Stock Picks Bob's Advice

Friday, 27 July 2007

On "Averaging Down"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I thought you might enjoy this illustration from the 3 Quarks Daily Blog which illustrates the concept of averaging down. What better topic to discuss after this week of dismal trading activity?

I thought you might enjoy this illustration from the 3 Quarks Daily Blog which illustrates the concept of averaging down. What better topic to discuss after this week of dismal trading activity?

But seriously, the letter from Raj that I discussed earlier today presented the question about averaging down without me commenting on that issue. That is something that really needs to be addressed imho and I would like to share with you some of my thoughts on this subject.

First of all, let's explain what "averaging down" means. In a simple fashion, this means reducing the mathematical average of your cost of an equity by purchasing more shares after it declines in price, much like Raj did with Synalloy. This isn't necessarily a bad idea. It would seem that if a stock was a good buy at $30/share, then shouldn't it be a 'better buy' at $25? And if the reasons to make a purchase were good at $30, wouldn't those reasons make that decision to buy even more compelling at a lower price?

Perhaps.

I would like to suggest there are two different perspectives one could have on this subject depending on whether one is essentially a 'value investor' or whether one is more of a 'momentum investor' or 'market timer'.

Jim Cramer has on occasion been an advocate of 'averaging down'.

A couple of examples: On November 29, 2006, Cramer commented on UnitedHealth (UNH):

"I think the nightmare is about to change. Because we're at the beginning of a healthcare rally that UNH will participate in. Pull the trigger. Average down. Buy more. I don't think you'll regret it."

This year, on June 15, 2007, Cramer commented on Switch & Data Facilities (SDXC):

"No, it has not been good. It does what is known as co-location. It's a terrific, terrific play on internet growth... I know averaging down is not something people like. I made a lot of money doing it when I'm investing, and I bless more buying."

So Cramer sometimes believes so strongly in stocks that he suggests it is wise to buy shares, at least occasionally, in a stock that has declined after your purchase.

But Cramer is not alone on this.

Rick Munarriz wrote a piece on Motley Fool in a Bull/Bear discussion of this topic and advocated averaging down. Rick commented in part:

"Yet when you refuse to take advantage of a buying opportunity when a quality company tumbles because you are tied to a "Cut Your Losses" mantra or cocky to the point that you refuse to accept that you didn't "Buy Low" in the first place, do you know what you're doing? You are passing up on a more attractive purchase scenario than the one your initial due diligence led you to make."

Jonathan D. Poland made the argument for averaging down based on a Benjamin Graham valuation argument:

"I always seek value and believe in what Ben Graham taught: there are no good or bad stocks, just cheap or expensive. That's where the margin of safety and using the markets fluctuations to your advantage."

But there are many voices out there that speak against averaging down (including mine).

A nice column on dummyspots.com writes about "Rule 7: When To Average Down":

"Never. Never ever. Never ever ever. Never Never ever Never Never ever ever.

This one should actually not even come up. When you enter a position, you know your time frame and you have an initial stop. If you stay with your time frame and respect your stop, you’ll be taken out when the position turns against you, and you won’t have the opportunity to add to a losing position.

If you are tempted, remember: the fact that you are “under water” in your position proves that you were already wrong in your evaluation of this stock. What makes you think you’re a better judge of it now that you’re bleeding?

Adding to a losing position is the ego’s attempt to be right at any cost, or even worse, greed trying to add to the profits you’ll make when the rest of the world figures out it was wrong and you were right. If that’s what you’re experiencing, you should be exploring the deeper reasons why you’re trading in the first place."

Another well-known investor, Harry Domash had this to say about averaging down:

"4. Never average down.

Averaging down means buying more shares after a stock you bought went down instead of up. Say you buy 100 shares of a stock for $20 per share. Then it drops to $10. To get back to break-even, the stock would have to double. By averaging down, which in this case means buying 100 more shares at $10, you can break even if the stock pops back up to $15, instead of $20.

Bad idea! The stock dropped because something went wrong. Chances are, the stock will drop even further."

David Forrest, on Motley Fool, had this to say in the bear/bull case on averaging down:

"Never average down! You heard me. Don't ever average down. The process of buying a stock, watching it fall, and then throwing more money at it in the hopes that you'll either get back to even or make a bigger killing is one of the most misguided pieces of advice Wall Street has ever dispensed. I'm talking about when someone buys a stock, watches it fall 10 points (or however much it takes to make you violently ill), and then contemplates the absurd: "Shall I risk even more than I originally intended in a desperate attempt to lower my cost and save my butt?" The answer, over and over again, is a big, fat "NO.""

So what is the proper approach? I believe very strongly that one should listen to what the market is telling you. It is foolish to believe that you are wiser than the market in each and every decision that you make. When you make an investment decision to purchase a stock and the stock price increases (assuming you are long the investment), then that was a wise and correct decision.

If, on the other hand, the stock price declines after your purchase, you may well have done your homework, but you should never consider yourself wiser than the market. Respect the market. In other words, if you have set up an 8% loss limit, and I do, and the stock has reached that limit on a decline, your are wiser to sell that stock and limit your losses to a small loss than to buy more shares believing that this was time to 'increase your wager' on your decision because somehow you are wiser than the rest of the market.

