Stock Picks Bob's Advice

Saturday, 12 July 2008

Watchful Waiting in the Stock Market

I wanted to share with you a picture I took a couple of weeks ago at the Mendenhall Glacier in Alaska.

Peaceful, isn't it?

I haven't been doing much in my portfolio this past week. But I continue to follow my own investing system, waiting for my own portfolio to signal me as to whether it is time to be buying or replacing a stock holding. Currently, I am down to 5 positions. This is my minimum exposure to equities with my maximum of 20.

I didn't get to 5 by any "thinking" or "planning" or "anticipating". I don't deserve any credit for this. Just my own portfolio indicated that it wasn't time to be replacing stocks sold on "bad news". And I listened.

So I continue to monitor my portfolio, waiting for the 'all-clear' signal. This will come when the market turns higher and one of my own stocks hits a sale on the upside. When will that be? I don't know.

But I know when I am given the opportunity to buy, that nickel will once again be burning a hole in my pocket. Sure would be nice.

Yours in investing,

Bob

Sunday, 6 July 2008

Copart (CPRT) "Weekend Trading Portfolio Analysis"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I 'wear' a lot of hats on this website.

Well maybe not that many hats :). But seriously, by wearing different hats I mean I am trying to accomplish many different things simultaneously. My success with doing that certainly varies from time to time and week to week.

I try to write about how to select stocks, what stocks I believe are worth selecting, how to build a portfolio, when to sell a stock and when to buy a stock, when to move from cash into equities and when to move from equities into cash. At the same time, I have been sharing with all of you readers my actual account in which I am 'practicing what I preach'. Since starting this blog, I have joined up with Covestor where you can see my actual trading account performance by visiting my Covestor Page. And I have participated with SocialPicks where you can monitor the performance of all of my stock picks.

I have also been sharing with all of you my experience with a person-to-person loan site where consortiums of individual investors join up to provide unsecured loans to borrowers. You can visit Prosper.com and find out more and sign up if you like. (You will earn $25 if you make a loan and I will also receive $25 after your first loan goes through.)

Needless to say, my picks haven't been exempted from this bear market.

But one of my key roles on this blog is to keep you informed of my actual trading portfolio. I do this with reviews of the entire account as well as trying on intervals to focus on my holdings one-by-one. It is the latter that I should like to do tonight.

My last review of a holding of mine was on April 12, 2008, when I reviewed my Meridian Bioscience (VIVO) stock. My Fidelity account orders my holdings by their symbol so I am now at the bottom of the alphabet with my five holdings. Going back to the top brings me to Copart (CPRT).

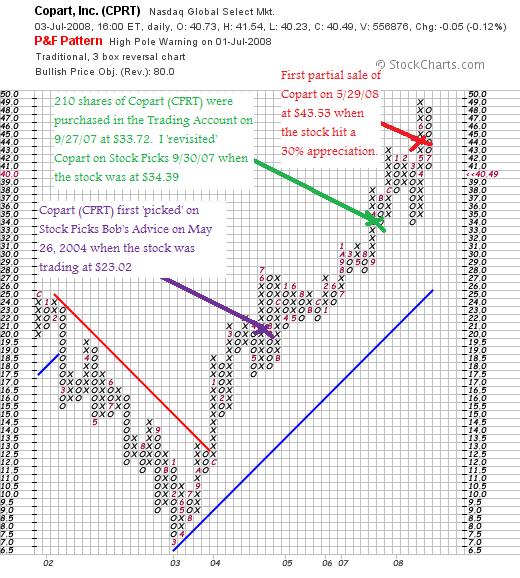

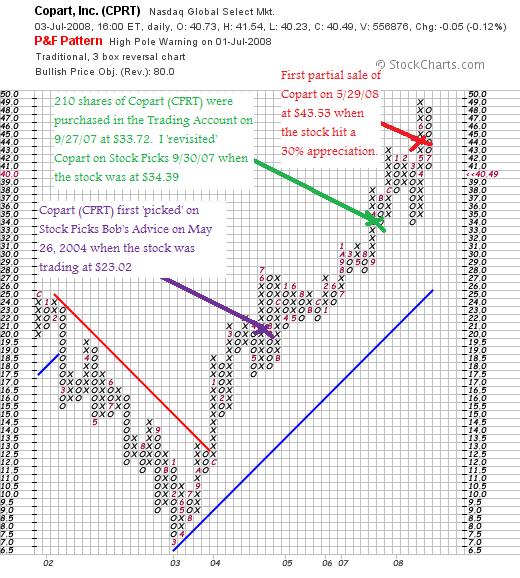

Copart (CPRT) is what I would call an 'old favorite' of mine. That is, I first discussed Copart (CPRT) on Stock Picks Bob's Advice on May 26, 2004 when the stock was trading at $23.02/share. On September 30, 2007, shortly after actually buying some shares of Copart, I 'revisited' Copart on the blog when the stock was selling at $34.39/share.

