Stock Picks Bob's Advice

Sunday, 3 December 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

As I like to do on weekends, this is a review of past stock picks from a little more than a year ago. Why more than a year? Actually, I started out with a yearly review advancing a week at a time....but I have missed a few weeks along the way. And thus, here we are!

This review assumes a buy and hold strategy that assumes an equal dollar purchase of stocks during the week reviewed. In practice, I employ and advocate a disciplined portfolio management system that practices quick sales of declining stocks and partial sales of gaining stocks at targeted appreciation points. This difference in strategy would certainly affect performance over time.

On July 25, 2005, I posted Diagnostic Products (DP) on Stock Picks Bob's Advice when it was trading at $56.05. On September 5, 2006, Siemens announced that it had completed the acquisition of Diagnostic Products Corporation for $58.50/share. Thus, this stock pick would have appreciated $2.45 or 4.4% since posting.

On July 25, 2005, I posted Diagnostic Products (DP) on Stock Picks Bob's Advice when it was trading at $56.05. On September 5, 2006, Siemens announced that it had completed the acquisition of Diagnostic Products Corporation for $58.50/share. Thus, this stock pick would have appreciated $2.45 or 4.4% since posting.

On July 27, 2005, I picked Anteon Intl (ANT) fgor Stock Picks Bob's Advice when it was trading at $47.86/share. Anteon was acquired by General Dynamics for $55.50/share in June, 2006, for an effective gain on the stock pick of $7.64 or 16.0% since being "picked" on the blog.

On July 27, 2005, I picked Anteon Intl (ANT) fgor Stock Picks Bob's Advice when it was trading at $47.86/share. Anteon was acquired by General Dynamics for $55.50/share in June, 2006, for an effective gain on the stock pick of $7.64 or 16.0% since being "picked" on the blog.

On July 28, 2005, I posted Advanced Neuromodulation Systems (ANSI) on Stock Picks Bob's Advice when it was trading at $48.40/share. ANSI was acquired by St Jude Medical for $61.25/share resulting in an effective appreciation of $12.85 or 26.5% since posting.

On July 28, 2005, I posted Advanced Neuromodulation Systems (ANSI) on Stock Picks Bob's Advice when it was trading at $48.40/share. ANSI was acquired by St Jude Medical for $61.25/share resulting in an effective appreciation of $12.85 or 26.5% since posting.

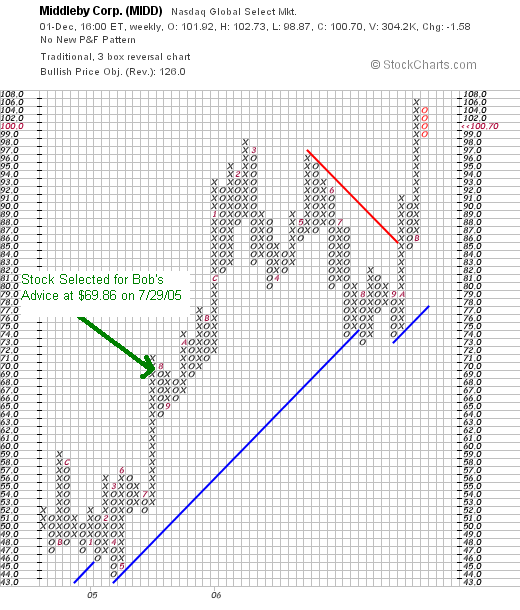

Finally, on July 29, 2005, I posted Middleby Corporation (MIDD) on Stock Picks Bob's Advice when the stock was trading at $69.86/share. MIDD closed at $100.70 on December 1, 2006, for a gain of $30.84 or 44.1% since posting.

Finally, on July 29, 2005, I posted Middleby Corporation (MIDD) on Stock Picks Bob's Advice when the stock was trading at $69.86/share. MIDD closed at $100.70 on December 1, 2006, for a gain of $30.84 or 44.1% since posting.

Here is the chart showing my selection point.

You can note the outstanding price move after the stock was selected on the blog! Unfortunately, I didn't and I still don't own any shares of this stock.

On November 6, 2006, Middleby announced 3rd quarter 2006 results. Net sales for the quarter rose 27.6% for the quarter, coming in at $103,239,000, up from $80,937,000 in the same quarter last year. Net income rose to $12.2 million or $1.48/share, up from $9.6 million or $1.19/share last year during the same period. The company exceeded estimates of $1.28/share for the quarter.

On November 6, 2006, Middleby announced 3rd quarter 2006 results. Net sales for the quarter rose 27.6% for the quarter, coming in at $103,239,000, up from $80,937,000 in the same quarter last year. Net income rose to $12.2 million or $1.48/share, up from $9.6 million or $1.19/share last year during the same period. The company exceeded estimates of $1.28/share for the quarter.

So how did I do doing that week a bit over a year ago? Fabulous! I don't think I have ever posted four stocks only to find that three of them were acquired a year later! Overall, the average performance for the four stocks worked out to a gain of 22.75%!

Thanks so much for stopping by and visiting. If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, drop by my Stock Picks Podcast site where I have been discussing a few of the many stocks that I write about on the blog!

Bob

Posted by bobsadviceforstocks at 11:45 AM CST

|

Post Comment |

Permalink

Updated: Sunday, 3 December 2006 12:00 PM CST

Thursday, 30 November 2006

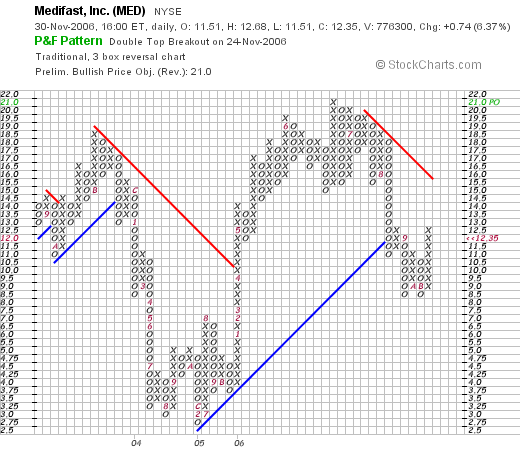

Medifast (MED)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I was going through the list of top % gainers on the NYSE today and came across a name which I have noticed showing up on this list more than once: Medifast (MED). I do not own any shares nor do I have any options on this stock.

I was going through the list of top % gainers on the NYSE today and came across a name which I have noticed showing up on this list more than once: Medifast (MED). I do not own any shares nor do I have any options on this stock.

As I write, Medifast is trading at $12.35, up $.74 or 6.37% on the day. Let's take a brief look at this stock and I will share with you my thinking about why it deserves to be on this blog.

According to the Yahoo "Profile" on MED, the company "...through its subsidiaries, engages in the production, distribution, and sale of weight and disease management products, and other consumable health and diet products in the United States. Its products also include meal replacement and sports nutrition products."

Medifast announced 3rd quarter 2006 results on November 14, 2006. For the quarter ended september 30, 2006, they had revenue of $19.6 million, a 79% increase over the $11 million reported in the same quarter the prior year. Net income came in at $1.5 million or $.11/diluted share, vs. $607,000 or $.05/diluted share the prior year. The company announced guidance for full year 2006 at $70-$72 million in revenue and $.38 to $.40/share. This stock has at least one analyst who had forecast $.09/share on $17 million in revenue. The company beat these expectations handily.

Looking longer-term at the Morningstar.com "5-Yr Restated" financials on MED, we can see the nice picture of steady revenue growth, with $5 million in revenue in 2001, growing to $40 million in 2005 and $60 million in the trailing twelve months (TTM).

Looking longer-term at the Morningstar.com "5-Yr Restated" financials on MED, we can see the nice picture of steady revenue growth, with $5 million in revenue in 2001, growing to $40 million in 2005 and $60 million in the trailing twelve months (TTM).

Earnings during this period have been a little less consistent with $.07/share in 2001, increasing to $.30/share in 2002, dropping to $.14/share in 2004, and increasing since then to $.19/share in 2005 and $.32/share in the TTM.

The company has been increasing its shares outstanding with 9 million in 2003, increasing to 12 million in 2005 and 14 million in the TTM.

Free cash flow has been small but improving with $(1) million in 2003, $-0- in 2004, $2 million in 2005 and $2 million in the TTM.

The balance sheet, per Morningstar.com, appears solid with $5.3 million in cash and $11.4 million in other current assets. This total of $16.7 million, when compared to a $4.6 million in current liabilities, yields a current ratio of over 3.0. The company has enough current assets to pay off their current liabilities of $4.6 milllion AND their long-term liabilities of $3.7 million combined.

Looking at Yahoo "Key Statistics" for some valuation numbers on Medifast, we can see that this is a small cap stock with a market capitalization of only $167.82 million. The trailing p/e is a tad rich at 30.67, with a forward p/e estimated (fye 31-Dec-07) at 22.53. Thus, with the rapid growth in earnings expected, the 5 yr expected PEG works out to a reasonable 1.49.

According to the Fidelity.com eresearch website, MED has a Price/Sales (TTM) of 2.48, compared to an industry average of 1.94, putting it at the 78th percentile in its industrial group.

Their Return on Equity (ROE) (ttm), is at 19.92% which is below the industry average of 31.24%, but still puts it near the top of its group at the 74th percentile.

