Stock Picks Bob's Advice

Tuesday, 8 April 2008

Is the Sirius-XM Merger forming a Monopoly?

I love my XM radio.

Most of the time I listen to CNBC getting the latest Stock Market information while driving along in my car. But I also like the wide range of music choices; I enjoy channel 28 which is the Broadway Tunes channel. When my daughters get in the car, they are switching over to current hits. The choices are terrific. I plug the service to all of my friends.

Most of the time I listen to CNBC getting the latest Stock Market information while driving along in my car. But I also like the wide range of music choices; I enjoy channel 28 which is the Broadway Tunes channel. When my daughters get in the car, they are switching over to current hits. The choices are terrific. I plug the service to all of my friends.

But is the proposed merger between XM and Sirius anti-competitive and somehow forming a monopoly?

The Department of Justice didn't think so.

As reported:

"Our data confirms that there was very little switching between companies after a person subscribes to a particular service," said Assistant Attorney General Thomas Barnett during a conference call with reporters Monday afternoon. "

As the same article summarized:

"Despite cries from some politicians and traditional broadcast companies calling the pending deal harmful to consumers, the Department of Justice determined that an XM-Sirius merger was not anti-competitive. The Justice Department argued that other media companies such as Clear Channel (CCU, Fortune 500), CBS (CBS, Fortune 500), or even Apple (AAPL, Fortune 500) with its iTunes software and iPod music player served as alternate options for music and media customers."

Oh really?

I know that my favorite commentator Jim Cramer had been plugging away for the merger. He has argued:

I know that my favorite commentator Jim Cramer had been plugging away for the merger. He has argued:

"- The combined company would have more offerings and pricing plans that have clear benefits for the consumer, which is precisely what the FCC is looking for.

- It’s just not an antitrust violation. Satellite radio makes up less than 5% of all radio, and neither XM nor Sirius is profitable. What sort of monopoly would that be?

- Current market conditions are so bad that it would be hard for the Feds to turn away this merger, especially given all the negativity and the huge decline in M&A."

So what exactly is a Monopoly under the Sherman Act?

Not being a lawyer, I found this opinion online:

"A monopoly power is defined as the ability of a business to control a price within its relevant product market or its geographic market or to exclude a competitor from doing business within its relevant product market or geographic market. It is only necessary to prove the business had the "power" to raise prices or exclude competitors. The plaintiff does not need to prove that prices were actually raised or that competitors were actually excluded from the market.

Today, a general definition of a monopoly is where nearly all of one product type or service is owned by one person or group of people within a community or area. Thereby, the sole control of this product or service is given to one party to the elimination of all others within the marketplace. To determine whether purchasing a competitor's business or creating an agreement with a competitor may result in a monopoly within your market place, please seek the advice of an attorney."

I found this comment from a longer article from the Department of Justice in 2003 before this merger was proposed:

"The ultimate inquiry in any merger review is whether the proposed merger will affect the state of competition: why does this merger matter? Under a coordinated effects analysis, that inquiry focuses on whether, post-merger, suppliers will have a greater incentive and ability to coordinate. That is, will the merger make coordination more likely, more perfect, more complete, or more durable? A merger could make coordination more likely simply by reducing the number of players needed for consensus or by removing an industry "maverick" with a history of undercutting or resistance to market leadership. A merger could make coordination more perfect by creating a price leader or by enabling the now fewer number of firms to support a higher price or otherwise more stringent terms of coordination. In much the same way, a merger could make coordination more complete by, for example, extending the duration, product coverage, or geographical reach of coordination. Finally, a merger could make coordination more durable by enabling firms to better monitor compliance."

Excuse me for diving into this one. But if each of these companies were so great, wouldn't they also be able to be acquired by a larger media firm that might maintain competition by strengthened financials while these satellite firms matured and became profitable?

And are we rewarding mismanagement that would award Howard Stern a $500 million deal while barely staying afloat financially?

And are we rewarding mismanagement that would award Howard Stern a $500 million deal while barely staying afloat financially?

As I recall, the initial license for two providers of satellite services was designed to provide the minimum for some sort of competition.

How is just one provider really protecting the basic capitalist idea of competition in this service? How does one satellite provider offer a consumer or an automobile manufacturer any incentive at negotiating for a better deal, better service, or more innovation?

Excuse me for asking, but I just don't get it.

Yours in investing,

Bob

Sunday, 6 April 2008

"Trading Portfolio Update" April 6, 2008

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

There are many different things I am trying to accomplish on this website simultaneously. First of all, I like to discuss and refine my own investment strategy. Next I discuss many stocks that I consider 'investable'--stocks that meet my own criteria of consistent revenue growth, earnings growth, stable outstanding shares, free cash growth, good balance sheet, reasonable valuation and a solid latest quarterly report.

At the same time, I am also providing all of you with an inside look at this particular amateur investor's actual trading account. O.K. that isn't such a big deal :), but I am still working at providing all of you with transparency. That is, when I buy or sell stock, I post it here and provide all of you with the rationale. Except for my occasional 'trades' that I am avoiding as much as possible, this keeps me honest. This provides me with a reason to continue to abide by the 'rules' that I have set up for myself. And insofar as this process continues to be thankful, I thank all of you for your participation on this website.

About once per month I have been updating my actual 'trading portfolio'. You can now verify what I write on Covestor by visiting my Covestor Page where that website also tracks my trading, holding and performance. Their performance figures, however, are as of when I signed up for Covestor. The numbers I share with you are for my performance with each of these holdings since purchase. (If any of you would like an 'invitation' to joing Covestor, which I am not sure is absolutely needed to get an account, I do have four more invitations in my name---just email me and I will email it back to you!)

Well back to work. I last reviewed my trading portfolio back on February 26, 2008. This review is as of today, April 6, 2008. The holdings are listed in alphabetic order of their symbols, followed by the number of shares, date of purchase, price of purchase (cost basis), latest price (4/4/08), and percentage unrealized gain or (unrealized loss).

Copart (CPRT), 210 shares, 9/27/07, $33.73, $41.31, 22.48%

Covance (CVD), 102 shares, 4/9/07, $62.61, $86.28, 37.80%

IHS Inc. (IHS), 140 shares, 10/1/07, $58.53, $62.34, 6.51%

Morningstar (MORN), 103 shares, 11/22/05, $32.57, $65.13, 99.94%

ResMed (RMD), 150 shares, 2/4/05, $29.87, $45.16, 51.20%

Meridian Bioscience (VIVO), 171 shares, 4/21/05, $7.42, $34.74, $368.26%

Currently I am down to six positions. As you may recall, I have a minimum of 5 positions in my 'strategy' going to a maximum of 20. The current market value of securities if $45,626.19 with $110.68 in the money market portion of the account.

As of April 5, 2008, I had $(1,250.59) in total realized losses in 2008 made up of $(4,534.09) in short-term losses, and $3,283.50 in long-term realized gains. In 2008 I have had $29.63 in total income and $(221.13) in margin interest paid.

The relative decrease in cash and the performance in this account is related to the unfortunate 'trade' in Lehman Bros which I tried to do a 'trade' outside of my regular 'rules'. I continue to learn.

I shall be waiting for either a sale if stocks decline, bringing me down to my minimum of 5 positions, or a sale on appreciation should my stocks move higher, in which case I shall be once again looking to add another position!

Thanks so much for once again visiting here! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 10:05 PM CDT

|

Post Comment |

Permalink

Updated: Sunday, 6 April 2008 10:06 PM CDT

"Looking Back One Year" A review of stock picks from the week of September 18, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It is now Sunday evening, and I really want to get this review out before the weekend is over. I have missed a few weeekends along the way and the result is that the 'year ago' period is more like a year-and-a-half....and it might even close on two years out!

Anyhow, these reviews are based on a presumed buy and hold strategy. In practice I advocate and employ a disciplined investment strategy. The difference between these two approaches would certainly affect performance and should be taken into consideration.