Copart (CPRT) is what I would call an 'old favorite' of mine. That is, I first discussed Copart (CPRT) on Stock Picks Bob's Advice on May 26, 2004 when the stock was trading at $23.02/share. On September 30, 2007, shortly after actually buying some shares of Copart, I 'revisited' Copart on the blog when the stock was selling at $34.39/share.

Currently, I own 180 shares of Copart which were purchased 9/27/07 at a cost basis of $33.72/share. Copart (CPRT) closed at $40.49/share on 7/3/08 for a gain of $6.77 or 20.1% since purchase. I did sell 30 shares of Copart on 5/29/08 at a price of $43.53 which represented a 1/7th of my holding at the first sale point on the upside which I have set at 30% appreciation from my cost.

On the upside, my next sale would be at a 60% appreciation target which would calculate out to $53.96. On the downside, after a single sale at a 30% gain, my sale point is raised to break-even or $33.72, up from the (8)% loss limit I usually place after an initial purchase.

Let's take another look at Copart and I shall show you why

COPART (CPRT) IS RATED A BUY

First of all, what exactly do they do?

According to the Yahoo "Profile" on Copart, the company

"...provides a range of remarketing services to process and sell vehicles over the Internet through its Virtual Bidding Second Generation Internet auction-style sales technology to vehicle suppliers primarily insurance companies. Its services include online supplier access, salvage estimation services, virtual insured exchange, transportation services, vehicle inspection stations, on-demand reporting, DMV processing, flexible vehicle processing programs, buyer network, and sales process, as well as CoPartfinder, an Internet-based used vehicle parts locator that provides vehicle dismantlers with resale opportunities for their salvage purchases."

"...provides a range of remarketing services to process and sell vehicles over the Internet through its Virtual Bidding Second Generation Internet auction-style sales technology to vehicle suppliers primarily insurance companies. Its services include online supplier access, salvage estimation services, virtual insured exchange, transportation services, vehicle inspection stations, on-demand reporting, DMV processing, flexible vehicle processing programs, buyer network, and sales process, as well as CoPartfinder, an Internet-based used vehicle parts locator that provides vehicle dismantlers with resale opportunities for their salvage purchases."

And how did they do in the latest quarter?

On June 4, 2008, Copart (CPRT) reported 3rd quarter 2008 results. Revenue climbed 52% to $221.2 million from $145.7 million the prior year same period. Earnings increased to $46.5 million or $.52/share, up from $38.9 million or $.41/share last year. The company beat expectations on both revenue which had been expected according to analysts polled by Thomson Financial at $207.9 million, and earnings which had been expected to come in at $.48/share.

And longer-term?

If we review the Morningstar.com "5-Yr Restated" financials on Copart (CPRT), we can see that revenue growth is solid, increasing from $335 million in 2003 to $561 million in 2007 and $733 million in the trailing twelve months (TTM). Earnings have also steadily grown from $.62/share in 2003 to $1.46/share in 2007 and $1.68/share in the TTM. No dividend is paid. And the outstanding shares are rock solid at 93 million reported in 2003 and 93 million in the TTM.

Free cash flow is positive and appears to be growing with $70 million reported in 2005 and $91 million in the TTM.

The balance sheet is solid with $96 million in cash and $175 million in other current assets. This total of $271 million in total current assets, when compared agains the $128.9 million in current liabilities yields a current ratio of 2.1. The company is almost without any long-term liabilities with $16.7 million reported on Morningstar.com.

And what does the chart look like?

If we examine a 'point & figure' chart on Copart (CPRT) from StockCharts.com, we can see that the stock, after dipping to a low of $7.00 in March, 2003, has steadily climbed for the past five years to a high of $49 in June, 2008, only to pull back currently to its $40.49 level in July, 2008. The upward move of this stock has barely budged in the midst of the terrible market action we have been observing. The chart looks just fine to me!

Summary:

I really like this stock a lot. I guess the only thing that might be nicer would be if it paid a dividend. And I wouldn't be surprised to see this company do exactly that in the future. Of course I don't have any inside information on this or any of my other 'guesses'!

In light of the weakness in the economy and the possible recession, even this blog points out the utility of repairing that old car instead of buying a new one when times are tough:

"Drive your car until it’s old. This works really well when you buy a car that will run for 200,000 miles."

It was my 'hunch' that this company would be recession-resistant. People deferring new car purchases may well find themselves replacing parts on their old car. I know I am personally responsible for purchases of parts for my kids' 1994 Jeep Grand Cherokee. It is cheaper to keep it running than to replace it.

