Stock Picks Bob's Advice

Sunday, 13 November 2005

A Reader Writes "I never thanked you for turning me onto MTW..."

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I received a comment on my

post on Jos. A Bank Clothiers (JOSB) earlier this weekend. I wanted to share it with you and hopefully this will continue to answer questions about my own strategy and the rationale behind it.

Ydurp wrote:

Fantastic stock ya got there. Hey, I never thanked you for turning me onto MTW. I bought it after reading your review (my broker just shook his head) and it took a while bit it managed to take off. I don't understand why it's in a slump, unless it's because of the marine aspect of the biz. But that seems to be a relatively small part of their operation. Would you have sold all of it by now? When I read about their growing sales in China I'm inclined to hang in there. Another question I have is that don't you get taxed differently on stock you sell before a year is up?

Your posts, and this one in particular, are sounding more and more professional. I like the lingo. Thanks for everything you do.

I

posted Manitowoc Co. (MTW) on 11/22/04 when it was trading at $38.29. I haven't really been following it closely, so let me take a closer look at the stock. (Always remember that even if I start sounding "professional", I am an amateur investor in real life....). MTW is currently trading (11/11/05), one year later, at $46.96, so this is a nice appreciation of $8.67 or 22.6% since posting. I do not unfortunately own any shares of this company.

On November 2, 2005, just a few days ago really, the company

announced 3rd quarter 2005 results. Revenue climbed 23% to $564.9 million from $460.8 million. Diluted eps came in at $.55/share, up from $.47. This was a nice quarterly report.

Checking the Morningstar.com

"5-Yr Restated" financials (one of my favorite pages for getting a handle on a stock), we can see that at least as updated by Morningstar, the steady revenue growth is intact, the earnings growth is intact, the company did increase its dividend from 2004 to the past twelve months, but that the free cash flow turned negative with $(10) million reported in the TTM.

The balance sheet looks adequate, if not overwhelmingly positive. The company is a bit heavy on debt. Otherwise things look ok.

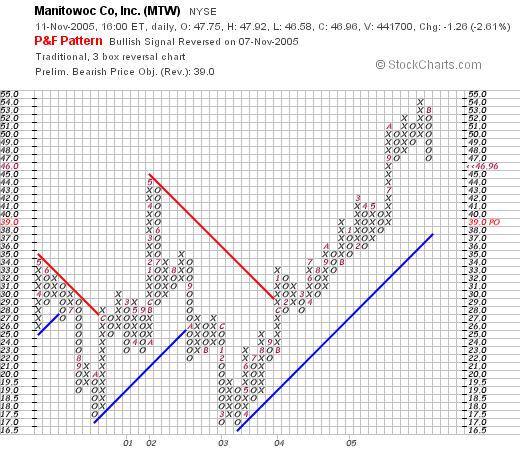

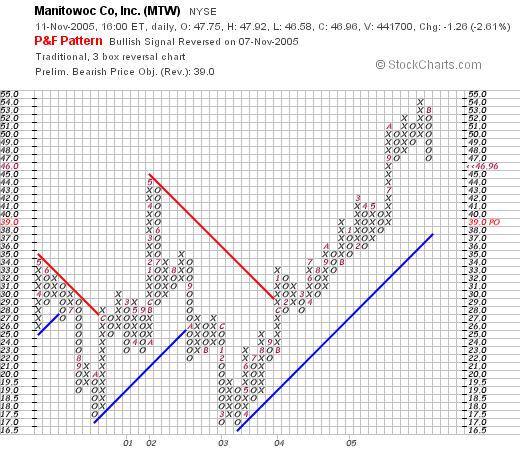

Looking at a

"Point & Figure" chart on MTW from Stockcharts.com I think the technical performance of this particular stock is intact. It hasn't really broken down. Take a look at the chart that I have linked to. I don't see any news items that would explain anything about the company. Overall, I like what I see.

As far as selling, please remember that you can do what you choose to do. My own strategy involves selling all of my shares if a stock declines either to an 8% loss after a first purchase, to break-even after a single partial sale on a gain, or if it retraces 50% of my last targeted gain sale.

Recall that I sell shares on the upward appreciation of a stock if it hits 30%, 60%, 90%, 120%, 180%, 240%, 300%, 360%, 450%....etc. At each of these appreciation levels, I sell 1/4 of my holding. Sort of "hedging" my bet! Thus, if I have never sold a stock at any gain, then I sell if it declines to an 8% loss, if I sold 1/4 of my holdings at a 30% gain, then I would sell ALL of my shares at break-even. Same if I have sold twice, once at a 30% gain, and once at a 60% gain; if it declines back to the 30% level (1/2 of my highest gain), then I sell all of my shares. It is very mechanical. I don't do very much thinking.

I do reserve the right to sell all of my shares if there is something that comes out that is clearly fundamentally negative for the company. Even then I may react too quickly to sell when I should have just let the stock price dictate my action.

Finally, you ask about the holding period and taxation in the United States.

Quoting an article from MSNBC.com from 11/2/05:

If you're in the 10% or 15% tax bracket:

Assets held for a year or less are taxed at your ordinary income tax rate.

Assets held for more than a year are taxed at a 5% rate.

If your tax bracket is greater than 15%:

Assets held for a year or less are taxed at your ordinary income tax rate.

Assets held for more than a year are taxed at a 15% rate.

The difference can be enormous. If you hold a security for 12 1/2 months and then sell, you'll likely pay just a 15% tax on the gains. If you sell after holding for only 11 1/2 months, though, you'll be taxed at your ordinary income rate, which can be as high as 35%. So you might pay more than twice as much in taxes.

I think this explains the difference, but you might wish to check with your own accountant or do a Google search for more information.

My strategy is not sensitive to tax questions. I am just trying to maximize my portfolio performance. However, since short-term gains are taxed higher, it does work out that I accumulate a lot of small short-term losses when I sell stocks quickly at an 8% loss that cancel out the gains. Over time, most of my gains are long-term gains, and are thus taxed at a lower rate.

Thanks again for your kind words. I have been blogging now for almost three years and I think I am getting more of a system down. I am glad that you checked with your broker before making an investment decision. I think that my rationale for the stocks I discuss is something you could share with him/her before making a decision and I am sure they will appreciate your homework on the investment idea.

Regards! And thanks for visiting here.

Bob

Posted by bobsadviceforstocks at 4:50 PM CST

|

Post Comment |

Permalink

Updated: Sunday, 13 November 2005 5:07 PM CST

A Reader Writes "I disagree with your statement...."

