Stock Picks Bob's Advice

Thursday, 31 January 2008

Interactive Intelligence (ININ) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Earlier this morning, seeing an 'old favorite' of mine, Interactive Intelligence (ININ) on the list of top % gainers on the NASDAQ, I chose to stick my toes once more into the trading world and purchased 1,200 shares at $15.75. This is once again my 'trade position' and I do not plan to sit with the entire 1,200 shares long-term. If the stock works out for me by moving higher yet, than I shall be selling approximately 900 shares and leaving 300 for the portfolio. Otherwise, I shall be unloading the entire position at the smallest loss I can tolerate.

Earlier this morning, seeing an 'old favorite' of mine, Interactive Intelligence (ININ) on the list of top % gainers on the NASDAQ, I chose to stick my toes once more into the trading world and purchased 1,200 shares at $15.75. This is once again my 'trade position' and I do not plan to sit with the entire 1,200 shares long-term. If the stock works out for me by moving higher yet, than I shall be selling approximately 900 shares and leaving 300 for the portfolio. Otherwise, I shall be unloading the entire position at the smallest loss I can tolerate.

As I write, ININ is trading at $15.85, up $2.26 or 16.63% on the day.

I use the term 'old favorite' to indicate that this is a stock that I have reviewed previously. In fact, I posted ININ on Stock Picks Bob's Advice on June 30, 2006, when the stock was trading at $14.27. The stock has had a rocky course since then and has been under some significant pressure price-wise recently.

Let me share with you some of my thinking regarding this trade. Feel free to comment and share with me your own ideas as I am more of an 'investor' than a short-term trader.

The market sold off yesterday after a spike in the Dow on the back of the .50% Federal Funds rate cut. The market opened up today sharply lower, but appeared to be steadily reversing course and moving to the upside. It was in this environment that I looked to my lists of top % gainers, hoping to find something first of all that I would be familiar with and next that had some fundamental news that might continue to drive the stock higher.

As is often the case, from my experience, it was earnings news that pushed the stock higher today. After the close of trading yesterday, ININ announced 4th quarter 2007 results. Revenues came in at $109.9 million, up 32% from $83 million in the same quarter the prior year. Net income was $10.3 million or $.53/share which included a $(840,000) expense regarding stock options as well as a $8.1 million one-time benefit.

Taking these one-time expenses and gains out of the picture, which is probably a very prudent move for analysis, leave us with a non-GAAP result of net income of $3.1 million or $.16/share, compared to last year's non-GAAP result of $2.1 million or $.11/share. This is still a very strong report.

Checking the Morningstar.com "5-Yr Restated" financials, we can see that this improved earnings/revenue picture was a bit of a turn around from what some year-over-year declines. That is, while revenue has continued to steadily improve, earnings did dip in the last twelve months from $.56/share to $.41/share. Free cash flow has been positive and the balance sheet appears solid.

