Stock Picks Bob's Advice

Friday, 13 July 2007

Kinetic Concepts (KCI) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

As I mentioned yesterday, my Precision Castparts (PCP) stock hit an appreciation target and I sold 1/7th of my holding. This was right after my MEDTOX (MTOX) stock tanked and I bailed out of that entire position. The long and short of it (really the long and long) is that with the sale, and being at 18 positions (of my maximum of 20) I now had a 'permission slip' to add a new position to the Trading Portfolio. And that nickel started burning a hole in my pocket almost immediately.

Earlier today, checking the list of top % gainers on the NYSE, the only stock that I found that seemed to fit my criteria was Kinetic Concepts (KCI), an old favorite of mine here on Stock Picks Bob's Advice! In fact, I wrote up Kinetic Concepts almost exactly a year ago on July 14, 2006, when the stock was trading at $44.45. As I write, KCI is trading at $55.95, up $1.10 or 2.06% on the day.

KINETIC CONCEPTS (KCI) IS RATED A BUY

With that nickel in my pocket, I went ahead an purchased 140 shares of KCI at $56.2356 for my account. Wish me luck!

Before making the purchase I checked the latest quarter results as well as the Morningstar.com "5-Yr Restated" financials. Everything appears intact, and I went ahead and made a purchase.

Thanks so much for stopping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Thursday, 12 July 2007

Precision Castparts (PCP) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments before the close of trading my Precisions Castparts (PCP) hit another sale point and I sold 12 shares (1/7th of my 86 shares remaining) at $131.29. These shares were originally purchased 10/24/06 at a cost basis of $69.05. Thus, I had a gain of $62.24 or 90.1% since purchase. This was my third targeted sale, having sold 20 shares on 2/1/07 and 14 shares on 5/9/07.

On the upside, my next sale shall be 1/7th of my remaining 74 shares or 10 shares at a 120% appreciation target which works out to 2.20 x $69.05 = $151.91. To the downside, after a 90% appreciation target is reached, I pursh up my stop to 1/2 of that gain or a 45% appreciation level to sell the remaining shares if they should decline to that level. That works out to 1.45 x $69.05 = $100.12.

By the way, since I am at 18 positions (after my sale of MEDTOX earlier this afternoon), this subsequent sale on 'good news' indeed gives me a 'permission slip' to add a new position. I didn't have enough time to identify anything (did look a bit at the JCrew Group stock which was attractive but didn't have time to execute a purchase of shares). Thus, I have a 'permission slip' which carries over tomorrow and shall be on the look-out for a new stock! Wish me luck!

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where my actual stock holdings and performance is tracked. Also be sure and check out my Social Picks Page where my stock selections on this blog have been recorded and followed by that website. If you have any time left after all of that, you might be interested in visiting my Stock Picks Podcast Website, where I discuss some of the stocks I write about here on the blog (and sometimes even sing a song or read a poem :)).

Have a great evening friends!

Bob

MEDTOX Scientfic (MTOX) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I wanted to keep you updated on a trade that I just executed in my Trading Account. A few moments ago I sold my 350 shares of MEDTOX at $25.80. As I write, MTOX is trading at $25.70, down $(2.72) or (9.57)% on the day. I do not know of any reason for the dip in this otherwise outstanding market. However, I purchased these shares on 6/26/07 at a cost basis of $28.58, giving me a loss of $(2.88) or (10.1)% since purchase.

After an initial purchase I sell my holdings, regardless of news, etc., if they hit an 8% loss. MEDTOX did it. And out it went.

I am now down to 18 positions. I may have an opportunity to purchase a new position if I can have one of my holdings hit a sale point (PCP and KYPH are near!) Anyhow, that's the news. I hope you all are having a great day otherwise. Even with this sharp dip, my shares are up overall and the rest of the portfolio is performing just fine.

Bob

Monday, 9 July 2007

Bolt (BTJ) "Dealing with a sharp price decline" (Part 2)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

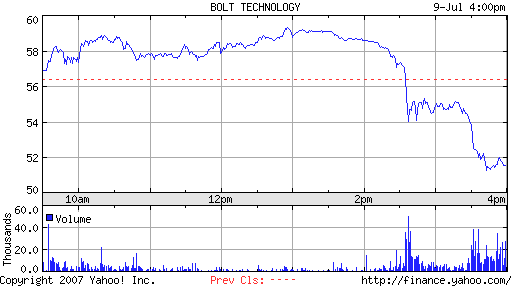

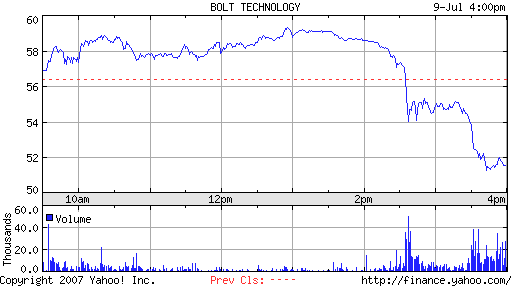

Bolt (BTJ) had a tumultuous day today. closing at $51.53, down $(4.90) or (8.68)% on the day. In fact, after hours as I write it is trading down another $(.54) or (1.05)% on the day. And this on a day it was up 4% earlier on only to sell-off and take a big swing lower.

This is today's chart from Yahoo. It isn't very pretty :(.