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Checking my mail this weekend, I saw that I had a note from my good friend Bob K. who wrote:

Hi Bob,

I disagree with your statement that you did not do very well the week of September 6, 2004...see quote below. According to my math (and following your sell formula) an equal dollar investment in all three would have yielded 48.8% -8% -8% for a net of 32.8% gain. I could live with 32%.

If you weren't willing to take a chance on those two losers how would you have found the winner? You are like Babe Ruth, some strike-outs, but the homeruns more than compensate...sort of like life. This is a great example of diversification and your practice of selling losers quickly.

And yes I did notice you were off the air and missed your blog.

Bob

First of all, thank you for writing and visiting here! You are probably one of my most loyal readers.

You make an excellent point about the losing positions. As I explained in my blog post, the actual return

would be different if one used my selling strategy with these picks. I try to assume a "buy and hold" approach on these reviews because I think it gives a better assessment on how the stock actually performed. But if you

were buying all of the stocks from each week, potentially the return could be better. Or at least different. As it is possible that one of my picks that actually ended up higher, might have dropped 8% and be sold before moving to a higher level.

But overall, I believe this is an excellent demonstration of the helpfulness of selling losing stocks quickly and holding on to the winners. In my own view, this represents a type of "natural selection", (or should I say "intelligent design"?) in my portfolio with the resultant stocks that "survive" being the most promising for future price appreciation imho.

Again, thank you for your continued participation here and your kind words!

Bob

Saturday, 12 November 2005

"Looking Back One Year" A review of stock picks from the week of September 6, 2004

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

As I like to do on weekends, this is a review of past stock picks from about a year earlier on this blog. These may include stocks that I own, but generally, these are just selections that have been discussed on this website and are not stocks that I have any ownership in. In order to simplify this review process, I assume a buy and hold strategy in this review. In practice, if you have been following what I write, you will know that I do

not buy and hold, but rather sell my stocks quickly if they decline after a first purchase, or sell portions of them slowly if they appreciate in price. Please keep this in mind when reviewing my discussions!

On September 7, 2004, I

posted Aviall (AVL) on Stock Picks Bob's Advice at $21.30. AVL closed at $31.69 on 11/11/05, for a gain of $10.39 or 48.8% since posting.

On October 20, 2005, AVL

reported 3rd quarter 2005 results. Net sales grew 13% over the prior year to $334 million from $295 million the prior year. Earnings per share climbed to $.41/diluted share in the quarter up 37% from $.30/share in the prior year same period. This was a solid report imho.

On September 8, 2004, I

posted Sierra Wireless (SWIR) on Stock Picks Bob's Advice at $19.15. SWIR closed on 11/11/05 at $12.59, for a loss of $(6.56) or (34.3)%.

On October 27, 2005, SWIR reported

3rd quarter 2005 results. For the 3rd quarter ended September 30, 2005, decreased 53.5% to $27.5 million this year compared with $59.1 million in the same quarter last year. Net loss for the 3rd quarter 2005 was $(3.1) million or $(.12)/share, down from net earnings of $7.1 million or $.27/share in the third quarter 2004.

On September 11, 2004, I

posted Leadis (LDIS) on Stock Picks Bob's Advice at $12.68. LDIS closed at $5.18 on 11/11/05, for a loss of $(7.50) or (59.1)%.

On October 20, 2005, LDIS reported

3rd quarter 2005 results. Revenues came in at $17.6 million, down from $40.9 million the prior year. The company reported a loss of $(2.5) million or $(.09)/diluted share down from net income of $5.0 million or $.16/diluted share the prior year.

So how did we do? Well, not very well :(. I had one gain of the three and two losers with an average of loss of (14.9)% on the three stocks. This, as I wrote, assumes a buy and hold approach and emphasizes, imho, the importance of selling losers quickly to prevent these large losses that can accrue even from stock picks where I have done "my homework".

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com or leave your words right here on the blog!

Bob

"Weekend Trading Portfolio Analysis" Jos. A Bank Clothiers (JOSB)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I am glad to be back blogging after a few days hiatus. Sometimes I get so busy in my daily responsibilities that I have a hard time finding the time to get to my computer and blog! If you missed my posting, well I appreciate your interest. If you didn't notice that I hadn't been writing, well, then I didn't disappoint I guess :).

This blog has two parallel activities going on. First, I generally have been writing about stock market ideas that I find attractive as potential stocks that might be showing appreciation in price in the future. In addition, I try to share with you my own experiences in dealing with the stock market, by posting my actual holdings and transactions within my trading portfolio. These holdings are generally stocks that I have purchased from the greater list of "stock picks" and share the same characteristics of stocks that I discuss on the blog.

Several weeks ago I started reviewing the stocks in my trading portfolio on weekends. Going alphabetically, last week I

discussed Hibbett Sporting Goods. This week, I would like to share with you my experience with Jos. A Bank Clothiers (JOSB).

On April 4, 2005, I purchased 240 shares of Joseph A. Bank Clothiers (JOSB) at a price of $31.90/share. On June 7, 2005 I sold 60 shares of JOSB at $41.62/share for a gain of $9.72/share or 30.5% from my purchase cost. Thus, this represented 1/4 of my holdings at my first sale target, which as you may know is a 30% gain. Currently, I own 180 shares of JOSB which closed 11/11/05 at $46.21. This represents a gain of $14.31 or 44.9% from my purchase in April. My next sale will be at a 1/4 of my holdings sale at a 60% gain or 1.6 x $31.90 = $51.04, or if the stock should decline, I shall be selling

all of my remaining shares at approximately break-even or $31.90.

O.K., let's take a look at the stock and update our review. By the way, I first

posted Jos. A Bank on Stock Picks Bob's Advice on August 7, 2003 when it was trading at $44.16. JOSB had a 3:2 stock split on 2/19/04, and a 5:4 stock split on 8/19/04 giving me an effective "pick price" of $44.16 x 2/3 x 4/5 = $23.55. Thus, the stock has actually appreciated $22.66 or 96.2% since first posting on the blog in August, 2003.

According to the

Yahoo "Profile" on Jos. A Bank, the company "...engages in designing, retailing, and direct marketing men't tailored and casual clothing, and accessories in the United States. It offers formal, business, and business casual apparel, as well as sportswear and golf apparel."

Probably a step that I regularly do but do not always discuss on this blog is to scan the news stories for anything that might be affecting this stock. Looking through the headlines, a very significant recent story was the

announcement, on November 3, 2004, of October, 2005 sales. Since JOSB does a lot of internet sales as well as actual "bricks and mortar" stores, it is helpful to look at total sales as well as same store sales. As I was discussing in the earlier post on a reader question on the Limited, I generally would like to see

at least high single digit same store sales growth reports.