Returning to Yahoo, we find that there are only 13.55 million shares outstanding and 11.17 million that float. As of 11/10/06, there were 1.06 million shares out short, representing 9.9% of the float or 4.1 trading days of volume. This short interest was down from the prior month, but with the strong earnings report out this month, the appreciation in the stock price might be contributed to by the covering of the short positions of the short-sellers.

No dividend is paid, and no stock split was reported on Yahoo.

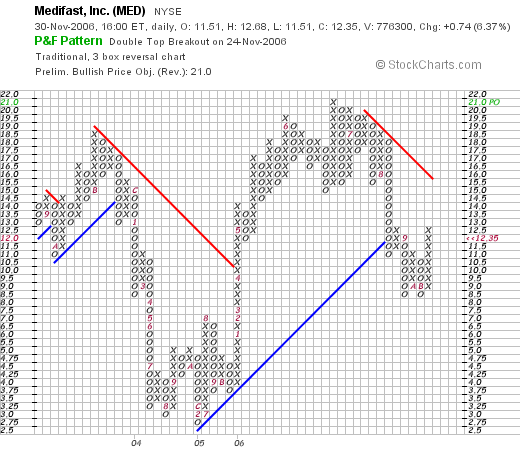

Reviewing a "Point & Figure" chart on Medifast from StockCharts.com, we can see that this is a very volatile stock which reached a high of $18 in November, 2003, only to fall back to $2.75/share in February, 2005. The stock rebounded to a new high of $21 in June, 2006, and then recently pulled way back to the $8.50 level which it bounced off of twice in September and November, 2006. The stock is once again moving higher, but if we are to use the "resistance" lines on the chart, I would like to see the stock trading above $15 to feel comfortable that it is once again technically looking good.

This is a very small company which is trading in a very volatile fashion. The latest quarterly report was quite strong and actually the company has been growing nicely the past several years. Valuation appears fairly reasonable for the fast growth that this company has been reporting. And technically, the chart looks volatile but not over-extended. A little small and a little speculative, but then again, that adds a little interest to this blog and it might fill a spot in somebody's portfolio. I just am not in a position to be adding any stocks to my own holdings!

Thanks so much for stopping by and visiting. Please feel free to drop me a line at bobsadviceforstocks@lycos.com if you have any comments or questions or just leave them right on the blog. Also, if you get a chance, be sure and visit my Stock Picks Podcast Site, where I also talk about some of the stocks I write up.

Bob

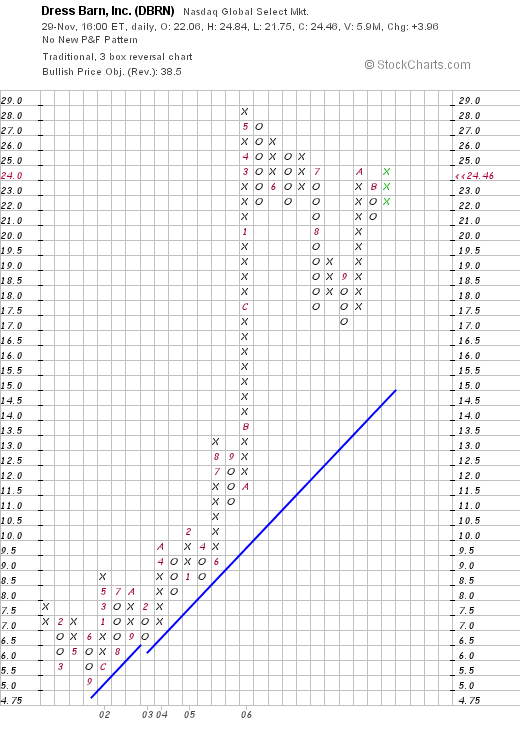

Dress Barn (DBRN)

CLICK HERE FOR MY PODCAST ON THIS ENTRY!

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

O.K., I was going to call it a night and get some sleep but there was something that I had been intending to get around to all afternoon and just hadn't. And that was writing a bit about Dress Barn (DBRN), a stock that I don't own any shares or options in, but a stock which made a great move today in a great trading environment.

O.K., I was going to call it a night and get some sleep but there was something that I had been intending to get around to all afternoon and just hadn't. And that was writing a bit about Dress Barn (DBRN), a stock that I don't own any shares or options in, but a stock which made a great move today in a great trading environment.

According to the Yahoo "Profile" on DBRN, the company "...and its subsidiaries operate a chain of women's apparel specialty stores in the United States. It offers casual fashion apparel and sportswear, dresses, suits, special occasion clothing, jewelry, hosiery, handbags, and shoes. The company sells its products under the brands ‘dressbarn’ and ‘maurices’. As of July 29, 2006, it operated 1,339 stores in 48 states and the District of Columbia, consisting of 575 combo stores, 173 dressbarn stores, 45 dressbarn woman stores, and 546 maurices stores."

It is late, so I don't want to write up a real detailed review, but let me get to the facts and you can do some more research if you like what your read. First of all, I came across DBRN because it hit the list of top % gainers on the NASDAQ, my first place to look for names. DBRN closed at $24.46, up $3.96 or 19.32% on the day.

As is frequently the case, what drove the stock higher today was an earnings announcement. In particular, the company, after the close of trading yesterday, announced results for the 1st quarter 2007, ended October 28, 2006. Here's the low-down on the report: net sales increased 12% to $358.4 million compared with last year's $318.9 million. Comparable store sales, the so-called "same-store sales" results showed a solid increase of 7%. Net earnings climbed 35% to $27.4 million or $.40/diluted share, up from $20.4 million or $.32/diluted share in the same period last year.

As is frequently the case, what drove the stock higher today was an earnings announcement. In particular, the company, after the close of trading yesterday, announced results for the 1st quarter 2007, ended October 28, 2006. Here's the low-down on the report: net sales increased 12% to $358.4 million compared with last year's $318.9 million. Comparable store sales, the so-called "same-store sales" results showed a solid increase of 7%. Net earnings climbed 35% to $27.4 million or $.40/diluted share, up from $20.4 million or $.32/diluted share in the same period last year.

As part of what I call an outstanding earnings report, the company raised guidance for the full year 2007 to $1.30 to $1.35, from prior company guidance of $1.25 to $1.30. The company also suggested that comparable store sales would show growth at a rate of 4%. Going along with this picture, the company also announced after the close yesterday that the November sales for the company grew 9% overall with comparable sales for the month increasing by 4%.

Another part of a solid earnings report is to consider what the expectations were for earnings and whether a company failed to meet, met, or exceeded those expectations. As would be expected, companies that beat expectations often see a rather strong upward move in their stock prices. In this case, while DBRN reported quarterly earnings of $.40/share, analysts at Thomson First Call were expecting $.37/share. And revenue, which came in at $358.4 milion, exceeded expectations as well of $352 million. So this quarterly report, did what I call a "trifecta-plus", a term which I have been using to describe a report in which the company grows revenue, increases earnings, beats expectations AND raises guidance! There isn't much more a company could do...except maybe raise their dividend or announce a stock buy-back....which would also add excitement to an investment!

Let me also go ahead and share with you some of the facts reported on the Morningstar.com "5-Yr Restated" financials on Dress Barn. Revenue, which did drop from $717 million in 2002 to $707 million in 2003, has since been increasing steadily to $1,000 million in 2005 and $1,300 million in 2006. Earnings, which also dropped from $.49/share in 2002 to $.11/share in 2003, turned back around and increased to $.51/share in 2004, and up to $1.15/share in 2006. The company does not pay a dividend. But an interesting point on the Morningstar.com page, is that the number of shares has been decreasing from 72 million in 2002 to 62 million in the trailing twelve months (TTM).

Free cash flow has been positive and increasing the past few years with $58 million in 2004, $106 million in 2005, and $164 million in 2006.

The balance sheet looks solid on Morningstar with $152.9 million in cash and $196.5 million in other current assets reported. This total of $349.4 million in current assets, easily covers the $227.5 million in current liabilities. When calculated, the current ratio works out to a healthy 1.54. The company has an additional $210.2 million in long-term liabilities, which, with the growing free cash flow, does not appear to be a significant burden.

Taking a look at Yahoo "Key Statistics" on DBRN, we find that this is a mid-cap stock with a market capitalization of $1.51 billion. The trailing p/e is a reasonable 21.29 (imho), with a forward (fye 29-Jul-08) p/e of 16.53. The PEG (5 yr expected) comes in at a very nice .98. (Generally PEG ratios between 1.0 and 1.5 are reasonable imho.) I just realized that my Fidelity.com eresearch website has changed its reporting somewhat, so now we can see that the Price/Sales is at 0.92, below the industry average of 1.03. The company has a Return on Equity (ROE) of 21.18%, slightly below the average of 22.87%, but at the 78th percentile for its industry. Thus, valuation is reasonable while profitability is relatively high for its group.

Returning to Yahoo, we find that there are 61.78 million shares outstanding with 45.76 million that float. Of these, there were 4.16 million shares out short as of 11/10/06, giving the company a "short ratio" of 5.7 days. This is greater than my cut-off of 3 days for significance, and may be fueling the price rise today on the back of positive news.

No dividends are paid, and the company last split with a 2:1 in April of 2006.

