions, so this isn't likely soon. And I don't have any stocks near sell-points on the upside. So I sit tight and wait for the selling to conclude; monitoring my stocks and selling anything that hits a selling price on the way down.

In the midst of this negative environment, we can still be looking for new names in the market. There are always some stocks moving higher when the rest are moving in the other direction. It is my challenge to monitor these stocks and find possible investments that could be considered if I did have the appropriate buy signal.

Looking through the

list of top % gainers on the NASDAQ today, I came across an old favorite of mine, Diodes (DIOD) which closed at $38.39, up $4.94 or 14.77% on the day. I actually

do own 240 shares of this stock in a managed IRA account that I do not control or direct. I first

posted Diodes (DIOD) on Stock Picks Bob's Advice on June 14, 2005, almost exactly one year ago, when the stock was trading at $33.30/share. The stock split 3:2 on December 1, 2005, giving my stock pick an effective price of $22.20. Given today's close at $38.39, this gives my pick from one year ago an appreciation of $16.19 or 72.9% since posting!

Let's take a closer look at this stock and I will share with you my observations on the characteristics that make this stock still attractive to me!

1. What does this company do?According to the

Yahoo "Profile" on Diodes, the company

"...engages in the design, manufacture, and marketing of discrete and analog semiconductor products worldwide focusing on various end user applications in the consumer electronics, computing, industrial, communications, and automotive sectors."

2. Is there any news to explain today's big move?Checking Yahoo

"Healines" on Diodes, I noted a couple of stories regarding company guidance. In a

story from the AP, the company is reported to have guided its second quarter revenue

higher with revenue growth of 10 - 12%

sequentially up from prior guidance of 3 - 6% revenue growth. As noted in the article, this works out to expected revenue of $81-$82.4 million up from the first quarter revenue of $73.6 million. This is also higher than analysts were expecting which was revenue of $77 million. In addition, the company expects second-quarter profit margin to increast "slightly" from 32.9% in the first quarter. Thus, not only is revenue to grow faster than expected, the margin on the revenue is also increasing which should also lead to even higher earnings. This was a win-win announcement that led to the stock moving higher in fact of a lousy trading environment!

3. How did the company do in the latest reported quarter?Diodes

reported 1st quarter 2006 results last month on May 4, 2006. As reported:

"- Revenues increased 51% year-over-year and 20% sequentially to

$73.6 million

- Operating income increased 19% to $10.8 million; pro forma up 36% to

$12.4 million

- Net income increased 29% to $9.3 million, or $0.34 per share"

These were nice results especially with the sequential growth reported. The latest news about increased guidance for the upcoming quarter combined with the last quarter's report is terrific!

4. How about longer-term results?Reviewing the

Morningstar.com "5-Yr Restated" financials we see a steady pattern of revenue growth from $93.2 million in 2001 to $214.8 million in 2005 and $239.8 million in the trailing twelve months (TTM).

Earnings which were just break-even in 2001, grew to $.29/share in 2002, and $1.29/share in 2005 with $1.32/share reported in the TTM.

During this time, the company has rather aggressively increased its float from 14 million shares to 23 million shares in 2005 and 26 million in the TTM. This almost doubling of shares outstanding was still outpaced by the rapid growth in earnings and revenue with revenue more than doubling, and earnings more than quadrupling since 2002.

And the free cash flow? Morningstar reports DIOD with $3 million in 2003, $3 million in 2004, $31 million in 2005 and $27 million in the TTM. Clearly this trend at least recently looks nice.

How about the balance sheet? This looks great to me. The company has $99.5 million in cash. I like it when a company can pay off all of its libilities: short and long-term combined with cash alone. And DIOD does this with only $68.6 million in current liabilities and $10.0 million in long-term liabilities reported. What about the "current ratio"? If we add together the $99.5 million in cash with the $108.3 million in other current assets, this gives us a total of $207.8 million in total current assets, which, if compared to the $68.6 million in current liabilites, yields a current ratio of 3.03. Generally current ratios, as I understand them, are considered "healthy" if 1.5 or higher.

5. What about some valuation numbers on this stock?Looking at

Yahoo "Key Statistics" on Diodes, we find that this company has a market capitalization of $980.06 million which makes it a mid-cap stock. The trailing p/e is moderate at 29.22. However, the anticipated growth is so strong that the forward p/e (fye 31-Dec-07 estimated) is only 18.91. This rapid anticipated growth gives us a PEG (5 yr expected) of only 0.98. Generally PEG ratios, imho, between 1.0 and 1.5 are fairly valued. Those under 1.0 are "cheap" and should be considered a good buy from a growth at a reasonable price (GARP) perspective.