Jos A Bank, in this report, noted that October sales overall grew 28.5% to $37.0 million compared with sales of $28.8 million in October, 2004. This was a GREAT number to report! Better yet, look at the "same store sales" number: an increase of 16.2%! This company is having an outstanding period of growth with solid catalog and internet sales growth of 19.5% and same store sales growth in the mid teens! Looking at retail ventures, this is about as good as it gets!

Having scanned the news on this stock, I like to look at the latest quarterly earnings report. On September 6, 2005, JOSB

reported 2nd quarter 2005 results. During the quarter ended July 30, 2005, total sales increased 20.2% to $98.6 million, compared with $82.0 million in the prior year same period. During the quarter, same store sales increased 4.9%, and combined catalog and internet sales jumped 23.4% during the quarter. Net income increased to $5.3 million for the quarter up from $3.4 million and earnings per share increased 54% to $.37/share up from $.24 in the same period last year. The company actually raised guidance for the

second time this year within the earnings report. As Robert Wildrick, CEO of JOSB stated:

"Based on these strong results and the current business outlook, we are raising our earnings guidance for the second time for the year ending January 28, 2006 (fiscal 2005) to at least $2.15 to $2.19 per share, compared with $1.72 per share in fiscal 2004."

This was a very strong earnings report!

What about longer-term? Taking a look at the

Morningstar.com "5-Yr Restated" financials on JOSB, we can see the steady increase in sales from $206 million in 2001 to $406 million in the trailing twelve months (TTM). Earnings have also steadily improved from $.43/share in 2001 to $1.95/share in the TTM.

The free cash flow has been a bit erratic, dropping from $12 million to $(31) million in 2004 but has improved to $10 million in the TTM.

The balance sheet is solid with $1.1 million in cash and $189.5 million in other current assets, enough to cover both the $97.8 million in current liabilities and the $52.1 million in long-term liabilities.

How about valuation? Reviewing the

Yahoo "Key Statistics" for JOSB, we can see that this is a small mid-cap stock with a market cap of $630.54 million. The company has a very reasonable p/e of 23.73 and a forward p/e (fye 29-Jan-07) of 17.70. The PEG is a reasonable .78. (Anything under 1.0 is a great buy imho if everything else is in order.) Yahoo reports only 13.65 million shares outstanding with 4.04 million shares (10/11/05) our short (!) representing 12.3 trading days of volume. With the reasonable valuation and fabulous earnings report, I have to wonder what these short-sellers were smoking, and whether they are now scrambling to buy some shares back. Looks like a squeeze to me. But then again I am just an amateur.

No cash dividend is reported and Yahoo reports, as I mentioned above, the 5:4 stock split on 8/19/04.

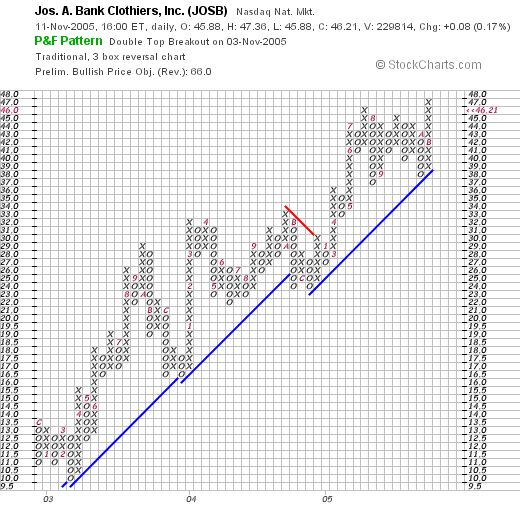

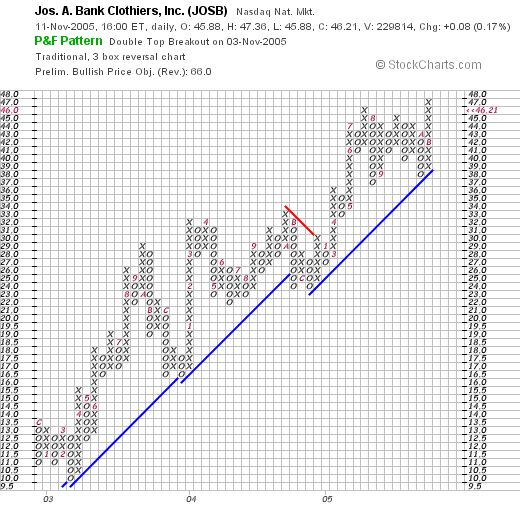

How about a chart? Looking at a

"Point & Figure" chart on JOSB from Stockcharts.com:

This chart looks quite strong with the stock bouncing off a support line at $10/share in March, 2003, and moving almost perfectly higher to the $47 range recently reported. A very strong chart with strong underlying fundamentals.

So what do I think? Well, I own the shares :). But seriously, the stock looks great with an accelerating earnings report, steady growth, great latest quarter, reasonable valuation, strong chart, and a bunch of short-sellers probably looking to cover their sales with a relatively limited number of shares to find to buy.

Thanks again for stopping by! Excuse my occasional absence from the blog. And do come back and visit, comment, and send me any of your questions or thoughts at bobsadviceforstocks@lycos.com. Also, feel free to comment right on the blog!

Bob

Monday, 7 November 2005

A Reader Writes "Have you ever looked at Limited or Limited Brands?"

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I was checking my email this afternoon and found a very nice letter from John A. D. who wrote:

Bob: this is a really impressive site. I should say a work of

art. Congrats and please keep up the great work. BTW, have you

ever looked at Limited or Limited Brands?

John A. D.

Well first of all John, Thank You! Thanks for the kind words, the encouragment, and your participation here on the blog.

One of the downsides of being truly an amateur is that the organization of this blog is rather amateurish :). I actually had to go and Google myself with Limited to see if I had written this stock up! I don't believe I have but I would be happy to take a brief look. Let's view the latest quarter, the Morningstar report, and a chart and see what it looks like. I don't own any shares or options on this company.

First, the latest quarterly report. On August 18, 2005, Limited Brands (LTD)

reported 2nd quarter 2005 results. As reported: "Comparable store sales for the quarter ended July 30, 2005 were flat and net sales of $2.291 billion increased 4% compared to $2.211 billion last year." This isn't very encouraging :(. Earnings per share, as reported in the same news story, actually

declined to $.27/share in the quarter from $.31/share the prior year. This is also a negative. Operating income was $203.9 million, compared with $226.9 million last year, with net income of $113.1 million this year compared with $148.0 million last year. With flat same store sales, and declining net income, I wouldn't really look any further for a stock pick on this website.