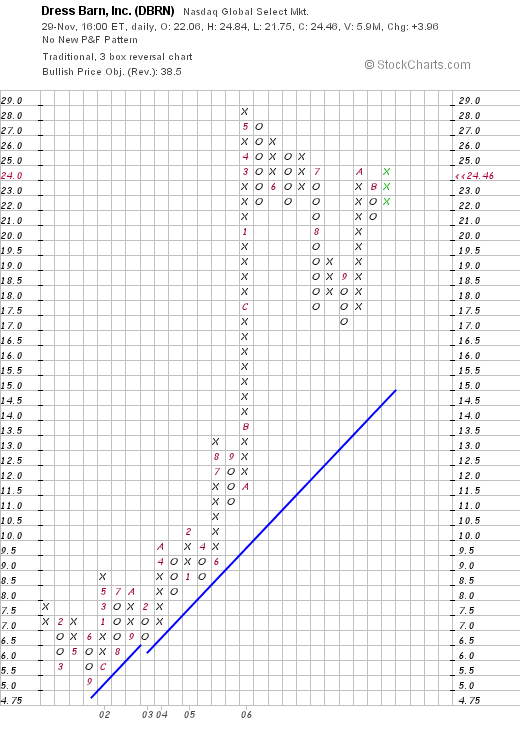

Looking at the "Point & Figure" chart on Dress Barn from StockCharts.com, we see what appears to me to be a beautiful graphy, with the company bottoming at $5.00/share in September, 2001, only to start moving higher, to a recent high of $28 in May, 2006. The company pulled back recently to $17 in September, 2006, only to resume its ascent topped off by its strong move higher today to the $24.44 level.

So what do I think of this stock? Well, I like it. In fact, if I were in the market to be buying some shares, I probably wouldn't hesitate to add this one to my portfolio. Let me explain. The company made a nice move higher today, likely with short-sellers scrambline to cover. They did this on the back of a strong earnings report which beat expectations. The company also announced raised guidance for the rest of the year. This is what I like to see in a stock!

The Morningstar.com report is quite impressive with a steady growth in both revenue and earnings the past four years. In addition, the company has even been buying back shares, increasing free cash flow, and sports a solid balance sheet. Valuation appears reasonable with a PEG under 1.0, a Price/Sales relatively low and a ROE relatively high. Finally, the chart shows almost uninterrupted price appreciation since 2001. The company has been a bit volatile recently, but the numbers really look nice on this one.

Anyhow, I guess I can get to sleep now! I just wanted to write this up before I crashed for the night! Thanks so much for stopping by and visiting! If you have any comments or questions, of course please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Also, be sure and visit my Stock Picks Podcast Site where I talk about lots of the stocks I write about here on the blog.

Bob

Posted by bobsadviceforstocks at 12:11 AM CST

|

Post Comment |

Permalink

Updated: Saturday, 9 December 2006 6:13 PM CST

Sunday, 26 November 2006

Good-bye Dave Johnson!

Blogging can be a lonely business. Bloggers sit before their keyboards and write and formulate ideas and communicate into cyberspace. We get consolation looking at our Sitemeters knowing that someone has stopped by and hope that they have enjoyed their visits. We enjoy linking to each others blog, creating a network that allows visitors to travel across the internet, blog-hopping almost as easily as the bar-hopper on Saturday night. And we find it sad when one of our own hangs it up for personal, family, or business reasons. This is the case with Dayve Johnson on the Markets. Last week Dave Johnson, the actual spelling of his name, called it quits. As Dave wrote:

Blogging can be a lonely business. Bloggers sit before their keyboards and write and formulate ideas and communicate into cyberspace. We get consolation looking at our Sitemeters knowing that someone has stopped by and hope that they have enjoyed their visits. We enjoy linking to each others blog, creating a network that allows visitors to travel across the internet, blog-hopping almost as easily as the bar-hopper on Saturday night. And we find it sad when one of our own hangs it up for personal, family, or business reasons. This is the case with Dayve Johnson on the Markets. Last week Dave Johnson, the actual spelling of his name, called it quits. As Dave wrote:

"Over the past few months I have been mulling over the thought of discontinuing posts to this blog. It has been something that once I started blogging it was a difficult decision to stop because deep inside I had a true joy in posting my ramblings, thoughts, and trades. But it has also become a burden, somewhat of a drudgery in the necessity to say something. Each and every night I would go through the process and each successive night it was becoming less of a joy.

So today I am done. The thing I really enjoyed most about the blog was the interaction between readers- their questions and comments generally made me have to think of the blog from the perspective of the reader. This was not always easy because I know at times I was not always clear and concise in my postings. This mostly stems from my poor ability to relate my thoughts into the blog posts.

One of the conflicts that I had to resolve ultimately was the fact I love to travel. Being away forced me to have to post a pick each day regardless of where I was. I hated that. Certainly that's one of the downfalls of trying to post a daily trackable trading log that would have some credence in the end. It's hard enough just finding a dog sitter for the darn dog when were away."

Well thank you Dave for your efforts! There is a fabric of inter-connectedness on the internet, and when one blogger calls it quits, one can feel the ripple in far distant places. I am sure that you have also touched your readers and that many will miss your posts. I certainly appreciated your link to my blog and feel your angst over hanging it up!

But the nice thing about blogging, is that you can quit, and you can restart again! And I hope that you find the time to do the things with your family, take care of your travels, and consider jumping back in to the blogosphere once again in the future!

Meanwhile, stop by once in a while and let us all know how you are doing!

Bob

Saturday, 25 November 2006

Wolverine Worldwide (WWW) "Weekend Trading Portfolio Analysis"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of the things I have been trying hard to do on this blog, is to keep you informed of my actual holdings and the transactions that I make with the stocks that I really own. I do this in addition to the running commentary on what I call my "vocabulary" of investing....the discussion of the many stocks that I consider "investable". My updating you as frequently as possible, I try very hard to maintain as close to absolute 'transparency' as I can. This allows you to see what I am doing with my own stocks as well as allows you to hear about other stocks that I find attractive but have not owned...but might own in the future!

A couple of years ago, I started reviewing my "trading portfolio" stocks on a regular basis here on the blog. I stopped updating the link to my trading portfolio some time back as all of the housework started catching up with me and I found it absolutely unrealistic to do all of this manually by myself. But I continue to run through my holdings, trying to review a stock I actually own, about twice/month. Two weeks ago I reviewed my Ventana holding on Stock Picks. This evening, I would like to take another look at Wolverine Worldwide (WWW), a relatively recent acquisition for me.

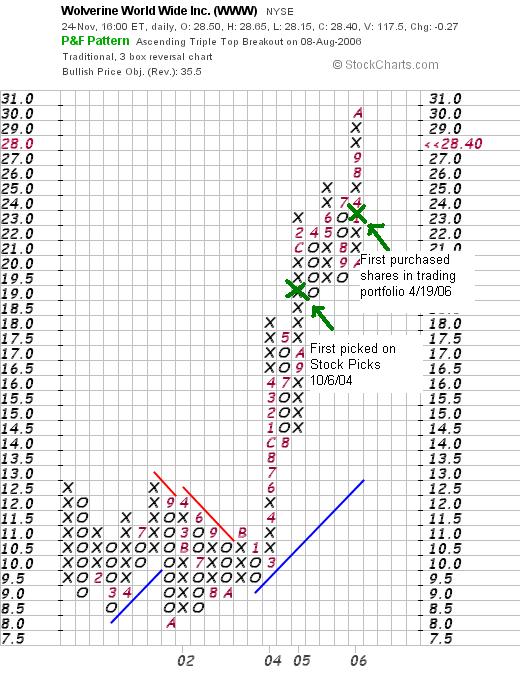

I first reviewed Wolverine Worldwide (WWW) on Stock Picks Bob's Advice on October 6, 2004, when it was trading at $28.90. WWW had a 3:2 stock split on February 2, 2005, making my effective stock pick price actually $19.27. WWW closed at $28.40 on November 24, 2006, for a gain of $9.13 or 47.4% since it was picked on the blog.

I first reviewed Wolverine Worldwide (WWW) on Stock Picks Bob's Advice on October 6, 2004, when it was trading at $28.90. WWW had a 3:2 stock split on February 2, 2005, making my effective stock pick price actually $19.27. WWW closed at $28.40 on November 24, 2006, for a gain of $9.13 or 47.4% since it was picked on the blog.

I purchased 240 shares of WWW in my actual trading portfolio on April 19, 2006, with a cost basis of $23.55/share. With Friday's closing price of $28.40, this represents an unrealized gain of $4.85 or 20.6% since purchase. I have not sold any of my original purchase. According to my plan of selling 1/6th of my shares at a 30% gain, if the stock reaces 1.30 x $23.55 = $30.62, then I would plan on selling 40 shares and this would give me the "permission" to add a new position to my trading portfolio. On the other hand, since I have not sold any shares, if the stock would fall to an (8)% loss, or .92 x $23.55 = $21.67, then I would plan on selling all of my holding at that time.