Using the

Fidelity.com eresearch website for some relative valuation numbers, we find that DIOD is in the "Semiconductor-Integrated Circuit" industrial group. Within this group, DIOD is moderately priced with a Price/Sales ratio of 3.9. Topping the group is Marvell Technology (MRVL) with a ratio of 8.2, Broadcom (BRCM) at 5.9 and Semtech (SMTC) at 4.8. Priced cheaper than DIOD is RF Micro Devices (RFMD) with a Price/Sales ratio of only 1.6 and Skyworks Solutions (SWKS) at 1.1.

If we compare profitability by examining the Return on Equity (ROE) within this group we find that Diodes (DIOD) leads the pack with a ROE of 17.7%. Following DIOD is BRCM at 15.6%, MRVL at 11.7%, SMTC at 9.9%, RFMD at 2.9% and SWKS at 2%. Certainly by this measure, Diodes looks quite nice as well.

Returning to Yahoo, we can see that there are only 25.53 million shares outstanding with 19.21 million that float. As of May 10, 2006, there were 1.63 million shares out short, representing 6.5% of the float or 5 trading days of volume (the short ratio). I use a 3 day cut-off for significance in this ratio. This is just my own personal cut-off. If we do use this 3 day rule, the 5 days is a bit heavy on short-sellers who are betting against this company with the superb numbers. I suspect these short-sellers had a rude wake-up call today as the company and the stock climbed in the face of a really weak trading environment?

The company does not pay a dividend, and as I noted above, the stock last split 3:2 on 12/1/05.

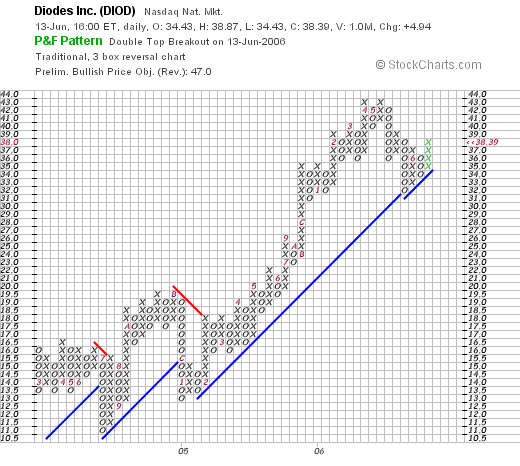

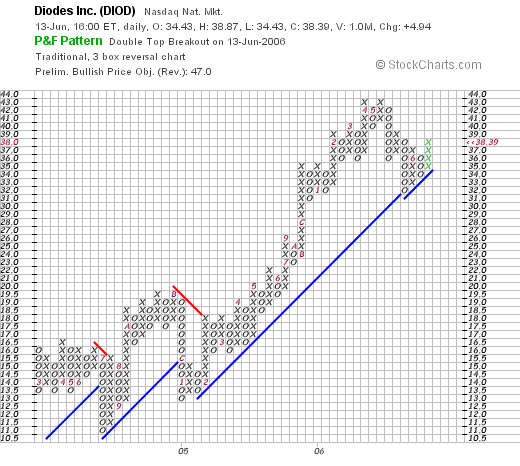

6. What does the chart look like?If we take a look at the

Diodes "Point & Figure" chart from StockCharts.com:

We can see that the stock after dipping from $16 in June, 2004, to a low of $11.00 in June, 2004, started climbing in a very strong fashion to a high of $43 in May, 2006. The stock subsequently came down to a low of $31 in late May, 2006, and has been powering higher since. The chart looks quite strong to me.

7. Summary: What do I think?

Needless to say, I like this stock a lot. Let me explain why and review some of the findings in the above review. First of all the company guided higher for the upcoming quarter. This was enough to drive the stock higher in a weak market. The latest quarter was strong with both solid revenue and earnings growth both year over year and sequentially. Looking at Morningstar.com, we find that the company has indeed been steadily growing its revenue AND earnings. They have been floating a few more shares than I like but even with this, earnings per share have grown steadily!

Free cash flow is positive and growing. The balance sheet is solid with enough cash to pay off all liabilities!

