Stock Picks Bob's Advice

Thursday, 14 September 2006

NeuroMetrix (NURO)

Hello Friends! I don't have time to do a whole post...but take a look at NURO and I think you might like what you see. Latest quarter, Morningstar, and today's move make it an interesting idea. I haven't looked at this one before, don't own any shares, am not planning at this time to buy any shares (I don't have a buy signal), but I was afraid that with my busy schedule, I wouldn't get around to writing this one up!

Regards!

Bob

Wednesday, 13 September 2006

"Revisiting a Stock Pick" Global Payments (GPN)

CLICK HERE FOR MY PODCAST ON GLOBAL PAYMENTS

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

We had another nice day in the market. I cannot remember how long it has been since we have had so many up days in a row! I hope it is not premature to start getting optimistic about things, but with the interest rate hikes on hold and energy prices pulling back, we might just have the beginnings of a new bull market. Hopefully, that is not wishful thinking :).

We had another nice day in the market. I cannot remember how long it has been since we have had so many up days in a row! I hope it is not premature to start getting optimistic about things, but with the interest rate hikes on hold and energy prices pulling back, we might just have the beginnings of a new bull market. Hopefully, that is not wishful thinking :).

Going back to my usual haunts looking through the top % gainers lists, I came across what I call an "old favorite" of mine, Global Payments (GPN) which made the list of top % gainers on the NASDAQ, closing at $41.25, up $2.61 or 6.75% on the day. I have an arbitrary rule on this blog that I do not like to review past stock picks until at least a year has passed.

I first reviewed Global Payments on Stock Picks Bob's Advice on September 9, 2005, when it was trading at $68.89. GPN had a 2:1 stock split October 31, 2005, making my effective stock pick price actually $34.45. With today's close at $41.25, the stock has appreciated $6.80 or 19.7% over the past year. I do not own any shares nor do I have any options on this stock.

Let's take another look at this stock and see why I think it deserves a spot on Stock Picks!

1. What exactly does this company do?

If we look at the Yahoo "Profile" on Global Payments, we can see that this company

"...provides payment processing and consumer money transfer services worldwide. The company operates in two business segments, Merchant Services and Money Transfer."

2. Was there any news today to explain the stock price move?

Today, as reported, UBS upgraded GPN from "Neutral" to "Buy". Scouring the news on Global Payments, I found another story regarding GPN's acquisition of Sarajevo-based Diginet, an "indirect payment processor" adding to its "presence in the Balkan region." Personally, I have observed that most acquisitions result in the acquiring company dropping slightly in price and the company to be acquired climbing higher. However, some acquisitions might well be additive to earnings. It does appear that the UBS upgrade may have been the bigger news.

3. How did the latest quarterly report turn out?

This news report was a little harder to locate but was easily retrieved from the company website. Global Payments announced 4th quarter 2006 results on July 28, 2006. For the quarter ended May 31, 2006, revenue grew 15% to $238.8 million, up from $207.7 million in the same quarter the prior year. 4th quarter GAAP net income was $34.1 million, compared with $23.5 million the prior year. On a per share basis this worked out to $.41/diluted share, up from $.29/diluted share the same quarter the prior year.

4. How has this company done longer-term?

Reviewing the Morningstar.com "5-Yr Restated" financials on GPN, we can see the steady pattern of revenue growth from $463 million in 2002 to $784 million in 2005 and $908 million in 2006.

Earnings have grown just as consistently with $.31/share reported in 2002, increasing to $1.16/share in 2005 and $1.53/share in 2006. The company has been paying a dividend of $.08/share steadily since at least 2002. Nicely, even though there has been a slight increas in shares outstanding, this has been a modest increase from 72 million shares in 2002 to 79 million shares in 2006. This is less than a 10% increase in the shares while revenue doubled and earnings quintupled.

Free cash flow is also gorgeous. Global Payments had $68 million in free cash flow in 2004, increasing to $195 million in 2005 and $210 million in 2006.

The balance sheet is solid with $218.5 million in cash, enough to pay off the current liabilities of $149.7 million and most of the long-term liabilities of $98.8 million. Calculating the current ratio, the company has a total of $348.4 million in total current assets, which when divided by the $149.7 million in current liabilities yields a current ratio of 2.33. Current ratios over 2 are considered healthy.

5. How about some valuation numbers on this stock?

Using the Investopedia definition of market capitalization:

"Mega Cap: Market cap of $200 billion and greater

Big/Large Cap: $10 billion to $200 billion

Mid Cap: $2 billion to $10 billion

Small Cap: $300 million to $2 billion

Micro Cap: $50 million to $300 million

Nano Cap: Under $50 million"

Global payments would be considered a mid-cap stock with a market capitalization of $3.30 billion per Yahoo "Key Statistics". Elsewhere on this blog, I have described mid-cap stocks as companies with market capitalizations of $500 million to $3 billion, so this certainly varies from source to source.

The trailing p/e is a moderate 27, with a forward p/e (fye 31-May-08) of only 20.62. Analysts are apparently fairly bullish on growth prospects as the PEG ratio works out to a reasonable 1.35.

Examining the Price/Sales ratio on the Fidelity.com eresearch website, and using the Paul Sturm perspective, we find that Global Payments (GPN) is in the "Business Services" Industrial Group, and is fairly richly valued with a Price/Sales ratio of 3.5. This is exceeded only by Getty Images (GYI) with a ratio of 3.7, and is followed by Choicepoint (CPS) with a ratio of 3.1, Fidelity National Information Services (FIS) at 2.9, and Cintas (CTAS) at 1.9.

Looking at profitability, as measured by Return on Equity (ROE), finds Global Payments leading this group with a figure of 18.1%, this is followed by Cintas at 15.3%, Choicepoint at 12.9%, Getty Images at 11.6%, and Fidelity National Information Services at 9.6%.

Returning to Yahoo for some more numbers, we find that there are 79.91 million shares outstanding and 66.66 million of them that float. Currently, as of August 10, 2006, there were 2.47 million shares out short, representing 3.10% of the float or 2.5 trading days of volume (the short ratio). Using my own arbitrary 3 day rule on short ratios, I do not find this a very significant level of short interest.

As I noted earlier, the company does pay a small dividend of $.08/share yielding 0.2%. The last stock split was a 2:1 split on October 31, 2005.

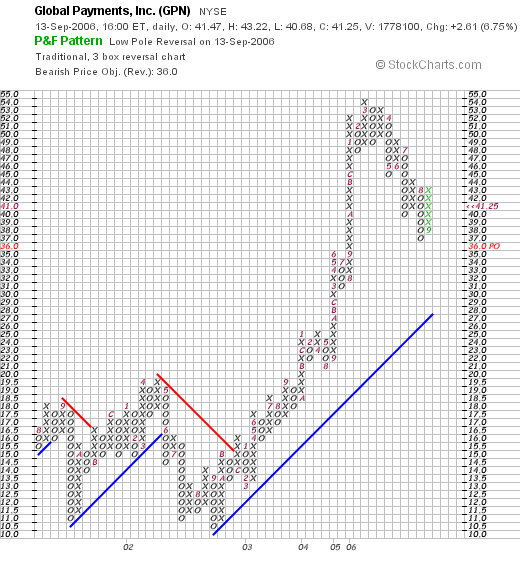

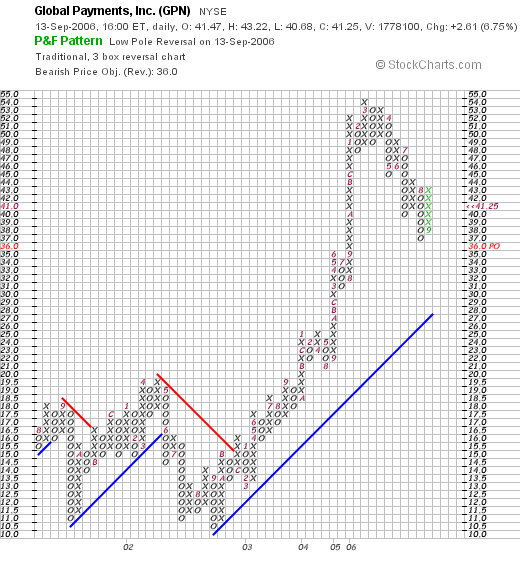

6. What does the chart look like?

If we review the "Point & Figure" chart on Global Payments from StockCharts.com, we can see that this stock was going nowhere between August, 2001, and December, 2002, when it traded in a range between $10.50 and $20. The stock broke out in December, 2002, breaking through resistance at $15. The stock moved steadily higher until accelerating in January, 2006, and topping out at $54/share. Recently the stock has pulled back to the $37 level, but moved sharply higher today back up to the $41.25 range. The stock chart looks solid to me.

