Stock Picks Bob's Advice

Wednesday, 31 October 2007

Ebix (EBIX)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

First of all, Happy Halloween to all of my good friends out there in internetland! (I found this great picture of pumpkins from Iron Kettle Farm in New York!) Don't eat too much candy tonight!

It was more treat than trick from the Fed today. A quarter-point cut in the federal funds rate was enough to push stocks higher with the Dow closing at 13,930.01, up 137.54, and the Nasdaq closing at 2,859.12, up 42.41 and the S&P 500 closing at 1,549.38, up 18.36 on the day.

With a strong day in the market today, I figured it would be easy to find one of 'my kind of stocks' moving higher, and I wasn't disappointed!

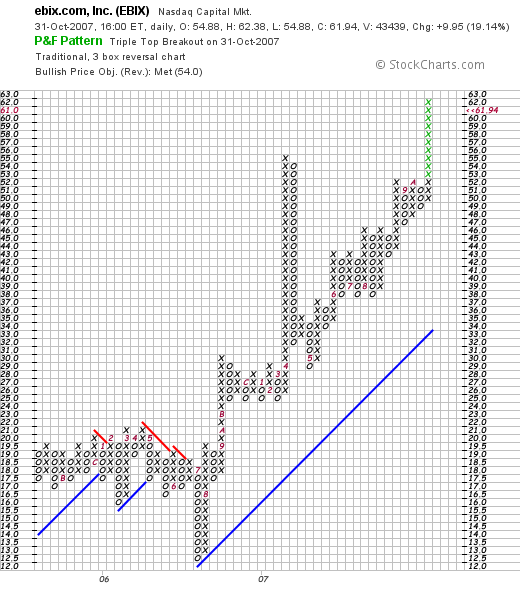

Checking the list of top % gainers on the NASDAQ today, I came across Ebix Inc. (EBIX), which closed at $61.94, up $9.95 or 19.14% on the day. I do not own any shares nor do I have any options on this stock. Let's take a closer look at this stock and I will explain why I think it deserves a spot on my blog and why

Checking the list of top % gainers on the NASDAQ today, I came across Ebix Inc. (EBIX), which closed at $61.94, up $9.95 or 19.14% on the day. I do not own any shares nor do I have any options on this stock. Let's take a closer look at this stock and I will explain why I think it deserves a spot on my blog and why

EBIX (EBIX) IS RATED A BUY

What exactly does this company do?

According to the Yahoo "Profile" on Ebix, the company

"... provides software and Internet-based solutions for the insurance industry. It focuses on the sale, customization, development, implementation, and support of its insurance carrier system product, known as Business Reinsurance and Insurance Company System (BRICS)."

How did they do in the latest quarter?

This morning before the opening of trading, EBIX announced 3rd quarter 2007 results. Revenue for the quarter ended September 30, 2007, came in at $11.81 million, a 62% increase over last year's $7.3 million figure. Net income came in at $3.69 million up 123% from $1.66 million or $1.00/diluted share, up from $.53/diluted share last year.

The 'street' saw this phenomenal result and bid up the price today accordingly!

How about longer-term results?

Checking the Morningstar.com "5-Yr Restated" financials on EBIX, we find that the company over the past 5 years has steadily grown revenue from $13 million in 2002 to $29 million in 2006 and $35 million in the trailing twelve months (TTM). Earnings have increased from $.20/share in 2002 to $1.90/share in 2006 and $2.40/share in the TTM. Meanwhile, the outstanding shares have increased from 2 million in 2002 to 3 million in the TTM.

Free cash flow has been positive and growing from $2 million in 2004, $5 million in 2005, $4 million in 2006 and $6 million in the TTM. The balance sheet, while numbers are small, is quite solid with $12 million in cash, which alone could pay off both the $10 million in current liabilities and the $700,000 in long-term liabilities combined. Calculating the current ratio, the company has $23 million in total current assets, which when divided by the $10 million in current liabilities yields a very satisfactory 2.3 figure.

What about some valuation numbers?

Reviewing the Yahoo "Key Statistics" on EBIX, we can see that this is a small cap stock with a market capitalization of only $202.48 million. The trailing p/e is moderate at 25.50, especially considering the remarkable growth in earnings just recorded. Without any estimates, we cannot calculate the PEG ratio.

Using the Fidelity.com eresearch website, we can see that in terms of the Price/Sales (TTM) ratio, the stock is reasonably valued with a ratio of 4.15 compared to the industry average of 7.54. The company is not quite as 'profitable' as its peers in terms of the Return on Equity (TTM) figure which comes in at 25.33% compared to the industry average of 33.64%.

Finishing up with Yahoo, we can see that there are only 3.27 million shares outstanding with 2.83 million of them that float. As of 10/10/07, there were 3,320 shares out short representing 1 trading day of volume or 0.1% of the float.

No dividends are reported on Yahoo and the last split was actually a reverse stock split of 1:8 reported on October 1, 2002.

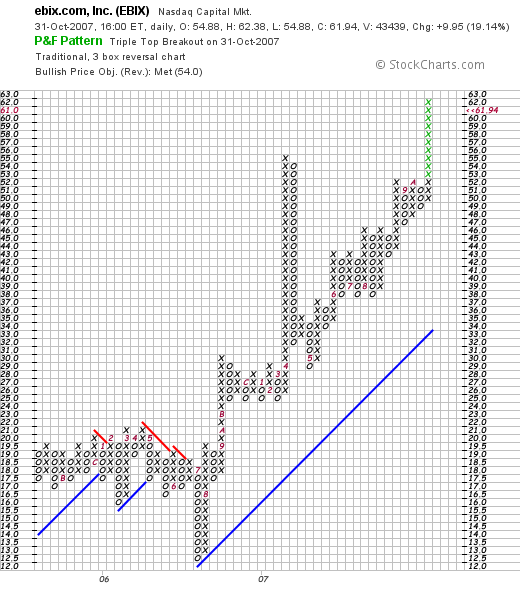

What does the chart look like?

Reviewing the "Point & Figure" chart on EBIX from StockCharts.com, we can see that the stock traded fairly 'sideways' between October, 2005 until August, 2006, beetween $20 and a low of $12.50. During the month of August, 2006, the stock broke out to the upside and has been moving strongly higher from this $20 level to the current $60 level where it is currently trading. This chart looks strong, if a bit over-extended, to me.

Summary: What do I think?

I actually first commented briefly on EBIX on May 24, 2007, when Doug S., a great reader and commenter on this blog wrote me about MLAB. This however, is my first in depth examination. I certainly like this stock and this company.

The company certainly reported terrific results. Blow-out growth in terms of both revenue and earnings expansion. A five year record of steady growth in revenue, earnings, positive free cash flow all while maintaining a very stable number of shares outstanding and a solid balance sheet. The stock is rather thinly traded and this can increase volatility both on the upside as it demonstrated today, or even on the downside as any large investor tries to unload shares. That is the underlying problem with purchasing shares in rather small companies which can also work to your advantage!

Thanks again for stopping by and visiting my blog. If you get a chance be sure and visit my Stock Picks Podcast Website, and you can listen to me ramble on about a few of the many stocks that I write up here on the blog. Check out my Covestor Page where Covestor has been analyzing my actual trading portfolio, and my SocialPicks Page where SocialPicks has been following my stock picks from this blog since the first of this year.

Thanks again for stopping by and visiting my blog. If you get a chance be sure and visit my Stock Picks Podcast Website, and you can listen to me ramble on about a few of the many stocks that I write up here on the blog. Check out my Covestor Page where Covestor has been analyzing my actual trading portfolio, and my SocialPicks Page where SocialPicks has been following my stock picks from this blog since the first of this year.

If you are so inclined, drop by and visit Prosper.com where I am starting to dip my toes into the water of personal lending eBay style. Be aware of the risks of these person-to-person unsecured loans, as well as the opportunities of higher interest rate returns on your investment.

