Stock Picks Bob's Advice

Sunday, 11 March 2007

Dave Johnson Returns to the Blogosphere!

Two months ago I gave Dave Johnson, who has written at DayveJohnson on the Markets a farewell speech. I cannot tell you how many times I have looked at my own blog and figured I might just be better 'packing it up'. So I could completely empathize with him. But I hoped he just might return to write and add to the world of financial blogging with his honest and insightful perspective. Well he has.

I was happy to see a comment the other day from Dave who dropped by and alerted me to his new website where he has joined forces from John (from Texas) to blog at The Trading Digest. Welcome Back Dave!

So if you are a loyal reader to this blog, drop by and say hello to Dave and John the Connecticut and Texas partnership, and tell them Bob from Wisconsin says hello! Good-luck Dave and be sure and drop by here from time to time and add some of your Connecticut perspective to what I write!

Bob

Saturday, 10 March 2007

Middleby (MIDD) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on this website.

I was looking through the list of top % gainers on the NASDAQ yesterday and came across an 'old favorite' of mine, Middleby Corporation (MIDD), which closed at $123.96, up $12.68 or 11.39% on the day. I do not own any shares of this company nor do I have any options on the stock.

I was looking through the list of top % gainers on the NASDAQ yesterday and came across an 'old favorite' of mine, Middleby Corporation (MIDD), which closed at $123.96, up $12.68 or 11.39% on the day. I do not own any shares of this company nor do I have any options on the stock.

When I write 'old favorite' I mean that I have looked at this stock previously on this blog. Generally, my policy is to wait 12 months or close to that prior to reviewing a stock again. When I do re-examine a stock, I call it "revisiting a stock pick." Some of my best stock picks show up again and again on the list of top % gainers as they move higher in price.

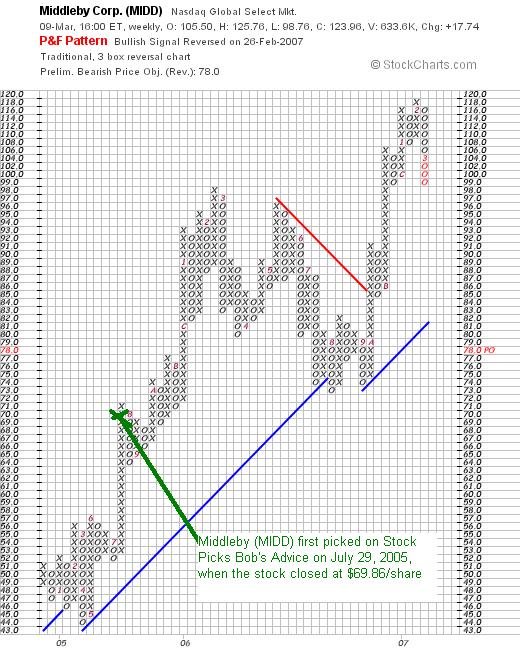

I first posted Middleby (MIDD) on Stock Picks Bob's Advice on July 29, 2005, when MIDD closed at $69.86/share. With yesterday's close at $123.96, this represents a gain of $54.10 or 77.4% since I first posted this stock a little under two years ago! I believe the stock still is worthy of a place on this blog, so let's take another look at this stock!

What exactly does this company do?

According to the Yahoo "Profile" on Middleby, the company

"...through its subsidiaries, engages in the design, manufacture, marketing, distribution, and service of a broad line of cooking equipment and related products in the United States. The company operates in three segments: Commercial Foodservice Equipment, Industrial Foodservice Equipment, and International Distribution."

"...through its subsidiaries, engages in the design, manufacture, marketing, distribution, and service of a broad line of cooking equipment and related products in the United States. The company operates in three segments: Commercial Foodservice Equipment, Industrial Foodservice Equipment, and International Distribution."

How did they do in the latest quarter?

As I commonly point out on the blog, this stock soared because of the earnings report which was released after the close of trading on Thursday. On March 8, 2007, Middleby announced 4th quarter 2006 results. For the quarter ended December 30, 2006, net sales increased 27.8% (even excluding acquisitions, sales still increased 13.3% in the quarter). Sales came in at $98.3 million this year vs. $76.9 million last year. Net earnings came in at $11.1 million this year vs. $7.2 million in the same quarter the prior year. On a diluted per share basis this worked out to $1.34/share in the 4th quarter 2006, vs. $.88/share in the same quarter last year.

The company beat expectations with this report.

What about longer-term financial results?

Reviewing the Morningstar.com "5-Yr Restated" financials on MIDD, we find that the stock has had steady revenue growth from $103.6 million in 2001 to $316.7 million in 2005 and $359.5 million in the trailing twelve months (TTM).

Earnings have also been steadily increasing from $.18/share in 2001 to $3.98/share in 2005 and $4.39/share in the TTM. The company apparently did pay a dividend in 2003 and 2004 but no dividend is reported on Morningstar.com since. Outstanding shares have been steady with 9 million in 2001 and 8 million in the trailing twelve months.

Free cash flow has been positive with $29 million reported in 2003, $17 million in 2004, $41 million in 2005 and $40 million in the TTM.

The balance sheet, as reported on Morningstar.com, appears adequate with $3.2 million in cash and $109.7 milllion in other current assets. This total of $112.9 million in current assets, when compared to the $94.1 million in current liabilities works out to a current ratio of 1.27. In addition, the company has $109.5 million in long-term liabilities.

What about some valuation numbers on this stock?