7. Summary: What do I think about this stock?

Let's review some of the things going on with this stock which moved nicely higher today. First of all the stock was upgraded by UBS and also announced a strategic acquisition. The latest quarter was very strong with a steady growth in revenue and earnings. Looking at the Morningstar report, we found that this revenue growth was remarkably steady the past five years with steady revenue and earnings growth with only a small increase in the shares outstanding. The company even pays a small dividend.

Free cash flow has been positive and growing solidly the past few years, the balance sheet is solid with ample cash and a current ratio over 2. Valuation-wise, the p/e isn't bad in the 20's, the PEG is only a big over 1.2, the Price/Sales is a bit rich, but GPN leads its group in terms of return on equity. There aren't many shares out short. And finally, the chart looks nice to me.

This "profile" of a company is the kind of stock I am looking for and this company has once again demonstrated it deserves a place in this blog! Of course, I am not buying any shares now. I am still waiting for a signal from my own portfolio--a sale of a portion of my holdings at a gain. Meanwhile, I continue to 'sit on my hands'.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Please also be sure to come and visit my Stock Picks Podcast Site!

Bob

Tuesday, 12 September 2006

Psychiatric Solutions (PSYS) September 12, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

It is a nice change to be looking at a stock market moving ahead strongly on the back of additional gains in the prior weeks. We have had so many days and months of corrections as the Fed relentlessly pushed interest rates higher. Perhaps most of that weakness is behind us. In any case, with the market indices moving ahead all day today, we have the opportunity of finding additional companies that are worth evaluation on this website.

It is a nice change to be looking at a stock market moving ahead strongly on the back of additional gains in the prior weeks. We have had so many days and months of corrections as the Fed relentlessly pushed interest rates higher. Perhaps most of that weakness is behind us. In any case, with the market indices moving ahead all day today, we have the opportunity of finding additional companies that are worth evaluation on this website.

My method of identifying candidates for consideration continues to start with the top % gainers list. Why? Well, if we wish to identify a timely stock that will move higher from this point in time, why not start with stocks moving higher today? In any case, using this list gives us a manageable group of names to evaluate.

In fact, looking through the top % gainers list from the NASDAQ today, I came across Psychiatric Solutions (PSYS), which is, as I write, trading at $35.78, up 10.91% on the day. I do not have any options or hold any shares in this company.

I have already examined this stock for myself, but let me share with you why I believe it deserves to be on the blog.

1. Is there any news to explain the company's move higher?

As reported, it was announced after the close of trading yesterday that PSYS will be replacing RSA Security in the S&P MidCap 400 Index. Since there are investment vehicles like the iShares MidCap 400 Index fund, this means that individuals or institutions that are trying to reflect the performance of this index will be more or less 'swapping' shares of RSA to buy shares of PSYS. In any case, this recognition by the S&P people, also is helpful in bringing this stock to the public's attention and the stock price responded nicely today.

2. What exactly does this company do?

Checking the Yahoo "Profile" on PSYS, we find that the company

"...and its subsidiaries provide inpatient behavioral health care services in the United States. The company operates in two divisions, Inpatient and Inpatient Management Contract."

3. How did they do in the latest quarter?

On July 26, 2006, Psychiatric Solutions reported their 2nd quarter results. For the quarter ended June 30, 2006, revenue came in at $248.4 million, up 78% from $139.5 million reported in the prior year same period. Net income increased 38% to $.29/share up from $.21/share last year. Just as in retail evaluations, we can talk about "same-store sales growth", since this company may have sales affected by opening new hospitals, or acquiring hospitals which has occurred, the "same facility growth" is important and PSYS noted that the 'same-facility revenue' increased by 8%.

An additional note in the earnings report was the raised guidance for the 2006 fiscal year from the previous $1.02-$1.05 to a new range of $1.08-$1.10. Since analysts had been expecting $.27/share on revenue of $248.4 million, this result also beat expectations by $.02. This is what I call my 'trifecta-plus' in earnings reports: increasing revenue, increasing earnings, beating expectations, and raising guidance--a nice combination that imho often tends to precede stock price appreciations.

4. What about longer-term results?

My favorite place to examine longer-term results if Morningstar.com, and the "5-Yr Restated" financials on PSYS look superb. What do I mean by that? What I am searching for in my quest to identify stocks worth of investment is quality. For me quality in an investment is defined by a consistent pattern of financial results including steadily increasing revenue, earnings, and positive and growing free cash flow. This should be done without diluting the equity by issuing an abundance of shares and without a perilous balance sheet.

Looking specifically at Psychiatric Solutions, we can see the rapid growth in revenue as represented by the series of increasing purple bars on the graph, from $44.0 million in 2001 to $727.8 million in 2005 and $944.7 million in the trailing twelve months (TTM).

Earnings have grown from $.22/share in 2003 to $.82/share in the TTM. Unfortunately, the company has been a bit liberal with issuing shares growing the shares outstanding from 17 million in 2003 to 53 million in the TTM. In spite of the tripling of shares with the tripling of revenue, the company has still been able to almost quadruple earnings pere share.

Free cash flow has been positive, increasing from $13 million in 2003 to $23 million in 2004, $58 million in 2005 and $80 million in the TTM.

The balance sheet is o.k. with $56.5 million in cash and $195.3 million in other current assets. This total of $251.8 million in current assets, when compared to the current liabilities of $101.6 million yields a current ratio of 2.48. I have generally followed the 'rule' that a current ratio of greater than 1.5 is considered 'healthy'. Clearly, the company does have a significant amount of long-term debt; apparently financing its rapid growth through both the issuance of stock and borrowing, but the presence of a solid and growing free cash flow with a healthy current ratio suggests that this debt will be handled satisfactorily in the immediate future.

5. How about some valuation numbers on this company?

Reviewing the Yahoo "Key Statistics" on PSYS, we find that indeed this stock is a mid-cap stock with a market capitalization of $1.91 billion. There are many definitions for market capitalization, but this one from the Investopedia states:

"Mega Cap: Market cap of $200 billion and greater

Big/Large Cap: $10 billion to $200 billion

Mid Cap: $2 billion to $10 billion

Small Cap: $300 million to $2 billion

Micro Cap: $50 million to $300 million

Nano Cap: Under $50 million"

The trailing p/e is a fairly rich 43.93, but the forward p/e (fye 31-Dec-07) is a more-reasonable 25.34. Thus, the PEG ratio (5 yr expected) is a very reasonable 1.19.

Reviewing the information from the Fidelity.com eresearch website, we can see that PSYS is in the "Specialized Health Services" industrial group. Looking at the Price/Sales ratio, as Paul Sturm explained in Smart Money, relative to other companies in this group, PSYS is reasonably priced with a Price/Sales ratio of 1.9. Leading this group is another favorite of mine, Healthways (HWAY) with a Price/Sales ratio of 4.6. This is followed by United Surgical Partners (USPI) with a ratio of 2.4, then PSYS at 1.9, then DaVita (DVA) at 1.9, VISTACARE (VSTA) at 1, and Caremark Rx (CMX) at 0.7.

Reviewing the Return on Equity (ROE), for a measure of profitability, PSYS also is low on the list with DaVita leading the list at 24.3%, Healthways at 13.6%, Caremark Rx at 12.7%, United Surgical Partners at 9%, Psychiatric Solutions at 7.9% and VISTACARE at the bottom of the list at -6.6%.

Thus from these two meaures, PSYS is average-priced in terms of Price/Sales for a relatively less profitable business. Apparently, in light of the rapid growth in both revenue and earnings, investors have been willing to pay a premium for these shares.