Thanks again for visiting! Here is some candy corn for all of you 'Trick or Treaters!'. Enjoy the holiday and stay safe!

Bob

Tuesday, 30 October 2007

Interactive Intelligence (ININ) "Revisiting a Stock Pick"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I wanted to give a brief post this afternoon on Interactive Intelligence (ININ) and why I think

I wanted to give a brief post this afternoon on Interactive Intelligence (ININ) and why I think

INTERACTIVE INTELLIGENCE (ININ) IS RATED A BUY

First of all, ININ had a great day today in an otherwise mediocre market. ININ made the list of top % gainers on the NASDAQ, closing at $24.60, up $2.06 or 9.14% on the day. I do not have any shares nor do I have any options on this stock.

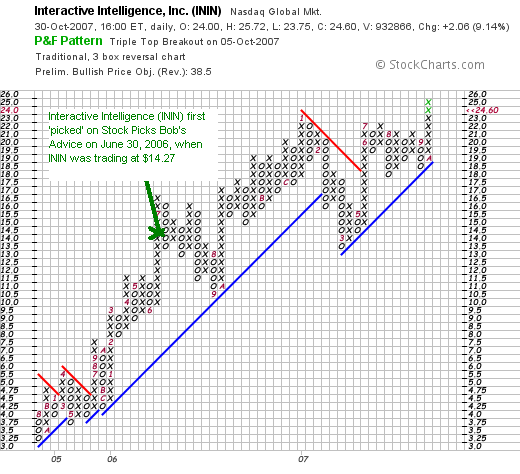

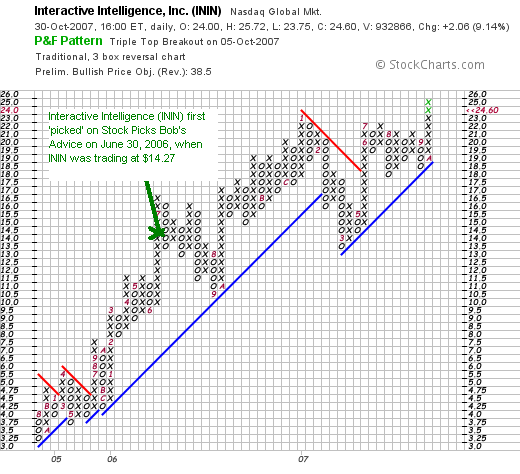

This is a 'revisit' for me, as I first posted Interactive Intelligence on Stock Picks Bob's Advice on June 30, 2006, when the stock was trading at $14.27.

Here is the 'point & figure' chart on ININ from StockCharts.com with my purchase price/date highlighted:

A couple more points to make. ININ reported their

3rd quarter 2007 results yesterday after the close of trading. Disregarding a one-time tax benefit in 2006, revenue came in at $28.7 million for the current quarter, up 29% over revenue of $22.2 million in 2006. Operating income climbed 23% to $2.1 million from $1.7 million in 2006 and non-GAAP earnings were $.17/share this quarter vs. $.12/share last year (taking out the one-time gain in 2006.)

The company beat expectations as analysts, according to Thomson Financial, expected profit of $.12/share on revenue of $26.9 million.

Finally, the Morningstar.com '5-Yr Restated' financials appear quite solid, with steady revenue growth, steady earnings growth, stable outstanding shares, steady improvement in free cash flow, and a solid balance sheet with no long-term liabilities reported at all.

This is the kind of stock I would be buying if I were buying shares today. In any case, thanks for dropping by! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. Be sure and visit my Stock Picks Podcast page, my Covestor page where my trading portfolio is analyzed, and my SocialPicks page where that website assesses the quality of my stock picks--at least since early this year.

Bob

Saturday, 27 October 2007

"Looking Back One Year" A review of stock picks from the week of May 1, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

It sounds trite to comment that I am amazed that it is the weekend once again and it is time to write up some reviews. I don't know about you, but my weeks are so busy with work and family that I seem to turn around and there goes another week, another month, another year.

Anyhow, it is a beautiful fall day here in Wisconsin. I had a little time to get outside and wrap some of our smaller trees with some PVC so that the deer don't abuse them too badly. Maybe you don't have deer near where you live. But they come down out of a nearby woods and eat everything in sight. Beautiful animals. But boy what an appetite!

Oh I am digressing once again. I suppose you came here to find out about stocks and not about my garden adventures :). But what I do here on weekends is to write up reviews of past stock picks. It is enough to more or less shoot my mouth off about different stocks on this blog, but the responsibility to you, the reader, requires me to dig back into my past entries and find out how all of those stocks turned out. Hopefully, from this analysis, we can identify in some fashion what criteria appear to be working and what aren't. Last week I reviewed stocks from the week of April 24, 2006. Let's move a week ahead and take a look at the stocks "picked" during the week of May 1, 2006.

As I also like to point out to all of you readers, is that these reviews assume a buy and hold strategy for investing. In fact, I practice and employ a disciplined selling strategy that requires me to sell stocks if they incur small losses

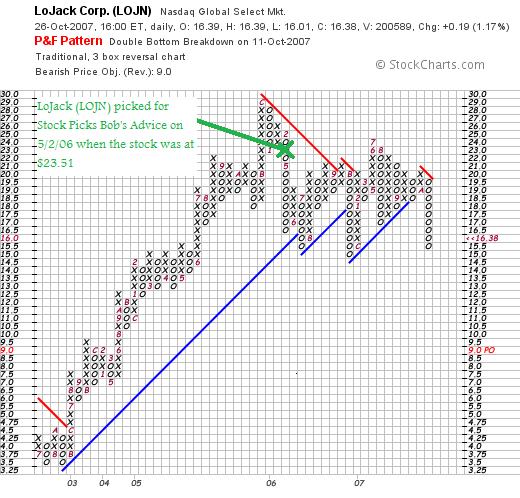

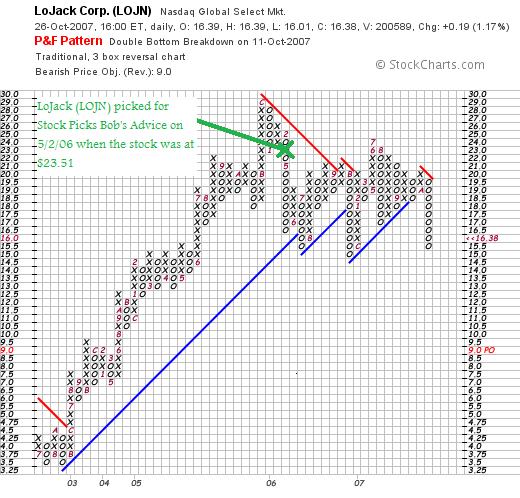

On May 2, 2006, I posted LoJack on Stock Picks Bob's Advice when the stock was trading at $23.51. LOJN closed at $16.38 on October 26, 2007, for a loss of $(7.13) or (30.3)% since posting.

On August 1, 2007, LoJack (LOJN) announced 2nd quarter 2007 results. Revenue for the quarter ended June 30, 2007, climbed 3% to $58.2 million from $56.7 million in the same quarter the prior year. Net income was up 22% to $6.7 million or $.35/diluted share from $5.5 million or $.29/diluted share the prior year.

The Morningstar.com "5-Yr Restated" financials page is intact.