If we refer to Yahoo "Key Statistics" on Middleby, we find that the company is a small cap stock with a market capitalization of $984.24 million. The trailing p/e is a moderate 26.50 with a forward p/e (fye 31-Dec-07) of 21.41. The PEG is a reasonable 1.59.

Checking the Fidelity.com eresearch website, we find that Middleby is a bit richly valued insofar as the Price/Sales ratio is concerned, coming in with a ratio of 2.44 (Price/sales TTM), compared to an industry average of 1.34. However, the company is also more profitable than average when viewed from the return on equity (ROE) perspective. The ROE (TTM) for MIDD comes in at 54.37% vs. an industry average of 22.81%.

Returning to Yahoo we find that there are 7.94 million shares outstanding with 7.15 million that float. Of these, as of 2/12/07, there were 830,630 shares out short representing a significant (imho) 11.4 trading days of volume. (higher than my arbitrary 3 day rule for significance). Thus with good news, the 'stage is set' so to speak for a squeeze of the shorts in face of strong earnings reported. No dividends and no stock splits are reported on Yahoo.

What does the chart look like?

If we review a "Point & Figure" chart on Middleby on StockCharts.com, we can see that the stock has been moving ahead fairly strongly since late 2004 with aperiod of consolidation through much of 2006. The stock is on the upswing again and the chart appears encouraging to me.

Summary: What do I think about this stock?

In a word, this was a GREAT stock pick in 2005 and still looks nice today! Middleby reported a terrific earnings report that beat expectations, they have had at least five years of strong financial results, and valuation appears reasonable with a bit of a steep Price/Sales but a strong Return on Equity. The p/e is moderate and the PEG is just a little over 1.5. Free cash flow looks nice and the balance sheet is reasonable. Finally, there are a significant number of short-sellers on this stock, and with the great earnings report, the 'stage is set' for an unwinding of those positions and significant buying of shares to cover the short sales.

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website where I discuss many of the same stocks I write about here on the blog.

Bob

Monday, 5 March 2007

A Reader Writes "Do you trade stocks according where we are in the current business cycle?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I was delighted to receive an email from Marcus A. L. who had some questions about my investing strategy. Marcus wrote:

I was delighted to receive an email from Marcus A. L. who had some questions about my investing strategy. Marcus wrote:

"Hello Bob,

I've been reading your extensive web site for over a year now. The 8% rule is wonderful; it take a lot of the emotion out of the trading process. I want to know how do you feel about the trading with business cycle? Do you trade stocks according where we are in the current business cycle? Keep up the great work.

Thanks,

Marcus A L"

First of all Marcus, thanks so much for writing and taking the time to drop me a line. You raise an excellent question about investing, taking into consideration our position in the "business cycle". A lot of thought has gone into this approach. In fact, looking through the internet for an explanation of this, I found this comment from "Tradingonlinemarkets.com":

"As the economy grows and expands the Federal Reserve usually raises interest rates to try to control inflation. When the economy contracts the Federal Reserve will lower interest rates to try to stimulate demand by lowering the costs of borrowing. If you hear that the Federal Open Market Committee (FOMC) has raised or lowered rates, they are actually raising or lowering the federal funds rate for banks. The federal funds rate is the interest rate at which depository institutions lend balances at the Federal Reserve to other depository institutions overnight.

The business cycle has implications for markets and investors. Broadly, a recession often corresponds with a sustained period of weak stock prices, or a bear market. And a healthy, expanding economy that keeps inflation from rising too quickly often corresponds with a bull market, or period of sustained market growth.

Fortunately, there are investment strategies for all parts of the cycle, thanks to the diverse economy we have. Companies that do well when the economy is experiencing good times are called cyclical stocks. Industries that fall under this group include travel and leisure companies, airlines, consumer electronics firms and jewelry makers. Companies that make goods that are necessities, such as food and health care are called non-cyclical stocks. These stocks tend to provide more stability during an economic downturn. During an economic expansion one should invest in cyclical stocks. On the other hand during an economic contraction one should consider investing in non-cyclical stocks."

It is this philosophy that will often drive commentary about different stocks as discussed by analysts on CNBC or elsewhere. They may say we are "late in the cycle" or that "cyclical stocks are best now...." etc. These assessments may well be useful and be profitable advice that should be heeded but that is not how I structure my own activity.

I do not preclude the investment in cyclical stocks. But in practice, I do avoid stocks that I consider tied to commodity prices. Recently I made an exception with Bolt (BTJ) which is clearly moving in tandem with oil prices. Gold stocks will also tend to follow the price of the underlying metal closely.

My approach is to stay with stocks that are generating consistency in their financial results regardless of the point that we may be in the "cycle". However, with my "Zen approach" of allowing stocks that are moving higher to attract my attention, sort of allowing them to come to me rather than me figuring out which stocks to "pick", if those particular stocks are indeed strong relative to the market due to the underlying business cycle, then those stocks may well show up on my blog.

My purchases of stocks are dependent on my own portfolio developing a "signal" to add a new stock by the partial sale of an existing position at an appreciation target--and the simultaneous appearance of an acceptable investment on the top % gainers list. This semi-random selection process will open up new stocks for me to consider.

However, when I do have a "permission slip" to buy a new stock, I always reserve the right to choose which stock to buy when several are eligible. This small "wiggle room" allows me to bias my purchase to stocks I feel may represent the greatest promise by whatever personal prejudice or preference I may hold. I recognize this, and generally bias myself towards names that are already stocks I am familiar with, what I call "part of my vocabulary".

To answer your question, I suppose that if stocks that are doing well are indeed responding to the business cycle, then my system will also pick up those stocks. However, I do not try to anticipate moves in stock groups or sectors; rather, I like to respond to their developing momentum with developing interest on my part.