Valuation-wise the p/e is a bit rich but with the rapid growth expected the PEG is under 1.0. Looking at similar companies, we find that the Price/Sales ratio puts the company right in the middle of its industrial group. However, the company is the top in profitability as measured by ROE which is a plus. On top of this there are a lot of short-sellers which may be feeling the squeeze of a rapidly climbing stock. To top it off, the chart looks nice to me. In other words, the stock price is moving higher on the chart :).

Anyhow, that's my pick this evening. A stock that I do own some shares in a managed account. However, I picked this stock a year ago and the stock has subsequently performed magnificently. Hopefully, this can continue.

If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com or just leave your comments on the blog. Please also be sure and stop by and visit my Stock Picks Bob's Advice Podcast Site.

Bob

Posted by bobsadviceforstocks at 9:32 PM CDT

|

Post Comment |

Permalink

Updated: Wednesday, 14 June 2006 1:01 AM CDT

Sunday, 11 June 2006

A Reader Writes "...I come to you for advice on a stock."

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I had the pleasure of getting a nice letter from "Jeff in Indiana" who wrote earlier today:

"Bob,

Again I come to you for advice on a stock. This is in your field of medicine and is called Amsurg Corp. (AMSG). After doing my research, it seems to meet or beat the main criteria that you utilize in your stock-picking process. It also is going up in a lousy market, which has to be a bullish sign. Please comment at your convenience.

Thanks,

Jeff in Indiana"

Jeff, thanks so much for writing! It was late Sunday, and instead of writing out the response, I posted the

response on Amsurg (AMSG) on my podcast!

I hope that is helpful!

Thanks again for writing. If you or anyone else have any other questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Be sure to listen to this podcast and others on stocks I discuss on the blog as well as philosophy on investing on my

Stock Picks Bob's Advice Podcast Site.

Bob

"Looking Back One Year" A review of stock picks from the week of March 14, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I would like to apologize for the paucity of posts these past two weeks. I did a real number on my back and after missing some work, have been avoiding sitting at the computer. Things are doing a bit better, and I shall try to catch up with the blog!

One thing that I try to do on weekends (which I missed last weekend) is to review stock picks from a trailing one year period. I simply look through the posts from that particular week and list all of the stocks "picked" and the price that week and the latest price. This review assumes a buy and hold strategy. In practice, I advocate and use a disciplined sale strategy whereby I sell my losing stocks completely and quickly and my appreciating stocks slowly and partially. This strategy will of course affect the return. However, for the sake of review, it is simplest to just determine the return based on a purchase and hold strategy.

On March 16, 2005, I

posted Career Education (CECO) on Stock Picks Bob's Advice when it was trading at $36.35. Career Education closed at $32.94 on June 9, 2006, for a loss of $(3.41) or (9.4)% since posting.

On May 3, 2006, CECO

reported 1st quarter 2006 results. Revenue for the three months ended March 31, 2006, increased 4% to $528.6 million up from $510.4 million in the same period the prior year. Consolidated net income came in at $52.7 million or $.53/diluted share, down (5.7)% from the $55.9 million or $.53/diluted share during the same period in 2005.

On March 18, 2005, I

posted DRS Technologies (DRS) on Stock Picks Bob's Advice as a "revisit" when it was trading at $42.43. DRS closed at $50.44 on June 9, 2006, for a gain of $8.01 or 18.9% since posting.

On May 12, 2006, DRS

reported 4th quarter 2006 results. For the quarter ended March 31, 2006, revenue came in at $645.7 million, up 79% from the $361.2 million in the same period last year. As noted in the news report, the large jump in revenue and earnings is attributable to a successful acquisition of ESSI on January 31, 2006. Net earnings for the quarter climbed 76% to $28.8 million or $.79/diluted share, (on 30% additional shares outstanding) compared with the prior year's results of $16.3 million or $.58/diluted share. The company also went ahead and raised guidance for 2007 earnings.

So how did I do picking these two stocks? One pick lost ground, and the other did well. The average performance for these two picks was a gain of 4.75% since they were picked that week a bit more than a year ago.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Also, please be sure to stop by and visit my

Stock Picks Bob's Advice Podcast Site.

