Stock Picks Bob's Advice

Tuesday, 18 October 2005

October 18, 2005 Graco (GGG)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

First of all, I would like to apologize to any of my readers that were looking for my posts the last few days. I was away from my computer, and I am sure I missed posting at least as much as some of you may have missed reading what I had to write :). Anyhow, I am back at work so let's see what we have here today.

Looking through the

list of top % gainers on the NYSE today, I came across Graco, Inc. (GGG), near the top, trading at $35.89, up $2.61 or 7.84% on the day as I write. I do not own any shares nor do I have any options on this stock.

According to the

Yahoo "Profile" on GGG, the company "...supplies various systems and equipment for the management of fluids in industrial, commerical, and vehicle lubrication applications."

On July 25, 2004, the company reported

2nd quarter 2005 results. Net sales for the quarter ended July 1, 2005, grew 24% from year-earlier figures to $198.2 million. Net earnings of $35.6 million were up 19% from the prior year. Diluted net earnings per share came in at $.51, a 19% increase over the $.43 reported the previous year.

Looking a bit longer-term at the

Morningstar.com "5-Yr Restated" financials, we can see that except for a dip from 2000 to 2001, revenues have grown steadily from $494.4 million in 2000 to $679.1 million in revenue in the trailing twelve months (TTM).

Earnings have also grown nicely, again except for a dip between 2000 when the company earned $1.01/share, dropping to $.92/share in 2001, earnings subsequently increased steadily to $1.70/share in the TTM.

Free cash flow has been solidly positive, increasing from $83 million in 2002 to $100 million in the TTM.

The balance sheet as presented on Morningstar also looks strong with $7.1 million in cash and $209.1 million in other current assets, more than enough to cover both the $139.1 million in current liabilities and the $43.6 million in long-term liabilities and still have about $30 million left-over.

In general, I like to use the

Ameritrade definition of Market Capitalization when discussing stocks:

Small-cap -- less than $500 million Mid-cap -- between $500 million and $3 billion Large-cap -- over $3 billion

Thus, looking at the

Yahoo "Key Statistics" on GGG, we can see that GGG is still considered a "mid-cap" with a market capitalization of $2.45 billion.

Other parameters on the Yahoo page reveal that Graco has a trailing p/e of 21.03, and a forward p/e of 16.83 (fye 31-Dec-06). Even with these moderate p/e's, growth is still expected to be relatively modest as the PEG (5 yr expected) still comes in at a bit of a rich level of 1.49.

What about the Price/Sales ratio? As Paul Sturm from Smart Money has

written, the Price/Sales ratio can provide you a sense of relative valuation of a stock compared to similar companies in its general "industrial group.". In particular, using the

Fidelity.com eresearch site, we can see that Graco (GGG) sits at the top of its group "Diversified Machinery" in terms of valuation with a Price/Sales ratio of 3.4. Graco is followed by Roper (ROP) at 2.6, Illinois Tool Works (ITW) at 1.9, and Ingersoll Rand (IR) and Pentair (PNR) at 1.3, and Eaton (ETN) at the bottom of the pack with a Price/Sales of 0.9. Thus, GGG is certainly not a screaming bargain by this parameter.

Looking back at Yahoo for some additional statistics, we find that the company has 68.70 million shares outstanding. As of 9/12/05 there were 1.51 million shares out short representing 2.20% of the float or 9.1 trading days of volume. This is a fairly significant chunk of shares out short (imho), as I use a 3 day short ratio as a cut-off. Thus, we could have some short-sellers feeling a "squeeze" and pushing the stock higher today.

The company does pay a small dividend of $.52/share yielding 1.56%. Yahoo reports that the company last split its shares on 5/31/04 with a 3:2 split.