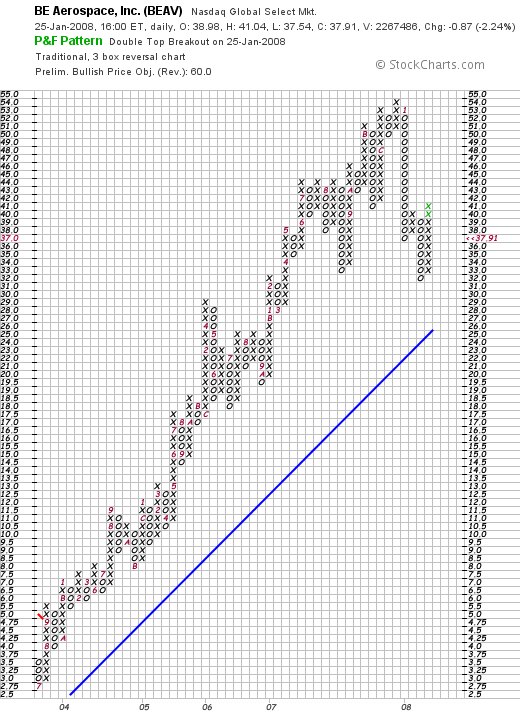

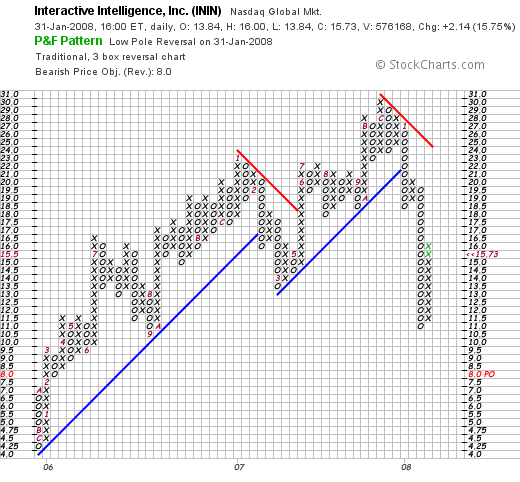

Reviewing the StockCharts.com 'point & figure' chart on ININ, we can see that the stock has been under tremendous pressure. From December, 2005, when the stock was trading at around $4.25 until December, 2007, when the stock peaked at $31, the stock was at that time trading steadily higher. Only since the first of this year, the stock has taken a beating along with the rest of the market, dipping from $27 to a low of $11 just days ago. The stock appears to be 'fighting back' but overall the chart is not encouraging long-term. It would be nice to see this stock trade over $25 and establish new support levels before feeling more confident that this technical picture has reversed. Certainly the latest quarterly report is helpful in this regard.

With the solid earnings report changing the recent dip in earnings in an otherwise beautiful Morningstar.com report,

INTERACTIVE INTELLIGENCE (ININ) IS RATED A BUY

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Wednesday, 30 January 2008

Dover Corporation (DOV) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I think that interview with the Associated Press went right to my head.

Or perhaps it is just very dangerous to trade in these volatile waters. Bullish advances turn on the dime like they did today and turn a profit into a loss in minutes. I should have known better but after this "trade" turned south, I pulled the plug and took a loss. Even though I like this stock.

In a nutshell, I purchased 800 shares of Dover (DOV) at $42.184. With the market heading south and Dover pulling back from its large move to the upside, I started unloading my shares--selling 100 at $41, 100 at $41.01, 200 at $41.07, and 400 at $41.18. That was a loss of a little over $1.00/share, or somewhere north of (2)% on these shares in a matter of minutes.

In a nutshell, I purchased 800 shares of Dover (DOV) at $42.184. With the market heading south and Dover pulling back from its large move to the upside, I started unloading my shares--selling 100 at $41, 100 at $41.01, 200 at $41.07, and 400 at $41.18. That was a loss of a little over $1.00/share, or somewhere north of (2)% on these shares in a matter of minutes.

Yikes.

Let me explain briefly about why I liked Dover, and why I still feel

DOVER (DOV) IS RATED A BUY

even though I personally just lost a handful of change on this stock and I do not currently own any shares.

It still deserves a spot in my blog.

Dover made the list of top % gainers on the NYSE today, closing at $41.04, up $2.66 or 6.93% on the day.

According to the Yahoo "Profile" on Dover, the company

"...together with its subsidiaries, manufactures industrial products and components, and manufacturing equipment in the United States and internationally. It operates in four segments: Electronic Technologies, Engineered Systems, Industrial Products, and Fluid Management."

What drove the stock higher today was an outstanding fourth quarter earnings report. Sales climbed 11% to $1.86 billion, exceeding forecasts of $1.8 billion. Net earnings jumped 56% to $185.4 million or $.94/share ahead of the $118.5 million or $.58/share a year earlier. Earnings from continuing operations came in at $.86/share 4 cents ahead of expectations.

Longe-term, the Morningstar.com "5-Yr Restated" financials look outstanding with steady revenue growth, steady earnings growth, steady dividend growth (!), and a steady number of outstanding shares. Free cash is solid and has grown in the past few years and the balance sheet appears solid.

Valuation-wise, checking the Yahoo "Key Statistics" on DOV, we can see that this is a large cap company with a market cap of $8.16 billion. The trailing p/e is cheap at 14.18 and the PEG works out to an estimated 0.79. Even so, there are 6.26 million shares out short as of 12/26/07, representing 6.8 trading days of volume. The company pays a dividend of $.80/share yielding 2.1%. The last stock split reported on yahoo was a 2:1 split way back in December, 1997.