Bob

Thursday, 8 June 2006

"Trading Transparency" Jos A Bank (JOSB)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

A little earlier this morning I unloaded my 187 shares of Jos A Bank (JOSB) at $27.00. I had purchased these shares on 4/4/05 at a cost basis of $25.59. So actually, I had a small gain on these shares of $1.41/share or 5.5% since purchase. JOSB is having a

HORRIBLE day in the market, trading at $25.64 or down $(11.49) or (30.95)% since the close yesterday. The stock virtually collapsed on a poor earnings report that came out this morning prior to the opening of trading with earnings at $.32/share down from $.38/share last year.

I don't need to know why the stock is down. It dropped to a sale point after passing through the 30% gain point. I have had two previous sales of this stock at 30 and 60% appreciation points, and the current price was below my sale point.

Since this is another sale on bad news. I shall once again be sitting on my hands with the proceeds as I continue to batten down the hatches in the face of this bear market. I do not know how much farther down it goes, but I shall let my stocks dictate my response and hopefully, we shall start seeing some good news that allows me to add a few positions.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Please be sure to stop by and visit my

Stock Picks Bob's Advice Podcast Site where you can

listen to me discussing many of these same stocks and issues I am facing along with all of you!

Bob

Wednesday, 7 June 2006

"Trading Transparency" Packeteer (PKTR)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Checking through my trading portfolio, I realized that my Packeteer stock (PKTR), which I had recently purchased, hit an 8% loss and I sold my shares in this position. I had purchased 400 shares of PKTR at a cost basis of $11.94/share. A few moments ago I sold these shares when the stock was trading at $10.86 for a loss of $(1.08)/share or (9.0)% since my purchase. Having sold this position at a loss, I shall not be looking to purchase another position, but shall instead be 'sitting on my hands' with the proceeds, waiting for a sale on 'good news' to add a new position to my trading portfolio.

Although slow and unwieldy, my trading system continues to direct me to move from equities into cash (or at least a reduced level of margin.) I will continue to avoid re-investing proceeds until I get to a minimum number of stocks in my trading portfolio, which would be at 1/4 of my maximum or 6 positions. I have a ways to go before that!

Thanks so much for visiting my blog. If you have any comments or questions, please feel free to leave them right on the blog or email me at bobsadviceforstocks@lycos.com. Please also be sure and visit my

Stock Picks Bob's Advice Podcast Site where you can download an mP3 where I talk about many of the same stocks and issues facing us as we look to invest in the market.

Bob

Monday, 5 June 2006

Mikron (MIKR) A Podcast on this Stock

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

This evening, I put together a

Podcast on Mikron (MIKR).

If you have any comments or questions, please feel free to drop me a line at bobsadviceforstocks@lycos.com or leave your comments on the blog. Also, please be sure to visit all of my podcasts at my

Stock Picks Bob's Advice Podcast Site.

Bob

Wednesday, 31 May 2006

An Update on my Trading Portfolio!

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I try very hard to maintaing an almost absolute transparency on this website regarding the stocks that I actually own and occasionally sell or purchase shares. I have also been writing up my trading strategy on MSN at

Jubak's Refugee Site under the topic heading "Timing the market". As part of that update, this is what I wrote this afternoon regarding my own actual holdings:

"Hello Jubak Refugees Friends!

As part of my long-term review of my trading strategy, I have been updating my portfolio performance every month or two. I hope that you all find this helpful.

This analysis is as of the close of trading May 31, 2006.

My trading portfolio now consists of 18 positions of my maximum 25 positions planned. Several stocks were sold during the recent correction.

The account net worth is $64,872.03. I have a 61.64% equity percentage. The market value of my securities stands at $105,250.17. The margin debit balance stands at $40,378.14.

Current positions (# shares, date of purchase, closing price, cost basis):

Barnes Group (B) (180 shares, 2/16/06, $41.29, $39.15)

Coach (COH) (102 shares, 2/25/03, $29.08, $8.33)

Cytyc (CYTC) (225 shares, 1/29/04, $26.28, $14.86)

Genesco (GCO) (200 shares, 5/26/06, $35.19, $34.40)

Helix Energy Solutions (HELX) (142 shares, 11/3/04, $35.46, $19.10)

Healthways (HWAY) (107 shares, 6/18/04, $53.14, $23.53)

Jos A. Bank Clothiers (JOSB) (187 shares, 4/4/05, $36.32, $25.59)

Kyphon (KYPH) (150 shares, 5/20/05, $36.96, $29.21)

Morningstar (MORN) (167 shares, 11/22/05, $42.19, $32.57)