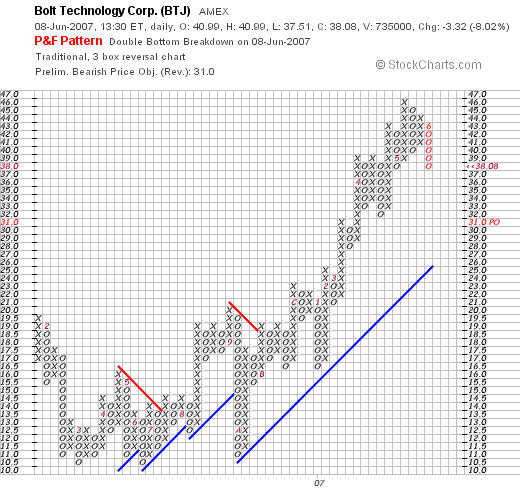

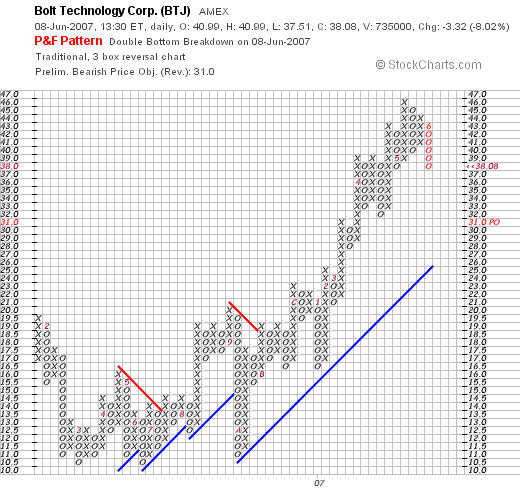

But I say "Part 2" in my title because we had this exact problem a month ago. On June 8, 2007, I wrote up a note about Bolt because it was selling off about 8% in a single day. I wrote:

"Bolt (BTJ) is having a lousy day in an otherwise up market.

In fact, as I write, Bolt is trading at $38.01, down $(3.40) or 8.21% on the day. But why? The Yahoo Message Boards are busy, with apparent short-sellers trying to talk down the share price. The word according to these unconfirmed rumor-mongerers is that BTJ will be listed at a lower level on the IBD 100 listing that comes out each Monday in the Investor's Business Daily. But I don't see any confirmation of that either."

In fact, the Message Boards are busy again.

Let's take a look at the chart I posted just one month ago:

You can see the big price drop.

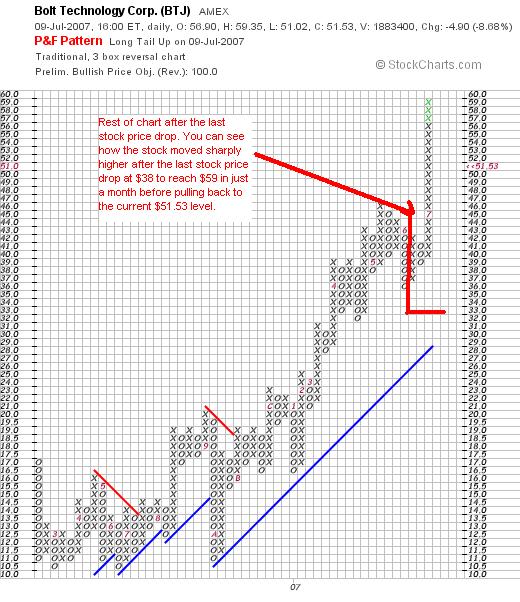

Now let's look at today's "point and figure" chart from StockCharts.com on Bolt (BTJ): (I have drawn in the 'rest of the chart' as Paul Harvey would say, after the last big correction!)

Will this happen again? Will Bolt turn back higher and go to $100 or is it heading lower to $25. Frankly, I don't know. My strategy is to sell portions of a quickly appreciating stock and I have done that already. I have sold portions of Bolt at 30, 60, 90, 120, and 180% appreciation points. I was nearing my 240% appreciation point sale when Bolt turned lower. If the stock declines to a 90% appreciation level for me that will also trigger a sale on the downside.

Meanwhile I sit tight.

The stock has moved almost vertical in appreciation, and it is to be expected tha the stock will move lower before consolidating and moving higher once again....I hope!

Thanks again for visiting. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 5:19 PM CDT

|

Post Comment |

Permalink

Updated: Monday, 9 July 2007 5:20 PM CDT

Sunday, 8 July 2007

"Trading Portfolio Update" July 8, 2007

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As I like to do from time to time on this blog, I would like to share with you the current status of my Trading Portfolio. I last wrote up my "trading portfolio update" on June 7, 2007, a month ago. There have been a few changes since then. But the biggest development has been my partipation in Covestor. You now can check my Covestor page and see the daily changes, all trades, and my performance relative to the indices and other registered investors. Thus far, I have been doing quite well as it has been a fortunate month for me especially with he Ventana bid by Roche. I am always grateful when my portfolio and my investing strategy is woking; but I am aware that there will be times when nothing seems to work. Sometimes the most successful approach is about persistence and patience.

This past month also found me shaken-out of Gildan Activewear, which seemed to almost know I had sold on a dip and gleefully turned around to move higher making the top % gainers list that same day! O.K. that's a bit too anthropomorphic, but still, don't you just hate those days sometimes :).

So I am back to 19 positions. Let's take a look at them and I will share with you in order: the symbol, number of shares, date of purchase, price of purchase, latest price (7/6/07), and percentage gain (or loss).

Baldor Electric Co. (BEZ), 140 shares, 5/22/07, $47.19, $50.04, 6.04%.