That is a formula for disaster imho.

There are multiple sides to managing a portfolio. One has to decide what criteria are required to pick a stock to place into your holdings. After that you need to decide when you need to sell both on the upside and on the downside.

When your stocks decline, your portfolio is talking to you. It is telling you to exercise caution. Be ready to pull the plug on those investments. Be prepared to 'sit on your hands' with the proceeds.

There will be many times when averaging down works well. If you have a great stock that declines and you buy more shares then the market turns around and the stock climbs again you shall look brilliant. But there shall be stocks that decline and then spend years with large decreases in price to possibly never assume their heights of price valuation. The more you buy as those stocks decline, the greater your loss. You will not look or feel brilliant.

When managing your portfolio, sell your losing stocks quickly and completely at preset limits. Respect the market. Listen to what it is telling you.

So averaging down, while ok for some, will not work with my strategy. Otherwise you will be like Raj feeling like you were broadsided with a loss and wondering 'what to do next?'.

Thanks so much for visiting my blog. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. I do not mean to be so gloomy. But then again, it was a pretty awful day in the market, wasn't it?

Bob

A Reader Writes "What do you suggest....?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of my favorite things about writing this blog is corresponding with fellow investors who have questions about investments and 'what to do...'. I have to emphasize that my advice should always be taken with a grain of salt. That is, remember that I am an amateur at all of this. I am not qualified to advise anyone regarding their own particular investments and am not trying to do so. I can only respond in telling people what I do in those situations. That doesn't mean that my response is correct for them; this is just to help all of us think about investing. My suggestion to consult with professional investment advisers holds.

One of my favorite things about writing this blog is corresponding with fellow investors who have questions about investments and 'what to do...'. I have to emphasize that my advice should always be taken with a grain of salt. That is, remember that I am an amateur at all of this. I am not qualified to advise anyone regarding their own particular investments and am not trying to do so. I can only respond in telling people what I do in those situations. That doesn't mean that my response is correct for them; this is just to help all of us think about investing. My suggestion to consult with professional investment advisers holds.

That being said, I did receive a nice letter from Raj who had a good question for me. Raj wrote:

"Hi Bob,

Thanks for the great work you been doing in helping

new players in market. I am one such new player who is

losing a lot of money day by day on SYNL. I bought the

stock at 37$(100 shares) at the end of june and since

then its been following a down trend and i being a new

player was ignorant and added 75 more shares at

34$/share. Today it hit a low of 21.5/share and i am

at loss of 2500 $ totally. What do you suggest, should

i dispose it off or do you think it still would yield

something fruitful. Any help in this regard would be

greatly appreciated

Regards

Raj"

Raj, thanks so much for writing! The market has been very rough on investors, and I am sure there are many people who are facing this same problem every day. What to do with a stock that declines in a never-ending pattern. As I wrote above, I cannot tell you what is write with your particular situation. I don't know all of the facts and besides, I am an amateur myself. But let me tell you about what I do in similar situations.

After many years facing similar trading near-disasters like this, I have adopted, in a very disciplined fashion, my first rule of investing which is to limit your losses. Let me again repeat the first rule of investing, just in case my point has not been made. When I buy a stock, I set my maximum tolerated loss ahead of time (I do this with a 'mental' stop, but you could actually enter a real stop if your brokerage allows this.) For me, after a first purchase of an equity, I sell the stock, regardless of my own affection or interest in the equity, if the stock sells down or passes an 8% loss.

In your particular case, with a cost of $37, I would sell if the stock dropped to 92% of that level or .92 x $.37 = $34.04. I would not be owning the stock anymore at the $21.50 level. So when you ask me what to do at this level, I really don't have much recent experience with stocks losing so much recently. Because I would have and do sell those stocks that decline. By the way, as I write, SYNL is trading at $22.18, up $.41 or 1.88% in an otherwise weak market.

If I were owning a stock that declined, I would need to decide whether I wished to continue holding that stock if the facts were favorable, and if I hadn't done so, I would then set a stop of 8% under the current level and sell the stock at that price if it declined further. All of these losses must stop!

You probably really like this stock. Maybe I could say you love the stock because of what you have read and what you believe the company's prospects are. I haven't looked yet but shall in a moment review some of those facts. It doesn't matter. I strongly believe that managing your holdings is equally important to the process of a successful investment strategy as is picking the stocks to put into your portfolio. That is why, over and over again, I explain how I sell my losing stocks quickly and completely and my appreciating stocks slowly and partially. I do not know if this strategy works or is right for anyone else anyhow. But it seems to be working for me.

In addition, after selling a stock at a loss, it is important to avoid compounding that loss by immediately looking for a new stock to buy. And you guessed it, I did that many times, limited my losses then went and bought a new holding only to lose some more money.

Recently, I have been looking for the signals to help me make those investment decisions. I use sales of my own shares at appreciation points as a source of a 'good news' indicator that allows me to put a new position into my portfolio. Sales on the downside or on otherwise bad news, means that I should be 'sitting on my hands' as I like to explain.

