Stock Picks Bob's Advice

Sunday, 19 August 2007

"Trading Portfolio Update" August 19, 2007

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Transparency. Such an important topic. As part of my blogging, I have worked very hard to keep all of my readers informed of my actual holdings, my actual trades, and how I have been doing. I don't know how to write about stocks without letting you know whether I own or don't own positions in the stocks I write about. I cannot discuss with you portfolio management philosophy without showing you what I am actually doing in my own 'trading portfolio'. This blog is not about hyping any stocks or pretending to be something it isn't. It is just about thinking about stocks, developing investment strategy, and dealing with the volatile market in equities that we face. I hope this has been helpful in this regard.

On about a monthly basis, I have been trying to write up a summary of my holdings and an update on recent trading activity. Fortunately, I am now participating in Covestor and you can view my Covestor Page where my holdings and their performance are also reviewed. But Covestor doesn't provide actual share #'s and doesn't have the long-term history of each stock purchase. So I don't think these reviews will be completely obsolete in the near future.

My last review of my holdings was on July 8, 2007. Since then we have seen an extremely volatile stock market. We have observed 200 point swings or more on many trading days. We have witnessed the near-collapse of the subprime mortgage market and the challenges facing even Countrywide Financial.

My portfolio is now down to 16 positions. I shall be waiting for a partial sale of an existing position to move to 17 positions (up to a maximum of 20), and shall be prepared to move to 15 if one of my holdings hits a sale point. (down to a minimum of 5 positions if needed).

Let's take a look at my 'trading portfolio' which I shall list in alphabetical order followed by: symbol, number of shares held, date of purchase, price of purchase, latest price (8/17/07), and percentage unrealized gain (or unrealized loss).

Bolt Technology (BTJ), 129 shares, 1/12/07, $17.44, $39.45, 126.25%

Cerner Corp. (CERN), 120 shares, 2/2/07, $49.76, $57.48, 15.51%

Coach (COH), 61 shares, 2/25/03, $8.33, $44.32, 431.97%

Covance (CVD), 119 shares, 4/9/07, $62.61, $71.08, 13.52%

Harris Corp. (HRS), 120 shares, 1/31/07, $50.05, $57.60, 15.08%

Kinetic Concepts (KCI), 140 shares, 7/13/07, $56.31, $58.44, 3.78%

Morningstar (MORN), 120 shares, 11/22/05, $32.57, $62.22, 91.01%

Precision Castparts (PCP), 74 shares, 10/24/06, $69.05, $131.50, 90.44%

Quality Systems (QSII), 88 shares, 7/28/03, $7.75, $39.68, 412.08%

ResMed Inc (RMD), 150 shares, 2/4/05, $29.87, $40.79, 36.57%

Satyam Computer Svcs (SAY), 210 shares, 4/20/07, $25.55, $24.55, (3.92)%

Starbucks (SBUX), 50 shares, 1/24/03, $11.40, $26.70, 134.11%

Universal Electronics (UEIC), 155 shares, 2/23/07, $25.24, $28.47, 12.79%

Meridian Bioscience (VIVO), 232 shares, 4/21/05, $7.42, $25.15, 238.99%

VCA Antech (WOOF), 210 shares, 7/27/07, $41.04, $38.94, (5.11)%

Wolverine World Wide (WWW), 200 shares, 4/19/06, $23.55, $27.44, 16.54%

Since my last review on July 8, 2007, I sold my 350 shares of MedTox Scientific (MTOX) at a loss on 7/12/07, sold 12 shares of Precision Castparts at a gain on 7/12/07, and purchased 140 shares of Kinetic Concepts on 7/13/07. On 7/24/07 I sold 17 shares of Kyphon (KYPH) at a gain and purchased 105 shares of National Oilwell Varco (NOV) on 7/25/07. On 7/27/07 I sold my position in Kyphon (KYPH) of 108 shares. I then purchased 210 shares of VCA Antech (WOOF) on 7/27/07. On 8/6/07, my recent purchase of National Oilwell Varco (NOV) hit a sale point on a loss and my 105 shares were sold. On 8/6/07, 20 shares of Morningstar (MORN) were sold at an apprreciation target and I purchased 280 shares of Cubic (CUB) on 8/6/07. Also on 8/6/07, my Baldor (BEZ) hit a sale point at a loss and 140 shares were sold.

On 8/8/07 my Cubic (CUB) stock declined to a sale point and my 280 shares were sold. On 8/9/07 I sold my 120 shares of Hologic (HOLX) as it declined to a sale point. on 8/13/07 38 shares of Meridian Bioscience (VIVO) were sold at an appreciation point. With that 'permission' I purchased 280 shares of Flotek (FTK) on 8/13/07. On 8/14/07 my shares of Mesa Laboratories (MLAB) hit a sale point and all 210 shares were sold. The next day, on 8/15/07, my 280 shares of Flotek (FTK) were sold as the stock hit a targeted sale at a loss.

