Stock Picks Bob's Advice

Sunday, 30 September 2007

Copart (CPRT) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any decisions based on information on this website.

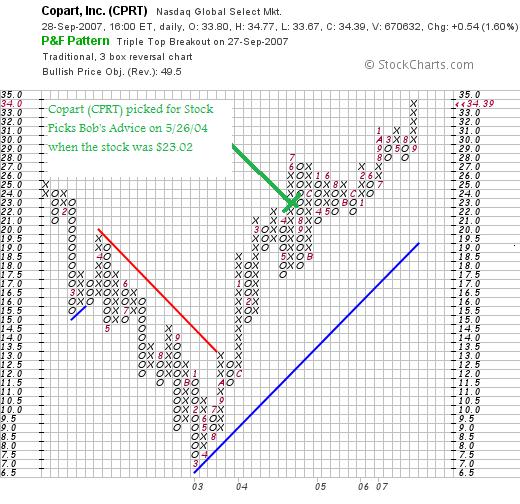

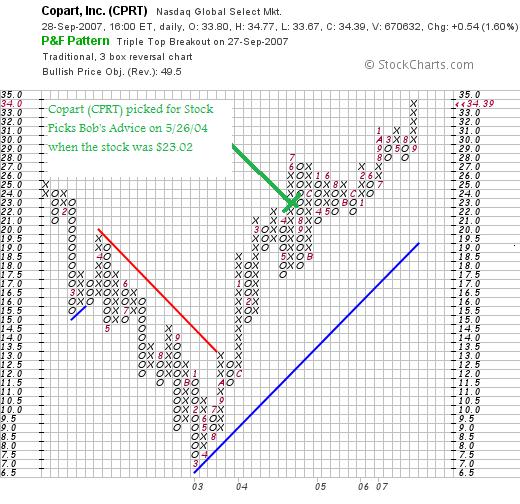

Last Thursday I reported on my purchase of shares of Copart (CPRT) and promised I would try to get a bit more of a review on the blog than the brief comments after the purchase. As I reported in that entry, I do own shares and infact purchased 210 shares on 9/27/07 at a price of $33.68. Copart is not a new name for me. In fact, I wrote up Copart on 5/26/04 when the stock was trading at $23.02. Copart (CPRT) closed at $34.39 on 9/28/07, for a gain of $11.37 or 49.4% since posting this stock three years ago.

Last Thursday I reported on my purchase of shares of Copart (CPRT) and promised I would try to get a bit more of a review on the blog than the brief comments after the purchase. As I reported in that entry, I do own shares and infact purchased 210 shares on 9/27/07 at a price of $33.68. Copart is not a new name for me. In fact, I wrote up Copart on 5/26/04 when the stock was trading at $23.02. Copart (CPRT) closed at $34.39 on 9/28/07, for a gain of $11.37 or 49.4% since posting this stock three years ago.

Let me go through some of the data underlying my decision to purchase shares and explain why

COPART (CPRT) IS RATED A BUY

What exactly does this company do?

According to the Yahoo "Profile" on CPRT, the company

"...provides salvage vehicle sale services primarily in the United States. It offers vehicle suppliers, primarily insurance companies, with a range of services to process and sell salvage vehicles over the Internet through its virtual bidding Internet auction-style sales technology."

"...provides salvage vehicle sale services primarily in the United States. It offers vehicle suppliers, primarily insurance companies, with a range of services to process and sell salvage vehicles over the Internet through its virtual bidding Internet auction-style sales technology."

How did they do in the latest quarter?

On September 26, 2007, after the close of trading, Copart announced 4th quarter 2007 results. Revenue for the quarter ended July 31, 2007, came in at $154.0 million, up 12.2% from last year's results. Income came in at $36.7 million or $.40/diluted share up 21.2% from last year's result of $31.6 million or $.35/share.

Analysts according to Thomson Financial had expected profit of $.35/share on revenue of $138.1 million. Thus the company handily beat expectations.

How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on CPRT, we can see the steady increase in revenue from $306.5 million in 2002 to $528.6 million in 2006 and $547.8 million in the trailing twelve months (TTM). Except for a dip in 2006 to $1.00 from $1.10/share, earnings have been growing nicely since 2003 when the company earned $.60/share. The latest twelve months shows Copart with earnings of $1.40/share.

No dividend is paid but the shares outstanding are stable with 89 million reported in 2002 increasing only to 90 million in the TTM.

Free cash flow is positive with $70 million in 2005, $45 million in 2006 and $84 million in the TTM. The balance sheet from Morningstar appears very strong, with $124 million in cash which by itself could easily pay off both the $80.7 million in current liabilities and the $1.5 million in long-term liabilities combined.

What about some valuation numbers?

Using the numbers from Yahoo "Key Statistics" on Copart, we find that the company is a mid cap stock with a market capitalization of $3.04 billion. The trailing p/e is a moderate 23.57 with a forward p/e (fye 31-Jul-09) estimated at 17.91. Estimating the earnings going forward over the next five years, the PEG works out to an acceptable 1.42.

According to the Fidelity.com eresearch website, Copart has a Price/Sales (TTM) ratio of 5.54, much higher than the average in the industry of 2.35. On a positive note, the company is reported to be somewhat more profitable than average, with a Return on Equity (TTM) of 15.40%, higher than the industry average of 13.09%.

Finishing up with Yahoo, we find that there are 88.33 million shares outstanding with 69.21 million that float. As of 9/11/07, there were 1.02 million shares out short, representing 1.4% of the float or 4 trading days of volume. This is slightly higher than my own 3 day rule for short interest. No dividends are paid and the last stock split reported on Yahoo was a 3:2 stock split on January 22, 2002.

What does the chart look like?

Reviewing the "Point & Figure" chart on CPRT from StockCharts.com, we can see the weakness in the price chart through much of 2002 as it dipped from $25/share in January, 2002, to a low of $7.00 in March, 2003. Since that time, the stock has been moving steadily higher . The chart does not appear particularly 'overexteded' to me.

Summary: What do I think?

Well I like this stock! In almost a 'recession play', the stock fills a niche for automobiles and is involved in car auctions. I am confident that in any weakness in the economy, more and more car purchasers are looking at used cars...of courst that is only my speculation.