Packeteer (PKTR) (400 shares, 1/27/06, $11.45, $11.94)

Quality Systems (QSII) (88 shares, 7/28/03, $33.22, $7.75)

ResMed (RMD) (150 shares, 2/4/05, $45.46, $29.87)

Starbucks (SBUX) (50 shares, 1/24/03, $35.65, $11.40)

SRA International (SRX) (320 shares, 2/1/05, $31.46, $29.82)

Toro (TTC) (120 shares, 5/25/06, $48.27, $48.36)

Meridian Bioscience (VIVO) (210 shares, 4/21/05, $23.79, $11.13)

Ventana Medical Systems (VMSI) (188 shares, 4/16/04, $47.46, $23.47)

Wolverine World Wide (WWW) (240 shares, 4/19/06, $22.94, $23.55)

Since 4/7/06, the following transactions have occurred:

On 4/11/06, I withdrew $5,000 from margin to pay for a 2006 IRA contribution. On 4/18/06, I sold my 113 shares of Sybron Dental (SYD) at $46.92. I purchased 120 shares of SanDisk (SNDK) the same day at $61.95. Also on 4/19/06, I purchased 240 shares of Wolverine World Wide (WWW) at $23.50, after selling 9 shares of Starbucks (SBUX) at $38.96. On 5/2/06, I purchased 300 shares of Dynamic Materials (BOOM) at $36.856. I sold 37 shares of Ventana (VMSI) on 5/3/06 at $46.49. I sold these 300 shares of BOOM on 5/3/06 at $38.174. On 5/3/06 I purchased 200 shares of Angiodynamics (ANGO) at $30.242. I sold 30 shares of ResMed (RMD) at $47.84 on 5/10/06. I purchased 240 shares of CNS Inc. (CNXS) at $24.395 on 5/10/06. On 5/16/06 I sold my 200 shares of Angiodynamics at $27.85. I sold my 200 shares of Dynamic Materials (BOOM) on 5/17/06 at $33.125. My 320 shares of JLG Industries (JLG) were sold on 5/18/06 at $23.67. I sold my 240 shares of CNS (CNXS) at $22.3701 on 5/18/06. My 84 shares of Hibbett (HIBB) were sold on 5/24/06 at $24.56. I purchased 120 shares of Toro (TTC) at $48.2699 on May 31, 2006. I sold 21 shares of Healthways (HWAY) on 5/31/06 at $51.73. Finally, I sold my 120 shares of SanDisk (SNDK) at $56.82 on 6/2/06.

As of the close of trading on 5/30/06, this trading account had realized net gains of $6,807.80, including net short-term losses of $1,201.65 and net long-term gains of $8,009.45.

As of the close of trading on 5/31/06, the account had unrealized gains totaling $29,039.29.

I hope this information continues to be helpful and I look forward to your comments and opinions. If you are interested in learning more, you can visit my blog at Stock Picks Bob's Advice or listen to my podcast at Stock Picks Bob's Advice Podcast Website.

Thanks!

Bob"

For those of you who are following my trials and tribulations, I thought you would appreciate my re-post of this data! Today was a better day and hopefully I am once again on the path of profitability!

Bob

Posted by bobsadviceforstocks at 4:21 PM CDT

|

Post Comment |

Permalink

Updated: Wednesday, 31 May 2006 5:19 PM CDT

Tuesday, 30 May 2006

"Trading Transparency" SanDisk (SNDK)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

A little while ago I noticed that my SanDisk (SNDK) stock had hit an 8% loss and I sold my shares in the company. These shares were just purchased last month on 4/13/06 and have a cost basis of $62.04. I sold these 120 shares at $56.82, with a loss of $(5.22) or (8.4)%.

Since this was a sale on "bad news", I shall be sitting on my hands with the proceeds, waiting for a sale on "good news", that is at a targeted gain, to add a new position. It is this simple strategy that moves me slowly from equities towards cash when the market environment is as rough and bearish as it is today!

Thanks so much for stopping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Be sure to stop by and visit my

Stock Picks Bob's Advice Podcast Website where I discuss many of the same stocks and issues I have been writing about here!

Bob

Saturday, 27 May 2006

"Looking Back One Year" A review of stock picks from the week of March 7, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

It is the weekend, and a long weekend at that! Happy Memorial Day!