I purchased 240 shares of WWW in my actual trading portfolio on April 19, 2006, with a cost basis of $23.55/share. With Friday's closing price of $28.40, this represents an unrealized gain of $4.85 or 20.6% since purchase. I have not sold any of my original purchase. According to my plan of selling 1/6th of my shares at a 30% gain, if the stock reaces 1.30 x $23.55 = $30.62, then I would plan on selling 40 shares and this would give me the "permission" to add a new position to my trading portfolio. On the other hand, since I have not sold any shares, if the stock would fall to an (8)% loss, or .92 x $23.55 = $21.67, then I would plan on selling all of my holding at that time.

Let's take another look at this stock and see if it still deserves a place on this blog!

1. What does this company do?

According to the Yahoo "Profile" on WWW, the company

"... engages in the design, manufacture, and marketing of a line of casual shoes, rugged outdoor and work footwear, and constructed slippers and moccasins primarily in the United States. It offers work, outdoor, uniform, and lifestyle boots and shoes; performance and lifestyle footwear; and comfortable casual, dress footwear, and slippers through its Wolverine Footwear Group, Outdoor Group, Heritage Brands Group, and Hush Puppies Company. The company provides its products under various brand names, including Bates, CAT, Harley-Davidson, Hush Puppies, HyTest, Merrell, Sebago, Stanley, and Wolverine."

2. How did Wolverine do in the latest reported quarter?

On October 4, 2006, Wolverine announced 3rd quarter 2006 results. Revenue for the quarter came in at $298.9 million, a 7.1% increase over the $279.1 million reported in the same quarter the prior year. Earnings per share were up 9.5% to $.46/share, up from $.42/share the prior year. The company also raised guidance for 2006 to $1.41 to $1.44/share, from prior guidance of $1.38 to $1.42. WWW left revenue estimates for the year unchanged. This result exceeded expectations of $.44/share, although revenue was in line with the estimated $299 million.

3. How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on Wolverine Worldwide (WWW), we can see a pretty picture of steady revenue growth from $720 million in 2001 to $1.06 billion in 2005 and $1.1 billion in the trailing twelve months (TTM).

Earnings per share have also steadily increased from $.71/share in 2001 to $1.27 in 2005 and $1.37/share in the TTM. The company also pays a dividend and has been steadily increasing the dividend from $.11/share in 2001 to $.26/share in 2005 and $.28/share in the TTM.

Also nice, the company has kept its shares stable with 61 million outstanding in 2001, 56 million in 2005, and 60 million in the TTM.

Free cash flow has been nicely positive with $86 million in 2003, $100 million in 2005 and $97 million in the TTM.

The balance sheet, as presented by Morningstar.com, appears gorgeous to me! The company is reported to have $81 million in cash and $377.5 million in other current assets giving a total of $458.5 million in total current assets. When compared to the $132.8 million in current liabilities this yields a current ratio of 3.45...with a ratio of 1.5 or higher being considered strong. The company is reported to have a nominal $60.1 million in long-term liabilities, easily covered by the current assets. The balance sheet looks quite strong to me.

4. What about valuation?

Reviewing the Yahoo "Key Statistics" on Wolverine, we see that this is a mid-cap stock with a market cap of $1.58 billion. The trailing p/e is a moderate 20.11, with a forward p/e (fye 31-Dec-07) of 17.53. The PEG is a reasonable 1.42. (Generally PEG ratios between 1.0 and 1.5 are acceptable to me).

Reviewing Fidelity.com eresearch for some more valuation numbers on this stock, WWW is in the "Textile-Apparel Footwear/ Accessories" industrial group. Compared to the other stocks in the group, WWW is reasonably priced with a Price/Sales ratio of 1.4. Leading this group is another favorite (and holding) of mine, Coach (COH) with a Price/Sales ratio of 7.2. They are followed by VOLCOM (VLCM) at 4.1, Nike (NKE) at 1.6, then Wolverine (WWW) at 1.4, and Timberland (TBL) at 1.3.

Insofar as one measure of profitability, Return on Equity (ROE) is concerned, Coach is actually the most profitable with a 40.1% ROE, followed by VOLCOM at 25.1%, Timberland at 21.8%, Nike at 21.5%, and Wolverine at the bottom of this group with a ROE of 17%.

Returning to Yahoo, we find that there are 55.66 million shares outstanding with 53.84 million that float. Currently, there are 2.38 million shares out short (10/10/06) representing 4.4% of the float or 4.5 trading days of volume. Using my "3 day rule" on short interest, this is somewhat significant and may be supporting the stock price in the event of any 'good' news. As already noted the company pays a dividend with a forward rate of $.30/share and an anticipated forward yield of 1.00%. The last stock split, as I noted above, was a 3:2 split on February 2, 2005.

5. What does the chart look like?

Reviewing the "Point and Figure" chart on Wolverine Worldwide (WWW) from StockCharts.com, we can see that the stock was grading sideways from 2001 into 2002, and broke out at around $10.50 in March, 2003, and then climbed very strongly to its current level around $28.40. The chart looks quite strong. I noted my first stock pick price and my purchase price on the chart below.

6. Summary: What do I still think about this stock?

Let me try to review some of the things I discussed above. First of all the stock is performing just fine trading within 10% of its all time high. The latest quarter was steady with growth in both revenue and earnings and found the company beating expectations on earnings and raising earnings guidance. Both are strong.

Longer-term, the company has been remarkably steady in raising revenue, increasing revenue, and paying an increasing dividend. All this while maintaining a steady number of outstanding shares and spinning off an adequate amount of free cash flow. The balance sheet looks superb with assets outweighing liabilities substantially. Valuation-wise the p/e is moderate with a PEG of about 1.5. The Price/Sales is quite cheap, although the return on equity (ROE) figure is less impressive. Finally, there are even a good number of short-sellers (who probably, and rightfully so, believe the chart looks a bit over-extended), however, with any good news, we may see a bit of a squeeze. In summary, I still like this stock. Now, of course I am biased as I am an owner of this, and I also remember my first pair of Hush Puppies years and years ago which I was crazy about....those light shoes with the fuzzy leather!

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to drop me a line at bobsadviceforstocks@lycos.com and be sure to visit my Stock Picks Podcast website where I discuss many of the stocks and strategies that I write about here on the blog.

Have a Happy Thanksgiving Weekend everyone!

Bob

"Looking Back One Year" A review of stock picks from the week of July 18, 2005

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of my weekend tasks that I try to perform here on the blog, is to look at past stock selections and see if they are still worthy of consideration. This evaluation assumes a buy and hold strategy without any sales at either declines or appreciation in price. In practice, I advocate and practice a disciplined portfolio investment strategy that unloads stocks quickly and completely on small losses and directs me to sell small portions of my positions if and when they reach certain appreciation targets. This strategy would certainly affect investment performance and be taken into consideration.

I like to give a simple "thumbs-up" or "thumbs-down" on these stocks simply based on latest quarter earnings report. All that I require to give the stock a thumbs-up is that BOTH the earnings and revenue have increased. I simply do not do an involved fundamental and/or technical analysis on these stocks that I briefly review.

On July 18, 2005, I picked Charles and Colvard (CTHR) on Stock Picks Bob's Advice when it was trading at $27.87. CTHR had a 5:4 stock split on 1/31/06 making my effective stock pick price actually $22.30. CTHR closed at $8.18 on 11/24/06, for a loss on my stock pick of $(14.12) or (63.3)% since posting.

On July 18, 2005, I picked Charles and Colvard (CTHR) on Stock Picks Bob's Advice when it was trading at $27.87. CTHR had a 5:4 stock split on 1/31/06 making my effective stock pick price actually $22.30. CTHR closed at $8.18 on 11/24/06, for a loss on my stock pick of $(14.12) or (63.3)% since posting.

On October 14, 2006, CTHR announced 3rd quarter 2006 results. Net sales increased 7% to $12.1 million, up from $11.3 million for the same quarter in 2005. Net income was flat at $2.2 million or $.12/share, unchanged from the $2.2 million or $.12/share reported in the same quarter the prior year.

On October 14, 2006, CTHR announced 3rd quarter 2006 results. Net sales increased 7% to $12.1 million, up from $11.3 million for the same quarter in 2005. Net income was flat at $2.2 million or $.12/share, unchanged from the $2.2 million or $.12/share reported in the same quarter the prior year.

On July 19, 2005, I posted CDW Corp (CDWC) on Stock Picks Bob's Advice when it was trading at $61.98/share. CDWC closed at $70.09 on November 24, 2006, for a gain of $8.11 or 13.1% since posting.

On July 19, 2005, I posted CDW Corp (CDWC) on Stock Picks Bob's Advice when it was trading at $61.98/share. CDWC closed at $70.09 on November 24, 2006, for a gain of $8.11 or 13.1% since posting.

On October 18, 2006, CDWC reported 3rd quarter 2006 results. Sales came in at $1.74 billion, up 4.1% over the prior year. Net income grew 6.3% to $77.7 million, and diluted earnings per share came in at $.98/share up 11% over the prior year results.

On October 18, 2006, CDWC reported 3rd quarter 2006 results. Sales came in at $1.74 billion, up 4.1% over the prior year. Net income grew 6.3% to $77.7 million, and diluted earnings per share came in at $.98/share up 11% over the prior year results.

Finally, on July 19, 2005, I posted FileNet (FILE) on Stock Picks Bob's Advice when it was trading at $29.97/share. As announced on August 10, 2006, IBM acquired FileNet (FILE) for $35.00/share with a resultant appreciation of $5.03 or 16.8% over the stock pick price. FILE is no longer traded as an independent company.

