Stock Picks Bob's Advice

Saturday, 5 August 2006

"Looking Back One Year" A review of stock picks from the week of April 11, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I hope you all are having a nice Saturday and that the week ahead is profitable and productive for you! Regular readers of my blog will realize that most weekends (?) I have been trying to review past selections on the blog and see how they would have done if I had indeed purchased shares in the stocks I discuss. For the sake of ease of analysis, I have been assuming a "buy and hold" investment strategy instead of the actual disciplined investment and portfolio management approach.

Rather than just buying and holding equities, I sell stocks quickly and completely on losses, and slowly and partially on targeted gains. This certainly will affect the result of purchasing such investments! But for our basic purposes, this analysis works just fine.

I continue to review past selections; however, after missing another weekend, my 'year-earlier' period is increasing by the week! Two weeks ago I reviewed the selections on the blog from April 4, 2005. Today, I would like to take a look at the next week: the week of April 11, 2005. Fortunately for me :), I only "picked" one stock that week: LoJack (LOJN). I do not own any shares nor do I have any options on this stock.

On April 13, 2005, I picked LoJack (LOJN) for Stock Picks Bob's Advice when the stock was trading at $13.94. LOJN closed at $17.55 on 8/4/06, for a gain of $3.61 or 25.9% since posting.

On April 13, 2005, I picked LoJack (LOJN) for Stock Picks Bob's Advice when the stock was trading at $13.94. LOJN closed at $17.55 on 8/4/06, for a gain of $3.61 or 25.9% since posting.

On May 5, 2006, LoJack announced first quarter 2006 results. For the quarter ended March 31, 2006, revenue climbed 18% to $50.7 million from $43 million in the same quarter last year. Net income increased to $2.94 million from $2.64 million in the prior year. On a per share basis, this worked out to $.15/share, up from $.14/dilutedshare last year.

On May 5, 2006, LoJack announced first quarter 2006 results. For the quarter ended March 31, 2006, revenue climbed 18% to $50.7 million from $43 million in the same quarter last year. Net income increased to $2.94 million from $2.64 million in the prior year. On a per share basis, this worked out to $.15/share, up from $.14/dilutedshare last year.

Since that was the only stock I reviewed that week, I feel safe to say that the average performance of stock picks that week was a gain of 25.9% since posting! Thank you for visiting! If you have any comments or questions, please feel free to leave them on the blog or drop me a line at bobsadviceforstocks.tripod.com. Please also be sure and visit my Stock Picks Bob's Advice podcast site.

Bob

Friday, 4 August 2006

August 4, 2006 Anaren (ANEN)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Looking through the list of top % gainers on the NASDAQ this afternoon, I came across Anaren Microwave (ANEN) which closed at $19.22, up $1.55 or 8.77% on the day. I do not own any shares nor do I have any options on this stock.

Looking through the list of top % gainers on the NASDAQ this afternoon, I came across Anaren Microwave (ANEN) which closed at $19.22, up $1.55 or 8.77% on the day. I do not own any shares nor do I have any options on this stock.

According to the Yahoo "Profile" on Anaren, the company

"... engages in the design, development, and manufacture of microwave and radio frequency components, assemblies, and subsystems for wireless communications, satellite communications, and defense electronics markets."

This certainly is pretty high-tech stuff, and I don't think I can use my Peter Lynch strategy to pick stocks. But the numbers were pretty compelling so let's take a closer look at this company!

Like so many stocks on the move this time of year, the company moved sharply higher on the back of an earnings report. Yesterday, after the close of trading, Anaren announced 4th quarter 2006 results. For the quarter ended June 30, 2006, net sales came in at a record $29.1 million, up 21% over the $24.1 million in the same quarter the prior year. Net income worked out to $3.7 million or $.20/diluted share, up from $2.6 million or $.14/diluted share in 2005.

How about longer-term results?

If we review the Morningstar.com "5-Yr Restated" financials on ANEN, we can see that revenue actually dipped from $85 million in 2001 to $71 million in 2002 before resuming its climb to $94 million in 2005 and $100 million in the trailing twelve months (TTM).

Earnings also dipped from $.52/share in 2001 to $.16/share in 2003, before climbing to $.37/share in 2005 and $.56/share in the TTM.

I find it interesting and provocative to see that the outstanding shares which were 22 million in 2001, increase to 23 million in 2002, but then started declining....dropping to 20 million shares in 2005 and 17 million in the TTM. It is fairly rare to see a company retiring shares instead of increasing its float, but for the investor, this means a lower number of shares to spread the same earnings over, and thus pressure to the upside on earnings growth.

Free cash flow has been a bit erratic, with $8 million in 2003 reported, increasing to $11 million in 2004, then to a negative $(1) million in 2005 but a positive $9 million in the TTM.

The balance sheet, as reported on Morningstar, looks solid. $75.5 million in cash is reported, enough to easily pay off both the $10 million in current liabilities and the $6.5 million in long-term liabilities combined more than 4 times over. In fact, if we add in the $40.6 million in other current assets to the $75.5 million in cash, we have a sum of $116.1 million, which when compared to the $10 million in current liabilities yields a current ratio of 11.6, the highest current ratio on any stock I have reviewed as far as I can remember. This company appears from this exam to be quite solvent.

What about some valuation numbers?

Looking at the Yahoo "Key Statistics" on Anaren, we can see that this is a small cap stock with a market capitalization of only $330.37 million. The trailing p/e is a moderate 30.95, but the forward p/e is only 21.60 (fye 30-Jun-07), and the PEG (5 yr expected) isn't too bad at 1.38.

Checking the Fidelity.com eresearch website on Anaren, Fidelity has assigned them to the "Scientific/Tech Instruments" industrial group. In regards to the Price/Sales ratio, Anaren is relatively cheap with a ratio of 3.1. Topping this group is Garmin (GRMN) at 8.4, SiRF Technology (SIRF) at 5.9, Flir Systems (FLIR) at 3.8, Applied Biosystems (ABI) at 3.3, then Anaren at 3.1, and Beckman Coulter (BEC) at the cheapest ratio of 1.4.

Unfortunately, looking at profitability with a review of the 'return on equity' (ROE), ANEN is also at the bottom of the list with a ROE of 6.5%. Topping the list is Garmin (GRMN) at 30.8%, Flir at 24.7%, Applied Biosystems at 19.5%, Beckman Coulter at 11.4% and SiRF at 7%.

Finishing up with Yahoo, ANEN has only 17.19 million shares outstanding with 16.33 million that float. As of 7/11/06, there were 758,560 shares out short representing 4.60% of the float or 5.9 trading days of average volume (the short ratio). No cash dividends and no stock splits are reported.