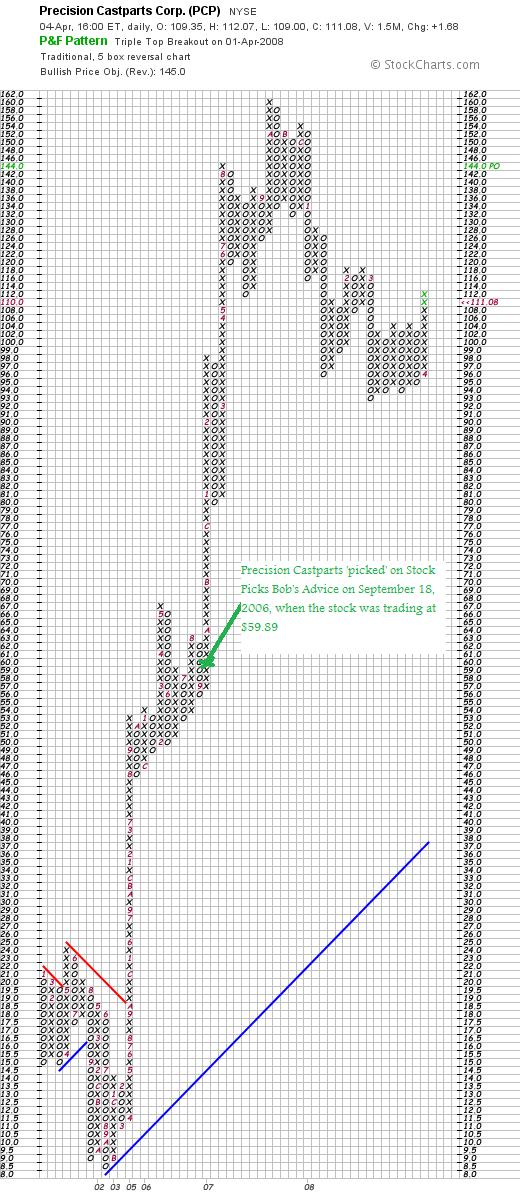

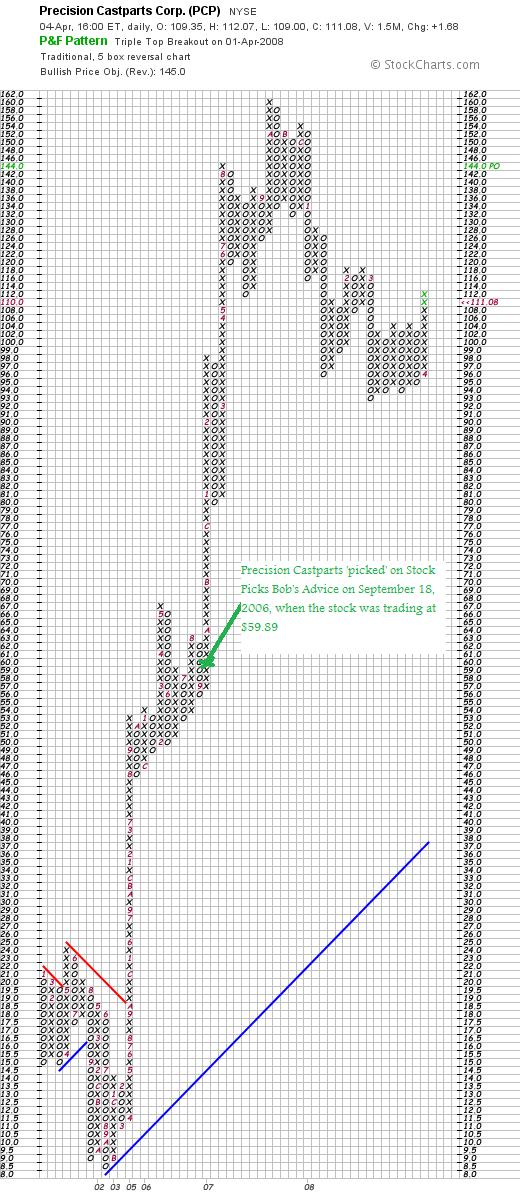

On September 18, 2006, I posted Precision Castparts (PCP) on Stock Picks Bob's Advice when the stock was trading at $59.89. I purchased some shares later for my own account and later sold it on a decline. I do not own any shares of PCP at this time. Let's take another look at this stock and I shall explain why

On September 18, 2006, I posted Precision Castparts (PCP) on Stock Picks Bob's Advice when the stock was trading at $59.89. I purchased some shares later for my own account and later sold it on a decline. I do not own any shares of PCP at this time. Let's take another look at this stock and I shall explain why

PRECISION CASTPARTS (PCP) IS RATED A BUY

PCP closed at $111.08 on April 4, 2008, for a gain of $51.19 or 85.5% since posting.

On January 22, 2008, Precision Castparts (PCP) announced 3rd quarter 2008 results. Sales increased 22.7% to $1.70 billion from $1.38 billion the prior year same period. Net income came in at $246.5 million, up from $158.7 million the prior year. This was $1.78/share this year vs. $1.17/share last year.

The company came in a little light on revenue, but beat expectations on earnings according to analysts polled by Thomson Financial who on average had been expecting earnings of $1.72 on sales of $1.74 billion.

The Morningstar.com "5-Yr Restated" financials on PCP are intact with solid revenue growth, earnings growth, stable outstanding shares, free cash flow growth, and a solid balance sheet.

If we review the recent StockCharts.com 'point & figure' chart on Precision Castparts, we can see how the stock has recently been under pressure (as have most all stocks), but that how the stock price hasn't fundamentally broken down long-term.

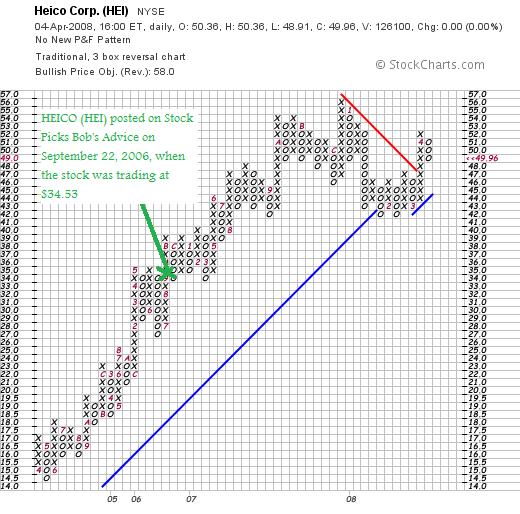

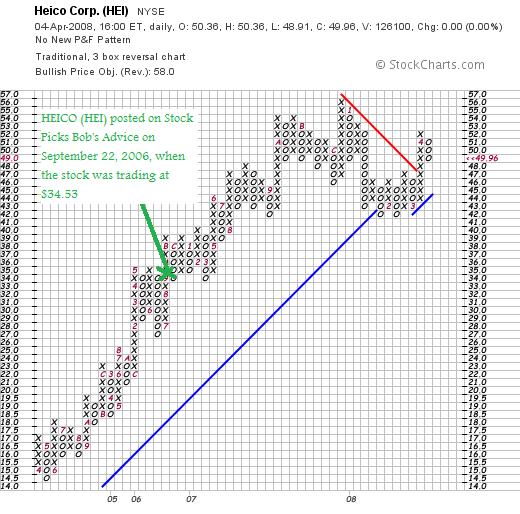

On September 22, 2006, I posted HEICO (HEI) on Stock Picks Bob's Advice when the stock was trading at $34.53. I do not own any shares nor any options on this stock. However, I would like to share with you why I believe

HEICO (HEI) IS RATED A BUY

HEICO closed at $49.96 on April 4, 2008, for a gain of $15.43 or 44.7% since posting.

On February 28, 2008, HEICO reported 1st quarter 2008 results. Net sales increased 18% to $134.3 million from $113.7 million the prior year same period. Net income grew 27% to $10.1 million or $.37/diluted share from $7.9 milion or $.30/diluted share last year.

The Morningstar.com "5-Yr Restated" financials page is intact with continuing steady revenue growth, earnings growth, dividend growth, stable outstanding shares, free cash flow growth, and a solid balance sheet.

Reviewing the StockCharts.com 'point & figure' chart on HEICO (HEI), we can see that the stock price, which did come under pressure this year, has been acting stronger, breaking through recent price resistance and overall has held up quite well from my perspective.

Actually I did quite well with these two stock picks. These selections had an average appreciation of 65.1% since being selected for this website.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where my actual trading portfolio is monitored, my SocialPicks Page where my many stock picks are being tracked, and my Podcast Page where you can download some 'radio shows' I have done explaining some of the stocks and ideas I share with all of you on this website.

Have a great week ahead everyone!

Yours in investing,

Bob

A Reader Writes: "I was hoping you could answer a few questions...."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of my favorite tasks on this blog is to answer questions and comments from readers who have obviously given them a lot of thought. If you would like to reach me, feel free to drop me a line at bobsadviceforstocks@lycos.com. I read all of my emails but unfortunately cannot answer each one. I received a great comment from Erik C. who wrote:

"Hello Bob,

I was hoping you could answer a few questions I've had lingering on my mind for the past couple months. But before I do that, thank you for your response regarding the state of the US dollar. You went beyond my expectations, the amount of thought you put into your response was greatly appreciated.

When I started investing, I decided to stick to the Warren Buffet school because hey, you need to start somewhere right? I've been examining my portfolio and calculating my gains if I were to adopt a style closer to your own and it would have resulted in noticeably larger gains. I believe one of the contributing factors is because some of my holdings appreciated extremely quickly and as a result made them too p/e rich for me. As a result, I am considering adopting a small portion of my portfolio to a style similar to yours as an experiment.

My understanding of your investment style is to purchase on good news and a sale on bad news leaves you sitting on your hands. Is this to invest when momentum is on your side; to be a bull when your holdings are bullish and vice versa? The market has been up a fair bit the past week, if you reach a sale on appreciation, would you purchase more to capture more gains in the temporary bullish run up when another detrimental bombshell could easily hit at anytime? Are you willing to be a bull if your portfolio is bullish even though the market has a whole is bearish?

Last year during the beginning of the subprime mess, you lamented being whipsawed over a couple trades (Sorry, I had a great deal of difficulty finding the appropriate entries or I would cite them for reference). How did lessons learned during previous unstable markets affect your current "Buy Signal" indicator? Does the risk of being whipsawed affect your style now that we are deep in an extremely volatile market?

Finally, forgive me if this is incorrect, I am not a resident of the United States and I'm not completely familiar with your tax laws. I am under the belief that capital gains on stock held for less than a year are taxed considerably higher. How do you structure your portfolio around this? When I did the math on my portfolio, if I were to adopt your strategy from when I started to present, I would be up more money post tax. How has taxes affected the decision to adopt a more active strategy versus buy and hold?

As always thanks for reading, your thoughts are always appreciated

PS before sending this, I briefly checked your past entries looking for literature on how you deal with a bear market and found an old post reiterating your trading strategy. I waffled between editing my questions with that post in mind, but ultimately felt that I was asking questions that have not been asked. My apologies in advance if they already have been answered, your blog has a lot of content and you can only sift through so much before giving up."

Erik thanks so much for writing once again! Your comments are more than generous towards my website.