Bolt Technology (BTJ), 129 shares, 1/12/07, $17.44, $56.43, 223.63%

Cerner (CERN), 120 shares, 2/2/07, $49.76, $58.23, 17.02%

Coach (COH), 61 shares, 2/25/03, $8.33, $49.37, 492.58%

Covance (CVD), 119 shares, 4/9/07, $62.61, $70.19, 12.10%

Hologic (HOLX), 120 shares, 1/31/07, $55.58, $56.46, 1.58%

Harris (HRS), 120 shares, 1/31/07, $50.05, $55.91, 11.71%

Kyphon (KYPH), 125 shares, 5/20/05, $29.21, $53.18, 82.03%

Mesa Labs (MLAB), 210 shares, 5/23/07, $24.05, $24.75, 2.90%

Morningstar (MORN, 140 shares, 11/22/05, $32.57, $47.61, 46.16%

MEDTOX Scientific (MTOX), 350 shares, 6/26/07, $28.58, $29.89, 4.57%

Precision Castparts (PCP), 86 shares, 10/24/06, $69.05, $127.82, 85.11%

Quality Systems (QSII), 88 shares, 7/28/03, $7.75, $39.04, 403.82%

ResMed (RMD), 150 shares, 2/4/05, $29.87, $41.72, 39.68%

Satyam Computer Services (SAY), 210 shares, 4/20/07, $25.55, $26.25, 2.73%

Starbucks (SBUX), 50 shares, 1/24/03, $11.40, $26.55, 132.80%

Universal Electronics (UEIC), 155 shares, 2/23/07, $25.24, $36.78, 45.72%

Meridian Bioscience (VIVO), 270 shares, 4/21/05, $7.42, $22.00, 196.54%

Wolverine World Wide (WWW), 200 shares, 4/19/06, $23.55, $28.51, 21.08%

Since my last review on June 7, 2007, I sold 23 shares of Ventana at $76.83, and the rest of the 139 shares of Ventana (VMSI) at $76.502 later the same day on 6/26/07. On that day I purchased 350 shares of MEDTOX at $28.5534, Bolt hit another appreciation target and I sold 1/7th of my holding (21 shares) at $50.52. Finally, on 7/5/07, I sold my 210 shares of Gildan at $33.1101 when it hit an (8)% loss after purchase.

Currently I am at 19 positions. My equity value is $119,962.09, my margin balance is at $56,031.51, giving me a 53.29% margin equity percentage. The account has a net value of $63,930.58.

As of 7/6/07, I have $33,571.01 in unrealized gains in my account, and with the above trades have taken $3,100.15 in net short-term gains, and $17,824.18 in net long-term gains for a total of $20,924.33 in realized gains for 2007. I also have paid $2,563.07 in margin interest and have received a total of $272.58 in ordinary dividends and distributions and miscellaneous income.

Please let me know if you have any comments or questions regarding my Trading Account. Please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Bob's Advice Covestor page, where you can see a third-party analysis of my holdings and performance.

Bob

Posted by bobsadviceforstocks at 8:13 PM CDT

|

Post Comment |

Permalink

Updated: Sunday, 8 July 2007 8:29 PM CDT

Bradley Pharmaceuticals (BDY) "Long-Term Review #7"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As I write entry after entry on this blog, sometimes I feel like my early entries have gotten buried under the pile of posts. I do a 'weekend review' of stocks from a year or so ago, but what about the very early posts? Whatever happened to them? Or I hope you are asking that question.

I started this blog back on May 12, 2003. Now, into my fifth year of blogging, I have 1,533 posts on this website. Even I have problems finding entries. One day I will have to develop a better search engine and index for my blog. Meanwhile, if you ever want to find a post, just use Google (I do!). Simply enter "Stock Picks Bob's Advice" along with the Stock name you are searching for. That usually works.

Anyhow, sometime back I decided to dig back into the early entries and find out how things have worked out for the companies years later. I have been trying to do this on weekends as a "Long-Term Review", but one thing always leads to another, and now I am only up to my entry #7 Brady Pharmaceuticals which I first posted on Stock Picks on May 19, 2003. My last long-term review was for Genentech (DNA) which I had originally posted also on May 19, 2003, and re-reviewed on April 14, 2007.

I wrote about Bradley:

"May 19, 2003

Bradley Pharmaceuticals (BDY)

As the market nears its close, with the Dow down about 170 points, it seems a strange time to pick stocks with positive momentum. But only the strongest are able to buck the tide.

Bradley Pharmaceuticals (BDY)as I write is trading at $15.77 up $1.02 or 6.92% on the day. This past quarter was reported on April 30, 2003, for the quarter ending March 31, 2003, sales totaled $14.9 million and increase of 60% over 2002. Net income was $1.2 million or an increase of 67% year over year....very nice numbers!

Looking for the 5 year numbers on Morningstar we find revenue of $16 million in 1998, $19 million in 1999, $19 million in 2000, $26 million in 2001, and $40 million in 2002. Extrapolating current sales would give us a $60 million rate for 2003 (!).

Prior to this recent quarter of a 60% sales increase, the prior four quarters in sequence showed a 75.90% (3/020, 57.93% (6/02), 48.84% (9/02), and 41.6% increase in sales (12/02).

The company is small with a tiny market cap of $154 million but is very reasonably priced with a p/e of about 17. Good luck investing and remember the 8% stops EVEN on recent purchases! Bob

P.S. I do not own any shares nor do any of my family members own shares in this company."

Let's take a closer look at Bradley and see how things turned out!

I shall explain why

BRADLEY PHARMACEUTICALS (BDY) IS RATED A HOLD

First of all, Bradley (BDY) closed at $21.52 on July 6, 2007, for a gain of $5.75 or 36.5% since posting. I do not own any shares nor do I own any options on this stock.

What exactly does this company do?

According to the Yahoo "Profile" on Bradley, the company

"...engages in acquiring, developing, and marketing prescription and over-the-counter products. It offers various dermatologic and podiatric products, including ADOXA and ZODERM for acne; ROSULA AQUEOUS for rosacea and acne; ROSULA NS PADS for antibacterial treatment; KEROL  REDI-CLOTHS and KERALAC for mild to severe dry skin; and KERALAC GEL and KERALAC NAILSTIK for mild to severe dry skin and nail disorders. The company also offers CARMOL for mild to severe dry skin, xerosis, nail disorders, and inflammatory skin conditions; VEREGEN for external genital or perianal warts; SOLARAZE for actinic keratoses and pre-cancerous skin lesions; LIDAMANTLE HC for topical anesthetic and anti-inflammatory; ACIDMANTLE, a cosmetic skin pH balancer; ZONALON for topical anesthetic; SELSEB and CARMOL SCALP LOTION for dandruff; and AFIRM and BETA-LIFT for office procedure for chemical peels."