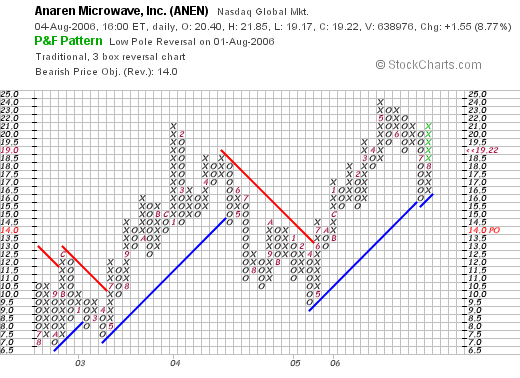

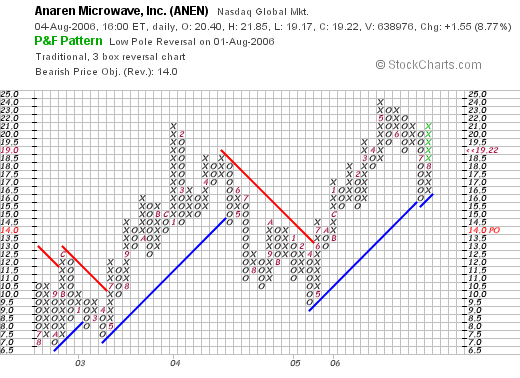

What about the chart?

Reviewing the "Point & Figure" chart on ANEN from StockCharts.com, we can see that the company has been moving higher from its lows of around $7 from October, 2002. The company did sell-off in 2004 down to a low of $9.50, but since April, 2005, the stock has been moving steadily higher to the current level of around $19.22, a little under the highs of $24.00 in May, 2006. The chart looks relatively strong to me without appearing over-extended.

So what do I think? Well, the stock moved nicely higher today on the back of a terrific earnings report. Looking at Morningstar.com, this report is part of a longer trend of earnings and revenue growth. Free cash flow is positive recently, the company is reducing its outstanding shares, and the balance sheet is gorgeous. The p/e is reasonable imho with a PEG under 1.5. The Price/Sales isn't bad, but the profitability as measured by ROE is a bit low. Finally, the chart looks nice.

I don't really understand the business that this company is in from an intuitive perspective. However, if I were in the market to be buying a stock, this is the sort of company I would be purchasing!

Thanks so much for stopping by! Please remember to drop me a line at bobsadviceforstocks@lycos.com if you have any comments or questions. Certainly feel free to leave a comment right on the blog. Also, be sure and visit my Stock Picks Bob's Advice podcast site! You can listen to me rant as well as read my rants whenever you like!

Bob

Thursday, 3 August 2006

"Revisiting a Stock Pick" Christopher & Banks (CBK)

CLICK HERE FOR MY PODCAST ON CHRISTOPHER & BANKS

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

We have certainly had some tough days in the stock market recently! I haven't completely stayed with my investment strategy as you will see from my trading attempt with Kendle (KNDL). I always reserve the right to do something silly, and I managed to do just that. It isn't that I didn't like Kendle, it was just not part of my strategy to do a trade like that. And it didn't work out. So I am back to my plodding strategy that has been working a bit better than the old shoot from the hip approach!

We have certainly had some tough days in the stock market recently! I haven't completely stayed with my investment strategy as you will see from my trading attempt with Kendle (KNDL). I always reserve the right to do something silly, and I managed to do just that. It isn't that I didn't like Kendle, it was just not part of my strategy to do a trade like that. And it didn't work out. So I am back to my plodding strategy that has been working a bit better than the old shoot from the hip approach!

With the market trading a little better, I thought I would see if I couldn't find something to discuss this afternoon. Looking through the list of top % gainers on the NASDAQ today, I came across an old favorite of mine, Christopher & Banks (CBK), which, as I write, is trading at $29.44, up $1.30 or 4.62% on the day. I do not own any shares of this stock, nor do I own any options or other futures related to this company.

With the market trading a little better, I thought I would see if I couldn't find something to discuss this afternoon. Looking through the list of top % gainers on the NASDAQ today, I came across an old favorite of mine, Christopher & Banks (CBK), which, as I write, is trading at $29.44, up $1.30 or 4.62% on the day. I do not own any shares of this stock, nor do I own any options or other futures related to this company.

I say this is an "old favorite" because I have reviewed this stock previously on the blog. In fact, I first reviewed Christopher & Banks on Stock Picks Bob's Advice on June 5, 2003, when the stock was trading at $33.45. CBK had one stock split since that post on August 28, 2003, when the stock split 3:2. This results in an effective pick price for me of $22.30. Thus, with today's current stock price of $29.45, this means an effective appreciation of $7.15/share or 32.1% since posting.

And what does Christopher & Banks do? According to the Yahoo "Profile" on CBK, the company

"... operates retail specialty stores that sell women’s specialty apparel in the United States. It operates its retail stores under the Christopher & Banks, C.J. Banks, and Acorn names. Christopher & Banks stores offer fashions featuring co-ordinated assortments of sportswear and sweaters in sizes 4 to 16. C.J. Banks stores offer similar assortments of women’s specialty apparel in sizes 14W and up."

What drove the stock higher today, was the announcement of the 'all-important' same-store sales figures for July. When looking at retail companies like CBK, the same-store figure gives the investor a feeling for the 'organic' growth of the company; that is, by examining the performance of stores that have been open at least a year, we can take out the effect of opening new stores on the underlying growth results of the firm. This number can be considered a 'truer' criterion in examining sales results imho.

Basically, total sales for the five-week period ended July 29, 2006 "...increase 21% to $49.6 million from $41.1 million last year. July same-store sales rose 10%." In my expereience, anytime a retail firm can come in with high single-digit or low double-digit same-store sales increases, we have a great result. In addition, since same-store sales figures were a healthy 8% increase for the five month period ending July 29, 2006, this means that we are observing at least a short-term acceleration of sales growth. This report exceeded expectations according to the CEO Joe Pennington, and the company went ahead and raised guidance for the quarter ending August 26, 2006, to $.19 to $.20/diluted share, up from prior guidance of $.17 to $.19/share. This "trifecta" of sales reports----strong sales growth, exceeding expectations, and raising guidance, was enough to fire-up investors and get them to push the price of this stock higher.

And how about the latest quarterly result?

On June 20, 2006, CBK announced first quarter earnings results. As reported:

"Net sales in the first quarter increased 16% to $142.5 million, from $122.7 million in the prior year period, while same-store sales increased 7%. Net income for the first quarter increased 57% to $14.6 million, or $0.39 per diluted share, compared with $9.3 million, or $0.26 per diluted share, in the year ago period."

This was a very nice earnings report imho.

And longer-term results?

Looking at the Morningstar.com "5-Yr Restated" financials, we find that revenue, which was $276 million in 2002, has increased steadily to $490.5 million in 2006 and $510.4 million in the trailing twelve months (TTM).

Earnings have been a bit more erratic, climbing from $.83/share in 2002 to $1.01/share in 2004. However, they dropped to $.73/share in 2005, but have increased steadily since to $.97/share in the TTM. As an added plus, the company initiated dividends in 2004 with $.08/share paid. They have subsequently increased this to $.16/share in 2005 and since. the number of shares outstanding has been very stable with 37 million in 2002 and 37 million in the TTM.