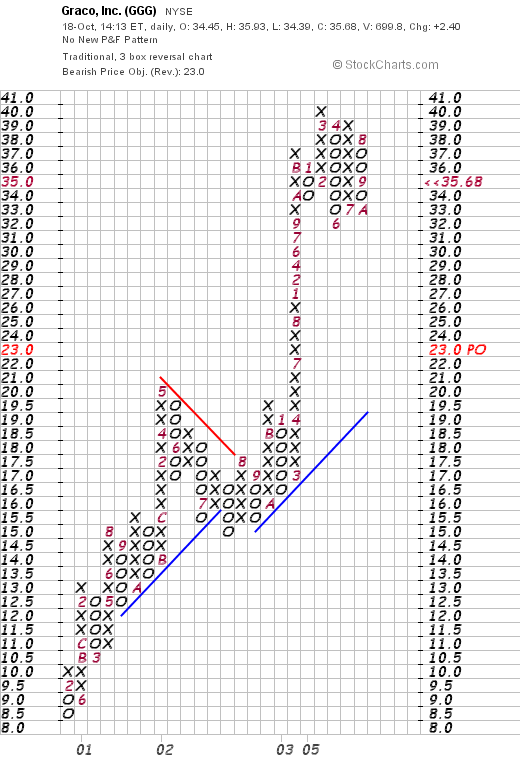

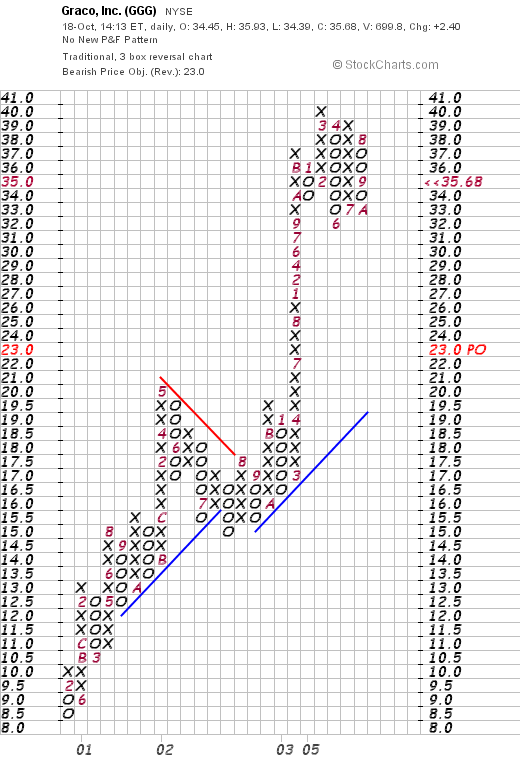

And what does the chart look like? Taking a look at the

Graco "Point & Figure" chart from Stockcharts.com:

We can see that this stock has been a very strong performer for as long as this chart records, which is at least since February, 2001. With little interruption, the stock has been steadily moving higher.

So what do I think? Well, the latest quarter looks strong, the past five years the company has done well fundamentally with strong revenue and earnings growth, the company has solid free cash flow and a strong balance sheet. Technically, imho, the chart looks strong as well.

On the downside, valuation is a bit rich with a PEG at about 1.5, and the Price/Sales at the top of its group. However, the positives may well outweigh the negatives imho.

Thanks again for stopping by! I am glad to be back from my short hiatus from blogging! I hope you all had a great weekend and we have a reasonably good trading week ahead of us! If you have any questions or comments, please feel free to leave them right on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Thursday, 13 October 2005

A Reader Writes "What do You Think? (MDT)"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

My mailbox has been 'humming' lately. I love getting mail! Always have, ever since I was a kid. Something exciting about snail mail and even email.

Bob K. wrote in, with questions about Medtronics (MDT). My wife does have a few shares (under 100) in an IRA, otherwise, I don't own any of these shares or have any options on them. I have

posted Medtronics (MDT) on Stock Picks back on November 13, 2003, (even though I wrote November 13, 2002(!)) when it was trading at $46.39. As I write, MDT is trading at $55.00, up $.21 or 0.38% on the day (the market has moved back into the green for now.).

Back to the letter:

Hi Bob,

I was looking at the top gainers for the NYSE today and Medtronics caught my eye. Everything looks good except the earnings decline and heavy insider trading. The earnings decline is with an increase in sales. Looks as though they bought some market share, but their margin can afford it. What do you think?

Thanks,

Bob

PS You asked if your trading transparency is useful. As a novice in this area I appreciate this information immensely. So often personal financial information of this type is a deep dark secret. There are not many ways a beginner can see how a real-world investor manages his portfolio. This is a valuable educational experience for me. Thanks for the insight!

First of all thank you for writing. You make some excellent points about earnings. I do not think that my approach is the only way to invest. It might not even be the best way. It is just something that I have found helpful. But let's take a look at that latest quarterly report on MDT.

Looking through the headlines, I found something very bullish for the stock price of Medtronic (MDT). On October 11, 2005, the company announced that they were

raising guidance for 2006-2008. Whenever a company

raises guidance, it is as if they are raising the "thermostat" on valuation. If you are a 'wonk' (excuse me if I am being offensive), I imagine there are people out there feeding numbers into computer terminals all the time trying to figure out the 'appropriate' price of a stock. And if earnings and revenue expectations are raised, well that means the stock price is relatively undervalued and deserves to be pegged at a higher price.

On August 17, 2005, MDT

announced 1st quarter 2006 results. Revenue grew 15% to $2.7 billion over the prior year. However, as Medtronic reported:

In the quarter, Medtronic recorded pre-tax, IPR&D charges totaling $363.8 million related to the acquisition of Transneuronix, Inc.; a patent cross-licensing agreement with NeuroPace, Inc.; and the purchase of intellectual property from Gary K. Michelson, M.D. and Karlin Technologies, Inc.

It was this expense that knocked the company from a profit to a loss. What to do with this? If you avoid one-time expenses like this, the results look good. I probably will miss stocks by avoiding quarterly reports like this.

But if everything goes well with Medtronic with this acquisition, etc., then I suspect the stock will come in with better reports in the next and ensuing quarters, and I will have other opportunities to purchase shares. (Since I am not looking for a purchase, I wouldn't bother with it anyway). If I

were in the market to make a purchase, I would skip over a stock that has too many footnotes explaining a loss. Even a great company like this!

Anyhow, that's my amateur take on the report! I hope you find this helpful. I sure do appreciate your participation in the blog.

If you have any other questions or comments, please feel free to leave them right on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

A Reader Writes "We took a bath yesterday with COH."

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Checking my mail this morning, I saw that I had received another comment from Faith who wrote earlier about Coach (COH).

She commented today:

Thanks Bob,

I wasn't looking for inside info...just some insight.

We took a bath yesterday with COH.