REDI-CLOTHS and KERALAC for mild to severe dry skin; and KERALAC GEL and KERALAC NAILSTIK for mild to severe dry skin and nail disorders. The company also offers CARMOL for mild to severe dry skin, xerosis, nail disorders, and inflammatory skin conditions; VEREGEN for external genital or perianal warts; SOLARAZE for actinic keratoses and pre-cancerous skin lesions; LIDAMANTLE HC for topical anesthetic and anti-inflammatory; ACIDMANTLE, a cosmetic skin pH balancer; ZONALON for topical anesthetic; SELSEB and CARMOL SCALP LOTION for dandruff; and AFIRM and BETA-LIFT for office procedure for chemical peels."

How did they do in the latest quarter?

On May 10, 2007, Bradley reported 1st quarter 2007 results.

Net sales for the quarter ended March 31, 2007, came in at $37.8 million, up $3.0 million or 9% over the prior year same perid. Net income for the quarter was $2.5 million or $.15/diluted share, up strongly from $.01/diluted share the prior year.

Net sales for the quarter ended March 31, 2007, came in at $37.8 million, up $3.0 million or 9% over the prior year same perid. Net income for the quarter was $2.5 million or $.15/diluted share, up strongly from $.01/diluted share the prior year.

Even though this was a relatively strong quarter, the company disappointed analysts who had estimated that earnings would come in at $.24/share.

More recently, the company stock has been doing better after an investment group led by the CEO, Daniel Glassman, made a bit to take the company private. Here is a review of that development by Motley Fool.

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on BDY, we can see that revenue growth has been steady with $40 million in revenue in 2002, increasing to $133 million in 2005 and $145 million in 2006. Earnings have been erratic, increasing from $.67/share in 2002 to $1.35/share in 2003. Since then they dropped to $.49/share in 2004, stayed at $.49/share in 2005, and increased to $.58/share in 2006. The company has meanwhile increased outstanding shares from 10 million in 2002 to 16 million in 2006 and 17 million in the TTM.

Free cash flow has been nicely positive and improving with $16 million in 2004 increasing to $29 million in 2006. The balance sheet is adequate with $46.7 million in cash and $41.7 million in other current assets. This total of $88.4 million in total current assets, when divided by the current liabilities of $69.5 million yields a current ratio of 1.27. Generally, from my perspective, current ratios of 1.25 or higher are nominally healthy.

What about some valuation numbers?

Reviewing the Yahoo "Key Statistics" on Bradley reveals this company to be a small cap stock with a market capitalization of only $363.1 million. The trailing p/e is moderate at 29.85 with a forward p/e (fye 31-Dec-08) estimated at 19.74. The PEG is also a bit rich at 1.79.

Reviewing the Fidelity.com eresearch website on BDY, we find that the Price/Sales (TTM) ratio shows a reasonable valuation for Bradley coming in at 2.41 with an industry average of 7.07.

However, the company is less profitable than average as evaluated by the Return on Equity (TTM), Bradley is reported at 6.45% compared to an industry average of 26.93%.

Finishing up with Yahoo we can see that the company has 16.87 million shares outstanding with 13.08 million that float. Currently, as of 6/12/07, there were 2.28 million shares out short representing 4.5 trading days of average volume (the short ratio). This is 15.10% of the float and is a bit significant from my perspective as it is above the '3 day rule' that I have arbitrarily been using for significance of short interest.

No dividends are paid per Yahoo, and no stock split is reported.

What does the chart look like?

Looking at the "Point & Figure" chart on Bradley Pharmaceuticals from StockCharts.com, we can see that the stock peaked shortly after my "pick", climbing from the $15 level in May, 2003, to a high of $32 before dipping sharply back to a low of $8.00 in May, 2005. Since then, the stock has been recovering nicely, currently at the $21.52 level.

Summary: What do I think about this stock?

I have rated this stock a "HOLD" because of the weakness in earnings the past several years. The latest quarter did show significant improvement and is encouraging. Also, the potential buy-out by the CEO and his investor group also adds interest to this as a stock investment. However, even though revenue has been positive, earnings have disappointed. The company has also used issuance of stock which is also hampering earnings growth.

Valuation-wise, the Price/Sales looks good, but the ROE is a bit weak and the PEG suggests that the price also is a bit rich in terms of future earnings growth as estimated. An interesting stock pick. A stock which I would have sold if I had purchased it back in 2003 because of the subsequent stock dip in price; but a stock which is ahead significantly from the original pick price.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Be sure and visit my Stock Picks Bob's Advice Podcast Website, where you can listen to me discuss some of the stocks I write about here on the blog. In addition, check out the Social Picks Website that tracks Stock Picks Bob's Advice and see what a third-party has to say about my performance the past six months! If you are interested, for the past month I have been followed by Covestor and you can visit the Stock Picks Bob's Advice Covestor Website and see how my actual holdings in my Trading Portfolio have been working out for me!

Have a great weekend everyone! Thanks once again for visiting and sharing your thoughts and ideas with me!