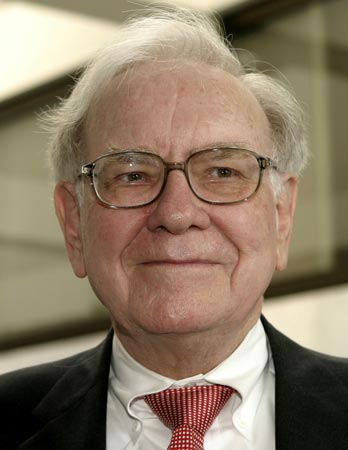

You started out talking about Warren Buffett a brilliant investor who really is in a class all by himself.

Mr. Buffett is the most well-known 'value investor' and also likely the most successful.

As this article from Investopedia explains:

"Warren Buffett descends from the Benjamin Graham school of value investing. Value investors look for securities with prices that are unjustifiably low based on their intrinsic worth. When discussing stocks, determining intrinsic value can be a bit tricky as there is no universally accepted way to obtain this figure. Most often intrinsic worth is estimated by analyzing a company's fundamentals. Like bargain hunters, value investors seek products that are beneficial and of high quality but underpriced. In other words, the value investor searches for stocks that he or she believes are undervalued by the market. Like the bargain hunter, the value investor tries to find those items that are valuable but not recognized as such by the majority of other buyers.

Warren Buffett takes this value investing approach to another level. Many value investors aren't supporters of the efficient market hypothesis, but they do trust that the market will eventually start to favor those quality stocks that were, for a time, undervalued. Buffett, however, doesn't think in these terms. He isn't concerned with the supply and demand intricacies of the stock market. In fact, he's not really concerned with the activities of the stock market at all. This is the implication this paraphrase of his famous quote : "In the short term the market is a popularity contest; in the long term it is a weighing machine."

But that isn't what I do. It isn't a bad approach, but I have chosen to pay attention to the 'activities of the stock market'. In fact, the market's activities virtually controls my own direction and decision-making.

You write about my strategy regarding buying stocks on 'good news' and selling on 'bad news'. Actually the difference between what I do and your observation is subtle. I sell stocks either on their reaching appreciation targets (I use 30, 60, 90, 120, 180, 240, 300 360, 450, 540%....etc.) at which time I currently sell 1/7th of a holding. Or I sell on a decline of 8% after an initial purchase, back to break-even if I have sold a holding once at a 30% gain, or if it should decline to 1/2 of its highest appreciation-point-sale. In those cases I sell the entire position. The last sale-point might be explained by noting if I happened to own Stock "XYZ" and had sold it four times (at 30, 60, 90 and 120% appreciation levels), then I would sell the entire position if it declined to 1/2 of the highest sale point or at a 60% appreciation level.

In addition to all of that I do reserve the right to 'bail-out' of a stock on actual bad news. Sort of like a criminal investigation or some horrible earnings report or other development. I have also retained the right to purchase stocks 'for a trade' but am trying to suppress that activity entirely as it hasn't been very successful for me.

But getting back to your comment, when I sell a stock at an appreciation point, I call that "good news" and use it to as a signal on the entire market environment. Thus, I give myself permission, if I am under my maximum number of positions, which currently I have placed at 20 (I am actually at 6 positions as I write), to add a new holding to my portfolio.

In the same way, sales on declines aren't based necessarily on any particular 'bad news', (except in the aforementioned arbitrary right that I reserve to sell on such events), but rather are declines in stock prices that trigger sales simply based on reaching price levels on the downside. I refer to these sales as "bad news" and you are correct, I 'sit on my hands' with the proceeds.

Again, your question: "Is this to invest when momentum is on your side?"....is actually on the mark.

I am trying to remove my own emotional input into the decision of 'when' to be buying stock from the equation. I am assuming that my own portfolio is somewhat of a reflection of the entire investment world. (It is certainly a stretch, but I think it works!). Thus when one of my own stocks hits a sale on good news, I am using this as a signal to add a new positions. Likewise, on the downside, I am using this as a signal not to be investing.

You ask about the short-term appreciation of the stock market, and whether if I reached a sale on appreciation I would be buying. The answer is 'Yes!'. But you will also note that my portfolio of six stocks hasn't reached any sale this week and doesn't appear to be very close.

So I am willing to be a bull when the rest of the market is bearish. I am deferring to my own stocks to dictate to me. I suspect my own holdings will act more rationally than I will as the market swings from optimistic upward moves to sharp declines.

You also asked about some whipsawing that happened in my own account and what I might have learned. Basically, the biggest problem I have had in my account is related to my impulsive trades that shouldn't have been done at all. My overall strategy is working fine. I have been performing several points ahead of the S&P since Covestor started tracking me, and would be doing even better if I had avoided the 'trades', large positions that I tried to trade on the sharp moves in the market.

The volatility in the market has firmed my resolve at following my own investment strategy.

The tax question is a good one. Indeed we have taxes to pay when short-term gains are recorded that are a higher rate than long-term gains.

As this article explains:

"Your tax will depend on a few things. If you have a short term capital gain you will be taxed at your normal tax rate. However, if you have a long term gain you will be taxed at 15%. If you are in a tax bracket of 14% or less you'll be taxed at 5%.

How do I know if I have a short term or long term gain? To determine whether you have a long or short term capital gain is quite simple. Property that you own for less than one year is defined as short term. Property that you own for more than one year is defined as long term."

So you are correct that it would be wiser, taxwise, to hold stocks for longer periods rather than selling. However, losses can be used to reduce gains....

"If you lost money on a capital asset it can be deducted on your taxes. Money that you lost on an investment is used first against profits you've made on another investment. Short term and long term capital losses can both be deducted but there are certain rules for each type of capital gain.'

And you will recall that my trading strategy involves taking losses aggressively. Hopefully, I shall have many more gains than losses both short-term and long-term. I am prepared to pay taxes to guarantee my long-term success.

Thanks for looking through the blog for some of these answers. I am more than happy to write up this response from a very well-thought-out reader! Thank you for loyally dropping by and thank you for taking the time to write!

Again, if you or any other readers have questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where my actual trading portfolio is monitored, my SocialPicks page where many of my stock discussions this past year are reviewed, and my Podcast Page where you can download mp3's of discussions of many of the same stocks discussed on the blog!

Yours in investing,

Bob

Wednesday, 2 April 2008

Immucor (BLUD) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

With the market acting a little more reasonable today, I wanted to find a stock that fit my criteria that I could share with all of you. Going to my usual 'first step' in identifying stocks, I noted that Immucor (BLUD) had made the list of top % gainers on the Nasdaq today, where it is currently trading at $25.78, up $2.17 or 9.19% on the day. I do not own any shares of Immucor nor do I have any options.

With the market acting a little more reasonable today, I wanted to find a stock that fit my criteria that I could share with all of you. Going to my usual 'first step' in identifying stocks, I noted that Immucor (BLUD) had made the list of top % gainers on the Nasdaq today, where it is currently trading at $25.78, up $2.17 or 9.19% on the day. I do not own any shares of Immucor nor do I have any options.

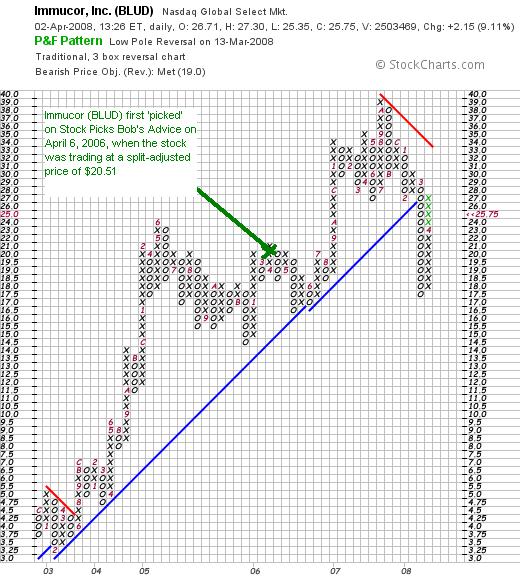

I use the term "revisit" on this entry because Immucor is what I like to call an 'old favorite' of mine, having reviewed it previously on Stock Picks Bob's Advice on April 6, 2006, almost two years ago. At that time the stock was trading at $30.76/share. However, Immucor split its stock 3:2 on May 16, 2006, making the effective pick price actually $20.51. Thus, with the stock trading currently at $25.78, this represents an appreciation of $5.27 or 25.7% since the stock was first discussed on this blog.

Let's take a closer look at this stock once again and I will share with you why I have decided

IMMUCOR (BLUD) IS RATED A BUY

First of all,

What exactly does this company do?

According to the Yahoo "Profile" on BLUD, the company

According to the Yahoo "Profile" on BLUD, the company

"...together with its subsidiaries, develops, manufactures, and sells a range of reagents and automated systems. Its products are used primarily by hospitals, clinical laboratories, and blood banks in various tests performed to detect and identify certain properties of the cell and serum components of human blood prior to blood transfusion."

How did they do in the latest quarter?

As is often the case on this blog, Immucor just announced 3rd quarter 2008 earnings yesterday after the close of trading, and it was this announcement that pushed the stock higher in trading today!

For the quarter ended February 29, 2008, revenue came in at $67.0 million, up 17% from 57.1 million during the same period last year. Net income for the quarter was $19.3 million, up 28% from the $15.0 million in the same quarter a year earlier. This worked out to $.27/share this year vs. $.21/share last year.

From my perspective these were solid results. But more important than earnings to a stock performance is what the expectations were on these results, and how the company did relative to these expectations. In fact, the company beat expectations in the quarter with net income of $.27/share when analysts polled by Thomson Financial were expecting $.22/share.

What about longer-term results?

If we review the Morningstar.com "5-Yr Restated" financials page on BLUD, we can see that the company has done a superb job with its underlying fundamentals, with revenue growing from $99 million in 2003 to $224 million in 2007 and $244 million in the trailing twelve months (TTM). During this time earnings have increased from $.28/share (except for a dip to $.18/share from $.28/share beetween 2003 and 2004), to $.85/share in 2007 and $.95/share in the TTM. No dividends are paid.

