Stock Picks Bob's Advice

Thursday, 16 August 2007

Some Thoughts on Selling Strategy

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

With today's tumultuous trading, it would be helpful and step back for some perspective.

This is a beautiful Zen garden picture from Kyoto as published on Pattern Recognition blog.

Do you feel a little more peaceful?

As we think about the trading going on, I want to stress the importance that I have found for both perspective and planning. Perspective on what is important in life, and planning to deal with whatever the market may bring.

Throughout this blog, I have discussed the importance of limiting losses within my portfolio. As well, I have discussed the need to take small gains as stocks appreciate. It is from this approach that responding to as bad a market as today is made possible.

After each purchase and each sale of stock in my portfolio I know exactly when I need to sell my shares both on the upside as well as the downside. After each sale, I know whether I have a 'permission slip' to add a new position (after a sale on 'good news'), or whether my own trading strategy demands that I 'sit on my hands'.

My trading system lags the market. It doesn't respond quickly to the violent swings that we are witnessing. But it is tremendously helpful in getting through days like today.

My ResMed stock actually hit a sale point briefly at a 30% appreciation level (down from my last sale at a 60% gain.) Pausing to observe, the stock rebounded off that level and I deferred the sale.

I have other stocks that are near sale points including Bolt (BTJ) which has corrected from its 180% appreciation level to near a 90% appreciation for me, and Satyam (SAY) which is near an (8)% loss. Others are not far behind.

The point is that I am not able to own stocks that beat the overall market when a market moves as it is doing today. The point is that I know when I need to implement trades and at what level.

It isn't perfect, but it is working for me. Albeit slowly.

I hope that all of you are keeping your 'cool'. That doesn't mean you should be so cold that you are frozen in place. But it does mean that you should have a plan about each of your holdings. The plan doesn't necessarily need to look anything like my plan! But a plan will give you some limits, a structure that will assist you in dealing with wild gyrations in stock prices so that you do not over- or under-react.

Good Luck to all of my readers!

Bob

Wednesday, 15 August 2007

Flotek Inds (FTK) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

The market is talking to me loud and clear through my portfolio!

A few moments ago I sold my 280 shares of Flotek at $29.65 (average of two lots at $29.62 and $29.74). These shares had JUST been purchased (!) at $32.44 on August 13, 2007. You do the math. Today is August 15, 2007. YIKES.

This represented a loss of $(2.79) or (8.6)% since purchase.

Rules are rules. I hit my loss and the shares were sold. I am now down to 16 positions and holding....for now. With the sale at a loss, I shall be sitting on my hands. Unfortunately, my Meridian (VIVO) was a sale at a gain in the middle of this correction and I foolishly bought some stock. I could ask what was I thinking, but I was just following my own system which is more or less doing what it is supposed to be doing.

Anyhow, that's the glum news for now! Thanks again for visiting and feel free to leave any comments or questions on the blog or email me at bobsadviceforstocks@lycos.com. Sometimes I feel as much like an amateur as I write about being one.

Bob

Tuesday, 14 August 2007

A Reader Writes "So you use your stocks as a guide...."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I had the pleasure of getting another nice email from S.J.K. in Anchorage, Alaska, who wrote:

I had the pleasure of getting another nice email from S.J.K. in Anchorage, Alaska, who wrote:

"Thanks bob for your thoughts. We do have an investment advisor, but

often feel like he is selling us funds to get his commission or management fee. We have taken small steps into individual stock holdings with success, but only because we bought when nobody else was buying (ie. the lead up to the iraq invasion). I really appreciate your disciplined approach. It makes sense in a normal market.

So you use your stocks as your guide, as you say on your blog. To clarify, do you ever have your cash fully invested? When you sell on appreciation, you take a portion of your cash holdings in addition to the appreciation to purchase the next equity... so in theory, at 20 postions, you still have an amount of cash on hand equal to the liquidated appreciation. Is that correct?

My partner is a fellow Wisconsiner. (she's a cheesehead from green bay). That might be why I enjoy your podcast so much. Thanks again for your response.