However, with the anemic growth in revenue from the latest quarterly report, the weak-appearing 'point & figure' chart from StockCharts.com,

LOJACK (LOJN) IS RATED A HOLD

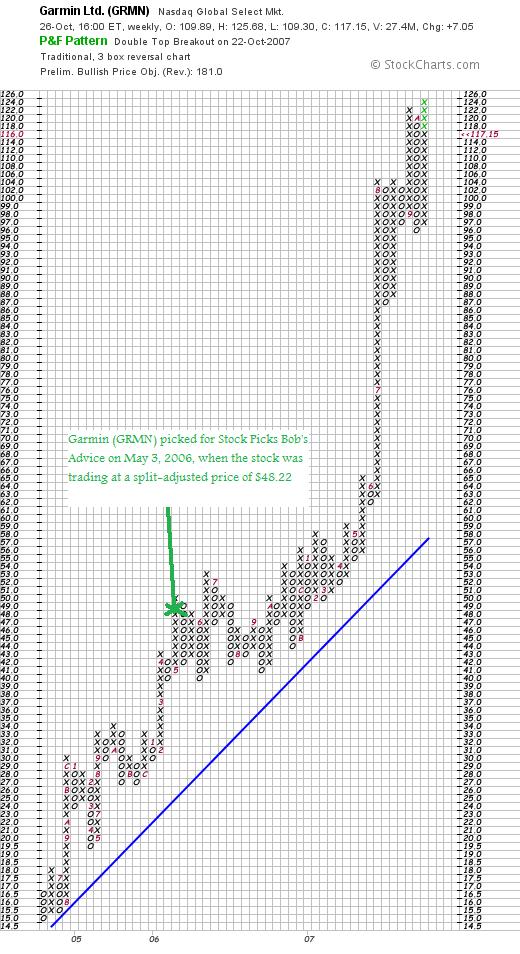

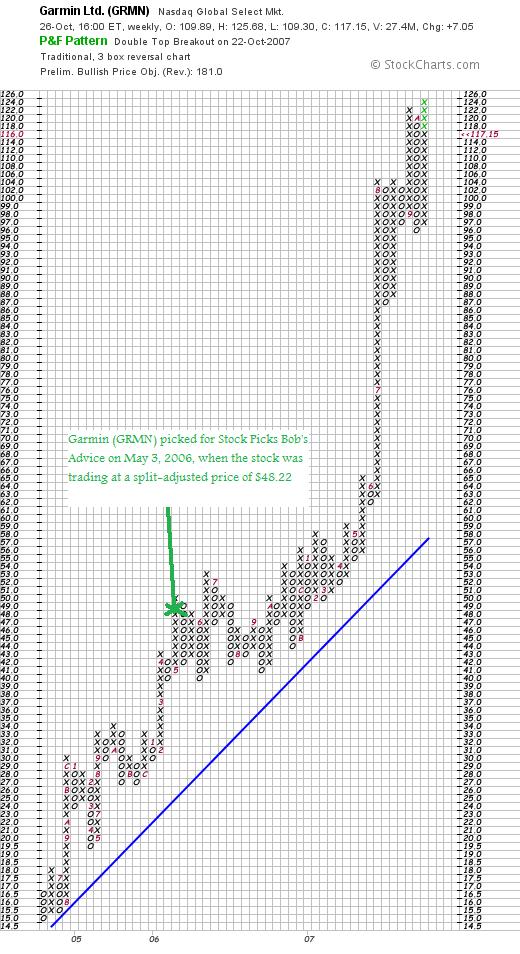

On May 3, 2006, I posted Garmin (GRMN) when the stock was trading at $96.43. Garmin stock split 2:1 on August 16, 2006, making my effective stock price actually $48.22. Garmin closed at $117.15 on October 26, 2007. This gives my pick a gain of $68.93 or 142.9% since posting.

On August 1, 2007, Garmin (GRMN) announced 2nd quarter 2007 results. Revenue came in at $742 million, up 72% from $433 million in the same quarter the prior year. Net income, excluding foreign currency translation, increased to $219.6 million, up sharply from $120.8 million the prior year. Net income per diluted share (GAAP) came in at $.98/share, up from $.56/share last year.

On August 1, 2007, Garmin (GRMN) announced 2nd quarter 2007 results. Revenue came in at $742 million, up 72% from $433 million in the same quarter the prior year. Net income, excluding foreign currency translation, increased to $219.6 million, up sharply from $120.8 million the prior year. Net income per diluted share (GAAP) came in at $.98/share, up from $.56/share last year.

Garmin beat expectations with earnings of $.98/share (analysts were expecting $.74/share) and came in with revenue of $742.5 million (analysts were expecting revenue of $645.7 million per Thomson Financial.)

The company also raised guidance for 2007 to earnings above $3.15/share on revenue of at least $2.8 billion. Analysts have been projecting earnings of $2.90/share on revenue of $2.62 billion.

With the fabulous quarterly report, the strong 'point & figure' chart from StockCharts.com and the beautiful Morningstar.com "5-Yr Restated" financials page,

GARMIN (GRMN) IS RATED A BUY

On May 6, 2006, I 'revisited' CNS (CNXS) when the stock was trading at $24.14. CNXS was purchased by GlaxoSmithKline plc on December 19, 2006, for $37.50 in cash. This represented a gain of $13.36 or 55.3% since my 'pick'.

On May 6, 2006, I 'revisited' CNS (CNXS) when the stock was trading at $24.14. CNXS was purchased by GlaxoSmithKline plc on December 19, 2006, for $37.50 in cash. This represented a gain of $13.36 or 55.3% since my 'pick'.

Since CNS (CNXS) is no longer traded, I do not have an opinion on this stock :).

So how did I do that week back in May, 2006. Pretty darn good actually! I had one stock pick decline moderately, one that shot to the moon, and one that made a very nice move and got acquired in the process! On average, these three stocks had a gain of 56.0% since posting.

Please remember that past performance is not a guarantee or a reliable indicator of future performance, but it was a pretty good performance, don't you think?

Thanks again for visiting! If you get a chance be sure and visit my Covestor Page where my actual trading portfolio is reviewed and my SocialPicks page where all of my picks from the first of the year have been evaluated, and don't forget to visit my Podcast Page, and if I get a chance I shall be doing a podcast this week!

Have a great week trading!

Bob

Posted by bobsadviceforstocks at 2:29 PM CDT

|

Post Comment |

Permalink

Updated: Sunday, 28 October 2007 9:24 PM CDT

Graham Corporation (GHM) "A Reader Suggests a Stock Pick!"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I am very fortunate to have readers like Doug S., who regularly drops me a line with mostly great ideas and comments. I cannot answer all of his emails, and I look forward to his and any you may write, just drop me a line at bobsadviceforstocks@lycos.com if you would like to email me.

I am very fortunate to have readers like Doug S., who regularly drops me a line with mostly great ideas and comments. I cannot answer all of his emails, and I look forward to his and any you may write, just drop me a line at bobsadviceforstocks@lycos.com if you would like to email me.

Doug generally seems to invest and pick stocks much in the same fashion as I have been doing. He wrote me an email this morning about a stock that I believe deserves a spot on this blog. He wrote:

"GHM....I took a page out of both our books when I purchased this mid session yesterday. Talk about relative strength/momentum; talk about earnings; talk about no shorts or analysts to mess things up; what's not to

love? This should go to the moon!"

Well Doug, I don't know if this stock will go as high as the cow that jumped over the moon but I really liked the numbers so let's take a closer look at this stock and I will share with you and my readers why I agree that this is the kind of stock that may well reach stellar heights :).

Well Doug, I don't know if this stock will go as high as the cow that jumped over the moon but I really liked the numbers so let's take a closer look at this stock and I will share with you and my readers why I agree that this is the kind of stock that may well reach stellar heights :).

First of all, I guess that Doug owns shares of Graham (GHM) as per his letter. I personally do not own any shares nor do I have any options on this stock. Graham (GHM) indeed had a fabulous day yesterday closing at $58.25, up $12.65 or 27.74% on the day!

Let's review the stock and I will show you why

GRAHAM CORPORATION (GHM) IS RATED A BUY

What exactly does this company do?