Earnings were great as the company handily beat expectations. Valuation isn't bad with a moderate p/e and a PEG under 1.5. The Price/Sales is a bit rich but the Return on Equity was a bit better than average. Finally, the stock chart looks nice.

Thanks so much for stopping by and visiting. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you can, be sure and visit my Stock Picks Podcast site, my Covestor Page where my trading portfolio is analyzed, and my SocialPicks page where all of my stock picks from early 2007 are stored.

Have a great week trading!

Bob

Posted by bobsadviceforstocks at 11:00 AM CDT

|

Post Comment |

Permalink

Updated: Sunday, 30 September 2007 9:17 PM CDT

Friday, 28 September 2007

Another Person-to-Person Lender for the Developing World!

In earlier posts, I have discussed Prosper.com where individuals like you or me can participate in loans to individual consumers. If you haven't visited Prosper.com, please check it out. Be aware of the risk, but it is another way to possibly receive a higher interest return on your money when you carefully invest in loans that are credit-checked and collected by Prosper.com. (Full disclosure, I receive credit for referrals as you can as well after you set up an account. I also have $200 in 4 loans outstanding and am continuing to try to understand that process as well as I have a grasp on investing in stocks.)

I write tonight, not to mention Prosper.com, but to introduce you to Kiva.org, a website that facilitates micro-loans to entrepreneurs in developing regions that require small loans to lift them possibly out of poverty. (Full disclosure, I receive nothing for this plug for Kiva.org. I heard about it today during an interview with the former President Bill Clinton on Keith Olbermann, a favorite show of mine!)

The loans on Kiva are loans without interest. As Kiva reports:

"Kiva lets you connect with and loan money to unique small businesses in the developing world. By choosing a business on Kiva.org, you can "sponsor a business" and help the world's working poor make great strides towards economic independence. Throughout the course of the loan (usually 6-12 months), you can receive email journal updates from the business you've sponsored. As loans are repaid, you get your loan money back."

So make your own choice about these websites. Consider putting a bit of money in both of them. One where you can get the satisfaction of receiving above average interest. Or Kiva, where you get the satisfaction of helping out others in need lift themselves out of poverty.

Have a great weekend everyone.

Bob

Thursday, 27 September 2007

A Reader Writes "Trigger Points...%price increase?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I received another great letter from Doug S. today and thought I would comment right on the blog. If you have any comments or questions, please always remember you can leave comments on the blog or email me at bobsadviceforstocks@lycos.com.

I received another great letter from Doug S. today and thought I would comment right on the blog. If you have any comments or questions, please always remember you can leave comments on the blog or email me at bobsadviceforstocks@lycos.com.

Doug S. wrote:

"Bob: Back to an old topic for a second. As previously discussed mine

is earnings/revenue announcement, your's % price increase. How did you

original choose that and are there any rules/principals you developed

to further refine before you buy? Thanks"

Once again, thank you for writing Doug! You have been a loyal reader and writer of questions of comments for quite awhile now. I appreciate your enthusiasm and home that my continued blogging is helpful for you.

I have written about stock selection before on this blog, but I am quite happy to revisit this topic because there are so many different readers who stop by and many probably don't have the faintest idea about what I am doing and why I am doing it :). (Sometimes I also am wondering about the same thing!)

Selection of a stock for inclusion in the blog as part of what I call my "investing vocabulary" is the same technique that I utilize for selecting stocks to purchase. Some years back when the NASDAQ and the high-tech bubble was expanding, I noticed that simply looking at stocks that were making large gains was a useful method of selecting stocks to trade over the short-term. However, with the implosion of this bubble, this wasn't useful by itself, but it made me aware that this factor, when in conjunction with other fundamental findings on the stocks selected, might well be a good initial screen.

I start with the top % gainers lists. This is the CNNMoney.com site where the gainers are listed, and which I frequently use. If you click on the individual NYSE, NASDAQ, or AMEX links, you will get the individual lists for those exchanges. But this is just the starting place for my search. I try to avoid stocks that are much below $10 in this screening process.

My next step is generally to take a look at the Morningstar.com "5-Yr Restated financials" page. Using CPRT as an example, this page gives me a large supply of information that I utilize for making my decisions. In a nutshell, I am looking for a quality investment (aren't we all?). For me, quality is about consistency in reporting improved financial numbers. In other words, a stock that steadily grows its revenues, increases earnings, maintains a steady # of shares, has positive free cash flow that hopefully is increasing, and has a balance sheet where there are lots of assets and relatively less liabilities. Especially current assets over current liabilities.

Early on in the blog history, I was looking for perfection. I have become more realistic and look for near-perfection but am willing to tolerate a few 'blemishes' on these financial records. But not many!

If this page passes muster, I check over to the latest earnings report. As you mention, you are attracted to stocks with strong earnings/revenue reports. I am looking for stocks moving higher, but their latest quarterly report is critical in this review. Again, using Copart (CPRT), we can find their latest earnings report here on Yahoo. What am I looking for? Simple stuff really. Because I don't really understand complex financial statements. I am looking for increasing revenue, and increasing earnings. Hopefully, I can find something about expectations. I like it when results beat expectations. Hopefully for both earnings and revenue. Here you can see that Copart handily beat expectations. I have occasionally called this a 'trifecta' or 'trifecta plus'. Just silly terms that I made up using some horse-racing talk. (I don't really know much about horses either!)

Next step I take a look at valuation. Using Yahoo again, here is the page on "Key Statistics" on Copart. I prefer to see low p/e's (usually in the 20's or lower), I like to see a reasonable PEG (1.0 to 1.5). And sometimes we can find stocks with lots of short interest on this sheet, which for me is a short ratio of greater than three days. I have been using Fidelity.com for valuation numbers which you can find here for Copart. And here for profitability numbers. In general, these are ancillary numbers that do not determine my decision as much as the Morningstar page and the latest quarter earnings report.

Finally, I like to look at a "point & figure" chart. I developed a 'taste' for these charts in my stock club meetings where we had a broker from Piper Jaffrey (Bob A.), who would often present these charts to us. Perhaps it is an acquired taste, but I like looking at them.