Briefly about Synalloy (SYNL), checking the Morningstar.com "5-Yr Restated" financials, thinks look okay in the earnings department and revenue growth, except that the company in 2006 and the TTM has been cash flow negative. Otherwise, on July 19, 2007, the company reported a strong second quarter 2007 result. Sales climbed to $43.9 million from $36.7 million in the year ago same period. Diluted earnings more than doubled to $.50/share from $.24/share. However, in light of the cash flow being negative, the best I could do with this stock is

SYNALLOY (SYNL) IS RATED A HOLD

I am not sure if I answered your question. I hope so. And what is right for me may not be right for you. It is just that I have found something that works for me. You need to establish your own trading rules and stick to them. That, at least, is my take on all of this.

Good luck! Keep me posted and thanks for writing!

Bob

Posted by bobsadviceforstocks at 11:11 AM CDT

|

Post Comment |

Permalink

Updated: Friday, 27 July 2007 11:12 AM CDT

VCA Antech (WOOF) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always please remember that I am an amateur investor, so please check with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago I spent that nickel that was burning that hole in my pocket :). Checking the top % gainers lists, I saw that an old favorite of mine, VCA Antech (WOOF), a stock that I had owned earlier this year and actually had sold at a loss, was behaving well. It was, you could say, barking for attention :). (Excuse the pun so early in the morning). But the stock, as I write, is trading at $40.99, up $4.38 or 11.96% on the day. I went ahead and purchased 210 shares at $40.986. (I purchase in these odd numbers so that they are divisible by 7. It isn't superstitious, but it is easier to do the division :)).

WOOF had announced 2nd quarter 2007 results after the close of trading yesterday. Revenue climbed 17.7% to $300.3 million, net income climbed 21.3% to $35.8 million, and diluted eps was up 20.0% to $.42/share. The Morningstar.com "5-Yr Restated" financials appear intact although earnings have been a bit volatile. For all of these reasons,

VCA ANTECH (WOOF) IS RATED A BUY

and buy is exactly what I did! Wish me luck!

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Kyphon (KYPH) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago I sold my remaining 108 shares of Kyphon at $67.9863. These shares were originally purchased 5/20/05 at a cost basis of $29.21. Thus, I had a gain of $38.77/share or 132.7% since purchase.

I sold all of my remaining shares, instead of my usual 1/7th of my holding as the stock moved sharply higher today (currently it is trading at $67.86, up $14.1818 or 26.42% on the day as I write) due to the announcement of an impending acquisition of the company by Medtronic (MDT) at $71/share. I could probably have hung on to get the last few points, but the risk factor is that the acquisition doesn't go through. My goal in investing is to be involved in stocks with capital appreciation due to their internal growth and price momentum not by making money by arbitrage.

On top of this, the company announced 2nd quarter 2007 results today which were strong with sales up 43% and net up 16%.

In any case, I am back to 19 positions and with this sale of a position on 'good news' I am 'entitled' to add a position #20. So I shall keep you posted as I am on the 'look-out' again, and that nickel is burning a hole in my pocket :).

Thanks again for visiting. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Wednesday, 25 July 2007

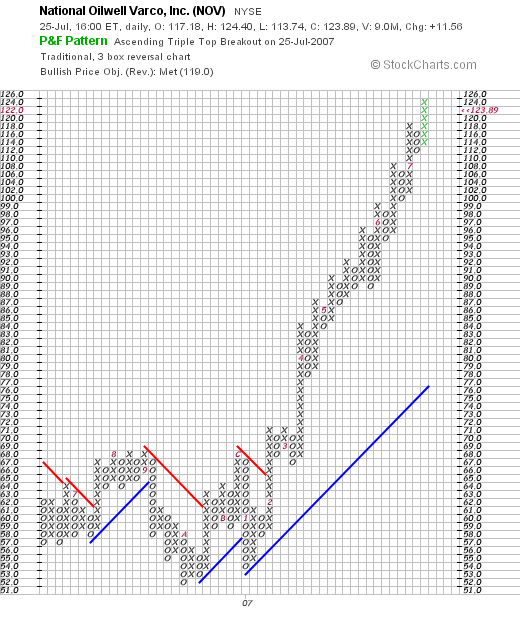

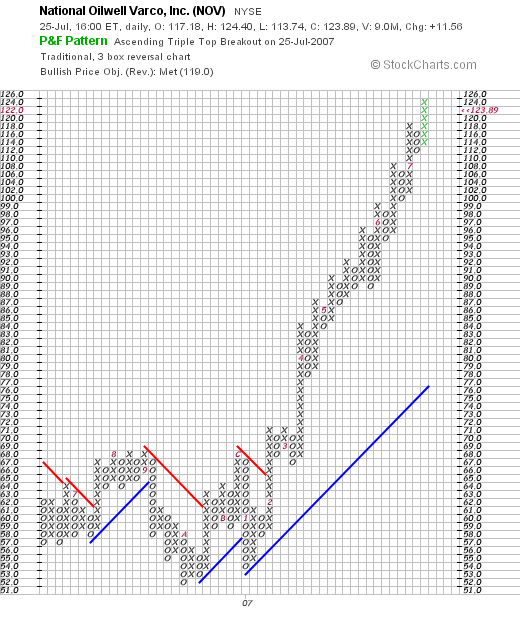

National Oilwell Varco (NOV)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Earlier today I posted about how I purchased 105 shares of National Oilwell Varco (NOV) at $117.92. This purchase was enabled by my partial sale of Kyphon (KYPH) yesterday which, since I was below my maximum of 20 positions, 'entitled' me to add a new position to bring my portfolio up to the maximum of 20 positions that I recently established (from my prior portfolio size of 25 positions). NOV closed at $123.89, up $11.56 or 10.29% on the day.