To make matters worse, imho, the news on the same store sales figure lately have been worse. As

reported on November 3, 2005, same store sales for the four weeks just ended on October 29, 2005, declined 4% with net sales declining 1% to $629.0 million for the period down from $633.8 million last year. When looking at retail companies, it is imperative, imho, to choose those companies with same store sales growth consistently in the mid single digits or higher.

What about Morningstar? Looking at the

"5-Yr Restated" financials from Morningstar.com, we can see that revenue has been stagnant the last few years with $10.1 billion in sales in 2001, and $9.5 billion in sales in the trailing twelve months (TTM).

Earnings have been a bit erratic, increasing from $.96/share in 2001, to $1.47 by 2005. However, earnings actually

declined to $1.31/share in the TTM.

Free cash flow has been solidly positive with $434 million reported in the TTM. The balance sheet also looks satisfactory with $719.1 million in cash and $1.5 billion in other current assets. This is to be balanced against $1.26 billion in current liabilities and $2.3 billion in long-term debt.

Looking at some

"Key Statistics" on LTD from Yahoo, we can see that this is a large cap stock with a market capitalization of $8.41 Billion. The trailing p/e is a very reasonable 15.37, the forward p/e is even nicer at 13.97 (fye 29-Jan-07). Thus Yahoo has the PEG at a very reasonable 1.16.

Looking at the

Fidelity.com eresearch snapshot on LTD, we find Limited Brands in the "Apparel Stores" Industrial Group. Within this group, the Limited Brands is the best bargain with a Price/Sales ratio of only 0.9. Topping the list is Abercrombie & Fitch (ANF) with a ratio of 2.3, followed by American Eagle (AEOS) at 1.9, PacSun (PSUN) at 1.6, and Gap (GPS) at 1.0. By this criterion, Limited is a good value investment.

How about a chart? Looking at a

"Point & Figure" chart on LTD from Stockcharts.com:

We can see that the stock price has been essentially moving sideways between early 2001 and June, 2003, when it broke through resistance at $16. The stock has been trading higher fairly steadily since then, but is showing some weakness recently, testing support levels around $21. The stock chart looks reasonably bullish imho.

So what do I think? Well, I am not a big booster of this stock and would not include it as a "pick" on this blog. "Why?" you might be asking. Well, for one thing, the latest quarter didn't qualify with flat revenue and declining earnings. Furthermore the latest same store sales figures were actually negative. And revenue over the past five years has gone absolutely nowhere.

So what do I think? Well, I am not a big booster of this stock and would not include it as a "pick" on this blog. "Why?" you might be asking. Well, for one thing, the latest quarter didn't qualify with flat revenue and declining earnings. Furthermore the latest same store sales figures were actually negative. And revenue over the past five years has gone absolutely nowhere.

On a positive note, free cash flow is positive, the balance sheet is reasonable and valuation is actually very nice, with a relatively low P/E, a PEG just over 1.0 and a Price/Sales ratio which is the lowest in its industrial group. The chart also looks modestly optimistic.

However, I am not in any way a value investor. I am not interested in getting good value for my investment. Instead, I am looking for growth in earnings and revenue with a solid balance sheet and a good chart as well. Limited Brands (LTD) just doesn't make the grade imho.

Thanks again for stopping by! And thanks for the encouragement and the question. I hope that I can continue to live up to your expectations. If you or anyone else has any questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. I will answer any comments on the blog at the same entry they were posted.

Bob

November 7, 2005 Tennant Co. (TNC)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

As I work through the process of finding new stock market investment ideas, I first like to look through the lists of stocks that are showing strong upward momentum. In practice this means checking the lists of top percentage gainers for the day!

Reviewing the

list of top % gainers on the NYSE today, I came across Tennant (TNC) which appears to fit my idea of a good idea for an investment! As I write, TNC is trading at $47.85, up $2.50 on the day or 5.51%. I do not own any shares or options on this stock.

According to the

Yahoo "Profile" on TNC, this company "...engages in the design, manufacture, and marketing of products used primarily in the maintenance of nonresidential surfaces. Its products include machine products, including carpet cleaners, floor coatings, brushes, detergents, floor maintenance equipment, outdoor cleaning equipment, coatings, and related products, as well as vacuums, sweepers, and scrubbers are used to clean factories, office buildings, parking lots and streets, airports, hospitals, schools, warehouses, and shopping centers."

One of the first things I like to check when looking at a possible "selection" for the blog, is the latest quarterly results. I insist on growth in both earnings and revenue in the latest period. Tennant

reported 3rd quarter 2005 results on October 27, 2005. Net sales came in at $137.8 million, up from $120.5 million last year for the quarter ended September 30, 2005. Net earnings grew to $6.3 million, or $.69/diluted share, up 123% from the $2.8 million or $.31/diluted share last year. In addition, the company raised guidance for the remainder of 2005.

How about longer-term?

Reviewing the

Morningstar.com "5-Yr Restated" financials on TNC, we can see that revenue has climbed steadily, except for a dip between 2000 and 2001, from $452.2 million to $523.0 million in the trailing twelve months (TTM).

Similarly, earnings, which dropped from $3.04/share in 2000 to $.50/share in 2001, have also steadily increased since then to $1.90/share in the TTM. Free cash flow has been solidly positive, increasing from $6 million in 2002 to $18 million in the TTM.

The balance sheet, as presented by Morningstar, looks nice with $22.3 million in cash and $156.2 million in other current assets. This is plenty to cover both the $72.2 million in current liabilities and the $26.1 million in long-term liabilities more than 1.5 times over.

Looking at

Yahoo "Key Statistics" on TNC, we can see that this is a very small company with a market capitalization of only $429.15 million. The trailing p/e is a reasonable 19.33 with a forward p/e (fye 31-Dec-06) even nicer at 16.53. There is no PEG listed, but with the latest quarter showing dynamic growth, this would likely be under 1.0 (imho).

Using the

Fidelity.com eresearch website, we can find that this company is in "Diversified Machinery" industrial group, and is a relative bargain on the Price/Sales basis. Topping this list is Roper Industries (ROP) with a Price/Sales of 2.7, Idex (IEX) at 2.2, Illinois Tool Works (ITW) at 1.9, and Ingersoll-Rand (IR) at 1.3. At the bottom of the list is boath Eaton (ETN) at 0.8, and Tennant (TNC) at 0.8 as well. Looks like a nice value for this company on this basis.