One of the important parts of this blog is my use of a portfolio strategy to limit losses by selling losing stocks quickly and completely. I also advocate and implement a strategy of selling gaining stocks slowly and partially at targeted appreciation points. However, for the ease of analysis, this review assumes a "buy and hold" strategy. Certainly results using this strategy as opposed to a more disciplined buying and selling strategy will affect actual performance of stock ownership.

On March 7, 2005, I

Posted EGL Inc. (EAGL) on Stock Picks Bob's Advice when it was trading at $26.97. EAGL closed at $45.99 on 5/26/06 for a gain of $19.02 or 70.5% since posting.

On May 8, 2006, EGL

reported 1st quarter 2006 results. Gross revenue climbed 7% to $752.4 million from $701 million in the same quarter in 2005. Net income increased 54% to $11.1 million from $7.2 million last year. Diluted earnings per share increased 93% to $.27/share up from $.14/share in the same quarter in 2005.

On March 10, 2005, I

posted Hibbett (HIBB) on Stock Picks Bob's Advice when it was trading at $29.49. Hibbett declared a 3:2 split on 9/28/05, making my effective stock pick price actually $19.66. HIBB closed at $25.70 on 5/26/6, giving my pick an appreciation of $6.04 or 30.7%.

On May 18, 2006, HIBB

reported 1st quarter 2007 results. Net sales increased 10.5% to $126.9 million, up from $114.8 million for a similar 13 week period ending April 30, 2005.

However "Comparable store sales decreased 0.07% compared with comparable store sales increases of 8.2% and 8.8% in the same periods in fiscal 2006 and fiscal 2005, respectively." It was this

decrease in same store sales that led me to sell my own shares the other day in this otherwise exciting retail concept.

Earnings per share increased 12.9% to $.35 from $.31/diluted share the prior year same period. The company did guide to earnings of $.14/share to $.16/share in the next quarter and expected a slight improvement to 1 to 2% same store sales growth.

So how did we do that week a year ago? Really quite well thank you. I picked two stocks that both appreciated nicely in price: EAGL with a 70.5% appreciation, and HIBB with a price appreciation of 30.7%. These stocks had an average appreciation of 50.6%.

Please remember that past performance is

no guarantee of future performance and that owning stocks assumes risk of loss. Phew. I wanted to get that warning out after that great review :).

Thanks again for visiting! If you have any comments or questions, I love to hear from any and all of you at bobsadviceforstocks@lycos.com. Please be sure to stop by and visit my

Stock Picks Bob's Advice Podcast Site where you can hear me discuss many of the same stocks I write about on this blog!

Bob

Friday, 26 May 2006

Buffalo Wild Wings (BWLD)

CLICK HERE FOR MY PODCAST ON BUFFALO WILD WINGSHello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

As many of you probably know, my first step for identifying a new stock pick for the blog is to scan the top % gainers lists. Looking through the

list of top % gainers on the NASDAQ earlier today I came across Buffalo Wild Wings (BWLD) which as the market progressed actually dropped off the top % gainers list but currently is trading at $39.42, up $2.18 or 5.85% on the day. I do not own any shares nor do I have any options on this stock.

Let's take a closer look at this company and I shall show you why I think it belongs on this blog!

1. What exactly does this company do?According to the

Yahoo "Profile" on Buffalo Wild Wings, the company

"...engages in the ownership, operation, and franchising of restaurants in the United States. The company’s restaurants serve various food items, as well as domestic and imported beers, wines, and liquor. As of December 25, 2005, it operated 122 company-owned restaurants and 248 franchised restaurants."

2. How about the latest quarterly report?

On April 25, 2006, BWLD

announced 1st quarter 2006 results. Some of the highlights of this report include total revenue, which increased 26.5% to $64.3 million for the quarter ended March 26, 2006, from $50.8 million in the same quarter last year. Same-store sales growth for the quarter was 7.7% at company-owned stores and 6.7% at franchised restaurants. Net earnings grew 43% to $3.52 million from $2.45 million during the same period last year. Earnings per diluted share also grew 43% to $.40/share from $.28/share in the same quarter in 2005. These were very strong results imho.

3. How about longer-term results?Taking a look at the

"5-Yr Restated" financials on BWLD from Morningstar.com, we can see the steady revenue growth from $74.6 million in 2001 to $171.0 million in 2004 and $209.7 million in 2005.

Reported earnings start in 2004 with $.84/share, increasing to $1.02/share in 2005. There has been a slight increas in shares from 8 million outstanding in 2004 to 9 million in the trailing twelve months (TTM). No dividend is reported.