Bob

Saturday, 7 July 2007

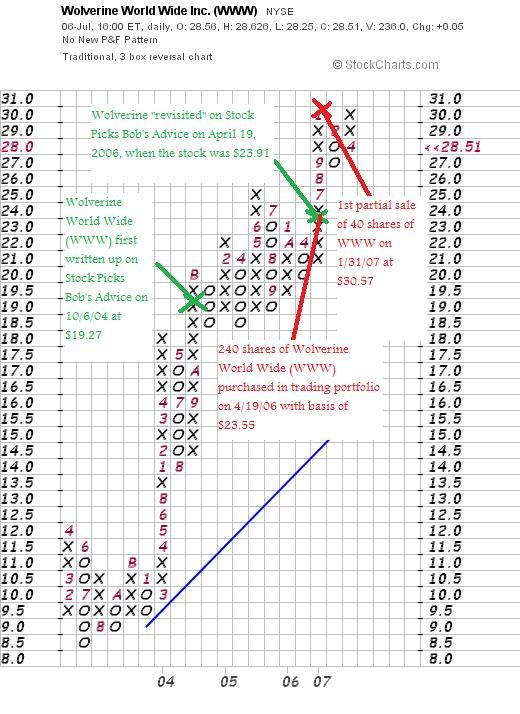

Wolverine World Wide (WWW) "Weekend Trading Portfolio Analysis

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amater investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As one of the things I like to do to share with all of my readers what I am thinking about investments, I have chosen to share with all of you my actual trading portfolio and my actual trades. On weekends, I have been trying to go through each of my now 19 positions, and update you as I once again review some of the basic fundamental information about each of these stocks.

On June 17, 2007, I wrote up my holding Ventana Medical Systems (VMSI), which I recently sold after a 25 point rise after Roche announced a bid for the stock. Going alphabetically, I am now back to the bottom of my list with Wolverine World Wide (WWW).

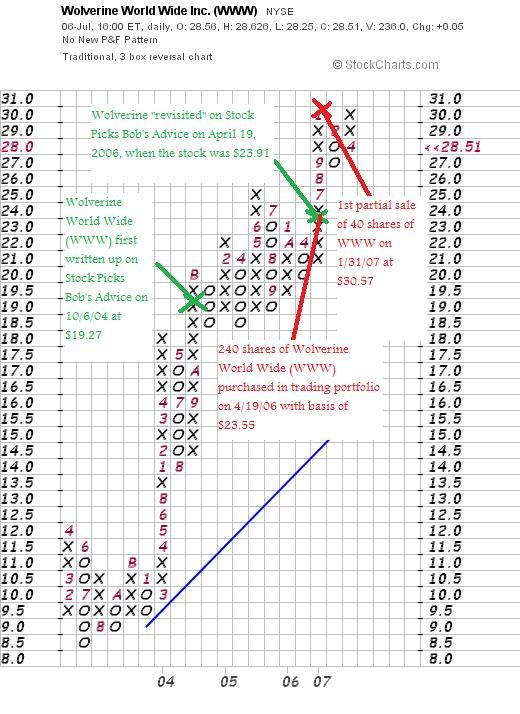

WWW is an old favorite of mine. I first wrote up Wolverine when the stock was trading at $28.90 (or actually $19.27 when adjusted for a 3:2 stock split February 2, 2005) on October 6, 2004. I "revisited" Wolverine on April 19, 2006, when the stock was trading at $23.91.

Currently, I own 200 shares of Wolverine World Wide (WWW) in my trading account that have a basis of $23.55, purchased on 4/19/06. WWW closed at $28.51 on July 6, 2007, for an unrealized gain of $4.96 or 21.1% on these shares. On January 31, 2007, I sold 40 shares of my 240 original shares (1/6th of the holding) at $30.57 for a gain of $7.02 or 29.8%.

Currently, I own 200 shares of Wolverine World Wide (WWW) in my trading account that have a basis of $23.55, purchased on 4/19/06. WWW closed at $28.51 on July 6, 2007, for an unrealized gain of $4.96 or 21.1% on these shares. On January 31, 2007, I sold 40 shares of my 240 original shares (1/6th of the holding) at $30.57 for a gain of $7.02 or 29.8%.

I am now trying to sell 1/7th of my holdings at appreciation targets, not 1/6th as I did with Wolverine, and would plan on the upside of selling 1/7th of my 200 shares or 28 shares if the stock should reach a 60% gain or 1.6 x $23.55 = $37.68. On the downside, after a single sale at a 30% gain, my sale point would be at break-even or $23.55.

First, let's take a look at the "point & figure" chart on Wolverine World Wide from StockCharts.com:

Let's take another brief look at WWW and see if it deserves a spot on the blog!

On April 18, 2007, Wolverine World Wide (WWW) announced 1st quarter 2007 results. Revenue totalled $281.1 million, up 6.9% over last year's first quarter revenue of $262.8 million. First quarter earnings per share climbed 14.7% to $.39/share, up from $.34/share. Net earnings were $22.3 million, up from $19.6 million last year.

On April 18, 2007, Wolverine World Wide (WWW) announced 1st quarter 2007 results. Revenue totalled $281.1 million, up 6.9% over last year's first quarter revenue of $262.8 million. First quarter earnings per share climbed 14.7% to $.39/share, up from $.34/share. Net earnings were $22.3 million, up from $19.6 million last year.

In light of the solid quarter, the upping of guidance at that time, the strong price chart, the impressive Morningstar.com "5-Yr restated" financials which show steady revenue, earnings, and dividend growth. Stable outstanding shares. Solid free cash flow, and a solid balance sheet.

WOLVERINE WORLD WIDE (WWW) IS RATED A BUY

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

"Looking Back One Year" A review of stock picks from the week of January 23, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As one of the weekend "tasks" of this website, I like to look back on stock picks from the past. Starting about a year out, I have missed enough weekends of review that I am now 1 1/2 years out on reviews. On June 17, 2007, I reviewed stock picks from the week of January 16, 2006. Moving ahead a week, let's take a look at the picks from the week of January 23, 2006!

As I have frequently pointed out, these reviews assume a 'buy and hold strategy' of investing, where equal dollar amounts of each stock are purchased and held regardless of subsequent price action. In practice, I advocate and employ a very different strategy that sells stocks quickly on small losses and slowly as the stocks appreciate. However, for the ease of this review, this analysis assumes a simpler buy and hold approach to all of these stock picks. The difference in this approach would certainly affect the outcome of the performance.

Enough of the introduction! Let's take a look at the four stocks that were "picked" on the blog during the week of January 23, 2006. Please note that all charts are posted from StockCharts.com.