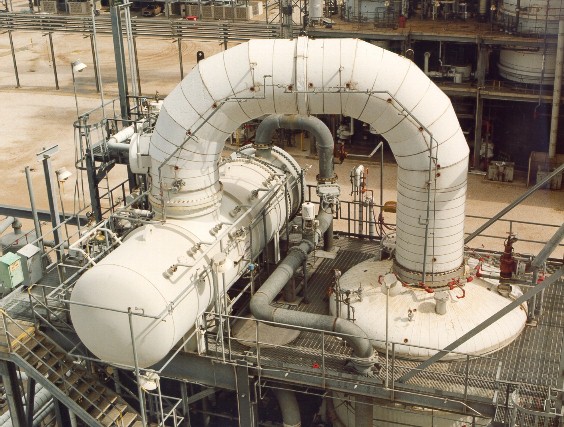

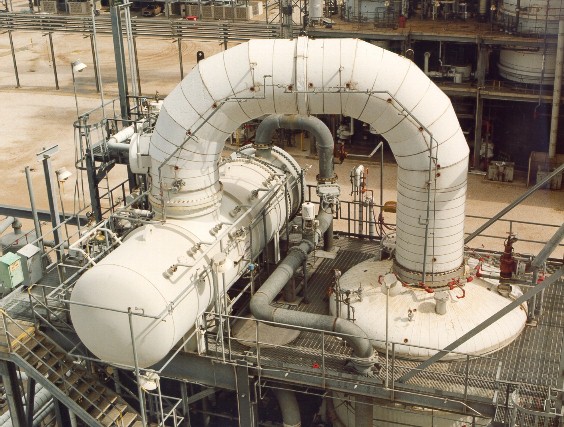

According to the Yahoo "Profile" on Graham (GHM) the company

"engages in the design, manufacture, and sale of vacuum and heat transfer equipment used in the chemical, petrochemical, petroleum refining, and power generating industries worldwide. Its products include steam jet ejector vacuum systems; surface condensers for steam turbines; vacuum pumps and compressors; various types of heat exchangers, including helical coil heat exchangers marketed under the Heliflow name; and plate and frame exchangers. These products are available in various metal and non-metallic corrosion resistant materials."

How did they do in the latest quarter?

Like so many of the entries on this blog, it was the announcement of quarterly earnings that drove this stock price higher. Friday, October 26, 2007, before the opening of trading, Graham (GHM) announced 2nd quarter 2008 results.

For the quarter ended September 30, 2007, revenues came in at $23.1 million, a 45% increase over last year's $15.9 million result. Net income for the quarter came in at $4.4 million up over 600% from last year's $563,000. On a per diluted share basis this worked out as $1.10, up over 600% from last year's $.14/share. The market liked what it read and bid the stock price up strongly on Friday!

To add to the enthusiasm behind investors' pursuit of this stock was the announcement of a 5:4 stock split in the form of a 25% stock dividend and the increase in the dividend to an after-split $.03/share amount.

What about longer-term results?

For this information, let's take a look at the "5-Yr Restated" financials on Graham (GHM) from Morningstar.com. Here we can see that the company actually had a dip in revenue from 2003 when they had $45 million in sales to $38 million in 2004. However, since 2004, revenue has steadily improved to $66 million in 2007 and $71 million in the trailing twelve months (TTM)

Earnings, which showed a loss in 2004 of $(.40), dipped even further to a $(.90)/share loss in 2005, then turned profitable at $1.00/share in 2006, increased to $1.50/share in 2007 and $1.80/share in the TTM. The company has paid dividends at $.10/share since 2003 and as reported above, is now increasing its dividend as well. The outstanding shares have been very stable with 3 million reported in 2004, and increasing to 4 million in the TTM.

Free cash flow which was negative at $(1) million in 2004 and $(5) million in 2005, turned positive at $5 million in 2006, $4 million in 2007, and $11 million in the TTM.

The balance sheet is solid with $1 million in cash and $40 million in other current assets, easily covering the $16.3 million in current liabilities yielding a current ratio of 2.52.

What about some valuation numbers?

Reviewing the Yahoo "Key Statistics" on Graham (GHM), we find that this is a small cap stock with a market capitalization of only $227.82 million. The trailing p/e is a moderate 31.59, with a forward p/e (fye 31-Mar-09) estimated at 23.87. No PEG is reported.

According to the Fidelity.com eresearch website, the company is quite profitable with a return on equity (TTM) of 33.89, compared to an industry average of 22.39%.

Finishing up with Yahoo, we again see that there are 3.91 million shares outstanding with 3.62 million of them that float. As of 10/10/07, there were only 4,170 shares reported out short representing a short ratio of only 0.1. As also noted, the company pays a dividend of $.10/share (to be increased) yielding 0.2%. The last stock split was a 2:1 stock split back on October 4, 2005.

What does the chart look like?

Reviewing the 'point & figure' chart on Graham (GHM) from StockCharts.com, we can see that the stock really traded sideways between July, 2005 and May, 2007, when the stock was stuck in a trading range between $12 and $19.50. However, in May, 2007, the stock broke out of this range and moved higher from the $18 level to its current level near $60.

Summary: What do I think?

Well, I think that Doug has once again introduced me to a great stock that fits all of my own peculiar criteria for stock selection. The company had a great move higher yesterday, terrific earnings announced with an increased dividend and stock split to top it off, and has a several year history of solid growth. On top of this, the chart looks very strong, and I do like these companies on the AMEX that seem to escape attention like Bolt (BTJ) until they announce a superb quarter and everyone tries to pile on to the stock which in this case, doesn't have many shares outstanding anyhow.

Thanks again for commenting, visiting, and contributing to the blog Doug!

And thanks to all the rest of you for visiting!

If you have any comments or questions, please feel free to leave them right on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Podcast Site, or my Covestor page where my actual trading portfolio is monitored and evaluated, or my SocialPicks page where my stock picks from the first of the year are monitored.

Finally, if you have any interest in a different sort of investment vehicle, visit Prosper.com where you can bid on unsecured loans and earn above-average interest rates. This eBay style website was started by the E-Loan founder, but does have very significant risks involved. So be careful, spread out your risk by lending in multiple loans, stick to higher rated loans for less risk, and be aware of the potential of loss!

(I know that some of you readers have indeed signed up and I thank you for doing so. Please share with me and with my readers your experiences with Prosper.com so that we all can develop a better feel for the potential of this site as well and the risks and benefits entailed.)

I hope you all are having a wonderful weekend. If I get a chance, I shall get to my 'weekend review' and perhaps check out one of my actual holdings to see how things are doing in that department.

Regards.

Bob

Thursday, 25 October 2007

Covance (CVD), Kinetic Concepts (KCI), and Abaxis (ABAX) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I wanted to get this quick update out today, but one thing led to another, and you know the story! Anyhow, my Covance stock hit a sale point and I sold 1/7th of my 119 shares or 17 shares today at $83.67. These shares were originally purchased 4/9/07 at a cost basis per share of $62.61. Thus, this represented a gain of $21.06 or 33.6% since purchase.

COVANCE (CVD) IS RATED A BUY

If you are new to my strategy, I sell my gaining stocks slowly and partially--currently selling 1/7th of my remaining shares---at targeted appreciation points. I use gains at 30, 60, 90, 120, 180, 240, 300, 360, 450%...etc. as points to sell shares. I also use these sales as "signals" that the market is more or less 'healthy' and that I have 'permission' to add a new position if I am below my maximum holding. Thus, being at 14 positions, below my maximum of 20, I set out to find a new holding.

With a lot of my assets tied up in my KCI position, I figure I had made my point with the stock up about a point, and unloaded my additional 280 shares of KCI at $59.07. I had purchased these shares at $58 the prior day and if I didn't have as heavy a margin level as I do, I would maybe hang in there, but I wanted to add that 'new position' and went ahead and sold with a small gain.

KINETIC CONCEPTS (KCI) IS RATED A BUY

Looking through the list of top % gainers today, I came across an old favorite, Abaxis (ABAX), which closed at $29.38, up $5.19 or 21.46% on the day today. I purchased 210 shares today when the stock was trading at $28.24, so I also made about a point already on this purchase. ABAX stock was up strongly today on the back of 2nd quarter 2008 results that were announced after the close of trading yesterday.