Finishing up with Yahoo, we can see that there are 53.13 million shares outstanding with 5.86 million shares out short. This is a hefty short ratio of 8.1 representing the 5.86 million shares or 11% of the float. It may well be, that in the light of relatively good news today, that the shorts were squeezed, pressuring the stock price higher. But that is of course just my speculation on today's move.

No cash dividend is paid and the last stock split was a 2:1 split earlier this year on January 10, 2006.

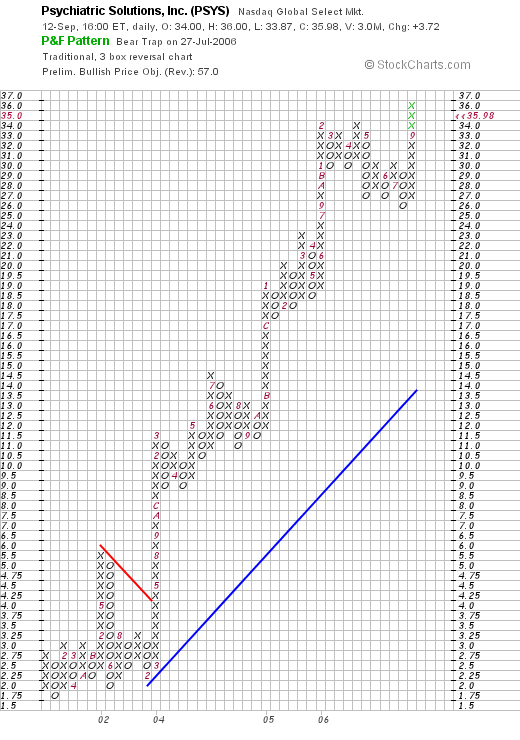

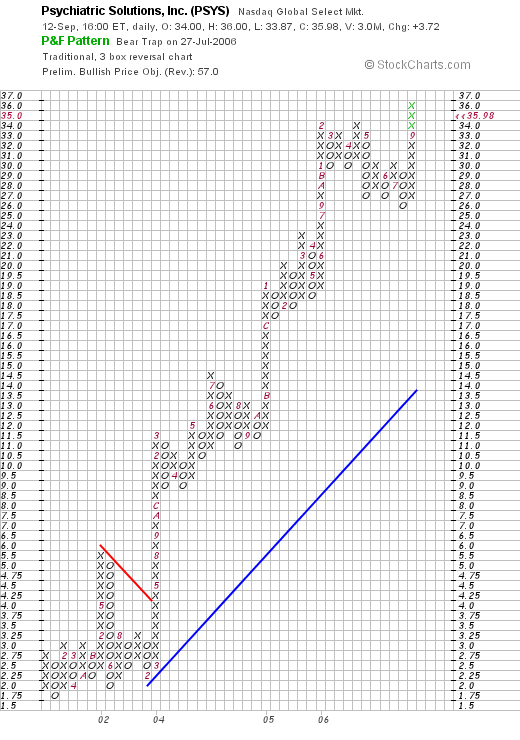

6. What does the chart look like?

Looking at a StockCharts "Point & Figure" chart on PSYS, we see an incredibly strong chart of a company that was consolidating from January, 2001, through February, 2004, when the stock broke through resistance at $4.00 and start an ascent into the $36 range where it is now trading. The stock was pulling back a bit since February of this year, but after its big move today is once again heading into new highs territory.

7. Summary: What do I think about this stock?

To summarize, the stock had a large move higher today on the back of good news about its inclusion in the S&P 400 MidCap index. On top of this, there are a large number of short-sellers who may well have been taken unawares and 'squeezed' with this price rise adding to the buying pressure. In any case, the last quarter's report was solid, the Morningstar.com report is good except for a bit of long-term debt and the habit of this company to issue new shares to fund its activities. Value-wise the company's p/e is rich in the 60's, the PEG however is reasonable under 1.2, suggesting that the prospects may well justify the premium. Both Price/Sales ratios and ROE are unimpressive, again suggesting fairly rich valuation. Finally the chart is strong and may in fact be a bit over-extended. However, with all of the other criteria met, this is the kind of stock I might be adding to my portfolio, if I had a signal to be buying in the market at all!

Thanks again for stopping by and spending some time here on the blog. If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com and be sure to listen to my Stock Picks Podcast.

Bob

Posted by bobsadviceforstocks at 3:10 PM CDT

|

Post Comment |

Permalink

Updated: Tuesday, 12 September 2006 4:00 PM CDT

Saturday, 9 September 2006

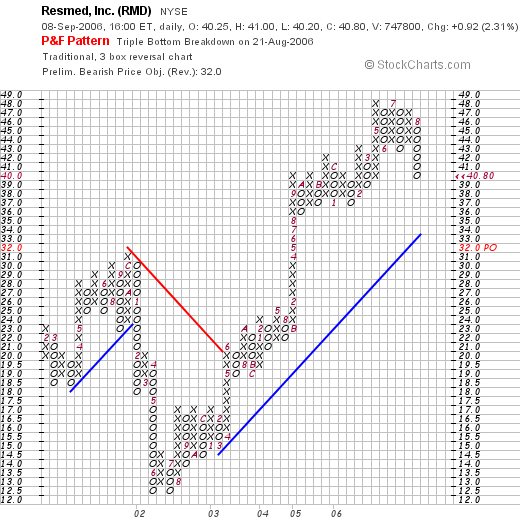

"Weekend Trading Portfolio Analysis" ResMed (RMD)

CLICK HERE FOR MY PODCAST ON RESMED!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of the things I like to do on this blog is to share with you both ideas about investments that I am reviewing (my "stock picks") as well as let you know about the actual transactions I make (my "trading transparency"). A year or so ago, I thought I would add a regular review of stocks that I actually own...what I call my "Trading Portfolio". With only 11 positions, out of my maximum of 25 positions possible, I have been reviewing positions, going alphabetically, about every other week. Two weeks ago I reviewed Quality Systems (QSII). My next holding is ResMed (RMD).

I currently own 150 shares of ResMed in my Trading Portfolio. RMD closed at $40.80 on September 8, 2006. These shares were purchased on 2/4/05, with a cost basis of $29.87. Thus I have an unrealized gain of $10.93 or 36.6% on these shares.

I currently own 150 shares of ResMed in my Trading Portfolio. RMD closed at $40.80 on September 8, 2006. These shares were purchased on 2/4/05, with a cost basis of $29.87. Thus I have an unrealized gain of $10.93 or 36.6% on these shares.

I have sold shares of ResMed twice since the original purchase. One portion at a 30% appreciation, and another at a 60% appreciation level. Thus, on the upside, I shall be selling approximately 1/6th of my position if the stock should reach a 90% appreciation at a price of 1.90 x $29.87 = $56.75. On the downside, the sale of all of my remaining shares would be at 50% of the highest sale point (my personal strategy) or at a 30% gain level (since the highest sale was at a 60% sale). Or all shares would be sold at 1.30 x $29.87 = $38.83. With ResMed pulling back from the latest sale, I am closer to a sale at the 30% level than a sale at a 90% appreciation target.

Let's take another look at this firm and see if it still deserves a spot on this website.

1. What does this company actually do?

According to the Yahoo "Profile" on ResMed (RMD), the company

"... through its subsidiaries, engages in the design, manufacture, and marketing of equipment for the diagnosis and treatment of sleep-disordered breathing and other respiratory disorders, including obstructive sleep apnea. Its products include airflow generators; diagnostic products; mask systems; headgear; and other accessories, including humidifiers, cold passover humidifiers, carry bags, breathing circuits, Twister remote, the Aero-Click connection system, and the AeroFix headgear."

2. How did the company do in the latest quarter?

On August 17, 2006, ResMed reported their 4th quarter 2006 results. For the quarter ended June 30, 2006, revenue grew 36% to $171.2 million, up from $125.4 million the prior year same period. Diluted eps came in at $.30, up from $.22/share last year. Net income was $23.1 million, up sharply from $15.6 million in the same period the prior year.

3. How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials, we see a genuinely beautiful picture of steadily increasing revenue as represented by the increasing purple bars on the bar graph. Revenue has increased from $155.2 million in 2001 to $425.5 million in 2005 and $561.2 million in the trailing twelve months (TTM).