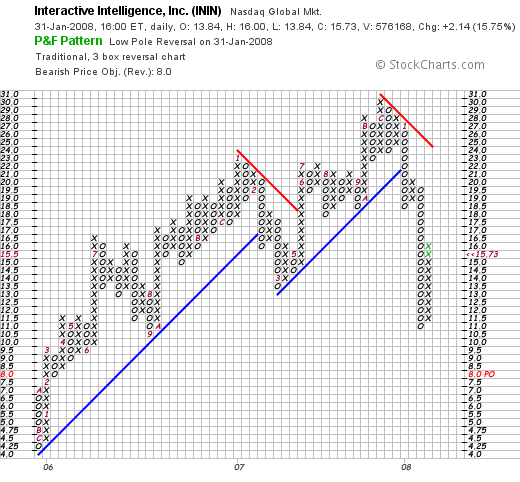

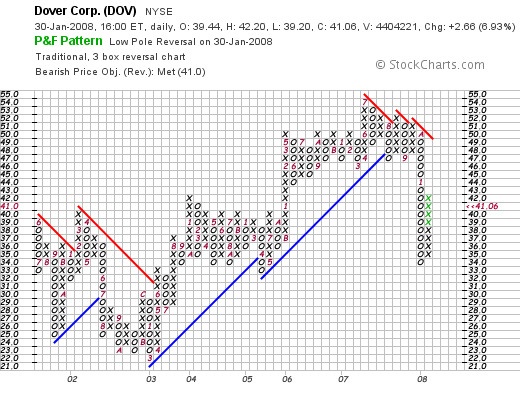

Probably the weakest part of this analysis is the chart. Looking at the 'point & figure' chart on DOV from StockCharts.com, we can see a very nice move higher from $22.00 in March, 2003 to a hnigh of $54 in july, 2007. The stock broke down in October, 2007, and is now struggling to resume its upward momentum.

In any case, I got 'whipsawed' and got caught in the violent volatility of this stock market that moved sharply higher on the Fed rate cut and then turned on a dime and dropped lower. Yikes.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

My Fifteen Minutes of Fame!

Andy Warhol predicted that everyone would 'get their 15 minutes of fame'.

Andy Warhol predicted that everyone would 'get their 15 minutes of fame'.

Thanks to my friends at Covestor, my name was forwarded to Tim Paradis who writes business stories for the Associated Press.

I was interviewed as an "amateur investor" which I believe fairly accurately reflects my activity :).

It was fun to get some publicity, but I hope I haven't used up all of my minutes.

Maybe there are a few left. Meanwhile, back to blogging.

P.S., you can view the article here.

Bob

Tuesday, 29 January 2008

Silicom Ltd (SILC) "Trading Transparency'

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As I have blogged earlier, I purchased a large position of Silicom (SILC) yesterday and as the stock has moved higher, I have been selling off 'pieces' of this investment and now, with 350 shares remaining, I am leaving it as a new position in my Trading Account.

Earlier today, with 900 shares left of my 2000 share purchase that I picked up yesterday at a cost basis of $13.67, I sold 300 shares at $14.25, and then later in the day sold 250 shares at $14.2101, leaving me the 350 share position which constitutes the new position.

If my SILC shares dip to my 'break-even' point or lower I shall be selling the shares. On the other hand, if the shares appreciate to the 30% appreciation level, I shall be implementing my 1/7th of my position sale as I do with my other holdings.

Even though I was selling shares today and yesterday, this was just part of my 'trade'. I am still upbeat on the stock and

SILICOM (SILC) IS RATED A BUY

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where my Trading Portfolio is analyzed, my SocialPicks page where my stock picks are recorded and analyzed, and my Podcast Page where you can download programs discussing some of the various stocks and investing strategies from my blog.

Have a great rest-of-the week, and if you are in the Midwest like I am, drive carefully and stay warm. There is a lot of cold air coming through.