ABAXIS (ABAX) IS RATED A BUY

I mention "old favorite" on Abaxis, as I recently wrote up the stock on January 27, 2007, when the stock was trading at $20.57. This was not my first review, as I also discussed Abaxis on September 26, 2003, when the stock was trading at $13.40.

Thanks so much for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Covestor Page where my trading portfolio is analyzed and reviewed, my SocialPicks page where all of my picks from the first of the year are also evaluated. If you are into podcasts, I have a good number of podcasts on varying stocks from the past two years kept on my Stock Picks Podcast page.

If you are interested in a new investment idea that may involve some additional risk, check out Prosper.com, a website that my nephew introduced me to, that involves some considerable risk with unsecured loans that are bid on eBay style in a sort of Dutch auction by multiple investors, most of whom are putting up $50 to be part of the lending consortium. While considerable risks are present, it is possible to widely spread out your loans and the returns are impressive unless individual borrowers default. So do your homework if you decide to pursue that website.

Until the end of the year, if you sign up you can receive $25 as a bonus and I also receive credit for referring you to the website! Definitely win-win.

Thanks again for visiting! Good-luck on Friday!

Bob

Wednesday, 24 October 2007

Snap-On (SNA)

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

I wanted to try to be brief this evening as I actually have some plans to attend to! I wanted to review Snap-on (SNA), a stock that I do not own any shares or options, but a stock that I do believe belongs on the blog.

I wanted to try to be brief this evening as I actually have some plans to attend to! I wanted to review Snap-on (SNA), a stock that I do not own any shares or options, but a stock that I do believe belongs on the blog.

SNAP-ON (SNA) IS RATED A BUY

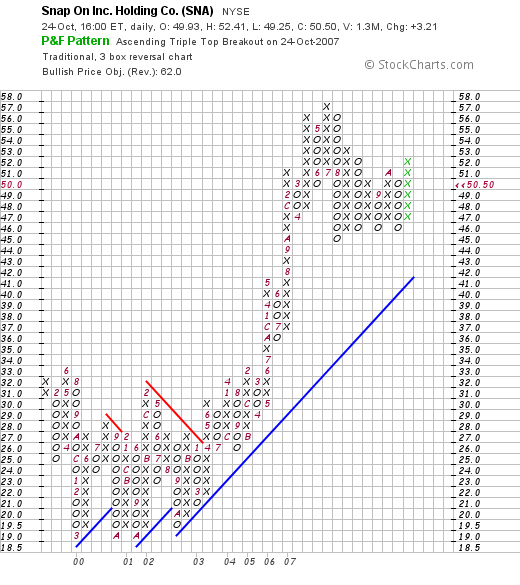

First of all, Snap-On made the list of top % gainers on the NYSE today, closing at $50.50, up $3.21 or 6.79% on the day. The stock rose today after the company announced strong 3rd quarter 2007 results, with increasing revenue and earnings. The company beat expectations of analysts both on earnings and revenue results.

Longer-term, the company has virtually a perfect

Morningstar.com "5-Yr Restated" financials page, with steady revenue growth, increasing earnings, increasing dividend, stable outstanding shares, growing free cash flow and a solid balance sheet.

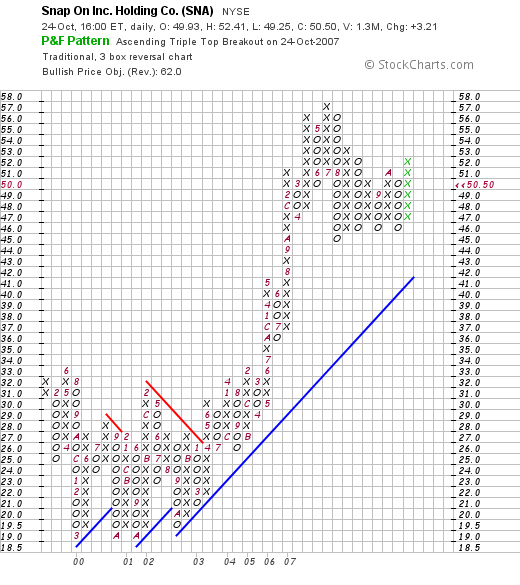

Finally, the 'point & figure' chart from StockCharts.com looks strong with a steady recent price appreciation.

Valuation-wise, per the

"key statistics" from Yahoo, the company has a trailing p/e of 20, a PEG of 1.43, and minimal shares out short.

This is the kind of stock that deserves a spot on my blog, if not a place in my portfolio in the future!

Thanks so much for dropping by! I hope you don't mind this brief entry; I may well move towards briefer posts and let you do some of the grunt work with the links :).

If you get a chance, drop by and visit my Covestor Page, my SocialPicks page, and if you are interested, take a look at Prosper.com, the person-to-person lending website that I have started getting involved with. Be sure to be aware of all the risks involved in participating in unsecured loans that can also default, but you have to admit that this website is pretty amazing and a preview of what the Internet can offer all of us in the future!

Bob

Tuesday, 23 October 2007

Kinetic Concepts (KCI) "Trading Transparency--Breaking All of My Rules!"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Every once in awhile, I break all of my rules and do something like I have done in the past, go with my gut :). My trading portfolio is down today because of a drop in Kinetic Concepts (KCI) which as I write, is trading at $58.23, down $(4.77) or (7.57)% on the day.

But why?

Early this morning the company released 3rd quarter 2007 results. As reported:

NEW YORK (AP) -- Shares of medical technology company Kinetic Concepts Inc. sank Tuesday despite strong third-quarter earnings and sales, and an increased full-year outlook.

Before trading began, the company said its profit grew 21 percent for the quarter as sales of its vacuum assisted closure devices increased. The results surpassed analyst expectations, and Kinetic Concepts raised its fiscal 2007 profit and sales forecasts.

The San Antonio company now expects to earn between $3.20 and $3.30 per share for the year, on $1.58 billion to $1.6 billion in revenue.

However, shares dropped $6.41, or 10.2 percent, to $56.59.

The stock price has nearly doubled in the last year, and Jefferies & Co. analyst Mark Richter said investors who have taken short positions may be selling. The company reported a large profit margin increase during the quarter, and sales of its products, which treat bed sores and lung fluid buildup, will stay strong, he said.

"We believe the upward guidance revision will prove conservative," he said in a telephone interview. "All things from our perspective demonstrated a very good quarter, so we are surprised to see the sell off."

I mean the company reported good results, beat expectations, and then raised guidance. For me that's about as 'good as it gets'. I haven't yet sold any shares of my initial position. So as this stock declined, on what appeared to me to be a totally irrational basis (?), I chose to use my brain for a change (?) and added 280 shares (!) to my 140 share postion of Kinetic Concepts. I purchased the shares at $57.99.

KINETIC CONCEPTS (KCI) IS RATED A BUY

Wish me luck. I always reserve the right to act arbitrarily in managing my portfolio. Usually, it is exactly the wrong thing to do. But what is a person supposed to do when the market takes good news and turns it inside out? Maybe I am just missing something. Then again, time will tell, won't it!

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Posted by bobsadviceforstocks at 2:15 PM CDT

|

Post Comment |

Permalink

Updated: Tuesday, 23 October 2007 2:21 PM CDT

Monday, 22 October 2007

Immucor (BLUD) "Trading Transparency"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

A few moments ago my Immucor (BLUD) stock hit a sale point at an (8)% loss. I sold 154 shares at $34.90. These shares were purchased only a couple of weeks ago, on October 4, 2007, at a cost basis of $38.02. Thus, I had a loss of $(3.12)/share or (8.2)% since purchase.