So how did I do with these three stocks? Well, because of the stock implosion of CTHR, rather poorly actually. There was one losing stock and two gainers for an average loss of (11.1)%. You can see from this how important it is to limit losses to avoid undermining your entire portfolio. I did not own any of these three stocks and do not currently.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com or simply leave your comments right on the blog. Please also stop by and visit my Stock Picks Podcast Website.

Bob

A Reader Writes "...thought you might be interested in this observation."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

One of my favorite things about writing a blog about my experience with investing and some ideas that I have had about how to do this, is to receive feedback from readers who also are thinking about investing and approaches to managing their portfolios.

One of my favorite things about writing a blog about my experience with investing and some ideas that I have had about how to do this, is to receive feedback from readers who also are thinking about investing and approaches to managing their portfolios.

The other day I received a very nice letter from Imad Y. who wrote:

"Hi Bob,

I have been reading your blog on and off for the last

year. I like your strategy. However, going through

last spring's sell off (losses), I concluded that

something still missing on reacting to market.

After few observations, I think I found the missing

link (I could be wrong but it seems to work)

As market trended down earlier this year, you started

unloading stocks that hit -8% (Many did!)

What we can add to this strategy is that if the down

trend is market related, not company performance, we

should sit on our hands until the market starts

correcting then go back buy all/ most of the stocks

that were unloaded. The reasoning behind this is that

your selection criterion is strong; therefore at a

correcting market, what is better than buying strong

stock at a bargin price!

To verify this, you can pull the charts for the stocks

that you sold in April/ May and see how they did from

July onward.

Once again I could be off track since I am first-grade

amateur trader, but thought you might be interested in

this observation.

Regards,

Imad "

First of all, thanks so much for writing and thinking about what I have been writing! I must tell you that there is a great deal of truth in what you write. It would be very nice to sell stocks only that were dropping due to stock-specific news. In other words, if the stock drops due to a market condition, then maybe ignore the drop...and hopefully as the market turns back up, the stock price will be moving higher once again.

First of all, let me review my four stocks that I sold the last six months on "bad news", meaning either fundamental information or stock price performance regardless of market conditions. And let's see if your premise is correct. I shall draw in a red "x" to show the sale point on all of these stocks.

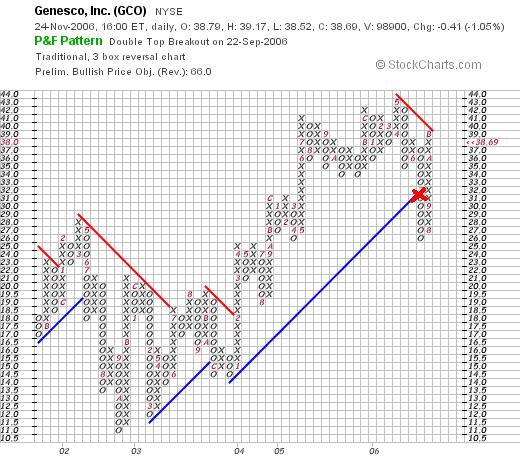

First, Genesco (GCO) was sold on 7/12/06 at $31.59.

Here you can see that indeed you are correct. Genesco did continue to drop after my sale, but then turned around and rebounded to its current level...where it closed at $38.69 on November 24, 2006.

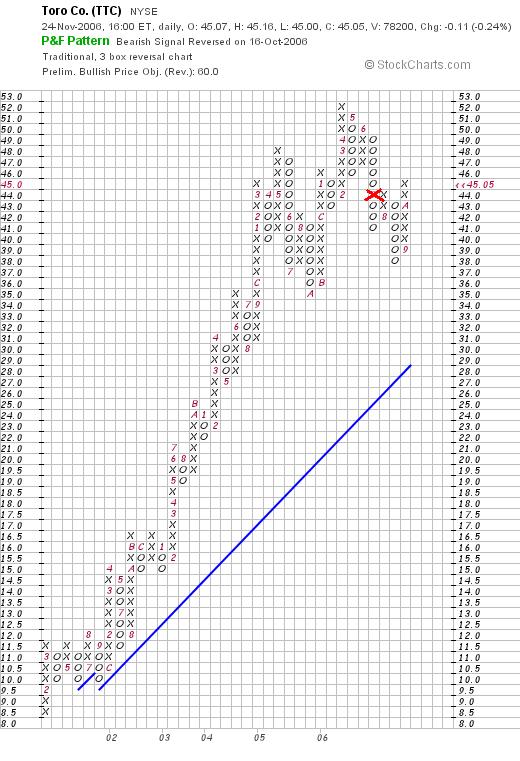

My next sale was Toro (TTC), which I sold at $44.06 on July 13, 2006.

Here is the current chart with the red "X" again being my sale point:

My next sale was Barnes (B) on July 17, 2006, when I sold my shares at $17.97.

Again Barnes (B) dropped further after my sale, but did indeed move to a higher level, closing at $21.06 on 11/24/06.

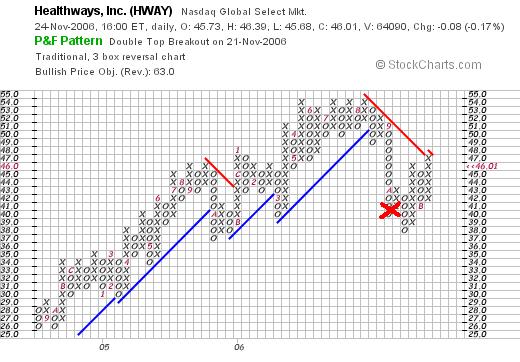

All three of those stocks were sold because of my own technical indicators, that is they had hit sale points that I had determined. However, my most recent sale was my own assessment of a fundamental problem with earnings results. Healthways (HWAY) was sold on 7/17/06 at $40.64.

Once again, you are correct. HWAY turned lower after my sale, but then moved higher to its current level of $46.01, where it closed on 11/24/06. This particular graph is not quite as reassuring as the others but it is noteworthy that the stock price recovered.

Before completely agreeing with you, even though each of these examples does show price recovery in each of these stocks, I believe that this is more a testimony to my stock-picking techniques than a condemnation of my portfolio management strategy.

Let me explain. You point out correctly that stocks may decline just due to market forces and that we should thus "sit on our hands". I suppose you would also agree that selling stocks on fundamental 'bad news' is reasonable, and I would concur with that.

My strategy of selling stocks even if the price decline is due to the overall market stems from my belief, that if it is all possible, it would be nice to be relatively underinvested in a bear market. If the market is starting to maul all of the stocks, why would anyone like to be in the market at all? Yet, how can any individual actually predict the overall future market direction successfully. I do not claim to be able to predict where the market will be even a month into the future.

My sensitivity to the Market comes from my experience with the CANSLIM theory as advocated by O'Neil. For him, being out of the market in overall market corrections, and being fully-invested in strong bull-markets is an admirable goal. By giving each new investment a short leash, so to speak, I hopefully will avoid large losses due to a market correction, or for that case, due to anything. However, there will be times that I shall be "shaken out", especially on newer stock picks.

So while I completely agree with you on your points in general, I plan on continuing with my current strategy. I simply cannot know when I should be breaking my "rules" without losing complete control of my disciplined trading strategy.

Also, you will note that as I hold stocks longer and longer, I give them longer and longer leashes so-to-speak, allowing them to pull-back and advance without a sale. That is why, as my portfolio has "matured", I find myself trading less and less and sitting on my hands more often!

I sure hope that explains my behavior. Thank you for pointing out your observations. They aren't wrong, they just represent a different approach to managing a portfolio. If you do try to make this modification, why don't you email me again in a few months and let me how it is working out for you and how you deal with managing your portfolio to prevent losses in case of a major market melt-down.

If you have any other comments or questions, please feel free to email me at bobsadviceforstocks@lycos.com or simply leave them on the blog. Also, be sure and visit my Stock Picks Podcast Website where I discuss many of the same stocks and strategies that I write about on the blog.

Bob

Posted by bobsadviceforstocks at 10:35 AM CST

|

Post Comment |

Permalink

Updated: Saturday, 25 November 2006 4:27 PM CST

Wednesday, 22 November 2006

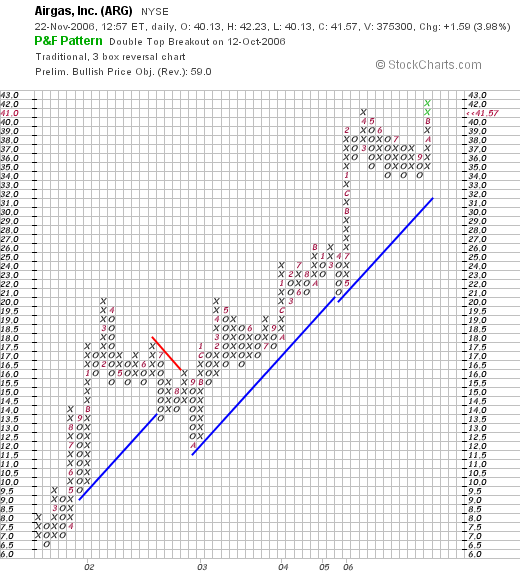

Airgas (ARG)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I was looking through the list of top % gainers on the NYSE and came across Airgas (ARG), which as I write is trading at $41.61, up $1.63 or 4.08% on the day. I do not own any shares nor do I have any options on this stock.