Bob

Monday, 28 January 2008

Silicom (SILC) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Continuing my brief update on my Silicom Stock (SILC) which I purchased this morning. I have now sold 400 shares twice and just sold an additional 300 shares of SILC at $14.47 leaving me 900 shares remaining in my Trading Portfolio.

I would like to leave 300 or 400 shares longer-term if possible as a small position so that would mean either 600 or 500 shares remaining to be sold as needed. I have been very lucky with this stock and maybe should have held on longer, but I am happy to continue to eke out small gains as this unfolds.

Bob

Silicom (SILC) "Trading Transparency"

Just a quick update to the previous post. I just sold an additional 400 shares of SILC at $14.306. Now down to 1200 shares and holding :).

Bob

Silicom Ltd (SILC) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

This market sure has a lot of 'mood swings' don't you think?

Just when I was feeling a bit blue over selling my WOOF stock for the second time since I have been an owner of shares, the market turns around and starts to rally. Almost feeling the strength of the market move higher I thought I would take a look and see if there were any names that caught my attention.

Sure enough, Silicom (SILC) was moving strongly higher on earning news. I had just reviewed Silicom on December 10, 2007, and you might want to refer to that review for information about the Morningstar.com report and valuation.

With all of that in mind, I took a big plunge and purchased 2,000 shares of Silicom (SILC) at a cost of $13.668. With the stock trading higher this afternoon, I have already sold 400 shares of SILC at $14.1301, for a gain of $.4621/share or 3.38% since purchase. (400 x $.4621 = $184.84 gain). Nothing to sneeze at but I will take each small gain as I try to climb back into the black this year and move my performance ahead.

I would like to leave 400 shares in my Trading Account if possible, so I shall be looking to making three additional 400 share purchases----if I do this piecemeal as it appears I may do. Anyhow, that's an update!

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

VCA Antech (WOOF) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website!

I wanted to share with you a trade that I just implemented in my account. I sold my complete position (210 shares) of VCA Antech (WOOF) at $37.74/share. These shares were purchased on 7/27/07 at a cost basis of $41.04/share. Thus I had a loss of $(3.30)/share or (8.04)% since purchase.

As you probably know, I use the (8)% loss as a point of sale of any position in my portfolio after an initial purchase, and not having sold any shares at higher appreciation targets. Furthermore, I use this sale on "bad news" as a simple portfolio management signal. (As if I hadn't been paying attention to what the market is doing!). In other words, I do not plan to reinvest these funds. Fortunately, my margin balance continues to dwindle along with my equity positions.

I shall be waiting for some 'good news' signal to resume expanding the size of my portfolio with new positions. I am now down to 8 positions in my trading account: ABAX, CERN, CPRT, CVD, IHS, MORN, RMD, and VIVO. No position is immune from a sale. So if the market continues to go lower, I shall update you on the progress in my portfolio.

As for WOOF, this is my second unsuccesful attempt to own the stock. With my own sale of shares, I am thus reducing my rating:

VCA ANTECH (WOOF) IS RATED A HOLD

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Have a good week everyone!

Bob

Posted by bobsadviceforstocks at 9:20 AM CST

|

Post Comment |

Permalink

Updated: Monday, 28 January 2008 9:22 AM CST

Sunday, 27 January 2008

I post a New Podcast---Listen to my Show on Hologic (HOLX), a stock I recently discussed on this blog!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

CLICK HERE FOR MY PODCAST ON HOLOGIC (HOLX)

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 8:56 PM CST

|

Post Comment |

Permalink

Updated: Sunday, 27 January 2008 9:56 PM CST

Saturday, 26 January 2008

"Looking Back One Year" A review of stock picks from the week of July 24, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As one of my weekend tasks, I try to get a review up examining past stock selections from this website. Going one week at a time, last week I reviewed the picks from July 17, 2006. This week, let's take a look at the stock picks from the week of July 24, 2006.

These reviews assume a 'buy and hold' approach to investing. In practice, I advocate and employ a disciplined portfolio management strategy that utilizes limiting losses to small percentages, preserving larger gains with sales and selling portions of stocks as they appreciate to targeted appreciation levels. This difference would certainly affect investment performance and this should also be taken into consideration.