Since this was a sale on "bad news", meaning a loss, I shall not be reinvesting the proceeds, but instead moving this towards cash (and actually paying down the margin a bit). I shall be waiting for a sale on "good news" to be adding a replacement to my portfolio. I am now down to 14 positions, under my maximum of 20 and well above my minimum of 5 positions.

Hopefully, this system of 'listening to my own holdings' and moving towards cash makes sense at this time. As my stocks drop in price, I feel as if I am really the amateur investor that I talk about non-stop. But I am glad that I have some sort of disciplined approach to deal with all of this. I know that in the past I would have been over-reacting with each swing of the market. Time will tell how successful I am in this strategy; wish me luck.

With this sale of my own position of Immucor, I shall be reducing the rating on the stock:

IMMUCOR (BLUD) IS RATED A HOLD

I am as guilty as the analyst who writes hold and means sell. I do this because my sale is not based on anything fundamentally wrong with the stock. It is simply that my timing wasn't good. Thus, if you don't have a loss in the stock, I indeed would otherwise be recommending a "hold".

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com.

Bob

Sunday, 21 October 2007

NVR (NVR) "Long-Term Review #14"

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

One of my weekend tasks that I like to try to accomplish has been to look way back into the early posts of this blog and see how they have turned out. Of course, just like my 'looking back one year' reviews, these assessments assume a buy and hold approach to my picks. In practice I advocate and employ a very disciplined, idiosyncratic process of selling stocks quickly on declines and slowly and partially on appreciation. This difference in managing a holding would of course affect the performance of any stock actually purchased. But for the ease of review, let's take a look at a pick from the 'early days' of this blog and see how the company and the stock is doing now!

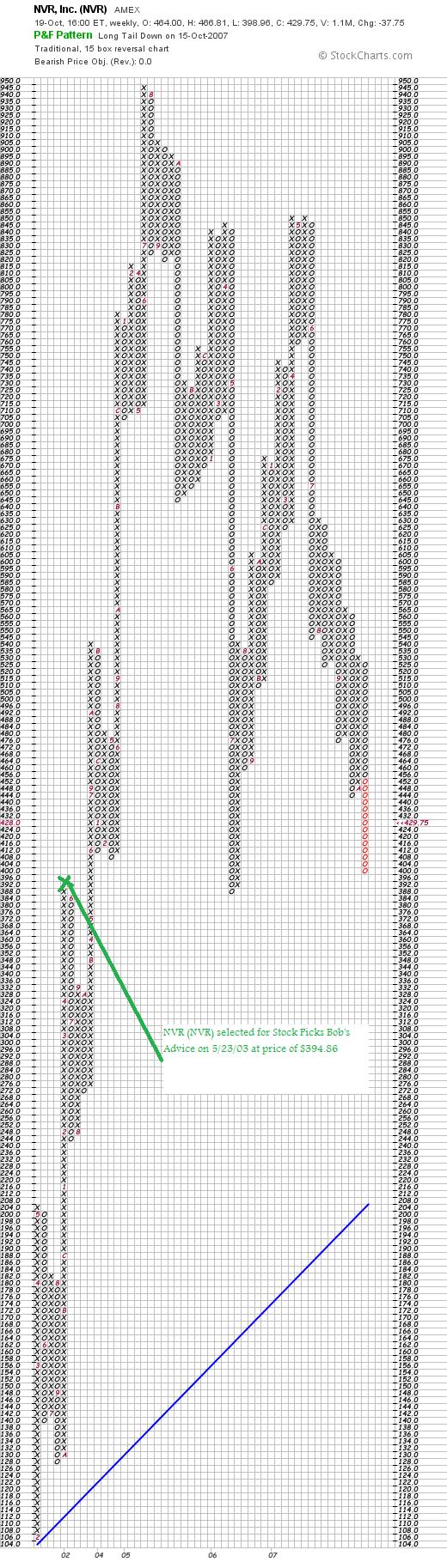

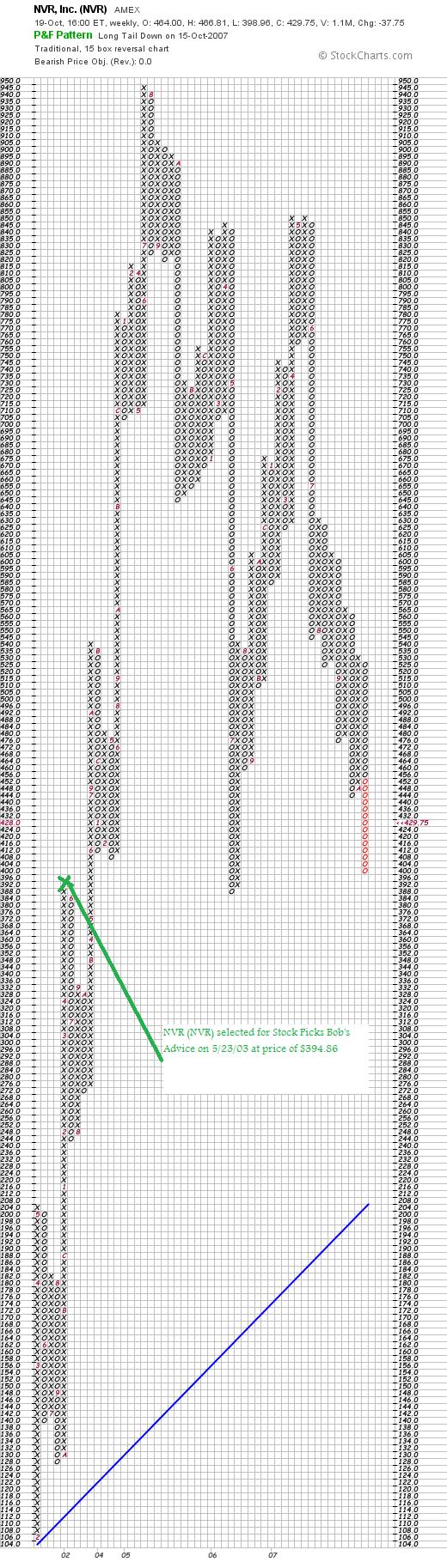

Last week I reviewed my stock pick #13, Red Robin Gourmet Burger (RRGB); on the same day I also reviewed NVR, a stock that I selected for this blog on May 23, 2003, when the stock was trading at $394.86, almost 4 1/2 years ago. In the meantime, this real estate related stock experienced the boom of that market climbing into the $900 range, and recently has suffered the collapse of the same market, trading back just over where it was picked. NVR closed at $429.75 on October 19, 2007, for a gain of $34.89 or 8.8% since the original post. Here is what I wrote:

Last week I reviewed my stock pick #13, Red Robin Gourmet Burger (RRGB); on the same day I also reviewed NVR, a stock that I selected for this blog on May 23, 2003, when the stock was trading at $394.86, almost 4 1/2 years ago. In the meantime, this real estate related stock experienced the boom of that market climbing into the $900 range, and recently has suffered the collapse of the same market, trading back just over where it was picked. NVR closed at $429.75 on October 19, 2007, for a gain of $34.89 or 8.8% since the original post. Here is what I wrote:

"May 23, 2003

NVR, Inc. (NVR) (AMEX stock)

It is getting late in the session...I guess you could say it is long in the tooth and I need something better for all of you stock fans.

Didn't see much on the NYSE or NASDAQ but on the Amex list we have one called NVR, Inc. According to Morningstar, NVR "builds single-family homes, condominiums, and townhouses, primarily in the Washington, D.C. area. The company builds about 3,000 homes per year ranging in price from $70,000 to $640,000 and averaging $182,000." NVR "also provides morgage financing through 23 offices in 15 states." A little bit of overlap with our New Century Financial I guess....but not much.

Not a cheap price, but not at the Berkshire Hathaway level (!), but today stock is trading at $394.86 (!) up $16.36 at 1:32 pm (CST) or a 4.32% increase.