"Coach (COH: sentiment, chart, options), the peddler of such luxury

goods as fine leather purses and made-to-impress day planners, has lost

more than five percent today without any notable news to account for the

drubbing. COH has been in decline mode since late July, dropping about

one-fifth of its value beneath the resistance of its 10-day and 20-day

moving averages. Today's decline shoved the stock beneath its 10-month

moving average, below which the shares have not endured a solid monthly

close since November 2001."

http://www.schaeffersresearch.com/commentary/observations.aspx?ID=14357

Faith

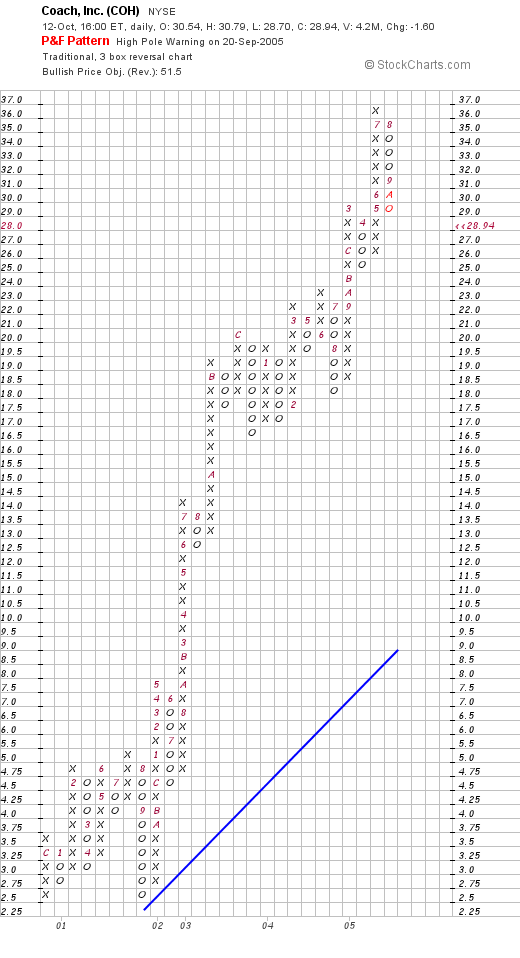

Thanks Faith! I am not a big technician. It just looks from my "point & figure" chart from Stockcharts.com, that the stock doesn't looks as terrible as Schaeffer wants to point out. I basically believe that since COH has been one of the very top performers in the market this past 18 months, that when profit-taking came in, as we are observing right now, the top gainers tend to get nailed. That is just my own particular perspective.

As you know, I just let the stock price dictate my action on a stock, unless something truly fundamental arises to make me sell earlier. Even in those cases, I find I might have done better sitting tight! Thus, since I have taken profits on this stock multiple times, the latest quarterly report still looks solid, well, I shall be sitting tight unless my sell-point should hit.

The stock is still under a bit of pressure today. As I write, COH is trading at $28.16, down $(.78) or (2.70)% on the day. I currently own 102 shares with a cost basis of $8.33 so that looks ok. My last sale was on 6/16/05, when I literally had a 300% gain. Thus, if I were to let the stock retrace to 50% of my last gain, or a 150% gain level, then I should be selling my remaining shares if the stock declines to $8.33 x 2.5 = $20.83. I have a few more points to go before I bail.

As for what you should do, I never recommend buying stocks as they are declining. Sort of trying to catch a "falling knife" as they say in the trade. I also suggest keeping losses very small; I use an 8% loss limit on initial purchases regardless of how long I have held a stock. I have literally sold stocks withing 24 hours of buying them.

Unfortunately, I don't have much more insight to provide you on this. I believe that COH is a solid company , but is currently under pressure in a weak market environment. Good luck and let me know what you do/have done! I hope you don't mind me sharing your comments with our readers here! Your comments are important, your thoughts are appreciated, and your participation is very-much desired!

If you have any other comments, or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

"Trading Transparency" Quiksilver (ZQK)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

A few moments ago I checked my "Trading Portfolio" and realized that Quiksilver (ZQK) had passed the 8% loss level, and I went ahead and sold my shares. Currently, as I write, ZQK is trading at $13.04, down $(.20) or (1.51)% on the day.

I sold my 400 shares at $12.98 (so it has already rebounded a tad from there). These shares were purchased 4/25/05 at a cost basis of $14.23/share, so I had a loss of $(1.25) or (8.8)%, so out they went. I am now down to 23 positions, from my maximum of 25 positions. This will eventually entitle me to add two new positions into the portfolio. As you know, my strategy is to listen to what my portfolio is telling me! That is, since I just sold a position at a loss, without even looking at market statistics, my portfolio is telling me to sit tight! That is, I shall use the proceeds to pay down a bit of my margin and wait until one of my positions hits a sale point at a gain to be adding a new stock!

I will continue to be monitoring my portfolio. I do not try to anticipate what the market will be doing. I let my stocks dictate my actions to me. I hope this is a successful strategy!

Regards to all of you readers as you "batten down the hatches" and sit tight as this Category 3 of a correction rips through our portfolios! Thanks so much for stopping by. If you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Wednesday, 12 October 2005

A Reader Writes "Would you buy now? (COH)"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor (!), so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I was checking my mail today and I was surprised to find two emails about Coach (COH). I have owned Coach in my own portfolio since February, 2003, however recently, the stock has been weak and questions are arising about whether it is time to sell, buy, or just sit tight with Coach. Before discussing this, let me remind you that I am honestly, truly, absolutely an amateur investor! I use the news sources that I can obtain on my high speed internet connection. I grab news stories from Yahoo, CNN, or Fidelity.com. I have no access to inside information, and I don't interview managers or anything like that!

But let me first share with you the emails:

First, Faith wrote:

Hi Bob,

I enjoyed your blog of, Saturday, 1 October 2005 "Weekend Trading

Portfolio Analysis" Coach (COH). Do you know what the heck is going on

with Coach today???? We're losing our shirts. Any news you know that

Google News doesn't know?