Earlier today I posted about how I purchased 105 shares of National Oilwell Varco (NOV) at $117.92. This purchase was enabled by my partial sale of Kyphon (KYPH) yesterday which, since I was below my maximum of 20 positions, 'entitled' me to add a new position to bring my portfolio up to the maximum of 20 positions that I recently established (from my prior portfolio size of 25 positions). NOV closed at $123.89, up $11.56 or 10.29% on the day.

Let's take a closer lok at this company and I will share with you why, as I wrote previously,

NATIONAL OILWELL VARCO (NOV) IS RATED A BUY

What exactly does this company do?

According to the Yahoo "Profile" on NOV, the company

"...engages in the design, construction, manufacture, and sale of systems, components, and products to the oil and gas industry worldwide. It operates in three segments: Rig Technology, Petroleum Services & Supplies, and Distribution Services."

"...engages in the design, construction, manufacture, and sale of systems, components, and products to the oil and gas industry worldwide. It operates in three segments: Rig Technology, Petroleum Services & Supplies, and Distribution Services."

How did they do in the latest quarter?

As we have seen in many of the stocks written up on this blog, it was the announcement of 2nd quarter 2007 results this morning hat pushed the stock higher early today. Revenue for the quarter increased 44% to $2.38 billion from $1.66 billion during the same period last year. Net income increased to $318.5 million or $1.79/share, up from $147.9 million or $.84/share last year. This was more than a 100% increase in earnings year over year!

In addition, the backlog increased to $7.2 billion compared with the $6.4 billion in backlog the previous quarter.

As reported, this result was $.25/share higher than the $1.54/share expected by analysts. The revenue came in at $2.38 billion while analysts had been expecting $2.2 billion.

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on National Oilwell, we can see that revenue has steadily increased from $1.5 billion in 2002 to $7.0 billion in 2006 and $7.7 billion in the trailing twelve months (TTM).

Earnings have also increased, although they dipped from $1.30 in 2004 to $.60/share in 2005, from $.80/share in 2002 to $1/40/share in 2006 and $4.70/share in the TTM.

The company has increased its float from 86 million in 2004 to 175 million in the TTM. During the same period, revenue more than tripled while the shares increased by 100%.

Free cash flow has also been a little erratic, dropping from $127 million in 2004 to a negative $(28) million in 2005 than rebounding strongly to $1.01 billion in 2006 and $1.18 billion in the TTM.

The balance sheet appears solid with $1.2 billion in cash and $4.3 billion in other current assets. Compared to the current liabilities of $3.0 billion, the current ratio works out to a 'healthy' 1.84.

What about some valuation numbers?

Reviewing the Yahoo "Key Statistics" on National Oilwell Varco, we find that this is a large cap stock with a market capitalization of $22.00 billion. The trailing p/e is a moderate 26.13 and the forward p/e (fye 31-Dec-08) is estimated at a more reasonable 16.67. The PEG ratio (5 yr expected) is estimated at 0.63, well below my acceptable level of 1.0 to 1.5 in terms of valuation relative to growth.

According to the Fidelity.com eresearch website, valuation is also reasonabl in terms of Price/Sales. NOV comes in with a Price/Sales (TTM) of 2.57 compared to an industry average of 3.88 per Fidelity. However, the Retun on Equity (ROE) (TTM) is below the industry average at 17.01% compared ot the industry average of 30.61%.

Finishing up with Yahoo we can see that there are 177.61 million shares outstanding with 177.26 million that float. As of 6/12/07, there were 7.59 million shares out short representing 2.7 trading days of volume (the short ratio) or 4.3% of the float.

No dividend is paid per Yahoo. The last stock split reported on Yahoo was a 2:1 back on November 19, 1997.

What does the chart look like?

If we review the "point & figure" chart on National Oilwell Varco from StockCharts.com, we can see that the stock which was consolidating through the latter part of 2006 in the $52 to $67 level, broke through resistance in February, 2007, and the $65 level. The stock has moved relatively quickly to its current level of $123.89. The chart looks quite strong to me!

Summary: What do I think?

I have generally avoided investing in companies that are so dependent on the price of commodities like oil. Well, excep for Bolt (BTJ) which has indeed been a terrific investment, although quite volatile, for me.

Here is a chart of light crude oil.

You can certainly see the upward price pressure of oil supporting the strong move in all of these oil service companies like NOV.

In any case, National Oilwell Varco made a strong move today. Fortunately, I caught the move relatively early and achieved a buffer of almost five points the very first day. I would not be surprised to see some profit-taking tomorrow.

They announced earnings that were incredibly strong. Especially for a stock with a p/e in the mid 20's with earnings reported up over 100%. They beat expectations and have bene growing strongly for the last four or five years. Finally, valuation, while not perfect, isn't bad.