Reviewing the Morningstar.com "5-Yr Restated" financials, we see a genuinely beautiful picture of steadily increasing revenue as represented by the increasing purple bars on the bar graph. Revenue has increased from $155.2 million in 2001 to $425.5 million in 2005 and $561.2 million in the trailing twelve months (TTM).

On a per-share basis, the company has reported earnings/share of $.18 in 2001, growing steadily and strongly to $.91/share in 2005 and $1.09/share in the TTM.

The company has not paid dividends and has increased the number of shares outstanding slightly from 63 million in 2001 to 69 million in 2005. 75 million shares were outstanding in the TTM. Thus, the float has grown about 16% from 2001 to currently, while revenue has almost gone up 400% and earnings are up more than 400% as well.

Free cash flow has been positive except for the latest twelve months. $34 million in free cash flow in 2003, $19 million in 2004, $31 million in 2005, and $(8) million in the TTM. The negative free cash flow reflects the large increase in capital spending in the latest twelve months.

ResMed's balance sheet looks solid as presented on Morningstar.com with $168.2 million in cash and $264.5 million in other current assets. Thus, the total current assets of $432.7 million when compared to the $110.5 million in current liabilities yields a current ratio of 3.92. (I generally conclude that ratios over 1.5 represent a healthy balance sheet from this particular perspective). The current assets can easily pay off the current assets and the $114.3 million in long-term liabilities combined....again supporting the healthy balance sheet of this company.

4. What about some valuation numbers on this stock?

Reviewing the data from Yahoo "Key Statistics" on RMD we find that this stock is a large mid-cap stock with a market capitalization of $3.08 billion. The trailing p/e is a fully-valued 35.02, with a foward p/e (fye 30-Jun-08) of 20.82. The (5-yr expected) PEG is a more reasonable 1.24.

Referring to the Fidelity.com eresearch website, we find that this stock is in the "Medical Appliances/Equipment" industrial group. Within this group, ResMed is the most 'expensive' relative to the Price/Sales ratio with a ratio of 5.6. Following RMD is Zimmer Holdings (ZMH) at 5, Medtronic (MDT) at 4.7, St. Jude (STJ) at 4.5, Biomet (BMET) at 4, and Edward Lifesciences (EW) at 3.

Examining the company for profitability, in terms of the Return on Equity (ROE), ResMed is actually one of the least profitable in its group with a ROE of 14.8%. Topping this group is Medtronic at 26.8%, followed by Biomet at 25%, Edwards Lifesciences at 16.6%, Zimmeer Holdings at 16.3%, St. Jude at 15.8% and then ResMed at the bottom of this group.

Yahoo reports that there are 75.41 million shares outstanding with 73.03 million shares that float. Currently 2.93 million shares are out short representing 4.10% of the float or 5.9 trading days of average volume. Using my own 3 day rule for the short ratio, this stock does appear to have a significant number of shares that have been already sold by short-sellers speculating that the stock will decline. In the event of good news we may see a bit of a squeeze of these short-sellers.

No dividend is paid and the last stock split was a 2:1 stock split on October 3, 2005.

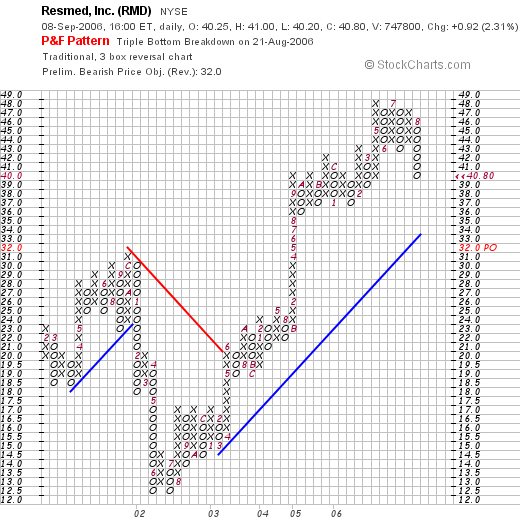

5. What does the chart look like?

Reviewing the "Point & Figure" chart on RMD from StockCharts.com, we can see that although the stock has pulled back recently from its highs near $48, the stock is still well above its support level which would be down in the mid $30's. The stock did retreat from $30 in October, 2001, to a low of $13 in June, 2002, but since that time, the stock appears to be moving strongly higher.

6. Summary: What do I think about this stock? Reviewing some of the things discussed earlier, the company is trading currently a little below its recent highs. The latest quarterly report was quite strong, with both steady revenue and earnings growth. The Morningstar numbers look nice with steady revenue and earnings growth over the past five years with just a slight increase in the stock shares outstanding. Free cash flow was negative in the TTM, but otherwise has been positive. The balance sheet is solid. Valuation is a bit rich, but with the rapid growth in revenue and earnings, the PEG works out to a bit over 1.2. Price/Sales is rather rich, and the profitability (ROE) is less than stellar. Supporting the stock price, ironically, may be the relative large number of short-sellers placing bets on the stock. On a Peter Lynch perspective, the market for CPAP machines may continue to grow as the number of overweight individuals grows worldwide and our understanding of sleep apnea improves. I shall be staying with the stock and shall be selling based on the price performance of the shares.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com and also please be sure to stop by and visit my Stock Picks Podcast Site.

Bob

Posted by bobsadviceforstocks at 6:41 PM CDT

|

Post Comment |

Permalink

Updated: Saturday, 9 September 2006 11:31 PM CDT

"Looking Back One Year" A review of stock picks from the week of May 9, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

Once again it is the weekend! And one of the tasks I like to perform around this website is to check back on prior stock picks and see how they turned out! Last Week I reviewed the week of May 2, 2005. This afternoon, I would like to take a look at those stocks selected for inclusion from the week of May 9, 2005.

Please note that this review assumes a buy and hold strategy of investing. My analysis assumes an equal dollar purchase of each of the stocks selected that week. Currently I employ an active portfolio management system that sells declining stocks quickly at small losses and sells portions of appreciating stocks at targeted appreciation points. This difference in strategy would certainly affect a portfolio performance in practice. Also please recall that past performance is never a guarantee of future performance whether you are looking at a mutual fund or an individual equity or any investment actually!

On May 9, 2005, I posted Part Technology (PTC) on Stock Picks Bob's Advice when the stock was trading at $22.17. PTC had a 3:2 stock split on January 9, 2006 making my effective stock pick price $14.78. PTC closed at $8.88 on September 8, 2006, for a loss of $(5.90) or (40)% since the stock pick.

On May 9, 2005, I posted Part Technology (PTC) on Stock Picks Bob's Advice when the stock was trading at $22.17. PTC had a 3:2 stock split on January 9, 2006 making my effective stock pick price $14.78. PTC closed at $8.88 on September 8, 2006, for a loss of $(5.90) or (40)% since the stock pick.

On July 26, 2006, PAR announced 2nd quarter 2006 results. Revenues came in at $53.3 million, a 4% increase over the $51.2 million reported in the same period the prior year. Net income, however, dipped to $2.34 million this quarter from $2.35 million in the prior year. On a per share basis, this was flat at $.16/share, unchanged from $.16/share last year.

On July 26, 2006, PAR announced 2nd quarter 2006 results. Revenues came in at $53.3 million, a 4% increase over the $51.2 million reported in the same period the prior year. Net income, however, dipped to $2.34 million this quarter from $2.35 million in the prior year. On a per share basis, this was flat at $.16/share, unchanged from $.16/share last year.

On May 11, 2005, I posted Varian Medical Systems on Stock Picks Bob's Advice when the stock was trading at $35.10. Varian closed at $52.63 on September 8, 2006, for a gain of $17.53 or 50%.

On May 11, 2005, I posted Varian Medical Systems on Stock Picks Bob's Advice when the stock was trading at $35.10. Varian closed at $52.63 on September 8, 2006, for a gain of $17.53 or 50%.

On July 26, 2006, Varian reported 3rd quarter 2006 results. Revenues grew 14% to $396 million from $347 million in the same period last year. Net earnings climbed to $65.7 million, up from $51.1 million last year. On a diluted share basis this worked out to $.49/share this year vs. $.37/share in the same period last year.