Thanks,

Faith

And tonight I got a second email, this time from Kevin who wrote:

Hello, Bob

You have quite an impressive site, at least the part

that I saw regarding stocks and COH in particular. I

bought some at $32.50 a month or so ago and would like

to buy more now, but I'm not sure. The stock price has

fallen quite a bit in the last week or so. Would you

buy now? Or would you wait? My logic is saying buy

low, and wait. After all it's an investment, and it

will eventually recoup, right?

thanks for you advice

Kevin (a newcomer to this world of stocks)

First of all, let me thank both of you for writing. Let me start with Faith. Coach

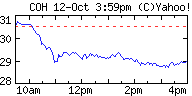

did have a rough day today closing at $28.94, down $(1.60) or (5.24)% on the day.

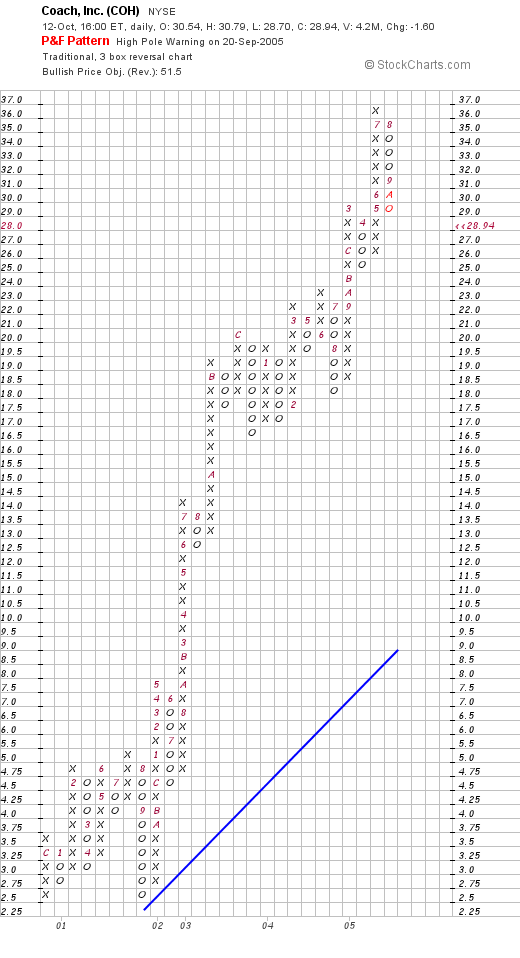

Looking at the one-day graph from Yahoo demonstrates the slide in the stock. However, let's take a step back and look at the "Point & Figure" graph on COH:

Here we can see that the strength of COH appears undiminished. The stock has pulled back slightly from its recent high at around $36.50, but has not broken down below the support level (imho). It does help to get the big picture!

I searched news the same way you did and I couldn't find much. There was a story from Motley Fool suggesting that if the consumer pulls back a bit, the high end stores like COH might feel the heat. Otherwise, no news that I can find.

Insofar as "losing your shirts", I recommend and utilize an 8% stop under my stocks after an initial purchase to prevent small losses from becoming major disasters. You will need to consider your strategy prior to making your stock purchase.

Back to the question about "what happened" to COH. This might be best explained by looking at the CANSLIM definition especially the "M" in CANSLIM meaning "Market". The stock market has been in a funk, and in general, there has been a lot of what I would describe as "profit-taking" on stocks where some investors have large profits (like COH).

As I pointed out in my COH Review, COH sits in the industrial group called Textile-Apparel/Footwear/Ac. (?accessories?).

Other stocks in this group include NKE which closed at $81.92, down $(1.06) or (1.28)% on the day; Reebok (RBK) which closed at $57.45 down $(.09) or (.16)%; Timberland (TBL) which closed at $32.12, down $(.38) or (1.17)% on the day; and Wolverine Worldwide (WWW) which closed at $21.29, up $.33 or 1.57%.

In conclusion, I don't know anything particular about COH that you wouldn't know.

Taking a look at what Kevin wrote, I cannot tell whether COH would or wouldn't be a good buy in here, My hunch is that it would likely be profitable. However, in my own portfolio, I don't buy stock that have declined and are thus better "values". COH may well be a great value and thus would be a profitable transaction to pick up some shares in here. I prefer to buy stocks that are moving higher (found on the top % gainers list). I cannot predict whether COH will recoup, although I have a hunch that is quite likely.

I would prefer to see you buying something with more momentum, such as the CMN stock ahat I reviewed recently. Just my style I guess. Good luck and keep me posted on how you are handling these issues.

Bob

Posted by bobsadviceforstocks at 11:33 PM CDT

|

Post Comment |

Permalink

Updated: Wednesday, 12 October 2005 11:39 PM CDT

"Revisiting a Stock Pick" Johnson Controls (JCI)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Looking at the

list of top % gainers on the NYSE today, I came across a familiar name, Johnson Controls (JCI), which closed at $63.60, up $2.75 or 4.52% on the day. My son owns about 20 shares of JCI, otherwise I do not own any shares nor do I have any options.

I first

posted JCI on Stock Picks on 7/9/04 when it was trading at $53.24. Thus, this stock has appreciated $10.36 or 19.5% since posting on the blog.

There were two stories that were released yesterday that appear to be contributing to the strength of this stock in the midst of a rather pessimistic trading environment. JCI

announced a joint venture for hybrid vehicle batteries and also

reassured the "street" on 2006 and 2007 promising continued double-digit growth in the next two years. These stories in themselves appear to have added support to the stock price!