And the chart is quite strong as well.

I like the stock a lot. In fact enough to buy some shares! Wish me luck!

Thanks again for dropping by and visiting! If you have any comments or questions, please feel free to leave them on the blog. If you get a chance, be sure and visit my Stock Picks Podcast Website! Also, stop by and visit my Social Picks Page where Social Picks evaluates my many stock selections since early 2007 and evaluates my picking performance relative to many other bloggers and stock pickers! Finally, if you would like to see how my actual Trading Portfolio has been performing, you can visit my Covestor Page where Covestor, for the past two months, has been monitoring my actual trading account and holdings and evaluating my performance relative to other investors on the website.

Have a great Thursday everyone! Please remember that I do own shares in this stock, so take that into consideration. Also remember that past performance is not guarantee of future performance and that I am truly an amateur so please check with your own advisers prior to making any investment decision!

Bob

National Oilwell Varco (NOV) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago I purchased Position #20, after getting a 'permission slip' yesterday after my partial sale of Kyphon at a gain. (See my previous entry for more details on that transaction).

Looking through the list of top % gainers today, I came across National Oilwell Varco (NOV) which as I write, is trading at $116.47, up $4.14 or 3.69% on the day. I have not discussed this stock previously, and I owe all of you a good review.

I purchased 105 shares at $117.92, so I am actually down a bit over a point on this one already :(. NOV announced strong 2nd quarter 2007 results today which drove the stock higher in trading. The 5-Yr Restated Financials on Morningstar.com appear solid. And I went ahead and bought some shares! Wish me luck. I am a bit under my purchase price already, but time will tell if this one works out.

NATIONAL OILWELL VARCO (NOV) IS RATED A BUY

Bob

Tuesday, 24 July 2007

Thoughts on a Dreary Day in the Market!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

What a day in the market! The Dow closed down 226.47 points at 13,716.95, the NASDAQ was down 50.72 points at 2,639.86, and the S&P closed down 30.53 points at 1,511.04.

And yet my only sale was a small sale of 1/7th of a position that hit an appreciation target.

That doesn't mean that I didn't suffer losses. In fact my Trading Account dropped about $1,600 or so in value.

But the difference is that having exit points allows one to weather the market. It doesn't prevent losses. It prevents panics. In other words, it is imperative to have a working strategy dealing with every single investment that you own if you are to responsibly deal with your portfolio. Of course, this is an amateur's perspective. So take that into consideration.

For me, I know when I shall be selling each and every one of my holdings. If the time comes, they shall be gone.

I know that I shall not be replacing my stocks unless I have an indication to be buying. Ironically, I got that signal today with my sale on "good news". I now have permission to add a new position up to my maximum of 20 holdings.

Planning.

That's what it is all about.

I am banking on a long-term bias towards upward movement in the overall market. I am a long-term investor as long as stocks move in a reasonably positive direction.

Just a brief comment to let you know that I am here. I am also losing money when stocks decline. I am sitting tight when sitting tight is indicated. And I am prepared to sell when the price dictates that action.

Have a better day trading tomorrow!

Bob

Kyphon (KYPH) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

The market is doing lousy as I write. Dow is down 100+, NASDAQ down 25+. Yet my Kyphon stock (KYPH) hit a sale point on a price rise. In fact, a few moments ago I sold 1/7th of my 125 shares (17 shares) at $56.29/share. This was my third targeted sale, having sold twice before, thus my target was a 90% appreciation level.

These shares were originally purchased 5/29/05 at a cost of $29.21. Thus, I had a realized gain of $27.08 or 92.7% since my purchase. When will I next sell a portion of Kyphon? On the upside, I shall be looking to sell 1/7th of my holding if the stock should appreciate to a 120% appreciation level. This works out to 2.20 x $29.21 = $64.27. On the downside, if the stock should drop to 1/2 of the highest appreciation level, which now works out to 1/2 of 90% or a 45% appreciation level, then I would plan on selling ALL remaining shares. This price level would work out to 1.45 x $29.21 = $42.35.

With only 19 positions (maximum of 20), this sale at a gain gives me a "permission slip" to add a new position. That "nickel" is burning a hole in my pocket already!

Thanks so much for stopping by! If you have any comments or questions, please leave them on the blog or email me at bobsadviceforstocks@lycos.com!

Bob

Sunday, 22 July 2007

"Looking Back One Year" A review of stock picks from the week of January 30, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Please excuse me if my absence caused any concerns among all of my readers. From time to time I shall, like all people, need to get away from the blogosphere and step back from the responsibilities of blogging. But I do not think I shall be staying away often or more than just temporarily.

But it is the weekend, and before the day is done, I would like to get a review in on past stock picks from the weke of January 30, 2006. My last "Weekend Review" was on July 7, 2007, when I reviewed the week of January 23, 2006. Let's see what was posted during the next week and how all of those stock picks would have turned out if they were purchased and held.

As I have commented on frequently on this subject, these reviews assume a "buy and hold" strategy with investing, with equal dollar amounts utilized in purchasing each of the stock selected and no sales of any of the holdings regardless of the price action of the holding. In practice I recommend and employ a disciplined strategy of selling my declining stocks quickly and completely and my gaining stocks slowly and partially at targeted appreciation points. However, for the sake of analysis, I utilize a "buy and hold" assumption for all of these reviews.