Here is the chart for Copart. In no ways am I an accomplished technician or chartist. Quite to the contrary. Simply put, I like to see a chart which looks like the price is moving higher. That is, there appears to be a trend which is yet unbroken of increasing price as we move from left to right across the chart :). That is about how sophisticated I am :).

Topping off my process is a little bit of Peter Lynch. Maybe it is just a 'gut check' or some sort of Gestalt process. But that is what I do.

I do not necessarily think this is better than what you are doing. But I am trying to make some reason out of chaos, to develop rules for stock selection, and stock sales. Reasons for buying and reasons for selling stocks. Reasons for sitting on my hands and reasons for replacing positions.

Thanks again for writing! I hope this is helpful in explaining my own thought processes. You might visit websites where methods are proprietary. Maybe those writers are smarter and will be rich with their secret recipes. My desire is to be transparent. To be explaining everything so that I can learn and bounce my ideas and thoughts off of all of you readers. Hopefully, I shall be successful in doing this and shall continue to refine my own approach to stock market investment strategy.

Bob

Posted by bobsadviceforstocks at 1:49 PM CDT

|

Post Comment |

Permalink

Updated: Thursday, 27 September 2007 5:47 PM CDT

Bolt Technology (BTJ) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

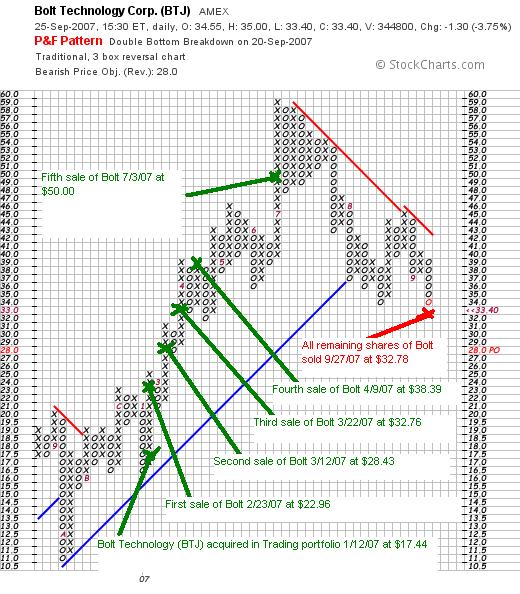

A few moments ago I sold my remaining 129 shares of Bolt (BTJ) at $32.78/share. These shares had been purchased 1/12/07 at a cost basis of $17.44, so I had a gain of $15.34 or 88% since purchase. This was a sale on a decline and no matter how I would like to spin this (!) I shall be 'sitting on my hands' with the proceeds of this sale, waiting for something more positive, like a sale of a portion of a holding, before adding another position.

Why did I sell? (I can already see the emails showing up in my mailbox!) As part of my own trading strategy, I sell stocks on declines on one of four reasons. Either there is some fundamental information out there that indicates that a sale is simply a wise thing to do (see Starbucks sale today), or if after an initial purchase the stock declines 8% (See ICOC sale yesterday). Other declines include after one partial sale at a 30% gain, I move the selling point up from an 8% loss to 'break-even'. After multiple sales, I will sell the remaining shares if a stock should decline to 50% of its highest % gain. In this particular case, I had sold portions of Bolt (BTJ) five times this year. First at 30%, then 60%, 90%, 120% and 180% appreciation points. Thus with a decline to under a 90% appreciation, much like my experience with Jones Soda (JSDA), I had a signal to sell my remaining shares.

I have been trying very hard to ignore this signal. I like this stock a lot. But even after trying to bounce back after closing yesterday under a 90% gain for me, the stock sold off once more to under a 90% appreciation level, and I didn't want to ignore the signal that my own stock holding was generating.

Let's take a look at the "point & figure" chart on BTJ from StockCharts.com:

With my own sale of Bolt, yet without any fundamental change in the outlook for this company, I am reducing my rating:

BOLT TECHNOLOGY (BTJ) IS RATED A HOLD

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to leave them right on the website or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website, or my Covestor Page where my Trading Portfolio is monitored and evaluated, or my SocialPicks Page where all of my picks are reviewed as of early 2007.

My latest investing experiment is the Prosper.com person-to-person loan plan. I only have $200 invested in that program but you are encouraged to least explore the Prosper.com website and see how intriguing this E-Bay style loan system is. (Full disclosure, I do receive a small payment for referrals that I generate...but I would tell you about this anyhow.) Be sure you understand the risks over at Prosper.com as well prior to investing any money in loans there.

Have a great day. I hope to get something up on Copart later today if I get a chance!

Bob

Copart (CPRT) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

After selling my Starbucks (SBUX) stock earlier today on my own discretion, I chose to use this as an opportunity to replace that position with something with a bit more exciting prospects (?), or pizzazz as I wrote.

Looking through the list of top % gainers, I came across an old favorite of mine Copart (CPRT) which I had discussed as far back as May 26, 2004 on Stock Picks Bob's Advice, making a nice move higher. As I write, Copart is trading at $33.51, up $3.53 or 11.78% on the day.

This morning Copart reported strong fiscal 4th quarter results that beat expectations. Except for a dip in earnings in 2006, their Morningstar.com "5-Yr Restated" financials is intact, and their StockCharts.com "point and figure" chart looks strong.

Thus,

COPART (CPRT) IS RATED A BUY

A few moments ago I purchased 210 shares of Copart (CPRT) for my Trading account at a price of $33.6757. Wish me luck!

Thanks again for stopping by and visiting. If I get a chance, I shall try to write up a more complete update on Copart, but the above links should give you any needed additional information. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 10:43 AM CDT

|

Post Comment |

Permalink

Updated: Thursday, 27 September 2007 10:50 AM CDT

Starbucks (SBUX) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago I exercised my discretion in selling stocks based on fundamental changes in information available. I sold my 50 shares of Starbucks (SBUX) in my trading account at $27.00/share. It has been a great stock for me having purchased shares originally at a cost basis of $11.40/share on 1/24/03, slightly before starting this blog. Thus this represented a gain of $15.60 on these shares or 136.8% since their original purchase. This was the seventh sale of shares since my purchase, having sold shares at the 30, 60, 90, 120, 180, and 240% level. Sticking just with my own trading system, a sale of shares would have been triggered at the 120% gain point, so I pulled the plug on these shares a bit earlier than required.