Free cash flow appears quite healthy with $33 million in 2004, increasing to $39 million in the TTM.

CBK's balance sheet appears solid with $112.6 million in cash and $54.2 million in other current assets. The cash alone is enough to cover both the $41.5 million in current liabilities and the $33.8 million in long-term liabilities combined. Adding the cash and current assets together, gives us a sum of $166.8 million, which, when compared to the $41.5 million in current liabilities, yields a 'current ratio' of 4.02. Generally, anything 1.5 or higher is relatively 'healthy'.

How about some valuation numbers?

Reviewing the Yahoo "Key Statistics" on Christopher & Banks, we find that this is a mid-cap stock with a market capitalization of $1.10 billion. The trailing p/e is a moderate 30.02, with a forward (fye 25-Feb-08) p/e of 22.12. The PEG (5 yr expected) works out to a reasonable 1.14.

Looking at the Fidelity.com eresearch website, we can see that CBK is in the "Apparel Stores" industrial group and has a Price/Sales ratio of 2, near the top the retailers. Topping this group is Chicos Fas (CHS) with a ratio of 2.7, followed by Christopher & Banks (CBK) at 2 along with American Eagle (AEOS) at 2. Further down the list is Abercrombie & Fitch (ANF) at 1.7, Limited (LTD) at 1 and PacSun (PSUN) at 0.9.

Looking at profitability, we find Christopher & Banks at the bottom of the list of "return on equity" (ROE) with an 18.5% ROE. Topping the list is ANF at 37.6%, LTD at 31.9%, AEOS at 26.4%, CHS at 26% and PSUN at 23.1%. Thus, from these parameters, the company is relatively richly priced and is relatively less profitable than some of these other retailers.

Returning to Yahoo for some additional numbers, we see that there are 37.41 million shares outstanding and 36.41 million that float. Currently (as of 7/11/06) there are 2.54 million shares out short, representing 7% of the float or 4.4 trading days of average volume (the short ratio). This looks a little significant based on my own 3 day short interest 'rule'.

The company, as noted, pays a small $.16/share dividend yielding 0.60%. The last stock split, also as reported above, was August 28, 2003, when a 3:2 split was declared.

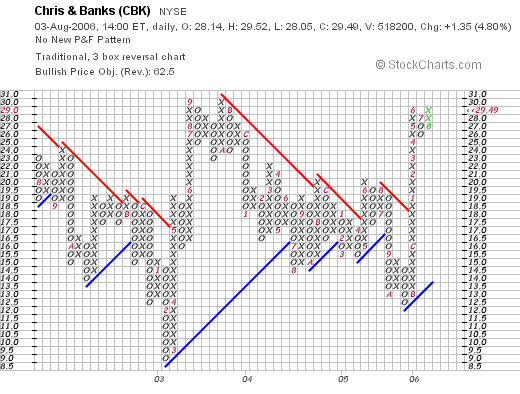

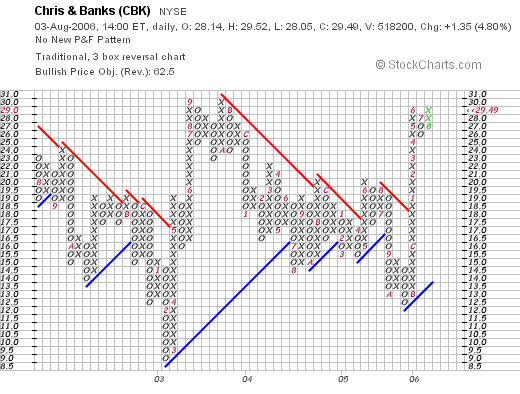

And what does the chart look like?

If we review a "Point & Figure" chart on CBK from StockCharts.com:

We can see that the stock has been trading sideways for the greater part of the past four years. Recently, the stock has moved back to historic highs and is poised to move into higher territory, as long as the underlying market allows. The graph is relatively neutral imho, and certainly doesn't look way over-priced.

So what do I think? Reviewing some of the above points on CBK, the company reported strong same store sales today in the low double-digit range and raised guidance for the current quarter. The latest quarterly results were solid with growing revenue and earnings. Morningstar.com looks strong as well except for a dip in earnings a few years ago, the company is free cash flow positive and has a nice balance sheet with lots of cash. Valuation wise, the p/e is a tad rich but the PEG is just over 1.1. The Price/Sales figures are a bit rich for the group and the profitability as measured by ROE is a tad low ...not my favorite combination of measurements. Finally, the graph is neutral and more recently appears to be moving higher.

In summary, I like the sales and earnings momentum on this company. Especially the same-store sales results. The other numbers are also supportive. While there is a premium being paid as indicated by the relatively rich price/sales ratio, the latest numbers certainly suggest the premium is well worth it!

Thanks so much for stopping by and visiting. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Please also visit my Stock Picks Bob's Advice podcast site where I also talk about , in addition to writing about, my various stock market ideas!

Bob

Posted by bobsadviceforstocks at 1:10 PM CDT

|

Post Comment |

Permalink

Updated: Thursday, 3 August 2006 11:18 PM CDT

Tuesday, 1 August 2006

"Trading Transparency" KNDL

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Today I learned another lesson :(. Stick with your strategy especially when it is working. As much as I like Kendle (KNDL), I will not let the loss I have grow. I do think the selling is overdone, but I cannot continue to fight this one. It is very important to recognize mistakes early and keep losses as small as possible.

A few moments ago, I sold my 800 shares of KNDL at $25.41. These shares had just been purchased (see the prior entry) on 7/27/06 at a price of $28.48. Thus, I had a loss of $(3.07) or (10.8)% on this investment. Even though I did not stick to my rules on making this purchase, I shall be sticking to my rules on limiting losses! And exceeding an 8% loss, I pulled the plug moments ago.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com and be sure to drop by and listen to my Stock Picks Bob's Advice podcast site.

Bob

Thursday, 27 July 2006

"Trading Transparency" KNDL---Breaking All of My Rules!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please rememeber to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

A few moments ago, I broke all of my trading rules---much the same way that I did with Dynamic Materials (BOOM) a few months ago. Kendle announced 2nd quarter earnings results this morning, and unfortunately missed expectations by a nickel. The market is in a "take no prisoners" mode and decimated the stock this morning. Kendle is trading at $28.22, down $(7.38) or (20.73%) as I write. I went ahead, believing that this was entirely overdone, and entered a purchase for 800 shares (!) of Kendle at $28.4799. Hopefully, I shall be correct on this move, as this is actually a larger than average purchase for me, totalling $22,783.92.

Let's review that earnings report and you will hopefully see why I would 'break' my trading rules and enter this stock purchase.