Finally, on May 12, 2005, I posted Pall Corporation (PLL) on Stock Picks Bob's Advice when the stock was trading at $28.58. Pall closed at $27.20 on September 8, 2006, for a loss of $(1.38) or (4.8)% since posting.

Finally, on May 12, 2005, I posted Pall Corporation (PLL) on Stock Picks Bob's Advice when the stock was trading at $28.58. Pall closed at $27.20 on September 8, 2006, for a loss of $(1.38) or (4.8)% since posting.

On June 1, 2006, Pall announced 3rd quarter 2006 results. While revenue came in at $510 million, up from $493.5 million, this was actually shy of expected revenue of $515 million. Earnings, however, came in at $.20/share, down from $.35/share last year in the same period. This was also far short of analysts expectations of $.38/share.

So how did I do with these three stock picks from that week in May, 2005? In a word, mediocre. I had one terrific stock pick, Varian, one awful pick, Part Technology, and a mediocre pick in Pall. The average performance for the three stocks worked out to a gain of 1.7%. Nothing really to write home about I guess.

Thanks again for visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Also, please remember to stop by and visit my Stock Picks Podcast Site where I occasionally make time to talk about and not merely write about these stocks!

Bob

Tuesday, 5 September 2006

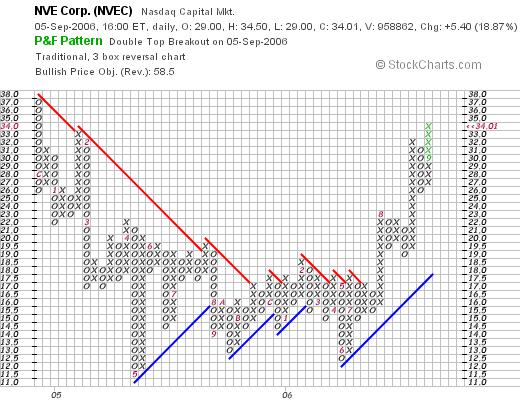

"Revisiting a Stock Pick" NVE Corporation (NVEC)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I didn't manage to make any stock 'picks' last week and am anxious to find some stocks that are provocative enough to find a place on this website. Looking through the list of top % gainers on the NASDAQ this afternoon, I came across an old favorite of mine, NVE Corporation (NVEC) which had a nice day in the market.

I first posted NVEC on Stock Picks Bob's Advice on June 23, 2004, when the stock was trading at $36.61. NVEC closed today at $34.01, up $5.40 or 18.87% on the day. The stock is actually lower than it was when I first posted it by $(2.60) or (7.1)%. After the initial posting of this stock, the price of the stock actually took a nosedive (!) and is only now reaching the previous price levels.

I first posted NVEC on Stock Picks Bob's Advice on June 23, 2004, when the stock was trading at $36.61. NVEC closed today at $34.01, up $5.40 or 18.87% on the day. The stock is actually lower than it was when I first posted it by $(2.60) or (7.1)%. After the initial posting of this stock, the price of the stock actually took a nosedive (!) and is only now reaching the previous price levels.

Let's take a closer look at this company and I will explain why I still like this stock after it failed to cooperate at my first post over two years ago:

1. What exactly does this company do?

According to the Yahoo "Profile" on NVEC, the company

"... engages in the development and sale of devices using spintronics, a nanotechnology, which utilizes electron spin rather than electron charge to acquire, store, and transmit information. Its products include magnetic sensors to acquire precise data, such as the position of a robot arm, and couplers to transmit data between electronic systems at a high speed. The company provides standard sensors that detect the presence of a magnet or metal to determine position or speed; custom sensors primarily for medical devices; and couplers that use semiconductor input stages, primarily for factory and industrial networks."

Please don't ask me to explain the above hi-tech explanation :). I am not really a Peter Lynch investor! I pick stocks not on the basis of what I know about their product but what I know and can glean about their corporate performance.

2. How did they do in the latest quarter?

On July 19, 2006, NVE Corporation reported 1st quarter 2007 results. Product sales climbed 71% to $3.05 million from the prior year first quarter results of revenue of $1.78 million. Total sales increased 20% to $3.64 million from $3.03 million. Net income was up over 100% at $891,806 or $.19/share up from net income of $412,649 or $.09/diluted share the prior year same period.

3. How about longer-term results?

If we review the Morningstar.com "5-Yr Restated" financials on NVEC, we can see that revenue has grown nicely from $7 million in 2002 to $12.2 million in 2006 and $12.8 million in the trailing twelve months (TTM).

Except for a dip in earnings between 2004 and 2005, earnings per share have grown steadily from a loss of $(.62)/share in 2002 to $.39/share in 2006 and $.49/share in the trailing twelve months (TTM). This is a small company with 4 million shares outstanding in 2004 increasing to 5 million in the TTM.

Free cash flow which was $-0- in 2004, increased to $3 million in 2006. The balance sheet appears solid on Morningstar, with $2.5 milliion in cash, enough to pay off the $700,000 in current liabilities. No long-term liabilities are even reported on the Morningstar report.

Calculating the 'current ratio', adding the $2.5 million in cash to the $5.9 million in other current assets gives us total current assets of $8.4 million, which when compared to the current liabilities of $.7 million yields a current ratio of 12. Generally ratios of 1.5 or higher are considered financially 'healthy'.

4. What about some 'valuation' numbers?

Reviewing the Yahoo "Key Statistics" on NVE Corporation, we can see that this is a really small small-cap stock with a market capitalization of only $156.99 million. (At $100 million in market cap or less, I like to refer to these tiny companis as 'micro'-cap stocks).

The trailing p/e is rich at 69.69. There is no forward p/e and no PEG to assess valuation. I suspect this company is below the radar of most analysts.

Review the Fidelity.com eresearch website for more valuation comparisons on NVEC, we find that this company is in the "Semiconductor-Specialized" industrial group. Within this group, NVEC is the richest in valuation relative to the Price/Sales ratio with a ratio of 10.5. This is followed by Linear Technology (LLTC) at 10.1, Altera (ALTR) at 6.6, Xilinx (XLNX) at 4.4, Nvidia (NVDA) at 4.4, and ATI Technologies (ATYT) at 2.4.

NVEC is in the middle of the group in terms of profitability when measured by the Return on Equity (ROE). Topping the group is Nvidia at 23.1%, Altera at 20.9%, Linear Technology at 20.2%, then NVE Corp at 14.2%, Xilinx at 13.2% and ATI Technologies at the bottom of the pack at a negative (3.3)%.

Returning to Yahoo for a few additional valuation numbers, we find that there are 4.62 million shares outstanding and 4.25 million that float. Of these shares, 1.02 million shares or 22.70% of the float were out short as of 8/10/06. The sharp upward rise in the stock price today might well represent a short squeeze in which the large number of short sellers might be in a buying panic as the stock rises and paradoxically increases their losses. No dividend is paid and the last stock split was actually a reverse stock split of 1:5 on 11/22/02.

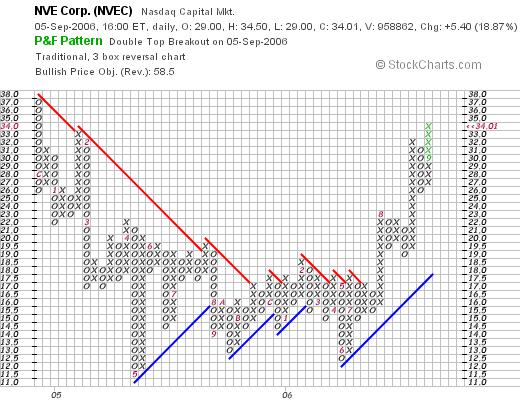

5. What does the chart look like?

Reviewing the "Point & Figure" chart from StockCharts.com on NVEC, we can see that the stock has mad a "u-shaped" chart with the stock declining from $37 level in late 2004 and bottoming at around $11.50 in May, 2005. The stock recently came out of this trough after breaking through resistance at $17 in July, 2006, and appears to be moving strongly higher now.