I hope that answers your question. If you have any other questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, please feel free to drop by and visit my Stock Picks Podcast Website!

Bob

"20 Questions" on "Gannon on Investing"

I had the pleasure of being interviewed by Geoff Gannon, a value investor who is also a value investor advocate who blogs on "Gannon on Investing" and also does a podcast.

Thank you Geoff! Visit Gannon on Investing to read this post.

Bob

VCA Antech (WOOF) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

A few moments ago, as I have been commenting about here on the blog, my VCA Antech (WOOF) passed an (8)% loss position, and I sold my 180 shares, that I recently purchased, at $35.88. I had purchased these shares on February 22, 2007, at a cost basis per share of $39.21. With this sale, this represented a loss of $(3.33) or (8.5)% since purchase. I don't care how much I like this stock---a lot---rules are rules. And out the shares went. Especially with my heavy margin, I cannot afford to bend my trading rules and need to raise cash when stocks hit their sale points on the downside.

Fortunately, this is the first sale at a loss in this correction. Another recent purchase Harris (HRS) is also flirting with a sale and if it hits that 8% level, out it will go! As is my strategy, since this is a sale on "bad news", this does not entitle me to buy a replacement stock but requires, since I am above my minimum of 6 positions (now at 16) to 'sit on my hands' and use the money to either add to my cash position (or in my case to pay down some of the margin!).

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website!

Bob

Saturday, 3 March 2007

"Looking Back One Year" A review of stock picks from the week of October 17, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of the tasks I assign myself each weekend is to review past stock picks. I want to find out if these picks would have been successful if I had actually purchased them (I only pick a few of the many stocks discussed on this blog to actually purchase for my own Trading Account.) This review assumes a "buy and hold" strategy. In fact, I practice and advocate something quite different--a strategy that involves selling losing stocks quickly and completely and gaining stocks partially and slowly. This difference in strategies would certainly affect the performance evaluation. I have been using the 'buy and hold' evaluation assumption simply for the ease in evaluating past stock picks.

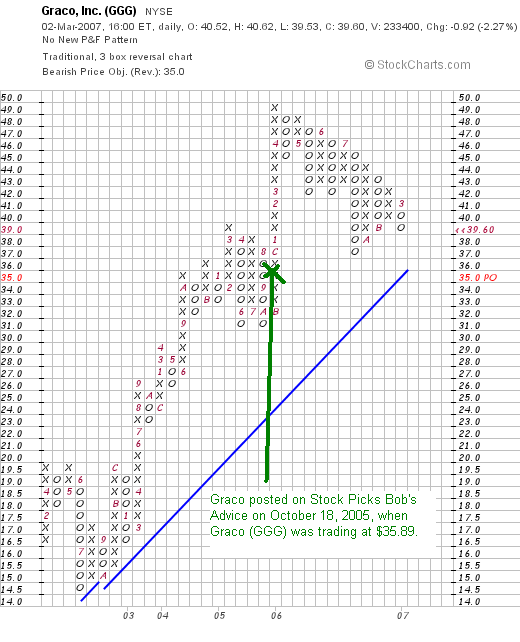

On October 18, 2005, I posted Graco (GGG) on Stock Picks Bob's Advice when the stock was trading at $35.89. Graco closed at $39.60 on March 2, 2007, for a gain of $3.71 or 10.3% since posting.

On October 18, 2005, I posted Graco (GGG) on Stock Picks Bob's Advice when the stock was trading at $35.89. Graco closed at $39.60 on March 2, 2007, for a gain of $3.71 or 10.3% since posting.

On January 29, 2007, Graco reported 4th quarter 2006 results. For the quarter ended December 29, 2006, net sales increased 10% to $203.4 million. Net earnings increased to $35.6 million from $32.3 million last year, and diluted earnings per share grew to $.52/share, up from $.46/share last year.

On January 29, 2007, Graco reported 4th quarter 2006 results. For the quarter ended December 29, 2006, net sales increased 10% to $203.4 million. Net earnings increased to $35.6 million from $32.3 million last year, and diluted earnings per share grew to $.52/share, up from $.46/share last year.

The company met analysts' expectations of $.52/share, but came in a bit light of expectations on revenue of $205.8 million.

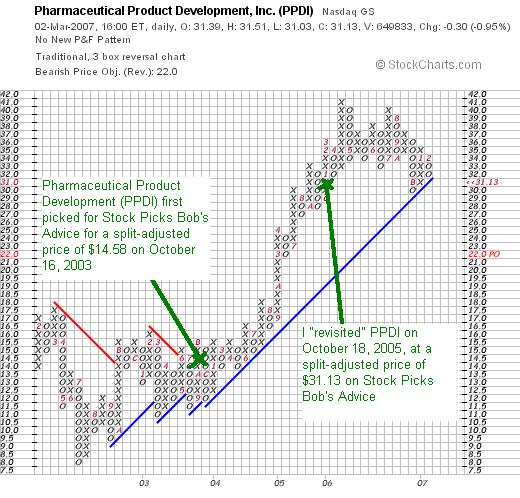

On October 18, 2005, I posted Pharmaceutical Product Development on Stock Picks Bob's Advice when the stock was trading at $62.26 as a "revisit". The first time I had written up PPDI, was on October 16, 2003, when the stock was trading at $29.16. I do not currently hold any shares or options on this stock. PPDI underwent a 2:1 split on March 1, 2006, making the latest pick price effectively $31.13. In a strange coincidence (?), PPDI closed at $31.13 on March 2, 2007, unchanged, from the prior post a bit more than a year ago.