Looking at a few additional supporting facts on this stock, the

3rd quarter 2005 earnings were announced on July 21, 2005. Sales for the quarter grew 9% to $7.1 billion from $6.5 billion in the same quarter the prior year. Net income came in at $254.7 million, up from $222.2 million the prior year, and on a diluted eps basis, this was $1.31/share, yup from $1.15/share the prior year.

Looking at the

Morningstar.com "5-Yr Restated" financials, we can see a beautiful picture of steady revenue growth from $17.2 billion in 2000 to $28.6 billion in the trailing twelve months (TTM).

Earnings have also grown steadily from $2.55/share in 2000 to $4.63/share in the TTM. At the same time, the company has been paying a dividend and increasing it each year as well, with $.56/share paid in 2000, increasing to $.98/share in the TTM.

Free cash flow has been a bit erratic but has stayed positive with $563 million reported in 2002, increasing to $673 million in the TTM.

The balance sheet is adequate if not fabulous, with $385.2 million in cash and $6.3 billion in other current assets, balanced against $6.3 billion in current liabilities and $3.1 billion in long-term debt.

Looking at Yahoo

"Key Statistics" for JCI, we find that the company is a large cap stock with a market capitalization of $12.25 billion. The trailing p/e is downright cheap at 13.72, with a PEG of only 1.12 and a Price/Sales of 0.41. There are as of 9/12/05, 1.75 million shares out short representing only 0.9% of the float or 1.8 trading days of volume. The short interest doesn't look too significant to me.

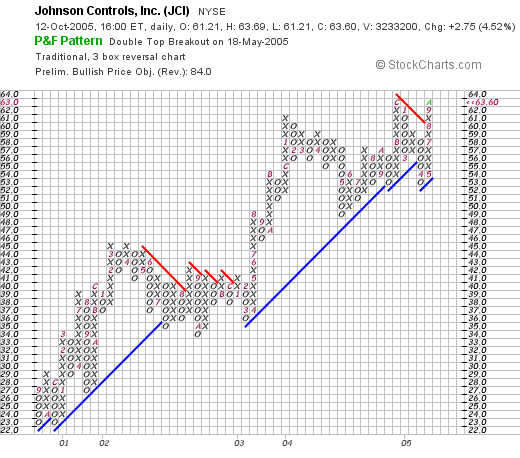

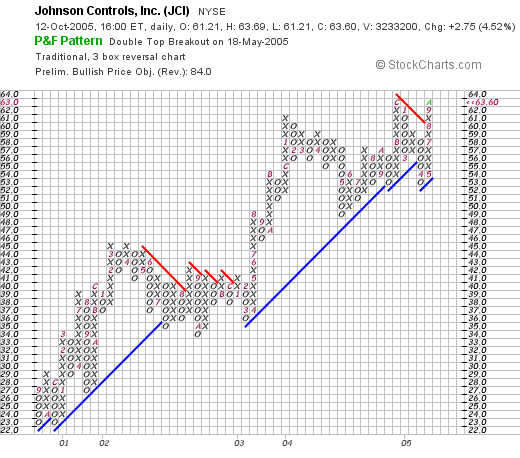

If we look at a

Johnson Controls "Point & Figure" chart:

We can see what looks to me as a very strong and steady appreciation in stock price from the $23 level in September, 2000, to the $63 level in September, 2005. There have been periods of consolidation in the stock price, yet the stock has not broken down the past five years, nor does it appear over-extended.

What do I think? I think this is a great stock. Of course, I am not buying anything until I sell a portion at a gain, but the latest quarter, the past five years, the record of increasing dividends, the steady free cash flow, the solid balance sheet, reasonable valuation, and steady chart looks very attractive to me!

Thanks so much for stopping by! Hope that you all survive this bear market correction intact. Remember to stick to whatever trading rules you might have....I shall be monitoring my own stock prices closely. If you have any questions or comments, please feel free to leave them right here on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Tuesday, 11 October 2005

A Reader Writes, "I wanted to bring to your attention...."

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please rmemember that I am an amateur investor so please remember to consult with your professional investment advisors prior to making any decisions based on information on this website.

Checking my mail a couple of days ago, I saw that Matt P. had written me another nice note. I would like to share it with you here:

Bob,

Hey, thanks for the direction on the stock club. It was very useful.

I'm hoping to go to one of the meetings here in Boise soon. I'm

excited about that. One stock that I wanted to bring to your

attention is Aqua American, WTR. I've only held it for a month or

two, but it has been a great position for me. An article was

released on them recently in Kiplinger's.

http://www.kiplinger.com/personalfinance/columns/picks/archive/2005/pick1007.htm

This article excited me about the stock. I bought at $32, and saw it

go to nearly $40 but has been declining for the past few days. I

think its a very interesting play.

have a great day, and don't let the bears get ya down!

Matt

Thanks again for writing Matt! The bears haven't gotten me down yet but they are chasing me up a tree!

Image from "A Bear's Story"

But seriously, let's take a look at WTR! It is a bit late here, but let's look at the latest quarterly result, a Morningstar.com review, and the latest "Point & Figure" chart.

First of all, Aqua America (WTR) closed at $34.53 on 10/11/05 down $1.00 or 2.81% on the day. WTR reported 2nd quarter 2005 results on August 3, 2005. Operating revenue increased 16% to $123.1 million for the second quarter, from $106.5 million last year. Net income was up 24% to $22.2 million from $17.9 million for the same period last year. Finally, diluted earnings per share grew 21% to $.23, up from $.19 the same quarter the prior year.