6. Summary: So what do I think about this stock?

In summary, this stock had a strong recent quarter. I cannot completely explain today's move except that a move higher may well have resulted in a panic among the short-sellers trying to cover their positions. The Morningstar.com financials look nice. Valuation, however, is a bit rich with a p/e in the 60's and a Price/Sales ratio at the top of its group. Technically, the stock looks strong with the stock price moving higher into near new-high territory. I don't have any shares of this stock, but if I were in a position to be buying stock, this is the kind of stock I would be adding to my portfolio.

Thanks so much for stopping by and visiting my blog! If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com and be sure to listen to my Stock Picks Podcast!

Bob

Monday, 4 September 2006

"Looking Back One Year" A review of stock picks from the week of May 2, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website!

Please excuse my absence from blogging this past week. Certainly if I have any trades in my trading portfolio, I shall post them. In addition, I plan on continuing to peruse the lists of stocks on the move, and shall continue to post new ideas.

One of my weekend 'tasks' is to examine past stock picks and see how they turned out. For the sake of this review, I employ an assumed "buy and hold" strategy. In practice, I sell my declining stocks quickly and completely and sell my gaining stocks slowly and partially.

On May 2, 2005, I posted Moldflow (MFLO) on Stock Picks when the stock was trading at $13.93. On September 1, 2006, MFLO closed at $12.33 for a loss of $(1.60) or (11.5)%.

On May 2, 2005, I posted Moldflow (MFLO) on Stock Picks when the stock was trading at $13.93. On September 1, 2006, MFLO closed at $12.33 for a loss of $(1.60) or (11.5)%.

On August 10, 2006, Moldflow reported 4th quarter 2006 results. Revenue came in at $17.1 million, down (6)% from the same period last year when the company reported $18.3 million in revenue. Net income for the quarter came in at a loss of $(.04)/share, down from a profit of $.12/share the prior year.

On August 10, 2006, Moldflow reported 4th quarter 2006 results. Revenue came in at $17.1 million, down (6)% from the same period last year when the company reported $18.3 million in revenue. Net income for the quarter came in at a loss of $(.04)/share, down from a profit of $.12/share the prior year.

On May 3, 2005, I posted Amedisys (AMED) on Stock Picks Bob's Advice when the stock was trading at $33.84. AMED closed at $40.18 on September 1, 2006, for a gain of $6.34 or 18.7% since posting.

On May 3, 2005, I posted Amedisys (AMED) on Stock Picks Bob's Advice when the stock was trading at $33.84. AMED closed at $40.18 on September 1, 2006, for a gain of $6.34 or 18.7% since posting.

On August 1, 2006, Amedisys reported 2nd quarter 2006 results. For the quarter ended June 30, 2006, the company reported service revenue of $132.9 million. This was a 66% incrfease over $80.1 million reported in the comparable period the prior year. Net income came in at $9.1 million or $.55/share, up 10% from the $7.9 million or $.50/share the prior year.

On August 1, 2006, Amedisys reported 2nd quarter 2006 results. For the quarter ended June 30, 2006, the company reported service revenue of $132.9 million. This was a 66% incrfease over $80.1 million reported in the comparable period the prior year. Net income came in at $9.1 million or $.55/share, up 10% from the $7.9 million or $.50/share the prior year.

On May 6, 2005, I posted Multi-Color Corporation (LABL) on Stock Picks Bob's Advice when it was trading at $23.60. LABL closed at $29.89 on September 1, 2006, for a gain of $6.29 or 26.7% since posting.

On May 6, 2005, I posted Multi-Color Corporation (LABL) on Stock Picks Bob's Advice when it was trading at $23.60. LABL closed at $29.89 on September 1, 2006, for a gain of $6.29 or 26.7% since posting.

LABL announced first quarter 2007 results on July 21, 2006. Net sales increase 11% to $51.7 million from $46.7 million in the same quarter last year. Net income grew 30% to $2.5 million from $1.9 million. On a per share basis, earnings grew 28% to $.37/diluted share, up from $.29/diluted share last year.

LABL announced first quarter 2007 results on July 21, 2006. Net sales increase 11% to $51.7 million from $46.7 million in the same quarter last year. Net income grew 30% to $2.5 million from $1.9 million. On a per share basis, earnings grew 28% to $.37/diluted share, up from $.29/diluted share last year.

On May 5, 2005, I posted Education Management Corporation on Stock Picks Bob's Advice when it was trading at $27.97. Education Management (EDMC) was acquired by Providence Equity Partners and Goldman Sachs Capital Partners for $43.00/share in cash. This acquisition was completed in Summer, 2006, and the shares no longer trade. However, this acquisition represented a gain of $15.03 or 53.7% since posting on the blog.

On May 5, 2005, I posted Education Management Corporation on Stock Picks Bob's Advice when it was trading at $27.97. Education Management (EDMC) was acquired by Providence Equity Partners and Goldman Sachs Capital Partners for $43.00/share in cash. This acquisition was completed in Summer, 2006, and the shares no longer trade. However, this acquisition represented a gain of $15.03 or 53.7% since posting on the blog.

So how did I do picking stocks that week in May, 2005? Pretty good imho :). There were four stock selections made and one declined and the three others advanced for an average gain of 21.9% on these stocks.

Please remember that past performance is not a guarantee of future performance.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to drop me a line at bobsadviceforstocks@lycos.com. Also, remember to visit my Stock Picks Podcast site!

Bob

Posted by bobsadviceforstocks at 1:28 PM CDT

|

Post Comment |

Permalink

Updated: Monday, 4 September 2006 1:30 PM CDT

Sunday, 27 August 2006

Rothstein Recognizes "Stock Picks"!

I had a nice email from Juliana Kim from Rothstein Asset Management, LP, who noted that Jack Rothstein has nominated Stock Picks Bob's Advice for recognition as one of the best Stock Market Blogs. This note is certainly very much appreciated!

If you haven't visited Jack's blog at Wealthcast.com, consider stopping by to read what Jack has to say. He is bright, a true professional (unlike my amateur status!), and writes a very comprehensive and insightful column. I have been linking to him for quite awhile and Jack has been kind enough to link to me as well!

Full Disclosure: Kim says that if Stock Picks is recognized by Rothstein as an outstanding stock blog, I might be eligible to receive an iPod. With three kids of my own, an iPod will be a big hit around this household.

If you have a blog that you would like me to review or link to, please feel free to drop me a line at bobsadviceforstocks@lycos.com and I will give it a look!

Bob

Saturday, 26 August 2006

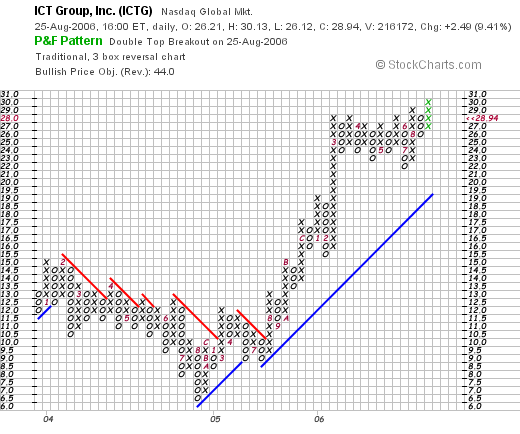

ICT Group (ICTG)

CLICK HERE FOR MY PODCAST ON ICT GROUP!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

As I have done previously, I should like to once again apologize for my two week absence. It is a bit strange apologizing to anonymous people who read my blog, but I still feel a connection with all of you who have become regular readers here...who are sharing with me my own exploration of stocks and working to develop a coherent strategy in selecting and owning equities. But before I was philosophic, let me share with you a stock that deserves a place in this blog.

As I like to do on most trading days, I reviewed the list of top % gainers on the NASDAQ from yesterday. I generally stay away from stocks much under $10....leaving just a few to examine with some of my screening techniques.

As I like to do on most trading days, I reviewed the list of top % gainers on the NASDAQ from yesterday. I generally stay away from stocks much under $10....leaving just a few to examine with some of my screening techniques.

ICT Group (ICTG) had a nice day yesterday, closing at $28.94, up $2.49 or 9.41% on the day. I do not own any shares nor do I have any options on this stock. Let's take a closer look at this company and I shall try to show you why I find it worthy of a review.