Yours,

---S J.

Anchorage, Alaska"

S.J., thank you for writing! The market has been tough on everyone. I guess maybe the short-sellers without the 'uptick rule' are making money.

Let me talk a little about how I use my stocks 'as a guide' as you write. I should qualify this as one of those 'do as I say not as I do' moments :). Because, if you have been reading through my blog, you will realize that I carry a sizeable amount of margin which I have been hoping to pay down through sales---preferably on the upside.

But in an ideal world, I would not be in margin. My stock holdings have a value of approximately $5,000 apiece. And it would take $100,000 in cash or equity value for the 20 positions which is now my current maximum.

First your question about being at the maximum size of the portfolio. If I am at 20 positions and I sell a portion of a stock at a gain and normally would have a signal to add a position, instead in that case I 'sit on my hands' and would move that appreciation sale into a money market account.

On the other hand, if I am at my minimum of 5 positions (1/2 of the neutral 10 position portfolio), then if I sell a stock at a loss, instead of 'sitting on my hands' and applying that proceeds into a money market account, I would instead replace that sold stock to keep my exposure at 5 positions.

My system requires a minimal exposure to equities which I use as 1/4 of the maximum number of positions, because my own holdings act as the signals to be buying and selling new positions.

Also, if I were, for example, and I sold 1/7th of a holding at a gain and had a signal, like I did recently with my VIVO purchase, to add a new position, I would ideally be using the proceeds of the sale and some additional cash to purchase the new position. (In my particular case, I unfortunately use margin which is borrowed money to make the same move).

You might ask why I am so against margin. But it is due to two basic reasons. First of all, I am paying interest against that loan which reduces my performance, and secondly, the margin, especially in a down market, adds leverage to the performance which in this case is doubly bad. I don't think I need to explain further :(.

As a matter of course, I would prefer to be adding positions to the portfolio that are slightly larger than the average position I already own. I do this so that I can grow my portfolio over time. In addition, in a correction, as you will observe, the first stocks that I am letting go of are the most recent purchases. Thus, I will more quickly be moving into cash.

Another thing, I strongly suggest an automatic deposit of new cash each month into your trading account that will also assist you over time in building that portfolio into a more significant account, no matter where you start.

Thank you for your kind words and loyal listenership to my amateur podcast about my amateur investing.

This is a picture of Anchorage, October, 2006, as posted by PA2AKgirl in her travel blog. I have never been there but what a gorgeous view!

I hope tomorrow finds us in better trading shape!

Bob

Mesa Laboratories (MLAB) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago, upon checking my holdings, I saw that my Mesa Labs (MLAB) stock had plummeted and passed my (8)% loss limit. In fact, MLAB, as I write, is trading at $21.38/share, down $(3.37) or (13.62)% on the day. I sold 210 shares at $22.20 which were purchased 5/23/07 at a cost basis of $24.05. Thus, I had a loss of $(1.85) or (7.7)% on the purchase. Ironically, when I entered the sale order the stock had a greater than (8)% loss and by the time the order was filled it had rebounded a few cents to be sold just under this. Anyhow, that stock is now history and I shall be 'sitting on my hands' with the proceeds as the market corrects and my own portfolio tells me it isn't a good time to be buying anything!

Ironically, on August 13, 2007, MLAB reported solid 1st quarter results as far as I can tell. Sales climbed 17% to $4.3 million from $3.7 million and net income grew 28% to $1.01 million up from $790,000 or $.31/diluted share, up from $.25/diluted share last year.

In spite of the good earnings, in light of my own sale, I have reduced my rating on MLAB and

MESA LABORATORIES (MLAB) IS RATED A HOLD

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Monday, 13 August 2007

Flotek Industries (FTK) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago, with that 'nickel' in hand, I saw that Flotek Industries (FTK) had made the list of top % gainers on the AMEX. Flotek is an old favorite of mine having written it up as recently as May 26, 2007. Their 2nd quarter 2007 report was strong, their Morningstar.com "5-Yr Restated" page looks intact, and the chart still is impressive.