Outstanding shares have been stable at 64 million in 2003, increasing only to 68 million in the TTM.

Free cash flow has been positive and essentially growing from $35 million in 2005 to $55 million in the TTM. The balance sheet is solid with $138 million in cash which by itself can easily cover both the current liabilities of $43.1 million and the long-term liabilities of $15.7 million combined. Calculating for the current ratio, the total current assets of $238 million, divided by the current liabilities of $43.1 million yields a figure of 5.52, well above the level of 2.0 considered by some to be an indication of financial health.

What about some other valuation numbers?

Looking at Yahoo "Key Statistics", we can see that the company has a market capitalization of $1.8 billion, still considered a 'small cap stock' since it is under the $2 billion level.

The trailing p/e works out to 27.26 with a forward p/e (fye 31-May-09) estimated at 27.70. However, this doesn't quite jive with the PEG of 1.03 (5 yr estimated) which suggests that earnings ought to be estimated at growing at a 25% rate.

Checking the Fidelity.com eresearch website, we find that valuation is a tad rich as measured by the Price/Sales (TTM) ratio which for BLUD works out to a level of 6.72 relative to an industry average of 5.85. In terms of profitability, Fidelity calculates the Return on Equity (TTM) at a level of 29.27%, ahead of the industry average of 20.46%.

Finishing up with Yahoo, there are 69.97 million shares outstanding with 68.92 million that float. Currently, as of 2/26/08, there were 8.41 million shares out short yielding a short ratio of 10.8 or 12.2% of the float. I have been using my own idiosyncratic cut-off of these ratios of 3 days suggesting that this is quite a load of shares out short which might expain today's rise in stock price if the stock was subject to a short squeeze.

As I noted above, no dividend is paid and the last stock split was on May 16, 2006, when the stock split 3:2.

What does the chart look like?

Of all of the measures of this stock, the appearance of the "point & figure" chart from StockCharts.com gives me the greatest pause. We can see a beautiful run for this stock from a low of $3.25 in February, 2003, to a peak of $39 in October, 2007. However, since March, 2008, the stock broke through support at $28, dipped to a low of $17.50, and is fighting back to prior support levels. I would like to see the stock trading above $34 before I would be ready to give this stock an 'all clear'!

Summary: What do I think about this stock?

Needless to say, I like this stock a lot. I think it is likely to be recession-resistant in the medical technology field. They reported great earnings that beat expectations and have been steadily reporting terrific financial results for the past five years at least! Valuation is reasonable with a p/e in the 20's and a PEG just over 1.0. Price to Sales was a bit rich on analysis, but the Return on Equity suggests solid profitability. Their balance sheet is superb, and with a lot of shares out short there could well be a few short-sellers scrambling to buy shares if the stock rise continues!

Now, if I only had a signal to be buying stock!

Thanks again for visiting my blog! If you have any comments or questions, please feel free to leave them on the website or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where my actual trading account is reviewed, my SocialPicks Page where you can review my past year's stock picks and their performance subsequently, and my Podcast Page where you can download some mp3's on many of the same stocks I discuss here on the blog!

Have a great week!

Yours in investing,

Bob

Saturday, 29 March 2008

"Looking Back One Year" A review of stock picks from the week of September 11, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It has been a quiet week around these parts. I haven't found many stocks to write up and it is once again the weekend and time for a review! Last week I took a look at the week of September 4, 2006. Going a week ahead, let's review the picks from the week of September 11, 2006, which was a bit busier in regards to posting than some other weeks.

Needless to remind you, these reviews assume a "buy and hold" strategy of investing in which equal dollar amounts are purchased in each of these picks from the week and held without regard to price movement. In fact, I advocate and employ a disciplined investment strategy that requires me (except when I have rashly tried to do a 'trade'), to buy stocks only when I have a market signal o buy stocks, to sell stocks on declines, and to lock in appreciating stocks by partial sales at appreciation targets. Thus, the difference between this approach and a 'buy and hold' strategy would certainly be different....not necessarily better!

But, as I have commented elsewhere, it is easier to evaluate my picks assuming a simple purchase and hold than to evaluate it otherwise. Please do take that into consideration.

I should also like to be brief this afternoon/evening as I have a 'lot of things on my plate' this weekend but did want to get around to writing up a bit on the stocks I covered last year.

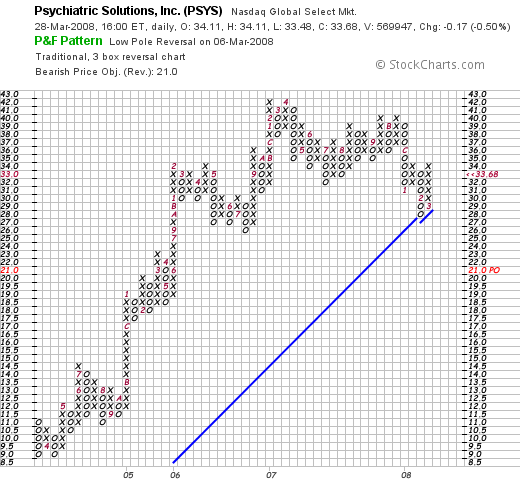

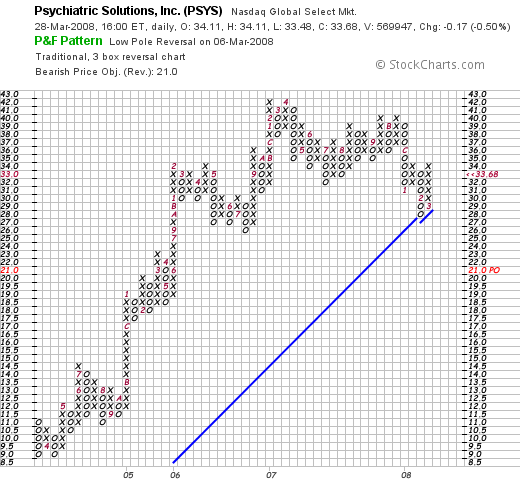

On September 12, 2006, I posted Psychiatric Solutions (PSYS) on Stock Picks Bob's Advice when the stock was trading at $35.78. PSYS closed at $33.68 on March 28, 2008, for a loss of $(2.10) or (5.9)% since posting. I do not own any shares or options of Psychiatric Solutions.

On September 12, 2006, I posted Psychiatric Solutions (PSYS) on Stock Picks Bob's Advice when the stock was trading at $35.78. PSYS closed at $33.68 on March 28, 2008, for a loss of $(2.10) or (5.9)% since posting. I do not own any shares or options of Psychiatric Solutions.

PSYCHIATRIC SOLUTIONS (PSYS) IS RATED A BUY

On February 20, 2008, PSYS reported 4th quarter 2007 results. Revenue for the quarter increased 44.1% to $403.4 million, from $279.9 million the prior year same period. Net income increased to $23.2 million or $.42/diluted share, up from $17.6 million or $.32/diluted share the prior year. The company raised guidance for the 2008 fiscal year by $.10/share to $1.93 to $1.97/share reflecting the benefit of lower interest rates.

Analysts polled by Thomson Financial had been expecting 2008 results of $1.88/share. However, first quarter 2008 guidance of $.42 to $.43/share was below expectations of $.44/share. The announcement was 'mixed' because the company was reducing guidance over the short-term, but raising guidance for the full year. Within the same announcement, they optimistically estimated same-store sales figures (which for them means same-facility revenue numbers) to grow at a 7-8% rate in 2008 compared to the strong 6.5% increase reported in 2007.

Reviewing the Morningstar.com "5-Yr Restated" financials, we can see that the revenue growth is intact, earnings growth has not been interrupted, total shares while being slightly more than doubled between 2003 and 2007, have increased while revenue is up six-fold, and earnings are up six-fold as well.

Free cash flow is positive and the balance sheet appears adequate with $340 million in total current assets compared to $182.2 million in current liabilities. The company does carry a significant $1.2 billion in long-term liabilities which apparently is being managed adequately but should be noted.

Finally, looking at a 'point & figure' chart on PSYS from StockCharts.com, we can see that while under a bit of selling pressure recently (what stock isn't?), the chart actually appears to be holding up under the recent preessure and hasn't broken down from its long-term bullish move from early 2004 when the stock was selling at as low as $9/share to the high of $42 in April, 2007.

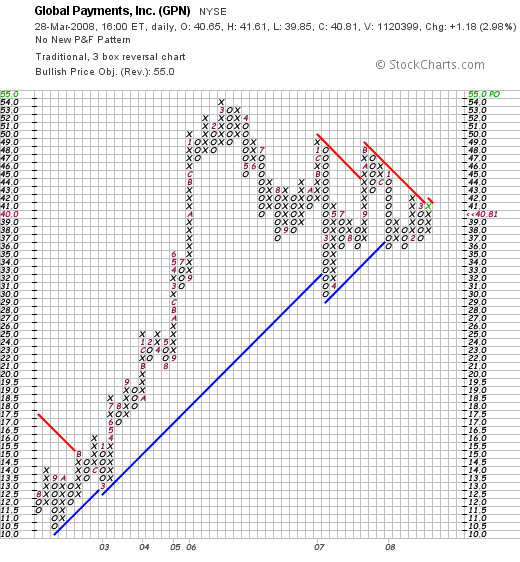

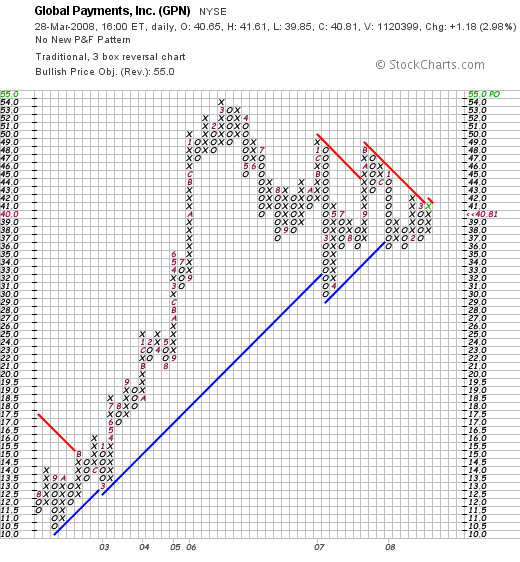

Next that week, on September 13, 2006, I 'picked' Global Payments (GPN) for Stock Picks at a price of $41.25. GPN closed at $40.81 on March 28, 2008, for a loss of $(.44) or (1.1)% since posting. I do not own any shares or options of Global Payments.