1. What exactly does the company do?

According to the Yahoo "Profile" on ICTG, the company

"... and its subsidiaries provide outsourced customer management and business process outsourcing solutions. The company offers a mix of sales, service, marketing, and technology solutions, which include customer care/retention, technical support and customer acquisition, and cross-selling/upselling, as well as market research, database marketing, data capture/collection, email management, collections, and other back-office business processing services."

2. What about the latest quarterly report?

On July 27, 2006, ICT group reported 2nd quarter earnings results. For the quarter ended June 30, 2006, revenue increased 15% to $111.3 million from $97 million in the same quarter last year. In addition, net income came in at $3.9 million or $.25/share, up from $1.7 million or $.14/diluted share in the year ago period. According to the same news story, the company beat expectations by $.04/share. In addition, the company raised guidance to $1.08 to $1.13 for the full year on sales of $445 to $451 million. In April, 2006, guidance was $1.03 to $1.09/share on revenue of $440 to $448 million. While not a huge guidance higher, the fact the company beat expectations and also raised guidance for the full year is very significant imho.

3. How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on ICTG, we can see a fairly steady growth in revenue (except for a small dip between 2001 and 2003) from $239.3 million in 2001 to $401.3 million in 2005 and $434.7 million in the trailing twelve months. Earnings, however, have been more erratic, dropping from $.63/share in 2001 to a loss of $.21/share in 2004. Since 2004, earnings have come in at $.94/share in 5006 and $1.18 in the trailing twelve months. The number of shares outstanding has increased modestly from 12 million in 2001 to 13 million in 2005 and 15 million in the trailing twelve months (TTM).

Free cash flow which was negative at $(4) million in 2003 and $(12) million in 2004, turned positive at $5 million in 2005 and grew to $6 million in the TTM.

The current assets total $125.6 million, which could easily pay off all of the current liabilities listed as $40.1 million and the $4.1 million of long-term liabilities combined. Calculating the 'current ratio' yields a value of 3.13 suggesting a picture of financial health. This is especially true in light of the nominal long-term liabilities listed as $4.1 million on Morningstar.com.

4. What about some valuation numbers?

Using Yahoo "Key Statistics" on ICT Group, we observe that the company is a small cap stock with a market capitalization of only $445.50 million. The trailing p/e is a moderate 24.74 and the forward p/e (fye 31-Dec-07) works out to 20.82. The PEG is also reasonable (imho) at 1.20.

As noted by the Fidelity.com eresearch website, this company is in the "Business Services" industrial group. Within this group, this stock is the most reasonably priced in regards to the Price/Sales ratio with a ratio of 1. This group is led by Getty Images (GYI) with a Price/Sales ratio of 3.6. Getty is followed by Global Payments (GPN) with a ratio of 3.3, Choicepoint (CPS) at 3, Fidelity National Information Services (FIS) at 2.8, Cintas (CTAS) at 1.8 and finally ICT Group with a ratio of 1.

Profitability, as measured by the "Return on Equity" (ROE), shows that while ICTG is relatively cheap when measured by Price/Sales; the company is actually quite profitable with an ROE of 16.6%. This is only exceeded by Global Payments at 18.1%, and followed by Cintas with a result of 15.3%, Choicepoint at 12.9%, Getty at 11.6% and Fidelity National Information Services with a result of 9.6%.

Returning to Yahoo for a few more statistics, we see that there are only 15.39 million shares outstanding and only 6.39 million of them float. Currently there are 364.06 thousand shares out short representing 4% of the float and a short ratio of only 3.6. The short-sellers do not appear to be very significant in this stock.

No cash dividends and no stock dividends are reported on Yahoo.

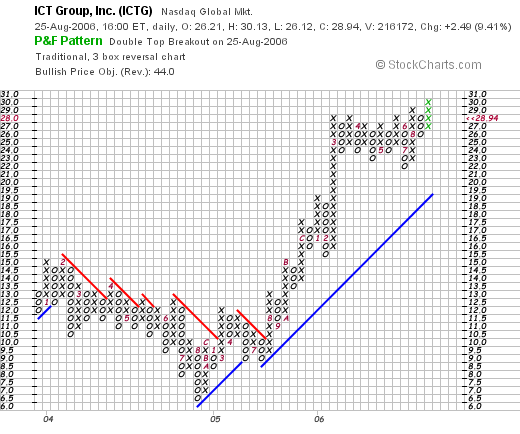

5. What does the chart look like?

If we review the "Point & Figure" chart on ICTG from StockCharts.com, we can see the decline in the stock price from $14 in February, 2004, to a low of $6.50 in August, 2004. The stock subsequently has been trading higher to the $28 level in March, 2006. Consolidating at this level, it now appears to be moving higher to new price levels.

6. Summary: What do I think about this stock?

In summary, I like this stock due to the strong price move Friday (yesterday) in an otherwise anemic trading environment. The last quarter's results were strong with both increasing revenue and earnings and the company did beat expectations as well as raise guidance!

The Morningstar.com report shows a company turning itself around, from losses to increasing profits while growing its revenues at the same time. The number of shares outstanding is fairly stable, and the free cash flow picture also shows the negative free cash flow becoming positive and increasing in size. Balance-sheet-wise, the company has lots of current assets, almost no long-term liabilities and a current ratio of over 3. Valuation-wise, the p/e is barely over 20, the PEG is at 1.2, and while the Price/Sales ratio is one of the lowest in its industrial group, the profitability of the company, as measured by ROE is one of the highest in the same group....a nice combination of results.

Finally, the chart looks strong, and the company appears to be moving into new high territory.

So there are lots of things I like about this company. I am not exactly sure of their business :), but it appears that they are doing quite well.

Thanks again for stopping by and visiting! If you have any comments or questions, please be sure to email me at bobsadviceforstocks@lycos.com. If you get a chance, please also feel free and know you are invited to listen to my Stock Picks Podcast, where I discuss many of the same stocks and investment strategy as I like to discuss on this blog!

Bob

Posted by bobsadviceforstocks at 8:06 PM CDT

|

Post Comment |

Permalink

Updated: Sunday, 27 August 2006 4:50 PM CDT

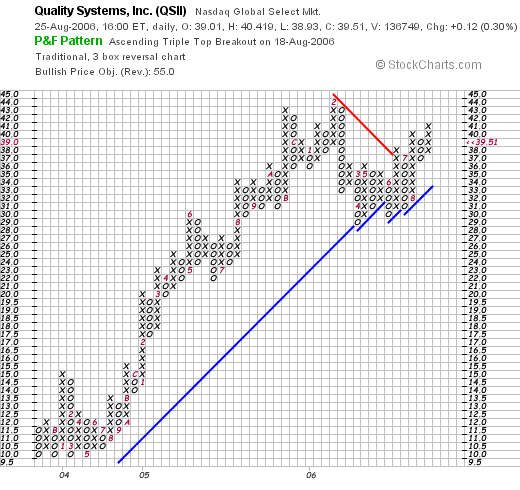

Quality Systems (QSII) "Weekend Trading Portfolio Analysis"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

It has been a few weeks since my last portfolio review. On August 5, 2006, I reviewed my Morningstar holding on this blog. With the many sales I have had in my trading portfolio, I am now down to 11 positions, and going alphabetically through my portfolio, I am up to Quality Systems (QSII) which happens to be my most successful investment in my account.

I currently own 88 shares of Quality Systems (QSII) which closed at $39.51 on August 25, 2006. These shares were purchased with a cost basis of $7.75/share, acquired on 7/28/03. Thus, I have an unrealized gain of $31.76/share or 409.8% since purchase. As has been my practice, I have been selling portions of QSII as the stock has been appreciating. I have sold portions on 8/19/03, 8/22/03, 1/21/04, 2/1/05, 3/4/05, 4/21/05, 8/16/05, 10/3/05 and 11/22/05. These nine sales represent sales at 30%, 60%, 90%, 120%, 180%, 240%, 300%, 360%, and 450% appreciation levels. Thus, on the upside, my next targeted gain is at a 540% level which works out to 6.40 x $7.75 = $49.60. On the downside, my strategy dictates a sale at 50% of the highest appreciation point or at a 225% gain level = 3.25 x 7.75 = $25.19. Unfortunately, many of my earlier sales were 25% of my remaining position causing my position to diminish in size. I am now at a 1/6th of the remaining position at each targeted gain, and hopefully this position will continue to grow in size as the stock appreciates.