On October 18, 2005, I posted Pharmaceutical Product Development on Stock Picks Bob's Advice when the stock was trading at $62.26 as a "revisit". The first time I had written up PPDI, was on October 16, 2003, when the stock was trading at $29.16. I do not currently hold any shares or options on this stock. PPDI underwent a 2:1 split on March 1, 2006, making the latest pick price effectively $31.13. In a strange coincidence (?), PPDI closed at $31.13 on March 2, 2007, unchanged, from the prior post a bit more than a year ago.

On February 5, 2007, PPDI reported 4th quarter 2006 results. Net revenue came in at $327.0 million for the quarter ended December 31, 2006, a 19.1% increase over net revenue of $274.6 million for the same quarter in 2005. Net income increased sharply to $41.6 million from $30.5 million in the same period last year. On a diluted eps basis, this came in at $.35/share, up from $.26/share last year.

On February 5, 2007, PPDI reported 4th quarter 2006 results. Net revenue came in at $327.0 million for the quarter ended December 31, 2006, a 19.1% increase over net revenue of $274.6 million for the same quarter in 2005. Net income increased sharply to $41.6 million from $30.5 million in the same period last year. On a diluted eps basis, this came in at $.35/share, up from $.26/share last year.

The company beat expectations in the latest quarter which according to Thomson Financial, analysts had been expecting profit of $.33/share on revenue of $299.6 million.

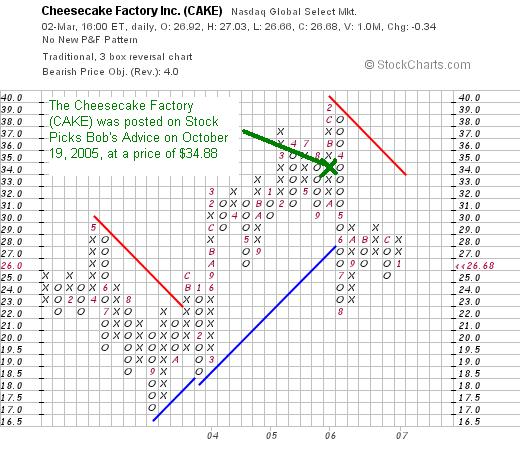

On October 19, 2005, I posted The Cheesecake Factory (CAKE) on Stock Picks Bob's Advice when it was trading at $34.88. CAKE closed at $26.68 on March 2, 2007, showing a decrease of $(8.20) or (23.5)% since posting.

On October 19, 2005, I posted The Cheesecake Factory (CAKE) on Stock Picks Bob's Advice when it was trading at $34.88. CAKE closed at $26.68 on March 2, 2007, showing a decrease of $(8.20) or (23.5)% since posting.

On February 6, 2007, The Cheesecake Factory reported 4th quarter 2006 results. For the quarter ended January 2, 2007, revenue came in at $360.7 million, an 18% increase from the fourth quarter of 2005 when revenue was $328.6 million. Net income, however, dropped to $20.4 million in this year's fourth quarter compared with $22.6 million in last year's 4th quarter. On a per share diluted basis this worked out to $.26/share this year, down from $.28/share last year.

On February 6, 2007, The Cheesecake Factory reported 4th quarter 2006 results. For the quarter ended January 2, 2007, revenue came in at $360.7 million, an 18% increase from the fourth quarter of 2005 when revenue was $328.6 million. Net income, however, dropped to $20.4 million in this year's fourth quarter compared with $22.6 million in last year's 4th quarter. On a per share diluted basis this worked out to $.26/share this year, down from $.28/share last year.

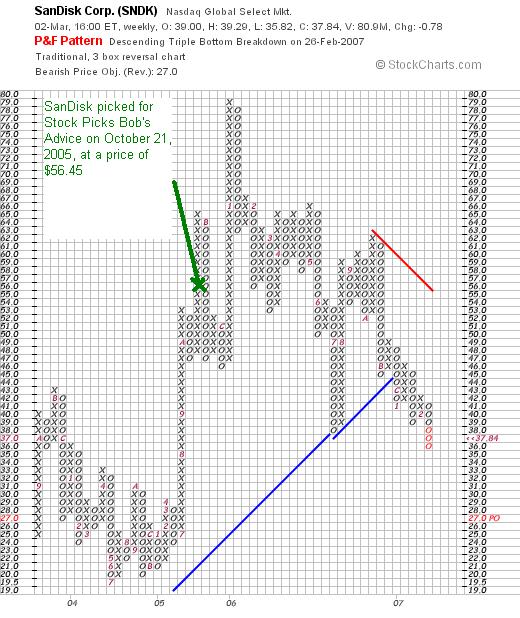

On October 21, 2005, I posted SanDisk on Stock Picks Bob's Advice when it was trading at $56.45/share. SanDisk (SNDK) closed at $37.84/share on March 2, 2007, for a decrease of $(18.61) or (33.0)% since posting.

On October 21, 2005, I posted SanDisk on Stock Picks Bob's Advice when it was trading at $56.45/share. SanDisk (SNDK) closed at $37.84/share on March 2, 2007, for a decrease of $(18.61) or (33.0)% since posting.

On January 30, 2007, SanDisk (SNDK) reported 4th quarter 2006 results. For the quarter ended December 31, 2006, revenue climbed 55% to $1.164 billion, compared with $750.6 million in the year-ago same quarter. Net income however, dropped to a loss of $(35.1) million, compared with an income of $133.9 million last year. On a diluted per share basis this worked out to a loss of $(.17)/share, compared with an income last year of $.68/share.