On January 25, 2006, I picked Trimble Navigation (TRMB) for Stock Picks Bob's Advice when the stock was trading at $41.76. On February 23, 2007, Trimble had a 2:1 stock split making my effective pick price actually $20.88. TRMB closed at $32.50 on July 6, 2007, for a gain of $11.62 or 55.7% since posting.

On January 25, 2006, I picked Trimble Navigation (TRMB) for Stock Picks Bob's Advice when the stock was trading at $41.76. On February 23, 2007, Trimble had a 2:1 stock split making my effective pick price actually $20.88. TRMB closed at $32.50 on July 6, 2007, for a gain of $11.62 or 55.7% since posting.

On May 3, 200, Trimble reported 1st quarter results. Revenue for he quarter increased 27% to $285.7 million from $225.9 million in the first quarter of 2006. Net income came in at $28.7 million, up 11% over net income of $25.8 million in the same quarter in 2006. Earnings per share came in at $.24/diluted share, up from $.22/diluted share during the 1st quarter of 2006.

On May 3, 200, Trimble reported 1st quarter results. Revenue for he quarter increased 27% to $285.7 million from $225.9 million in the first quarter of 2006. Net income came in at $28.7 million, up 11% over net income of $25.8 million in the same quarter in 2006. Earnings per share came in at $.24/diluted share, up from $.22/diluted share during the 1st quarter of 2006.

With this great earnings report, a solid Morningstar.com "5-Yr Restated" financials, and the nice chart,

TRIMBLE NAVIGATION (TRMB) IS RATED A BUY

On January 26, 2006, I posted Headwaters (HW) on Stock Picks Bob's Advice when the stock was trading at $35.00. Headwaters closed at $17.54 on July 6, 2007, for a loss of $17.46 or (49.9)% since posting.

On May 1, 2007, Headwaters (HW) announced 2nd quarter 2007 results. Revenue increased 2% to $274.1 million from $269.7 million in the same quarter in 2006. Net income came in at $27.2 million or $.59/diluted share, up 48% from the March 2006 quarter results of $18.4 million or $.40/diluted share.

On May 1, 2007, Headwaters (HW) announced 2nd quarter 2007 results. Revenue increased 2% to $274.1 million from $269.7 million in the same quarter in 2006. Net income came in at $27.2 million or $.59/diluted share, up 48% from the March 2006 quarter results of $18.4 million or $.40/diluted share.

With the relatively strong quarter, an examination of the Morningstar.com "5-Yr Restated" financials shows that earnings have been dipping after peaking at $2.79/share in 2005. Earnings were rported at $2.19/share in 2006 and $2.15/share in the trailing twelve months (TTM). Thus, with the weak chart, unimpressive Morningstar report, even with the good latest quarter report,

HEADWATERS (HW) IS RATED A HOLD

On January 26, 2006, I posted National Instruments (NATI) on Stock Picks Bob's Advice when the stock was trading at $36.81/share. NATI closed at $32.31 on July 6, 2007, for a loss of $(4.50) or (12.2)% since posting.

On January 26, 2006, I posted National Instruments (NATI) on Stock Picks Bob's Advice when the stock was trading at $36.81/share. NATI closed at $32.31 on July 6, 2007, for a loss of $(4.50) or (12.2)% since posting.

On April 26, 2007, National Instruments (NATI) reported

1st quarter 2007 results. Revenue for the quarter came in at $172 million, up 11% over the prior year same quarter. Net income (GAAP) came in at $19 million, up 51% from prior year's $12.6 million result. On a per share basis this was $.23/diluted share, up from $.15/diluted share the prior year.

With the satisfactory price chart, a solid quarterly report, and a still good Morningstar.com "5-Yr Restated" financials,

NATIONAL INSTRUMENTS (NATI) IS RATED A BUY

On January 28, 2006, I posted Packeteer (PKTR) on Stock Picks Bob's Advice when the stock was trading at $12.15. Packeteer closed at $8.16 on July 6, 2007, for a loss of $(3.99) or (32.8)%.

On April 19, 2007, Packeteer (PKTR) announced 1st quarter 2007 results. Revenues came in at $34.7 million, up 7% from the $32.3 million reported in the first quarter of 2006. However, net revenues declined sequentially from the $42.7 million reported in the 4th quarter of 2006. The company reported a net loss of $(6.1) million or $(.17)/diluted share, down from a net gain of $4.5 million or $.13/diluted share in the prior year same period.

On April 19, 2007, Packeteer (PKTR) announced 1st quarter 2007 results. Revenues came in at $34.7 million, up 7% from the $32.3 million reported in the first quarter of 2006. However, net revenues declined sequentially from the $42.7 million reported in the 4th quarter of 2006. The company reported a net loss of $(6.1) million or $(.17)/diluted share, down from a net gain of $4.5 million or $.13/diluted share in the prior year same period.

With the weak latest quarterly report, a very weak price chart, and a Morningstar.com "5-Yr Restated" financials page showing decreasing earnings for the third straight year,

PACKETEER (PKTR) IS RATED A SELL

So how did I do with these four stocks from about 18 months ago? In a word, mediocre. The four stocks had an average loss of (9.8)%.

This once again has a few important take-home lessons. First of all, the Packeteer chart looked awful even when I posted it. I even made note of the weak chart in the post. What was I thinking? Above all, this shows the importance of limiting losses so that small losses don't become huge and that small gains are allowed to run as much as possible.

Anyhow, thanks again for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. I have a few reminders for you as well! Remember to visit my Stock Picks Bob's Advice Podcast Website, where you can listen to me discuss some of the many stocks I write about here on the blog. To review the performance of my stock picks since January 22, 2007, (my blog goes back to 2003 but I signed up with Social Picks this year), you can visit my Social Picks Stock Picks Bob's Advice Website.