Thus,

FLOTEK (FTK) IS RATED A BUY

And buy I did. A few moments ago I used up that nickel and purchased 280 shares of Flotek (FTK) at $25.41 ($32.40--please see comment below...thanks to Allan for noticing the error!) Wish me luck. I don't know if this rally is just a 'dead cat bounce' or is something more substantial. I shall stay with my system.

Bob

Meridian Bioscience (VIVO) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

The market opened up strongly this morning, and my Meridian Bioscience (VIVO) stock opened up higher with all of the other issues. In fact, VIVO hit a sale point on the upside and I sold 38 shares of my 270 shares at $25.41. (I now have 232 shares remaining of VIVO).

Since the latest quarterly report was strong, the "5-Yr Restated" financials on Morningstar are still impeccable, to avoid confusion on SocialPicks and elsewhere, let me re-emphasize

MERIDIAN BIOSCIENCE (VIVO) IS RATED A BUY

These shares were originally purchased on 4/21/05 at a cost basis of $7.42. Thus I had a gain of $17.99 or 242.5% since my actual purchase. If you have been following my blog for awhile, my sale points on appreciation are at 30, 60, 90, 120, 180, 240, 300, 360, 450% points. As planned, this was my sixth sale of a portion of my holding, and I currently am selling 1/7th of remaining shares at each targeted site.

On the upside, my next sale point would be at a 300% gain, if it gets there, or it would work out to 4.00 x $7.42 = $29.68. If the stock reaches that level, I plan on selling 1/7th of my remaining shares or 232/7 = 33 shares. On the downside, unless there is some fundamentally bad information released that should trigger a sale sooner, I plan on selling at 1/2 of the highest appreciation level which I have had a sale. In this case, that would be at a 120% gain having just sold shares at a 240% appreciation target. That price would work out to 2.20 x $7.42 = $16.32. You can see how, in my system, as a stock performs well, I continue to give each stock more leash on the downside and actually less leash on the upside before selling!

Final point (I am getting verbose early in the morning!), since I am now at 17 positions, the sale on the upside gives me a "permission slip" to look for a new position for #18. I shall be checking the lists of top % gainers, and if anything strikes my fancy I shall be buying. As I like to say, 'that nickel is already burning a hole in my pocket!'.

Thanks again for dropping by! Please feel free to leave a comment if you have any questions or input you would like to share with me. If you would prefer, drop me a line at bobsadviceforstocks@lycos.com. Please give me your first name and a location so that we can share that with our readers if you wouldn't mind. Just makes an impersonal thing a tad more personal.

Regards!

Bob

Sunday, 12 August 2007

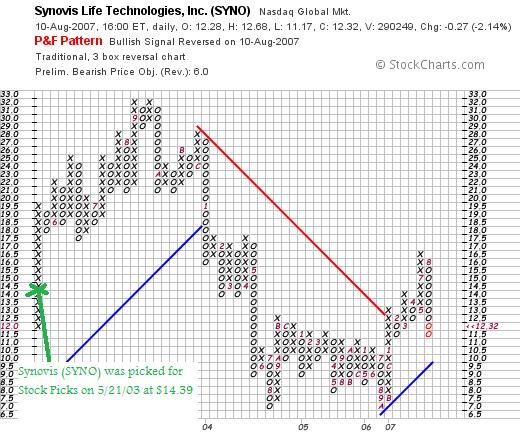

Synovis Life Technologies Inc. (SYNO) "Long-Term Review #9"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I had a little time this evening to do another one of those 'long-term' reviews on this blog. If you don't realize it, this blog had its first entry back on May 12, 2003, over four years ago and over 1,500 entries ago as well!

So many of those early posts are easily forgotten (and I wish I could forget more than a few of those!). But there are lessons to be learned from the first entries I made on this website as I was just developing my investing strategy and the investment rules were just forming.