Copart continues to show good technical strength, a solid record of underlying fundamentals, and is the kind of company that might just help me get through this market correction and likely recession.

When your portfolio is banged-up, maybe a stock like Copart which specializes in 'wrecks' might just be able to find a place to make itself at home!

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com or leave them right on the website. Please remember to check out my Covestor Page where you can find out more about my actual trading account, my SocialPicks page where my many stock picks from the last year-and-a-half are reviewed, and my Podcast Page where you can download an mp3 or two of me discussing some of the many stocks and topics I blog about right here!

Yours in investing,

Bob

Posted by bobsadviceforstocks at 10:05 PM CDT

|

Post Comment |

Permalink

Updated: Sunday, 6 July 2008 10:12 PM CDT

"Looking Back One Year" A review of stock picks from the week of October 30, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of my weekend "tasks" that I like to attend to is to review past stock selections, thereby examining the success or failure of this process. Last weekend I reviewed the stock picks from the week of October 23, 2006 (there were none) and this week going forward, I planned on reviewing the picks from the week of October 30, 2006. Unfortunately, again there were no picks that week either so I shall not be doing any reviews.

But I do have some news to share with you.

I am a never-ending fan of the internet and ended up over the weekend over at Gather.com. Gather.com is a community of bloggers that is divided up into different topics. I have been writing a couple of articles to kick off my participation and if you would like to read them, I wrote a small piece about the bear market entitled "Is the Stock Market Getting Un-BEARable?" and introduced the 'Gather.com' readers to my own investing strategy. Today I wrote another short piece entitled "Using Morningstar to Help Research Stocks". If you are interested in these reviews please feel free to visit and join Gather so you can participate over there.

I am a never-ending fan of the internet and ended up over the weekend over at Gather.com. Gather.com is a community of bloggers that is divided up into different topics. I have been writing a couple of articles to kick off my participation and if you would like to read them, I wrote a small piece about the bear market entitled "Is the Stock Market Getting Un-BEARable?" and introduced the 'Gather.com' readers to my own investing strategy. Today I wrote another short piece entitled "Using Morningstar to Help Research Stocks". If you are interested in these reviews please feel free to visit and join Gather so you can participate over there.

The rest of the weekend has been rather quiet. Except of course for the diminishing supply of fire crackers and back-yard fireworks still going off from time to time around here.

I hope you all had a wonderful 4th of July Holiday!

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Saturday, 5 July 2008

A Reader Writes "A couple of questions...."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I always enjoy receiving correspondence. Even when I was a kid I liked to run to the mailbox and find out what had just come in. O.K. it isn't as bad as in the musical The Music Man and The Wells Fargo Wagon song....but just the same...I really do like to hear from all of you readers.

I always enjoy receiving correspondence. Even when I was a kid I liked to run to the mailbox and find out what had just come in. O.K. it isn't as bad as in the musical The Music Man and The Wells Fargo Wagon song....but just the same...I really do like to hear from all of you readers.

One of my regular readers, John H. had a comment about my last response to the investor that had been losing money....

He wrote:

"First off, thanks for the great site, information, and willingness to share your methods and stock picks. I am going through your analysis of the current email from the person that lost money, and also how you go about

analyzing stocks to invest it or at least consider.

A couple of questions: for possible candidates to consider, do you look at any other sources initially other then top gainers? Also, in setting you

apprciation sell targets, rather then a percentage above the initial purchase price taking you out 1/7th, why not go with a trailing stop on the whole position?

I have my account with TDAmeritrade, and if I understand

them correctly there is such a thing as a percentage trailing stop which would move up as the price increased; thereby allowing a person to enjoy the

rising trend.

Thanks. John H."

Thank you John for writing!

Let me try to respond to your question. Please understand that in now way am I trying to imply that my approach to investing is the best or the only way to go about picking stocks and managing your holdings. I do not even know for sure if it is profitable over the long haul. It is just my best attempt to set up some sort of system that seems to be working for me.

In my current trading portfolio, you are absolutely correct. My first step is to look at the top % gainers each day. That is it. Nothing else. I have tried a few times (mostly unsuccessfully) to make a 'trade' of a stock after it seems to have 'over-reacted' to some news or other. Or just on a 'hunch'. I do those transactions less and less and my performance has improved significantly.

Of course it is not enough that a stock is on the top % gainers list to get my 'seal of approval'. I generally try to stay with stocks $10 or higher, and then go through my routine of checking the latest quarter, the Morningstar.com '5-Yr Restated' reports, valuation figures from Yahoo, and a 'point & figure' chart from StockCharts.com. It is only after looking at all of those that I 'pick' a stock for my blog.