Net service revenue for second quarter 2006 came in at $62.1 million, an increase of 24% over net service revenue in the same quarter last year. Net income for the quarter came in at $4.29 million, up about 200% from last year's $1.44 million result. Again on a per share basis, this worked out to $.29/share, up sharply from $.10/share last year. Fully diluted "adjusted" net income, still worked out as $.39/share up over 100% from last year's "adjusted" fully diluted net income of $.19/share.

The Morningstar.com "5-Yr restated" is perfect. Almost perfectly steady revenue growth, earnings which dropped to a loss in 2002 at $(4.30)/share, have improved steadily, turning to a profit in 2004 at $.27/share, increasing to $.76/share in 2005, and $.93/share in the TTM.

Even the number of shares outstanding has been fairly steady at 12 million in 2001, increasing to 14 million in the TTM.

Free cash flow was $12 million in 2003, $18 million in 2005, and $17 million in the TTM.

The Morningstar balance sheet shows $51.6 million in cash and $80.6 million in other current assets, easily paying down the $60.3 million in current liabilities and the $1.5 million in long-term liabilities combined.

Anyhow, wish me luck. I am not following my intensely disciplined trading rules with this purchase. I am just trying to use my head and reserve the flexibility to make a purchase like this when things get entirely overdone imho.

Thanks again for stopping by! If you have any comments or questions on this or anything else on the blog, please feel free to leave your comments right on the blog or email me at bobsadviceforstocks@lycos.com. Also, be sure to visit my Stock Picks Bob's Advice Podcast website, where, if you are so inclined :), you can listen to me as well as read what I write!

Bob

Wednesday, 26 July 2006

July 26, 2006 BE Aerospace (BEAV)

CLICK HERE FOR MY PODCAST ON BE AEROSPACE

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I was looking through the list of top % gainers on the NASDAQ today and came across BE Aerospace (BEAV) which, as I write, is trading at $23.05, up $2.83 or 14.0% on the day. I do not own any shares or options on this stock. The overall market is anemic with the middle-east conflict and climbing oil prices once again hanging over the market.

I was looking through the list of top % gainers on the NASDAQ today and came across BE Aerospace (BEAV) which, as I write, is trading at $23.05, up $2.83 or 14.0% on the day. I do not own any shares or options on this stock. The overall market is anemic with the middle-east conflict and climbing oil prices once again hanging over the market.

After reviewing some of what I consider relevant data, I thought that this stock deserved a spot on the blog! Let me share with you some of my observations.

First of all, on what the company does, according to the Yahoo Profile on BEAV, the company

"... engages in the manufacture and marketing of cabin interior products for commercial aircraft and business jets. It also distributes aerospace fasteners. The company operates in three segments: Commercial Aircraft, Distribution, and Business Jet."

Insofar as news driving the stock higher, the company announced 2nd quarter 2006 results and also announced an acquisition of Draeger, a German oxygen delivery system manufacturer for the aerospace market.

For the three months ended June 30, 2006, net sales climbed 30.8% to $271.5 million, from $207.6 million in the same quarter in 2005. Net earnings for the quarter came in at $18.7 million or $.24/diluted share, up over 100% from the $8.4 million or $.14/diluted share last year. The company raised guidance for 2006 in the same announcement, guiding to $1.19/diluted share, up $.02 for the estimate. According to the MarketWatch report on the earnings, analysts had been looking for earnings of $.21/share on sales of $252 million. Thus, the company did a "trifecta-plus" as I like to irreverantly refer to the earnings report; that is, they increased their revenue, increased their net income, exceeded expectations and raised guidance all in the same announcement. The stock climbed with this report!

How about longer-term results? Reviewing the Morningstar.com "5-Yr Restated" financials on BE Aerospace, we can see the steady (except for a dip in 2003) increase in revenue from $666.4 million in 2001 to $844.1 million in 2005 and $894.8 million in the trailing twelve months (TTM). Earnings, however, have been far less steady, dropping from a profit of $.78/share in 2001 to a loss of $(3.18) in 2002. The loss/share has been steadily improving until 2005, when the company reported a profit of $1.39/share and increased financial results to $1.50/share in the TTM.

Free cash flow, which was negative in 2003 at $(37) million improved to a negative $(4) million in 2005 and turned positive at $24 million in the TTM.

Reviewing the balance sheet, as reported on Morningstar, we find that the company has $140.5 million in cash and $434.2 million in other current assets. This works out to a total of $574.7 million in current assets, which, when compared to the current liabilities of $205.3 million yields a current ratio of 2.80. (Generally over 1.5 is considered 'healthy').

The company also has a not-insignificant $436.1 million in long-term liabilities.

What about valuation? Looking at the Yahoo "Key Statistics" on BE Aerospace, we find that the company is a mid-cap stock with a market capitalization of $1.8 billion. The trailing p/e is a very moderate 16.05, and we find the current forward p/e (?) at 17.60. However, with the growth in earnings expected, the 5 Yr expected PEG is only 0.81.

Using the Fidelity.com eresearch website for some more data, I found that BEAV is in the "Aerospace/Defence-Products/Services" industrial group. Within this group, BEAV has a very 'average' Price/Sales ratio of 1.7. Leading this group is Rockwell Collins (COL) with a ratio of 2.6, followed by BEAV at 1.7, then Orbital Sciences (ORB) at 1.5, Alliant Techsystems (ATK) at 0.9, DRS Technologies (DRS0 at 0.8, and EDO Corp (EDO) at 0.6.

Profitability, however, puts BEAV near the top of the group with a return on equity of 24%. Leading the group is Rockwell Collins with a 39.6% ROE, followed by BEAV at 24%, Alliant Techsystems at 21.7%, EDO at 9.5%, DRS at 9.3% and Orbital Sciences at 7.8%.

Finishing up the Yahoo review, there are 77.44 million shares outstanding with 76.42 million of them that float. Currently there are 3.70 million shares out short representing 3.6 trading days of average volume (the short ratio). No cash dividends are paid and no stock splits are reported on Yahoo.