On January 30, 2007, SanDisk (SNDK) reported 4th quarter 2006 results. For the quarter ended December 31, 2006, revenue climbed 55% to $1.164 billion, compared with $750.6 million in the year-ago same quarter. Net income however, dropped to a loss of $(35.1) million, compared with an income of $133.9 million last year. On a diluted per share basis this worked out to a loss of $(.17)/share, compared with an income last year of $.68/share.

So how did I do with these four picks from that week in October, 2005? Mediocre in a word! In fact, the overall performance for these stocks, assuming an equal dollar purchase of each and a buy and hold strategy, works out to an average loss of (11.55)% on these stocks. It was certainly a difficult week for me picking stocks! Just goes to show that I am quite capable of picking stocks that lose money, and that it is imperative to have a strategy to limit losses to enhance your overall returns.

Thanks so much for stopping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and stop by and visit my Stock Picks Podcast Website where you can get a chance to listen to me discuss many of the same stocks I write about on the blog.

Have a great week trading everyone!

Bob

Posted by bobsadviceforstocks at 10:12 PM CST

|

Post Comment |

Permalink

Updated: Sunday, 4 March 2007 8:09 PM CST

Friday, 2 March 2007

Superior Energy Services (SPN)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

While this bear market correction continues, I still want to use each trading day to identify stocks that are 'high quality' companies which fit into my own trading strategy. While not in the market to be buying anything, and actually close to the sale point on a few stocks on the downside, I plan on continuing to expand my 'vocabulary' of investable companies, so that when the opportunity should arise, I shall be more literate in the investing world and ready to act in a knowledgeable fashion.

While this bear market correction continues, I still want to use each trading day to identify stocks that are 'high quality' companies which fit into my own trading strategy. While not in the market to be buying anything, and actually close to the sale point on a few stocks on the downside, I plan on continuing to expand my 'vocabulary' of investable companies, so that when the opportunity should arise, I shall be more literate in the investing world and ready to act in a knowledgeable fashion.

Looking through the list of top % gainers on the NYSE this afternoon, I came across Superior Energy Services (SPN), which closed at $32.72, up $1.47 or 4.70% on the day. I do not own any shares nor do I have any options on this company. I do believe that it meets many of the factors I use in selecting stocks and wanted to briefly share it with all of you.

What exactly does this company do?

According to the Yahoo "Profile" on Superior, the company

According to the Yahoo "Profile" on Superior, the company

"...provides oilfield services and equipment focusing on serving the drilling and production-related needs of oil and gas companies primarily in the United States. It operates through five segments: Well Intervention Services, Rental Tools, Marine Services, Other Oilfield Services, and Oil and Gas Operations."

How did they do in the latest quarter?

Just this past Monday, on February 26, 2007, the company reported 4th quarter 2006 results. For the quarter ended December 31, 2006, revenue almost doubled at $319 million compared with $188 million in the same period last year (last year was negatively impacted by Katrina). Net income came in at $62.2 million, up again almost 300% from net income of $16.2 million, or $.76/share up again almost 300% from $.20/diluted share in the same period in 2005.

The company beat expectations, according to Thomson Financial, of earnings of $.71/share on revenue of $298 million.

In addition, the company raised guidance on the upcoming first quarter, announcing an expected increase of 90% from the year ago quarter. With last year's first quarter coming in at $.40/share, this would work out to $.76/share expected. Currently analysts are predicting earnings of $.73/share on revenue of $326.4 million in the first quarter of 2007.

How about longer-term results?

Examining the Morningstar.com "5-Yr Restated" financials on SPN, we can see that while revenue dipped from $449.0 million in 2001 to $443.1 million in 2002, it subsequently steadily increased to $735.3 million in 2005 and $962.7 million in the trailing twelve months (TTM). Earnings also dipped from $.77/share in 2001 to $.30/share in 2002. However, since 2002 earnings have steadily increased to $.85/share in 2005 and $1.75 in the TTM. The company has held its outstanding shares fairly stable, increasing by about 15% from 69 million to 80 million between 2001 and the TTM. In the same period, earnings were up over 100% and revenue also doubled.

Free cash flow has been positive but erratic over the past few years with $50 million in 2003, and $8 million in the TTM.

The balance sheet looks strong with $111.9 million in cash and $344.3 million in other current asssets giving the company a total of $456.2 million in total current assets, which when compared to the $253.8 million in current liabilities yields a current ratio of 1.80.

How about some valuation numbers?

Checking Yahoo "Key Statistics" on Superior Energy Services, we find that this is a mid cap stock with a market capitalization of $2.61 billion. The trailing p/e is a very reasonable 14.13, with a forward p/e (fye 31-Dec-08) estimated at a dirt cheap 8.45. The PEG, (5 yr expected) is estimated at 0.23, which again is a screaming buy, with a reasonable PEG being priced between 1.0 and 1.5 from my experience.

Referring to the Fidelity.com eresearch website, we find that the Price/Sales (TTM) is also reasonable when compared to similar companies coming in at 2.28 when the industry average is higher at 3.05.

In terms of profitability, the Return on Equity (TTM) is nearly at the average with SPN coming in at 29.59%, compared to an industry average essentially the same of 29.99%.

Finishing up with Yahoo, we find that there are 29.83 million shares outstanding with 79.23 million that float. As of 1/9/07, there were 2.37 million shares out short representing 3% of the float or 2.1 trading days of volume. No dividend is paid, and no stock splits are reported on Yahoo.