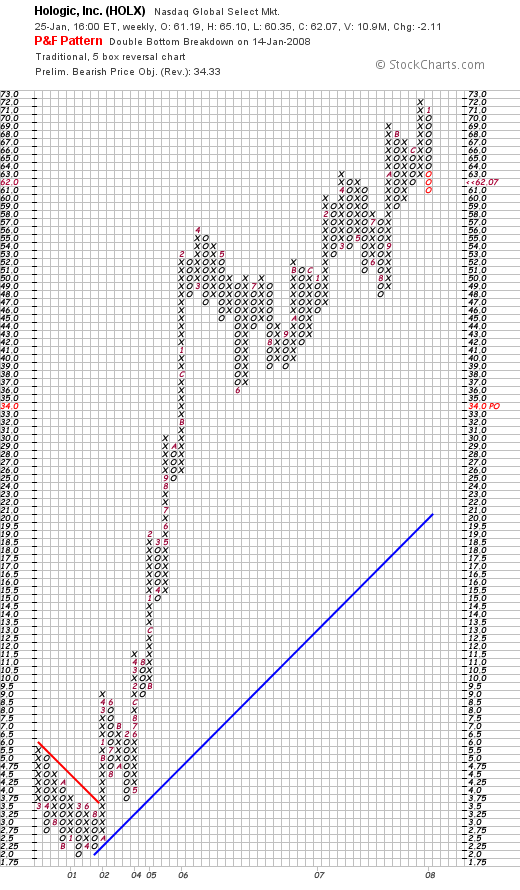

On July 25, 2006, I posted Hologic (HOLX) on my blog when it was trading at $48.34. This was my second post on this stock which was posted April 27, 2005, at a split-adjusted price of $17.93. Hologic closed at $62.07 on January 25, 2008, representing a gain of $13.73 or 28.4% since posting.

On July 25, 2006, I posted Hologic (HOLX) on my blog when it was trading at $48.34. This was my second post on this stock which was posted April 27, 2005, at a split-adjusted price of $17.93. Hologic closed at $62.07 on January 25, 2008, representing a gain of $13.73 or 28.4% since posting.

Let's take a closer look at this stock and update our analysis.

On November 6, 2007, HOLX announced 4th quarter 2007 results. Revenues for the quarter ended September 29, 2007, came in at $202.6 million, up 31% over last year's revenues of $154 million. Net income worked out to $32 million or $.58/diluted share, compared with a net loss of $(1.5) million or $(.03)/diluted share.

The company beat expectations of analysts polled by Thomson Financial who had expected earnings of $.47/share on revenue of $198.1 million. However, the company did reduce guidance on fiscal 2008 results on earnings. The company adjusted guidance to first quarter earnings of $2.15 to $2.20/share on revenue of $1.7 billion. Previous guidance had been for profit of $2.35 to $2.40 per share on the same $1.7 billion. Even the reduced guidance for 2008 still allows for a strong growth in earnings and revenue, but it is always helpful to have a company guide higher rather than lower in an announcement.

Longer-term, Hologics still has a very strong Morningstar.com "5-Yr Restated" financials page. Revenue growth remains uninterrupted and phenomenal increasing from $204 million in 2003 to $738 million in 2007. Earnings have increased from $.07/share in 2003 to $1.72/share in 2007 with a slight dip last year from $.63/share in 2005 to $.56/share in 2006 only to bounce back strongly in 2007. Shares outstanding have increased from 40 million in 2003 to 55 million in 2007. This 37.5% increase in shares was accompanied by an increase in greater than 200% in revenue and an increase of more than 1,500% in earnings.

Free cash flow has been positive, and while dipping from $37 million in 2005 to $4 million in 2006, rebounded strongly to $130 million in 2007.

The balance sheet on Morningstar.com is strong with $399.0 milllion in total current assets compared to $178.6 million in current liabilities and only $82 million in long-term liabilities.