Let's take a closer look at this stock and see if it still deserves to be on this blog:

1. What does this company do?

According to the Yahoo "Profile" on QSII, this company

"... and its subsidiary NextGen Healthcare Information Systems, Inc. engage in the development and marketing of healthcare information systems that automate medical and dental practices, physician hospital organizations and management service organizations, ambulatory care centers, community health centers, and medical and dental schools."

2. How did they do in the latest quarter?

On August 3, 2006, Quality Systems reported results for first quarter 2007. Net revenues came in at $36.1 million, up 32% from $27.4 million in the same quarter the prior year. Net income worked out to $7.7 million, up 51% over the net income of $5.1 million in the prior year same period. Fully diluted earnings were $.28/share, up 47% from the $.19/share reported last year. This exceeded analysts' expectations of $.24/share.

3. What about longer-term financial results?

Reviewing the Morningstar.com "5-Yr Restated" financials on QSII, we can see the beautiful picture of steady revenue growth with revenue of $44.4 million in 2002, growing to $119.3 million in 2006 and $127.9 million in the trailing twelve months (TTM).

Earnings have also steadily grown from $.21/share in 2002 to $.85/share in 2006 and $.94/share in the trailing twelve months. The company stqarted paying dividends in 2005 with $.75/share paid. This was increased to $.88/share in 2006. The company has slightly increased its outstanding shares from 24 million in 2002 to 27 million in the TTM. This 10% increase in shares during a period in which the company almost tripled its revenue and quadrupled its earnings is quite tolerable :).

The picture of free cash flow has also been very nice with $16 million in 2004 increasing to $28 million in 2006 and $32 million in the TTM.

The balance sheet is solid with $67 million in cash, more than enough by itself to pay off both the $50.2 million in current liabilities and the $3.5 million in long-term liabilities combined. Calculating the 'current ratio' we can see that QSII has a combined $112.5 million in total current assets, which, when compared to the $50.2 million in current liabilities yields a current ratio of 2.24. (Anything over 1.5 is generally considered 'healthy').

4. What about some 'valuation numbers' on this stock?

Taking a look at the Yahoo "Key Statistics" on QSII we see that this is a mid-cap stock with a market capitalization of $1.06 billion. The trailing p/e is a bit rich at 41.81, but the forward p/e (fye 31-Mar-08) is a bit nicer at 27.06. But then again, this is going out to 2008! However, analysts appear to be expecting continued rapid growth in earnings as the PEG on this stock is a very nice 0.98.

According to the Fidelity.com eresearch website, QSII is in the "Healthcare Information Services" industrial group. Within this group, Quality Systems is the 'priciest' of the group with a Price/Sales ratio of 8.4. Following QSII is Merge Technologies (MRGE) at 3.4, Cerner (CERN) at 2.9, Emdeon (HLTH) at 2.5, Eclipsys (ECLP at 2 and Trizetto Group (TZIX) at 1.8.

Fortunately, QSII is also the most profitable of the group with a Return on Equity (ROE) of 32.9%. Following Quality Systems is Trizetto at 23.1%, Cerner at 12.7%, Emdeon at 7.2%, Eclipsys at 2.1% and Merge at 0.3%.

Returning to Yahoo, we find that there are 26.74 million shares outstanding with 16.85 million that float. Of these, there were 3.49 million shares out short as of 7/11/06, representing 20.7% of the float or 11.7 trading days of volume (the short ratio). Using my own 3 day rule on short interest, I find that this large level of short interest may well support this stock in the event of any good news with a 'squeeze' of the shorts possible.

The company has a trailing dividend of $.88/share yielding 2.20%. The last stock split was a 2:1 stock split on 3/27/06.

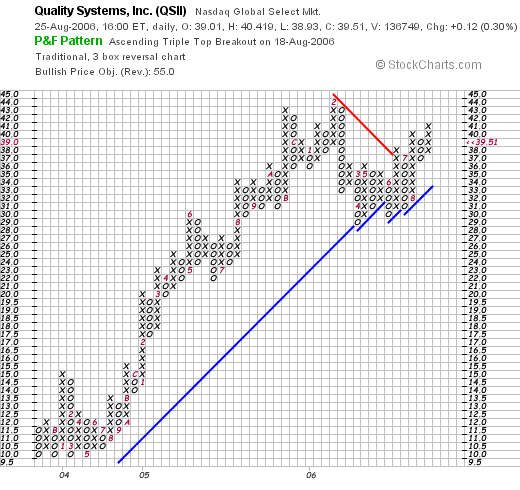

5. What does the chart look like?

If we examine the "Point & Figure" chart on QSII from StockCharts.com, we can see that the stock moved strongly higher from $10/share in late 2003, (about the time I purchased shares) to a high of $44/share in February, 2006. The stock pulled back to the $30 level in April, 2006, and has been finding support at this level before breaking through resistance and moving near the old highs. The stock looks strong to me!

6. Summary: what do I think about this stock?

First of all, I own this stock have watched the stock price quadruple over the last three years. So certainly I am biased! And there is of course no guarantee that the stock price will continue to rise! THAT is why I have and shall continue to take small portions of my investment off the table as this and any of my stocks appreciate!

However, the last quarter's earnings report is solid. The company is in the EMR (electronic medical record) field, and is at the cutting edge of the transition from paper records in the medical field to electronic records. Thus the "story" is compelling as well as the numbers. The Morningstar.com report is beautiful without even a blemish with steady revenue, earnings, and free cash flow growth. The balance sheet is solid with lots of cash. Valuation-wise, the p/e is certainly rich above 40, but the PEG is under 1.0 making the valuation seem reasonable. The Price/Sales ratio is rich compared to other stocks in its group, but the company is also the most profitable in terms of the ROE figure of its group. Interestingly, there are lots of short-sellers out there who have borrowed shares to sell this stock and now may have to scramble to find shares to cover their sales if the stock should continue to rise on any good news.

Even the chart looks nice, as the stock has now consolidated for a few months and now appears to be once again moving higher. There is little, imho, to discourage me on this particular stock, but I always remain poised to sell my shares on fundamental negative news or on negative price performance.

Thanks so much for stopping by and visiting. Once again I apologize for my absence from this website, but if I get a chance, I shall have to share with you my vacation experience. In any case, if you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com and feel welcome to visit and listen to me on my Stock Picks Podcast Site!

Bob

Newer | Latest | Older

We had another nice day in the market. I cannot remember how long it has been since we have had so many up days in a row! I hope it is not premature to start getting optimistic about things, but with the interest rate hikes on hold and energy prices pulling back, we might just have the beginnings of a new bull market. Hopefully, that is not wishful thinking :).

We had another nice day in the market. I cannot remember how long it has been since we have had so many up days in a row! I hope it is not premature to start getting optimistic about things, but with the interest rate hikes on hold and energy prices pulling back, we might just have the beginnings of a new bull market. Hopefully, that is not wishful thinking :).

It is a nice change to be looking at a stock market moving ahead strongly on the back of additional gains in the prior weeks. We have had so many days and months of corrections as the Fed relentlessly pushed interest rates higher. Perhaps most of that weakness is behind us. In any case, with the market indices moving ahead all day today, we have the opportunity of finding additional companies that are worth evaluation on this website.

It is a nice change to be looking at a stock market moving ahead strongly on the back of additional gains in the prior weeks. We have had so many days and months of corrections as the Fed relentlessly pushed interest rates higher. Perhaps most of that weakness is behind us. In any case, with the market indices moving ahead all day today, we have the opportunity of finding additional companies that are worth evaluation on this website.

Reviewing the

Reviewing the

On May 9, 2005, I

On May 9, 2005, I  On July 26, 2006,

On July 26, 2006,  On May 11, 2005, I

On May 11, 2005, I

Finally, on May 12, 2005, I

Finally, on May 12, 2005, I  I first

I first

On May 2, 2005, I

On May 2, 2005, I  On May 3, 2005, I

On May 3, 2005, I  On May 6, 2005, I

On May 6, 2005, I  On May 5, 2005, I

On May 5, 2005, I