Insofar as those trailing stops....am I mistaken or have you asked me that before? I know someone has inquired about that possibility.

It isn't a bad idea. But it isn't something I do. What I do is what Jim Cramer has described as "taking a little schnitzel off the table."

As was explained on TheStreet.com:

"Now on the German front, Cramer will use "schnitzel" when he's referring to making a small buy or sell. So if he's buying a "schnitzel," he's doesn't want to buy too much. He'd rather wait until the stock price pulls back, a.k.a. falls, more.

If he's selling a "schnitzel," he's selling a little bit. For instance, during a lightning round a few months ago in reference to Hansen Natural (HANS - Cramer's Take - Stockpickr), he said, "there's gonna be too much profit-taking. I don't trust it here ... I want you to schnitzel out of it." So he wanted the caller to start selling small pieces of his holding."

Now I happen to love Wiener-Schnitzel.

But that is an entirely different story!

But I view my approach to my stocks as even more conservative than yours. Not necessarily more profitable.

That is, by selling some of my gaining stocks as they appreciate I literally "lock-in" some of the gains. I can use these gains to balance against the losses that I take as stocks dip. I also use these sales as 'signals' for my own portfolio management system.

That doesn't mean that what I do is the best way to invest. It is just something that seems to work for me.

Same with the 'percentage trailing stop'. That isn't really a bad idea at all. But from my perspective, I want to give my top performing stocks more 'leash'. That is, instead of maintaining a standard percentage trailing stop, as you suggest, I base my trailing stop on the stock's prior performance. While a new purchase will be sold if it dips 8%, a stock that has appreciated 120% wouldn't be sold until it tipped to a 60% appreciation level....giving it almost a 50% dip before a sale. That way, I don't get 'whip-sawed' out of my 'favorites'....those stocks that have done the best for me.

Anyhow, I don't know if I answered your questions exactly as you might like, so if you have any other comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 1:57 AM CDT

|

Post Comment |

Permalink

Updated: Saturday, 5 July 2008 2:00 AM CDT

Thursday, 3 July 2008

A Reader Writes "I have lost a lot of money in the stock market...."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of my favorite parts of writing a blog is to receive email from readers with questions of their own. I am not a professional adviser so I am not qualified to give individual advice on anyone's particular situation. For that I would suggest seeking the advice of a professional.

One of my favorite parts of writing a blog is to receive email from readers with questions of their own. I am not a professional adviser so I am not qualified to give individual advice on anyone's particular situation. For that I would suggest seeking the advice of a professional.

However, I am happy to share some of my own ideas with readers about investing in general. Let me see if I can answer this question from Stan who obviously has not been treated very well by the market.

Stan writes:

"Dear Bob, I have been looking at your site and today I looked to see how your stock recommendation ECL made out.. For anyone getting into this they would have had to chase this right? Are all your picks like this where it moves immediately and perhaps during after hour trading and thus one would have to chase this stock?

Stan

ps

bob, you seem like a legitimate guy.;) I have lost a lot of money in the stock market and I would like to enter the market again but to be able to follow someone as astute as you are. Do you only give what you buy for yourself and do you also let people know what you are selling? If I were to follow your picks do I just hold on to them and wait for you to say sell? do you have stop losses and if so what kind will they be. If you dont mind calling me , my number is xxx xxxxxxx. I would love to meet you on the phone."

O.K....let me try and answer this question the best I can.

My goal in writing this blog is not about writing about stocks that anyone needs to 'chase'. I do start with stocks that are moving higher that particular day. It is my belief that identifying stocks moving higher that also have strong underlying fundamentals may also represent equities that are likely to move higher in the future as well.

Time will tell if that strategy will be successful. It appears to be working for me.

Regarding your losing a lot of money in the market, that is really a terrible thing. But perhaps you are not alone as this market has been merciless in destroying the value of equity after equity. For example, General Motors (GM) is now sitting at a 54 year low. ouch.

My strategy has been and continues to be to attempt to build a portfolio of stocks that have the brightest prospects. I sell my stocks quickly on declines to avoid developing large losses. I sell my holdings partially as they appreciate to targeted levels. Generally I sell 1/7th of my holdings if they reach levels of 30%, 60%, 90%, 120%...etc. appreciation levels. Similarly, I sell my entire position if the stock should drop 8% after an initial purchase, break-even--if I have sold once at a 30% gain, or at 1/2 of the highest appreciation level of sale. In other words, I sell an entire position if the stock should dip to a 30% appreciation level after having already had a partial sale at a 60% appreciation target.

Sounds a bit complicated? It is. But it is keeping me afloat.

In addition, I try to respond to market influences by monitoring the actions of my own portfolio. That is, if my maximum holdings are 20 positions, my minimum is 1/2 of 1/2 of that or 5 positions. "Neutral" would be at 10 positions.