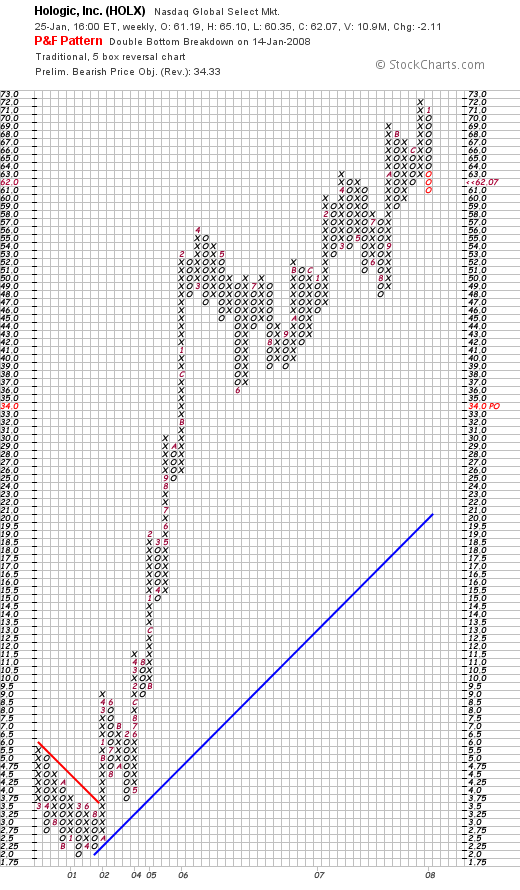

Finally, let's take a look at the "Point & Figure" chart from StockCharts.com on Hologic:

This is a PHENOMENAL graph.

With the strong quarterly report, the beautiful longer-term fundamentals and the solid price chart,

HOLOGIC (HOLX) IS RATED A BUY

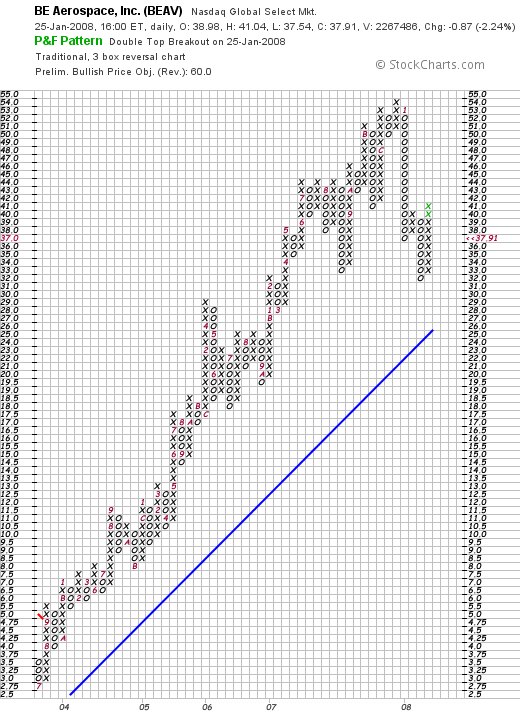

Let's take a look at the second stock I 'picked' that week, BE Aerospace (BEAV) which was selected on this blog on July 26, 2006. BEAV was posted on this blog when it was trading at $23.05. BEAV closed at $37.91 on January 25, 2008, for a gain of $14.86 or 64.5% since posting.

Let's take a look at the second stock I 'picked' that week, BE Aerospace (BEAV) which was selected on this blog on July 26, 2006. BEAV was posted on this blog when it was trading at $23.05. BEAV closed at $37.91 on January 25, 2008, for a gain of $14.86 or 64.5% since posting.

Let's review some of the fundamentals behind this stock as well.

On October 30, 2007, BE Aerospace (BEAV) reported 3rd quarter 2007 results. For the quarter ended September 30, 2007, revenues came in at $428.2 million, up 48.7% from the prior year's result of $287.9 million. Net earnings were $44.5 million, up strongly over last year's $31.4 million. GAAP earnings increased 20% to $.48/share from $.40/share last year.

The company in the same announcement raised guidance by $.12/share for the full year to approximately $1.69/share. BEAV beat expectations for the quarter which according to analysts polled by Thomson Financial had been for $.41/share on sales of $400 million.

And longer-term?

Examining the Morningstar.com "5-Yr Restated" financials, we find a solid, if somewhat imperfect report. Revenue has shown fabulous growth from $681 million in 2002 to $1.54 billion in the TTM. Earnings, which showed losses from 2002 to 2004 when they improved from $(3.18)/share to $(.53)/share between 2002 and 2004, and then turned profitable at $1.39/share in 2005. Earnings dipped to $1.10/share in 2006, and bounced back to $1.48/share in the TTM.