Currently I am at 16 positions. My equity value is at $95,453.58 and I am still carrying a margin balance of $(37,624.36) giving my account a net value of $57,829.22. (This is down from the account value of $63,930.58 last month.) However, with the sales, the margin equity percentage has improved to 60.58%.

As of 8/17/07, I have $26,306.07 of unrealized gains in the account. I have now taken a net of $(1,757.12) in short-term losses, and $23,712.56 in realized long-term gains for a total realized gain of $21,955.44 in 2007. I have also paid $3,078.30 in margin interest this year. I have received a total of $320.28 in ordinary dividends and miscellaneous income in 2007.

Thus, it hasn't been an awful year for me, but I have taken a 'hit' with this correction as I am sure most of you have also experienced. I continue with my disciplined investment strategy and very much enjoy the opportunity of sharing with all of my readers my thoughts and strategy on investing and dealing with the good times as well as the bad that we all must experience as we respond to the vagaries of the stock market!

Have a good week everyone and stay healthy!

Bob

Saturday, 18 August 2007

New Century Financial (NEWCQ.PK) "Long-Term Review #10"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I probably should rename this blog, The Good The Bad The Ugly, after that 1966 'spaghetti western' starring Clint Eastwood. It is a great movie if you somehow haven't seen it.

I probably should rename this blog, The Good The Bad The Ugly, after that 1966 'spaghetti western' starring Clint Eastwood. It is a great movie if you somehow haven't seen it.

There have been a lot of great stock picks on this blog. But then again, we have a few duds now and then. I emphasize over and over the need to manage one's holdings, to limit one's losses, and not to stick one's head in the sand and ignore the world.

It just isn't a good idea.

I unfortunately wrote up New Century Financial (NCEN) and also spent some time as a stockholder It wouldn't have been a good stock to hold long-term at all.

This was my tenth stock discussed on this blog. I wrote up New Century Financial (NCEN) on May 22, 2003, when the stock was trading at $47.02/share. This company is probably the most concentrated stock in the sub-prime mortgage area. Needless to say, its current financial status is rather bleak, and the company now trades on the pink sheets and is now a very speculative penny stock that last traded at $.10/share and trades under the new symbol NEWCQ.PK.

This is what I wrote on May 22, 2003, about this company:

"May 22, 2003

New Century Financial (NCEN)

As you can see from my post yesterday on the main website page here (http://bobsadviceforstocks.tripod.com), I am an owner of New Century Financial...in my trading account. I have actually purchased this several times starting in 12/02 when I purchased 100 at an average cost of $23.41, 12/24/02 another 100 at an average cost of $26.68, and a final 100 at an average cost of $28.03. Following my own rules, I sold 100 on 5/5/03 for an average cost of $39.93. I had reached over a 50% gain in this issue in a short period of time and starting lightening up a little. So important to sell losses QUICKLY and sell gainers SLOWLY. Can only help to bias your results to the upside.

Anyhow, NCEN is having a GREAT day trading at $47.02 up $6.57 as we write at 9:22 am Central Time. What caused this pop is the fact that NCEN TODAY announced that in was INCREASING 2003 eps guidance from the $7.40-$7.50 range up to $8.75 to $9.25 range. Yes....this company is anticipating earnning about $9.00 per share (!!!) and sells even after this move for only $46. The company "is engaged in originatin, purchasing, selling and servicing subprime mortgage loans secured by first mortgages on single-family residences," according to the CNN.money site http://money.cnn.com/MGI/snap/A1434.htm (I hope that works for you to get to the profile section). Last quarter total revenues rose 61% to $181 million and net income rose 50% to $45.7 million.

Looking at Morningstar.com on this issue, we find

sequential growth in revenue from $98.6 million in 1997, $176.4 million in 1998, $233.9 million in 1999, $163.9 million in 2000 (which IS a drop which I would RATHER not see....but the rest of this is so good!), $293.3 million in 2001 and $511.1 million in the 'trailing twelve months'.

In addition, in today's announcement, NCEN indicated that they would maintain their $.10/share dividend (an added plus)...which means in effect a 50% increase in effective dividend return. This is a 50% increase because they announced a 3 for 2 stock split.

Unfortunately, Morningstar does not have the free cash flow report but interestingly does have the growth in revenue the last four quarters showing a 779.39%, 134.17%, 117.42%, and 86.84% increase in revenue each quarter. Pretty impressive!