Finishing up some additional information from Yahoo, we find that there are only 8.95 million shares outstanding with 222,510 shares out short representing 2.50% of the float or 4.5 trading days of volume as of 10/11/05. This is somewhat significant and may be adding to the buying pressure we are observing.

Interestingly, (is that a word?), the company

does pay a small dividend of $.88/share yielding 1.90%. The last stock split reported by Yahoo was a 2:1 split in April, 1995.

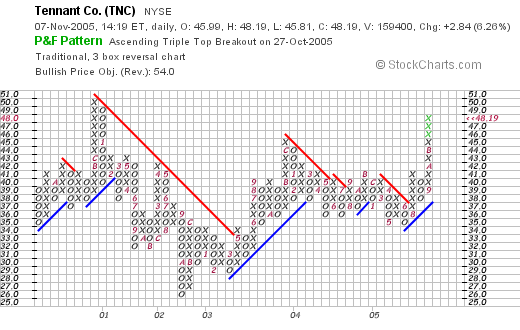

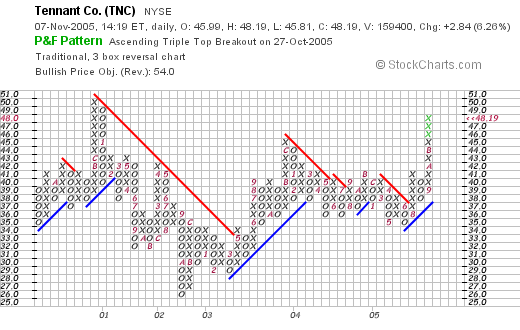

What about the chart? Taking a look at the

"Point & Figure" chart on Tennant (TNC) from Stockcharts.com, we can observe that the stock has moved sideways pretty much since 2000, and only recently, broke through resistance at $38/share in August, 2005, and has moved strongly higher since. At least over the short-term, the chart looks strong to me.

So what do I think? This is a fascinating stock pick imho. If only I had a signal to be buying some stock...well that is another post altogether! I like the latest quarterly report, the past five years results looks nice with the company growing both revenue and earnings (except for a dip between 2000 and 2001), free cash is solidly positive, and the balance sheet is nice. The company even pays a dividend. The P/E is low and the Price/Sales is the lowest in its group. The chart shows upward movement but certainly is not overvalued or overextended imho.

Thanks so much for stopping by and visiting! If you have any comments or questions please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Saturday, 5 November 2005

"Looking Back One Year" A review of stock picks from the week of August 30, 2004

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

In the previous post, I discussed a stock from my actual trading portfolio. In this post, I shall be reviewing stocks that I have "picked" for review but do not necessarily own. In fact, I

do own Cooper Companies in my trading account, but do not own any shares or options of Polaris Industries (PII).

On September 1, 2004, I

posted Cooper Companies (COO) on Stock Picks Bob's Advice at $63.33/share. COO closed at $72.74 on 11/4/05, for a gain of $9.41 or 14.9% since posting.

On September 7, 2005, COO

reported 3rd quarter 2005 results. For the quarter ended July 31, 2005, revenue came in at $222.1 million, 72% over the third quarter 2004 results. Income was $37.88 million, up over 50% from the $24.6 million reported the prior year. On a diluted per share basis, earnings came in at $.79/share, up 18% from the $.67/share reported the prior year same period.

On September 2, 2004, I

posted Polaris Industries (PII) on Stock Picks Bob's Advice when it was trading at $51.00/share. PII closed at $46.17/share on 11/4/05, for a loss of $(4.83) or (9.5)% since posting.

On October 13, 2005, Polaris (PII)

announced 3rd quarter 2005 results. Sales from continuing operations for the quarter increased 6% to $543.1 million, compared with $510.6 million the prior year. Net income from continuing operations came in at $1.17/dilued share, up 17% from last year's net income of $1.00/diluted share. However, the company did reduce full year 2005 results and this was enough to "throw some cold water" on the stock chart.

So how did we do? Well, I only "picked" two stocks that week, and Cooper showed a gain of 14.9%, and Polaris showed a loss of (9.5)% since posting. Averaging the two stocks, we get an appreciation of only 2.7% for the two stocks since they were introduced the prior year.

Thanks again for visiting! If you have any questions or comments, please feel free to email me at bobsadviceforstocks@lycos.com or feel free to leave you comments right on the blog!

Bob

"Weekend Trading Portfolio Analysis" Hibbett Sporting Goods (HIBB)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I occasionally get emails from people who are trying to figure out exactly

what I am doing on my blog! Basically, this website is about two things: stock market investment ideas that I find attractive, and my own experience using those same ideas and the same strategy in developing a trading portfolio. Several weeks ago, I decided to systematically review each of my actual holdings in my portfolio and share with you my experience with those stocks and the current status of those investments.

Last week, I

reviewed Genesco (GCO) on Stock Picks Bob's Advice. Going alphabetically through my current holdings, my next stock to discuss is Hibbett Sporting Goods (HIBB).

I currently own 111 shares of Hibbett (HIBB) in my trading account that was acquired 3/6/03 with a cost basis of $6.50/share. HIBB closed on 11/4/05 at $27.15, giving me a gain of $20.65/share or 317.7% for this stock(!). This investment has been a superstar in my portfolio!

I have sold portions of my original investment eight times (!), representing sales at 30%, 60%, 90%, 120%, 180%, 240% 300%, and 360%. Thus, my current next sale point would be either at a 450% (now going by 90% intervals) or $6.50 x 5.5 = $35.75 or on the downside, at a 180% gain level (half of the highest appreciation point or $6.50 x 2.80 = $18.20.

On August 18, 2005, HIBB

reported 2nd quarter 2005 results. Revenue for the quarter ended July 30, 2005, climbed 15.0% to $94.0 million, compared with $81.8 million for the prior year same period. During the quarter comparable store sales jumped 3.1%. Net income grew strongly by 66.9% to $4.9 million, up from $2.9 million the prior year. On a diluted per share basis, this worked out to a 75.0% increase to $.21/share, up from $.12/diluted share the prior year. In addition, the company raised 2006 guidance and announced a 3:2 stock split!

Taking a look at the

"5-Yr Restated" financials for HIBB from Morningstar.com, we can see that revenue growth has remained perfectly steady increasing from $209.6 million in 2001 to $408.1 million in the trailing twelve months (TTM).

Earnings have increased steadily as well from $.32/share in 2001 to $.85/share in the TTM. Free cash flow has been positive, increasing from $11 million in 2003 to $27 million in the TTM.

The balance sheet is solid with $48.9 million in cash and $125.8 million in other current assets balanced against $57.4 million in current liabilities and $9.7 million in long-term liabilities.