Driving this stock higher was the release on April 16th of the first quarter result ending March 31, 2003. They announced that total revenue increase to $743 million compared to $692.2 million last year, and earnings per share exceeded last year's result by 24%.

Looking at the last 5 years, we find that revenue has grown from 1.5 billion in 1998, 2.0 billion in 1999, 2.3 billion in 2000, 2.6 billion in 2001, and 3.1 billion in 2002.

Free cash flow, as reported in Morningstar, has grown from 189 million in 2000, to 149 million in 2001 (a decrease), then back up to 369 million in 2002. This company really generates money!

Market cap is 2.7 billion, no dividend is paid, and the p/e is a rather cheap 10.94. Just the PRICE is high! (Just buy less shares). I do not own any shares of this company...but it looks like a nice investment to me! Happy investing and a Peaceful Memorial Day to all my friends! Bob"

Let's take a closer look at NVR today.

NVR just posted their 3rd quarter 2007 results on October 19, 2007. For the quarter ended September 30, 2007, revenue declined (17)% to $1.29 billion, down from $1.55 billion in the prior year. Earnings for the quarter were $91.1 million or $15.26/diluted share, down 22% from $129.3 million or $19.63/diluted share.

NVR just posted their 3rd quarter 2007 results on October 19, 2007. For the quarter ended September 30, 2007, revenue declined (17)% to $1.29 billion, down from $1.55 billion in the prior year. Earnings for the quarter were $91.1 million or $15.26/diluted share, down 22% from $129.3 million or $19.63/diluted share.

The company actually beat expectations on earnings which had been expected to come in at $11.97/share, but missed expectations on sales which were expected to be $1.32 billion.

Looking at the 'point & figure' chart on NVR from StockCharts.com, we can see the wild ride this stock has had with the stock climbing sharply after the purchase to reach a high of $945 in July, 2005, only to start a gradual decline to the current levels.

With the weak quarterly report, the overal weakness in the housing industry, and the unimpressive stock chart,

NVR (NVR) IS RATED A SELL

Thanks again for stopping by and visiting! If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, be sure and visit my Stock Picks Podcast Site (where I need to post a new show soon!), my Covestor Page which analyzes my actual stock holdings in my trading account, and my SocialPicks page where my stock picks are evaluated since the first of this year.

Have a successful week trading everyone!

Bob

Saturday, 20 October 2007

"Looking Back One Year" A review of stock picks from the week of April 24, 2006

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

As one of my weekend 'tasks' I like to go back into the archives of this blog and look at past stock picks. For the ease of analysis, this review assumes an equal $ purchase of these stocks and a 'buy and hold' strategy after their purchase. In fact, I advocate and practice a very disciplined investment strategy that requires me to sell stocks quickly and completely on losses, and slowly and partially on targeted appreciation levels. This difference in strategy would certainly affect any actual performance and this should be taken into consideration when considering this review.

My last 'review' was last weekend when I reviewed the picks from the week of April 17, 2006. Let's go ahead a week and take a look at stocks picked during the week of April 24, 2006.

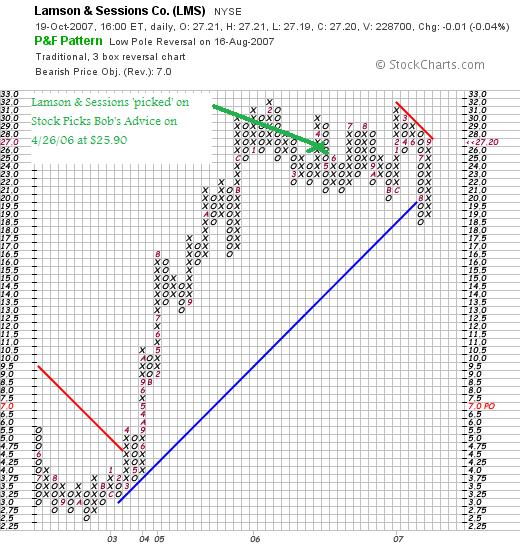

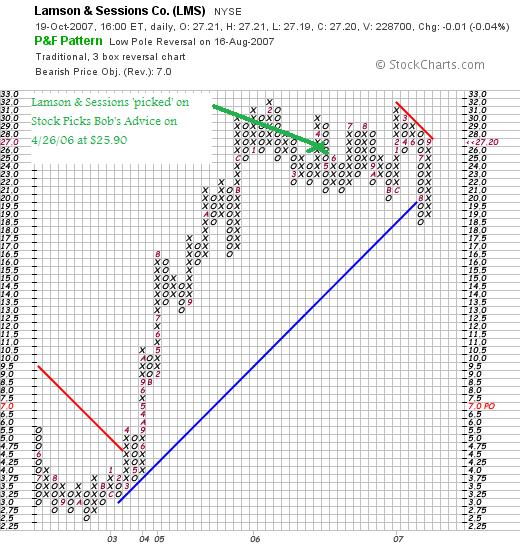

On April 26, 2006, I posted Lamson & Sessions (LMS) on Stock Picks Bob's Advice when the stock was trading at $25.90. LMS closed at $27.20 on October 19, 2007, for a gain of $1.30 or 5.0% since the 'pick'.

On April 26, 2006, I posted Lamson & Sessions (LMS) on Stock Picks Bob's Advice when the stock was trading at $25.90. LMS closed at $27.20 on October 19, 2007, for a gain of $1.30 or 5.0% since the 'pick'.

On August 12, 2007, it was announced that Lamson & Sessions would be acquired by Thomas & Betts (TNB) for $27/share.

In light of the upcoming acquisiton of this stock, and with the stock trading essentially at the acquisition price,

LAMSON & SESSIONS (LMS) IS RATED A HOLD

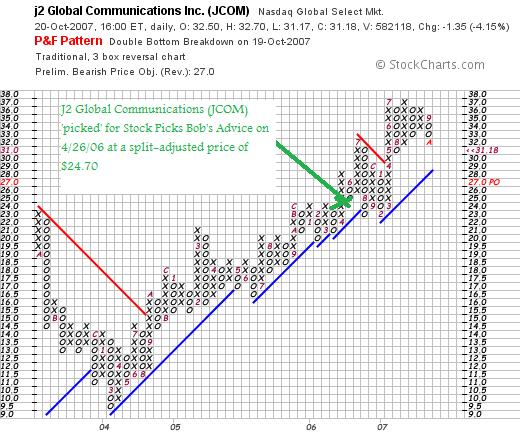

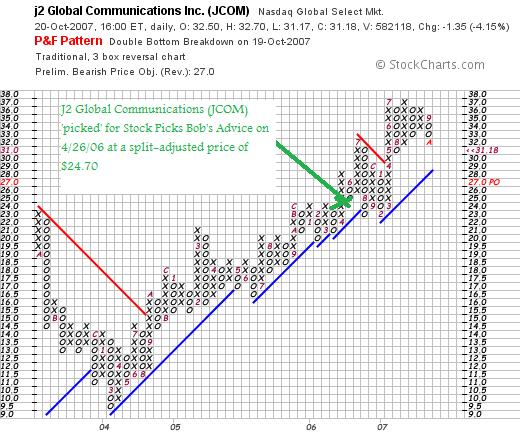

On April 26, 2006, I 'picked' J2 Global Communications (JCOM) for Stock Picks Bob's Advice when the stock was trading at $49.40. JCOM had a 2:1 stock split on May 25, 2006, making my effective stock pick price actually $24.70. JCOM closed at $31.18 on October 19, 2007, for a gain of $6.48 or 26.2% since posting.

On April 26, 2006, I 'picked' J2 Global Communications (JCOM) for Stock Picks Bob's Advice when the stock was trading at $49.40. JCOM had a 2:1 stock split on May 25, 2006, making my effective stock pick price actually $24.70. JCOM closed at $31.18 on October 19, 2007, for a gain of $6.48 or 26.2% since posting.