For a final note, even AFTER today's big price rise, NCEN sells at a p/e ratio of only 6.18 suggesting tremendous value in their shares.

As a caveat, I know NOTHING about the management of this company...and would hold to an 8% stop loss on any purchase which I always suggest on all issues. If the stock should rise further....start selling some shares at a 40-50% range in gain....this is really an insurance of reducing your overall cost

on any purchase. Good luck and happy investing."

My own personal experience with this stock is as noted, I purchased 100 shares at $23.41, and $26.68 in December, 2002, and another 100 at $28.03. I sold 100 5/5/03 at $39.03, I sold 50 shares 6/5/03 at $48.77, another 50 6/9/03 at $49.31. The last 100 shares split 3:2 and I received 50 shares on 7/14/03, and then went ahead and sold my last 150 shares 7/29/03 at $25.70.

Thus, my total cost of the shares was $2,341 + $2,668 + $2,803.00 for a total cost of $7,812.

My total proceeds were $3903 + $2438.50 + $2465.50 + $3855 = $12,662; thus, I had a gain of $4850 or 62.1% since purchase. I was very lucky with this particular stock that later melted down and ended up in bankruptcy. With the stock at just $.10/share this is a virtual complete decline from the initial pick price.

The last news

story that I could find on the web was a report dated August 10, 2007, in which New Century reported they will be unable to file second quarter 2007 results on time. In fact as noted:

"New Century has yet to report financial results for the first quarter and for full-year 2006.The last time the company issued financial results was November, when it reported its third-quarter 2006 performance.

New Century had been the second-largest provider of home loans to high-risk borrowers but New Century collapsed after a spike in mortgage defaults led its lenders to pull funding and demand that it buy back bad loans.

The company stopped trying to make new home loans in March due to lack of funds."

Anyhow, THAT was pick #10. I managed to get in an out of it fairly quickly, and I think I could even see the writing on the wall shortly after writing up the stock when the stock price started declining on what was really good news they reported.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Bolt Technology (BTJ) "Weekend Trading Portfolio Analysis"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amater investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of my weekend assignments on this blog is to update my trading portfolio. This blog serves several simultaneous tasks. I try to post as many stock market ideas as possible, I discuss my own stock holdings which I call my "Trading Portfolio", and I spend time suggesting and exploring portfolio management strategy. I hope that all of this is useful for all of you. If any of you have any comments or questions, I am always interested in reading them as comments on the blog or you can email me at bobsadviceforstocks@lycos.com.

Currently I am at 16 positions, down from my maximum of 20, yet well above my minimum of 5. I have been trying to review a holding every two or three weeks so that it takes close to a year to get through the list. Going alphabetically, following Baldor (BEZ), a stock I no longer own and that I reviewed on August 5, 2007, I am up to Bolt Technology (BTJ).