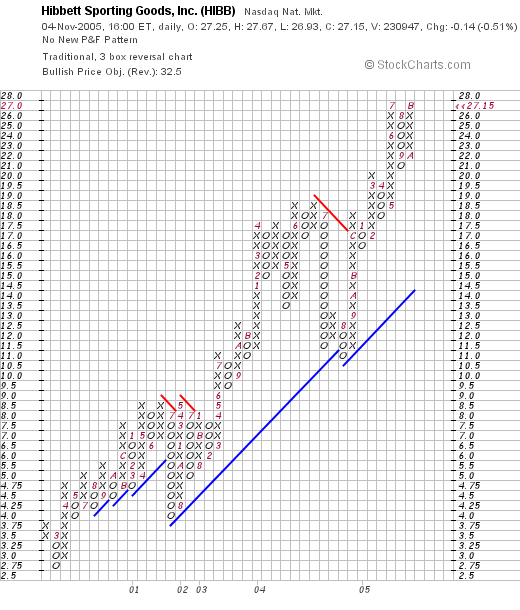

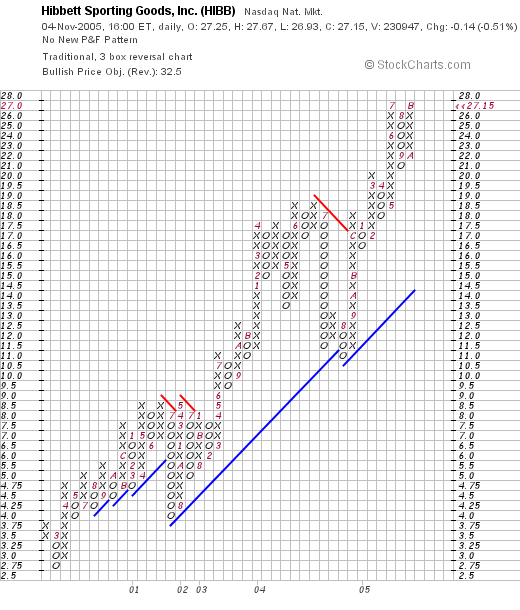

Looking at a

"Point & Figure" chart on HIBB from Stockcharts.com:

We can see an absolutely gorgeous graph with Hibbett appreciating steadily in price from $2.75 in March, 2000, to $27.50 level currently. The stock really has held to the support levels very nicely if not perfectly.

What do I think? This was a great investment for me! I cannot tell whether the future will continue to hold bright prospects for me or not but I have already hedged my bet so to speak having sold portions of this stock eight times already! Hopefully, the stock continues to advance as Hibbett spreads out opening sporting goods stores in small towns across America!

Thanks so much for stopping by! If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com, or just go ahead and leave your words on the blog!

Bob

Friday, 4 November 2005

A Reader Writes "I hope you don't mind me picking your brain...."

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always, please remember that I am an amateur investor and that you should always consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Reading my mail this afternoon, I saw that a friend of mine, Jeff S. had written a note to me with a question. This is what he had to say:

Hi Bob,

I have been frequently visiting your blog and tying to make sense of the information you share. I especially like it when you explain your strategies of when to sell a stock i.e. 8% loss or 30% gain. If the stock gains the 30% and you sell of 1/4 of your position, then do you follow the same rule again i.e.. if it loses 8% sell all or if your remaining holdings or gains 30% again sell another 1/4? How many different stocks do you think someone could comfortably manage? I am very interested in trying a few stocks but really don't know how to get started. As I filter through your past bog entries, I make notes of your tips and techniques. I hope you don't mind me picking your brain for the answers to my rudimentary questions.

Thanks

Jeff S.

Jeff, first of all, thanks for visiting my blog and for writing! You have written me about my selling strategy, and I think you understand the bulk of my approach. However, just in case, let me summarize my approach to selling a stock.

After a first purchase of an investment, I only allow it to decline 8% prior to selling

all of the shares that I own. I enter these sales manually, but I am sure there are automatic ways to set this up at the time of purchase.

However, I also sell portions of stock on gains. You could say that I believe that by selling losing stocks quickly and completely, and by selling gaining stocks partially and slowly, I am biasing my investments to stocks that are performing well. That is the essential philosophy to my selling behavior.

Back to selling stocks. If stocks move higher in price, I sell them a little at a time. I only sell the entire position of any of my holdings on some sort of bad news or decline in the stock price. Currently, I have set price goals of 30%, 60%, 90%, 120%, and then by 60% intervals: 180%, 240%, 300%, 360%, and then by 90% intervals etc. At each of these particular stock price appreciation levels, I sell 1/4 of my remaining holdings. Basically, I am trying to sell my "winnings". What do I mean by that? Well if a stock appreciates by 30%, you basically have 4/3 of a stock, and then by selling 1/4 of the holding, you are back to approximately 3/3 of the original investment.

How about on the downside? How does this affect my strategy?

I learned much from reading William O'Neill who is the publisher of the Investor's Business Daily. He is the one who influenced me to set 8% stops on my losses. He also makes the astute suggestion that once one has made a gain on a stock, that you shoud avoid "giving it back" and move your stop up to a break-even position. That is exactly what I do. If I have sold once, that is a 1/4 position after a 30% gain, then my sale point on the downside is 'break-even' not an 8% loss.

However, if I have sold a stock more than once, like I did with my Dell stock, which I had sold twice, then one should sell all of the remaining shares if the stock retraces back 50% of the highest gain point sale. That is, as with Dell, since I had sold 1/4 of my position at a 60% gain, when the stock retraced back 50% of the highest gain-sale point, which for Dell was at a 30% gain, then I should and did unload the entire position.

You ask about "how many stocks" one can manage. I find the number relatively easy with my Fidelity account online. The brokerage house shows me the % gain or loss of each of my holdings as well as the history of prior sales, so it is a cinch for me to calculate when I need to sell a stock either on a retracement or on a gain. I have a 25 position maximum. I think that 20 positions would be an excellent size for a portfolio.

One thing that I believe in is, when starting a portfolio, start at 50% equity/50% cash. I would call this a neutral bias. Allow yourself to go down to 1/2 of your original # of holdings....if you shart at 10, allow yourself to only drop to 5, and stick to your previous goal of 20. Only add a new position on a sale of a partial position (1/4) on a gain. Use this as a signal to increase your exposure to equities. On the other hand, assuming you started with 10 different stocks, I would suggest you drop down to a minimum of 5 positions. After that, replace the stocks in the 5 positions if they hit 8% losses. But use sales of portions of the exising holdings as a signal to be adding positions.