Starting out I would place 10 positions into equities and 50% of my account would be in cash.

If a stock got sold at a gain by appreciating I would add a position. If sold on the downside, I 'sit on my hands' and continue to add to cash. I replace positions if I sell a holding when I am at my minimum of 5 positions. Likewise, I sit on my hands if at my maximum and have a buy position by selling a portion of a holding that has appreciated.

Complicated? You bet. But I am doing it and it appears to work. I am currently at 5 positions.

I write up lots of stocks. Only a few I own. You can monitor my own activity by reading my blog. All of my entries are there going back to 2003. Read a few entries and you will start understanding my investment philosophy and my actual trades.

In addition, in the interest of transparency, I have my portfolio posted over at

Covestor. My stock picks are otherwise monitored over at

SocialPicks. And if you would like to hear me discuss my strategy and some of the stocks I write about, download some mp3's by going over to my

Podcast Page.

Whenever I buy or sell, this is recorded over at Covestor and I try to write up an entry ASAP entitled "trading transparency".

I do not tell people when they should sell stocks. I do not write up when a "buy" becomes a "sell". I leave that for my readers to determine. Setting up tight sale points at the time of purchase, identifying quality companies to invest in, managing my portfolio in response to market actions, these are all things I advocate and would believe they would work for many other people as well.

Please let me know if this has helped you understand my blog and my approach. So many people have lost so much in this bear market. You are not alone in this regard. But if you can always manage to learn from your experiences, if you can avoid repeating the same mistakes over and over again, and if you can develop a strategy that works for you in the future, it will all be worthwhile.

I hope that I can add to your understanding of how an amateur can approach investing. That is and has always been my goal. I am not even sure that I shall be successful myself.

If you have any other comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Ecolab (ECL)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

After so many days of downside action in the market, it was nice to see at least the Dow move higher today, trading at 11,288.54, up 73.03 on the day as I write. The Nasdaq, however, didn't participate in this rally and is currently at 2,245.38, down 6.08 on the day.

After so many days of downside action in the market, it was nice to see at least the Dow move higher today, trading at 11,288.54, up 73.03 on the day as I write. The Nasdaq, however, didn't participate in this rally and is currently at 2,245.38, down 6.08 on the day.

With the market moving a bit higher, this gave me an opportunity to identify a new name for this blog. Scanning the list of top % gainers on the NYSE today, I came across Ecolab (ECL), a stock that I haven't reviewed here before, and a stock that I believe deserves a spot on this website. Ecolab (ECL) closed at $44.48, up $2.04 or 4.81% on the day. I do not own any shares or options of this stock.

ECOLAB (ECL) IS RATED A BUY

Let me share with you my thoughts on this company that led me to this assessment.

First of all, what do they do?

According to the Yahoo "Profile" on ECL, the company

"...develops and markets products and services for the hospitality, foodservice, healthcare, and light industrial markets in the United States and internationally. The company offers cleaning and sanitizing products and programs, as well as pest elimination, maintenance, and repair services primarily to hotels and restaurants, healthcare and educational facilities, quick service units, grocery stores, commercial and institutional laundries, light industry, dairy plants and farms, food and beverage processors, and the vehicle wash industry."

"...develops and markets products and services for the hospitality, foodservice, healthcare, and light industrial markets in the United States and internationally. The company offers cleaning and sanitizing products and programs, as well as pest elimination, maintenance, and repair services primarily to hotels and restaurants, healthcare and educational facilities, quick service units, grocery stores, commercial and institutional laundries, light industry, dairy plants and farms, food and beverage processors, and the vehicle wash industry."

And how did they do in the latest quarter?

On April 24, 2008, Ecolab reported 1st quarter 2008 results. Revenue for the quarter increased 16% to $1.46 billion from $1.25 billion in the first quarter of 2007. Net income increased 15% to $102.9 million or $.41/share, from $89.5 million or $.35/share the prior year same period. The company beat expectations with this result as analysts polled by Thomson Financial had been expecting earnings of $.39/share.

What about longer-term results?

Examining the Morningstar.com "5-Yr Restated" financials on Ecolab, we can see that revenue has been steadily increasing from $3.76 billion in 2003 to $5.47 billion in 2007 and $5.67 billion in the trailing twelve months (TTM). In an equally impressive fashion, earnings have been increasing steadily from $.99/share in 2003 to $1.70/share in 2007 and $1.76/share in the TTM. Also convincing is the fact that the company pays a dividend and has increased the dividend each year during the past five years from $.30/share in 2003 to $.48/share in 2007 and $.49/share in the TTM.