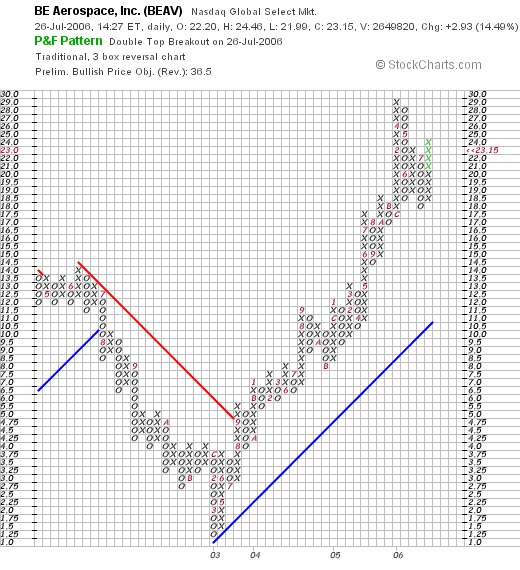

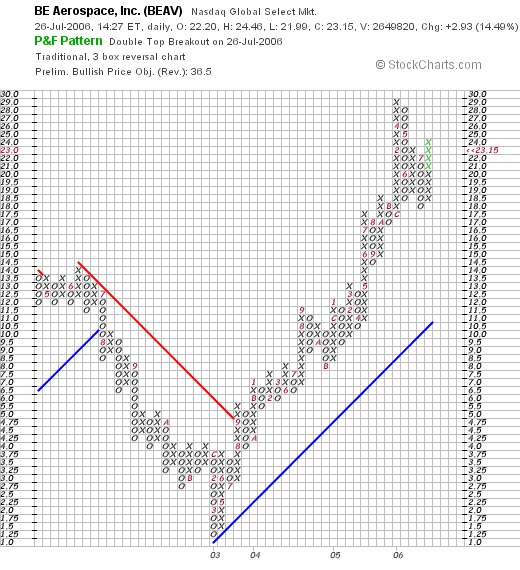

What about the chart? If we check the "Point & Figure" chart on BEAV from StockCharts.com, we can see that the stock was declining between July, 2002, when it was at $12.5, down to a low of $1.25 in March, 2003. Since then, the stock has moved strongly higher to the current level around $23.15. The stock chart looks strong to me!

So what do I think about this stock? Well, let's review a few of the findings.

First of all the company moved ahead strongly today on a great earnings report (they increased revenue, increased earnings, beat expectations, and raised guidance). The past five years have shown fairly steady improvement in the financial picture with growing earnings, revenue, and now positive free cash flow. The balance sheet is solid.

Valuation-wise, the p/e is in the teens and the PEG is under 1.0. The Price/Sales ratio is fairly average within its industrial group, and the profitability of the company is above average in its group. Finally, the chart appears solid. I do not know about the variability of the aerospace market, especially with the climbing fuel prices, but it appears most of the financial results are already "in the bag".

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Please be sure to stop by and visit my Stock Picks Bob's Advice Podcast Site.

Bob

Posted by bobsadviceforstocks at 1:50 PM CDT

|

Post Comment |

Permalink

Updated: Wednesday, 26 July 2006 11:09 PM CDT

Tuesday, 25 July 2006

"Revisiting a Stock Pick" Hologic (HOLX)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website. I apologize for not doing a lot of posting the last couple of weeks. I am still working at building a new blog website but with the market correction, I frankly have not been motivated to look for new stocks....but have been posting my sales as they arise.

With the market climbing once again today (two days in a row!) I figured I would be able to find a stock or two that I liked. In fact, Hologic (HOLX), an old favorite of mine, was on the list of top % gainers, and the last price I have for it is $48.34, up $3.47 or 7.73% on the day. It is near the close of trading and probably is the closing price. I don't have any shares of HOLX in my Trading Account but my son does own literally 20 shares and my stock club also has purchased shares in Hologic.

With the market climbing once again today (two days in a row!) I figured I would be able to find a stock or two that I liked. In fact, Hologic (HOLX), an old favorite of mine, was on the list of top % gainers, and the last price I have for it is $48.34, up $3.47 or 7.73% on the day. It is near the close of trading and probably is the closing price. I don't have any shares of HOLX in my Trading Account but my son does own literally 20 shares and my stock club also has purchased shares in Hologic.

I first posted Hologic on Stock Picks Bob's Advice on April 27, 2005, when the stock was trading at $35.85. HOLX had a 2:1 stock split on December 1, 2005, making my effective stock pick 'price' actually $17.93. With today's closing stock price of $48.34, this represents an appreciation of $30.41 or 170% since posting the stock just a little over a year ago. And to think I didn't buy any shares for myself! At least I talked my stock club into this stock and bought a few shares for my son's account!

Let's take a closer look at this company. First of all what they do. According to the Yahoo Profile on Hologic, this company

" ...engages in the development, manufacture, and supply of diagnostic and medical imaging systems for serving the healthcare needs of women. It focuses on mammography and bone densitometry."

Next, what about the latest quarterly report? Actually, it was the third quarter 2006 earnings report release that sparked today's rally in the stock. Revenue for the third quarter ended June 24, 2006, came in at $119.7 million, a 62% increase over the $74.1 million reported in the same quarter last year. Net income increased 46% to $12.0 million or $.25/diluted share up from $8.2 million or $.18/diluted share in the same quarter last year.

How about longer-term results? If we check the Morningstar.com "5-Yr Restated" financials on HOLX, we can see that revenue has been steadily increasing from $180.2 million in 2001 to $287.7 million in 2005 and $341.2 million in the trailing twelve months (TTM). Earnings during this period have increased from a loss of $(.67)/share in 2001 to a profit of $.01/share in 2002, $.63/share in 2005 and $.75/share in the TTM. The company has been increasing its number of shares outstanding from 31 million in 2001 to 43 million in 2005 and 46 million shares outstanding in the TTM. I would rather see a stable number of shares all things being considered, however, with the solid growth in revenue in earnings, the company has been growing its financial results faster than its outstanding shares!

Free cash flow has been a bit erratic but has increased from a negative $(4) million in 2003 to $37 million in 2005 and $17 million in the TTM.

The balance sheet looks solid with $108.3 million in cash, more than enough to cover the combined $65.4 million in current liabilities and the $5.3 million in long-term liabilities combined. Calculating the 'current ratio' gives us a total of $256.1 million, which when divided by the $65.4 million in current liabilities, yields a current ratio of 3.92. (1.5 or higher is the minimum for good financial health as a rule).

And how about some updated statistics/valuation numbers on this company? Looking at the Yahoo "Key Statistics" on Hologic, we find that the company is a mid-cap stock with a market capitalization of $2.20 billion. The trailing p/e is certainly rich at 65.01, and the forward p/e (fye 24-Sep-07) isn't much better at 40.48. The PEG, however, suggests a more reasonable valuation of the p/e, that since due to the rapid growth in earnings, the PEG is estimated at 1.32 (5 yr expected).

Reviewing the Fidelity.com eresearch website, we find the Hologic is in the "Medical Appliances/Equipment" industrial group, and is in fact the most richly valued of the group in terms of the Price/Sales ratio. HOLX leads this group with a Price/Sales ratio of 6.2. Following Hologic is Medtronic (MDT) at 5.1, St Jude (STJ) and Zimmer Holdings (ZMH) both at 4.2, Biomet (BMET) at 3.9 and Edwards Lifesciences (EW) with a Price/Sales ratio of 2.9.

Insofar as profitability, using the 'return on equity' (ROE) as a guide, we find that Hologic is only average in this measure. Leading the group is Biomet with a ROE of 25.9%, Medtronic at 23.8%, Zimmer at 16.6%, then Hologic at 15.1%, St Jude at 14.4% and Edwards Lifesciences at 13.8%.