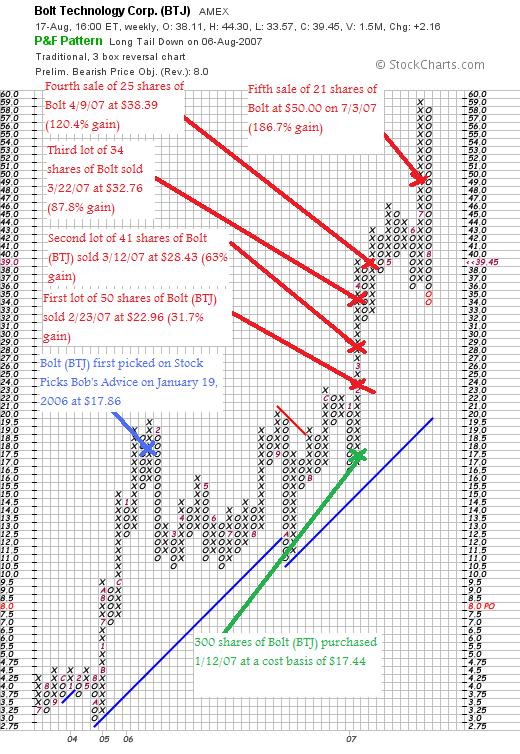

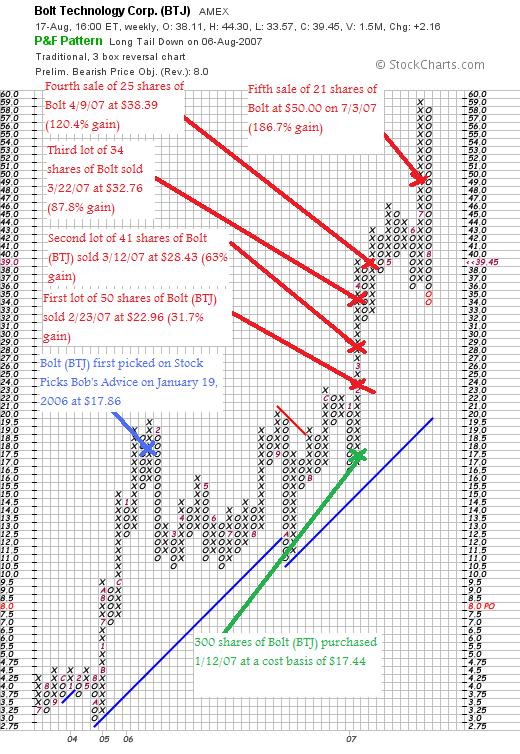

I first reviewed Bolt (BTJ) on Stock Picks Bob's Advice on January 19, 2006, when the stock was trading at $17.86. Currently I own 129 shares of Bolt (BTJ) which were purchased 1/12/07 with a cost basis of $17.44. Bolt closed on August 17, 2007, at $39.45, for an unrealized gain of $22.01 or 126.2% since purchase. I have sold portions of Bolt five times, at 30, 60, 90, 120, and 180% levels of appreciation.

On the upside, I would plan on selling 1/7th or 129/7 = 18 shares if the stock should appreciate to a 240% appreciation level or 3.40 x $17.44 = $59.30. On the downside, with the latest sale at a 180% appreciation level, I am planning on selling all remaining shares should the stock decline to a 90% appreciation point (1/2 the highest appreciation target at which the stock has been sold), or 1.90 x $17.44 = $33.06. You can see that this particular stock is closer to a sale on the downside rather than near the upside target at least for now.

Let's take a look at the 'point and figure' chart on Bolt (BTJ) from StockCharts.com:

The upward move of Bolt (BTJ) has not quite broken down but the stock is indeed coming close to a sale according to my own trading strategy.

The latest earnings report that I could locate was the 3rd quarter 2007 results which were reported on April 25, 2007, and are available on the Bolt website. For the quarter ended March 31, 2007, revenue increased 51% to $12.7 million from $8.4 million last year. Net income increased 118% to $2.85 million or $.50/diluted share, up sharply from the $1.3 million or $.23/diluted share reported in the prior year. As is often the case, the year-end and 4th quarter often take a bit longer than the 3 month interval we normally expect on quarterly reports. However, I would expect that these results would soon be forthcoming.

The latest earnings report that I could locate was the 3rd quarter 2007 results which were reported on April 25, 2007, and are available on the Bolt website. For the quarter ended March 31, 2007, revenue increased 51% to $12.7 million from $8.4 million last year. Net income increased 118% to $2.85 million or $.50/diluted share, up sharply from the $1.3 million or $.23/diluted share reported in the prior year. As is often the case, the year-end and 4th quarter often take a bit longer than the 3 month interval we normally expect on quarterly reports. However, I would expect that these results would soon be forthcoming.

Finally, the Morningstar.com "5-Yr Restated" on Bolt is intact with steady revenue growth, earnings growth, and stable outstanding shares. Free cash flow is positive and increasing, and the balance sheet is solid.

With the solid earnings report, a chart that while showing some recent volatility is still showing an intact upwards move, and a solid Morningstar report,

BOLT (BTJ) IS RATED A BUY

Thanks again for visiting my blog! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor page where my current Trading Portfolio is analyzed and monitored. Also, be sure and visit my SocialPicks page where all of my picks are reviewed and analyzed as well. If you still have time after all of that, consider listening to a podcast or two on my Stock Picks Podcast Website.

Phew....that's a mouthful of stuff to do!

Good luck next week in the market. Let's find out if the Fed's action has staying power and if the market can hold on to Friday's gains. Just like an increase in the Fed rate, a cut in the rates may well lead to another!

Bob

"Looking Back One Year" A review of stock picks from the week of February 27, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this weekend.

What a difference a day makes! The Fed cut rates by 0.5% on Friday to ease the credit crunch and the market soared...giving the S&P its best day in nearly 4 1/2 years!

There were many moments when I was anxious to throw in the towel and take my cash and put it in my mattress! Instead, I stuck with my investment strategy and sold when selling was indicated and sat on my hands when that was called for!

But it is Saturday and while I have a few moments to catch up on my weekend homework around here, let me get to the 'review'! In general, I try to keep working at examination of past stock selections each weekend going back a bit more than a year and see how they would have turned out if actually purchased as picked.