The company has increased the float from 33 million in 2002 to 81 milliion in the TTM. This 48 million or 145% increase in the float was matched by an $855 million or 126% increase in revenue. On a per share basis, earnings increased $4.66 or 146% increase in earnings. Thus, growth has been proportionate to the outstanding shares issued. I would rather see little share growth and in any case a disproportionate increase in revenue and earnings compared to the growth in outstanding shares.

Free cash flow has been erratic with $(14) million in 2004, $(4) million in 2005, $17 million in 2006, and then back to a negative $(29) million in the TTM.

The balance sheet is solid with a total of $943 million in current assets compared to current liabilities of only $296.1 million in current liabilities yielding a current ratio of greater than 3, and enough to easily cover the $191.9 million in long-term liabilities.

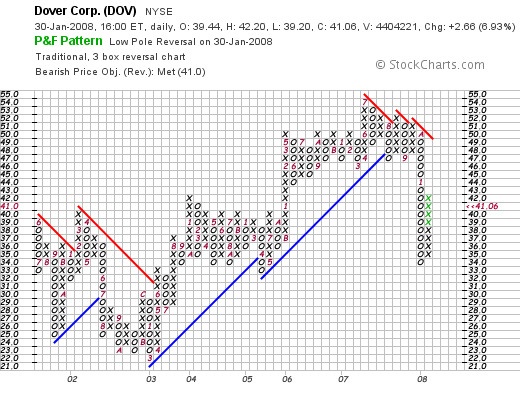

Looking at the "point & figure" chart from StockCharts.com on BE Aerospace, we can see an impressive display of price performance for this company.

But to summarize, this has been a phenomenal stock pick for this blog. The last quarter was strong, but the Morningstar.com report gives me some pause. Earnings have been a bit erratic, with a dip in 2006 from 2005, but a nice rebound in 2007. The company has been aggressive in issuing shares with only a commensurate effect on revenue and earnings growth. Free cash flow has been inconsistent and the latest results were negaive. However, the balance sheet is solid.

As much as I would like to rate this a 'buy', the best I can do:

BE AEROSPACE (BEAV) IS RATED A HOLD

So how did I do with these two stock picks from that week in July, 2006? In a word FABULOUS! The two stocks both made strong gains after being selected for the blog and in fact had an average gain of 46.45%

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

If you get a chance, be sure and visit my Covestor Page where my actual trading portfolio is reviewed and analyzed. Visit my SocialPicks Page where my stock picks are reviewed and analyzed. And if you still have some time, stop by and listen to my podcasts on my Podcast Page!

Wishing you all a peaceful weekend and a great week ahead!

Bob

Posted by bobsadviceforstocks at 8:33 PM CST

|

Post Comment |

Permalink

Updated: Sunday, 27 January 2008 8:33 PM CST

Newer | Latest | Older

Earlier this morning, seeing an 'old favorite' of mine, Interactive Intelligence (ININ) on the list of top % gainers on the NASDAQ, I chose to stick my toes once more into the trading world and purchased 1,200 shares at $15.75. This is once again my 'trade position' and I do not plan to sit with the entire 1,200 shares long-term. If the stock works out for me by moving higher yet, than I shall be selling approximately 900 shares and leaving 300 for the portfolio. Otherwise, I shall be unloading the entire position at the smallest loss I can tolerate.

Earlier this morning, seeing an 'old favorite' of mine, Interactive Intelligence (ININ) on the list of top % gainers on the NASDAQ, I chose to stick my toes once more into the trading world and purchased 1,200 shares at $15.75. This is once again my 'trade position' and I do not plan to sit with the entire 1,200 shares long-term. If the stock works out for me by moving higher yet, than I shall be selling approximately 900 shares and leaving 300 for the portfolio. Otherwise, I shall be unloading the entire position at the smallest loss I can tolerate.

On July 25, 2006, I

On July 25, 2006, I

Let's take a look at the second stock I 'picked' that week,

Let's take a look at the second stock I 'picked' that week,