I was looking through the list of top % gainers on the NYSE and came across Airgas (ARG), which as I write is trading at $41.61, up $1.63 or 4.08% on the day. I do not own any shares nor do I have any options on this stock.

I would like to briefly share with you my thinking as I believe this stock deserves a place on my blog!

According to the Yahoo "Profile" on Airgas, the company

"...and its subsidiaries distribute industrial, medical, and specialty gases and hardgoods primarily in the United States. Its products and services include packaged and small bulk gases, gas cylinder, and welding equipment rental, and hardgoods."

On October 25, 2006, Airgas reported 2nd quarter earnings results for the quarter ended September 30, 2006. Net sales for the quarter grew to $790.7 million from $702.2 million in the same quarter the previous year. Net earnings increased to $39.5 million this year vs. $29.6 million last year, or $.49/share this year, and $.38/share last year on a diluted basis. The company exceeded analysts' expectations of $.47/share on net sales of $790 million. In addition, the company raised guidance to $.47 to $.49/share for the third quarter, while analysts have forecast $.47/share.

Looking longer-term at the Morningstar.com "5-Yr Restated" financials on ARG, we see a steady increase in revenue from $1.6 billion in 2002 to $2.8 billion in 2006 and $2.9 billion in the trailing twelve months (TTM). Earnings also show steady improvement, and the company started paying a dividend of $.16/share in 2004 and has been increasing the dividend on a regular basis. The number of shares outstanding has grown from 69 million in 2002 to 78 million in the TTM. Free cash flow has been positive and steady and the balance sheet is adequate with $33.1 million in cash and $447.8 million in other current assets, adequate to cover the $433.2 million in current liabilities. There is another $1.1 billion in long-term debt on the balance sheet.

Looking at the Yahoo "Key Statistics" on ARG, we see that this is a mid-cap stock with a market capitalization of $3.25 billion. The trailing p/e isn't bad at 23.41, the forward p/e is 18.46 (fye 31-Mar-08), however the 5 yr expected growth is such that the PEG is quite high at 5.76.

Reviewing the Fidelity.com eresearch website, we can see that Airgas (ARG) is in the "Industrial Equipment Wholesale' industrial group. Within this group ARG is moderately priced with a Price/Sales ratio of 1.1. Topping this group is MSC Industrial (MSM) at 2.1, and the cheapest in the group is CE Franklin (CFK) at 0.4.

Airgas actually has the lowest return on equity (ROE) of its group at 15.15. Topping the group is DXP Enterprises (DXPE) with a ratio of 40.1%.

Finishing up with Yahoo, we can see that this company has 78.01 million shares outstanding with 70.39 million that float. Of these, 643,520 were out short as of 10/10/06 representing .9% of the float or 1.4 trading days of volume. The forward dividend is $.28 representing a .7% yield, and the stock last split 4/16/96 with a 2:1 split.

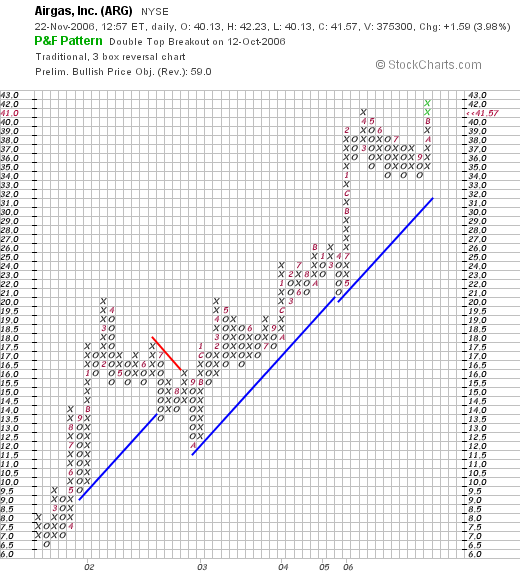

Airgas has a very pretty "Point & Figure" chart. The stock has climbed from a low of $6.50 in February, 2001, and has not broken down in price since. Currently the stock is pushing into new high territory at the $42 level.

To summarize, this has been a great stock to own the past several years. The company's stock moved higher today on the announcement of an acquisition of Linde's bulk gas unit for $495 million. The latest quarterly report was strong with the company beating expectations and raising guidance. The Morningstar evaluation looked nice with steady revenue and earnings growth, and an increasing dividend. The number of shares outstanding has been growing slowly. Free cash flow is positive and the balance sheet appears adequate. Valuation has been o.k. with a reasonable p/e but a PEG over 5.0. Finally, the chart looks terrific.

This is an interesting stock to consider. It isn't a perfect picture imho, but most of the numbers are in line and the price performance of the stock in the market has been superb!

Thanks again for stopping by! If you have any comments or questions, please feel free to drop me a line at bobsadviceforstocks@lycos.com. Also, please be sure to drop by and visit my Stock Picks podcast site, where I discuss many of the same stocks and topics that I write about on the blog.

Bob

Tuesday, 21 November 2006

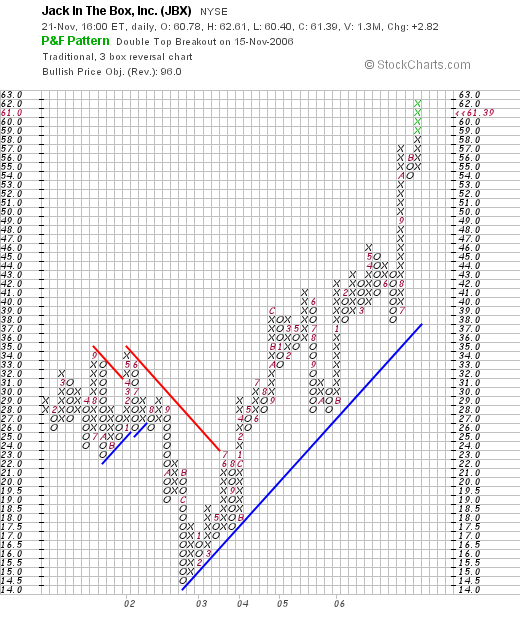

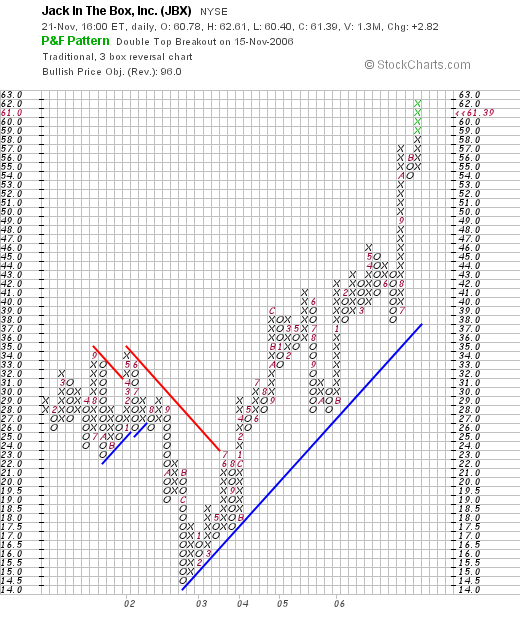

Jack in The Box (JBX)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

The longer I blog here, the more elaborate and complicated my entries are becoming. While that may be appreciated (?), it becomes more of an intimidation every time I face my keyboard, intent on another entry. Let me try tonight to write briefly (have I ever succeeded?), and tell you a bit about Jack in The Box (JBX), and why I think it deserves a spot on the blog.

The longer I blog here, the more elaborate and complicated my entries are becoming. While that may be appreciated (?), it becomes more of an intimidation every time I face my keyboard, intent on another entry. Let me try tonight to write briefly (have I ever succeeded?), and tell you a bit about Jack in The Box (JBX), and why I think it deserves a spot on the blog.

I do not own any shares nor do I have any options on this stock. But, having spent some of my younger years in California, I have indeed gone through the drive-in and have spoken with the "clown" to give it my order.

JBX made the list of top % gainers today, closing at $61.39, up $2.82 or 4.81% on the day.

What drove the stock higher was a terrific 4th quarter 2006 earnings report. Earnings for the quarter came in at $.92/share, up from $.59 last year. Net earnings came in at $33.2 million, up from $21.5 million last year. Total revenue came in at $670 million for the quarter up from $600.5 million last year. This beat expectations for $.66/share. The company reported solid same-store sales growth of 5.9% for the quarter. And the company announced a 5.5 million share buy-back, also bullish for the stock. The 'street' liked the news and the stock price climbed strongly today.

The Morningstar.com "5-Yr Restated" financials shows steady revenue growth, earnings growth, steady shares outstanding (37 million in 2003 and 35 million in the TTM), and positive free cash which appears to be growing as well. The balance sheet looks o.k. with plenty of current assets to cover the current liabilities, but there is the matter of $500 million in long-term liabilities on the balance sheet--doesn't appear to be a problem in light of the growing free cash flow.