What concerned me was the downgrade by Andrew Barish to a "sell" on SBUX. His comment:

"Although we believe that the company controls a very strong brand and can continue to grow, we believe the pace of growth will be slower (with international business still too small to make significant contribution to operating profits, and could be several years away from such a contribution), and that expectations are too high for a short-term recovery," Barish wrote in a note to clients."

I also went back and reviewed the 3rd quarter results which came in at the low end of their own estimates. The critical number that I like to review in retail stocks is the 'same store sales' growth. Apparently, as noted in the story, "...the number of purchases at U.S. locations grew less than 1% in the fiscal third quarter." Outside of the United States, growth was at 5%, better than domestically, but still somewhat less than dynamic. Comments about rising gas prices and other economic pressures didn't really reassure me. Fortunately, they matched expectations for $.21/share.

Thus,

STARBUCKS (SBUX) IS RATED A SELL

And I sold my shares. Now the big question is whether this sale with a large gain entitles me to replace this position. I am going to vote "yes". I guess I am the master of my own ship. Since the stock didn't get sold for a price decline reason, and I actually had a greater than 100% gain, it isn't really a truly 'bad news' situation. Sort of lukewarm I guess.

Anyhow, I am going to see if I can add a new position with a bit more pizzazz. (It is really a word!)

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, drop by my Stock Picks Podcast Website, visit my Covestor Page where my trading account is evaluated, and my SocialPicks Page where all of my 'picks' are tracked...starting sometime since January, 2007.

Finally, thanks for those people who signed up with Prosper.com....let me know what you think. (Full disclosure, I do receive a small referral fee if you do sign up with them.) It is an interesting website with person-to-person lending set up by the E-Loan founder.

Have a great day trading and I shall keep you posted if I find anything of interest that I wish to substitute for my Starbucks stock.

Bob

Wednesday, 26 September 2007

A Reader Writes "(ICOC) Why did you sell?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of my favorite activities as a writer of this blog is to receive and respond to emails from interested readers. Please remember that I am also an amateur investor, so I offer my responses as my opinion only, and not that I am more correct than anyone writing.

If you have any comments or questions, you are always welcome to leave them on the blog or email me directly at bobsadviceforstocks@lycos.com.

Earlier today, as I wrote, I sold my shares in ICO Corporation (ICOC). I sell shares for one of three reasons. Either there is some fundamental announcement whether bad financial results or some undefined announcement including an acquisition, the stock declines to a specified sale point, or the stock appreciates to a targeted level at which time I sell a portion of my holdings.

In this case, after an initial purchase, ICOC hit my 8% sale point and I sold my shares without regard to any fundamental change in the 'story' behind this company. Not all of my readers appreciated this move.

Alan T. wrote to me this afternoon:

"Why did you sell? Have you not seen the past volatility in this stock? I understand the thought of limiting losses, but maybe you should consider buying on a pullback, when a stock like this provides numerous pullback opportunities." |

|

| | |

|

| | |

This was a terrific question! Why wouldn't it be a great idea to buy some more shares on a pullback rather than selling my shares? Especially in a stock as volatile as this company, which 'provides numerous pullback opportunities.'

This isn't necessarily a bad approach. But it isn't my approach. Before I buy any stock, I have a plan about what my reaction will be when the stock either appreciates or declines in price. I like every stock that I own. But I am prepared to sell any or all of my holdings if those stocks decline to 'sale points'. It doesn't matter to me whether I have held a stock for one week or one year, these sale points are what matter to me.

In the past I have been ready to make exceptions to my trading rules. And my portfolio suffered subsequently. The purpose of this blog has been to involve all of my readers into increasing my own trading discipline and not to make exceptions or variations in my approach. Those who are value oriented might well find a stock that has declined to be of even greater attractiveness than a stock that has appreciated. The opposite is my assessment of those situations.

There will be times when these decisions won't be the best approach to every single trading situation. It may well be the time to be buying ICOC and not selling shares. I don't know. I don't have any insider information nor do I seek that information. And it doesn't matter if ICOC climbs back tomorrow, as I do suspect it shall do. What matters is my own trading discipline in the long-term.

But I cannot apologize for maintaining my own strategy that requires me to sell stocks with small losses. For my trading philosophy requires me to sell stocks quickly at small losses and completely, and partially and slowly at targeted gains. Let's find out how this strategy works. We will only know if we implement and follow our own rules for trading and investing.

Bob

ICO Inc. (ICOC) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago I sold my 420 shares of ICOC at $13.5505. These shares were purchased just last week (!) at a price of $14.979. Thus, this represented a loss of $(1.43) or (9.5)% since purchase. Virtually all of this loss occurred today (for no discernible reason that I could identify) with the stock trading at $13.56 as I write, down $(1.66) or (10.91)% today alone.

Since I am personally selling my shares I am thus reducing my rating:

ICO (ICOC) IS RATED A HOLD

I don't like to buy shares and only see them hit my tight 8% loss limits so quickly. That is one of the reasons I have not had a lot of success with relatively thinly traded shares of stocks priced not much over $10. But hopefully, my continued discipline in limiting losses by selling losing stocks quickly will continue to improve my overall portfolio quality long-term.

Since this was a sale on "bad news", I shall once again be 'sitting on my hands' waiting for a partial sale on appreciation to find a new position. In fact, my Bolt (BTJ) is bouncing very close to a sale as well, again on no apparent news that I can find either.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website. Also, my Covestor Page is an interesting addition to my blogging, as it has been tracking my trading portfolio and evaluating its performance since June, 2007, against the S&P as well as other managed accounts. Finally, if you have any time left, check out my SocialPicks page where SocialPicks evaluates my stock picks and has been doing so since some time in January, 2007.

Have a great week trading.

Bob

Sunday, 23 September 2007

"Looking Back One Year" A review of stock picks from the week of April 3, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It is the weekend, and that means that it is time to write up a review of my past stock picks. Last weekend I reviewed the stocks from the week of March 27, 2006. Moving one week ahead, let's take a look at all of the stock picks from the week of April 3, 2006. These reviews assume a buy and hold strategy. In reality, I advocate a disciplined portfolio management strategy that directs me to sell losing stocks quickly and completely and sell gaining stocks slowly and partially at targeted appreciation levels. I have discussed and shall continue to discuss these techniques throughout my blog.