As an exercise in this, I have been trying, from time to time, to go back to the beginning--so to speak--and see what happened to the stocks discussed early on. Last week, on August 5, 2007, I reviewed my stock pick #8, Home Depot (HD) which was first posted on May 20, 2003. The next pick was on May 21, 2003, when I discussed Synovis Life Technology (SYNO) on Stock Picks Bob's Advice.

On that date I wrote:

"May 21, 2003

Synovis Life Technology (SYNO)

The market cannot make up its mind today about direction. Appears to need to correct after its fairly good run-up the last two months.

Was checking the CNN-money list of most ups this morning....almost noon here at 11:55 am.....and thought we wouldn't find any candidates for our list. Came across this Synovis Life Technology stock....have never heard of it before....not exactly Peter Lynch investing....and it fits the bill.

SYNO is trading currently at $14.39 up $.94 (or 6.99%) Volume running at 184,572. Stock is SMALL with a market cap of $139.3 million...and only 9.683 million shares outstanding.

What moved the stock today is an outstanding earnings report which showed a 61% growth in Revenue and 63% increase in net income for the second fiscal quarter....not too shabby!

The net revenue increased to $15.3 million in the second quarter of fiscal 2003 from $9.5 million last year per the New York Times report of earnings today.

By the way the company "manufactures medical devices used in cardiac, brain, lung, and other surgeries. Its products include vascular grafts, patching materials, blood-flow interruptors, and vascular probes." That is per Morningstar.com.

Looking at the 5 year growth in revenue we see revenue of 12.0 million in 1998, 19.1 million in 1999, 22.1 million in 2000, 28.5 million in 2001 and 40.0 million in 2002. Extrapolating from the second quarter without acceleration we can anticipate a $60.0 million revenue in 2003.

There appears to be an ACCELERATION of this growth recently (!)....last four quarters before the reported quarter above...show 27.32%, 32.55%, 49.88%, and 48.07% increases in revenue year over year....free cash flow is positive by $1 million....and current assets are over $20 milllion with no long term debt and current liabilities at only $5.8 million.

This is a BEAUTIFUL stock. I don't own a share, never heard of it before scanning the lists today....but might just buy some shares in the future. Great luck investing! Bob"

Let's take a closer look at Synovis and see whether it deserves to be actively considered on this blog!

Synovis (SYNO) closed at $12.32 on August 10, 2007, for a net loss of $(2.07) or (14.4)% since posting.

On May 30, 2007, Synovis announced 2nd quarter 2007 results. Revenue increased 11% to $16.6 million and earnings turned around for a profit of $759,000 or $.06/diluted share, improved from a net loss of $(475,000) or $(.04)/share the prior year.

On May 30, 2007, Synovis announced 2nd quarter 2007 results. Revenue increased 11% to $16.6 million and earnings turned around for a profit of $759,000 or $.06/diluted share, improved from a net loss of $(475,000) or $(.04)/share the prior year.

Longer-term results as reported on Morningstar.com are less satisfactory with revenue peaking at $60.3 million in 2005, then dipping to $55.8 million in 2006 and only increasing to $56.7 million in the TTM.

Earnings have gone nowhere with $.50/share reported in 2003, dipping to $.10/share in 2004 and 2005, then back to a loss of $(.10)/share in 2006 and up to $.10/share in the TTM.

Free cash flow has improved from $2 million in 2005 and $2 million in 2006 to $3 million in the TTM.

The balance sheet is solid with a current ratio of 11!

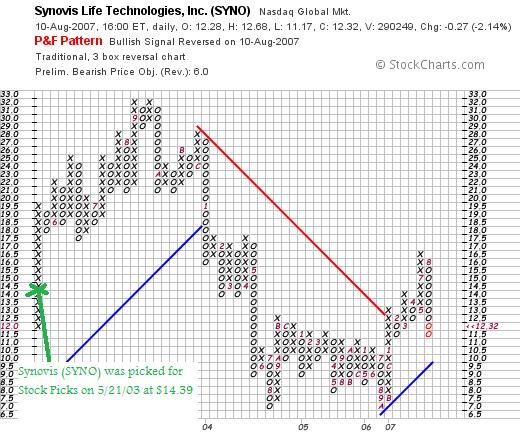

Let's take a look at the "Point & Figure" chart on SYNO from StockCharts.com. Here we can see that the stock moved sharply higher after being picked on the blog. However, in September, 2003, after bumping twice into the $32 level, the stock turned lower, finally bottoming twice at the $7 level, first in August, 2004, then again in October, 2006, before breaking through resistance and moving higher. Recently the stock has been under pressure with the turbulence in the market, but has not broken down from its short-term move higher.