Next that week, on September 13, 2006, I 'picked' Global Payments (GPN) for Stock Picks at a price of $41.25. GPN closed at $40.81 on March 28, 2008, for a loss of $(.44) or (1.1)% since posting. I do not own any shares or options of Global Payments.

Just the other day, on March 27, 2008, Global Payments (GPN) announced 3rd quarter 2008 results. For the quarter ended February 29, 2008, revenue climbed 19% to $310.6 million from $260.4 million the prior year. Diluted earnings per share (excluding a one-time favorable gain) increased 5% to $.44 compared to $.42/share last year during the same period.

GPN beat expectations of analysts polled by Thomson Financial who had expected earnings of $.42/share on revenue of $300.9 million. In addition, the company raised guidance for 2008--now expecting profits of $1.95 to $1.97, up from prior January guidance of $1.89 to $.96. In addition, the range of revenue expectations for fiscal 2008 was increased to $1.25 to $1.26 billion from prior January guidance of $1.23 to $1.26 billion.

Reviewing the Morningstar.com '5-Yr Restated' financials page, we can see a beautiful picture that remains intact of steadily increasing revenue from $516 million in 2003 to $1.06 billion in 2007 and $1.16 billion in the trailing twelve months (TTM). Earnings have increased from $.70/share in 2003 to $1.75/share in 2007 and $1.84/share in the TTM. The company does pay a dividend but has kept it at $.08/share during this same period. Total shares have climbed less than 10% during this time, from 75 million in 2003 to 78 million in 2007 and 81 million in the TTM. This less than 10% share dilution occurred during the same period that revenue increased more than 100% and earnings also climbed more than 100%.

Free cash flow is solidly positive although not particularly increasing between 2005 and the present. And the balance sheet is gorgeous with $363 million in cash which by itself can easily cover both the $189.1 million in current liabilities and the $109.9 million in long-term liabilities combined. With over $500 million in total current assets, the current ratio works out to a healthy 2.70.

Reviewing the 'point & figure' chart on Global Payments (GPN) from StockCharts.com, we can see that the stock while under pressure recently has neither broken down nor 'broken out' in its price performance. Instead it has been trading in a narrower and narrower range, most recently appearing to be ready to break-out on the upside. (Or is that wishful thinking?) In any case, it certainly doesn't appear to be over-extended, nor convincingly in a decline.

GLOBAL PAYMENTS (GPN) IS RATED A BUY

The next stock I 'picked' on the blog didn't fare as well as the previous two.

The next stock I 'picked' on the blog didn't fare as well as the previous two.

NeuroMetrix (NURO) was selected for Stock Picks Bob's Advice on September 14, 2006, when the stock was trading at $20.50. I do not own any shares nor any options of this stock. NURO closed at $1.92 on March 28, 2008, for a loss of $(18.58) or (90.6)% since posting.

On February 12, 2008, NURO reported 4th quarter 2007 results. For the quarter ended December 31, 2007, revenue came in at $10.1 million, down from $14.2 million during the same period last year. They also reported a net loss of $(2.1) million this year compared to net income of approximately $1 million the prior year. This worked out to a net loss of $(.17) per share for the quarter compared with a profit of $.08/share the prior year.

According to analysts polled by Thomson Financial, the company actually beat expectations on earnings by no losing as much as was expected (!). Analysts were looking for a loss of $(.21)/share during the quarter. However, the company disappointed on revenue, as analysts were expecting revenue of $11.2 million during the period.

Reviewing the Morningstar.com '5-Yr Restated' financials on NURO, we can see that after growing their revenue from $9 million in 2003 to $55 million in 2006, the company dipped to $45 million in 2007. Earnings likewise improved from a loss of $(5.66) in 2003 to a profit of $.33/share in 2006 then turned negative at $.66 in 2007. Outstanding shares increased from 1 million in 2003 to 13 million in 2005 but have stayed stable since.

Free cash flow increased from $1 million in 2005 to $7 million in 2006 then turned negative at $(8) million in 2007. The balance sheet is solid with $7 million in cash and $35 million in other current assets easily covering the $8.7 million in current liabilities and the $.9 million in long-term liabilities reported on Morningstar.

Finally, looking at the 'point & figure' chart on NeuroMetrix (NURO) from StockCharts.com, we can see the dismal price performance of this pick. The stock declined gradually from $41 in April, 2006, to a level of $11.00 in January, 2008, only to plunge recently to the $1.92 level in March, 2008.

Even though it appears rather late with this assessment, with the poor earnings report, the poor Morningstar.com page, and the terribly weak price chart,

NEUROMETRIX (NURO) IS RATED A SELL

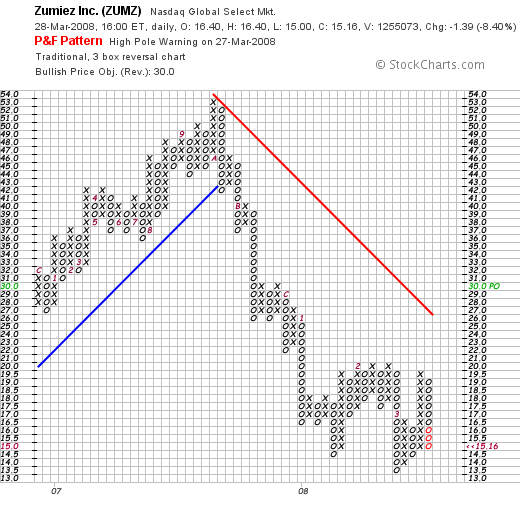

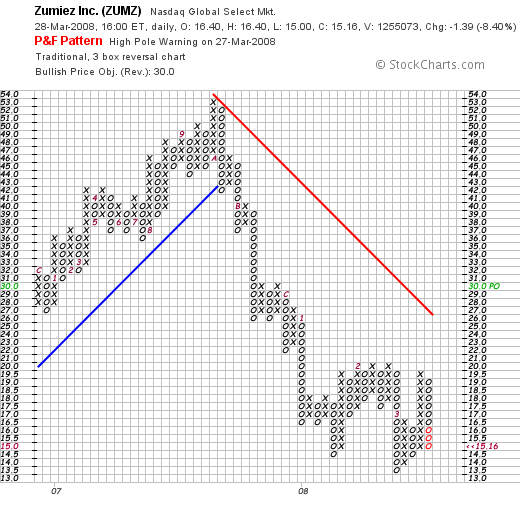

Finally, on September 16, 2006, I posted Zumiez (ZUMZ) on Stock Picks Bob's Advice when the stock was trading at $26.24 per share. I do not own any shares or options on this company.

Finally, on September 16, 2006, I posted Zumiez (ZUMZ) on Stock Picks Bob's Advice when the stock was trading at $26.24 per share. I do not own any shares or options on this company.

Zumiez closed at $15.16 on March 28, 2008, for a loss of $(11.08) or (42.2)% since posting.

On March 14, 2008, Zumiez (ZUMZ) reported 4th quarter 2007 results. For the quarter ended February 2, 2008, total net sales increased 12.7% to $126.6 million from $112.4 million in the same quarter last year. Net income for the quarter came in at $12.4 million or $.42/diluted share up from $11.3 million or $.39/share last year.

However, while positive, the torrid rate of growth at this retailer slowed considerably. For the quarter, same-store sales increased 4.0% compared with last year's same-store sales growth of 12.0%.

The company beat expectations during the quarter both on earnings and revenue. Sales, according to analysts polled by Thomson Financial, had been expected to come in at $126.1 million (they camne in at $126 million) and earnings were expected at $.38/share (they came in at $.42/share).

The company predicted low single digit same store sales growth in 2008 and profit of about $.90 to $.93/share. This was essentially in line with analysts' expectations for $.92/share in 2008.

With the recent recession fears and reports of weak retail sales, it is not surprising that Oppenheimer analyst Roxanne Meyer recently cut the ratings of Zumiez to "perform". However, with the relatively strong quarterly report,

ZUMIEZ (ZUMZ) IS RATED A HOLD

Reviewing the Morningstar.com '5-Yr Restated' financials, we can see that the record of steady revenue growth, earnings growth, stable shares, and positive free cash flow is intact. The balance sheet is solid with $136 million in total current assets, compared to $43.4 million in current liabilities and the $18.1 million in long-term liabilities.

Finally, looking at the 'point & figure' chart on Zumiez from StockCharts.com, we can see the terrible weakness in the price chart that developed in October, 2007, when the price declined from a peak of $53 to a low of $13.50 in March, 2008. Currently at $15.16, the stock is struggling to find support at this lower level. I do not like the technicals on this chart, but from the earnings news and the Morningstar.com report, I have to feel that the reaction of the street must be overdone on this chart and a reversal in price sentiment must soon be overdue.