But for the ease of measurement, let's find out what would have happened if we had indeed purchased equal dollar amount of each stock discussed that week about a year-and-a-half ago.

On April 4, 2006, I posted CheckFree (CKFR) on Stock Picks Bob's Advice when the stock was trading at $54.14. CKFR closed at $46.82 on September 21, 2007, for a loss of $(7.32) or (13.5)% since posting.

On April 4, 2006, I posted CheckFree (CKFR) on Stock Picks Bob's Advice when the stock was trading at $54.14. CKFR closed at $46.82 on September 21, 2007, for a loss of $(7.32) or (13.5)% since posting.

Since CheckFree is to be acquired at $48 in cash on December 31, 2007, subject to regulatory approval,

CHECKFREE (CKFR) IS RATED A HOLD

Looking at the 'point and figure' chart on CheckFree (CKFR) from StockCharts.com, we can see the relatively weak performance of the stock prior to the announcement of the acquisition.

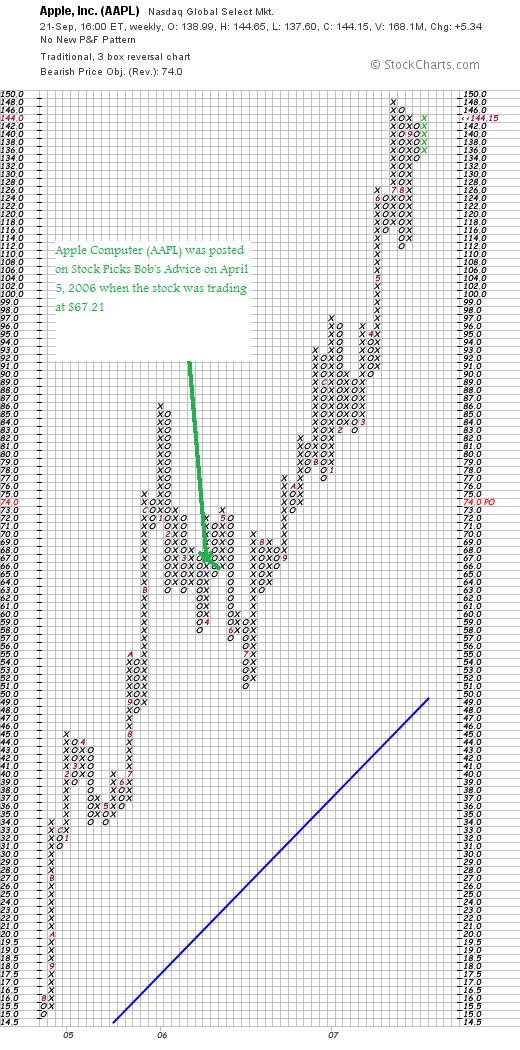

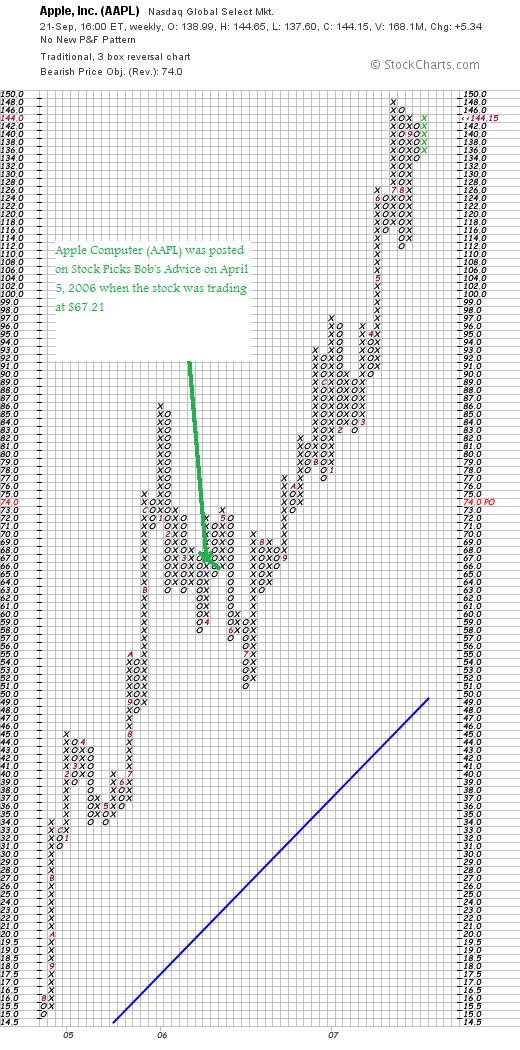

On April 5, 2006, I posted Apple Computer (AAPL) on Stock Picks Bob's Advice when the stock was trading at $67.21. AAPL closed at $144.15 on September 21, 2007, for a gain of $76.94 or 114.5% since posting.

On April 5, 2006, I posted Apple Computer (AAPL) on Stock Picks Bob's Advice when the stock was trading at $67.21. AAPL closed at $144.15 on September 21, 2007, for a gain of $76.94 or 114.5% since posting.

On July 25, 2007, Apple announced 3rd quarter 2007 results. Revenue came in at $5.41 billion up from $4.37 billion the prior year same period. Quarterly profit was $818 million, up sharply from last year's $472 million profit. On a per share basis this came in at $.92/diluted share up from $.54/share last year.

On July 25, 2007, Apple announced 3rd quarter 2007 results. Revenue came in at $5.41 billion up from $4.37 billion the prior year same period. Quarterly profit was $818 million, up sharply from last year's $472 million profit. On a per share basis this came in at $.92/diluted share up from $.54/share last year.

The company beat expectations of analysts who were expecting earnings of $.72/share on revenue of $5.29 billion.

The "5-Yr Restated" financials on AAPL from Morningstar.com are intact.

APPLE COMPUTER (AAPL) IS RATED A BUY

Looking at the "point & figure" chart on AAPL from StockCharts.com, we can see a chart that appears phenomenally strong!