With the satisfactory quarterly report, but the spotty Morningstar.com report with decent news just over the past 12 or so months, and a chart that only short-term looks encouraging, the best I can do is to decide that

SYNOVIS LIFE TECHNOLOGIES (SYNO) IS RATED A HOLD

Thanks so much for stopping by and visiting my blog! I hope that this week finds the markets trading a little less wildly, and that reason and calmness returns to your trading and your lives.

Have a good week my friends!

Bob

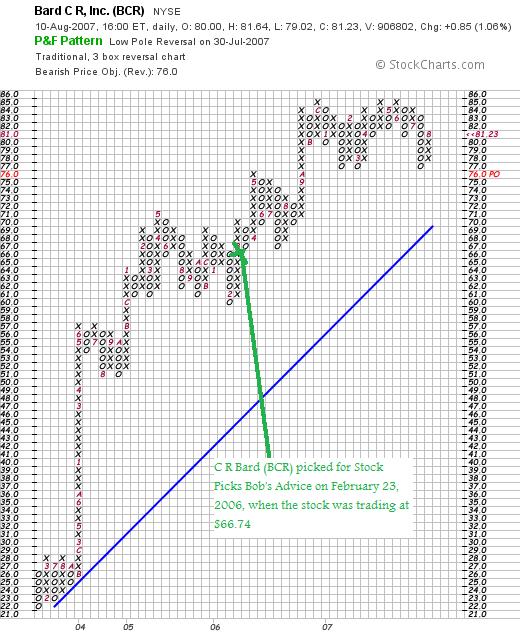

"Looking Back One Year" A review of stock picks from the week of February 20, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Sometimes after a difficult week in trading it is easy to lose perspective about the long-term results of investing. Let's take a look back to a year ago at the week of February 20, 2006, and see how those stock picks turned out. Last weekend I reviewed the selections from February 13, 2006, and as I like to do, I try to move ahead one week each weekend and check out the picks from that entire week.

These reviews assume a buy and hold strategy with all of the stocks selected. In practice, I utilize an active portfolio management strategy in which I try to limit my losses by selling my losing stocks quickly and completely and preserve my gains by selling appreciating stocks slowly and partially at targeted appreciation levels. This difference between the review and my actual practice would certainly affect performance measurements and should be taken into consideration.

On February 22, 2006, I posted Metrologic (MTLG) on Stock Picks Bob's Advice when it was trading at $23.57. Metrologic was taken private by Francisco Partners-led private equity firm at $18.50/share as reported on September 12, 2006. This worked out to a decline of $(5.07) or (21.5)% since posting.

On February 22, 2006, I posted Metrologic (MTLG) on Stock Picks Bob's Advice when it was trading at $23.57. Metrologic was taken private by Francisco Partners-led private equity firm at $18.50/share as reported on September 12, 2006. This worked out to a decline of $(5.07) or (21.5)% since posting.