So how did I do during that week in September, 2006? In a word, mediocre! The four stocks 'picked' during the week experienced an average loss of (35)% since posting. This certainly shows the risk of an kind of buy and hold strategy in a dynamic environment where prospects for companies do change.

In any case, thank you again for visiting! If you have any commnents or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

If you get a chance, be sure and visit my Covestor Page where my actual trading account is tracked and analyzed, my SocialPicks Page where my stock picks from the last year or so have been monitored, and my Podcast Page where you can listen to me discuss some of the same stocks I write about here on this website.

Have a great Sunday and a solid week ahead.

Yours in investing,

Bob

Posted by bobsadviceforstocks at 6:35 PM CDT

|

Post Comment |

Permalink

Updated: Tuesday, 8 April 2008 11:13 AM CDT

Wednesday, 26 March 2008

Playing the 'Stock Market Game' on Marketocracy!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Instead of talking about any particular stock this afternoon, I wanted to share with you my own experience with a great website Marketocracy where you can play what I would call the 'Stock Market Game' that is similar to the simulations that so many of us have played in high school, or have been asked by our kids to advise them as they were introduced to the Market in their own classes.

Instead of talking about any particular stock this afternoon, I wanted to share with you my own experience with a great website Marketocracy where you can play what I would call the 'Stock Market Game' that is similar to the simulations that so many of us have played in high school, or have been asked by our kids to advise them as they were introduced to the Market in their own classes.

I would absolutely encourage you all to sign up and get a free account with the $1 million in 'play money' to simulate a portfolio of stocks. (Unlike my Prosper.com account where I stand to get $25 and you the new lender also get $25 if you sign-up through my link, I do NOT receive anything in any way, shape, or fashion if you participate or not in Marketocracy.)

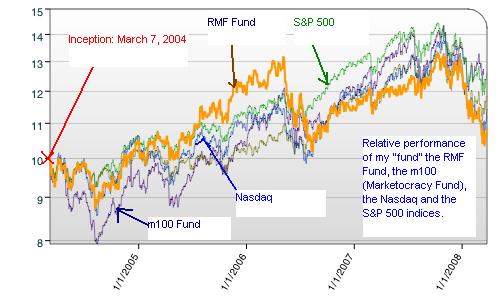

My own performance on Marketocracy dates back to March 7, 2004, when I first signed up and started the 'game'. In a word, my fund which I calll the RMF fund, while at times outperforming the market, has performed only in what I would have to call a very uninspired, almost mediocre fashion.

I wanted to share with you some of my latest 'strategy' in dealing with a large portfolio like this and see whether any of you might wish to comment on this portfolio management strategy which is quite different from my own idiosyncratic portfolio strategy that I employ in actuality and on the blog.

Currently my 'portfolio' has 53 positions (!). (Please remember that this Marketocracy fund is a simulated account which was strarted back in 2004 with $1,000,000 in value.) The current value, as of the close yesterday, is $1,073,526.93. Cash is at $5,765.21, with a stock value of $1,067,761.72. The current NAV (net asset value) is $10.74.

Ranking compared to all of the other portfolios on Marketocracy, as of December 31, 2007, the RMF Fund was at a 52.4% percentile for one month, 70.9% ranking for 3 months, 81.5% for 6 months, 72.2% for 1 year, 31.2% for 2 years and 55.7% at 3 years. A satisfactory performance, but nothing really to 'write home' about.

Marketocracy updates the portfolio frequently during the day, and you are able to make simulated trades based on recent trading prices for the equities involved. They keep track of your performance and monitor you for 'compliance' with some of their own Marketocracy rules. My fund has remained 'compliant' throughout the four year period I have been involved with this website.

My goal with the Marketocracy Account has been to make trading more or less automatic, with the emphasis on concentrating on the better-performing holdings, limiting my losses on the less-successful stocks, and developing a system to do this as automatically as possible.

Still trusting in the price momentum to identify possible purchase candidates, I check the list of top % gainers several times/week and consider buying stocks from these lists if they are over $10 and otherwise meet some of my criteria. (I am not quite as rigid as I am with my own actual trading account, and will often purchase small positions of stocks solely on the fact that they are on the top % gainers list).

Instead of purchasing a full position--which for me on this account would be at 4% of the portfolio--I have recently chosen to just purchase 100 shares of the stock, and let the price action either dictate me to be adding to that position or determining instead that it is time to sell.

In addition to these 100 share initial purchases, given that there are funds available, I try about once/day to go through the list of stocks and add 100 shares to any of the stocks that are in the top 1/3rd of performing stocks in my portfolio (Marketocracy breaks down the holdings into the top third, middle third, and bottom third of holdings), as long as I am under 4% in position size and the stock is moving higher in price. (If the stock is moving higher, even if it is a small position, I do not add to the position if it is in the middle third or lower third of holdings.)

If a stock is doing so well that it has now exceeded 5% of the holding, then I sell 100 shares of that holding. In addition, I sell 100 shares of a holding if it is in the lower third of the portfolio, is above 100 shares in size, and the stock price is declining. I only get down to a 100 share position, which finally is sold if the stock drops to an 8% loss or greater. If I have a large position, the stock is in the lower third of my portfolio, and the stock is declining, I still only sell 100 shares each day of that position. If the stock is actually rising, I don't sell any shares at all.

I don't do anything with stocks in the middle third of my portfolio. These stocks are more or less in 'no man's land' and are left alone whether they be rising or falling, whether they are at 4% or 1%. it just doesn't matter to me.

Anyhow, I wanted to write up a little something about my Marketocracy experience. I shall try to update it again in the future. I am still learning and developing 'systems' to manage the holdings in this account. I hope that if I am successful, then I shall have added to the understanding on managing stock holdings in larger accounts.

In the meantime, come and visit Marketocracy, set up an account, and start playing! As in that famous Alka-Seltzer commercial, let me just suggest,

In the meantime, come and visit Marketocracy, set up an account, and start playing! As in that famous Alka-Seltzer commercial, let me just suggest,

"Try it, you'll like it!"

Bob

Posted by bobsadviceforstocks at 3:49 PM CDT

|

Post Comment |

Permalink

Updated: Wednesday, 26 March 2008 3:55 PM CDT

Saturday, 22 March 2008

"Looking Back One Year" A review of stock picks from the week of September 4, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It was a shortened trading week with Good Friday giving us all a well-needed break from the volatility of trading recently. But one of the things I like to do on this blog is to review past stock picks. Going a week at a time, I started this process out reviewing stocks from the prior year. Well one thing led to another, and now I am about a year-and-a-half out from these reviews.

Last week I reviewed the picks from August 28, 2006 (there weren't any), and going a week ahead, let's look at the pick from the week of September 4, 2006. As I have pointed out previously, these reviews assume a buy and hold approach to investing. In practice, I advocate as well as personally employ a disciplined portfolio management strategy (except when I make one of my 'trades'), involving limiting losses on the downside by selling entire positions that are performing poorly, and locking in gains by selling small portions of holdings as they reach appreciation targets.

For the ease of analysis, I have always assumed a buy and hold approach to these stock picks. However, the difference in these strategies would certainly affect performance.

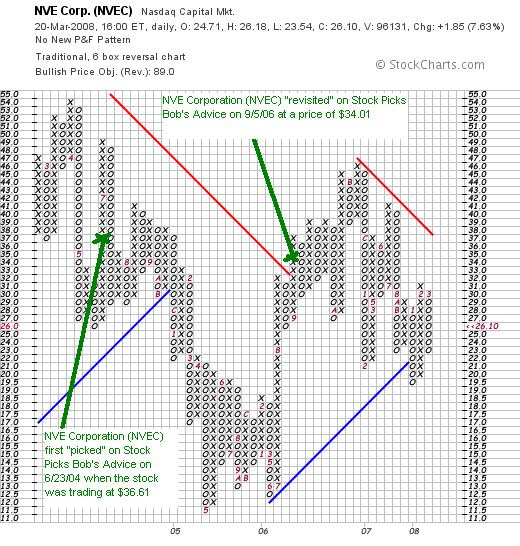

During the week of September 4, 2006, I actually posted only one stock pick idea: NVE Corporation was 'picked' on September 5, 2006, at a price of $34.01. NVEC closed on March 20, 2008, at $26.10 for a loss of $(7.91) or (23.3)%. I do not own any shares of this stock nor do I have any options on it.

During the week of September 4, 2006, I actually posted only one stock pick idea: NVE Corporation was 'picked' on September 5, 2006, at a price of $34.01. NVEC closed on March 20, 2008, at $26.10 for a loss of $(7.91) or (23.3)%. I do not own any shares of this stock nor do I have any options on it.

The post in 2006 was actually a 'revisit' of this stock as it has been a 'favorite' of mine (a previous selection on this blog), having 'picked' it on June 23, 2004, when the stock was trading at $36.61, an even higher price, and yet even though I have posted the stock twice previously, and the stock has declined each time subsequently (!), I would like to explain why

NVE CORPORATION (NVEC) IS RATED A BUY.

What exactly does this company do?

According to the Yahoo "Profile" on NVEC, the company

"...engages in the development and sale of devices using spintronics, a nanotechnology, which utilizes electron spin rather than electron charge to acquire, store, and transmit information. The company provides standard sensors that detect the presence of a magnet or metal to determine position or speed; custom sensors primarily for medical devices; and couplers that use semiconductor input stages, primarily for factory and industrial networks."

"...engages in the development and sale of devices using spintronics, a nanotechnology, which utilizes electron spin rather than electron charge to acquire, store, and transmit information. The company provides standard sensors that detect the presence of a magnet or metal to determine position or speed; custom sensors primarily for medical devices; and couplers that use semiconductor input stages, primarily for factory and industrial networks."

How did they do in the latest quarter?