But that isn't enough either! Insofar as maintaining a stable number of outstanding shares, the company has been regularly decreasing the shares from 263 million in 2003 to 252 million in 2007, with a slight increase to 253 million in the TTM.

Free cash flow has been solidly positive and steadily growing. Morningstar.com reports $321 million in free cash flow in 2005 increasing to $491 million in 2007 and $529 million in the TTM.

The balance sheet appears solid with $220 million in cash and $1.67 billion in other current assets, adequate to cover the $1.6 billion in current liabilities. The company has another $1.57 billion in long-term liabilities reported on the books.

And valuation?

Reviewing Yahoo "Key Statistics" on this stock, we can see that this is a large cap stock with a market capitalization of $10.99 billion. The trailing p/e is a tad rich at 25.34, with a forward p/e of 20.59. Thus the PEG (5 yr expected) also comes in a bit rich at 1.68. (I prefer to see stocks with PEG's in the 1.0 to 1.5 range...but with everything else looking nice, I can live with this PEG!)

Using the Fidelity.com eresearch website for some more statistics, we can see that valuation as measured by the Price/Sales (TTM) is more reasonable with Ecolab coming in at a 1.84 ratio compared to the industry average of 4.12. In terms of profitability, as measured by the Return on Equity (TTM), ECL also is a bit more profitable than its peers with a 24.19% ROE reported on Fidelity compared to the industry average of 22.8%.

Finishing up with Yahoo, there are 247.16 million shares outstanding with only 172.15 million that 'float'. Currently there are 5.06 million shares out short (as of 10-Jun-08), representing a short ratio of 5.6 trading days. This is ahead of my own '3 day rule' and may present opportunities for a 'squeeze'.

The company, as I have noted, currently pays a forward annual dividend rate of $.52/share with a 1.2% yield. The last stock split was a 2:1 June 9, 2003.

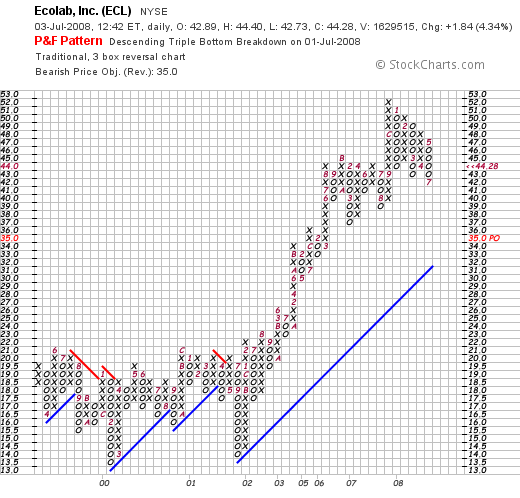

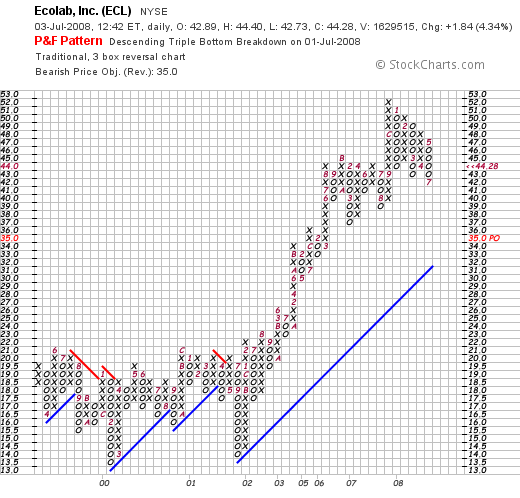

What about the chart?

Looking at a 'point & figure' chart on Ecolab from StockCharts.com, we can see a strong rise in price from September, 2001, when the stock dipped to $13.50/share. Since then the stock has been strongly moving higher, peaking at $52/share in December, 2007, only to dip down to $42 recently. The chart looks strong and 'optimistic' to me.

To summarize:

My search for stocks of potential interest involves identifying companies with strong price momentum with associated steady and high quality financials. This company fits the bill. They moved ahead nicely today, have been reporting steady revenue and earnings growth while maintaining a stable outstanding share count. They pay a dividend and have been steadily increasing it.

Valuation is reasonable with a bit of a steep PEG, but a solid Price/Sales ratio as well as Return on Equity compared to similar companies.

The chart looks good with only a recent pull-back reflecting the overall bearish environment of every stock. There are even a good number of shares out short waiting to be squeezed.

This is the kind of stock I would be buying if I had a 'signal' from my own portfolio indicating that it might be time to be moving into additional equities. Meanwhile I shall be adding this to my 'watch-list', waiting for the right time to be adding to my own portfolio. Hopefully, I shall be able to 'clean-up' with this stock one day!