This review assumes a buy and hold approach to investments. In practice, I actually employ a disciplined investment strategy that dictates to me when to be buying and when and how many shares to be selling. This difference in strategies will certainly affect ultimate performance. However, for ease of evaluation, I shall stick with these 'buy and hold' reviews. Perhaps someday I can implement a more accurate computer modeling using my own actual investment strategy!

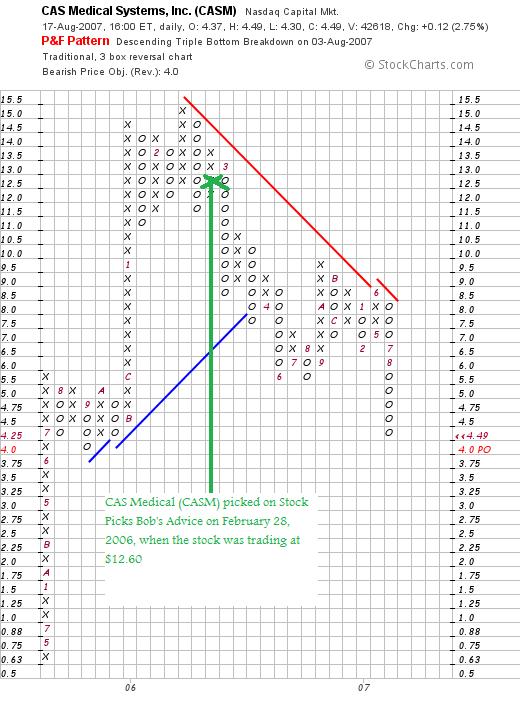

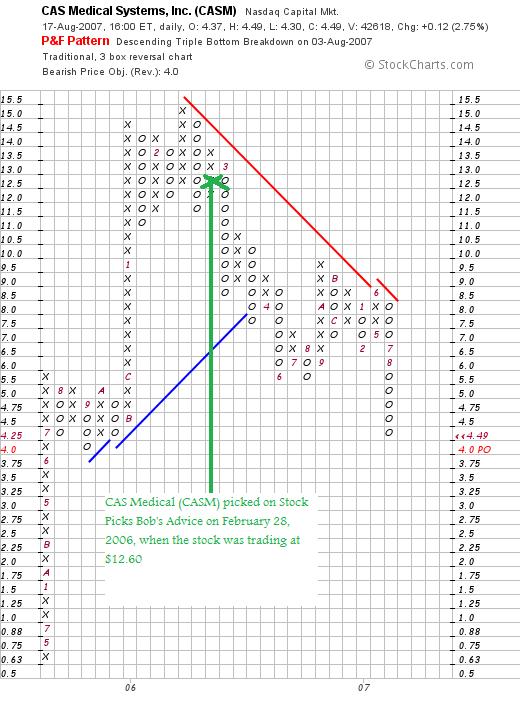

On February 28, 2006, I posted CAS Medical (CASM) on Stock Picks when the stock was trading at $12.60. CASM closed at $4.49 on August 17, 2007, for a loss of $(8.11) or (64.4)%.

On February 28, 2006, I posted CAS Medical (CASM) on Stock Picks when the stock was trading at $12.60. CASM closed at $4.49 on August 17, 2007, for a loss of $(8.11) or (64.4)%.

On August 9, 2007, CASM announced 2nd quarter 2007 results. Revenue for the quarter came in at $7.96 million, down $67,000 from $8.03 million reported in the same quarter in 2006. Earnings came in at a loss of $(.03)/diluted share, down from a profit of $.03/diluted share the prior year.

On August 9, 2007, CASM announced 2nd quarter 2007 results. Revenue for the quarter came in at $7.96 million, down $67,000 from $8.03 million reported in the same quarter in 2006. Earnings came in at a loss of $(.03)/diluted share, down from a profit of $.03/diluted share the prior year.

Reviewing the 'point and figure' chart on CASM from StockCharts.com, we can see the unfortunate timing of my pick with the stock hitting resistance in February, 2006 and then trading consistently under the resistance level. This is a very weak chart at this point from my perspective.

With the weak earnings report and weak chart,

CAS MEDICAL SYSTEMS (CASM) IS RATED A SELL

On March 1, 2006, I posted Autodesk (ADSK) on Stock Picks Bob's Advice when the stock was trading at $41.68. ADSK closed at $44.90 on August 17, 2007, for a gain of $3.22 or 7.7% since posting.

On March 1, 2006, I posted Autodesk (ADSK) on Stock Picks Bob's Advice when the stock was trading at $41.68. ADSK closed at $44.90 on August 17, 2007, for a gain of $3.22 or 7.7% since posting.