On January 23, 2008, NVE Corporation (NVEC) reported 3rd quarter 2008 results. for the quarter ended December 31, 2007, the company announced total revenue of $4.77 million, a 23% increase from the $3.86 million in the prior-year same period. Net income climbed 62% to $1.7 million or $.36/diluted share compared to $1.05 million or $.22/share the prior year.

As is so important with an earnings announcement, it was their performance relative to expectations that was most impressive. In fact, the $.36/share exceeded expectations according to analysts polled by Thomson Financial which had been looking for $.30/share. this was enough to have both Broadpoint Capital and Northland Securities upgrade their ratings on this stock to "Buy" and "Outperform" from neutral ratings.

What about longer-term results?

Looking at the Morningstar.com "5-Yr Restated" financials, we find that revenue has steadily increased from $9 million in 2003 to $16 million in 2007 and $19 million in the trailing twelve months (TTM), (except for a dip from $12.0 million in 2004 to $11.6 million in 2005). Earnings have also been improving recently with a bit of an erratic record between 2004 and 2006, from $.15/share in 2003 to $1.00 in 2007 and $1.37/share in the TTM. (Earnings dipped from $.45/share in 2004 to $.37/share in 2005 before rebounding and steadily increasing from $.39/share in 2006 to the current levels).

Outstanding shares have been stable with 4 million reported in 2003 increasing to 5 million in the TTM. Free cash flow has been positive and improving recently with -0- in 2005, $3 million in 2006, $5 million in 2007 and $6 million in the TTM.

The balance sheet is solid with $1 million in cash and $8 million in other current assets, which when compared to the $1.2 milliion in current liabilities yields a current ratio of over 7. NO long-term debt is reported on Morningstar.com.

What about some valuation numbers?

Checking the Yahoo "Key Statistics" on NVEC, we can see that this is really a tiny company, what we call a Micro Cap Stock, with a market capitalization of only $121.05 million.

The trailing p/e is reasonable (imho) at 19.12, with a forward p/e (fye 31-Mar-09) estimated at 15.17. This steady growth in earnings anticipated, results in a PEG of only 0.70, which for me is quite cheap.

Using the Fidelity.com eresearch website, we find that the Price/Sales (TTM) ratio is a bit steep at 6.35 compared to the industry average of 3.54. In terms of profitability, Fidelity reports that the Return on Equity (TTM) is a bit better than average at 24.52%, compared to the industry average of 22.22%.

Returning to Yahoo, we can see that this company has only 4.64 million shares outstanding with 4.62 million that float. As of 2/26/08, there were 444,640 shares out short representing 9.65 of the float or 5.9 trading days of volume. This is well down from the 1.08 million shares that were out short the prior month. This suggests that over 500,000 shares that were out short have been re-purchased as the negativity surrounding this stock appears to be reduced with the strong earnings report....at least that would be my take. I just don't see what is so negative about this company to be selling short!

Finally, as noted above, not dividends are paid and the last stock split was actually a reverse split of 1:5 on November 22, 2002.

What does the chart look like?

Reviewing the 'point & figure' chart on NVEC from StockCharts.com, we can see the very unimpressive technical appearance of this stock chart which has declined from a peak of $54 in April, 2004, to a low of $11.50 in may, 2005, only to start climbing in an erratic fashion to a peak of $46 in November, 2006, recently dipping past support at $19.50, and trying to find some support for a move higher. The stock is certainly not over-extended technically (lol), but appears longer-term to be breaking through the downward move from 2004 (?).

Summary: What do I think about NVE Corporation?

Well, needless to say, despite the mediocre chart, I really like this stock. Am I a glutton for punishment or what? But seriously, they reported a terrific quarter, beat expectations, and have a record recently of terrific revenue and earnings growth, positive free cash flow, and a solid balance sheet.

Valuation-wise, except for the rich Price/Sales ratio, they have a reasonable p/e, a great PEG, and a Return on Equity exceeding their peers. Now, if we could only see a bit more technical support in the stock chart :).

Thanks again for visiting! If you have any questions or comments, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where you can follow my actual trading account, my SocialPicks page where you can review my past stock picks from the last year or so, and my Podcast Page where you can download some mp3's of me discussing a few of the stocks I write up here on the website.

Have a great weekend everyone! And a Happy Easter to all of my friends!

Yours in investing,

Bob

Thursday, 20 March 2008

Do Large Banks Need More Financial Help than Homeowners?

Last week the White House made it clear that they would use the veto power of the President to stop the effort by Congressional Democrats to assist homeowners who may be facing foreclosure.

As reported:

"Opening what is likely to be an intense political battle in the deepening mortgage crisis, the White House said it strongly opposed the bill, which would let bankruptcy court judges modify the terms of a mortgage as part of the restructuring of a debt in a bankruptcy filing."

The article continued:

"But mortgage lenders, and the Wall Street firms that purchased the loans, have mounted a campaign against the bill, saying it would send a chilling message to investors and lead to higher borrowing costs in the future.

“We’re pulling out all the stops on this,” said Stephen O’Connor, chief lobbyist for the Mortgage Bankers Association. “How will lenders and investors react to the added risk? They will likely charge a higher interest rate, likely charge more points on the mortgage and likely demand higher down payments.”"

Not wanting to send any 'chilling messages' to investors, these same Wall Street firms are now borrowing billions of dollars to help their own financial future.

I read with interest today:

"The new lending program gives the 20 primary dealers of Treasury securities special access to the Fed's discount window. The overnight loans are overcollateralized and pay the prevailing discount rate, currently 2.50%."

But I guess it wouldn't be fair for a bankruptcy court to reduce a mortgage interest rate to say....something like 2.5% would it?

Who were these borrowers willing to take money from the Fed?

As noted in the same article:

"In the week ending Wednesday, the investment banks borrowed a daily average of $13.4 billion from the Fed, implying an average borrowing of about $19 billion for Monday and Tuesday.

Three investment banks -- Morgan Stanley, Goldman Sachs and Lehman Bros. -- have publicly announced they borrowed from the Fed. Others may also have done so, but the names of the borrowers are not announced by the Fed."

Also:

"As part of the takeover bid, the Fed also gave J.P. Morgan up to $30 billion in support for potential losses from the riskiest assets owned by Bear. That credit line had apparently not been tapped as of Wednesday."

And the cost of aid to the public instead of to Morgan Stanley and the like?

As the Wall Street Journal

reported, the Representative Barney Frank proposal would assist distressed homeowners and cost the FHA $10 billion.

Meanwhile, President Bush is also threatening to veto the reckless $4 billion in aid to states and localities to redevelop abandoned and foreclosed houses.

Contrast THAT to the aid given the last two days to the banks.

Is it really too much to ask for a government to offer

'fair and balanced' assistance to lenders and borrowers alike?

Bob

Posted by bobsadviceforstocks at 6:06 PM CDT

|

Post Comment |

Permalink

Updated: Thursday, 20 March 2008 6:14 PM CDT

Tuesday, 18 March 2008

FactSet Research Systems Inc. (FDS) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I am still getting over my terribly bad case of timing yesterday, when I bought and sold Lehman (LEH) for a quick loss. Very quick. Yesterday I bought a bunch of Lehman for $34+ and then sold about 20 minutes later at about $31+...for about a $(2,500) quick loss and swore I would be done (for quite a while) with these 'trades' after burning my fingers once more. Ironically (!), Lehman closed TODAY at $46.49, up $14.74. So I had the right idea but horrible timing. :(. I am an investor, not a trader. Let me write THAT one on the blackboard about 1,000 times....hmmmm.

Anyhow, the market was kind to me and I made up some of the loss with the big move higher. The Dow closed today (3/18/08) at 12,392.66, up 420.41, and the Nasdaq closed at 2,268.26, up 91.25, with the S&P closing at 1,330.74, up 54.14. What a volatile ride we have ALL been having! It is hard to know where the market will be in an hour, let alone next week!

Anyhow, the market was kind to me and I made up some of the loss with the big move higher. The Dow closed today (3/18/08) at 12,392.66, up 420.41, and the Nasdaq closed at 2,268.26, up 91.25, with the S&P closing at 1,330.74, up 54.14. What a volatile ride we have ALL been having! It is hard to know where the market will be in an hour, let alone next week!

As the French author, Francois de la Rochefoucauld has written:

"The only thing constant in life is change"

...so it is with the market these days.

Licking my wounds, and returning to the list of top % gainers today, I was pleased to see FactSet Research Systems Inc. (FDS) on the list closing at $52.43, up $7.90 or 17.74% on the day. I do not own any shares nor do I have any options on this stock.

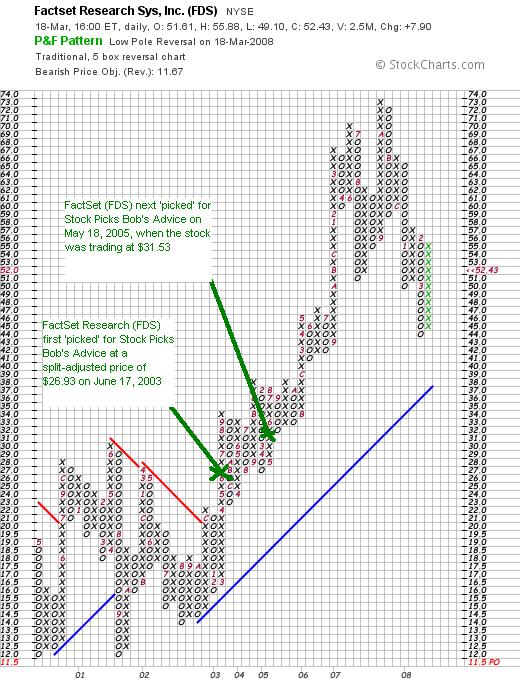

I should point out that FactSet is an 'old favorite' of mine, having written about this twice previously on this blog. I first reviewed FactSet (FDS) on Stock Picks Bob's Advice on June 17, 2003, when the stock was trading at $40.39, which adjusted for a 3:2 stock split on February 7, 2005, this works out to a price of $26.93. FactSet was next revisited on Stock Picks Bob's Advice on May 18, 2005, when the stock was trading at $31.53. With today's close at $52.43, this represents an appreciation of $25.50 or 94.7% since my 2003 post, and an appreciation of $20.90 or 66.3% since my 2005 post.