Thanks again for dropping by and visiting my blog. If you have any comments or questions, please feel free to leave them right on the website or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor page where you can review my actual trading portfolio and my performance with those holdings as well as my SocialPicks page where you can review my stock picks and their subsequent performance.

If you get a chance, be sure and visit my Podcast Page where you can listen to some of my podcasts about the stocks on this website.

Have a happy and safe 4th of July everyone!

Yours in investing,

Bob

Posted by bobsadviceforstocks at 12:47 PM CDT

|

Post Comment |

Permalink

Updated: Thursday, 3 July 2008 1:26 PM CDT

Sunday, 29 June 2008

***New Podcast*** "My Trading Portfolio" and "Adventures of Isabel" by Ogden Nash

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I found a little time to get a podcast together! If you are interested,

CLICK HERE FOR MY PODCAST

on "My Trading Portfolio", "Adventures of Isabel" by Ogden Nash, and some comments on Investment Philosophy, selling at an 8% loss, responding to market influences by paying attention to one's own portfolio, and blogging and being open to criticism on Seeking Alpha!

Yours in Investing,

Bob

Posted by bobsadviceforstocks at 10:56 PM CDT

|

Post Comment |

Permalink

Updated: Sunday, 29 June 2008 11:02 PM CDT

"Trading Portfolio Update" June 29, 2008

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

My blog and my investment strategy continues to be an experiment for me. I think it makes sense. And the only way to figure it out is to employ my idiosyncratic strategy in real life. Much like when I was younger and played with my Gilbert Chemistry Set!

As part of my promise to all of you to be as transparent as possible, I have been regularly sharing with you my actual trading portfolio. You can also monitor my trades and my current performance on my Covestor Page. And of course you can monitor all of my picks from the last year-and-a-half on my SocialPicks Page.

And if you have any comments or questions about all of that or anything I write, you certainly can leave them on the blog or email me at bobsadviceforstocks@lycos.com and I shall do my best at answering you.

My last update on my trading portfolio was a bit over a month ago on May 11, 2008. Let me try to get this done in as concise and brief a fashion as possible.

Currently I have 5 positions in my Trading Portfolio. This is my minimum exposure to equities in terms of number of positions. My maximum number of positions is 20. I haven't been up near 20 for awhile now.

My number of positions floats between 5 and 20 depending upon the actions of my own holdings. That is, when I sell a stock on 'bad' news, which for me is a result of a decline or an announcement of something fundamentally unfavorable with a stock---I sell that stock and "sit on my hands" with the proceeds (unless I am at the minimum---where I am now---in which case I would still sell the stock but look for a replacement.)

On the other hand, if I sell a portion (1/7th) of one of my stocks at an appreciation target (30, 60, 90, 120, 180%, etc.) appreciation, then I have a 'signal' to be adding a new position.

It is my hope that this "experiment" will be successful and allow me to react to market conditions my shifting my exposure to equities from a minimal to a maximal level. Like my Gilbert Set, this is still an experiment, and I am awaiting the final results :).

(Please let me know if any of you have also adopted this strategy so that I can share your comments regarding the utility or uselessness of this approach!)

Anyhow, back to my portfolio. And I did say I would be brief :(.

Copart (CPRT): 180 shares, acquired 9/27/07 with a cost basis of $33.68/share. CPRT closed at $44.90 on 6/27/08, giving me a gain of $11.22 or 33.1% since purchase. I have sold 1/7th of my holding when the stock reached a 30% gain. Thus, my next sale on the upside would be at a 60% appreciation target or 1.6 x $33.68 = $53.89. On the downside, my plan is to sell if the stock drops to 'break-even' or $33.68.

Covance (CVD): 102 shares, acquired 4/9/07 at a cost basis of $62.61. CVD closed at $84.24/share on 6/27/08, representing a gain of $21.63 or 34.5% since purchase. I have sold 1/7th of my holding at the 30% appreciation level, so like my Copart stock, my next partial sale on the upside would be at a 60% gain or 1.60 x $62.61 = $100.18. On the downside, my sale point would be at break-even or $62.61.

Graham (GHM): 105 shares, purchased 5/30/08, at a cost basis of $64.48. GHM closed at $69.82 on 6/27/08, giving me a gain of $5.34 or 8.3% since purchase. Since I have yet to sell any of these recently-acquired shares, my first sale on the upside is at a 30% gain or 1.30 x $64.48 = $83.82. On the downside, I plan on selling these shares should they incur an 8% loss, or at a price of .92 x $64.48 = $59.32.