Looking at a 'point & figure' chart on JCOM from StockCharts.com, we can appreciate the strong technical strength of this stock:

On August 6, 2007, JCOM reported 2nd quarter 2007 results. Revenue for the quarter ended June 30, 2007, increased 22% to $54.0 million from $44.3 million last year. Net earnings increased 29% to $17.1 million from $13.2 million or up 27% to $.33/diluted share from $.26/diluted share last year. The company beat expectations on earnings at $.36/share, when analysts were expecting $.35/share. Revenue at $54.0 million was a little light of the revenue of $54.3 million expected.

On August 6, 2007, JCOM reported 2nd quarter 2007 results. Revenue for the quarter ended June 30, 2007, increased 22% to $54.0 million from $44.3 million last year. Net earnings increased 29% to $17.1 million from $13.2 million or up 27% to $.33/diluted share from $.26/diluted share last year. The company beat expectations on earnings at $.36/share, when analysts were expecting $.35/share. Revenue at $54.0 million was a little light of the revenue of $54.3 million expected.

The Morningstar.com "5-Yr Restated" financials are intact.

With the strong earnings report, the intact chart, solid Morningstar.com analysis,

J2 GLOBAL COMMUNICATIONS (JCOM) IS RATED A BUY

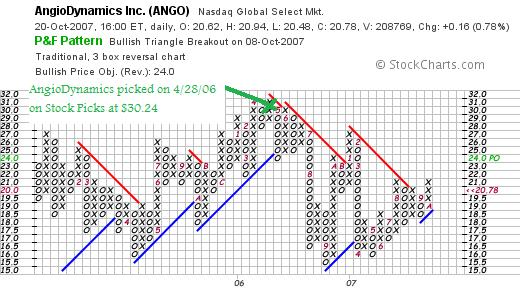

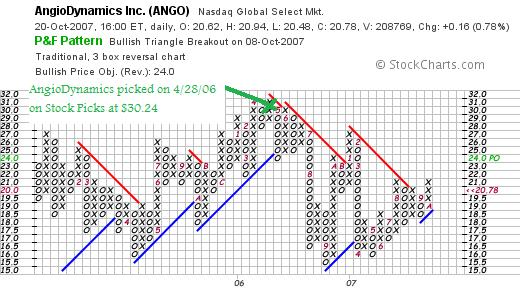

Finally, on April 28, 2006, I posted AngioDynamics (ANGO) on Stock Picks Bob's Advice when the stock was trading at $30.24. ANGO closed at $20.76 on October 19, 2007, for a loss of $(9.48) or (31.3)% since posting.

Finally, on April 28, 2006, I posted AngioDynamics (ANGO) on Stock Picks Bob's Advice when the stock was trading at $30.24. ANGO closed at $20.76 on October 19, 2007, for a loss of $(9.48) or (31.3)% since posting.

Looking at the 'point & figure' chart on AngioDynamics from StockCharts.com, we can see the sideways move of this stock which has recently shown some strength breaking through resistance lines.

On October 1, 2007, AngioDynamics (ANGO) reported 1st quarter 2008 results. For the quarter ended August 31, 2007, sales came in at $37.5 million an 85% increase over the $20.3 million reported in the prior year. Net income grew 25% to $2.4 million from $1.9 million. However, GAAP earnings per share actually decreased 17% to $.10/share from $.12/share attributed to the dilution of earnings related to the January, 2007 acquision of RITA Medical Systems.

On October 1, 2007, AngioDynamics (ANGO) reported 1st quarter 2008 results. For the quarter ended August 31, 2007, sales came in at $37.5 million an 85% increase over the $20.3 million reported in the prior year. Net income grew 25% to $2.4 million from $1.9 million. However, GAAP earnings per share actually decreased 17% to $.10/share from $.12/share attributed to the dilution of earnings related to the January, 2007 acquision of RITA Medical Systems.

The Morningstar.com "5-Yr Restated" is fair with strong revenue growth but earnings turning negative and free cash flow dropping to $-0- in the TTM. The balance sheet is solid.

In light of the marginally positive price chart, the solid revenue growth but decrease in earnings, and the marginal Morningstar.com report, the best I can come up with is

ANGIODYNAMICS (ANGO) IS RATED A HOLD

So how did I do with these three stocks from last year? With one stock with a small gain and the two others cancelling each other out with a moderate gain and a moderate loss, the overall average was a little bit negative at (.03)% since purchase. Essentially it was a wash!

Anyhow, thanks for visiting! I hope you find my continued reviews helpful. I am concerned about the health of the market but shall continue to implement my trading and portfolio management and let my own stocks talk to me and tell me what I need to do!

If you have any comments or questions, please feel free to leave them on the blog or email me at bobsadviceforstocks@lycos.com. If you get a chance, drop by and visit my Stock Picks Podcast website, my Covestor Page which reviews my actual trading portfolio, and my SocialPicks page which has begun summarizing all of my picks since January, 2007.

Have a wonderful Saturday evening and a good Sunday!

Bob

Newer | Latest | Older

Hello Friends! Thanks so much for stopping by and visiting my blog, Stock Picks Bob's Advice! As always, please remember that I am an amateur investor, so please remember to consult with your professional investment advisers prior to making any investment decisions based on information on this website.

Checking the list of top % gainers on the NASDAQ today, I came across Ebix Inc. (EBIX), which closed at $61.94, up $9.95 or 19.14% on the day. I do not own any shares nor do I have any options on this stock. Let's take a closer look at this stock and I will explain why I think it deserves a spot on my blog and why

Checking the list of top % gainers on the NASDAQ today, I came across Ebix Inc. (EBIX), which closed at $61.94, up $9.95 or 19.14% on the day. I do not own any shares nor do I have any options on this stock. Let's take a closer look at this stock and I will explain why I think it deserves a spot on my blog and why Thanks again for stopping by and visiting my blog. If you get a chance be sure and visit my Stock Picks Podcast Website, and you can listen to me ramble on about a few of the many stocks that I write up here on the blog. Check out my Covestor Page where Covestor has been analyzing my actual trading portfolio, and my SocialPicks Page where SocialPicks has been following my stock picks from this blog since the first of this year.

Thanks again for stopping by and visiting my blog. If you get a chance be sure and visit my Stock Picks Podcast Website, and you can listen to me ramble on about a few of the many stocks that I write up here on the blog. Check out my Covestor Page where Covestor has been analyzing my actual trading portfolio, and my SocialPicks Page where SocialPicks has been following my stock picks from this blog since the first of this year.

I wanted to give a brief post this afternoon on Interactive Intelligence (ININ) and why I think

I wanted to give a brief post this afternoon on Interactive Intelligence (ININ) and why I think

On August 1, 2007, Garmin (GRMN) announced

On August 1, 2007, Garmin (GRMN) announced  I am very fortunate to have readers like Doug S., who regularly drops me a line with mostly great ideas and comments. I cannot answer all of his emails, and I look forward to his and any you may write, just drop me a line at bobsadviceforstocks@lycos.com if you would like to email me.

I am very fortunate to have readers like Doug S., who regularly drops me a line with mostly great ideas and comments. I cannot answer all of his emails, and I look forward to his and any you may write, just drop me a line at bobsadviceforstocks@lycos.com if you would like to email me.  Well Doug, I don't know if this stock will go as high as the

Well Doug, I don't know if this stock will go as high as the

I wanted to try to be brief this evening as I actually have some plans to attend to! I wanted to review Snap-on (SNA), a stock that I do not own any shares or options, but a stock that I do believe belongs on the blog.

I wanted to try to be brief this evening as I actually have some plans to attend to! I wanted to review Snap-on (SNA), a stock that I do not own any shares or options, but a stock that I do believe belongs on the blog.

Last week I

Last week I  NVR just posted their

NVR just posted their

On April 26, 2006, I

On April 26, 2006, I

On April 26, 2006, I

On April 26, 2006, I

Finally, on April 28, 2006, I

Finally, on April 28, 2006, I