I should point out that FactSet is an 'old favorite' of mine, having written about this twice previously on this blog. I first reviewed FactSet (FDS) on Stock Picks Bob's Advice on June 17, 2003, when the stock was trading at $40.39, which adjusted for a 3:2 stock split on February 7, 2005, this works out to a price of $26.93. FactSet was next revisited on Stock Picks Bob's Advice on May 18, 2005, when the stock was trading at $31.53. With today's close at $52.43, this represents an appreciation of $25.50 or 94.7% since my 2003 post, and an appreciation of $20.90 or 66.3% since my 2005 post.

Let's take a closer look at this stock and I will show you why

FACTSET RESEARCH (FDS) IS RATED A BUY

What exactly does this company do?

According to the Yahoo "Profile" on FactSet (FDS), the company

"...provides financial and economic information, including fundamental financial data on various companies to the investment community worldwide. Its primary product includes Marquee, a quotes and news application for company's investment management and banking clients."

And how did they do in the latest quarter?

It was the announcement of 2nd quarter 2008 earnings today, combined with the rally in equities that led to the big spike in price in FDS stock today. Earnings for the quarter ended February 29, 2008, increased 21% to $140.2 million compared to the year earlier same period. Net income increased to $29.5 million from $26.5 million last year and diluted earnings per share grew to $.59 from $.52 last year.

As pointed out in this report, "Excluding one-time costs and gains, the company earned $31.1 million or 62 cents per share compared with $26.5 million or 52 cents per share last year." This was ahead of analysts expectations according to analysts polled by Thomson Financial who expected profit of $.60/share. The company also beat expectations on revenue which had been expected to come in at $139.6 million.

Factset also raised guidance today for the upcoming quarter, guiding sales to between $145 and $149 million compared to the $121.1 million reported in the 3rd quarter of 2007. Currently, analysts polled by Thomson Financial are expecting sales of $143.5 million.

This is what I have in the past referred to as a 'trifecta-plus' in an earnings report: strong growth in both revenue and earnings, beating expectations on both, associated with the raising of guidance for future results! There isn't much more an investor could want from a report than this!

What about longer-term results?

Since I am generally not interested in 'one-quarter wonders' on this blog, and instead am looking for stocks demonstrating persistence of quality results, I like to review the Morningstar results on each company.

Reviewing the "5-Yr Restated" financials from Morningstar.com on this company, we can see the steady revenue growth noted by the gradual pattern of increasing purple bars...with $222 million in revenue in 2003 increasing to $476 million in 2007 and $501 million in the trailing twelve months (TTM).

Earnings show an equally consistent and impressive pattern of growth, growing from $.99/share in 2003 to $2.14/share in 2007 and $2.25/share in the TTM. The company also pays a dividend and has been steadily increasing it from $.15/share in 2003 to $.36/share in 2007 and $.42/share in the TTM. Outstanding shares have been extremely stable with 52 million shares reported in 2003 actually decreasing to 51 million in the TTM.

Free cash flow has been positive and has grown, except for a slight dip in the TTM, from $72 million in 2005 to $117 million in 2007 and $110 million in the TTM.

The balance sheet appears quite healthy to me with $155 million in cash, which by itself could easily pay off both the $64.9 million in current liabilities and the $28.7 million in long-term liabilities combined with plenty left over as well! Calculating the current ratio, the $242 million in total current asset, when divided by the $64.9 million in current liabilities, yields a very healthy ratio of 3.73.

What about some valuation numbers?

Reviewing the Yahoo "Key Statistics" on FactSet (FDS), we find that the company is a mid cap stock with a market capitalization of $2.53 billion. The trailing p/e is a very acceptable (for me) 23.29, with a forward p/e (fye 31-Aug-09) of 18.53). With rapid growth estimated to continue, the PEG ratio works out to an acceptable 1.15 (generally I prefer PEG's between 1.0 and 1.5).

Looking at the Price/Sales ratio, we can see that the stock is reasonably priced with a Price/Sales (TTM) figure of 4.32 compared to the industry average of 4.78 per the Fidelity.com eresearch website. Profitability may be a little light compared to comparables, at least as measured by the Return on Equity (TTM) which comes in at 27.88% vs. the $31.41% ROE (TTM) of similary companies per Fidelity.

Finishing up with the Yahoo numbers, there are 48.23 million shares outstanding with 42.87 million that float. Currently (as of 2/26/08) there are 4.89 million shares out short, representing 9.7 trading days of volume (the short ratio)--far in excess of my own '3 day rule' for significance. This is 11.3% of the float---and may have well resulted in a 'short squeeze' today on the back of the great earnings report and the surge in overall stock prices.

As I noted, the company pays a dividend which on a 'forward basis' is $.48/share or yielding 1.00%. The last stock split, also noted above, was a 3:2 split on February 7, 2005.

What does the chart look like?

Looking at the 'point & figure' chart on FactSet Research (FDS) from StockCharts.com, we can see the tremendous appreciation in stock price from a low of $12 in September, 2001, to a high of $73 in October, 2007. The stock has been under some pressure recently along with all of the financial-related companies, but rebounded strongly today. The chart still looks acceptable to me without being over-extended but I would appreciate seeing the stock back at the $68 level before this amateur could feel that the technicals looked quite encouraging!

Summary: What do I think?

Needless to say I really like this stock. The only thing giving me concern has been the recent weakness in all of the Financial Stocks and this stock rides along with those companies. They reported great earnings, beat expectations and raised guidance. Longer-term, they have steadily raised revenue results, earnings results, and also pay a dividend which they have been steadily raising!

Outstanding shares are absolutely stable, free cash flow is positive and basically growing, and the balance sheet appears solid.

Valuation-wise, the p/e is moderate, the Price/Sales is low compared to its peers, the Return on Equity is a tad weak, but the PEG is at a very acceptable level. On top of this, there are a lot of short-sellers who are feeling the Cramer 'house of pain' in this stock. Finally, with the current move higher, the stock chart is moderately hopeful for a continued appreciation in this stock price. If I were buying a stock (at least when I am following my own rules :(), this is the kind of stock I would be buying.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where my actual Trading Portfolio is reviewed and analyzed, my SocialPicks page where you can find out more about my stock picks from the past year, and my Podcast Page where you can download some mp3's of me discussing some of the many stocks I review here on the blog.

I hope this entry finds you in good health and at least slightly better spirits today as fed pulls out almost all of the plugs to get the economy and this market moving once more.

Yours in investing,

Bob

Newer | Latest | Older

Most of the time I listen to CNBC getting the latest Stock Market information while driving along in my car. But I also like the wide range of music choices; I enjoy channel 28 which is the Broadway Tunes channel. When my daughters get in the car, they are switching over to current hits. The choices are terrific. I plug the service to all of my friends.

Most of the time I listen to CNBC getting the latest Stock Market information while driving along in my car. But I also like the wide range of music choices; I enjoy channel 28 which is the Broadway Tunes channel. When my daughters get in the car, they are switching over to current hits. The choices are terrific. I plug the service to all of my friends.

I know that my favorite commentator Jim Cramer had been plugging away for the merger. He has argued:

I know that my favorite commentator Jim Cramer had been plugging away for the merger. He has argued: And are we rewarding mismanagement that would award Howard Stern a $500 million deal while barely staying afloat financially?

And are we rewarding mismanagement that would award Howard Stern a $500 million deal while barely staying afloat financially?

On September 18, 2006, I

On September 18, 2006, I

With the market acting a little more reasonable today, I wanted to find a stock that fit my criteria that I could share with all of you. Going to my usual 'first step' in identifying stocks, I noted that Immucor (BLUD) had made the

With the market acting a little more reasonable today, I wanted to find a stock that fit my criteria that I could share with all of you. Going to my usual 'first step' in identifying stocks, I noted that Immucor (BLUD) had made the  According to the

According to the

Next that week, on September 13, 2006, I 'picked' Global Payments (GPN) for Stock Picks at a price of $41.25. GPN closed at $40.81 on March 28, 2008, for a loss of $(.44) or (1.1)% since posting. I do not own any shares or options of Global Payments.

Next that week, on September 13, 2006, I 'picked' Global Payments (GPN) for Stock Picks at a price of $41.25. GPN closed at $40.81 on March 28, 2008, for a loss of $(.44) or (1.1)% since posting. I do not own any shares or options of Global Payments.

The next stock I 'picked' on the blog didn't fare as well as the previous two.

The next stock I 'picked' on the blog didn't fare as well as the previous two.

Finally, on September 16, 2006, I

Finally, on September 16, 2006, I

Instead of talking about any particular stock this afternoon, I wanted to share with you my own experience with a great website

Instead of talking about any particular stock this afternoon, I wanted to share with you my own experience with a great website  In the meantime, come and visit

In the meantime, come and visit  During the week of September 4, 2006, I actually posted only one stock pick idea:

During the week of September 4, 2006, I actually posted only one stock pick idea:  "...engages in the development and sale of devices using spintronics, a nanotechnology, which utilizes electron spin rather than electron charge to acquire, store, and transmit information. The company provides standard sensors that detect the presence of a magnet or metal to determine position or speed; custom sensors primarily for medical devices; and couplers that use semiconductor input stages, primarily for factory and industrial networks."