Free cash flow has been a bit erratic with $7 million in 2003, a negative $(2) million in 2004,and $3 milllion in 2005.

The balance sheet looks solid with $52.4 milllion in cash, enough to pay off the combined $20.2 million in current liabilities and the $16.1 million in long-term liabilities combined. Calculating the current ratio, with $8.7 million in other current assets added to the cash gives us $61.1 million in total current assets, which, when balanced against the $20.2 million in current liabilities yields a current ratio of 3.02. Recall that ratios of 1.5 or higher are considered "healthy".

4. What about some valuation numbers on this stock?

4. What about some valuation numbers on this stock?Reviewing the

Yahoo "Key Statistics" on Buffalo Wild Wings, we find that this is a small-cap stock with a market capitalization of only $336.86 million.

The trailing p/e is a moderate 34.61; however, the forward p/e (fye 25-Dec-07) is more reasonable 22.29. With the rapid growth estimated (5 yr expected), we have a PEG on this stock of 1.02.

Referring to the

Fidelity.com eresearch website, we can see that BWLD is in the "Restaurants" industrial group. By the Price/Sales ratio, BWLD is moderately priced with McDonald's (MCD) topping this list with a ratio of 2. This is followed by BWLD at 1.5, Applebee's (APPB) at 1.3, Darden (DRI) at 1, Brinker Intl (EAT) at 0.8, and OSI Restaurant Partners (OSI) at 0.8.

Comparing profitability numbers, by comparing the return on equity (ROE) figures, we find that BWLD is actually the least profitable with a ROE of 10.4%. Leading the list is Darden (DRI) at 26.2%, Applebee's (APPB) at 21.1%, Brinker (EAT) at 18.2%, McDonald's (MCD) at 16.9% and OSI Restaurant Partners (OSI) at 11.1%.

Finishing up the Yahoo statistics, we find that there are only 8.54 million shares outstanding with only 6.88 million of them that float. Of these shares, 1.32 million are out short, representing 17.90% of the float as of 4/10/06, or 11.1 trading days of volume (the short ratio). This is significant imho and may result in a 'squeeze' of the short-sellers if the company continues to report good news.

No dividends are reported on Yahoo and no stock split is reported.

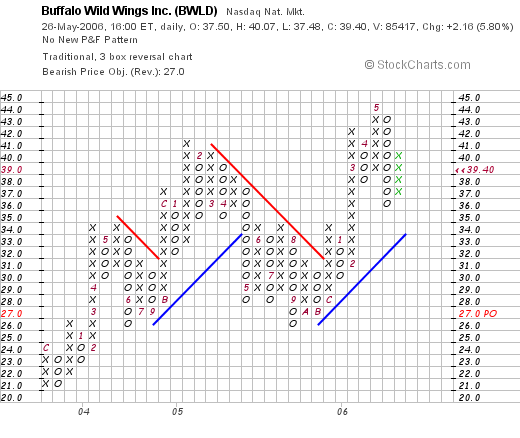

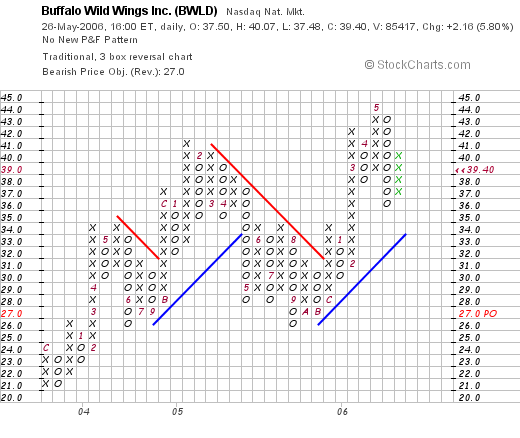

5. What does the chart look like?Examining the

"Point & Figure" chart on Buffalo Wild Wings from StockCharts.com, we can see the somewhat undulating advance of the stock price with a strong move from $21 in December, 2003, to a peak of $41 in January, 2005. The stock then pulled back to $26 in September, 2005, until breaking once again through resistance and climbing to $43 in May, 2006. The stock pulled back recently to the $36 level and now appears to be on the move higher once again.