Finishing up the statistics from Yahoo, we find that there are 45.59 million shares outstanding and 45.1 million that float. Currently there are 6.56 million shares out short representing 14.5% of the float or a significant 6.9 trading days of volume. (I use 3 days as my arbitrary cut-off for significance.)

No cash dividend is paid and as I noted above, the company last split its stock on 12/1/05 when it declared a 2:1 stock split.

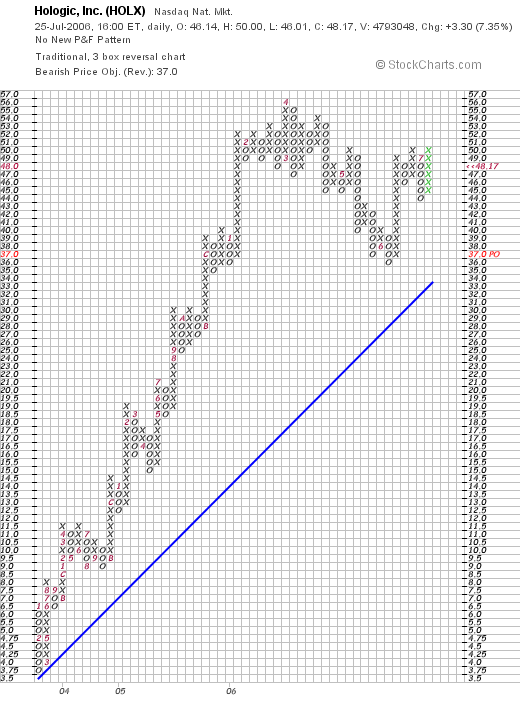

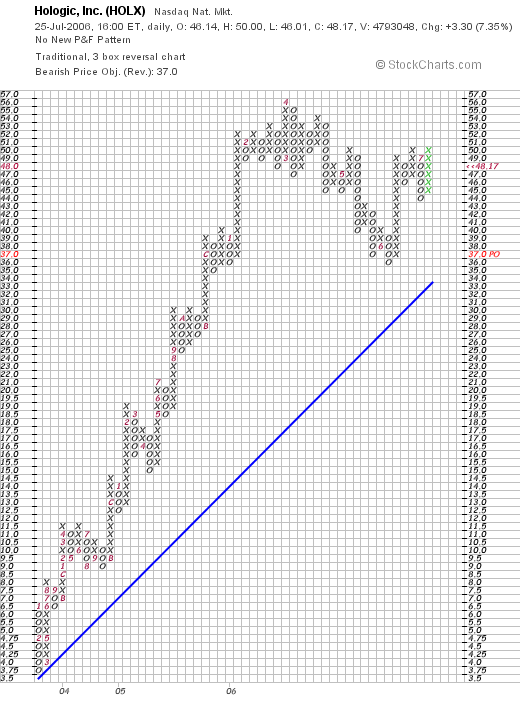

And what does the chart look like? Taking a look at the "Point & Figure" chart on Hologic from StockChart.com:

We can see a beautiful graph with an almost perfectly ascending price progression until May, 2006, when the stock sold off down to almost its support level. The stock appears to be appreciating once again.

So what do i think? I think the company reported a terrific quarter, has an outstanding Morningstar.com report (except for the very mild dilution of shares), and has a nice chart. Valuation, however, appears a bit rich and the stock thus appears to be "priced to perfection." Hopefull the company will continue to deliver perfect results. Certainly, the company's digital mammographer is selling well and this type of cancer detection may have some advantages over prior diagnostic procedures. with the p/e in the 60's and even the forward p/e in the 40's, fortunately we have a PEG just over 1.2. Even as measured by the Price/Sales ratio, the stock price appears rich. And profitability is not quite so phenomenal either. Only the rapid growth in earnings will continue to drive the stock higher.

Anyhow, that's the pick for this afternoon! A great performance from last year. Hopefull, for my son and my stock club, the stock will continue to perform well. Valuation, however, is a bit rich for what you are getting imho.

Thanks again for stopping by! If yhou have any comments or questions please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Also, please be sure to stop by and visit my Stock Picks Bob's Advice Podcast Website!

Bob

Posted by bobsadviceforstocks at 3:10 PM CDT

|

Post Comment |

Permalink

Updated: Tuesday, 25 July 2006 5:30 PM CDT

Saturday, 22 July 2006

"Looking Back One Year" A review of stock picks from the week of April 4, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of my weekend tasks that I try to address is the review of past stock picks on this blog. For ease of evaluation, I use a "buy and hold" assumption of past picks. In reality, I advocate and employ a disciplined buying and selling strategy with all of the stocks that I choose to own. This of course would affect the ultimate price performance of any investment.

Since I have again missed a couple of weeks in this review process, my trailing 52 weeks is getting closer to a trailing 65 weeks! In fact, I did review the week of March 28, 2005, but there weren't any stocks "picked" that week. My previous full review was on June 24, 2006 when I reviewed past picks from the week of March 21, 2005. Thus, I am now up to the week of April 4, 2005, which was a busy week for me on the blog! Let's take a look at those stock picks and see how they would have performed if we had purchased equal dollar amounts of the selections.

On April 4, 2005, I posted Jos A. Bank (JOSB) on Stock Picks Bob's advice when it was trading at $31.88. JOSB had a 5:4 stock split on 2/16/06, making my effective pick price actually only $23.88. JOSB closed on 7/21/06 at a price of $25.64 giving me a gain of $1.77 or 7.4% since "picking" the stock.

On June 8, 2006, JOSB announced first quarter 2007 results. For the quarter ended April 29, 2006, sales increased 17.7% to $113.7 million as compared with $96.6 million in the same quarter last year. Comparable store sales grew 4.7% during the period and combined catalog and internet sales climbed 25.0%. Net income, however, declined to $5.9 million or $.32/share, down from $6.7 million or $.38/share the prior year.

On June 8, 2006, JOSB announced first quarter 2007 results. For the quarter ended April 29, 2006, sales increased 17.7% to $113.7 million as compared with $96.6 million in the same quarter last year. Comparable store sales grew 4.7% during the period and combined catalog and internet sales climbed 25.0%. Net income, however, declined to $5.9 million or $.32/share, down from $6.7 million or $.38/share the prior year.

On April 5, 2005, I posted Greif Inc. (GEF) on Stock Picks Bob's Advice when it was trading at $74.06. GEF closed at $67.97 on 7/21/06, for a loss of $(6.09) or (8.2)% since posting.

On May 31, 2006, GEF announced 2nd quarter 2006 results. For the quarter ended April 30, 2006, net sales grew 1% to $620.1 million from $613.0 million in the same quarter last year. GAAP net income came inat $28.7 million or $.97/diluted Class A share and $1.49/diluted Class B share, compared to GAAP net income of $16.8 million or $.57/diluted Class A share and $.88/diluted Class B Share in the prior year.