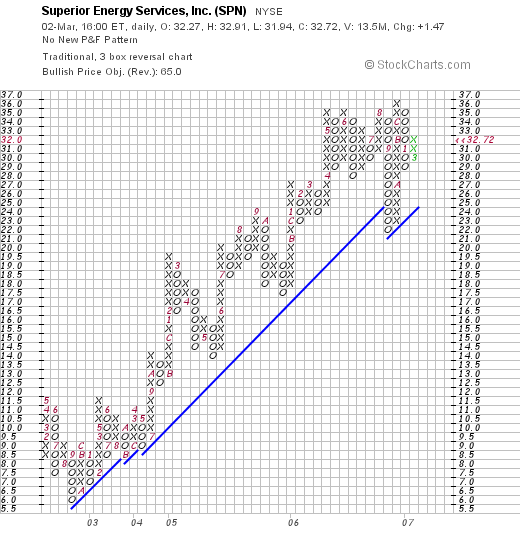

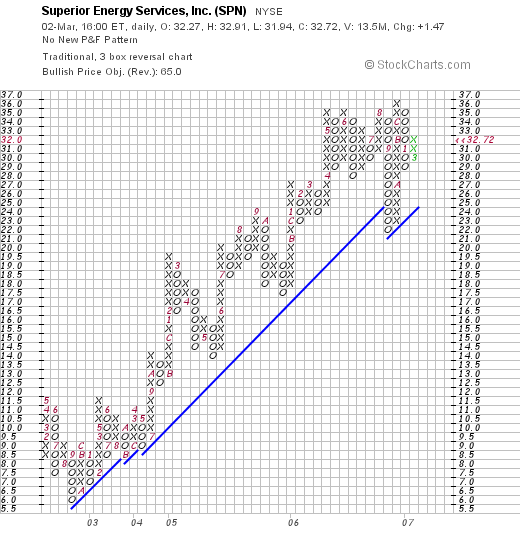

What does the price chart look like?

Looking at a "Point & Figure" chart on Superior (SPN) from StockCharts.com, we see that this stock has actually very steadily been increasing its share price from a low of $6/share in September, 2002, to a high of $36 in September, 2006. the stock is currently near its high at $32.72.

Summary: What do I think?

Well, I am not a big fan of commodity-driven stocks and this company certainly is subject to the effects of the oil market. However, in light of the fabulous earnings, its recent inclusion in the S&P Midcap 400, the steadiness of its earnings and revenue growth, and the cheapness in terms of p/e, PEG, and even Price/sales, this appears to be a relatively lower risk investment than might be expected. If I were buying a stock, I might well buy shares of this one. Of course, instead of buying anything, I am anxiously awaiting the next drop in the market when I shall probably start to unload shares instead. But that is another discussion entirely!

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them right in the blog or email me at bobsadviceforstocks@lycos.com. Also, be sure and visit my Stock Picks Podcast Site where I discuss many of the same stocks I write about on the weblog.

Bob

Thursday, 1 March 2007

It All Comes Back to Iraq.

Those of you who know me better know that I also have a political hat that I sometimes wear. As we face this market correction, I do think that we should ask whether there is something basically wrong with our government management of the American economy in the face of a questionable foreign policy. We can argue whether America needed to be involved in Iraq. Whether thst policy was implemented in an appropriate fashion.

But of greater concern, is my question whether it was responsible for this Administration to pursue a policy of tax cuts during a time of growth in expenditures. This pursuit of lower taxes without any regard to fiscal responsibility and reducing deficits, a policy that had been successfully pursued under the previous President Clinton, has resulted in reliance on the Federal Reserve which is supposed to manipulate money supply and inter-bank loan rates to control inflation.

Our deficit in America is now being held more and more by investors offshore and our economic future is more and more dependent on the success of economies in places such as China and other countries that hold more and more of our dollar-based Treasury notes and obligations.

The dollar has suffered as more have been 'printed', with the dollar dropping against foreign currencies. Yet we have not acted to reduce our dependence on foreign oil, we have not required more fuel efficiency from our vehicles, we have not made the needed investments in alternative fuels, we have not made Kyoto a goal, but have continued to increase our addiction on oil produced in areas of the world that are growing hostile to our own interests. Our trade deficits have grown simultaneous with our fiscal deficit.

So when we hear about how China can affect our own market, let us not examine this in a vacuum. Let us realize that we have been misled by our politicians who depended on our own greed to allow them to fail to make the hard decisions to restore fiscal responsibility and instead promise us never-ending 'tax cuts'. This fuzzy-math economics is coming home to roost.

And when we get out to drive in our Suburbans, Tahoes, and heavy-duty pick-ups, gloating about how we can buy gas cheaper than they do in Europe where high prices has moved drivers to efficient vehicles, let us be aware that our inability to encourage our leaders to make the hard decisions is costing us hard right here at home.

O.K., enough of the politics. But don't you just get sick when you see futures down more than 100 points before the market opens!

Wishing you all well. I shall try to reduce my political ranting here and try to stick to stocks. But let me know if it is ok with all of you to intersperse these stock market discussions with occasional political subjects. Whether you agree with me or not, I encourage you to respond to what I say and you are welcome to join in the discussion.

Bob

Wednesday, 28 February 2007

Deckers Outdoor (DECK)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

This morning I noticed that Deckers Outdoor Cp (DECK) was on the list of top % gainers on the NASDAQ. It has some interesting features that make it suitable for this blog. However, as the day went on, other stocks started outperforming DECK and it didn't make the final list of top gainers. The stock, however, still deserves a review! It closed today at $65.20, up $3.75 or 6.10% on the day. I do own 95 shares of DECK in a managed retirement account that I have assigned management responsibility to my own advisers.