Morningstar (MORN): 103 shares, purchased 11/22/05, at a cost basis of $32.57. MORN closed at $73.59 on 6/27/08 for a gain of $41.02 or 125.9% since purchase. I have sold portions of MORN four times (at 30, 60, 90 and 120% appreciation levels). My fifth sale on the upside would be at a 180% appreciation level or 2.80 x $32.57 = $91.20. On the downside, after multiple sales at appreciation targets, I move my sale point to 1/2 of the highest appreciation level. Thus, with the last sale at a 120% appreciation level, my targeted sale on the downside is 1/2 of that or at a 60% appreciation target. (Note, I didn't mean that I would be selling at 1/2 of that price, but 1/2 of the appreciation %). Thus, on the downside 1/2 of 120% = 60% or at a price of 1.60 x $32.57 = $52.11.

Meridian Bioscience (VIVO): 171 shares, purchased 4/21/05 at a cost basis of $7.42. VIVO closed at $27.74 for a gain of $20.32 or 273.9% since purchase. I have sold portions of VIVO eight times (!) at levels of 30, 60, 90, 120, 180, 240, 300, and 360% appreciation targets. Thus on the downside, if VIVO slips further to the 180% appreciation level or $7.42 x 2.8 = $20.78, then I would sell all of my shares. On the upside, a partial sale would next be at a 450% appreciatio level or 5.5 x $7.42 = $40.81.

As of 6/28/08, the entire portfolio had a value of $44,952.44. This included cash of $8,623.55 and equities of $36,328.89. As of 6/28/08 I had a realized net loss for 2008 of $(78.62) representing a net short-term loss of $(4,642.85) and a net long-term gain of $4,564.23.

As of 6/28/08, I had unrealized gains of $12,477.83 in my five current holdings.

So far my experiment appears to be working!

Thanks for dropping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Saturday, 28 June 2008

"Looking Back One Year" A review of stock picks from the week of October 23, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I have managed to miss a few more weeks in these 'reviews' and now am pushing two years out. Yikes. However, let's see if I can at least get this weekend covered! My last review was back on May 10, 2008, when I took a look at stock picks from the week of October 16, 2006. Going a week ahead, let's review the selections from October 23, 2006.

The reviews assume a buy and hold approach to investing. In practice, I advocate as well as employ a disciplined portfolio management approach that requires me to sell my declining stocks quickly at small losses and sell my appreciating stocks slowly at targeted appreciation levels. This difference in approach would certainly affect performance and should be taken into consideration.

Taking a look at the week of October 23, 2006, I noticed that I didn't have any picks that week!

I will take advantage of this past lull in posting by skipping any retrospective reviews this weekend and again take a look at past stock picks next week!

Yours in investing,

Bob

Thursday, 26 June 2008

'Seeing the Forest For the Trees'--More on Investment Philosophy!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Last week, after holding my Visa (V) shares for two weeks, I experienced a slightly greater than (8)% loss which triggered a sale. I wrote about this on this blog and also over on Seeking Alpha, where my entry was entitled: Visa: Why I Sold All of My Shares. I received considerable criticism, in fact getting 93 comments, mostly about my lack of intellect for dumping Visa shares so quickly.

But my sale of a stock is not merely about my belief in the long-term outlook on any particular companies. There are many forces that act upon a stock including in particular the actual movement of the overall market.

I listen to my stocks. And I respond to their sales either on the upside with a 'permission slip' to be adding a new position. Or on the downside by 'sitting on my hands' unless I am at my minimum of 5 positions (as I am presently.)

Those that are unable to perceive market influences while focused solely on individual stocks that they passionately hang on to might be said to be having problems "seeing the forest for the trees".

While my blog is about "stock picks" it is also my attempt to share with all of you my own effort at listening to my own holdings and either moving more heavily into equities (on the sale of stocks that are appreciating) or swinging more into cash (by sitting on my hands when I sell stocks like my Visa (V) at a loss).

I try to find the very best stocks to own in the universe of stocks.

Visa was one of these. I do believe the outlook may be terrific for this stock.

But I am also greatly aware of the dangers and opportunities of investing.

I am not smart enough to know when to move to cash or into stocks. But I am capable if disciplined to respond to the signals of my own holdings.

Currently I am at 5 positions. My minimum. And the market sucks. The system is working.

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing.

Bob

Newer | Latest | Older

Copart (CPRT) is what I would call an 'old favorite' of mine. That is, I first

Copart (CPRT) is what I would call an 'old favorite' of mine. That is, I first

I am a never-ending fan of the internet and ended up over the weekend over at

I am a never-ending fan of the internet and ended up over the weekend over at  I always enjoy receiving correspondence. Even when I was a kid I liked to run to the mailbox and find out what had just come in. O.K. it isn't as bad as in the musical The Music Man and

I always enjoy receiving correspondence. Even when I was a kid I liked to run to the mailbox and find out what had just come in. O.K. it isn't as bad as in the musical The Music Man and