I hope this explains my approach a little better to you! It is an idiosyncratic (I hope that's the right word!) strategy that works for me. You are welcome to utilize this approach as well. If you do, let me know how it works out. If you or any other reader has questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Thursday, 3 November 2005

"Revisiting a Stock Pick" Fair Isaac (FIC)

Hello Friends! Thanks so much for stopping by and visiting my blog,

Stock Picks Bob's Advice. As always please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I enjoy looking at stocks on this blog and finding stocks that may eventually appreciate in price. My strategy, as I have explained elsewhere, begins with monitoring the lists of

top % gainers; in this case, for the NYSE today.

Looking through the list, I came across Fair Isaac (FIC) which closed at $44.50, up $2.33 or 5.53% on the day. I do not currently own any shares of FIC nor do I have any options on this stock.

Reviewing the

Yahoo "Profile" on FIC, we can find that the company "...provides analytic, software, and data management products and services that enable businesses to automate decisions primarily in the United States, the United Kingdom, and Canada."

With literally hundreds of stocks discussed on this blog, I try to avoid repeating a stock "idea" for at least a year after its prior discussion. In this case, I

reviewed Fair Isaac on Stock Picks Bob's Advice on July 24, 2003, when it was trading at $55.42. FIC declared a 3:2 stock split making our effective price actually $55.42 x 2/3 = $36.95. Thus, the stock has appreciated only $7.55 or 20.4% since posting in 2003.

What drove the stock higher, and what has been driving so many similar stocks higher, was the announcement of quarterly results, in this case the

announcement of 4th quarter 2005 earnings. For the quarter ended September 30, 2005, revenues came in at $203.3 million, as compared to $190.4 million in the prior year same quarter, an increase in revenue of $12.9 million or 6.8% over the prior year. Net income came in at $35.7 million, or $.53/diluted share, compared to net income of $14.4 million or $.19/diluted share the prior year. This is greater than a 150% increase in net income year over year!

What about longer-term? Reviewing the

Morningstar.com "5-Yr Restated" financials on FIC, we can see the nice progression in revenue from $298.6 million in 2000 to $785.8 million in the trailing twelve months (TTM).

Earnings have grown (except for a dip from $.89/share in 2001 to $.32/share in 2002) from $.56/share in 2000 to $1.64/share in the trailing twelve months.

Dividends have also increased from $.04/share in 2000 to $.08/share in the TTM. Interestingly, the number of shares peaked at 72 million shares in 2003, and has now declined the past two years to 65 million in the TTM.

Free cash flow has been strong with $80 million reported in 2002 and $164 million reported in the TTM.

The balance sheet looks adequate with $254.4 million in cash, and $188.4 million in other current assets, plenty to cover the $133.8 million in current liabilites as well as almost all of the $408.5 million in long-term liabilities per Morningstar.

And how about some statistical measurements on this company? Looking at

Yahoo "Key Statistics" on FIC, we find that Fair Isaac is a large Mid-Cap stock with a market capitalization of $2.91 billion. The trailing p/e is a bit rich at 26.97 and the forward p/e (fye 30-Sep-06) is better at 21.60. The PEG ratio (5 yr expected) is also rich at 1.53.

Looking at the

Fidelity.com eresearch website, we can see that this stock is also fairly richly valued with a price/sales ratio of 4.4 in the "Business Services" industrial group. Topping this list is Global Payments (GPN) at 4.4, followed by Fair Isaac at 3.7, Equifax (EFX) at 3.4, Cintas (CTAS) at 2.3, Certegy (CEY) at 2.2 and IPAYMENT (IPMT) at 1.4.

Reviewing some more key statistics from Yahoo, we find that there are 65.38 million shares outstanding with 2.87 million shares out short as of 10/11/05. This represents 4.50% of the float or 6 trading days of volume (the "Short Ratio"). Thus, using my 3 days of short volume as a cut-off, this looks significant to me and may be driving the stock higher today in the face of good news.

The company, as noted earlier, does pay a dividend of $.08/share yielding 0.20%. The last stock split was a 3:2 split on 5/11/04.

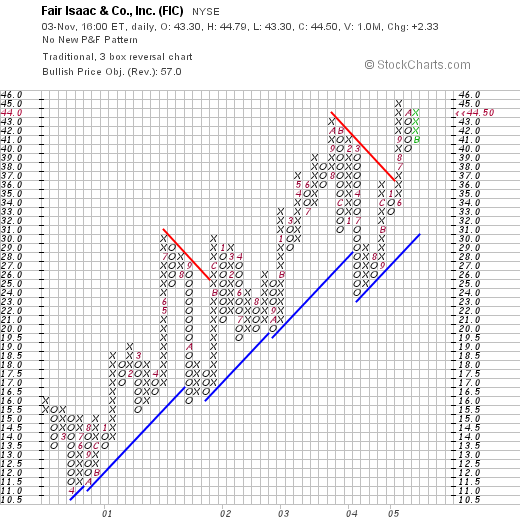

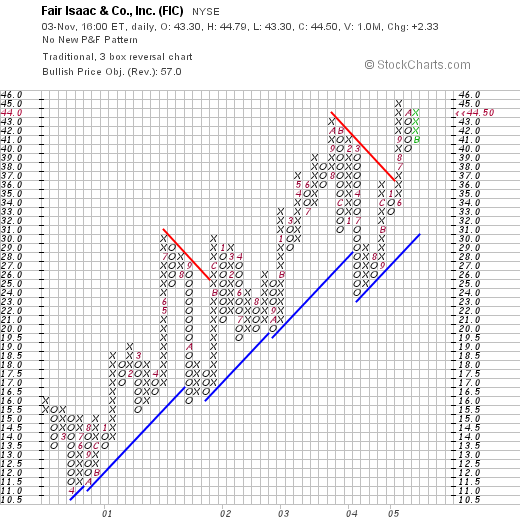

And what does the chart look like? lookint at a

"Point & Figure" chart on Fair Isaac from Stockcharts.com:

We can see a very strong chart with the company showing some significant short-term trading volatility but a long-term steady increase in price from $11.00/share in April, 2000, to the recent high near $45. The chart looks volatile but positive to me.

So what do I think? Well, I actually like this stock. The latest quarterly report was quite strong and I believe the company exceeded expectations. The past five years have been a bit inconsistent but strong overall, with free cash positive and growing and a solid balance sheet. Valuation in terms of PEG and Price/Sales ratios have been a bit on the expensive side as well.

The chart looks nice and I especially appreciate the company's effort at buying back shares to reduce the number of shares outstanding. All-in-all I like the stock even though it is not a big bargain in terms of P/E, PEG, and Price/Sales ratios.