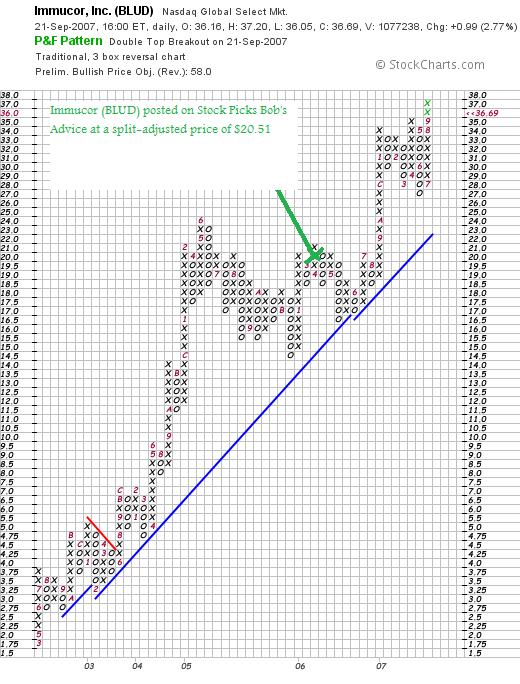

On April 6, 2006, I

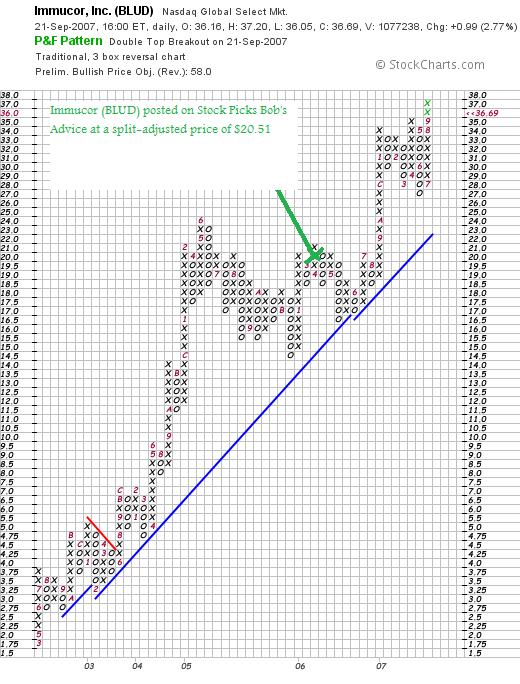

posted Immucor (BLUD) on Stock Picks Bob's Advice when the stock was trading at $30.76. BLUD split 3:2 on May 16, 2006, making my effective stock pick price actually $20.51. BLUD closed at $36.69 on September 21, 2007, giving this stock pick a gain of $16.10 or 78.5% since posting.

On July 25, 2007, Immucor announced 4th quarter 2007 results. Revenue for the quarter ending May 31, 2007, came in at $61.1 million, up 22% from $50.0 million. Net income for the quarter was $18.2 million, up 51% from $12.1 million last year. Diluted earnings came in at $.26/share, up 53% from the $.17/share the prior year.

On July 25, 2007, Immucor announced 4th quarter 2007 results. Revenue for the quarter ending May 31, 2007, came in at $61.1 million, up 22% from $50.0 million. Net income for the quarter was $18.2 million, up 51% from $12.1 million last year. Diluted earnings came in at $.26/share, up 53% from the $.17/share the prior year.

The Morningstar.com "5-Yr Restated" financials on BLUD are intact.

IMMUCOR (BLUD) IS RATED A BUY

Looking at the "point & figure" chart on BLUD from StockCharts.com, we can see the very strong price movement from as far back as March, 2002. The stock exhibited some weakness in late 2005, but never 'broke down' below the support lines.

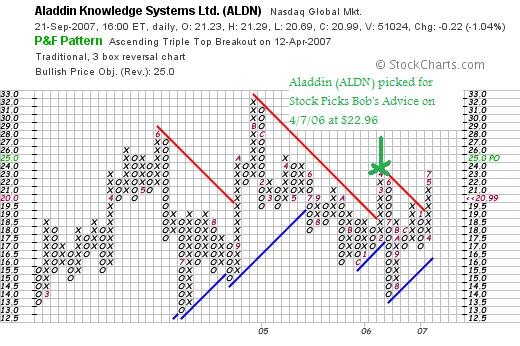

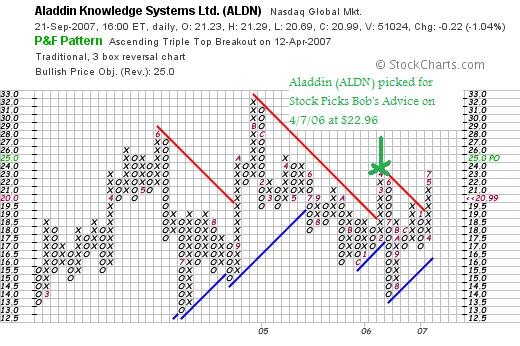

Finally, on April 7, 2006, I posted Aladdin Knowledge Systems (ALDN) on Stock Picks Bob's Advice when the stock was trading at $22.96. ALDN closed at $20.99 on September 21, 2007, for a loss of $(1.97) or (8.6)% since posting.

Finally, on April 7, 2006, I posted Aladdin Knowledge Systems (ALDN) on Stock Picks Bob's Advice when the stock was trading at $22.96. ALDN closed at $20.99 on September 21, 2007, for a loss of $(1.97) or (8.6)% since posting.

On July 19, 2007, Aladdin reported 2nd quarter 2007 results. For the quarter ended June 30, 2007, revenue came in at $25.5 million, up 22% from $20.9 million the prior year. Net income came in at $3.9 million or $.26/diluted share, up from $3.3 million or $.22/diluted share the prior year.

On July 19, 2007, Aladdin reported 2nd quarter 2007 results. For the quarter ended June 30, 2007, revenue came in at $25.5 million, up 22% from $20.9 million the prior year. Net income came in at $3.9 million or $.26/diluted share, up from $3.3 million or $.22/diluted share the prior year.

The company beat expectations of revenue of $24.1 million and profit of $24.1 million according to analysts polled by Thomson Financial. In addition, the company raised guidance for 2007 full year results for a profit of $1.00 to $1.12/share, up from prior guidance of $.90 to $1.09/share. In addition, they raised expectations on revenue to between $100 million and $106 million, from the prior guidance of $95 million to $102 million.