Looking at the "5-Yr Restated" financials, we can see the steady and very nice series of bar graphs symbolizing corporate revenue. Earnings have also steadily growth from $.65 in 2000 to $.91 in the trailing twelve months TTM.

Here's where things break down a bit. The company has had negative free cash flow since at least 2002 when the company reported $(24) million in free cash flow. This has fluctuated but has stayed negative the last yew years.

The balance sheet as reported by Morningstar.com also shows the effect of the persistently negative free cash flow. Morningstar shows WTR with $5.4 million in cash and $77.4 million in other current assets, not onough to cover the $230.6 million in current liabilities and the $1.4 billion in long-term liabilities. I prefer to see lots of cash and current assets and very little of the current and long-term liabilities that I do see today.

What about a graph? Taking a look at a Point & Figer chart, we can see some of the strength of this stock which has been trading higher the past 6 months. align="left">

In a nutshell, the last quarter was terrific. Earnings growth is solid, but the company is free cash flow negative and has been the last few years. In addition, the balance sheet is not as robust as might be hoped for.

If you have any other questions or comments, please feel free to leave them on the website, or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 11:17 PM CDT

|

Post Comment |

Permalink

Updated: Tuesday, 11 October 2005 11:20 PM CDT

Sunday, 9 October 2005

"Looking Back One Year" A review of stock picks from the week of August 2, 2004

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

As I like to do on weekends, I try to do a retrospective review of my stock picks. These are not necessarily, and usually not, actual stocks that I hold in my trading account. However, this week, I will touch on Mentor (MNT) which

is also a stock that I own.

The analysis of the performance of these stocks is based on a simple buy and hold approach. In actual practice, I sell my losing stocks quickly (triggered by an 8% loss), and sell my gaining stocks slowly and piecemeal, selling 1/4 of my holdings at various targeted gains, with a 30% gain being my first sale point. Obviously, if one employed this technique, performance would vary possibly greatly from what I report. However, for the sake of simplicity, I use the easier to calculate buy and hold approach.

On August 2, 2004, I

posted DHB Industries (DHB) on Stock Picks at $17.05. DHB closed at $4.03 on 10/7/05, for a loss of $(13.02) or (76.4)%. This

has to be one of my

worst selections on my blog! Which again shows you that my picks are not a guarantee to anything! However, If you

had owned this stock, and kept to the 8% loss limit, you still would be o.k.!

On July 28, 2005, DHB

reported 2nd quarter 2005 results. Revenue increased slightly to $88.2 million compared with $86.1 million the prior year. However diluted earnings/share, was flat at $.17/share compared with $.17/share the prior year same period. The stock recently took a tumble when it

announced the discontinuation of a bullet-proof vest line, when the federal government said "...vest containing Zylon might not provide officers with as much protection as they are supposed to" according to the article. Looking through the news, there are multiple lawsuits against the company pending.

On August 3, 2004, I made my only other stock pick for the week,

Mentor (MNT), which I posted on Stock Picks at a price of $34.45. As I pointed out just above, I also purchased some shares of Mentor for my "Trading Portfolio". MNT closed at $51.16 on 10/7/05, for a gain of $16.71 or 48.5% since posting.

On August 2, 2005, Mentor

reported 1st quarter 2006 results. Sales came in at $135.3 million, an 11% increase over the first quarter 2005 results. Earnings per share came in at $.47/share, a 27% increase over earnings in the same period the prior year. Helping the stock performance was the

July 28, 2005 report that the Mentor silicone gel-filled implants were "approvable" as announced by the FDA, meaning the product was nearing final regulatory acceptance.

So how did I do with these two stocks? Well one was terrible with a (76.4)% loss, and was was great with a 48.5% gain. Averaging these two, I had an average loss of (14.0)%.

Thanks again for stopping by! I hope the upcoming weak is a bit more positive in tone. The market imho does appear to be a bit oversold. But then again, I try hard to to respond to my own fears and hopes regarding any stock or portfolio, but instead respond to the stock moves themselves! If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com or just simply post them right here on the blog!

Bob

"Weekend Trading Portfolio Analysis" Cooper (COO)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I had a busy weekend, and am just getting around to a bit of 'housework' here on the blog! Last week, I sold my Dell stock when it hit a sell point on the downside in the face of continued Bearish trading activity on all of the markets. Thus, I am now down to 24 positions and am in a position to add a position if I sell a portion of one of my holdings at a targeted gain. On top of this, I just pulled $5k out of my portfolio as a downpayment on a new (slightly used) car! Thus, I shall be working hard to get that margin once more under control.

One thing I don't talk about, is my cash additions/withdrawals from the account. This doesn't affect my gains but it sure can cause problems for margin! Currently, I have been adding $200/month on a regular basis. With my margin level, the account is paying about $465/month just in interest expenses! I shall need to add a bit more to the monthly payment to at least offset more of the interest, continue paying down the margin with sales (hopefully on the upside), and may yet start making payments on my new vehicle from the account which shall confound all of you as well.

But let's get back to talking about stocks, shall we? One thing I have started doing on this website is to review positions in my actual trading account, that I follow along with my "picks" on this blog. I call that account my "Trading Portfolio", and when I make a trade in there, I try to post as soon as possible for you, the reader, and call it "Trading Transparency". This review of my holdings, started about a month ago, is a weekly stock in my actual account, and with 24 positions, it will take me about six months, going alphabetically through my list, reviewing one each week!

Last week I

reviewed Coach (COO) from my "Trading Portfolio". Next alphabetically is Cooper (COO).