This morning I noticed that Deckers Outdoor Cp (DECK) was on the list of top % gainers on the NASDAQ. It has some interesting features that make it suitable for this blog. However, as the day went on, other stocks started outperforming DECK and it didn't make the final list of top gainers. The stock, however, still deserves a review! It closed today at $65.20, up $3.75 or 6.10% on the day. I do own 95 shares of DECK in a managed retirement account that I have assigned management responsibility to my own advisers.

Let's take a look at this company and I shall share with you why I am so enthusiastic about the stock!

What exactly does this company do?

According to the Yahoo "Profile" on Deckers, the company

"...engages in the design, production, and brand management of footwear for men, women, and children in the United States. Its products include slides, sport sandals, thongs, amphibious footwear, trail running shoes, hiking boots, rugged closed-toe footwear, sheepskin boots and slippers, and other casual footwear. The company provides its products under Teva, Simple, and UGG brand names."

"...engages in the design, production, and brand management of footwear for men, women, and children in the United States. Its products include slides, sport sandals, thongs, amphibious footwear, trail running shoes, hiking boots, rugged closed-toe footwear, sheepskin boots and slippers, and other casual footwear. The company provides its products under Teva, Simple, and UGG brand names."

How did they do in the latest quarter?

What drove the stock higher today, as is often the case on stocks discussed on this blog, was the announcement of 4th quarter 2006 results yesterday after the close of trading yesterday. For the quarter ended December 31, 2006, net sales increased 36.7% to $124.4 million from $91.0 million. Net income came in at $23.5 million, up almost 100% from $12.1 million reported in the same period in 2005. Diluted earnings per share increased 93.6% to $1.82 from $.94/share last year.

The company blew away analyst expectations of a profit of $1.31/share on revenue of $110.7 million. The company announced 1st quarter 2007 guidance with earnings and revenue expected to increase 15% over the same quarter in 2006.

How about longer-term financial results?

Reviewing the Morningstar.com "5-Yr Restated" financials on DECK, we find that the company has shown recent rapid growth in revenue from $91.5 million in 2001 to $264.8 million in 2005 and $271.0 million in the trailing twelve months (TTM). Earnings, initially erratic, dipped from $.17/share in 2001 to a loss of $(.75)/share in 2002. However, since then they have turned profitable and increased quickly to $.77/share in 2003, $2.48/share in 2005 and $2.42/share in the TTM. Normally, I would be avoiding a stock with a recent dip in earnings. However, in light of the spectacular latest quarterly report, this doesn't appear to be a significant drop-off in earnings growth.

The company has been increasing its shares somewhat from 9 million in 2001 to 13 million in the TTM. This less than a 50% dilution in shares comes alongside essentially a 200% increase in revenue and a more than 1000% increase in earnings. This is an acceptable dilution imho.

Free cash flow is positive and increasing recently with $17 million reported in 2003, $11 million in 2004, then growing to $26 million in 2005 and $37 million in the TTM. The balance sheet looks solid with $45.3 million in cash, enough to easily cover the $26.3 million in current liabilities and the $4.3 million in long-term liabilities combined with literally millions left over! Calculating the 'current ratio', we find a combined $155 million in current assets, which when divided by the $26.3 million in current liabilities yields a strong 5.89.

What about some valuation numbers on this stock?

Looking at Yahoo "Key Statistics" on DECK, we can see that this is a small cap stock with a market capitalization of only $819.04 million. The trailing p/e is a reasonable (imho) 26.91, with a forward p/e (fye 31-Dec-07) estimated at 20.96. With the rapid growth anticipated, the PEG (5 yr expected) comes in at an acceptable 1.43.

Using the Fidelity.com eresearch website, we find that DECK has a Price/Sales (TTM) ratio of 2.53 compared to an industry average of 2.61. The company also has a fairly average Return on Equity (ROE) (TTM) of 21.28%, compared to the industry average of 21.59%.

Finishing up with Yahoo, we find that there are 12.56 million shares outstanding with 10.97 million that float. As of 1/9/07, there were 1.71 million shares out short representing 14.8% of the float. This may also be calculated as 7 trading days of volume (the short ratio). Since this is in excess of my own arbitrary '3 day rule' for short interest, this appears to be a significant short interest level and may well be fueling the price rise today on the back of good news. No dividend is paid and no stock split is reported on Yahoo.

What does the chart look like?

Examining a "Point & Figure" chart on Deckers Outdoor (DECK) from StockCharts.com, we can review the price appreciation from $30 in late 2004 to $49 before a sharp correction down to $17 in October, 2005. Since late 2005, the stock has been moving steadily and sharply higher closing today near its high at $65.20.

Summary: What do I think?

Well I do actually own some shares of DECK, although this holding is not part of my trading portfolio which I manage, so take that into consideration. But let's review some of the things of interest. First of all, the stock moved strongly higher today on a fabulous earnings report which blew away the estimates on both revenue and earnings. They have been growing revenue strongly the past several years along with earnings. Free cash flow has been positive and growing and the balance sheet appears to be rock solid.

Valuation-wise, the p/e isn't bad and the PEG is under 1.5. The Price/Sales and ROE figures are fairly average for DECK's industrial group. There are lots of shares out short which may well be fueling the additional stock increase with the terrific earnings report. Finally, the graph looks strong.

There are a good number of reasons why I like this stock and have included it here on the blog! Now of course, I would buy a stock like this if I had the 'permission' to add a position. Unfortunately, I am only close to a sale of one of my holdings (WOOF) which would result in me 'sitting on my hands' and not going shopping so to speak. In any case, this is a stock that is now in my vocabulary, and I hope yours as well!