Thanks so much for stopping by! Please feel free to comments right on the blog or email me at bobsadviceforstocks@lycos.com if you have any comments or questions!

Bob

Newer | Latest | Older

On September 7, 2004, I

On September 7, 2004, I  On October 20, 2005, AVL

On October 20, 2005, AVL  On September 8, 2004, I

On September 8, 2004, I  On October 27, 2005, SWIR reported

On October 27, 2005, SWIR reported  On September 11, 2004, I

On September 11, 2004, I  Hello Friends! Thanks so much for stopping by and visiting my blog,

Hello Friends! Thanks so much for stopping by and visiting my blog,  On April 4, 2005, I purchased 240 shares of Joseph A. Bank Clothiers (JOSB) at a price of $31.90/share. On June 7, 2005 I sold 60 shares of JOSB at $41.62/share for a gain of $9.72/share or 30.5% from my purchase cost. Thus, this represented 1/4 of my holdings at my first sale target, which as you may know is a 30% gain. Currently, I own 180 shares of JOSB which closed 11/11/05 at $46.21. This represents a gain of $14.31 or 44.9% from my purchase in April. My next sale will be at a 1/4 of my holdings sale at a 60% gain or 1.6 x $31.90 = $51.04, or if the stock should decline, I shall be selling all of my remaining shares at approximately break-even or $31.90.

On April 4, 2005, I purchased 240 shares of Joseph A. Bank Clothiers (JOSB) at a price of $31.90/share. On June 7, 2005 I sold 60 shares of JOSB at $41.62/share for a gain of $9.72/share or 30.5% from my purchase cost. Thus, this represented 1/4 of my holdings at my first sale target, which as you may know is a 30% gain. Currently, I own 180 shares of JOSB which closed 11/11/05 at $46.21. This represents a gain of $14.31 or 44.9% from my purchase in April. My next sale will be at a 1/4 of my holdings sale at a 60% gain or 1.6 x $31.90 = $51.04, or if the stock should decline, I shall be selling all of my remaining shares at approximately break-even or $31.90. According to the

According to the  Having scanned the news on this stock, I like to look at the latest quarterly earnings report. On September 6, 2005, JOSB

Having scanned the news on this stock, I like to look at the latest quarterly earnings report. On September 6, 2005, JOSB  What about longer-term? Taking a look at the

What about longer-term? Taking a look at the

First, the latest quarterly report. On August 18, 2005, Limited Brands (LTD)

First, the latest quarterly report. On August 18, 2005, Limited Brands (LTD)  To make matters worse, imho, the news on the same store sales figure lately have been worse. As

To make matters worse, imho, the news on the same store sales figure lately have been worse. As  Earnings have been a bit erratic, increasing from $.96/share in 2001, to $1.47 by 2005. However, earnings actually declined to $1.31/share in the TTM.

Earnings have been a bit erratic, increasing from $.96/share in 2001, to $1.47 by 2005. However, earnings actually declined to $1.31/share in the TTM.

So what do I think? Well, I am not a big booster of this stock and would not include it as a "pick" on this blog. "Why?" you might be asking. Well, for one thing, the latest quarter didn't qualify with flat revenue and declining earnings. Furthermore the latest same store sales figures were actually negative. And revenue over the past five years has gone absolutely nowhere.

So what do I think? Well, I am not a big booster of this stock and would not include it as a "pick" on this blog. "Why?" you might be asking. Well, for one thing, the latest quarter didn't qualify with flat revenue and declining earnings. Furthermore the latest same store sales figures were actually negative. And revenue over the past five years has gone absolutely nowhere. As I work through the process of finding new stock market investment ideas, I first like to look through the lists of stocks that are showing strong upward momentum. In practice this means checking the lists of top percentage gainers for the day!

As I work through the process of finding new stock market investment ideas, I first like to look through the lists of stocks that are showing strong upward momentum. In practice this means checking the lists of top percentage gainers for the day!

Reviewing the

Reviewing the  Finishing up some additional information from Yahoo, we find that there are only 8.95 million shares outstanding with 222,510 shares out short representing 2.50% of the float or 4.5 trading days of volume as of 10/11/05. This is somewhat significant and may be adding to the buying pressure we are observing.

Finishing up some additional information from Yahoo, we find that there are only 8.95 million shares outstanding with 222,510 shares out short representing 2.50% of the float or 4.5 trading days of volume as of 10/11/05. This is somewhat significant and may be adding to the buying pressure we are observing.

On September 1, 2004, I

On September 1, 2004, I  On September 2, 2004, I

On September 2, 2004, I  I occasionally get emails from people who are trying to figure out exactly what I am doing on my blog! Basically, this website is about two things: stock market investment ideas that I find attractive, and my own experience using those same ideas and the same strategy in developing a trading portfolio. Several weeks ago, I decided to systematically review each of my actual holdings in my portfolio and share with you my experience with those stocks and the current status of those investments.

I occasionally get emails from people who are trying to figure out exactly what I am doing on my blog! Basically, this website is about two things: stock market investment ideas that I find attractive, and my own experience using those same ideas and the same strategy in developing a trading portfolio. Several weeks ago, I decided to systematically review each of my actual holdings in my portfolio and share with you my experience with those stocks and the current status of those investments. I currently own 111 shares of Hibbett (HIBB) in my trading account that was acquired 3/6/03 with a cost basis of $6.50/share. HIBB closed on 11/4/05 at $27.15, giving me a gain of $20.65/share or 317.7% for this stock(!). This investment has been a superstar in my portfolio!

I currently own 111 shares of Hibbett (HIBB) in my trading account that was acquired 3/6/03 with a cost basis of $6.50/share. HIBB closed on 11/4/05 at $27.15, giving me a gain of $20.65/share or 317.7% for this stock(!). This investment has been a superstar in my portfolio! Taking a look at the

Taking a look at the

I enjoy looking at stocks on this blog and finding stocks that may eventually appreciate in price. My strategy, as I have explained elsewhere, begins with monitoring the lists of

I enjoy looking at stocks on this blog and finding stocks that may eventually appreciate in price. My strategy, as I have explained elsewhere, begins with monitoring the lists of  With literally hundreds of stocks discussed on this blog, I try to avoid repeating a stock "idea" for at least a year after its prior discussion. In this case, I

With literally hundreds of stocks discussed on this blog, I try to avoid repeating a stock "idea" for at least a year after its prior discussion. In this case, I  What about longer-term? Reviewing the

What about longer-term? Reviewing the  And how about some statistical measurements on this company? Looking at

And how about some statistical measurements on this company? Looking at