On August 16, 2007, Autodesk reported 2nd quarter 2007 results. Revenues came in at $526 million, up 17% over the 2nd quart of 2006. Net income was $92 million or $.38/share on a GAAP basis. (Or $.44/diluted share or $108 million on a non-GAAP basis). Prior year results worked out to $87 million or $.36/share on a GAAP basis (Or $96 million or $.39/diluted share the prior year). Whether you choose to go with GAAP results (my preference), or non-GAAP, either way this was an improvement year-over-year.

On August 16, 2007, Autodesk reported 2nd quarter 2007 results. Revenues came in at $526 million, up 17% over the 2nd quart of 2006. Net income was $92 million or $.38/share on a GAAP basis. (Or $.44/diluted share or $108 million on a non-GAAP basis). Prior year results worked out to $87 million or $.36/share on a GAAP basis (Or $96 million or $.39/diluted share the prior year). Whether you choose to go with GAAP results (my preference), or non-GAAP, either way this was an improvement year-over-year.

Looking at a 'point and figure' chart on Autodesk from StockCharts.com, we can see that while the stock has recently been under some short-term pressure, it has not broken down and appears to be trending higher above the 'support line'.

With the solid earnings report and the continued strength in the chart,

AUTODESK (ADSK) IS RATED A BUY

So how did I do that week back in February/March of 2006? Well actually pretty mediocre. With one stock down big, and the other stock moderately higher, the two stocks showed an average of a loss of (28.4)% since posting.

Once again, this demonstrates the importance of limiting losses and harvesting gains! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance be sure and visit my Stock Picks Podcast Website, where you can hear me discuss a few of the many stocks I write about on the blog, or my Covestor Website where my actual trading portfolio is monitored and evaluated, as well as my SocialPicks website where all of my stock picks have been reviewed this year!

Thanks so much for stopping by and visiting! I hope you all have a wonderful weekend and a great week trading next week!

Bob

Friday, 17 August 2007

A Reader Writes "Have you ever thought of using a close protective stop...?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I had another nice letter from Doug S., who has been a regular write and commenter here on the blog. Doug is bright and clever, and his thoughts deserve consideration. He has regularly written to me about different names to consider and he is a good stock picker as well!

I had another nice letter from Doug S., who has been a regular write and commenter here on the blog. Doug is bright and clever, and his thoughts deserve consideration. He has regularly written to me about different names to consider and he is a good stock picker as well!

Doug wrote:

"Hi: Have you ever thought of using a close protective stop on a certain percentage of your gain at segmented designated levels on the

way up. It seems to me with a little research on past history you could structure a plan that would afford you approximately the same protection and allow "that big winner(position)' to make you a lot more money."

Doug, thanks for writing!

There is absolutely a lot of truth in what you write. Your question is a little bit confusing for me. I believe you are suggesting that I move up my stops a little bit 'closer' on those stocks that have appreciated a lot for me. In that way, I might preserve my large gains so that they don't just drop back to a lower level. Please correct me if I have misinterpreted the question/comment.

You raise some interesting points--especially in the light of the recent volatile correction that we have experienced in the stock market. In other words, 'wouldn't it be wiser to have tighter stops under the big gainers to avoid 'giving back' so much of the profits'.

Let me review my current selling strategy on the downside. After a first purchase, I allow a stock to decline only 8% before selling the entire position. Thus selling at 92% of the price in a worst case scenario.

After a single sale at a 30% gain, I allow a stock to drift back to 'break-even' before selling. This represents selling at 100/130 or 77% of the peak price.

After two sales, or at 30 and 60%, I would plan on selling all remaining shares if the stock declined to 30% appreciation. That would work out to a level of 130/160= 81% of the peak.

After three sales, (30, 60, and 90%), I would sell at 45%, thus 145/190 = 76% of the peak.

Four sales (30, 60, 90, and 120%), I would sell at 60% or 73% of the peak.

Five sales (30, 60, 90, 120, 180%), then I would sell at 90% or 68% of the peak.

It isn't perfect, but I think you can see the trend. After each sale I move up the stops, but generally the 'leash' that I give each stock increases after each sale...giving a stock more 'room to play' in a turbulent market.

The result of this is that when a market corrects, my tendency is to unload my recent purchases before selling my longer-term holdings that might well survive smaller corrections better. In this fashion I retain my strongest stocks and sell my newer additions as I move from equities to cash.

Anyhow, that's how I do it. If I can figure some new methods to manage these questions, then I amn sure I shall make some changes. Meanwhile....

Thanks again for visiting! If you have any other comnenbts or quetions, please feel free to email me at bobsadviceforstocks@lycos.com or leave them on the blog.

Hopefully, today's rally will hold and we will find most of the correction behind us with smoother sailing ahead.