Yahoo "Key Statistics" on JBX: mid-cap stock with a market capitalization of $2.17 billion, trailing p/e not bad at 22.94, forward p/e (fye 02-Oct-07) at 20.81. A bit of a rich PEG at 2.08 (but probably will move lower in light of stellar financial results latest quarter), and Price/Sales at 0.77.

35.42 million shares outstanding, 34.72 million that float. As of 10/10/06 there were 1.71 million shares out short representing 3.9 trading days of volume. No dividend paid, no stock split reported.

"Point & Figure" chart on JBX, shows a weak chart between 2001 and 2003. The stock broke out to the upside at $23 in July, 2003, and has been moving strongly higher since, now in the low $60's near its high.

I like this stock! They moved strongly higher today on a great earnings report which beat expectations. To top it off they announced a 5.5 million share buy-back. The company has an interesting casual Mexican Grill chain called Qdoba which it is developing, as well as a chain of convenience stores called "Quick Stuff", so it is a bit more than a hamburger chain.

The Morningstar.com report is solid, the graph looks nice, and the company is still relatively small with a market cap of about $2 billion. For comparison McDonald's has a market cap of about $52 billion. So there should be room for JBX to grow!

Thanks so much for stopping by! I hope you don't mind my abridged note. If you have any comments or questions please feel free to email me at bobsadviceforstocks@lycos.com. Also, be sure and visit my Stock Picks Podcast Website.

Bob

Saturday, 18 November 2006

A Reader Writes "Among my own stock picks is Sonoco Products (SON).."

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisors prior to making any investment decisions based on information on this website.

I was over at a friend's house the other night for a political fund-raiser and as is often the case I found myself moving conversation towards investing. (Is that hard to believe?) I was trying to explain my investing strategy to some acquaintances and is often the case, discussion came around to Fastenal (FAST). This is a popular stock around here because the company is headquartered not too far from where I live, and indeed, the stock has done quite well over the years.

I was over at a friend's house the other night for a political fund-raiser and as is often the case I found myself moving conversation towards investing. (Is that hard to believe?) I was trying to explain my investing strategy to some acquaintances and is often the case, discussion came around to Fastenal (FAST). This is a popular stock around here because the company is headquartered not too far from where I live, and indeed, the stock has done quite well over the years.

I like Fastenal. But what I like about Fastenal is not its geographic location or the fact that some locals have literally become millionaires investing in the stock. What I tried to point out was that as an investor it is important to find stocks like Fastenal....by 'profiling' companies....I try to identify companies that have many of the same characteristics of FAST, as potential investments. William O'Neil attempted to do the same thing with his CANSLIM approach which was also a way to identify stocks in some objective, not subjective, fashion that had the characteristics of a winning stock. I do not use CANSLIM, but I have been affected by Mr. O'Neil's and the IBD approach.

Anyhow, Caroline wrote:

"Bob: thanks for your excellent write-up on Best Buy. You have a lot there!

Among my own stock picks is Sonoco Products (SON on NYSE)--founded in 1899 in Hartsville, S. C., and is a leader in packaging around the globe. It's another company like Fastenal in that the average person on

the street doesn't know the name, although this same average person comes into contact with the product nearly every day.

SON produces so many of the containers and packaging that consumers pick up at the grocery store-- Folger's coffee, Minute Maid orange juice, cookies, razor blades, etc. They are busy inventing new packaging devices for keeping food products fresh all the time.

Companies like Maytag, Amana, GE buy their packaging for refrigerators, stoves, microwaves--and the

consumer tosses Sonoco's products once the appliance is installed in the home. SON owns lots of forest acerage around the south, esp. S. C.Hugh McColl was ( or may still be) on the board--H. M. was behind the banking explosion--mergers, etc.--some years ago, and was responsible for making Charlotte a banking center of the south.

SON is NOT a glamous, go-go company making national headlines on the money shows. Slow and steady would describe the company.Just as people here know the name Fastenal, people in S. C. and the south know the name Sonoco. There is a plant in Wausau (I believe.)

It started out as the Southern Novelty Company, when they figured out how to make paper products out of pine trees. Early on they served the textile industry of North Carolina with cones, etc. for wrapping textiles on. A world lost on the south now!

More anon.

Bullish on SON, Caroline"

Caroline, thank you so much for writing. You have obviously done some work on this stock, and I am glad that you have done well and also have some family member(s) that work at Sonoco. I don't own any shares of this stock, but I would be happy to take a look at it and see what I can find out.

Most of your comments would fall into the Peter Lynch style of investing. Sort of like explaining what the company does and how all of its products are around us all the time. In addition, some investors like to follow certain people who may either be on the board or CEO's. Some of these gifted individuals do indeed seem to make a big difference on the fortune of companies.

However, my approach is closer to what might be called a "Quantitative Approach to Investing". While not using any computers, I am attracted to stocks not so much by what they do, but by how they are doing. For me, a quality investment is not determined by the quality of its products (although that can be helpful in the success of a company without a doubt), but by the quality of its financial results. For me, quality financial results is a matter of predictable consistency. I believe that a company that has been regularly been growing its revenue, earnings, and free cash flow, is likely to continue to do so into the future. This has also been referred to as earnings momentum.

But before completely digressing, let's take a quick look at Sonoco (SON) and Iu will let you know what I think from my perspective.

Sonoco (SON) closed at $36.75 on November 17, 2006. It was up $.02/share or 0.05% on the day.

Sonoco (SON) closed at $36.75 on November 17, 2006. It was up $.02/share or 0.05% on the day.

1. How did they do in the latest quarter?

On October 18, 2006, SON announced third quarter 2006 results. For the quarter ended September 24, 2006, net sales were up almost 6% to $932 million, from $881 milion in the same period last year. Net income climbed nicely, up 33% to $61.1 million, from $45.9 million the prior year. Diluted earnings per share were up 30% to $.60/share, from $.46/share last year. The company also pays a dividend and paid $.24/share this quarter, up $.01 from $.23/share paid in the same quarter the prior year. According to this report, the company beat expectations for earnings, but slightly missed on the revenue side.

2. How about longer-term results?

Reviewing the Morningstar.com "5-Yr Restated" financials on SON, we find that revenue has been slowly increasing from $2.5 billion in 2001 to $3.5 billion in 2005 and $3.6 billion in the trailing twelve months (TTM).

Earnings have also been steadily increasing from $.96/share in 2001 to $1.61/share in 2005 and $1.77/share in the TTM. The dividends, which were $.80/share in 2001, have been increased each and every year to $.91/share in 2005 and $.93/share in the TTM.

The number of shares outstanding has been increased slightly from 96 mnillion shares in 2003 to 99 million in 2005 and 99 million in the TTM.

Free cash flow has been positive, although not really increasing, with $219 million in 2003, dropping to $98 million in 2005, and rebounding to $191 million in the TTM.

The balance sheet is solid with $60.7 million in cash and $846.8 million in other current assets. When combined and compared to the $632.6 million in current liabilities, we find that the current ratio works out to a reasonable 1.43.

3. How about some valuation numbers?

If we review the numbers from the Yahoo "Key Statistics" page on SON, we find that this is a large mid-cap stock with a market capitalization of $3.67 billion. The trailing p/e is moderate at 19.11 with a forward p/e of 15.91. The PEG however, suggests that based on the 5 yr estimates, the stock is relatively richly valued, as it is a 2.37. Generally, I like PEG ratios of 1 to 1.5.

Recently I have looked more closely at the Price/Sales ratio. I read an excellent article by Paul Sturm last year who suggested that the importance of this ratio is relative to other stocks in the same group. Reviewing the information from the Fidelity.com eresearch website, we find that SON is in the "Paper & Paper Products" industrial group. Within that group, SON is reasonably priced with a Price/Sales ratio of 1. Leading this group is Kimberly-Clark (KMB) at 1.9, Avery Dennison (AVY) at 1.2, then Sonoco (SON) at 1, International Paper (IP) at 0.7, Smurfit-Stone Container (SSCC) at 0.4, and Bowater (BOW) at 0.3.

Another valuation parameter I like to review is the Return on Equity (ROE). I also like to compare this profitability measure with other companies in a similar business. Again, SON does fairly well with a return on equity of 15.2%. This is exceeded by Kimberly-Clark at 24.3%, Avery Dennison at 19.1%, and followed by International Paper at 3%, and two companies with losses: Smurfit-Stone at (10.1)%, and Bowarer with a negative (30.9)%. So by this measure, Sonoco also doesn't look too bad!

Finishing up with Yahoo, we find that there are 99.75 million shares outstanding with 96.54 million that float. As of 10/10/06, there were 488,310 shares out short representing 1.6 days of average volume (the short ratio). This is well below my idiosyncratic 3 day rule of significance.

The company does pay a nice dividend of $.96/share estimated going forward, yielding 2.6%. The last stock split was a 11:10 (or a 10% stock dividend), declared May, 13, 1998.

4. What does the chart look like?

Checking the Sonoco "Point & Figure" chart from StockCharts.com, we can see that the company which was basically moving sideways between 2001 and much of 2004, at a level around $20, broke through resistance in late 2004 and around $22 and has moved steadily higher to the $36 level now. The stock really has shown some strength since March, 2005.