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, please feel free to visit my Stock Picks Podcast Website, where I discuss many of the same stocks I write about here on this weblog. Wishing you all a successful week trading.

Bob

Tuesday, 27 February 2007

A Reader Writes "I'd just like to get your opinion on this market...."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I did what all investors did today. I watched in rather a state of disbelief as many of my gains were diminished by the relentless selling on Wall Street. Thus, with this perspective, I would like to share with you a letter from a loyal reader, William S. who writes for my views on the market melt-down:

I did what all investors did today. I watched in rather a state of disbelief as many of my gains were diminished by the relentless selling on Wall Street. Thus, with this perspective, I would like to share with you a letter from a loyal reader, William S. who writes for my views on the market melt-down:

"Hi Bob,

I'd just like to get your opinion on this market that is falling today. Even though fortunately none of my holdings are going into losses from my buy points, I am still watching plenty of nice gains vanish in a day that have been working for weeks or months, which is very frustrating. Does a day like this cause you to do any extra selling to lock in more gains than you might not otherwise, or do you just take it and keep a longer term view assuming you believe in your stocks and the companies behind them (which of course can be two different things).

Hope all is well...

Bill"

Thanks so much for writing Bill. I believe, as I responded, that you were writing to me just as I was writing my previous entry. Let me try to more directly respond to your inquiry.

I too watched many nice gains either vanish or diminish as the selling developed. Do I respond with any 'extra selling'. I didn't. Maybe I should have, but that isn't my strategy.

You are absolutely right about the stocks and companies being two different things. In the long run, the best companies shall have the best stocks to own. That is my ultimate belief.

So what do I do when things are melting down? I watch my portfolio, and if any of my stocks hit sale points, I sell. Thus far, nothing needed a sale. I have several now that are in small loss positions, and I wouldn't be surprised if my VCA Antech (WOOF) which is showing a bit more than a (5)% loss hits that (8)% loss limit tomorrow if the selling persists. If so, I shall unload shares.

Is this the best way to deal with a precipitous correction? Probably not. But I don't know that I can do any better. I don't know when a correction is done or just beginning. I don't know what the market will do next week or next month.

When I do have gains, you know that I am quick to take some of the profit off the table. It is my concern about events like today that drives me to keep hedging my bet you could say. And when stocks start losing money, then I am quick to sell them completely. I am trying very hard to avoid losses.

But I believe that the companies that I own are the right companies to be shareholders in. That doesn't mean I shall blindly hold on to them. No, I shall continue to stick to my trading rules. If I need to liquidate half of my stocks tomorrow morning, then that is what I shall do. But I personally use my own trading rules to guide my own actions. It is less stressful (?) to have a plan of action than to fret about when to pull a plug or to (?) start nibbling on dividend stocks as I heard Jim Cramer talk about tonight.

I will not be buying on weakness. The old problem of 'catching a falling knife' holds true. But I do not plan on panic either. Maybe it is wiser to panic (?), but it is better imho to face a chaotic market with reason than with rash decisions. Is this the best approach? Will my own approach even remain profitable in the face of a ferocious correction?

I guess that is what this blog is all about. It is not that I have all the answers. Or even the best approach. I am just trying to find an approach that will work for me. I have tried to anticipate market actions and to plan on my response each time. Thus far it is working. Let's see how it works tomorrow.

Good-luck my friend! Figure out your own 'rules' and apply them. You will not win every time against the market. But each time you face a difficult market environment, you shall be wiser if you are able to assess why what you did worked or why it was unsuccessful. I shall keep you posted.

Bob

Newer | Latest | Older

I was delighted to receive an email from Marcus A. L. who had some questions about my investing strategy. Marcus wrote:

I was delighted to receive an email from Marcus A. L. who had some questions about my investing strategy. Marcus wrote:

On October 18, 2005, I

On October 18, 2005, I  On January 29, 2007, Graco reported 4th quarter 2006 results. For the quarter ended December 29, 2006, net sales increased 10% to $203.4 million. Net earnings increased to $35.6 million from $32.3 million last year, and diluted earnings per share grew to $.52/share, up from $.46/share last year.

On January 29, 2007, Graco reported 4th quarter 2006 results. For the quarter ended December 29, 2006, net sales increased 10% to $203.4 million. Net earnings increased to $35.6 million from $32.3 million last year, and diluted earnings per share grew to $.52/share, up from $.46/share last year.  On October 19, 2005, I

On October 19, 2005, I  On February 6, 2007, The Cheesecake Factory reported

On February 6, 2007, The Cheesecake Factory reported  On October 21, 2005, I

On October 21, 2005, I  While this bear market correction continues, I still want to use each trading day to identify stocks that are 'high quality' companies which fit into my own trading strategy. While not in the market to be buying anything, and actually close to the sale point on a few stocks on the downside, I plan on continuing to expand my 'vocabulary' of investable companies, so that when the opportunity should arise, I shall be more literate in the investing world and ready to act in a knowledgeable fashion.

While this bear market correction continues, I still want to use each trading day to identify stocks that are 'high quality' companies which fit into my own trading strategy. While not in the market to be buying anything, and actually close to the sale point on a few stocks on the downside, I plan on continuing to expand my 'vocabulary' of investable companies, so that when the opportunity should arise, I shall be more literate in the investing world and ready to act in a knowledgeable fashion.  According to the Yahoo "Profile" on Superior, the company

According to the Yahoo "Profile" on Superior, the company

This morning I noticed that Deckers Outdoor Cp (DECK) was on the list of

This morning I noticed that Deckers Outdoor Cp (DECK) was on the list of