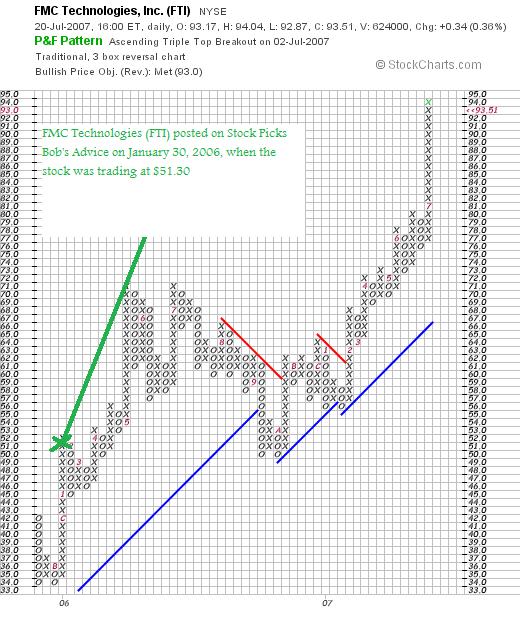

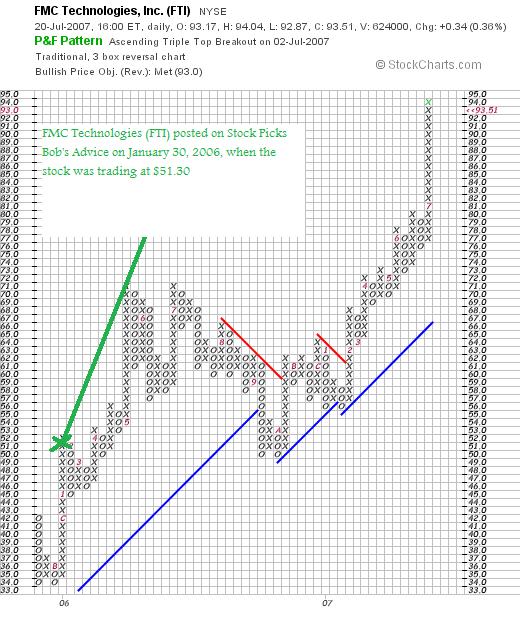

On January 30, 2006, I posted FMC Technologies (FTI) on Stock Picks Bob's Advice when the stock was trading at $51.30. FTI closed at $93.51 on July 20, 2007, for a gain of $42.21 or 82.3%.

On January 30, 2006, I posted FMC Technologies (FTI) on Stock Picks Bob's Advice when the stock was trading at $51.30. FTI closed at $93.51 on July 20, 2007, for a gain of $42.21 or 82.3%.

On May 9, 2007, FTI reported 1st quarter 2007 results. Revenue came in at $980 million, up 19% over the 1st quarter 2006 revenue results of $827 million. Net income climbed to $61.3 million from $47 million and diluted earnings per share increased to $.89/share from $.67/share last year.

On May 9, 2007, FTI reported 1st quarter 2007 results. Revenue came in at $980 million, up 19% over the 1st quarter 2006 revenue results of $827 million. Net income climbed to $61.3 million from $47 million and diluted earnings per share increased to $.89/share from $.67/share last year.

With the outstanding earnings and the impressive stock chart,

FMC TECHNOLOGIES (FTI) IS RATED A BUY

On January 31, 2006, Church & Dwight (CHD) was picked on Stock Picks Bob's Advice when the stock was trading at $36.80. CHD closed at $48.66 on July 20, 2007, for a gain of $11.86 or 32.2% since posting.

On January 31, 2006, Church & Dwight (CHD) was picked on Stock Picks Bob's Advice when the stock was trading at $36.80. CHD closed at $48.66 on July 20, 2007, for a gain of $11.86 or 32.2% since posting.

On May 8, 2007, Church & Dwight announced 1st quarter 2007 results. Revenue increased 16% to $514.3 million from $442.4 million in the prior year same period. Earnings came in at $45.1 million up from $39.9 million or $.66/share, up from $.60/share last year. This was a mixed results in terms of expectations, as analysts had been expecting income of $.63/share (the company beat expectations) on revenue of $526.6 million (the company missed on revenue).

On May 8, 2007, Church & Dwight announced 1st quarter 2007 results. Revenue increased 16% to $514.3 million from $442.4 million in the prior year same period. Earnings came in at $45.1 million up from $39.9 million or $.66/share, up from $.60/share last year. This was a mixed results in terms of expectations, as analysts had been expecting income of $.63/share (the company beat expectations) on revenue of $526.6 million (the company missed on revenue).