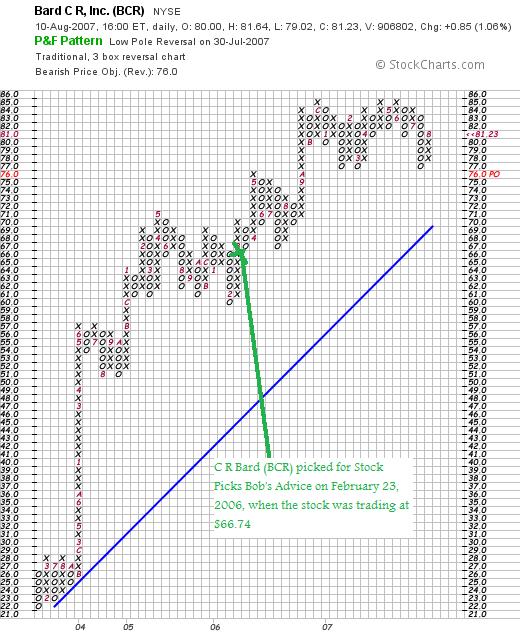

On February 23, 2006, I posted C R Bard (BCR) on Stock Picks when it was trading at $66.74/share. BCR closed at $81.23 on August 10, 2007, for a gain of $14.49 or 21.7% since posting.

On February 23, 2006, I posted C R Bard (BCR) on Stock Picks when it was trading at $66.74/share. BCR closed at $81.23 on August 10, 2007, for a gain of $14.49 or 21.7% since posting.

On July 24, 2007, Bard reported 2nd quarter 2007 results. Revenue climbed 10% to $545.7 million from $496.5 million. Net earnings came in at $97.5 million or $.91/share, up from $81.4 million or $.76/share. These were good results but did come in $.02 shy of estimates of $.93 according to Thomson Financial.

On July 24, 2007, Bard reported 2nd quarter 2007 results. Revenue climbed 10% to $545.7 million from $496.5 million. Net earnings came in at $97.5 million or $.91/share, up from $81.4 million or $.76/share. These were good results but did come in $.02 shy of estimates of $.93 according to Thomson Financial.

Reviewing the "point & figure" chart on BCR from StockCharts.com, we can see that while the stock has been under some short-term pressure and appears to be consolidating in price, the chart is still well above its support level.

With the solid earnings report and still strong chart,

C R BARD (BCR) IS RATED A BUY

On February 25, 2006, I posted NATCO Group (NTG) on Stock Picks Bob's Advice when the stock was trading at $24.61. NTG closed at $44.21 on August 10, 2007, for a gain of $19.60 or 79.6% since posting.

On August 1, 2007, NTG reported 2nd quarter 2007 results. Revenue came in at $140.7 million, up 9% over prior year revenue of $128.7 million. Net income was $11.8 million or $.62/diluted share up from $9.3 million or $.50/diluted share last year.

On August 1, 2007, NTG reported 2nd quarter 2007 results. Revenue came in at $140.7 million, up 9% over prior year revenue of $128.7 million. Net income was $11.8 million or $.62/diluted share up from $9.3 million or $.50/diluted share last year.

Looking at the "point and figure"chart on NTG from StockCharts.com we can see that this is quite a strong chart, and although it has recently experienced some small amount of profit-taking, does not appear to have broken down from its upward movement and appears to be trading well above its support levels.

In light of he solid earnings report and intact price chart,

NATCO GROUP (NTG) IS RATED A BUY

So how did I do with these three stock picks from that week back in February, 2006? In a word terrific! One stock was acquired, one showed a solid gain, and the other had a fabulous price appreciatio. The average gain for the three stocks works out to 26.6%.

It is nice sometimes to look back a bit to get perspective! Although it is true that past performance is not a guarantee of future performance and that as always, recall that I am an amateur investor.

Thanks again for visiting! Please feel free to leave your comments or questions right on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Saturday, 11 August 2007

Graftech (GTI) "A Brief Review and a Podcast Tonight!"

CLICK HERE FOR MY PODCAST ON GRAFTECH

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Let me briefly go through GrafTech (GTI), which was the topic of my podcast this evening.

Let me briefly go through GrafTech (GTI), which was the topic of my podcast this evening.

Graftech (GTI) made the list of top % gainers on Friday, gaining 17.07% to $15.64, up $1.65 on the day. I do not own any shares or options on this stock.

GrafTech (GTI) reported 2nd quarter 2007 results on August 2, 2007. It was a solid report that beat analysts expectations.