More exciting, in my opinion, is the possibility to follow my actual trading portfolio on Covestor where you can visit my Stock Picks Bob's Advice Covestor Page. This site monitors my actual holdings, my actual trades, and my actual performance. It will be interesting to let you know how I am doing with actual third-party evaluation numbers.

Thanks again for dropping by! Remember that I am truly an amateur so check with your professional advisers, please. Have a great weekend and a great week trading next week!

Bob

Friday, 6 July 2007

Wipro (WIT) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on this website.

It is Friday and we have all made it through another week! I haven't been writing up too many new ideas on the blog and I wanted to take a moment to write up a name that I have visited in the past, Wipro (WIT). I do not own any shares of Wipro directly, but my stock club does own some shares of this company.

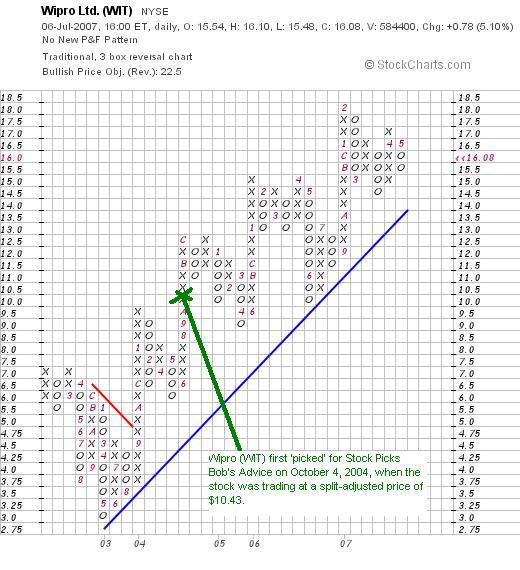

I was looking through the list of top % gainers on the NYSE this evening and noticed that Wipro Ltd (WIT) had made the list closing at $16.08, up $.78 or 5.10% on the day. I first reviewed Wipro on Stock Picks Bob's Advice on October 4, 2004, almost three years ago (!) when the stock was trading at $20.86. WIT split 2:1 on September 2, 2005, making my effective pick price actually $10.43. With the stock closing at $16.08, this represents a gain of $5.65 or 54.2% since my original post.

I was looking through the list of top % gainers on the NYSE this evening and noticed that Wipro Ltd (WIT) had made the list closing at $16.08, up $.78 or 5.10% on the day. I first reviewed Wipro on Stock Picks Bob's Advice on October 4, 2004, almost three years ago (!) when the stock was trading at $20.86. WIT split 2:1 on September 2, 2005, making my effective pick price actually $10.43. With the stock closing at $16.08, this represents a gain of $5.65 or 54.2% since my original post.

Let's take another look at Wipro and I will explain why

WIPRO (WIT) IS RATED A BUY

What exactly does this company do?

According to the Yahoo "Profile" on Wipro (WIT), the company

"...together with its subsidiaries, provides information technology (IT) services and products, including business process outsourcing services (BPO) worldwide. The company operates in three segments: Global IT Services and Products, India and Asia Pac IT Services and Products, and Consumer Care and Lighting. The Global IT Services and Products segment offers IT consulting, custom application design, development, re-engineering and maintenance, systems integration, package implementation, technology infrastructure outsourcing, and research and development services in the areas of hardware and software design. It also provides BPO services, which include customer interaction services, finance and accounting services, and process improvement services for repetitive processes."

"...together with its subsidiaries, provides information technology (IT) services and products, including business process outsourcing services (BPO) worldwide. The company operates in three segments: Global IT Services and Products, India and Asia Pac IT Services and Products, and Consumer Care and Lighting. The Global IT Services and Products segment offers IT consulting, custom application design, development, re-engineering and maintenance, systems integration, package implementation, technology infrastructure outsourcing, and research and development services in the areas of hardware and software design. It also provides BPO services, which include customer interaction services, finance and accounting services, and process improvement services for repetitive processes."

This company is an India-based technology outsourcing firm.

How did they do in the latest quarter reported?

On April 19, 2007, Wipro reported 4th quarter 2007 results. For the quarter ended March 31, 2007, total revenue was Rs (rupees) 149.43 billion ($3.47 billion), a 41% over the same period last year. Net income was Rs 29.17 ($677 million) a 44% increase over the same quarter the prior year. These results beat analysts expectations.

What about longer-term results?

Looking at the Morningstar.com "5-Yr Restated" financials on WIT, we can see that the company has been steadily, and strongly growing its revenue from $702 million in 2002 to $2.4 billion in 2006. Earnings which were $.13/share in 2002, stayed flat at $13 in 2003, then steadily increased to $.32/share in 2006. The total shares has been essentially stable with 1.39 billion reported in 2002, increasing to 1.41 billion in 2006 and 1.43 billion in the trailing twelve months.

Free cash flow has been positive and growing with $145 million reported in 2004, $276 million in 2005, and $287 million in 2006. The balance sheet appears solid with $878.2 million in cash, which by itself can cover both the $473 million in current liabilities and the negligible $11.7 million in long-term debt, and still leave almost $400 million in cash available! Calculating the current ratio, we find Wipro with a total of $1,609.4 million in total current assets, which, when compared to the $473 million in current liabilities yields a current ratio of 3.4.

What about some valuation numbers?

Looking at Yahoo "Key Statistics" on Wipro, we can see that this is a large cap stock with a market capitalization of $23.46 billion. The trailing p/e is a moderate 32.16 with a forward p/e (fye 31-Mar-09) estimated at 23.30. The PEG comes in at a very reasonable 1.00. The price/sales is a bit rich at 6.04 but I don't have any industry comparisons to truly value this number.

In terms of profitability, according to the Fidelity.com eresearch website, the company does well relative to similar companies with a Return on Equity (TTM) of 34.39% compared to the industry average of 28.42%.