The Morningstar.com "5-Yr Restated" financials on ALDN are intact.

ALADDIN KNOWLEDGE SYSTEMS (ALDN) IS RATED A BUY

Reviewing the "point & figure" chart on Aladdin from StockCharts.com, we can see that this is a very unimpressive price chart. The stock has been volatile since June, 2004, when the stock peaked at $27. The stock dipped as low as $13 in July, 2004, only to see the stock price climb right back to a peak at $32 in November, 2004. The stock then dipped back to a low of $14 in July, 2006. The stock appears to be moving higher once again. This stock chart is certainly not over-extended, however, the volatility is of concern and is the big negative factor for this stock.

So how did we do with these stock picks? In a word phenomenal! Two stocks showed small losses and two stocks had large gains. The average performance for these four stocks was a gain of 42.7%! Certainly past performance is not a reliable indicator for future performance but wasn't that a great week for picking stocks?

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, drop by and visit my Stock Picks Podcast Website, or my Covestor Page where my trading portfolio is continually being monitored, or my SocialPicks Page where my blog is reviewed by the people over at SocialPicks!

Regards and wishing you a great week trading!

Bob

Posted by bobsadviceforstocks at 3:20 PM CDT

|

Post Comment |

Permalink

Updated: Sunday, 23 September 2007 4:21 PM CDT

A Reader Writes "Are there techniques that help lessen the effect of currency fluctuation...?"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I always enjoy receiving letters from readers. Especially new investors that somehow have found my blog helpful as they are looking for new ideas for stock selection. They too must remember that I am an amateur investor as well and of course do their own homework including consulting with professional advisors prior to making any decisions. But I am glad that I can be a source of ideas.

I always enjoy receiving letters from readers. Especially new investors that somehow have found my blog helpful as they are looking for new ideas for stock selection. They too must remember that I am an amateur investor as well and of course do their own homework including consulting with professional advisors prior to making any decisions. But I am glad that I can be a source of ideas.

If you are interested in contacting me, please remember that the comments section after each entry is open to all. (I do occasionally try to remove blatent spam attacks that all websites must deal with.) Or if you prefer, you can write me directly at bobsadviceforstocks@lycos.com. I read all of my email, and try to respond to as many as possible.

Anyhow, back to the letter. Erik C. from Canada wrote:

"Hello Bob,

I recently turned 21 and I've just started investing in stocks almost a 13 months ago. Your blog was one of the websites that helped me decide what I should be looking for. I've been reading your blog a couple times a week ever since and I think you've been doing a great job. I especially appreciated your frequent  updates during the recently excitement in the subprime madness.

updates during the recently excitement in the subprime madness.

One question I haven't been able to easily wrap my head around is how the value of the US dollar affects me. I'm from Canada and roughly half my positions are on the TSX so those aren't the problem, but I have about $28,000 invested in US stocks. I bought $23,000 of it when our exchange rate was roughly 90 cents to the US dollar and now a year later, with Benanke cutting rates by half a percentage point, the exchange rate was last seen at 99 cents to the dollar.

It seems to me that due to the enormous change in value of the CAD relative to the USD, all my US stocks are naturally took a hit with nothing I can do about it. What is your take on it? Am I looking at it the wrong way? Are there techniques that help lessen the effect of currency fluctuations in these situations?

One good thing that has come from this is that I've been looking for an oil company to add to diversify my portfolio the last couple months, but I've been off on my own buy signal due to the instability of the market. With the rate cut, it gave me a signal to buy because stocks are rallying again and it affected the exchange rate effectively making whatever stock I choose to buy cheaper. In the end, I bought 40 shares of NOV, a company you actually blogged about in the past. As of now, I am already up a couple percentage points. I always feel better post purchase when the stock is floating in the green early on.

Thank you for taking the time to read my email, your insights are always taken in high regard."

Erik, than you so much for writing and for all of your kind words. I hope that you find my blog useful in your continued education in the investment world.

I would like to try to comment on your astute observation that while the Bernanke rate cut may well have rallied the market it didn't really do much positive for the value of the dollar which as reported on Bloomberg.com:

"Sept. 20 (Bloomberg) -- Canada's dollar traded equal to the U.S. currency for the first time in three decades, capping a five-year run on the back of booming demand for the nation's commodities.

The Canadian dollar rose as high as $1.0008, before retreating to 99.87 U.S. cents at 4:16 p.m. in New York. It has soared 62 percent from a record low of 61.76 U.S. cents in 2002. The U.S. dollar fell as low as 99.93 Canadian cents today. The Canadian currency last closed above $1 on Nov. 25, 1976, when Pierre Trudeau was Canada's prime minister."

A 62% increase in 5+ years is not a small change in currency. In fact, this is a challenge for Canadians investing in the market as the value of their own holdings (in Canadian dollars) has thus dropped by the same amount during this period.

A good explanation of this was written up on msn.money:

"What are the risks of buying foreign investments?

While most of your assets will probably be in dollar-denominated investments, you may be faced with substantial currency risk if you own stocks or bonds denominated in other currencies -- or if you plan to travel abroad.

Currency movements, which fluctuate daily based on each country’s economic and political conditions, can hand you significant gains or losses. When you buy an individual stock or bond in another country or own a mutual fund that invests in foreign securities, the value of your investment will fluctuate in part based on how many dollars it takes to buy a unit of the foreign currency. If you own a German stock, for instance, the money you paid to buy the stock has been converted into Euros, the currency of such countries as France, Germany, Italy and the Netherlands. If the value of the Euro falls against the U.S. dollar, your German shares will be worth less if you were to sell the stock and convert the Euros back into dollars. On the other hand, if the Euro gains against the dollar, your German stock would be worth more if you were to sell it."

So you are very correct. As the American dollar has dropped vis a vis the Canadian dollar, then the value of your U.S. holdings has dropped just based on the Canadian/American exchange rate.

Certainly this is a difficult problem. I haven't actually addressed this myself in my own holdings except in my own retirement account I hold foreign as well as domestic assets in the form of mutual funds but most of my own holdings are based in the United States and are priced in American dollars. Thus, without realizing it, I as have all American citizens, been losing buying power while my accounts appear to have appreciated. I kind of wish you hadn't reminded me about this :).