I first purchased 200 shares of Cooper Companies (COO) at $26.98 on 2/25/03. This was actually before my first entry on this blog, which was initiated back on

May 12, 2003, when I "picked" St Jude Medical. My first formal

discussion of Cooper on Stock Picks was on 9/1/04 when Cooper was trading at $63.33.

COO closed on October 7, 2005, at $72.08, giving me a gain of $45.10 or 167.2% on my original shares! I have sold portions of my Cooper shares four times: 50 shares were sold 6/2/03 at $34.46, for a gain of $7.48 or 27.7% (a little shy of my goal of 30%...back in 2003 I was still refining my strategy and working on my selling discipline); another 50 shares 9/4/03 at $41.00, for a gain of $14.02, or 52.0% (again a bit shy of that 60% target for my second sale today); a third sale of 25 shares on 12/31/03 at $46.92, for a gain of $19.94 or 73.9% (again shy of my 90% third sale target today); a fourth sale of 15 shares on 7/7/04 at $60.14, for a gain of 122.9% (

at my goal of 120% for my fourth sale); and a

fifth sale of 15 shares at $76.13 on 1/27/05 for a gain of $49.15 or 182.2% (with my goal of 180% you can see that my discipline and stragegy in selling is getting more refined!).

Thus, I made a purchase of $5,396 of Cooper (COO) in early 2003. Since then I have sold portions of this holding five times for proceeds totalling $7,034.98, and still own 45 shares of Cooper at $72.08, for a current value of $3,243.60.

When do I sell next, since I have sold 5 times with the last sale at the 180% gain point, my next sale will be either at the 240% gain point on the upside or 3.4 x $26.98 = $91.73 or at the 90% gain point on the downside, 1.9 x $26.98 = $51.26.

Let's take another look at the Cooper stock story! According to the

Yahoo "Profile" on COO, the company "...engages in the development, manufacture, and marketing of healthcare products worldwide. It operates in two segments, CooperVision and CooperSurgical."

On September 7, 2005,

Cooper reported 3rd quarter 2005 results. Due to the acquisition of Ocular Sciences, revenue climbed from $129 million to $222 million, Net Income jumped to $37.3 million from $24.0 million last year same quarter, and diluted earnings per share climbed to $.79/share from $.67/share the prior year same period.

Reviewing the

Morningstar.com "5-Yr Restated" financials, we can see the steady revenue growth from $201.2 million in 2000 to $716.6 million in the trailing twelve months (TTM).

Earnings during this period grew steadily from $1.00/share in 2000 to $2.71/share in the TTM. The company also pays a small dividend which has increased from $.04/share in 2000 to $.06/share in the TTM.

Free cash flow has also been growing steadily from $33 million in 2002, to $69 million in the TTM.

The balance sheet is strong with $18 million in cash and $420.3 million in other current assets, enough to pay off all of the current liabilities of $217.4 million, and make a dent in the long-term liabilities of $703.2 million. This long-term debt, while not excessive, was the only 'negative' on this page. Even that didn't look that bad!

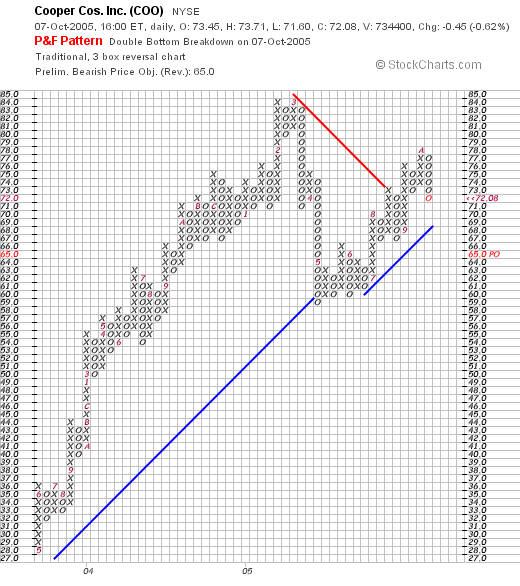

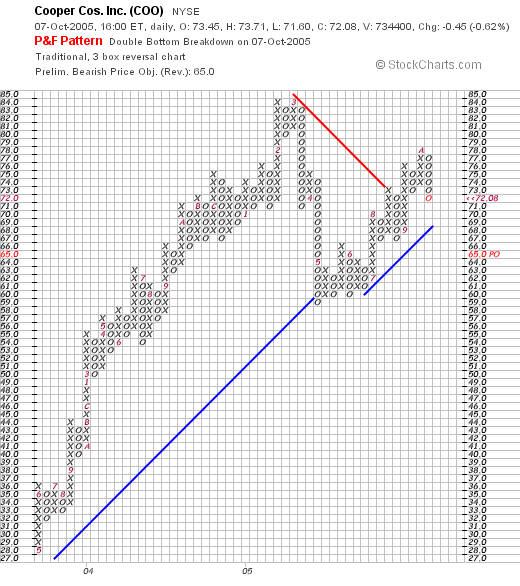

What about the chart? Taking a look at the

Stockcharts.com "Point and Figure" chart on COO:

This is an interesting chart, showing how the stock showed incredible strength between May, 2003, shortly after my purchase, and March, 2005, when the stock peaked at $84. At that point, weakness developed and the stock tested its support level at around $60 (the blue line), the stock held that level, and now has started moving higher once again. The stock chart looks fairly strong to me!