Finishing up with yahoo, we can see that there are 1.46 billion shares outstanding with only 270.6 million that float. As of 4/10/07, there were 2.74 million shares out short representing 7.5 trading days of volume.

The company currently pays a forward dividend of $.12/share yielding 0.85. The last stock split was, as noted, a 2:1 split on 9/2/05.

What does the chart look like?

Let's take a look at the "point & figure" chart on Wipro from StockCharts.com. We can see that after an initial decline from $7.00 in March, 2002, to a low of $3.00 in May, 2003, the company has been moving in a 'saw-tooth' pattern steadily higher to a level of $18 in February, 2007. The stock, at $16.08, is technically still moving higher with no evidence of a breakdown in the price appreciation pattern.

Summary: What do I think about the stock?

Avoiding any political implications of outsourcing (avoiding politics is always difficult for me!), this has been a great stock pick for me as the firm continues to show strong revenue and earnings growth along with price appreciation!

Reviewing a few of the pieces of information reviewed, the stock was moving sharply higher today, the latest quarter beat expectations with strong revenue and earnings growth. The company has been growing steadily the last 4 years with rather rapid increases in both revenue and earnings while still keeping a fairly steady hand on the outstanding shares. Free cash flow is positive and growing. And the balance sheet is solid. There really is little not to like about the company.

Thanks again for visiting my blog! I hope that you all have a nice weekend and if you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Thursday, 5 July 2007

Gildan Activewear (GIL) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I hope that all of you had a great time on the 4th.

I was down at the Riverfest but didn't catch the fireworks as this photo shows.

But this isn't about partying. This is about trading and managing a portfolio! So let me get down to business. Unfortunately, Gildan Activewear (GIL), a great company, and a strongly performing stock, hit an 8% loss in my portfolio. If I were to review the purchase, I would note that the chart looks a bit overextended. So this isn't a pan on the investment, it is a reflection of bad luck in entering a stock at the wrong time. But I shall be sticking to my rules now and in the future as much as possible. And I sold my Gildan Shares.

GILDAN ACTIVEWEAR (GIL) IS RATED A HOLD

So why did I rate the stock a 'hold' instead of a sell. Because the story appears to be intact, and I am selling my holding based on the performance within my portfolio, not because I dislike the company.

Anyhow, I sold my 210 shares at $33.11. These shares were purchased on 5/21/07 for $36.13. So this was a loss of $(3.02) or (8.4)% since my purchase.

Since this sale is on "bad news", even though I am now down to 19 positions, I do not have a "permission slip" to add a new position. I shall be waiting for a sale on "good news" which is a sale at an appreciation target, as a signal to add a new holding.

As you may recall, I sell my shares at 8% loss after an initial purchase, at break-even if I have sold once at a 30% targeted appreciation point, or at 50% of the highest appreciation sale percentage if I have sold more than once with gains.

Thanks so much for stopping by and visiting! Please feel free to leave a comment on the blog or email me at bobsadviceforstocks@lycos.com with any of your comments or questions.

Bob

Newer | Latest | Older

REDI-CLOTHS and KERALAC for mild to severe dry skin; and KERALAC GEL and KERALAC NAILSTIK for mild to severe dry skin and nail disorders. The company also offers CARMOL for mild to severe dry skin, xerosis, nail disorders, and inflammatory skin conditions; VEREGEN for external genital or perianal warts; SOLARAZE for actinic keratoses and pre-cancerous skin lesions; LIDAMANTLE HC for topical anesthetic and anti-inflammatory; ACIDMANTLE, a cosmetic skin pH balancer; ZONALON for topical anesthetic; SELSEB and CARMOL SCALP LOTION for dandruff; and AFIRM and BETA-LIFT for office procedure for chemical peels."

REDI-CLOTHS and KERALAC for mild to severe dry skin; and KERALAC GEL and KERALAC NAILSTIK for mild to severe dry skin and nail disorders. The company also offers CARMOL for mild to severe dry skin, xerosis, nail disorders, and inflammatory skin conditions; VEREGEN for external genital or perianal warts; SOLARAZE for actinic keratoses and pre-cancerous skin lesions; LIDAMANTLE HC for topical anesthetic and anti-inflammatory; ACIDMANTLE, a cosmetic skin pH balancer; ZONALON for topical anesthetic; SELSEB and CARMOL SCALP LOTION for dandruff; and AFIRM and BETA-LIFT for office procedure for chemical peels." Net sales for the quarter ended March 31, 2007, came in at $37.8 million, up $3.0 million or 9% over the prior year same perid. Net income for the quarter was $2.5 million or $.15/diluted share, up strongly from $.01/diluted share the prior year.

Net sales for the quarter ended March 31, 2007, came in at $37.8 million, up $3.0 million or 9% over the prior year same perid. Net income for the quarter was $2.5 million or $.15/diluted share, up strongly from $.01/diluted share the prior year.

Currently, I own 200 shares of Wolverine World Wide (WWW) in my trading account that have a basis of $23.55, purchased on 4/19/06. WWW closed at $28.51 on July 6, 2007, for an unrealized gain of $4.96 or 21.1% on these shares. On January 31, 2007, I sold 40 shares of my 240 original shares (1/6th of the holding) at $30.57 for a gain of $7.02 or 29.8%.

Currently, I own 200 shares of Wolverine World Wide (WWW) in my trading account that have a basis of $23.55, purchased on 4/19/06. WWW closed at $28.51 on July 6, 2007, for an unrealized gain of $4.96 or 21.1% on these shares. On January 31, 2007, I sold 40 shares of my 240 original shares (1/6th of the holding) at $30.57 for a gain of $7.02 or 29.8%.

On January 25, 2006, I

On January 25, 2006, I

On January 26, 2006, I

On January 26, 2006, I

On April 19, 2007, Packeteer (PKTR) announced

On April 19, 2007, Packeteer (PKTR) announced  I was looking through the

I was looking through the