On May 31, 2006, GEF announced 2nd quarter 2006 results. For the quarter ended April 30, 2006, net sales grew 1% to $620.1 million from $613.0 million in the same quarter last year. GAAP net income came inat $28.7 million or $.97/diluted Class A share and $1.49/diluted Class B share, compared to GAAP net income of $16.8 million or $.57/diluted Class A share and $.88/diluted Class B Share in the prior year.

On April 7, 2005, I posted Bed Bath and Beyond (BBBY) on Stock Picks Bob's Advice at a price of $40.80. BBBY closed at $32.62 on 7/21/06 for a loss of $(8.18) or (20.0)% since listing.

On April 7, 2005, I posted Bed Bath and Beyond (BBBY) on Stock Picks Bob's Advice at a price of $40.80. BBBY closed at $32.62 on 7/21/06 for a loss of $(8.18) or (20.0)% since listing.

On June 21, 2006, BBBY reported 1st quarter 2006 results. For the quarter ended May 27, 2006, net sales were $1.396 billion, a 12.2% increase from net sales of $1.244 billion in the same quarter in 2005. Net earnings for the quarter came in at $100.4 million, or $.35/diluted share, up from $98.9 million or $.33/diluted share the prior year. During the quarter, the company reported comparable store sales growth of 4.9%, better than the 4.4% same store growth in sales reported last year.

On June 21, 2006, BBBY reported 1st quarter 2006 results. For the quarter ended May 27, 2006, net sales were $1.396 billion, a 12.2% increase from net sales of $1.244 billion in the same quarter in 2005. Net earnings for the quarter came in at $100.4 million, or $.35/diluted share, up from $98.9 million or $.33/diluted share the prior year. During the quarter, the company reported comparable store sales growth of 4.9%, better than the 4.4% same store growth in sales reported last year.

Finally, on on April 8, 2005, I posted Buckle (BKE) on Stock Picks Bob's Advice when the stock was trading at $35.60. Buckle closed at $37.90 on 7/21/06 for a gain of $2.30 or 6.5% since posting.

On May 18, 2006, Buckle reported 1st quarter results. For the quarter ended April 29, 2006, sales came in at $109.6 million, up from $105.5 million. Income increased to $9.4 million or $.47/share, up from $8.6 million or $.40/share in last year's same quarter. However, same store sales, a better indicator imho of the long-term potential of a retail firm, declined (1.3)%. Thus, even though sales overall grew, this result was influenced by new store openings and results were not quite as encouraging taking into consideration the shrinkage of same store sales results.

So how did I do for that week in April last year? Well, the average performance of the four stocks listed came in at a loss of (3.6)% with two stock losing and two stocks gaining....but the loss in BBBY biased the entire group into a losing result.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Also, please be sure to stop by and visit my Stock Picks Bob's Advice podcast website!

Bob

Posted by bobsadviceforstocks at 3:45 PM CDT

|

Post Comment |

Permalink

Updated: Saturday, 22 July 2006 7:09 PM CDT

Monday, 17 July 2006

"Trading Transparency" Barnes Group (B)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I confess that all of this bear market is wearing me down! Earlier today, I sold one of my remaining twelve holdings in my trading account: Barnes Group (B) that hit an 8% loss. In fact, I sold my 360 shares that were acquired 2/16/06 at a cost basis of $19.58/share at a price of $17.97. This represented a loss of $(1.61)/share or (8.2)5 since purchase. Again, since I sold this stock at a loss instead of on a gain, this is a negative internal signal of my portfolio telling me once again to hang on to the proceeds and sit on my hands.

I am now down to 11 positions from my maximum of 25, and still above my minimum of 6. Hopefully the crisis in the middle-east will soon be resolved and the markets will move higher once again. I hope I am not too much of a Polyanna about these international events.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Also, please be sure to come and visitn my Stock Picks Bob's Advice Podcast site where you can hear me talk about many of the same stocks I have been writing about the past several years.

Bob

Friday, 14 July 2006

July 14, 2006 Kinetic Concepts (KCI)

CLICK HERE FOR MY PODCAST

ON KINETIC CONCEPTS

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

The market continues to back off with the Dow down 98.69 to 10747.60 as I write and the NASDAQ down 16.31 to 2037.80. Not wishing to get too discouraged, I decided to go ahead and scan the list of top % gainers on the NYSE

The market continues to back off with the Dow down 98.69 to 10747.60 as I write and the NASDAQ down 16.31 to 2037.80. Not wishing to get too discouraged, I decided to go ahead and scan the list of top % gainers on the NYSE

and came across Kinetic Concepts (KCI), trading as I write at $44.45, up $3.30 or 8.02% on the day. I do not own any shares nor do I have any options on this stock. In fact, I was planning to write this one up yesterday, but you know how that goes....one thing leads to another and pretty soon I haven't written anything at all! I shall try to keep this brief and get the information on this company posted this afternoon!

First of all, what does this company do? According to the Yahoo Profile on Kinectic, the company "...engages in the design, manufacture, marketing, and service of wound care and therapeutic products in the United States and internationally."

On April 25, 2006, KCI reported 1st quarter 2006 results. For the quarter ended March 31, 2006, total revenue increased 14% to $319.2 million. Net earnings increased 31% to $48.5 million and net earnings per share increased 29% to $.66/share.

Reviewing the 5-Yr Restated Financials from Morningstar.com, we can see revenue increasing steadily from $.5 billion in 2001 to $1.2 billion in 2005. Earnings per share increased from $1.67/share in 2005 to $1.82/share in the TTM. Free cash flow is positive with $204 million in 2003, $95 million in 2004 and $144 million in 2005. KCI reported $125 million in free cash flow in the trailing twelve months (TTM).

The balance sheet looks fine with $136.5 million in cash and $365.8 million in other current assets. With $200.6 million in curretn liabilities, this yields a current ratio of about 2.5. Long-term liabilities are not insignificant at $331.0 million, but the current assets are approximately equal to the combined short and long-term liabilities.

Looking at Yahoo Key Statistics on KCI, we can see that this is a large cap stock with a market capitalization of $3.2 billion. The trailing p/e is moderate at 24.45, but the forward p/e is even nicer at 14.78 (fye 31-Dec-07). Thus, with the rapid growth, the PEG works out to 0.91.

Reviewing the Fidelity.com eResearch website, we can see that this company is in the "Medical Appliances/Equipment" industrial group. Within this group, the stock's valuation is quite reasonable as measured by the Price/Sales ratio with this company coming in dead last at 2.4. Topping this group is Medtronic (MDT) with a Price/Sales ratio of 5.1, followed by St. Jude (STJ) at 4.2, Zimmer (ZMH) at 4.2, Biomet (BMET) at 3.9 and Edwards Lifesciences (EW) at 2.9.