5. Summary: So what do I think about Sonoco Products?

Quite frankly Caroline, this is an attractive stock. It isn't about what the company does, although that may contribute to the financial results. It isn't about the history, the geographic location, or who is on the board. It is simply about the steady increase in revenue, earnings, and positive free cash flow in the face of a solid balance sheet. In addition, the company has been keeping its number of shares stable and increasing it relatively significant dividend. The p/e isn't bad, but the PEG is rich. The Price/Sales and the ROE look reasonable, and the chart is encouraging.

I have to admit that this is a nice company from my perspective as well! I don't own any shares, but if it ever is making a nice move higher on the day i have a "permission slip" to add a new position, this might well be a stock i would be adding to my portfolio!

Thanks again for writing! If you have any other comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get the chance, drop by my Stock Picks Podcast Site, where I discuss some of the same stocks and topics I wrtite about here on the blog.

Bob

Newer | Latest | Older

On July 25, 2005, I posted Diagnostic Products (DP) on Stock Picks Bob's Advice when it was trading at $56.05. On September 5, 2006, Siemens announced that it had completed the acquisition of Diagnostic Products Corporation for $58.50/share. Thus, this stock pick would have appreciated $2.45 or 4.4% since posting.

On July 25, 2005, I posted Diagnostic Products (DP) on Stock Picks Bob's Advice when it was trading at $56.05. On September 5, 2006, Siemens announced that it had completed the acquisition of Diagnostic Products Corporation for $58.50/share. Thus, this stock pick would have appreciated $2.45 or 4.4% since posting.  On July 27, 2005, I picked Anteon Intl (ANT) fgor Stock Picks Bob's Advice when it was trading at $47.86/share. Anteon was acquired by General Dynamics for $55.50/share in June, 2006, for an effective gain on the stock pick of $7.64 or 16.0% since being "picked" on the blog.

On July 27, 2005, I picked Anteon Intl (ANT) fgor Stock Picks Bob's Advice when it was trading at $47.86/share. Anteon was acquired by General Dynamics for $55.50/share in June, 2006, for an effective gain on the stock pick of $7.64 or 16.0% since being "picked" on the blog. On July 28, 2005, I posted Advanced Neuromodulation Systems (ANSI) on Stock Picks Bob's Advice when it was trading at $48.40/share. ANSI was acquired by St Jude Medical for $61.25/share resulting in an effective appreciation of $12.85 or 26.5% since posting.

On July 28, 2005, I posted Advanced Neuromodulation Systems (ANSI) on Stock Picks Bob's Advice when it was trading at $48.40/share. ANSI was acquired by St Jude Medical for $61.25/share resulting in an effective appreciation of $12.85 or 26.5% since posting. Finally, on July 29, 2005, I posted Middleby Corporation (MIDD) on Stock Picks Bob's Advice when the stock was trading at $69.86/share. MIDD closed at $100.70 on December 1, 2006, for a gain of $30.84 or 44.1% since posting.

Finally, on July 29, 2005, I posted Middleby Corporation (MIDD) on Stock Picks Bob's Advice when the stock was trading at $69.86/share. MIDD closed at $100.70 on December 1, 2006, for a gain of $30.84 or 44.1% since posting. On November 6, 2006, Middleby announced 3rd quarter 2006 results. Net sales for the quarter rose 27.6% for the quarter, coming in at $103,239,000, up from $80,937,000 in the same quarter last year. Net income rose to $12.2 million or $1.48/share, up from $9.6 million or $1.19/share last year during the same period. The company exceeded estimates of $1.28/share for the quarter.

On November 6, 2006, Middleby announced 3rd quarter 2006 results. Net sales for the quarter rose 27.6% for the quarter, coming in at $103,239,000, up from $80,937,000 in the same quarter last year. Net income rose to $12.2 million or $1.48/share, up from $9.6 million or $1.19/share last year during the same period. The company exceeded estimates of $1.28/share for the quarter.

I was going through the

I was going through the  Looking longer-term at the

Looking longer-term at the

O.K., I was going to call it a night and get some sleep but there was something that I had been intending to get around to all afternoon and just hadn't. And that was writing a bit about Dress Barn (DBRN), a stock that I don't own any shares or options in, but a stock which made a great move today in a great trading environment.

O.K., I was going to call it a night and get some sleep but there was something that I had been intending to get around to all afternoon and just hadn't. And that was writing a bit about Dress Barn (DBRN), a stock that I don't own any shares or options in, but a stock which made a great move today in a great trading environment.  As is frequently the case, what drove the stock higher today was an earnings announcement. In particular, the company, after the close of trading yesterday, announced results for the

As is frequently the case, what drove the stock higher today was an earnings announcement. In particular, the company, after the close of trading yesterday, announced results for the

Blogging can be a lonely business. Bloggers sit before their keyboards and write and formulate ideas and communicate into cyberspace. We get consolation looking at our Sitemeters knowing that someone has stopped by and hope that they have enjoyed their visits. We enjoy linking to each others blog, creating a network that allows visitors to travel across the internet, blog-hopping almost as easily as the bar-hopper on Saturday night. And we find it sad when one of our own hangs it up for personal, family, or business reasons. This is the case with

Blogging can be a lonely business. Bloggers sit before their keyboards and write and formulate ideas and communicate into cyberspace. We get consolation looking at our Sitemeters knowing that someone has stopped by and hope that they have enjoyed their visits. We enjoy linking to each others blog, creating a network that allows visitors to travel across the internet, blog-hopping almost as easily as the bar-hopper on Saturday night. And we find it sad when one of our own hangs it up for personal, family, or business reasons. This is the case with

I first reviewed Wolverine Worldwide (WWW) on Stock Picks Bob's Advice on October 6, 2004, when it was trading at $28.90. WWW had a 3:2 stock split on February 2, 2005, making my effective stock pick price actually $19.27. WWW closed at $28.40 on November 24, 2006, for a gain of $9.13 or 47.4% since it was picked on the blog.

I first reviewed Wolverine Worldwide (WWW) on Stock Picks Bob's Advice on October 6, 2004, when it was trading at $28.90. WWW had a 3:2 stock split on February 2, 2005, making my effective stock pick price actually $19.27. WWW closed at $28.40 on November 24, 2006, for a gain of $9.13 or 47.4% since it was picked on the blog. I purchased 240 shares of WWW in my actual trading portfolio on April 19, 2006, with a cost basis of $23.55/share. With Friday's closing price of $28.40, this represents an unrealized gain of $4.85 or 20.6% since purchase. I have not sold any of my original purchase. According to my plan of selling 1/6th of my shares at a 30% gain, if the stock reaces 1.30 x $23.55 = $30.62, then I would plan on selling 40 shares and this would give me the "permission" to add a new position to my trading portfolio. On the other hand, since I have not sold any shares, if the stock would fall to an (8)% loss, or .92 x $23.55 = $21.67, then I would plan on selling all of my holding at that time.

I purchased 240 shares of WWW in my actual trading portfolio on April 19, 2006, with a cost basis of $23.55/share. With Friday's closing price of $28.40, this represents an unrealized gain of $4.85 or 20.6% since purchase. I have not sold any of my original purchase. According to my plan of selling 1/6th of my shares at a 30% gain, if the stock reaces 1.30 x $23.55 = $30.62, then I would plan on selling 40 shares and this would give me the "permission" to add a new position to my trading portfolio. On the other hand, since I have not sold any shares, if the stock would fall to an (8)% loss, or .92 x $23.55 = $21.67, then I would plan on selling all of my holding at that time.

On July 18, 2005, I

On July 18, 2005, I  On October 14, 2006, CTHR announced 3rd quarter 2006 results. Net sales increased 7% to $12.1 million, up from $11.3 million for the same quarter in 2005. Net income was flat at $2.2 million or $.12/share, unchanged from the $2.2 million or $.12/share reported in the same quarter the prior year.

On October 14, 2006, CTHR announced 3rd quarter 2006 results. Net sales increased 7% to $12.1 million, up from $11.3 million for the same quarter in 2005. Net income was flat at $2.2 million or $.12/share, unchanged from the $2.2 million or $.12/share reported in the same quarter the prior year. On July 19, 2005, I

On July 19, 2005, I

One of my favorite things about writing a blog about my experience with investing and some ideas that I have had about how to do this, is to receive feedback from readers who also are thinking about investing and approaches to managing their portfolios.

One of my favorite things about writing a blog about my experience with investing and some ideas that I have had about how to do this, is to receive feedback from readers who also are thinking about investing and approaches to managing their portfolios.  I was looking through the

I was looking through the

The longer I blog here, the more elaborate and complicated my entries are becoming. While that may be appreciated (?), it becomes more of an intimidation every time I face my keyboard, intent on another entry. Let me try tonight to write briefly (have I ever succeeded?), and tell you a bit about Jack in The Box (JBX), and why I think it deserves a spot on the blog.

The longer I blog here, the more elaborate and complicated my entries are becoming. While that may be appreciated (?), it becomes more of an intimidation every time I face my keyboard, intent on another entry. Let me try tonight to write briefly (have I ever succeeded?), and tell you a bit about Jack in The Box (JBX), and why I think it deserves a spot on the blog.

Sonoco (SON) closed at $36.75 on November 17, 2006. It was up $.02/share or 0.05% on the day.

Sonoco (SON) closed at $36.75 on November 17, 2006. It was up $.02/share or 0.05% on the day.