Bob

Posted by bobsadviceforstocks at 1:23 PM CDT

|

Post Comment |

Permalink

Updated: Friday, 17 August 2007 7:48 PM CDT

Thursday, 16 August 2007

Some Thoughts on Selling Strategy

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

With today's tumultuous trading, it would be helpful and step back for some perspective.

This is a beautiful Zen garden picture from Kyoto as published on Pattern Recognition blog.

Do you feel a little more peaceful?

As we think about the trading going on, I want to stress the importance that I have found for both perspective and planning. Perspective on what is important in life, and planning to deal with whatever the market may bring.

Throughout this blog, I have discussed the importance of limiting losses within my portfolio. As well, I have discussed the need to take small gains as stocks appreciate. It is from this approach that responding to as bad a market as today is made possible.

After each purchase and each sale of stock in my portfolio I know exactly when I need to sell my shares both on the upside as well as the downside. After each sale, I know whether I have a 'permission slip' to add a new position (after a sale on 'good news'), or whether my own trading strategy demands that I 'sit on my hands'.

My trading system lags the market. It doesn't respond quickly to the violent swings that we are witnessing. But it is tremendously helpful in getting through days like today.

My ResMed stock actually hit a sale point briefly at a 30% appreciation level (down from my last sale at a 60% gain.) Pausing to observe, the stock rebounded off that level and I deferred the sale.

I have other stocks that are near sale points including Bolt (BTJ) which has corrected from its 180% appreciation level to near a 90% appreciation for me, and Satyam (SAY) which is near an (8)% loss. Others are not far behind.

The point is that I am not able to own stocks that beat the overall market when a market moves as it is doing today. The point is that I know when I need to implement trades and at what level.

It isn't perfect, but it is working for me. Albeit slowly.

I hope that all of you are keeping your 'cool'. That doesn't mean you should be so cold that you are frozen in place. But it does mean that you should have a plan about each of your holdings. The plan doesn't necessarily need to look anything like my plan! But a plan will give you some limits, a structure that will assist you in dealing with wild gyrations in stock prices so that you do not over- or under-react.

Good Luck to all of my readers!

Bob

Wednesday, 15 August 2007

Flotek Inds (FTK) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

The market is talking to me loud and clear through my portfolio!

A few moments ago I sold my 280 shares of Flotek at $29.65 (average of two lots at $29.62 and $29.74). These shares had JUST been purchased (!) at $32.44 on August 13, 2007. You do the math. Today is August 15, 2007. YIKES.

This represented a loss of $(2.79) or (8.6)% since purchase.

Rules are rules. I hit my loss and the shares were sold. I am now down to 16 positions and holding....for now. With the sale at a loss, I shall be sitting on my hands. Unfortunately, my Meridian (VIVO) was a sale at a gain in the middle of this correction and I foolishly bought some stock. I could ask what was I thinking, but I was just following my own system which is more or less doing what it is supposed to be doing.

Anyhow, that's the glum news for now! Thanks again for visiting and feel free to leave any comments or questions on the blog or email me at bobsadviceforstocks@lycos.com. Sometimes I feel as much like an amateur as I write about being one.

Bob

Tuesday, 14 August 2007

A Reader Writes "So you use your stocks as a guide...."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I had the pleasure of getting another nice email from S.J.K. in Anchorage, Alaska, who wrote:

I had the pleasure of getting another nice email from S.J.K. in Anchorage, Alaska, who wrote:

"Thanks bob for your thoughts. We do have an investment advisor, but

often feel like he is selling us funds to get his commission or management fee. We have taken small steps into individual stock holdings with success, but only because we bought when nobody else was buying (ie. the lead up to the iraq invasion). I really appreciate your disciplined approach. It makes sense in a normal market.

So you use your stocks as your guide, as you say on your blog. To clarify, do you ever have your cash fully invested? When you sell on appreciation, you take a portion of your cash holdings in addition to the appreciation to purchase the next equity... so in theory, at 20 postions, you still have an amount of cash on hand equal to the liquidated appreciation. Is that correct?

My partner is a fellow Wisconsiner. (she's a cheesehead from green bay). That might be why I enjoy your podcast so much. Thanks again for your response.

Yours,

---S J.

Anchorage, Alaska"

S.J., thank you for writing! The market has been tough on everyone. I guess maybe the short-sellers without the 'uptick rule' are making money.

Let me talk a little about how I use my stocks 'as a guide' as you write. I should qualify this as one of those 'do as I say not as I do' moments :). Because, if you have been reading through my blog, you will realize that I carry a sizeable amount of margin which I have been hoping to pay down through sales---preferably on the upside.