The Morningstar.com "5-Yr Restated" financials on GTI are solid except for some erratic earnings which have indeed solidly grown the past few years. Free cash flow and the balance sheet look nice.

Yahoo "Key Statistics" on GTI showed this mid cap stock with reasonable p/e, nice PEG under 1.0, and lots of shares out short.

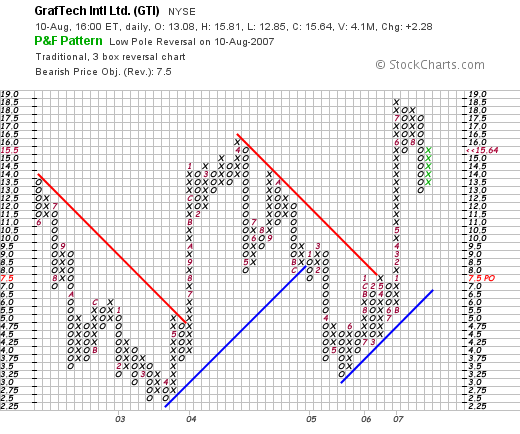

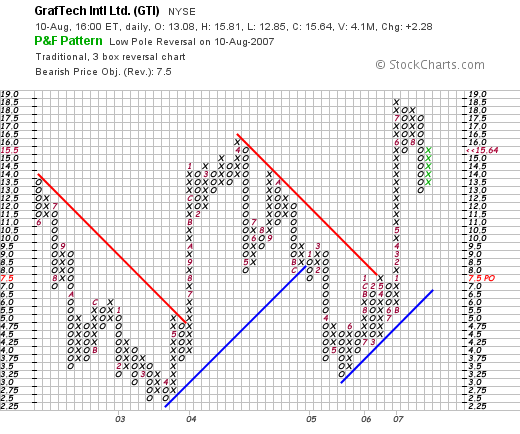

The "point and figure" chart from StockCharts.com appears encouraging without appearing overextended.

With the nice move Friday, the solid earnings report, decent valuation, great Morningstar.com report, and reasonable chart,

GRAFTECH (GTI) IS RATED A BUY

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

A Reader Writes "...although the principle behind having a stop is solid, fixing the % is not."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! It was nice to see that I had another letter this afternoon from a reader and follower of my Covestor Page. It is nice to see that I am reaching investors through this blog, my Podcast site as well as my Covestor account. I enjoy discussions about investing with fellow investors. I continue to learn much about the process from their comments and my need to find reasonable responses to their inquiries.

Don B. wrote:

Don B. wrote:

"Congrats on exiting when your stop was hit. It's rarely possible to find out beforehand why a given position is plunging.

Regarding the matter of O'Neil's 7-8% stop rule: I've long believed that although the principle behind having a stop is solid, fixing the % is not.

Why?

1. Some stocks fluctuate that much and more per day. CUB shot up 26% on 8/10.

2. The 7-8% pullback may well coincide with major chart support. If you’re buying on the basis of a chart idea, it makes some sense to me to base your initial stop on a chart idea as well. This would be right under the most recent low, not closer, no matter what % is involved, because closer means it’s well within the noise range, which means way too close!

There is a simple solution which will preserve the principle of having a stop, but not too close:

- Size your position before entering, so that your $ risk is the same for all positions. Here’s the way this works:

- Decide beforehand what % of your account you’re willing to lose per trade. The maximum should be 2%, but should probably be lower. So, if you have $50,000 in your account, the maximum you should risk on any trade would be 2% * $50,000, or $1000.

- Using CUB as an example, if you were to buy this at the close 8/10, 32.89, the closest you could put your stop would be at 25.99, one tick under the recent low. That’s a risk of 6.90 points per share, and 21% below the buy price. If you’re limiting your risk to $1000 in this hypothetical example, you’d divide the $1000 by 6.90, and that would give you 145 (rounded up) shares. To check your arithmetic, 145 * 6.9 = $1000.