Anyhow, that was avery long-winded discussion. Please let me know if you think this is helpful. I like to share with you both actual holdings as well as just stocks that look attractive! I hope the rest of your weekend goes well. Please remember that I am truly an amateur and that past performance in no means guarantees future performance both for my methods, my blog, my stock holdings, my picks, and any of the ideas you may see on the internet! If you have any comments or questions, please feel free to leave them right here on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Thursday, 6 October 2005

"Trading Transparency" Dell

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

The 'bear' is growling on Wall Street!

A few moments ago, I realized that my Dell (DELL) stock had hit a sale point on the downside. Since I have actually sold portions of my DELL twice, at approximately 30% and 60% gain points, on the downside, my target was at a 30% gain to unload the rest of my shares. The stock passed through this level and I sold my remaining 120 shares at $31.91.

These shares were originally purchased 2/14/03 at a cost basis of $25.13, so I still had a gain of $6.78/share or 27.0%. Thus, I am back to 24 positions but shall not be adding any final 25th stock until I sell a portion of one of my other 24 at a gain target. Meanwhile, I shall be paying down my margin, something you really do not want to have as a market declines, which just leverages your losses!

Thanks so much for stopping by! If you have any questions or comments, please feel free to leave them right here on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Newer | Latest | Older

First of all, I would like to apologize to any of my readers that were looking for my posts the last few days. I was away from my computer, and I am sure I missed posting at least as much as some of you may have missed reading what I had to write :). Anyhow, I am back at work so let's see what we have here today.

First of all, I would like to apologize to any of my readers that were looking for my posts the last few days. I was away from my computer, and I am sure I missed posting at least as much as some of you may have missed reading what I had to write :). Anyhow, I am back at work so let's see what we have here today. Looking through the list of top % gainers on the NYSE today, I came across Graco, Inc. (GGG), near the top, trading at $35.89, up $2.61 or 7.84% on the day as I write. I do not own any shares nor do I have any options on this stock.

Looking through the list of top % gainers on the NYSE today, I came across Graco, Inc. (GGG), near the top, trading at $35.89, up $2.61 or 7.84% on the day as I write. I do not own any shares nor do I have any options on this stock. Earnings have also grown nicely, again except for a dip between 2000 when the company earned $1.01/share, dropping to $.92/share in 2001, earnings subsequently increased steadily to $1.70/share in the TTM.

Earnings have also grown nicely, again except for a dip between 2000 when the company earned $1.01/share, dropping to $.92/share in 2001, earnings subsequently increased steadily to $1.70/share in the TTM. Other parameters on the Yahoo page reveal that Graco has a trailing p/e of 21.03, and a forward p/e of 16.83 (fye 31-Dec-06). Even with these moderate p/e's, growth is still expected to be relatively modest as the PEG (5 yr expected) still comes in at a bit of a rich level of 1.49.

Other parameters on the Yahoo page reveal that Graco has a trailing p/e of 21.03, and a forward p/e of 16.83 (fye 31-Dec-06). Even with these moderate p/e's, growth is still expected to be relatively modest as the PEG (5 yr expected) still comes in at a bit of a rich level of 1.49.

Hello Friends! Thanks so much for stopping by and visiting my blog,

Hello Friends! Thanks so much for stopping by and visiting my blog,

Looking at the

Looking at the

On August 2, 2004, I

On August 2, 2004, I  On July 28, 2005, DHB

On July 28, 2005, DHB  On August 3, 2004, I made my only other stock pick for the week,

On August 3, 2004, I made my only other stock pick for the week,  On August 2, 2005, Mentor

On August 2, 2005, Mentor  Hello Friends! Thanks so much for stopping by and visiting my blog,

Hello Friends! Thanks so much for stopping by and visiting my blog,  Last week I

Last week I  COO closed on October 7, 2005, at $72.08, giving me a gain of $45.10 or 167.2% on my original shares! I have sold portions of my Cooper shares four times: 50 shares were sold 6/2/03 at $34.46, for a gain of $7.48 or 27.7% (a little shy of my goal of 30%...back in 2003 I was still refining my strategy and working on my selling discipline); another 50 shares 9/4/03 at $41.00, for a gain of $14.02, or 52.0% (again a bit shy of that 60% target for my second sale today); a third sale of 25 shares on 12/31/03 at $46.92, for a gain of $19.94 or 73.9% (again shy of my 90% third sale target today); a fourth sale of 15 shares on 7/7/04 at $60.14, for a gain of 122.9% (at my goal of 120% for my fourth sale); and a fifth sale of 15 shares at $76.13 on 1/27/05 for a gain of $49.15 or 182.2% (with my goal of 180% you can see that my discipline and stragegy in selling is getting more refined!).

COO closed on October 7, 2005, at $72.08, giving me a gain of $45.10 or 167.2% on my original shares! I have sold portions of my Cooper shares four times: 50 shares were sold 6/2/03 at $34.46, for a gain of $7.48 or 27.7% (a little shy of my goal of 30%...back in 2003 I was still refining my strategy and working on my selling discipline); another 50 shares 9/4/03 at $41.00, for a gain of $14.02, or 52.0% (again a bit shy of that 60% target for my second sale today); a third sale of 25 shares on 12/31/03 at $46.92, for a gain of $19.94 or 73.9% (again shy of my 90% third sale target today); a fourth sale of 15 shares on 7/7/04 at $60.14, for a gain of 122.9% (at my goal of 120% for my fourth sale); and a fifth sale of 15 shares at $76.13 on 1/27/05 for a gain of $49.15 or 182.2% (with my goal of 180% you can see that my discipline and stragegy in selling is getting more refined!). Let's take another look at the Cooper stock story! According to the

Let's take another look at the Cooper stock story! According to the  Reviewing the

Reviewing the