Seriously, what to do? I suppose the first thing is to do nothing. To concentrate on the underlying business fundamentals---things like earnings and revenue growth. You also could concentrate on companies based in Canada, I know I have written up a few of those like Gildan (GIL) a great firm (I don't own any shares currently). Or other Canadian firms that you can identify using my own strategy. But that probably isn't going to be a satisfactory response.

The solution of this problem is called "Currency Hedging", and I needed to do a Google Search to get more information. Here is a page from that search that discusses complex solutions like "Spot Contracts", "Forward Contracts", "Foreign Currency Options", "Interest Rate Options", "Foreign Currency Swaps", and "Interest Rate Swaps", among other trading devices. I don't do any of these and doubt they would be appropriate for the individual amateur investor like you or me.

There are also some investors who believe that gold is a good hedge against currency fluctuations. Indeed there is some support to this thesis, but it isn't very consistent as this report by Caple, Mills, and Wood shows:

"Abstract

The extent to which gold has acted as an exchange rate hedge is assessed using weekly data for the last thirty years on the gold price and sterling–dollar and yen–dollar exchange rates. A negative, typically inelastic, relationship is indeed found between gold and these exchange rates, but the strength of this relationship has shifted over time. Thus, although gold has served as a hedge against fluctuations in the foreign exchange value of the dollar, it has only done so to a degree that seems highly dependent on unpredictable political attitudes and events."

Personally, I believe that much of the blame for this drop in the dollar has been the inability of Congress and the President to restore fiscal responsibility in the United States to the Federal budget process. There has been an aversion to any new taxes while tax cuts are instead adopted as being "stimulative" and expenditures, including unbelievable costs associated with the Iraq conflict, have been added to the budget.

As this New York Times article reported:

"Not all the moves can be explained by the dollar’s strength or weakness, of course. The relative attractiveness of other currencies has varied. Under President Bush, the dollar has almost held its own against the yen, as the Japanese government has feared a strong yen could damage the country’s exports.

Still, during the Bush administration, the dollar has fallen against each of the five currencies shown — the euro, the yen, the British pound, the Australian dollar and the Canadian dollar. It also is down against the two currencies in the index — the Swiss franc and the Swedish krona — that are not shown.

Over all, the dollar index has fallen at a rate of 4.8 percent a year in this administration, considerably more than the previous record of 2.7 percent a year, during the Carter administration. Mr. Bush is the first president not to show a gain against any of the currencies in this index."

So with Democrats now in nominal control of Congress (it now requires 60 votes to pass anything to avoid a filibuster), and with the 2008 elections close by, I suspect that economic and foreign policy changes are likely to ensue. So what has happened to the Canadian/American dollar may revert back to a normal relationship or at least see the deterioration of the American dollar slow. At least that is my hope.

Meanwhile, good luck with your investments and consider a visit to the United States where travel and merchandise is a better deal than may have been previously. As reported:

"BLAINE, Wash. -- In the spirit of '76 - 1976, that is - Canadians are swarming into Washington state to take advantage of the newly regained parity of the Canadian and U.S. dollars.

With the rising value of the loonie, a nickname based on the bird on the Canadian $1 coin, 50 percent more cars were recorded at the Peace Arch crossing at this border town last month than in August 2006, according to figures from the U.S. Bureau of Customs and Border Protection. The crossing at the northern end of Interstate 5 is the third-busiest on the U.S.-Canadian border.

U.S. businesses from retailers to real estate firms are benefiting.

"Being equal gives them the last reason they needed to spend more time and more loonies here in the U.S.," said Mike Kent, who sells houses in nearby Birch Bay and Semiahmoo for Windermere Real Estate. "It's not just because you can get good spending power, it's the lure of being in a different country. You feel as if you've truly gotten away.""

Thanks Erik for stopping by! I don't know if I have answered any of your answers. I do expect the exchange rate to stabilize in the future assuming America can adopt more responsible policies, and that this shouldn't be as much of an issue for you.

If you or anybody else have any questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Website, my Covestor Page where my actual trades are posted, and my SocialPicks Page where SocialPicks has been evaluating my performance on this blog.

Have a great Sunday everyone!

Bob

Newer | Latest | Older

Last Thursday I reported on my purchase of shares of Copart (CPRT) and promised I would try to get a bit more of a review on the blog than the brief comments after the purchase. As I reported in that entry, I do own shares and infact purchased 210 shares on 9/27/07 at a price of $33.68. Copart is not a new name for me. In fact, I wrote up Copart on 5/26/04 when the stock was trading at $23.02. Copart (CPRT) closed at $34.39 on 9/28/07, for a gain of $11.37 or 49.4% since posting this stock three years ago.

Last Thursday I reported on my purchase of shares of Copart (CPRT) and promised I would try to get a bit more of a review on the blog than the brief comments after the purchase. As I reported in that entry, I do own shares and infact purchased 210 shares on 9/27/07 at a price of $33.68. Copart is not a new name for me. In fact, I wrote up Copart on 5/26/04 when the stock was trading at $23.02. Copart (CPRT) closed at $34.39 on 9/28/07, for a gain of $11.37 or 49.4% since posting this stock three years ago."...provides salvage vehicle sale services primarily in the United States. It offers vehicle suppliers, primarily insurance companies, with a range of services to process and sell salvage vehicles over the Internet through its virtual bidding Internet auction-style sales technology."

I received another great letter from Doug S. today and thought I would comment right on the blog. If you have any comments or questions, please always remember you can leave comments on the blog or email me at bobsadviceforstocks@lycos.com.

I received another great letter from Doug S. today and thought I would comment right on the blog. If you have any comments or questions, please always remember you can leave comments on the blog or email me at bobsadviceforstocks@lycos.com.

On April 4, 2006, I

On April 4, 2006, I  On April 5, 2006, I

On April 5, 2006, I  On July 25, 2007, Apple announced

On July 25, 2007, Apple announced

On April 6, 2006, I

On April 6, 2006, I

Finally, on April 7, 2006, I

Finally, on April 7, 2006, I

updates during the recently excitement in the subprime madness.

updates during the recently excitement in the subprime madness.