With the reasonably strong earnings report and a strong chart,

CHURCH & DWIGHT (CHD) IS RATED A BUY

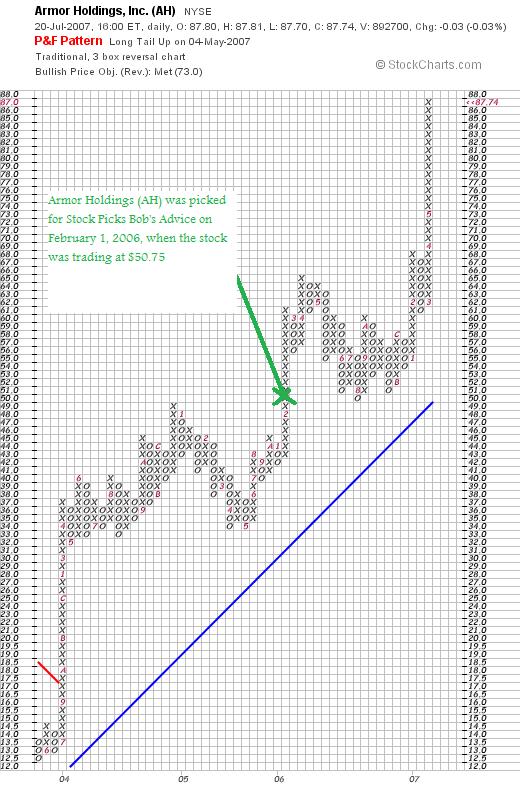

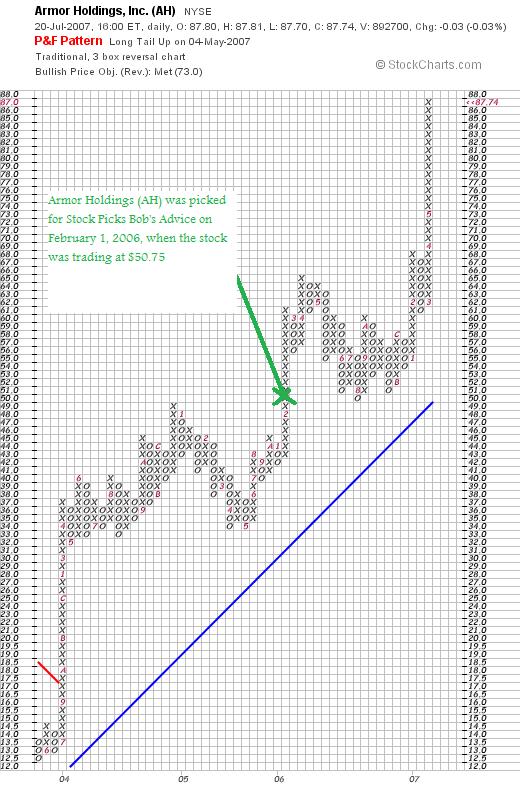

On February 1, 2006, I posted Armor Holdings (AH) on Stock Picks Bob's Advice when the stock was trading at $50.75. AH closed at $87.74 on July 20, 2007, for a gain of $36.99 or 72.9% since posting.

On February 1, 2006, I posted Armor Holdings (AH) on Stock Picks Bob's Advice when the stock was trading at $50.75. AH closed at $87.74 on July 20, 2007, for a gain of $36.99 or 72.9% since posting.

On May 7, 2007, Armor Holdings agreed to be acquired by BAE Systems Inc. for $88/share. The Justice Department approved the acquisition on July 18, 2007, and shareholders will be voting on this acquisition on July 25, 2007 (in 3 days).

With the stock being acquired I do not have an opinion on any further purchases or sales of this stock.

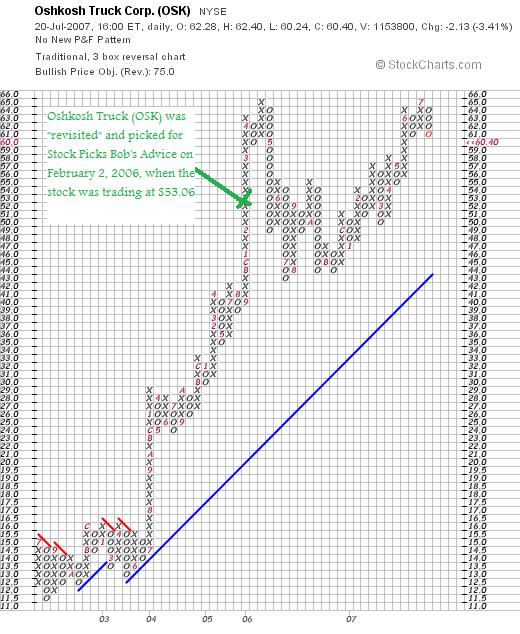

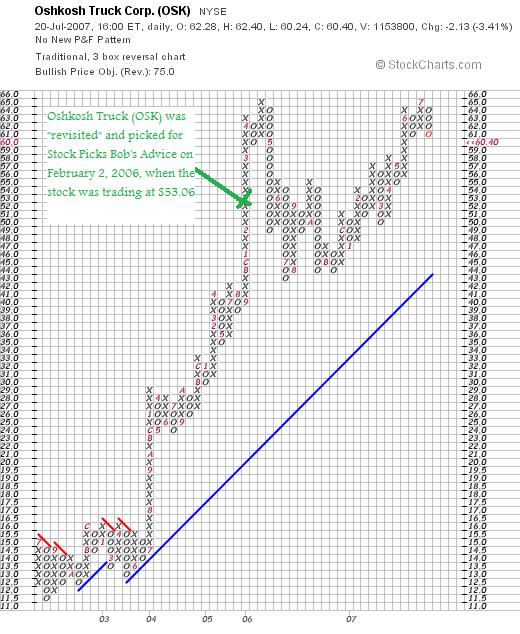

On February 2, 2006, I "revisited" Oshkosh Truck (OSK) and picked the stock for Stock Picks Bob's Advice when it was trading at $53.06. OSK closed at $60.40 on July 20, 2007, for a gain of $7.34 or 13.8% since posting.