But in an ideal world, I would not be in margin. My stock holdings have a value of approximately $5,000 apiece. And it would take $100,000 in cash or equity value for the 20 positions which is now my current maximum.

First your question about being at the maximum size of the portfolio. If I am at 20 positions and I sell a portion of a stock at a gain and normally would have a signal to add a position, instead in that case I 'sit on my hands' and would move that appreciation sale into a money market account.

On the other hand, if I am at my minimum of 5 positions (1/2 of the neutral 10 position portfolio), then if I sell a stock at a loss, instead of 'sitting on my hands' and applying that proceeds into a money market account, I would instead replace that sold stock to keep my exposure at 5 positions.

My system requires a minimal exposure to equities which I use as 1/4 of the maximum number of positions, because my own holdings act as the signals to be buying and selling new positions.

Also, if I were, for example, and I sold 1/7th of a holding at a gain and had a signal, like I did recently with my VIVO purchase, to add a new position, I would ideally be using the proceeds of the sale and some additional cash to purchase the new position. (In my particular case, I unfortunately use margin which is borrowed money to make the same move).

You might ask why I am so against margin. But it is due to two basic reasons. First of all, I am paying interest against that loan which reduces my performance, and secondly, the margin, especially in a down market, adds leverage to the performance which in this case is doubly bad. I don't think I need to explain further :(.

As a matter of course, I would prefer to be adding positions to the portfolio that are slightly larger than the average position I already own. I do this so that I can grow my portfolio over time. In addition, in a correction, as you will observe, the first stocks that I am letting go of are the most recent purchases. Thus, I will more quickly be moving into cash.

Another thing, I strongly suggest an automatic deposit of new cash each month into your trading account that will also assist you over time in building that portfolio into a more significant account, no matter where you start.

Thank you for your kind words and loyal listenership to my amateur podcast about my amateur investing.

This is a picture of Anchorage, October, 2006, as posted by PA2AKgirl in her travel blog. I have never been there but what a gorgeous view!

I hope tomorrow finds us in better trading shape!

Bob

Mesa Laboratories (MLAB) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago, upon checking my holdings, I saw that my Mesa Labs (MLAB) stock had plummeted and passed my (8)% loss limit. In fact, MLAB, as I write, is trading at $21.38/share, down $(3.37) or (13.62)% on the day. I sold 210 shares at $22.20 which were purchased 5/23/07 at a cost basis of $24.05. Thus, I had a loss of $(1.85) or (7.7)% on the purchase. Ironically, when I entered the sale order the stock had a greater than (8)% loss and by the time the order was filled it had rebounded a few cents to be sold just under this. Anyhow, that stock is now history and I shall be 'sitting on my hands' with the proceeds as the market corrects and my own portfolio tells me it isn't a good time to be buying anything!

Ironically, on August 13, 2007, MLAB reported solid 1st quarter results as far as I can tell. Sales climbed 17% to $4.3 million from $3.7 million and net income grew 28% to $1.01 million up from $790,000 or $.31/diluted share, up from $.25/diluted share last year.

In spite of the good earnings, in light of my own sale, I have reduced my rating on MLAB and

MESA LABORATORIES (MLAB) IS RATED A HOLD

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Monday, 13 August 2007

Flotek Industries (FTK) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago, with that 'nickel' in hand, I saw that Flotek Industries (FTK) had made the list of top % gainers on the AMEX. Flotek is an old favorite of mine having written it up as recently as May 26, 2007. Their 2nd quarter 2007 report was strong, their Morningstar.com "5-Yr Restated" page looks intact, and the chart still is impressive.

Thus,

FLOTEK (FTK) IS RATED A BUY

And buy I did. A few moments ago I used up that nickel and purchased 280 shares of Flotek (FTK) at $25.41 ($32.40--please see comment below...thanks to Allan for noticing the error!) Wish me luck. I don't know if this rally is just a 'dead cat bounce' or is something more substantial. I shall stay with my system.

Bob

Newer | Latest | Older

I probably should rename this blog,

I probably should rename this blog,

The latest earnings report that I could locate was the

The latest earnings report that I could locate was the

On February 28, 2006, I

On February 28, 2006, I  On August 9, 2007, CASM announced

On August 9, 2007, CASM announced

On March 1, 2006, I

On March 1, 2006, I

I had another nice letter from Doug S., who has been a regular write and commenter here on the blog. Doug is bright and clever, and his thoughts deserve consideration. He has regularly written to me about different names to consider and he is a good stock picker as well!

I had another nice letter from Doug S., who has been a regular write and commenter here on the blog. Doug is bright and clever, and his thoughts deserve consideration. He has regularly written to me about different names to consider and he is a good stock picker as well!