- But then figure your cost, which is 145 * 32.89 = $4769. This comes to 9.5% of your account. If you sized every position this large, you’d only be able to be in 10.5 positions, which is well under the optimal level for proper diversification. Ideally, an account needs to aim for 30 plus positions. If you were intent on aiming for 30+ positions, you’d divide your total equity by 30, which gives $1667, and then divide that by the buy price of 32.89, which gives 50 shares. So, depending on whether you are intent on diversifying broadly, or not, you could have as few as 50 shares, and as many as 145, but not more.

- Note: this approach is not the same as allocating the same total $ per trade. That will vary considerably. It’s a way to minimize risk across all positions, allowing for the great differences in various positions, and insuring your ability to stay diversified.

Good luck in this beast of a market!

Don"

It is a privilege to receive as thoughtful a comment as Don wrote. Don is an experienced commodity trader, and invesor. You can visit

Don's Covestor Page and find out more about his strategy and philosophy. In fact Don has written about his own strategy in a sort of explanation much like mine:

"1. Basing stock selection on some mix of fundamental and technical criteria whose validity is backed up by decades of research--as opposed to basing my selection on the hype du jour.

2. Having a clearly thought out plan for how much to risk on each position, as opposed to basing this on my gut feeling that this is my lucky day.

3. Having a specific plan for how I'll limit my loss if wrong, and maximize my profit if I'm right. In my case, this is a trend-following program.

4. Having a way to manage my own biases, greed, fear, etc., so that I don't let them sabotage my trades. I already have enough memories of the killer trades that I got out of prematurely. This involves recording in detail my reasons and criteria at the point of entry, as well as exit. I then carry out a rigorous periodic review of all of my trades, which is helping me become a more disciplined trader."

You can see that Don and I share many of the same philosophies that I suppose comes from years of doing things without that discipline and realizing that rules are necessary to increase one's chance at success.

Don has suggested a more flexible approach to the extremely rigid 8% rule that I follow on limiting losses. As I understand his suggestion, he is writing that it is wrong to limit a stock to an 8% loss. I

recently wrote about how Roger Nusbaum also shared this observation. Don here suggests that it would be wiser to allow each position to fluctuate a certain percentage of the entire account. Thus, unless each position is of equal value, then the fluctuation would also vary.

In the particular example, Don would have allowed a stock to decline about 21% before a sale would be triggered. In this particular case CUB turned around and climbed 26% on August 10th. And the sale was ill-advised.

I actually do not know if Don is right or wrong on this matter.

I do know that my goal is first and foremost to limit risk in investing.

I have found it easy and disciplined to implement this same 8% loss limit on every position. You will see that once a stock starts appreciating, this arbitrary loss limit disappears and my biggest gainers are given much more slack so to speak. Thus, my recent purchases are quickly dropped if the market turns on me.

It also seems that it might be wise to continually increase the size of your positions as you invest successfully. This makes sense from the perspective of undoing your investments in a declining market. Since your latest investments are most vulnerable to a quick sale on a market pullback, they would also be the larger positions to do so. It might help move your entire portfolio into cash quicker.

Anyhow, there are many ways to 'skin a cat'!

From "12 Ways to Skin a Cat" by Bob Jenyns of Australia.

Thank you all for writing and listening. There are many wiser and cleverer investors out there who may well have better approaches to managing a portfolio. The important part is to develop rules about your holdings. Knowing when to buy, when to sell, and how much to buy and sell.

Don and I don't have exactly the same approach to investing, but we are certainly reading from the same book.

Thanks Don and if any of you have other comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Newer | Latest | Older

I had the pleasure of getting another nice email from S.J.K. in Anchorage, Alaska, who wrote:

I had the pleasure of getting another nice email from S.J.K. in Anchorage, Alaska, who wrote:

On May 30, 2007, Synovis announced

On May 30, 2007, Synovis announced

On February 22, 2006, I

On February 22, 2006, I  On February 23, 2006, I

On February 23, 2006, I

Let me briefly go through GrafTech (GTI), which was the topic of my

Let me briefly go through GrafTech (GTI), which was the topic of my