6. Summary: What do I think about this stock?

First of all I know how difficult a successful restaurant concept can be to continue long-term growth and profitability. The company had a very strong first quarter in 2006. The Morningstar.com report looks solid with steady revenue and earnings growth and essentially steady free cash flow growth as well. The balance sheet is solid. Valuation insofar as the p/e is concerned is fair with a PEG just over 1.0 making this appear reasonably priced. However, when compared to other stocks in the same group, the Price/Sales ratio is only average, and profitability, as defined by the ROE numbers, actually looks poor compared to other restaurant stocks listed.

Finally, the chart looks strong. With the very small market presence, and the potential growth quite strong, I believe that this stock is likely worth the premium paid relative to some of the parameters. Now, if only I had a 'permission slip' to be adding a new stock!

Anyhow, thanks so much for stopping by and visiting. If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com or just leave your comments right on the blog.

Also be sure to come and visit my Stock Picks Bob's Advice Podcast Site.

Bob

Posted by bobsadviceforstocks at 1:36 PM CDT

|

Post Comment |

Permalink

Updated: Sunday, 28 May 2006 11:25 AM CDT

Newer | Latest | Older

Looking through the list of top % gainers on the NASDAQ today, I came across an old favorite of mine, Diodes (DIOD) which closed at $38.39, up $4.94 or 14.77% on the day. I actually do own 240 shares of this stock in a managed IRA account that I do not control or direct. I first posted Diodes (DIOD) on Stock Picks Bob's Advice on June 14, 2005, almost exactly one year ago, when the stock was trading at $33.30/share. The stock split 3:2 on December 1, 2005, giving my stock pick an effective price of $22.20. Given today's close at $38.39, this gives my pick from one year ago an appreciation of $16.19 or 72.9% since posting!

Looking through the list of top % gainers on the NASDAQ today, I came across an old favorite of mine, Diodes (DIOD) which closed at $38.39, up $4.94 or 14.77% on the day. I actually do own 240 shares of this stock in a managed IRA account that I do not control or direct. I first posted Diodes (DIOD) on Stock Picks Bob's Advice on June 14, 2005, almost exactly one year ago, when the stock was trading at $33.30/share. The stock split 3:2 on December 1, 2005, giving my stock pick an effective price of $22.20. Given today's close at $38.39, this gives my pick from one year ago an appreciation of $16.19 or 72.9% since posting!

I had the pleasure of getting a nice letter from "Jeff in Indiana" who wrote earlier today:

I had the pleasure of getting a nice letter from "Jeff in Indiana" who wrote earlier today:

On March 16, 2005, I

On March 16, 2005, I  On May 3, 2006, CECO

On May 3, 2006, CECO  On March 18, 2005, I

On March 18, 2005, I  On May 12, 2006, DRS

On May 12, 2006, DRS  On March 7, 2005, I

On March 7, 2005, I  On March 10, 2005, I

On March 10, 2005, I  As many of you probably know, my first step for identifying a new stock pick for the blog is to scan the top % gainers lists. Looking through the

As many of you probably know, my first step for identifying a new stock pick for the blog is to scan the top % gainers lists. Looking through the  Let's take a closer look at this company and I shall show you why I think it belongs on this blog!

Let's take a closer look at this company and I shall show you why I think it belongs on this blog! On April 25, 2006, BWLD

On April 25, 2006, BWLD  Reported earnings start in 2004 with $.84/share, increasing to $1.02/share in 2005. There has been a slight increas in shares from 8 million outstanding in 2004 to 9 million in the trailing twelve months (TTM). No dividend is reported.

Reported earnings start in 2004 with $.84/share, increasing to $1.02/share in 2005. There has been a slight increas in shares from 8 million outstanding in 2004 to 9 million in the trailing twelve months (TTM). No dividend is reported. 4. What about some valuation numbers on this stock?

4. What about some valuation numbers on this stock? Finishing up the Yahoo statistics, we find that there are only 8.54 million shares outstanding with only 6.88 million of them that float. Of these shares, 1.32 million are out short, representing 17.90% of the float as of 4/10/06, or 11.1 trading days of volume (the short ratio). This is significant imho and may result in a 'squeeze' of the short-sellers if the company continues to report good news.

Finishing up the Yahoo statistics, we find that there are only 8.54 million shares outstanding with only 6.88 million of them that float. Of these shares, 1.32 million are out short, representing 17.90% of the float as of 4/10/06, or 11.1 trading days of volume (the short ratio). This is significant imho and may result in a 'squeeze' of the short-sellers if the company continues to report good news.