On February 2, 2006, I "revisited" Oshkosh Truck (OSK) and picked the stock for Stock Picks Bob's Advice when it was trading at $53.06. OSK closed at $60.40 on July 20, 2007, for a gain of $7.34 or 13.8% since posting.

On May 3, 2007, Oshkosh reported 2nd quarter 2007 results. Sales nearly doubled to $1.66 billion from $844.8 million with much of that increase ($707.9 million) due to the recently acquired JLG Industries. Net income came in at $50.9 million or $.68/share, up from 449.8 million or $.67/share the prior year. The company met analysts' sales expectations which was for $1.66 billion in sales, and beat earnings expectations which had been at $.64/share. The company affirmed 2007 outlook of $3.15 to $3.25/share in earnings, which is below the average analyst which had been at $3.41/share.

With the reasonable earnings report in light of the short-term financial stress of integrating the JLG acquisition, the strong chart, and the continuing interest in armored vehicles by the Pentagon for Iraq duty that involves Oshkosh,

OSHKOSH TRUCK (OSK) IS RATED A BUY

Finally on February 3, 2006, I posted Aviall (AVL) on Stock Picks Bob's Advice when the stock was trading at $35.28/share. On May 1, 2006, Boeing (BA) announced the acquisition of Aviall for $48/share. This was a quick gain of $12.72 or 36.1% since the stock was picked.

Finally on February 3, 2006, I posted Aviall (AVL) on Stock Picks Bob's Advice when the stock was trading at $35.28/share. On May 1, 2006, Boeing (BA) announced the acquisition of Aviall for $48/share. This was a quick gain of $12.72 or 36.1% since the stock was picked.

With the stock now owned by Boeing, this stock will no longer be followed by this blog.

So how did I do during this week during the end of January, 2006, and the first few days of February, 2006? In a word, phenomenal! These five stocks showed an average appreciation of 47.46% since posting! And two were acquired!

Certainly, past performance is no indication of future performance. And don't forget I am just an amateur! But wasn't that a GREAT job of picking stocks!

Thanks again for visiting my blog! If you get a chance, be sure and leave a comment or question on the blog or email me at bobsadviceforstocks@lycos.com. If you can, be sure and visit my Stock Picks Podcast Website. Now, with my participation on the Covestor Site, you should also visit my Covestor Page which has been following my actual trading account since early June, 2007. Also, you might want to visit my Social Picks Page where that blog has been monitoring my picking activity on this website. Are you busy enough now?

Regards to all of my friends! Have a great week trading.

Bob

Tuesday, 17 July 2007

A Few Days Off!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I wanted to let you all know that I shall be busy with a few things this week and have decided not to be blogging (unless I break that rule as well) until I get things taken care of. If I make any trades, I shall be posting them, but shall try, if at all possible, to stay away from my computer (I have tried before :(), and get a few things done.

Expect to be back blogging in next few days. Drop me a line in the meantime if you have any comments or questions!

Bob

Newer | Latest | Older

I thought you might enjoy this illustration from the 3 Quarks Daily Blog which illustrates the concept of averaging down. What better topic to discuss after this week of dismal trading activity?

I thought you might enjoy this illustration from the 3 Quarks Daily Blog which illustrates the concept of averaging down. What better topic to discuss after this week of dismal trading activity?

One of my favorite things about writing this blog is corresponding with fellow investors who have questions about investments and 'what to do...'. I have to emphasize that my advice should always be taken with a grain of salt. That is, remember that I am an amateur at all of this. I am not qualified to advise anyone regarding their own particular investments and am not trying to do so. I can only respond in telling people what I do in those situations. That doesn't mean that my response is correct for them; this is just to help all of us think about investing. My suggestion to consult with professional investment advisers holds.

One of my favorite things about writing this blog is corresponding with fellow investors who have questions about investments and 'what to do...'. I have to emphasize that my advice should always be taken with a grain of salt. That is, remember that I am an amateur at all of this. I am not qualified to advise anyone regarding their own particular investments and am not trying to do so. I can only respond in telling people what I do in those situations. That doesn't mean that my response is correct for them; this is just to help all of us think about investing. My suggestion to consult with professional investment advisers holds.  Earlier today I

Earlier today I

On January 30, 2006, I

On January 30, 2006, I

On May 9, 2007, FTI reported

On May 9, 2007, FTI reported  On January 31, 2006, Church & Dwight (CHD) was

On January 31, 2006, Church & Dwight (CHD) was

On February 1, 2006, I

On February 1, 2006, I

On February 2, 2006, I

On February 2, 2006, I

Finally on February 3, 2006, I

Finally on February 3, 2006, I