Interestingly, looking at profitability, even though this company is the cheapest in valuation it is top in profitability with a return on equity of 73.2%. This is followed by Biomet at 25.9%, Medtronic at 23.8%, Zimmer at 16.6%, St. Jude at 14.4% and Edwards Lifesciences at 13.8%. This is an interesting combination of a cheap stock with great profitability.

Going back to Yahoo for some more numbers, we find that there are 71.68 million shares outstanding wtih 57.9 million that float. Currently, as of 6/12/06, there were 1.64 million shares out short representing 2.8% of the float and only 2.5 trading days of average volume (the short ratio). No dividend is paid and no stock split is reported.

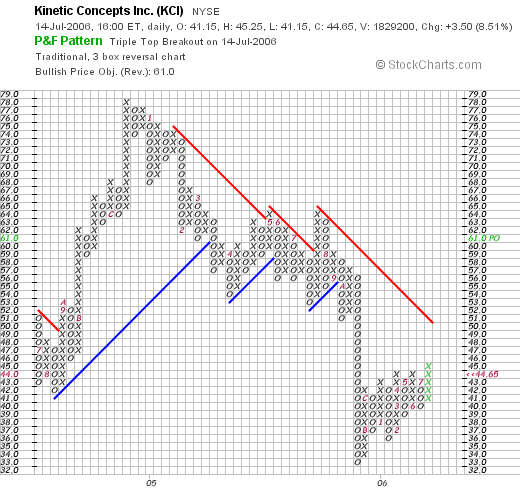

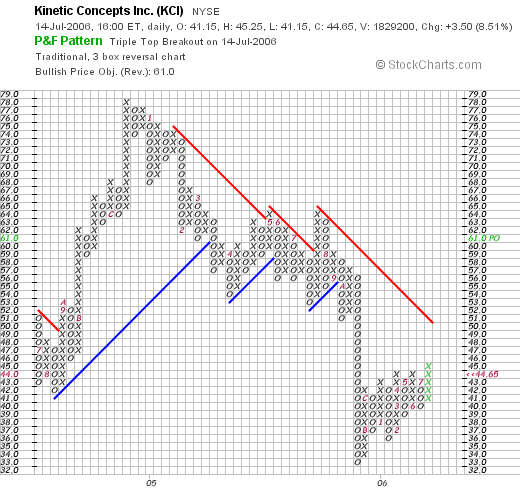

Looking at the StockCharts.com "Point & Figure" chart on KCI, we can see that this stock was trading much higher as recently as December, 2004, when the stock price hit $78/share. The stock has more recently been under pressure, with a drop to $33/share in July, 2005. Since that point, the stock has been trading higher to the current level of $44.65/share. Long-term the graph looks awful in my humble opinion, but short-term looks a little more promising:

So what do I think about this stock? Well it is an interesting company that has been moving higher the past two days in an otherwise very weak market. I suspect that earnings are due....maybe investors think the news will be strong (?). The last quarter was great, the Morningstar.com report looks nice, and valuation is attractive with a p/e in the low 20's, a PEG under 1.0, a Price/Sales ratio the lowest in its group and the profitability, as measured by return on equity (ROE), the highest in its group. Finally the chart looks interesting....the stock price does appear to be moving higher after a significant correction in valuation.

Anyhow, that's my stock for today! Thanks so much for stopping by and visiting! Please note that although I write up a stock today, I do not recommend purchase of any stock unless one has a "buy signal" generated by your own portfolio....that is one of your stocks is at a partial sale point due to price appreciation. If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com or just leave them on the blog. Also, please be sure to stop by and visit my Podomatic.com podcast site!

Bob

Posted by bobsadviceforstocks at 3:53 PM CDT

|

Post Comment |

Permalink

Updated: Friday, 14 July 2006 8:42 PM CDT

Newer | Latest | Older

On April 13, 2005, I picked LoJack (LOJN) for Stock Picks Bob's Advice when the stock was trading at $13.94. LOJN closed at $17.55 on 8/4/06, for a gain of $3.61 or 25.9% since posting.

On April 13, 2005, I picked LoJack (LOJN) for Stock Picks Bob's Advice when the stock was trading at $13.94. LOJN closed at $17.55 on 8/4/06, for a gain of $3.61 or 25.9% since posting.  On May 5, 2006, LoJack announced first quarter 2006 results. For the quarter ended March 31, 2006, revenue climbed 18% to $50.7 million from $43 million in the same quarter last year. Net income increased to $2.94 million from $2.64 million in the prior year. On a per share basis, this worked out to $.15/share, up from $.14/dilutedshare last year.

On May 5, 2006, LoJack announced first quarter 2006 results. For the quarter ended March 31, 2006, revenue climbed 18% to $50.7 million from $43 million in the same quarter last year. Net income increased to $2.94 million from $2.64 million in the prior year. On a per share basis, this worked out to $.15/share, up from $.14/dilutedshare last year.

Looking through the

Looking through the

We have certainly had some tough days in the stock market recently! I haven't completely stayed with my investment strategy as you will see from my trading attempt with Kendle (KNDL). I always reserve the right to do something silly, and I managed to do just that. It isn't that I didn't like Kendle, it was just not part of my strategy to do a trade like that. And it didn't work out. So I am back to my plodding strategy that has been working a bit better than the old shoot from the hip approach!

We have certainly had some tough days in the stock market recently! I haven't completely stayed with my investment strategy as you will see from my trading attempt with Kendle (KNDL). I always reserve the right to do something silly, and I managed to do just that. It isn't that I didn't like Kendle, it was just not part of my strategy to do a trade like that. And it didn't work out. So I am back to my plodding strategy that has been working a bit better than the old shoot from the hip approach!

I was looking through the

I was looking through the

With the market climbing once again today (two days in a row!) I figured I would be able to find a stock or two that I liked. In fact, Hologic (HOLX), an old favorite of mine, was on the list of top % gainers, and the last price I have for it is $48.34, up $3.47 or 7.73% on the day. It is near the close of trading and probably is the closing price. I don't have any shares of HOLX in my Trading Account but my son does own literally 20 shares and my stock club also has purchased shares in Hologic.

With the market climbing once again today (two days in a row!) I figured I would be able to find a stock or two that I liked. In fact, Hologic (HOLX), an old favorite of mine, was on the list of top % gainers, and the last price I have for it is $48.34, up $3.47 or 7.73% on the day. It is near the close of trading and probably is the closing price. I don't have any shares of HOLX in my Trading Account but my son does own literally 20 shares and my stock club also has purchased shares in Hologic.

On June 8, 2006, JOSB

On June 8, 2006, JOSB

On April 7, 2005, I

On April 7, 2005, I

The market continues to back off with the Dow down 98.69 to 10747.60 as I write and the NASDAQ down 16.31 to 2037.80. Not wishing to get too discouraged, I decided to go ahead and scan the

The market continues to back off with the Dow down 98.69 to 10747.60 as I write and the NASDAQ down 16.31 to 2037.80. Not wishing to get too discouraged, I decided to go ahead and scan the